The end of eight years of neoconservative belligerence in the White House came with a financial crisis exacerbated by decades of neoliberal economic policies. As a result of this coincidence, the ideological winds in the United States are blowing powerfully to the left.

The possibility of another great depression looming over the economy,1 left-wing and even liberal commentators have quickly pronounced the death of the neoliberal experiment — i.e. pro-investor, anti-labor, anti-state policies of the last three decades — and, indeed, of the free-market dogma in general of which neoliberalism is the latest political variant.

SEIU President Andy Stern writes that the “myth of the market as the unerring answer to all economic questions [has been] exposed as nothing more than a cynical hoax,” while historian Steve Fraser, author of Wall Street: America’s Dream Palace, exclaims: “It’s the beginning of the end of the era of infatuation with the free market.” On this point they agree with left-wing journalist Naomi Klein, who has proclaimed that “free-market ideology” has finally become a “discredited agenda.” Meanwhile, economists like Paul Krugman are drawing some insightful comparisons between the Great Depression and the current crisis.

However, most analyses have failed to appreciate a central lesson from the long-term view: financialization reflects deep problems in the real economy itself.

Neoliberal deregulation accelerated and amplified a global financial crisis, to be sure, but the crisis has more fundamental causes rooted in the structural contradictions of the capitalist economy.

As John Bellamy Foster argued forcefully in a recent Monthly Review article, entitled “The Financialization of Capital and the Crisis,” the financialization of the economy is a response of investors to underlying stagnation in the real economy. At the same time as the economy generates growing surplus, the opportunities for profitable investment in private-sector production (of both goods and services) become increasingly scarce.

Simply put, the dearth of investment opportunities is due to excess capacity and extreme inequality. The economy continually increases productivity, thus adding capacity, while inequality grows, thus severely limiting the ability of much of the population to contribute to demand.

The necessary outcome is growing stagnation in the real economy of goods and services. As a result, capital must find new investment opportunities for the economic surplus. As Foster explains, “A relatively small number of individuals and corporations control huge pools of capital and find no other way to continue to make money on the required scale than through a heavy reliance on finance and speculation.”

Hence, massive investment in the FIRE (finance, insurance, and real estate) sectors and the rapid growth in hedge funds, credit derivatives, and all manner of esoteric investment instruments, while getting workers to incur debts to make up for stagnant real wages. In the end, the financial wizardry destabilized the system — the derivatives got so complex that nobody could figure out how to value them — and the asset bubbles burst.

Liberals cheer in chorus, celebrating the return to Keynes: Neoliberalism is dead. Long live capitalism!

The analysis of the crisis, however, will be incomplete unless we return to Marx. Mainstream economics, preoccupied with the allocation of scarce resources, has focused only on the surface phenomena in the sphere of exchange: supply, demand, and prices. In mainstream economics, even macroeconomic aggregates such as GDP, inflation, and unemployment are analyzed only in those terms. Discussions of the structure of production, of wage labor employed by capital producing for profit — in other words, discussions of class relations — are off the table. But it is precisely in this structure of production where the contradictions that produce systemic instability are found.

One source of instability inherent in capitalism is the contradiction between collective production and private appropriation. Individualism is the central ideological principle of capitalism, the idea that all economic outcomes are the results of individual efforts and that the market is the best mechanism to effectively measure and reward individuals for their efforts and thus to give them just the right incentives to make greater efforts. However fair this argument seems to those who have already bought into it, it just ain’t true. The productivity, be it of a firm or an individual, is a function of a highly interdependent system of past and current collective efforts. Even Warren Buffet has admitted: “society is responsible for a very significant percentage of what I’ve earned.”

Public infrastructure, public education, and complex divisions of labor within and between organizations underlie modern dynamic economies. Railroads and trains, highways and cars, telecom cables and computers were all produced through the sweat and blood of countless millions of workers, past and present. The massive economic surplus in the hands of a small class of owners and their investment managers derives from the cooperative labor of the working people of the world.

Even aside from the question of equity, the aforementioned contradiction between collective production and private appropriation generates a chronic problem for capitalism: how to match supply capacity with demand. The system generates an ever greater productive capacity, but who is going to buy all the stuff churned out by it? With relentless pressure on wages, workers and their organizations have had to continuously struggle2 to get wages enough to keep them out of poverty.

A closely related contradiction derives from the profit motive itself. When commodities are produced for profit, production is not driven by the needs of the society (nor even by the dictates of efficiency) but by the demands of those with money. Hence, working families on welfare, sick people without medicine, children in terribly under-resourced schools, and so on (and endless supplies of water in single-serve plastic bottles, shoddy goods imported all the way from China, and so on, however ecologically destructive and economically inefficient they may be). In other words, investment doesn’t get made to meet the needs of people and instead only goes where the profits are, for instance, rampant speculation in the FIRE sectors, which has brought us where we are.

Mainstream economics based on assumptions of equilibrium cannot get us out of this mess. As Marxists, especially Paul Sweezy and Harry Magdoff, have long argued, the history of capitalism shows that disequilibrium and resulting stagnation are the norm of the capitalist economy. The anarchy of the market cannot but lead to recurrent crises.

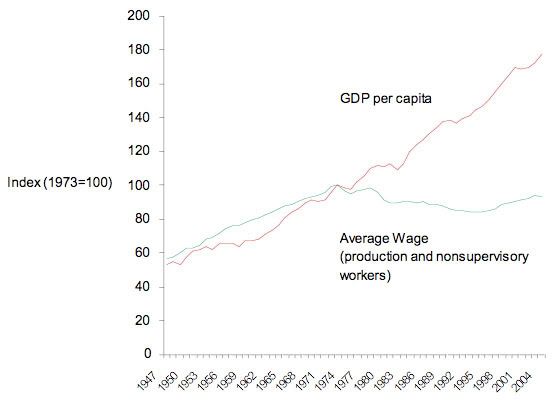

Indeed, in the history of American capitalism, there has been only one period of sustained growth with equity, the so-called golden years of the 1950s through the early 1970s. That era of Fordism was the heyday of the American mass-production economy, a virtuous cycle of growth sustained by combining mass production with institutions supporting mass consumption, in particular, a Keynesianism welfare state and a great class compromise (labor peace in return for higher wages and benefits), all regulated by the state, temporarily displacing the central contradictions of the capitalist economy. As a result, average annual wages grew in lockstep with GDP per capita, beginning in the 1940s until 1973, when average wages in the US began a 30-year period of stagnation despite the fact that productivity growth continued its long, steady increase (see Figure 1).

Figure 1. Productivity and average wages in the US, 1947-2004

Source: Author’s calculations based on data from the BLS and EH.Net.

What happened? The class compromise, successful from the point of view of many workers, was too successful from that of capital, eating too far into profits. Capital reignited the class struggle to counter the profit squeeze. The class struggle from above became official American policy when Reagan fired 11,345 striking air traffic controllers in 1981.

What are we to learn from all this? The key lesson here is twofold. First, while the proposed Keynesian stimuli may stave off another great depression, they cannot even begin to fix the fundamental problems in the real economy. What is necessary, for starters, is massive redistribution of the economic surplus to the working poor — whose ranks are growing fast in this crisis — so that they can contribute to economic growth without going into personal debt. A sustained program of public investment and public employment helps, but the level of economic imbalance in the society will require much more, including dramatically expanded welfare through such programs as basic income grants, financed by the taxation of the rich rather than ever more public debt.

Second, beware of the premature announcement of the death of neoliberalism. After all, neoliberalism was nothing more than the triumph of the free marketeers after the period of their political marginalization during the Fordist era of Keynesianism. If all we demand in the current crisis is more Keynesianism, then all we will get after Keynesianism resuscitates capitalism is the rise of yet another “new liberalism.” Been there, done that. Time to fight for a new system that puts people first.

1 Consider what happened in 2008 alone. Wall Street saw $7 trillion dollars of shareholder wealth vanish, nearly $2 trillion of which was the retirement savings of working people. The auto and steel industries are both currently seeking government bailout. 1.5 million jobs were lost in the last three months of the year, and, in December, the unemployment rate hit a 16-year high of 7.2 percent.

2 It was such struggles that were behind the Fair Labor Standards Act of 1938, which established a minimum wage and a 40-hour workweek, and it’s been the dearth of such struggles since the long sixties that have kept the minimum wage so low and have motivated workers to sacrifice their free time in search of overtime.

Matt Vidal is Lecturer in Work and Organizations at King’s College London, Department of Management. He has written widely on American politics and economics in popular media, in addition to his academic research on the political economy of work organization and industrial restructuring in the US. Vidal can be reached at <matt.vidal@kcl.ac.uk>.