Those aren’t my words. The quotation that forms the title of this post is from a recent Federal Reserve Bank of St. Louis blog post.

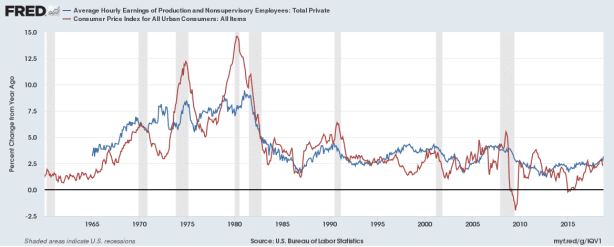

And they’re important to keep in mind in light of the news coverage (e.g., by the New York Times) of last week’s Labor Department report on hiring and unemployment. Yes, 250 thousand jobs were added in the U.S. economy last month and average earnings did rise by 0.2 percent and are up 3.1 percent over the past year.

But. . .

The rate of growth of American workers’ wages (the blue line in the chart above) is only a hair above the increase in consumer prices (the red line). So, for all intents and purposes, real wages remain stagnant.

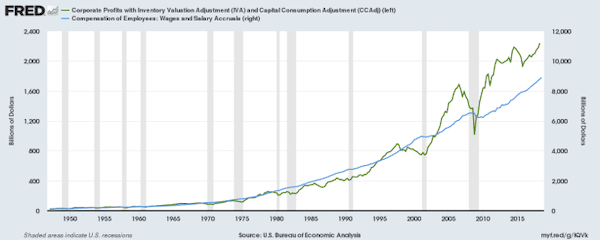

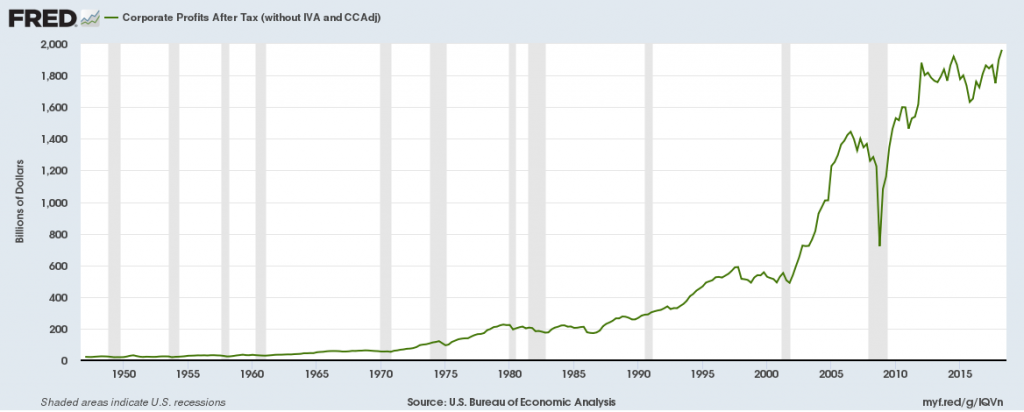

Meanwhile, the profits captured by American corporations continue to grow, reaching new record highs.

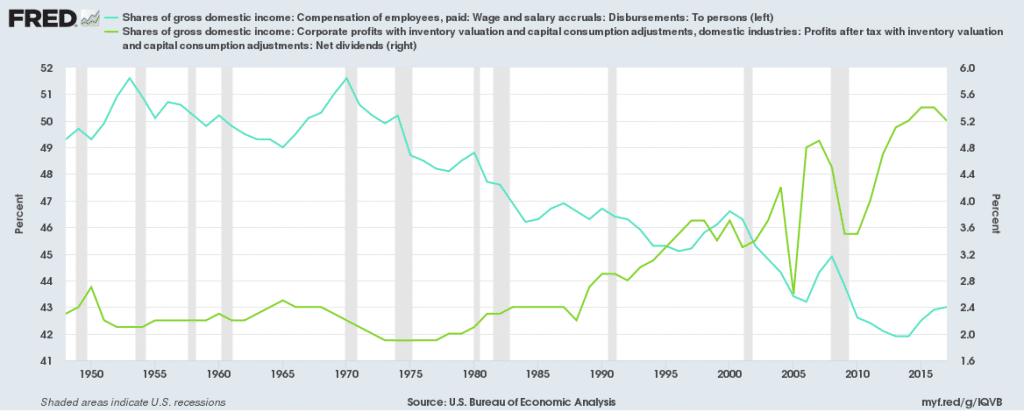

It should come as no surprise, then, that the labor share of national income (the light blue line in the chart above) remains below its pre-crash level (and much lower than any earlier year in postwar history), while the share of national income that is distributed to wealthy households in the form of dividends (the light green line) is still much higher than it’s been throughout the postwar period.

Never have corporate profits and dividends outgrown workers’ wages so clearly and for so long. And the political party dominating all three branches of the U.S. government is doing everything in its power to make sure that trend continues.

That’s the proper context for the latest jobs report—and for tomorrow’s elections across America.