I was in New York recently, and as per custom I like to walk its streets checking out used bookstores. Used bookstores are a species in danger of extinction in Manhattan, ever more picked off by rising rents and booming property prices. But one of my favourites, Mercer Books, along Mercer Street, smack in the heart of New York University’s ghetto, miraculously lives on. I’m always surprised, and not a little relieved, that NYU’s real estate machine hasn’t yet gobbled it up.

Piled up in one corner of the bookstore were dusty back copies of old literary and political journals, many dating from the 1960s, a treasure trove for those who cared to rummage, there at giveaway prices. Digging around I discovered a few gems: a Partisan Review from 1965, with an article by Joseph Frank on “Dostoevsky and the Socialists”; and a 1983 Antioch Review with Raymond Carver’s story “The Compartment.” My great find, though, was a 1978 issue of Dissent, containing Marshall Berman’s original take on “All That Is Solid Melts Into Air.”

For a couple of dollars, I now had my hands on an early draft of what would become the mainstay of Marshall’s famous book. Indeed, “All That Is Solid Melts Into Air: Marx, Modernism and Modernization” was a fascinating discovery for anybody who knows All That Is Solid Melts Into Air, published by Simon & Schuster in 1982. Not least because the Dissent piece, I’d soon recognize, read very much like a work in progress, sounding a lot flatter and less lyrical than the eventual book chapter. As a standalone article, I guess it had to sound more direct, spelling out more emphatically what would later get developed over the course of an entire book.

Marx’s dialectic is unique, Marshall says, because it straddles two distinctive ideas of modernization and modernism. Typically, analyses of each have been set apart. Modernization, on the one hand, has meant sustained economic development and industrial expansion, large-scale social planning and urban growth, bureaucratic regulation and rationality, the shattering of traditional cultures, perpetual progress and productivity. On the other hand, modernism suggests something more artistic and experimental, a movement more iconoclastic, sometimes destructive, occasionally destructive to its proponents as well. With modernism, Marshall says, “we find ourselves in the midst of an endless series of spiritual upheavals and cultural revolutions—the death of God, the theatre of cruelty, Dada, jazz, the twelve-tone scale, Existentialism, abstract art, and so on.”

Enter Marx, the first thinker, Marshall believes, to make these two worlds connect. It was Marx, after all, who wanted to discover the underlying unity of life. Marx’s horizon is vast and his vision packs together an enormous range of things and ideas that nobody had thought of throwing together before, breaking down boundaries, piling things together that seem to clash and totter on the brink. Take one of his central images from Part I of The Communist Manifesto (1848): “All that Is solid melts into air.” “The cosmic scope and visionary grandeur of this image,” Marshall says, “it’s highly compressed dramatic power, its vaguely apocalyptic undertones, the ambiguity of its point of view—the heat that destroys is also super abundant energy, an overflow of life—all these qualities are supposed to be hallmarks of the modernist imagination.”

Marx’s prose, says Marshall, hurtles along with the same breathless energy and reckless momentum as the society he depicts. The need for a constantly expanding market has the bourgeoisie settle everywhere, nestle everywhere, establish connections everywhere. A world market rapidly emerges, absorbing and destroying local and regional markets; improvements in communication draw everybody under the sway of bourgeois economy and culture; capital concentrates into the hands of fewer and fewer bigger and bigger producers; “Modern Industry” rationalizes production, in both the factories and on the land; rural labourers are uprooted and pour into ever-expanding cities; a factory proletariat swells its ranks, learning the hard way about machines and modern exploitation.

Before long, “no other nexus exists between man and man than naked self-interest, than callous ‘cash payment’.” A brave new world of capitalist modernity sprouts. Mountains are moved, railroads laid down, and canals rerouted, all of it done in the name of bourgeois modernity—should the price be right. Everything we once thought solid suddenly disintegrates into air. “By the time Marx’s proletarians appears,” Marshall says, “the world stage on which they were supposed to play their part has disintegrated and metamorphosed into something unrecognizable, surreal, a mobile construction that shifts and changes shape under the players’ feet”:

All fixed, fast-frozen relations, with their train of ancient and venerable prejudices and opinions are swept away, all new-formed ones become antiquated before they can ossify. All that is solid melts into air, all that is holy is profaned, and man is at last compelled to face with sober senses, his real conditions of life, and his relations with his kind.

Marshall wonders what kind of people these permanent revolutions produce? Those who’re compelled to face, “with sober senses,” everlasting uncertainty, this restless obsession with sweeping away forms of life “before they can ossify”? He’s talking about us, remember. “To survive in modern bourgeois society,” he thinks, “our personality must take on an open form.” “We must learn not to yearn nostalgically for the ‘fixed, fast-frozen relationships’ of the real or fantasized past, but to delight in mobility, to thrive on renewal, to look forward to future developments in our conditions of life and our relations with your fellow men.” It’s an exciting, if troubling, vision of ourselves.

A few days after I discovered that 1978 copy of Dissent, I did a big walk around the Hudson Yards development on Manhattan’s westside with my friend and former teacher, the Marxist theorist David Harvey. It was a soaking wet spring afternoon, chilly and grey, and we both tried our utmost not to let the weather, nor the awfulness of this project, a spillover from Michael Bloomberg’s mayoral years, dampen our spirits.

The twelve acre site, behind Penn Station and Madison Square Garden, had once been gritty rail tracks and storage yards for Long Island Rail Road trains. Now, a $20 billion mega-plan promises shingled blue-glass skyscrapers, with office space, deluxe condos and high-end retailing galore, to say nothing of an eco arts centre and bizarre pedestrian walkway. Talk about all that was solid melting into air! Completion isn’t destined until 2024; but much is already in place. Hooking up to the High Line and a revamped No. 7 subway station, Hudson Yards is set to symbolize the pride and joy of a post 9/11 Big Apple, a celebration of Michael Bloomberg’s bleeding edge: New York, Inc.

The bourgeoisie has torn away sentimental veils, Marx said in the Manifesto, and put in its stead “open, shameless, direct, bare exploitation.” In all this—in open, shameless, direct, bare exploitation—we are, at Hudson Yards, on familiar ground. The New York Times’ architectural critic, Michael Kimmelman, called the development “a super-sized suburban-style office park, with a shopping mall and a quasi-gated condo community targeted at the 0.1%.” It’s the largest private real estate venture in U.S. history, and in the brazen world-leader of private real estate deals that’s saying a lot.

In office, Bloomberg pumped 75 millions’ worth of public dollars into the development, matching it with a similar sum from his own deep pockets. Moreover, BlackRock, a midtown investment company, managing a $6 trillion portfolio, wrote off $25 million in state tax credits, buffering the move of its 700 workforce to Hudson Yards, less than a mile westwards. Some estimates suggest the whole initiative has totalled as much as $6 billion in tax breaks and public finding. Socialism for billionaires is how the scam has been described—even as those self-same scammers wax lyrical about the virtues of the “free market.”

Still, one of the most startling of Hudson Yards’ scams, reputed to have amassed some $1.6 billion’s worth of financing, is even more insidious, only recently becoming public news.(1) It centres on the controversial investor visa program called EB-5, part of Poppy Bush’s immigration reform of the early 1990s. Bizarre as it may sound, the program lets immigrants secure visas in exchange for investment in the U.S. economy. We’re talking here about super-rich foreigners, not fresh off the boat immigrants, nor even fresh over the wall ones. They’re people who can pump between $500k and a million bucks into American real estate. That’ll enable—no questions asked, no hoop-jumping—to gain fast-track visas, for work or study. (It’s been something of a favourite in recent years amongst wealthy Chinese families.) The monies are meant to go into federally-targeted areas, into poor and distressed neighbourhoods across America, so-called TEAs—Targeted Employment Areas.

But the jurisdiction of TEAs—where its boundary lines are drawn—is rather loose, hence open to meddling and manipulation. And in New York, the Empire State Development, a public-private organization under New York state’s banner, is the arch-meddler and manipulator. Somehow, it managed to secure Hudson Yards TEA status, stretching its remit into poor census tracks of Harlem. Thus funds intended for real estate aid in poverty-stricken neighbourhoods, like Harlem, were siphoned off and redirected into a super-luxury mega-development. “Think of it a form of creative financial gerrymandering,” is how Kriston Capps put it. That’s how the developer Related Companies raked in around $380 million at Hudson Yards, bypassing distressed area scrutiny through a greedy audacity that beggars belief. Or perhaps not, in Trump’s America. (And, by the way, son-in-law Jared Kushner has been busily promoting Kushner Companies’ projects with EB-5 investors in China.)

Something more publicly obvious at Hudson Yards is, however, the scale of its banality. A stroll around doesn’t reveal too much intrigue. What we find here is something not only unfair but uninteresting, a city space flattened by familiarity, even as those glitzy skyscrapers go up. It’s the sort of predictability that only money can buy. Its ubiquity resides in its sameness, in the predictability of both its form and function. Here, as elsewhere, we have the same predictable city within a city, the same predictable sleek glass and steel architectural structures, housing the same financial and high-tech services, same multinational corporations and accountancy firms, same banks and management consultancies, same retail giants, destined for the same wealthy consumers. In the mix, there’s no mix. All real urban texturing is expunged.

Apart from, that is, a mix of spectacular gimmickry. And at Hudson Yards there are a few. First off we have the “Vessel,” touted as Manhattan’s Eiffel Tower, designed by multimillionaire Brit developer Thomas Heatherwick, a $200 million 16-story pedestrian walkway, a stairway to nowhere, looking like a truncated giant honeycomb, serving no other purpose than to serve, than to promote spectacular contemplation.

Nearby, meanwhile, comes the “Shed,” a $500 million eco-friendly arts centre and performance space, which actually looks like a shed, or, as someone said, like an aircraft hangar wrapped in a down comforter. Maybe it’s a quilted Chanel handbag. At any rate, the structure is a movable feast, a shell that glides along rails, seating 1,200 people at any one time, “physically transforming itself,” the hype says, “to support artists’ most ambitious ideas.” Which artists? Whose ambitious ideas? We still have to see. In 2013, the City of New York handed over $50 million towards the project, to Related Companies and the Oxford Properties Group, representing the single biggest capital grant given in that year.

Wandering around Hudson Yards, David and I spoke of something he’d written about over thirty years ago, in his book Consciousness and the Urban Experience: “the restless analyst.” It’s the mythical figure haunting The American Scene (1907), Henry James’s roving travelogue around fin-de-siècle America. James had been away from the U.S. for twenty five years, living in Europe. As a “returning absentee,” between 1904-05, he spent a year rediscovering his native land, indignant at much he saw; many changes, he said, became “a perpetual source of irritation.” “Charming places, charming objects,” James wrote, “languish all around the restless analyst, under designations that seem to leave the smudge of a great vulgar thumb.”

The gaze of James’s restless analyst was the gaze of “an inquiring stranger.” The character likely came to mind at Hudson Yards because we, too, felt there like “inquiring strangers,” out of place and similarly indignant at much we saw. In Consciousness and the Urban Experience, David said he’d “long been impressed with this character the restless analyst. It seems to capture the only kind of intellectual stance possible in the face of a capitalism that reduces all aspects of social, cultural, and political (to say nothing of economic) life to the pure homogeneity and universality of money values and then transforms them according to the roving calculus of profit.” It’s hard to better this as an insight into what was unfolding all around us.

Maybe the restless analyst can be a sort of radical archetype, somebody we need more than ever today, an “inquiring stranger” who scours the capitalist landscape, restlessly keeping abreast with capitalism’s restless (and reckless) penchant for, as Marshall said, melting things into air, levelling everything even as it builds up. Perhaps the restless analyst is the archetypal modern commentator, whose sceptical gaze is never seduced by dazzling appearances, by that smudge of capitalism’s great vulgar thumb.

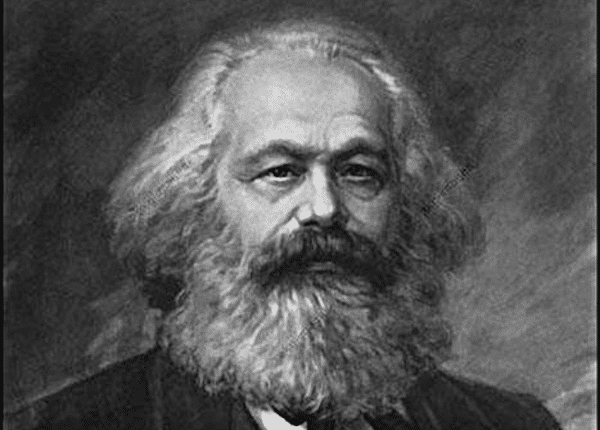

When it comes to the “roving calculus of profit” in cities these days, the question of land rent has to be foremost on any restless analyst’s mind. That most restless of restless analysts, Karl Marx, didn’t say much about urban land markets. His was a theory of agricultural ground-rent where the central challenge lay in understanding how land can have a value without being a product of labour. In The Limits to Capital, David’s masterpiece from 1982, urban land markets are tackled full on, and a brilliant reinterpretation of Marx’s theory is offered. It’s one of the most strikingly original features of Limits to Capital, a piece of genius in its apparent simplicity: that land under capitalism—especially urban land—has become another form of fictitious capital, another financial asset, having more in common with an asset-bearing investment—and hence with interest-bearing capital—than any arcane debate about rural soil fertility.

Ground-rent is a kind of “imaginary capital,” David said. What’s bought and sold isn’t so much land itself as “a title to the ground-rent yielded by it. The money laid out is equivalent to an interest-bearing investment. The buyer acquires a claim upon anticipated future revenues, a claim upon the future fruits of labour.” So the “value of land” is intimately related to the circulation of interest-bearing capital, as well as to the stock market, and to finance capital in general. In this way the spatial landscape of cities gets shaped by shifts in interest rates and by the ebbing and flowing of money capital, by its supply and demand. Perceptions of future rents deeply affect land values and property prices. This speculative bent can make or break certain locations, conditioning what might, and mightn’t, be built at any given moment. The built environment of cities thereby sways to the rhythm of capital accumulation.

In fact, the notion isn’t too far removed from Marx’s understanding; he’d hinted as much in drafts of Volume Three of Capital: “in cities that are experiencing rapid growth,” he’d said, “particularly where building is carried on with industrial methods, as in London, it is the ground-rent and not the house that forms the real object of speculation” (Marx’s emphases). And elsewhere: “capitalised ground-rent presents the appearance of the price of the value of land, so that the earth is bought and sold just like any other commodity.”

Curiously, the recent publication of Marx’s Economic Manuscript of 1864-1865, making available for the first time the only full draft of Volume Three of Capital, has shone light on Marx’s own view of ground-rent.(2) I say Marx’s “own view” here because the posthumous publication of Volume Three of Capital bore the heavy imprint of Marx’s collaborator, Friedrich Engels. Engels had edited and added, divided and subdivided what Marx wrote as a continuous interconnected flow; the sections on interest-bearing capital and ground-rent particularly suffered under Engels’s stewardship. The former he blanketed with an overriding (and erroneous) concern for the “credit system”; the latter discussion on rent he chopped up and reordered into discrete sections. The reordering, alas, severed Marx’s close affiliation between interest-bearing capital and ground-rent—vindicating just how Marxian David’s vision of rent actually is in Limits.

In the Economic Manuscripts of 1864-1865, Marx called interest-bearing capital “the externalization of surplus-value.” In interest-bearing capital, he said, “the capital relation reaches its most fetishized form.” Here we have the appearance of money breeding money, of money no longer bearing any trace of its origin. “The social relation is consummated in the relationship of a thing (money) to itself.” It’s clear how Marx viewed ground-rent as another form of “externalized surplus-value,” as something parasitic rather than productive, a redistribution of total surplus-value and hence a filching of the fruits of labour. Only, of course, it doesn’t look like that.

Somebody has to pay, always; and usually it’s the working classes who get fleeced with increased levels of exploitation and oppression. “The tremendous power this gives to landed property,” said Marx, “when it is combined together with industrial capital in the same hands enables capital practically to exclude workers engaged in a struggle over wages from the very earth itself as a dwelling place.” In a single sentence, Marx seems to have laid bare the whole dynamics of New York’s housing and labour market. (He added, immediately thereafter, in parentheses, “here one section of society demands a tribute from the other for the right to inhabit the earth, just as in landed property in general the proprietors demand the right to exploit the earth’s surface.”)

Interest-bearing capital circulates through land markets, chasing enhanced future ground-rents; land prices get fixed accordingly. In a certain sense, the process becomes self-fulfilling: the pursuit of enhanced rents will often enhance those rents. Marketing, publicity and “place-making” play their role. “In this case,” said David, “the circulation of interest-bearing capital promotes activities on the land that conform to the highest and best uses, not simply in the present, but also in anticipation of future surplus-value production.” “Highest and best uses,” are, needless to say, capitalistically defined. Exchange-values are gouged out of what should be use-values. Locations like Hudson Yards are preeminent expressions of capital becoming an automatic fetish. Space becomes an exploitable commodity, a monopolizable financial asset, a frackable parcel of planet earth. Maximizing rent is akin to power-drilling for oil. Black gold in the city.

By eyeing future gains, landowners and developers “inject a fluidity and dynamism into the use of land that would otherwise be hard to generate.” We could say that this is precisely the impetus behind all that is solid melts into air;(3) that speculation in land may be necessary to capitalism but its restlessness and recklessness unleashes “speculative orgies,” which, David said, “periodically become the quagmire of destruction of capital itself.” The twist is that capital has various lines of defence to buffer these crises, to underwrite potential financial loss. The principal risk manager is none other than the state itself, the “last line of bourgeois defence,” David called it.

It’s perhaps the only occasion in Limits to Capital where I find myself in disagreement! For, nowadays, the state is surely the first line of defence, a defender of bourgeois ranks even before battle is waged. The state has a variety of powers at its disposal: land regulation (zoning), land expropriation (eminent domain), planning initiatives and the provision of public infrastructure—using taxpayers money to put in subway stops, roads and transport links, all of which can be capitalized upon as private gain. Meanwhile, tax breaks and assorted corporate alms add to the state’s relief arsenal.

Perhaps, in the past, pre-1982, the state mobilized its power as a last resort, countering market hiccups and incoherences, stepping in, as we know it has, to bale out capital when its speculative binges have wrought havoc, rescuing the system from total collapse. And yet, increasingly, the state now anoints capital in the first instance, putting in the initial spade work so that those speculative wheels of motions can run smoothly. Therein the state absorbs the contradictions of rent as fictitious capital. But so long as it remains a capitalist state, especially a neoliberal one, it can never abolish those contradictions. And thus solid society seems forever fated to melt into air.

Later in my New York trip I reflected upon something I already knew but hadn’t much thought about before: David’s Limits to Capital and Marshall’s All That Is Solid appeared in the same year—1982, during the first term of Ronald Reagan and Margaret Thatcher. Not exactly the most auspicious moment for two books professing allegiance to Marxism. But then again, what a testing ground: the inauguration of a deregulated, union busting and fiscally-downsizing capitalism, privatizing daily life, handing out tax cuts to the rich while waging brutal class war against the poor.

Two sorcerers of the “free market” had conjured up the powers of the monetarist netherworld, and unleashed it on the world stage as right-wing economic orthodoxy. They’d “set up that single, unconscionable freedom: Free Trade”—like Marx suggested the bourgeoisie would, “wherever it got the upper hand.” All of all, then, maybe just the ticket to ride for seasoned Marxist analysis. A senseless material world that Marxists could make dialectical sense of? The great bearded prophet ought to have been our critical main man, the most trenchant thinker to expose the fetishism of the free market, together with the dogmatism of those free-marketeers.

Yet it wasn’t the case: Limits to Capital and All That Is Solid were both quietly received. Marshall’s friend, the cultural critic John Leonard, gave All That Is Solid a rave review in The New York Times (January 8th, 1982), with a little sting—“Seize the day and the change the world,” wrote Leonard, “Modernism is a ‘permanent revolution,’ full of radical sunrise and great dawn…I love this book and wished I believed it.” Elsewhere, All That Is Solid had no elsewhere, made little impact. For the bottom line Simon & Schuster, it wasn’t terribly important. The jacket image revealed bundles about its lack of commitment: dull blue with a faint gaseous white plume, dissipating upwards, going nowhere, signifying nothing. Marshall said his book fast disappeared, went immediately into limbo; the publishers, he said, placed it “into an ominous category of being ‘indefinitely out of stock’.”

Limits to Capital, meantime, did the academic rounds. The Annals of the Association of American Geographers described it as “a marvellous achievement, demonstrating a tremendous personal and intellectual feel for the texture of Marx’s arguments.” If anything, bourgeois geography warmed to Limits more than scholarly Marxism—a tradition, after all, dominated by historians (think of Eric Hobsbawm, Perry Anderson and E.P.Thompson). The privileging of history over geography, of time over space, within the Marxist tradition, has meant to a rather one-sided kind of leftism, an interpretation that has often downplayed capitalism’s spatial dimension. David suggested the system’s temporal and financial contradictions get displaced into space, that internal crises are susceptible to an external “spatial fix”: “geographical expansion and uneven geographical development,” he said, “hold out the possibility for a contradiction-prone capitalism to right itself.” In other words, capitalism buys time for itself out the space that it conquers, that it perpetually transforms, in both the city and the world.

As both books languished, though, radical publisher Verso stepped in, giving each the kiss of new life, a popular afterlife. After a few years of nasty exchanges and threats of lawsuits, Marshall said All That Is Solid was prised loose from Simon & Schuster; Verso then ensured it had a future, that it “had legs”—a longer shelf-life than anyone ever imagined, never out-of-print since, even venturing into regions and intellectual realms Marshall himself never dreamt of. Verso, moreover, pricked up its ears to Limits to Capital, a full seventeen years after its initial publication. But by 1999 they really listened, largely because one of their honcho authors, Fredric Jameson, said they should listen.

In the pages of publisher’s companion journal, New Left Review, he’d called David’s book “a magisterial review and re-theorization of Marx.” Limits was one of the “most lucid and satisfying recent attempts,” Jameson said, “to outline Marx’s economic thought.” And it was, he added, “perhaps the only one to tackle the thorny problem of ground-rent in Marx”—that “structurally necessary fiction” under capitalism. Jameson’s article was entitled “The Brick and the Balloon,” and it dealt with the link between architecture and real estate; how each is mediated by aesthetics, and how aesthetic mediation usually involves the economic logic of rent. It was a typically brilliant Jameson essay, piling up references and ideas and concepts almost to the point of bursting; yet it brought heavy-duty attention to David’s almost-forgotten opus.

David said Limits wasn’t about building firm or fixed building blocks, but a fluid, dialectical mode of argumentation and presentation; and in this he and Marshall found common ground. All That Is Solid depicts an impressionist Marx, the Marx of the Manifesto, loosely sketching out capitalism’s laws of motion; the brush strokes are fast, the detail fuzzy—especially if you venture up close. This isn’t necessarily a fault; it’s more a perspective from which Marshall wanted to enter a particular experience, the experience of being modern, of living within these broad brush strokes. Limits, on the other hand, moves inside that canvas, is more precise about where it applies its paint. Here Impressionism gives way to Realism; moving in close with David lets you see the detail of the layers of Marx’s paint, how he endlessly reworked and touched up.

Limits follows the Marx of Capital, beginning with the commodity, dealing at first with capitalism as a closed system. In Volume One of Capital, Marx had purposely closed it down. He’d wanted to capture the system’s purity, its essential movement—from the standpoint of its “cell-form.” Only when Marx understood what lay within this restless urge for movement and expansion could he let his theory be open to this restless urge for movement and expansion. Thus it’s only later in Limits, when David theorizes crisis, that his and Marshall’s vision complement one another. Crisis meant “creative destruction”; capitalism tears down its solid edifice in order to renew its monetary spirit. Renewal is an innately ruinous and nihilistic imperative. To accumulate capital, the built landscape is configured at one moment only to be ripped apart and reconfigured at a later moment. Devaluation somehow prefigures revaluation. So it goes.

But so it goes for how long, and how far? Nobody knows—not even Marx. Marx made a series of contingent projections about capitalism’s destiny, not, as some think, absolute predictions. Near the end of Volume One of Capital, we think it’s the end; we think Marx has finally had it in for capitalism, that its own “immanent laws” are about to destroy it. Here he is, in Chapter 32 on “The Historical Tendency of Capitalist Accumulation,” letting rip, giving us a crescendo of stirring prose, hitherto kept under wraps:

Along with the constant decrease in the number of capitalist magnates, who usurp and monopolize all the advantages of this process, the mass of misery, oppression, slavery, degradation and exploitation grows; but with this there also grows the revolt of the working class, a class constantly increasing in numbers, and trained, united and organized by the very mechanism of the capitalist process of production. The monopoly of capital becomes a fetter upon the mode of production which has flourished alongside and under it. The centralization of the means of production and the socialization of labour reach a point at which they become incompatible with their capitalist integument. The integument is burst asunder. The knell of capitalist private property sounds. The expropriators are expropriated.

This seems as good a place as any to stop, to finish Capital on an upbeat note, gleefully celebrating the collapse of bourgeois society, its own melting into air. But no, this isn’t how Marx’s dialectical brain operates. Suddenly, he moves against himself, against his own wishful thinking, forcing open his Pandora’s box, unsealing his closed system, opening it up to fresh rounds of “primitive accumulation.” Pow, now there seems no stopping capital’s expansion machine again, spinning off into a colonial orbit (Chapter 33). Now the world is seemingly its oyster. New fertile soils emerge to rip off and to privatize, to kickstart its accumulation process—in the U.S. and Canada, and in Australia.

Marx had earlier toyed with the “secret” of primitive accumulation; now he makes it public knowledge. Primitive accumulation, he says, plays the same role for capital as “original sin” does for theologists. It’s the starting point of something revelatory, an epiphanal beginning, an initiation into virgin territories, into pre-capitalist lands, into “New Worlds,” civilizing the uncivilized, exploiting where it hasn’t already exploited, already established links, putting in place new social relations of domination. The possibilities for primitive accumulation appear infinite. Isn’t Hudson Yards yet another instance of “primitive” accumulation in the “civilized” city?

Nowadays, primitive accumulation mobilizes high-tech sophistication, plunders modern territories, dispossesses lands and states—land-grabs, people evicts, invades the whole public realm (privatizing spaces, schools, services, hospitals, infrastructure)— smashing and pilfering where it can, anyway it can. Marx ends Capital devilishly open-ended because he knew how capital itself is devilishly open-ended. It turns on new axes, gyrates to all manner of new gyrations. What else could the man do but to gyrate himself?

And yet, and yet, perhaps the limits of capital’s gyrations in the city will be set by capital itself, by its own cannibalization of urban space. Aren’t there endemic problems with expelling workers “from inhabiting the earth as a dwelling place”? They’re value producers, after all. Won’t capital here fall foul of its own automatic fetish, of money creating more money ex nihilo? The limits to the “general law of capitalist accumulation” might really be the limits of the law’s inherent logic.

This law, remember, creates a “relative surplus population”; men and women who feel the brunt of capital’s business cycles, of the pushing and pulling of industrial production, sucking people in when the economy soars, spitting them out when it dips. Marx knew how this system “creates a mass of human material always ready for exploitation by capital’s own changing valorization requirements.” “Its own energy and extent,” he said, produces a “relatively redundant working population, i.e. a population superfluous to capital’s average requirements.”

So, too, now, in the city, capitalism’s new factory for valorizing capital, where primitive accumulation’s messenger boy is interest-bearing capital circulating through spaces, searching out those titles to future ground-rents. The process renders workers superfluous, not only from work but from the totality of living space, displacing from dwelling space as it downsizes the workplace. Can accumulation at one pole and relative superfluity at the other continue together, forever, in the city? Won’t we reach a point when a kind of Endgame sets in, when the general law of capitalist accumulation generalises its own illegality?

Here, when the rich have banished the poor from its urban core, from its isotropic plane of business immanence, won’t we have reached a strange apotheosis? Won’t we have reached an Endgame, like in chess, when the game is up although we continue to feign the moves? When, after little is left on the urban checkerboard besides a few loose pawns and kings, kings playing off against other kings, square by square, isn’t there’s nothing left to win nor any real possibility of ever winning? Nothing to exploit, nobody to valorize capital?

Or… or is it more that those pawns might learn “to thrive on renewal,” as Marshall said, and “delight in mobility,” keep moving on come what may? Maybe these pawns will edge along together, agonizingly, one square at a time, until they finally make it to the end of the board, transforming themselves into powerful queens, winning the Endgame against all odds.

Ah, I know this checkmate is probably pure fantasy. But even if it never happens, I’ll take comfort in the meantime from one basic idea underlying both David’s and Marshall’s work: that of a Marx without limits, an ever-renewable thinker whose thought and practice will live on so long as capitalism lives on, so long as working class people everywhere retain a capacity to still make moves.

Endnotes

- ↩ See Kriston Capps, “The Hidden Horror of Hudson Yards Is How It Was Financed,” CityLab (April 12, 2019): www.citylab.com

- ↩ See Marx’s Economic Manuscript of 1864-1865 (Haymarket Books, Chicago, 2017)

- ↩ In All That Is Solid Melts Into Air, Marshall suggests this melting process is an example of “bourgeois nihilism.” He also cities, in a footnote, David’s work to this effect. “It is only recently,” Marshall says, “that Marxist thinkers have begun to explore this theme. The economic geographer David Harvey tries to show in detail how the repeated intentional destruction of the ‘built environment’ is integral to the accumulation of capital.”