The capitalist extracts surplus labour from his workpeople, for which he does not pay.

Profits can only result from the “surplus labor which the capitalist extracts from his workpeople, but for which he does not pay”, Eleanor Marx shows. “From kings and queens to music-masters and greengrocers, live upon their respective shares of this surplus-value”. In this clear and concise analysis of her father’s chief work, Capital, Eleanor explains the “theory of value” and the origin of profits, in other words, the “groundwork of’ our whole system of production”.

Eleanor Marx (full name: Jenny Julia Eleanor Marx) (16 January 1855–31 March 1898) was the English-born youngest daughter of Karl Marx and a socialist/feminist activist during her short life.

Originally published as “Karl Marx II” in Progress, June 1883, pp.362-366 shortly after Karl Marx’s death (March 17, 1883). Transcribed by Ted Crawford and republished on the Marxists Internet Archive. Images by SE.

David Ricardo begins his great work, “Principles of Political Economy and Taxation,” with these words: “The value of a commodity, or the quantity of any other commodity for which it will exchange, depends upon the relative quantity of labor necessary for its production, and not on the greater or less compensation which is paid for that labor.” This great discovery of Ricardo’s, that there is but one real standard of value, labor, forms the starting-point of Marx’ “Das Kapital.’’ I cannot enter here into a detailed account of the way in which Marx completes, and partly corrects, Ricardo’s theory of value, and develops, out of it, a theory of that fearfully contested subject, currency, which by its clearness, simplicity, and logical force, has carried conviction even into the heads of many political economists of the ordinary stamp. I must confine myself to the mode, based upon his theory of value, by which Marx explains the origin and the continued accumulation of capital in the hands of a, thereby, privileged class.

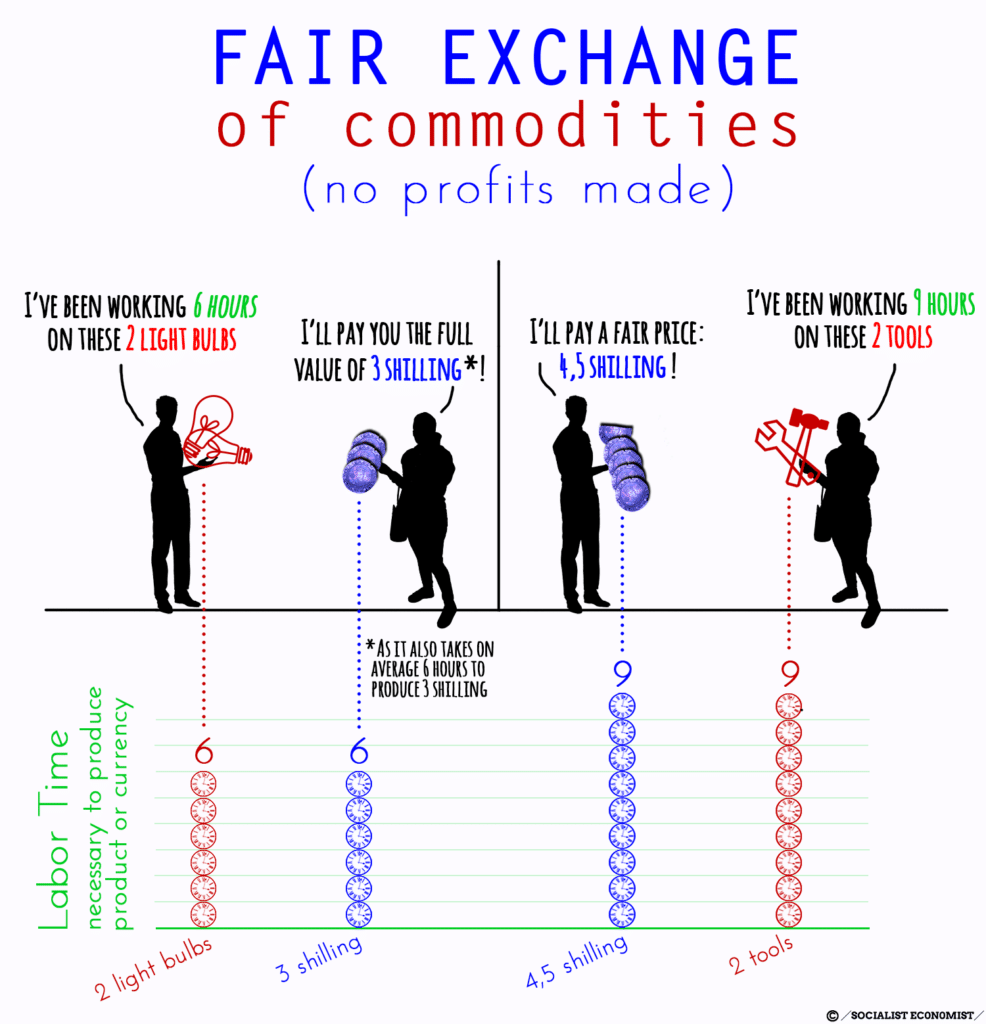

Suppose all exchanges of commodities to be entirely fair; suppose that every buyer gets the full value in goods for his money, and that every seller receives in money the full value of the necessary labor invested in his produce. If, then, as political economists are in the habit of assuming, every producer sells that which he does not want, and buys with the money thus obtained that which he does want, but which he does not himself produce, then all things are for the best in this best of economical worlds; but the formation of Capital—this word taken, for the present, in its usual meaning—is impossible. A man may save money, or store up goods, but he cannot, as yet, use them as Capital, except perhaps by lending the money on interest. But that is,, though a very ancient, yet a very subordinate and primitive form of Capital. The making of profits is impossible on the basis supposed above.

And yet, we see every day that profits, and very large profits, are made by some people. In order to account for this, let its begin by looking at the form of the transaction which produces profits. Hitherto we have dealt with independent producers, who, under a system of social division of labor, sell what they do not want, and buy what they do want for their own use. But now the producer appears as a man who enters the market, not with produce, but with money, and who buys, not what he wants, but what he does not want for his own use. He buys, in one word, in order to re-sell what he has bought. But to buy 20 tons of pig-iron, or 10 bales of cotton for £100, and to re-sell them for £100 would be an absurdity. And indeed we find our businessman does not commit such an absurdity. He buys his commodities, say for £100, and re-sells them, on an average, say for £110. But how is this possible?’ We still assume that all commodities are bought and sold at this full labor-value. Then no profit can come out of any amount of such buying and selling. A change in the value of the commodity bought and hold, for instance, the rise in cotton in consequence of the American Civil War, may explain how profits arise in a few solitary instances. But commodities do not always rise in value, they generally fluctuate about a certain average value and price. What is gained now is lost hereafter. With our supposition of equal exchanges, profits are impossible.

And yet, we see every day that profits, and very large profits, are made by some people. In order to account for this, let its begin by looking at the form of the transaction which produces profits. Hitherto we have dealt with independent producers, who, under a system of social division of labor, sell what they do not want, and buy what they do want for their own use. But now the producer appears as a man who enters the market, not with produce, but with money, and who buys, not what he wants, but what he does not want for his own use. He buys, in one word, in order to re-sell what he has bought. But to buy 20 tons of pig-iron, or 10 bales of cotton for £100, and to re-sell them for £100 would be an absurdity. And indeed we find our businessman does not commit such an absurdity. He buys his commodities, say for £100, and re-sells them, on an average, say for £110. But how is this possible?’ We still assume that all commodities are bought and sold at this full labor-value. Then no profit can come out of any amount of such buying and selling. A change in the value of the commodity bought and hold, for instance, the rise in cotton in consequence of the American Civil War, may explain how profits arise in a few solitary instances. But commodities do not always rise in value, they generally fluctuate about a certain average value and price. What is gained now is lost hereafter. With our supposition of equal exchanges, profits are impossible.

Very well. Suppose now, exchanges were not equal suppose every seller to be able to sell his article 10 per cent. above its real value. Then, what every one of them gains as a seller, he loses again as a buyer. Again, let every buyer buy at 10 per cont. below the value of the article bought. What he gains as a buyer, leaves his hands again as soon as he turns seller.

Suppose, finally, profits to be the result of cheating. I sell you a ton of iron for £5, while it is worth no more than £3. In that case, I am £2 richer, and you are £2 poorer. Before the bargain you had £5 in money and I had £3 in value of iron—together £8. After the bargain you hold £3 in iron and I £5 in gold—together again £8. Value has changed hands, but it has not been created, and profits to be real must be value newly created. It is self-evident that the totality of the capitalist class of a country cannot cheat itself.

Thus if equivalents are exchanged, profits are impossible; and if non-equivalents are exchanged, profits are equally impossible. Yet they exist. How is this economical enigma to be solved?

Now it is evident that the increase or value which appears in the re-sale as profits, and which transforms money into capital, cannot arise from that money, for both in the buying and in the selling the money merely represents the value of the commodity bought and sold (we assume here again all exchanges to be exchanges of equivalents). Nor can it arise from the value of the commodity which is supposed to be bought and sold at its full value, neither more nor less. The increase of value can, therefore, arise only out of the actual use of the commodity in question. But how can new value arise from the use, the consumption of a commodity? This would only be possible if our businessmen had the good luck to find in the market a commodity endowed with the special quality that its consumption would be, ipso facto, a creation of wealth.

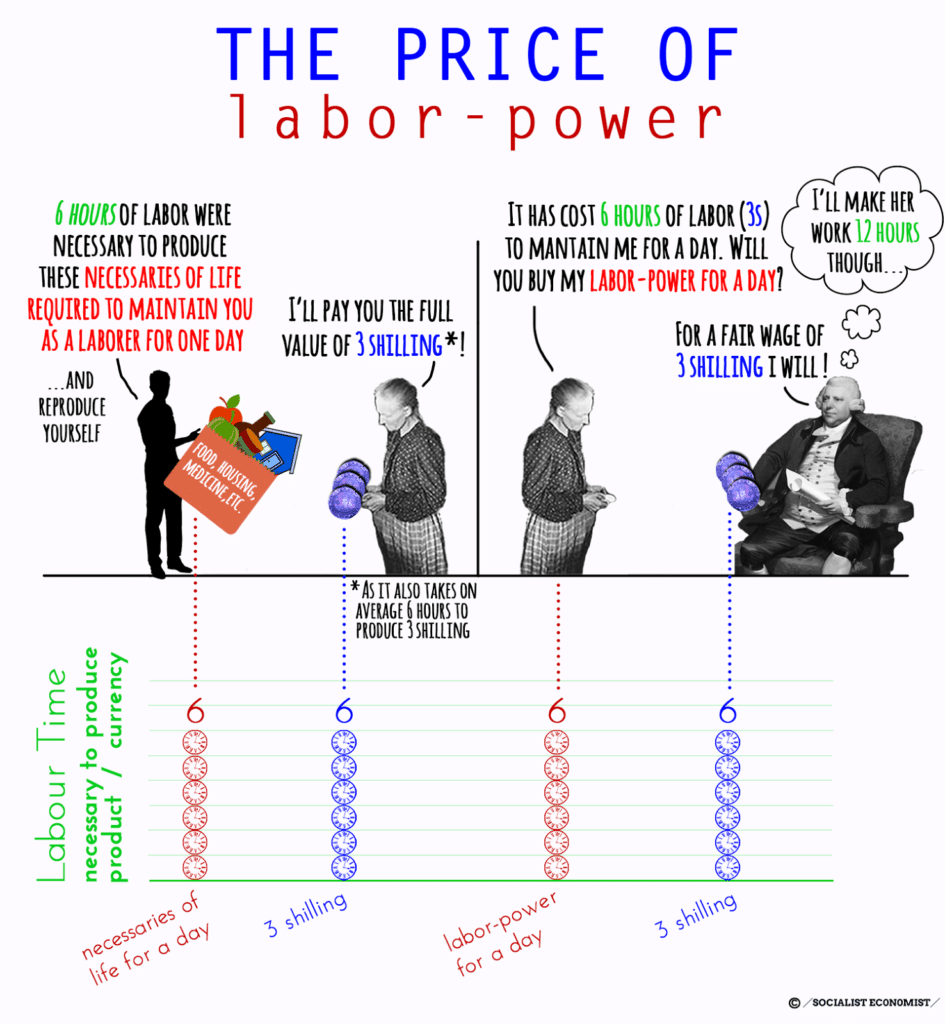

And that commodity exists in the market. That commodity is called by economists Labor but Marx, more correctly, calls it Labor-power, and this expression I shall use here.

The existence of Labor-power as a commodity in the market, pre-supposes that it is sold by its owner, and, therefore, that the latter is a free agent, who sells his Labor-power to another free agent, both dealing with each other voluntarily and on an equal footing. It presupposes, moreover, that the sale is for a limited time only, as otherwise the seller, from a free agent, would become a slave. And, finally, it presupposes that the owner of the labor-power, the future laborer, is not in a position to sell commodities, the produce of his own labor, but that he is compelled to sell, instead, his capacity to labor. Thus, our businessman lives in a society where he meets the free laborer in the market—free not only to dispose as a free agent of his labor-power, but free also from the possession of all means by which he himself could transform the labor-power into actual labor, into work. A free man—but free also from the ownership of victuals, of raw material, and of tools, unless, perhaps, the simplest and cheapest.

That our two “free agents” are enabled to meet each other in the market, is evidently not a phenomenon produced by simple nature. It is the result of a long historical process, the result of many previous revolutions of society. And, indeed, it is only since the latter half of the fifteenth century that we find the mass of the population being gradually turned into such “free” sellers of their own labor-power.

Now labor-power, as a saleable commodity, has a value and a price like other commodities. Its value is determined, as in all other cases, by the labor necessary for its production, and therefore its reproduction. The value of labor-power is the value of the necessaries of life required to keep the laborer in a state fit for his work, and, as he is subject, to natural decay and death, to reproduce and to continue the race of sellers of labor-power. The extent and composition of these necessaries of life varying very much for different epochs and countries, are yet more or less fixed for a single country, and a given period. The standard of life established there among the working class settles it.

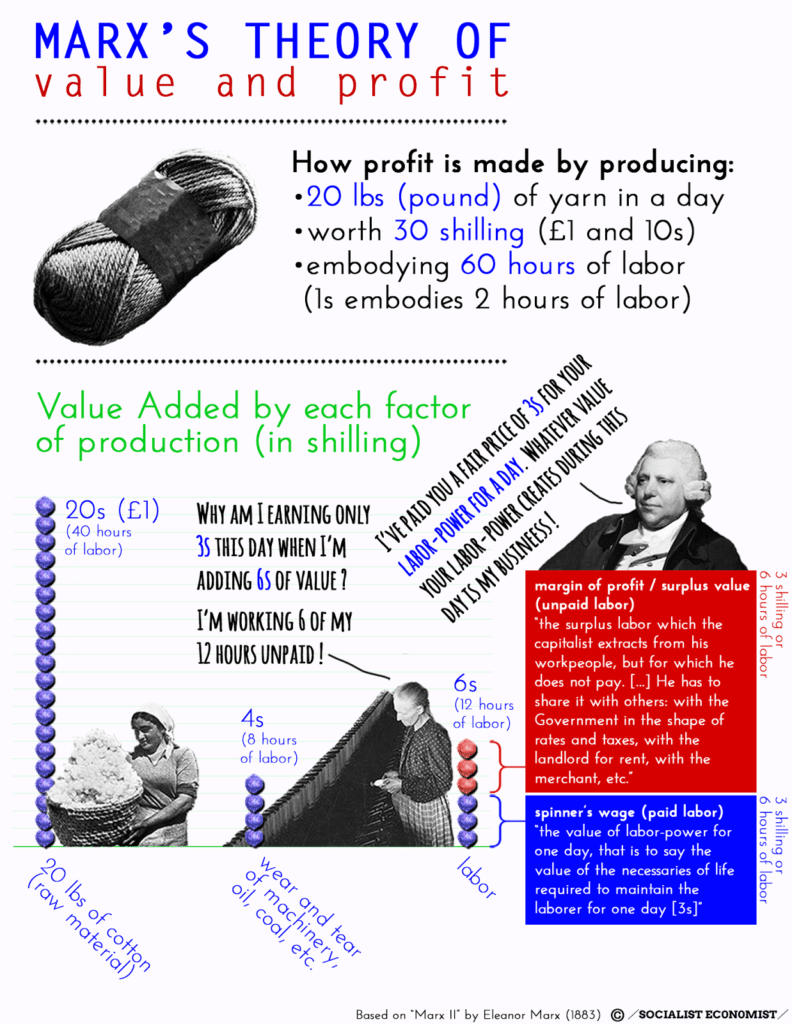

Let us now see how our business-man consumes the labor-power he has bought. Suppose the work to be done is cotton-spinning. The hired laborer is introduced into the factory and there finds all the requisites for his work: cotton in the state of preparation which renders it fit for spinning into yarn, machinery, etc. Suppose the normal production of’ a spinier per hour to be one and two-third pounds of yarn, for which one and two-thirds pounds of cotton are required (leaving unavoidable waste out of the question). Then in six hours our spinner will turn 10 lbs. of cotton into 10 lbs. of yarn. If the value of the cotton be 1s. per lb. the 10 lbs. of yarn will represent in value of cotton 10s. Assuming the wear and tear of machinery, oil, coal, etc., during these six hours to represent a value of 2s., that will raise the value of the yarn to 12s. There remains to be known how much is added to its value by the labor of’ the spinner.

If six hours’ labor suffice to keep the laborer for a full day, including the night, that is no reason why the laborer should not work a whole day.

Suppose the value of labor-power for one day, that is to say the value of the necessaries of life required to maintain the laborer for one day to be 3s. Suppose, again, that this sum of necessaries, or the 3s. representing it in money, are equivalent to, or embody the labor of one worker for six hour’s. Our spinner, then, at the end of six hours work has added a value of 3s. to the yarn, so that its total value is I5s. Our businessman, now a master cotton-spinner, has in his yarn the full equivalent of his outlay: 10s. for cotton, 2s. for wear and tear, etc., 3s. for labor-power employed—total 15s. He is repaid in the value of’ his yarn for every fraction of a farthing he has advanced. But there is no margin for any profits. But our master cotton-spinner or would-be capitalist very soon informs us that this is not the way at all in which he understood his bargain. If six hours’ labor suffice to keep the laborer for a full day, including the night, that is no reason why the laborer should not work a whole day. He, the master, has hired the man’s labor-power for a day. He, therefore, is entitled to have a full day’s work out of him. The value of the labor-power and the value of the labor it is capable of performing may be different things. If they are, then the worker is entitled to have the first and the employer is equally entitled to pocket the second. Labor is not only the source of wealth, and of value, but it is also the source of more value than that of the labor-power required to perform that labor. And that is the very reason why the employer has hired the laborer.

But there is no margin for any profits. But our master cotton-spinner or would-be capitalist very soon informs us that this is not the way at all in which he understood his bargain. If six hours’ labor suffice to keep the laborer for a full day, including the night, that is no reason why the laborer should not work a whole day. He, the master, has hired the man’s labor-power for a day. He, therefore, is entitled to have a full day’s work out of him. The value of the labor-power and the value of the labor it is capable of performing may be different things. If they are, then the worker is entitled to have the first and the employer is equally entitled to pocket the second. Labor is not only the source of wealth, and of value, but it is also the source of more value than that of the labor-power required to perform that labor. And that is the very reason why the employer has hired the laborer.

Instead of discharging his workman after the six hours he makes him work say another six hours, twelve in all (we will not at present mind the Factory Acts). Then after twelve hours’ work we have the following result:

| 20 lbs. of cotton at | 1s. £1 0 0 |

| Wear and tear twelve hours, twice | 2s 4 0 |

| Labor added in twelve hours | 6 0 |

| Value of 20 lbs. of yarn | £1 10 0 |

| OUTLAY OF EMPLOYER: | |

| 20 lbs. of cotton, as above, | £1 0 0 |

| Wear and tear | 4 0 |

| Wages paid to spinner | 3 0 |

| Margin for profit | 3s |

Editorial note: These numbers may seem to not add up, but they do. Here’s how you should read them (click to expand).

The enigma is solved, the possibility of profits explained. Money has been transformed into capital.

The above simple transaction between employer and workman not only explains the genesis of capital, but it forms the groundwork of’ our whole system of production (called by Marx capitalist production). It forms the gist of Marx’ whole book, and is at this moment perfectly understood by the Socialists of the Continent, especially by those of Germany and Russia.

I said the 3s. were not profit, but a margin for profit. The sum thus entering the pocket of the capitalist Marx calls surplus value. It is not all profit, but it includes the employer’s profit. He has to share it with others: with the Government in the shape of rates and taxes, with the landlord for rent, with the merchant, etc. The laws that regulate this repartition will be explained in the third book (2nd volume) of “Das Kapital,’’ which, together with the second, the author has left in manuscript. It will be published in German as soon as possible. Thus, all classes of society not composed of actual and immediate producers of wealth (and these, in England at least, are almost exclusively wages-laborers), all classes, from kings and queens to music-masters and greengrocers, live upon their respective shares of this surplus-value. In other words, they live upon the net produce of the surplus labor which the capitalist extracts from his workpeople, but for which he does not pay. It matters not whether the share of surplus-labor falling to each member of society not actually a producer is granted as a gift by Act of Parliament from the public revenue, or whether it has to be earned by performing some function not actually productive. There is no other fund out of which they can be paid, but the sum total of the surplus value created by the immediate producers, for which they are not paid.

Thus, all classes of society not composed of actual and immediate producers of wealth (and these, in England at least, are almost exclusively wages-laborers), all classes, from kings and queens to music-masters and greengrocers, live upon their respective shares of this surplus-value. In other words, they live upon the net produce of the surplus labor which the capitalist extracts from his workpeople, but for which he does not pay. It matters not whether the share of surplus-labor falling to each member of society not actually a producer is granted as a gift by Act of Parliament from the public revenue, or whether it has to be earned by performing some function not actually productive. There is no other fund out of which they can be paid, but the sum total of the surplus value created by the immediate producers, for which they are not paid.