The article “Palestinian Economic Dependency on Israel,”1 published on the Alternative Information Center’s website on 23 September 2010, briefly mentioned official development assistance (ODA) to Palestinians.2 This article will elaborate more fully on foreign aid to the Palestinians, particularly in relation to the Israeli economy.

Trade Deficit

The Occupied Palestinian Territory (OPT) has an increasing trade deficit with Israel, which reached 44% of gross national income (GNI) in 2008, the latest year for which trade data is available.3 The total Palestinian trade deficit was 55% of GNI. Comparing these two numbers shows that Palestinians are dependent on the Israeli economy for trade and even for most of their consumption. It is an unsustainable situation for any economy to carry a trade deficit that is about half the volume of the economy for an extensive period of time. When a country has a trade deficit, it means that money is flowing out of the country. If these money flows are not compensated by other sources, wealth will flow out of the country. Mainstream economic theory says that the local currency will then devalue,4 making it more expensive to import foreign goods and services while other countries will find it relatively cheap to import goods from this country. According to mainstream theory, this situation would eventually lead to a stabilized trade balance. In practice, however, it is not that simple because exchange rates are also used as political instruments. Exchange rates are much less flexible than theory assumes. So, in practice this is not a useful “tool” to deal with a trade deficit.

Even if this economic theory worked in practice, it would not be a solution for the Palestinian trade deficit. The lion’s share of the Palestinian trade deficit is a trade deficit with Israel (79%), while the OPT do not have their own currency but are obliged to use the Israeli currency (NIS). In 2008 the economy of the OPT was not even 3% of the Israeli economy,5 so Palestinian trade with countries other than Israel does not have a large impact on the exchange rate of the NIS with other currencies. So, the natural adjustment via the exchange rate does not work for the Palestinians.

Trade deficits can be paid for with foreign currency reserves. Since the OPT has neither its own currency nor its own central bank, the use of foreign currency reserves is negligible.

Another way to pay for the trade deficit is by borrowing money and increasing national debt. This is sustainable only for a short period of time because if the trade deficit remains, the debt will continue to grow. For highly indebted countries, it is very difficult if not impossible to borrow more money. Conditions attached to the borrowed money such as usually imposed by the International Monetary Fund (IMF) and the World Bank are very likely to include a change in policy to reach a situation of no trade deficit. The Palestinian Authority, however, cannot borrow significant amounts of money because it lacks the income sources to repay its debt. It is not a sovereign state and is thus not trusted by investors to be a reliable debt holder.

Foreign investment can also cover the trade deficit. This is the case in the United States. The US consumes more than it produces, so American imports exceed American exports and a trade deficit results. Foreign investors, of which the Chinese government is very important, buy for instance (parts of) US companies with which the US pays for its trade deficit. Because of Israeli policies towards the OPT, e.g. imposing closures, confiscating land, and destroying buildings and infrastructure, the investment climate in the OPT is unappealing, making it difficult to find foreign investors.

The OPT has a different source of money that is used to pay for its trade deficit: foreign aid.

Aid to the Palestinians

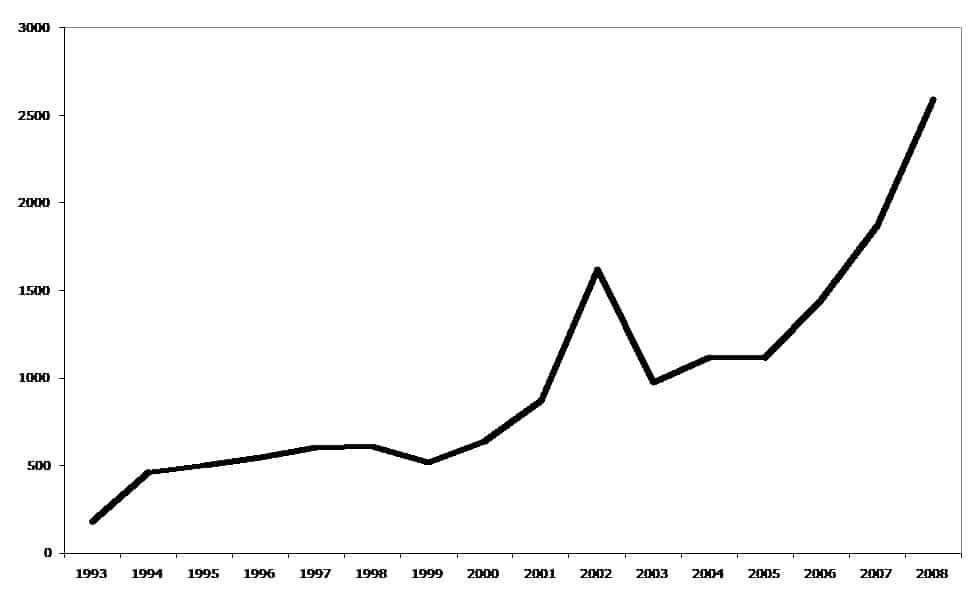

Figure 1 illustrates how official development assistance has grown from 179 million dollars in 1993 to 2.6 billion dollars in 2008, an increase of 1,350%. With the signing of the Oslo Accords in September 1993, the international community was eager to assist in creating a viable Palestinian economy. Development aid was given to the Palestinians in order to ease the transition process from occupation to independence.6 Figure 1 shows that aid increased by 157%, from 179 million dollars in 1993 to 460 million dollars in 1994.

Figure 1. Net Official Development Assistance (in million US$)

The start of the Second Intifada at the end of 2000 again led to an increase in foreign aid. While during the Oslo Process in the 1990s the lion’s share of aid was development aid (a ratio of 7:1), during the Second Intifada this was mainly humanitarian aid (a ratio of 5:1).7 In order to prevent a humanitarian crisis, NGOs provided food, shelter, and other basics to Palestinians in need rather than building the economy. This resulted in an increase in official aid of 213% from 516 million dollars in 1999 to 1.6 billion dollars in 2002, of which the largest increase took place between 2001 and 2002, when the humanitarian situation was worse than in previous years. After a decrease of 40% in 2003, official development assistance started to grow again in 2004.

Although in 2006 the United States and Israel decided that the democratically elected Hamas government had to be financially boycotted, a decision followed by the European Union, foreign aid increased by 30% in that year. The reason for this was that the United States and the European Union were afraid that the boycott of Hamas would lead to a humanitarian crisis among the Palestinian population, leading them to directly funnel even more money to the Palestinians through the Temporary International Mechanisms (TIM).8

As the article “Palestinian Economic Dependency on Israel,”9 described, the Fayyad government in the West Bank designed the Palestinian Reform and Development Plan (PRDP), a neoliberal program for the reform in the West Bank which made donors so enthusiastic that they pledged to donate 7.7 billion dollars. The increased confidence in the West Bank led to a further increase in aid starting in 2007.

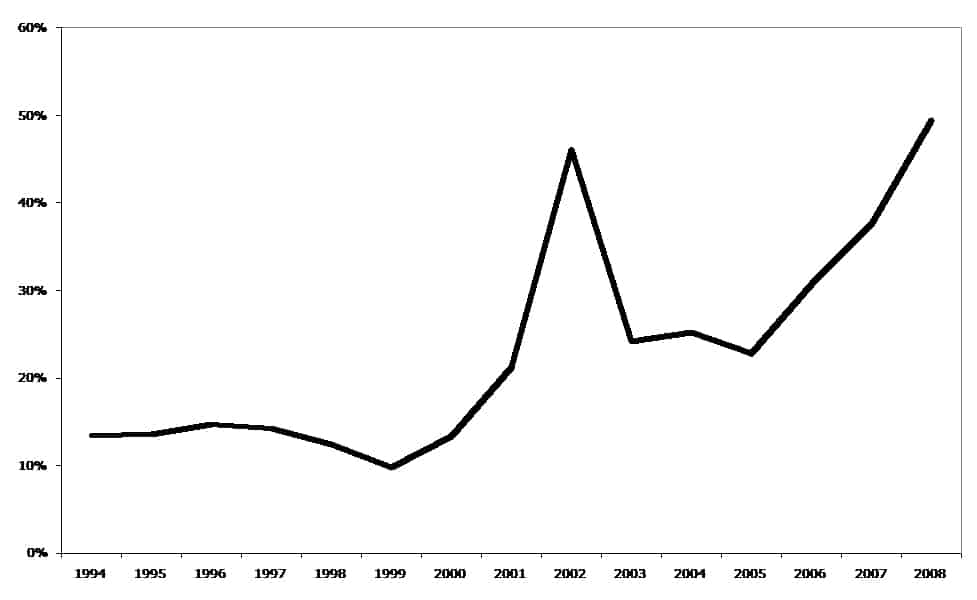

Figure 2 illustrates how, with some ups and downs, aid has become a larger and larger share of GNI between 1994 and 2008. In this period of 15 years, aid increased from 14% of the GNI in 1994 to 49% of GNI in 2008. Since the first year of the Second Intifada, aid has been at least 20% of GNI. As explained above, the humanitarian situation worsened in 2002. This led to an enormous increase in aid, while the GNI decreased by 14%. As a result, official development assistance reached 46% of GNI, a remarkably high percentage especially when considering that official development assistance is only a share of total aid given to Palestinians. The decrease in official aid in 2003 led to an increase in the share of GNI that represented ODA. The fact that foreign aid increased faster than GNI eventually resulted in a 49% share of GNI in 2008. With the promised aid to Gaza following Israel’s 2008-2009 military attack, the pledged aid to support the PRDP, and the fact that there has not been any incentive to make the Palestinian economy grow faster, it is very likely that aid as a percentage of GNI would be even higher for 2009 and probably also for 2010.

Figure 2. Net Official Development Assistance as a % of GNI

Aid to the Palestinians and the Israeli Economy

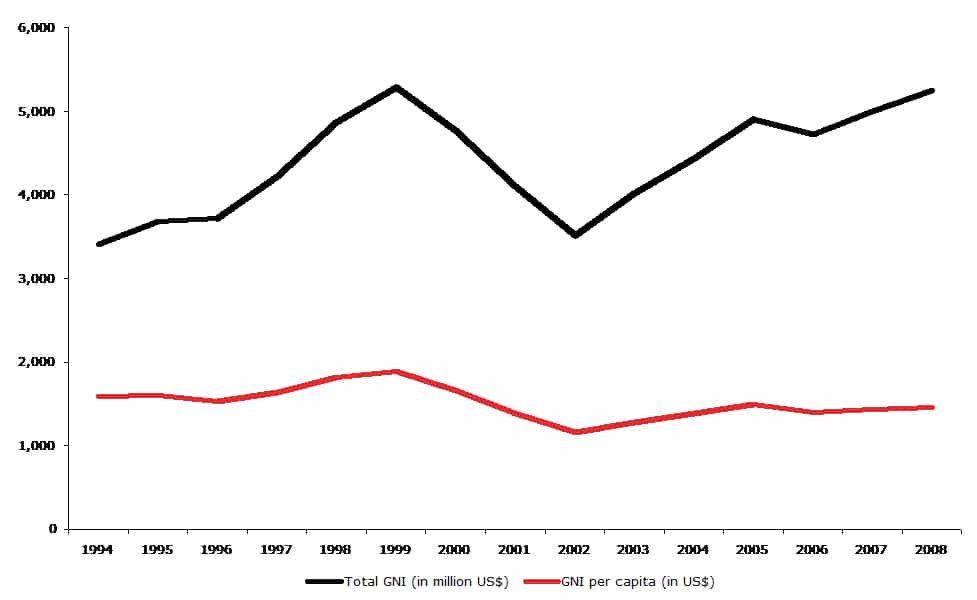

With all the aid given to the Palestinians in the previous decades, one would expect that the economy would have grown and that by now the Palestinians would be self-sufficient. The opposite is true. Although in several years Palestinian GNI has grown, this growth should be attributed to the population growth. As is shown in figure 3, GNI per capita has in fact decreased in this period of 15 years, from $1,590 in 1994 to $1,459 in 2008. Part of the aid might have covered up the population growth in this period, but the amounts of aid given to the Palestinians are simply too large for this to have been the only destination of the aid. While in the period between 1994 and 2008 ODA was 15.5 billion dollars, in the same period total GNI increased by only 1.8 billion dollars. For the years 1995 until 2008 the cumulative increase in GNI compared to 1994 is 14.8 billion dollars. If this total increase in GNI would be attributed to foreign aid, there would have been no normal economic growth. Which would be a strange situation indeed. Furthermore, ODA represents only a share of total aid given to the Palestinians, meaning that total aid given in this period is (much) higher than the cumulative income growth. Therefore, it seems that part of the aid has vanished.

Figure 3. Gross National Income (total and per capita)

A share of the aid given to Palestinians is used to construct buildings and infrastructure. During the past decades, Israel has put a lot of effort in destroying these buildings and infrastructures for supposed “security reasons.” The response of the donors that paid for these buildings and infrastructure is surprisingly not to demand compensation from the Israeli government. Instead, donors on the whole rehabilitate and rebuild what Israel destroys. While foreign aid is spent on such rehabilitation, this action does not lead to economic growth.10

Another part of the aid is paid to Israel as tariffs on imported goods and services for the Palestinians, or used to buy goods and services for the Palestinians in Israel. This share of aid therefore flows directly into the Israeli economy and is most important for the contention of this article.

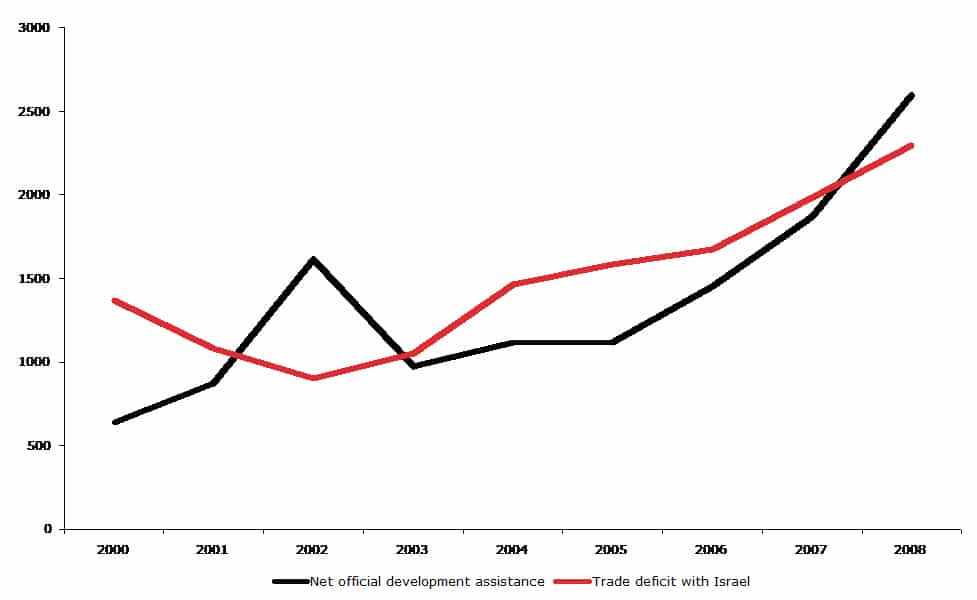

Figure 4 compares the trade deficit with Israel with net official development assistance. Apart from 2002, in which the Second Intifada caused development aid to be almost doubled and trade with Israel to fall to a low level, there seems to be a correlation between the two. The Pearson coefficient shows a correlation coefficient of 0.71. With 1.0 being perfect positive correlation and 0.0 being no correlation, 0.71 is quite a large number. One could draw the conclusion that on average 71% of aid given to the Palestinians ends up in the Israeli economy, meaning that, of the more than 12 billion dollars of foreign aid given to the Palestinians between 2000 and 2008, 8.7 billion dollars ended up in the Israeli economy. It also means that a larger share of the aid that is actually meant for the Palestinians ends up in the Israeli economy than in the Palestinian economy. This sounds very disturbing, because it demonstrates that Israel has subverted the purpose of the aid and has erected a system which steals most of the benefits of aid from the Palestinians.

Figure 4. Net Official Development Assistance and Trade Deficit with Israel

The Israeli economy is much larger than that of the Palestinians. The Palestinian trade deficit with Israel accounts for about 1% of Israeli gross domestic product (GDP) on average.11 This means that the aid which ends up in the Israeli economy contributes less than 1% to Israel’s GDP. This does not seem to be much, but we are talking about billions of dollars flowing into the Israeli economy for free during the last decade. Furthermore, foreign aid seems to be increasing, meaning that every year more foreign aid will flow into the Israeli economy.

Although for now this is the most accurate estimation we can make given the existing data, some remarks should be made.

The first distortion is that the data used for aid represent the net official development assistance as calculated by the World Bank. This includes only a share of total aid to the OPT. This excludes, for instance, budget support for the Palestinian Authority. It also excludes aid sent to Islamic charities by Arab states, because this is not reported to the World Bank or by the UN. No organization documents all aid provided to the Palestinians.12 So, the Pearson coefficient only represents part of the aid that is given to the OPT.

Another distortion is that the trade data are collected from the Palestinian Central Bureau of Statistics (PCBS) and that PCBS calculations do not include East Jerusalem. Trade between East Jerusalem and Israel is therefore not measured as trade between the OPT and Israel. Hence, the trade deficit can be either larger or smaller than what is derived from PCBS data. Furthermore, the situation in the Gaza Strip makes it very difficult to collect data that truly represents the current reality. There is always a margin of error for data collected from the Gaza Strip. Since the PCBS is the only source to have data available on total Palestinian imports from and exports to Israel, the best data available are used. Due to the continuous border closures of the Gaza Strip, trade between the Gaza Strip and Israel is very limited.

By only looking at the trade deficit with Israel, money that flows into the Israeli economy because it is spent as tariffs for imported goods and services is not taken into account. Israel is obliged to transfer tariffs collected for goods and services imported to the OPT and other taxes it collected on behalf of the Palestinian Authority to the Palestinian Authority. However, Israel is allowed to deduct money from these funds. These deductions are, for instance, costs that Israel said it incurred to collect the money.13 Israel has also frequently delayed these transfers to the Palestinian Authority. Since Israel and the United States decided to financially boycott the democratically chosen Hamas government, Israel has not transferred any of these funds to the Hamas government in Gaza. According to the annual reports of the Palestinian Authority Ministry of Finance,14 gross clearance revenues have not decreased since the election of Hamas. Israel has continued transferring money to the Fayyad government in the West Bank.

Furthermore, many international NGOs have their offices in Jerusalem and their employees thus live in Jerusalem, paying rent, buying groceries, and spending time in the city. Thus, a large part of their incomes, which are paid for by donor money, is spent in the Israeli economy. This share of foreign aid that ends up in the Israeli economy is not taken into account when comparing foreign aid with the trade deficit.

Another distortion is that Palestinians working in Israel are very likely to spend money in Israel. Their incomes are included in Palestinian GNI but these expenses are not counted as trade, meaning that this money flows into the Israeli economy is also not included in the calculations above.

Foreign aid to the Palestinians comes in foreign currency. When buying goods and services in the OPT or in Israel, this foreign currency has to be exchanged for NIS, because that is the currency used in both the OPT and Israel. As a result, the foreign currency reserve in the Israeli central bank increases. This reserve can be used by Israel to pay for its trade deficit if it has a trade deficit, but it also functions as an emergency stock or a means of strengthening the NIS. This is another way in which aid contributes to the Israeli economy, but which is not included in the calculations above.

Finally, the Pearson is a flawed statistical tool for dealing with such a complex relation as aid compared to trade deficit. It does not indicate causality, but only correlation, which could also stem from a third factor not considered in this article. The Pearson coefficient was calculated based on only nine data points (due to a lack of historical data on GNI and aid), which additionally weakens its statistical significance.

It follows from the above that the trade deficit is likely to be either higher or lower than can be calculated from the data available at the PCBS. On the other hand, foreign aid is higher than the data from the World Bank suggests. The share of foreign aid that actually ends up in the Israeli economy can therefore be either somewhat smaller or somewhat larger than the 71% calculated above. Nevertheless, the available data indicates that 71% is as close to the real number as we can get. Hopefully more detailed data will be published in the future that will allow for a more accurate estimate of the proportion of aid that is being subverted by Israel.

1 De Beer, N., (2010), “Palestinian Economic Dependency on Israel,” The Alternative Information Center.

2 This is calculated by the World Bank and represents only a part of the aid given to the Palestinians. This will be discussed later in this article.

3 Data in this article referring to trade or income is derived from publications of the Palestinian Central Bureau of Statistics (PCBS) website: www.pcbs.gov.ps.

4 Based on the precondition that exchange rates are allowed to float. If the exchange rate is fixed, the government of the country with the trade deficit (A) should buy local currency and sell the currency of the country with which it has a trade deficit (B) in order to keep the exchange rate fixed. When country A runs out of the currency of country B, the currency of country A would be devalued. If not, the exchange rate will become unsustainable and a black market for the currency will emerge.

5 Palestinian GNI is compared with Israeli GDP. GNI is used for the OPT because that also includes budget support. GDP is used for Israel because that is the most frequently used measure to define the size of an economy. Palestinian GNI is derived from the PCBS website (www.pcbs.gov.ps) and Israeli GDP is derived from the ICBS website (www.cbs.gov.il). Since Palestinian GNI is higher than the GDP, the figure of 3% is actually an overestimation of the comparison between the two economies.

6 Hever, S., (2008), “The Economy of the Occupation. Political Economy of Aid to Palestinians under Occupation,” The Alternative Information Center, p. 12-13.

7 Le More, A., (2004), “Foreign Aid Strategy,” in: Cobham, D. and N. Kunafani, The Economics of Palestine — Economic Policy and International Reform for a Viable Palestinian State, Routledge, p. 210.

8 Erlanger, S. (2007), “Aid to Palestinians Rose Despite an Embargo,” The New York Times.

9 Supra 1.

10 An example of foreign aid that did not lead to economic development of the OPT is the Dutch government’s “investment” in constructing the Gaza Seaport. Although the Dutch government spent millions of dollars on this development project, the Gazans still do not have a seaport. For a more detailed description of the Gaza Seaport what went wrong, see: De Beer, N., (2010), “Destroyed Gaza Seaport: Why Doesn’t Dutch Government Demand Compensation from Israel?”, The Alternative Information Center.

11 This is a percentage of Israeli GDP. GDP is derived from the Israeli Central Bureau of Statistics website: www.cbs.gov.il.

12 Supra 6, at p. 20.

13 According to article 4 of Annex V of the Israeli-Palestinian interim agreement on the West Bank and the Gaza Strip, Israel deducts 3% of every transfer to the Palestinian Authority in order to cover administrative costs.

14 Table 1 of both the annual reports of 2006 and 2007 of the ministry of finance of the Palestinian Authority, at www.pmof.ps.

This article was first published by the Alternative Information Center on 26 September 2010 under a Creative Commons license.

| Print