In the current recession, state and local governments are struggling. As economic activity slumps and tax revenue dwindles, governments have fewer resources at their disposal. At the same time, there is growing demand for government services during hard economic times. As more people lose their jobs, there is a greater demand for unemployment benefits. As more low-income families cannot afford healthcare, there is a growing demand for coverage under Medicaid. In short, governments are being asked to do more with less.

Predictably, state governments are discovering large gaps in their operating budgets. During the last fiscal year (FY 2009), 45 states plus the District of Columbia reported budget shortfalls totaling $110 billion. The situation has only gotten worse, with nearly every state reporting a sizeable budget shortfall in the current fiscal year (FY 2010). The total budget shortfall is estimated at nearly $170 billion. In several states, such as California and Nevada and New York, the size of the current budget gap is more than one-third of the state’s general fund.1

State governments are typically forbidden by law or tradition to run deficits. So, public officials must make difficult decisions in order to balance their budgets. Some states have accumulated sizeable reserves in their so-called “rainy day” funds. The funds are available for balancing their budgets, but these resources are finite and may only alleviate part of the problem.2 Another way to increase revenue is to raise taxes. The states that have done so during the current recession have focused their tax increases mainly on top earners, individuals making more than $150,000 a year.3 However, tax increases of any kind are typically going to be an unpopular political option.

Alternatively, state governments can reduce expenditures by cutting programs or reducing benefits, and in the current recession, many states are doing just that. Early childhood education, such as pre-kindergarten school, has been a budget reduction target for several states.4 Others have cut coverage or reduced benefits under state-sponsored healthcare programs like Medicaid.5 When these changes have failed to fill budget holes completely, states have resorted to direct layoffs of public employees. Since the beginning of this recession, there have been announcements of more than 110,000 positions being cut by state and local governments due to budget constraints.6

These actions may improve the budget situation for states, but they can be painful for the broader economy. Spending cuts and tax increases both restrict demand and increase unemployment. Layoffs deprive people of their jobs and their source of income. When the economy is already suffering from a lack of consumer demand in a recession, budget belt-tightening can make matters worse. These austerity measures are said to be “pro-cyclical” because they magnify the downward economic trends of a recession.

Still, state legislatures must find a way to balance their budgets, often with few options available. The last time state governments faced a similar situation, after the 2001 recession, they relied most heavily on spending cuts (42 percent), with some use of tax increases (14 percent) and rainy day funds (10 percent). States also made use of federal fiscal relief (10 percent), since the national government is less restricted from running deficits than state governments.7

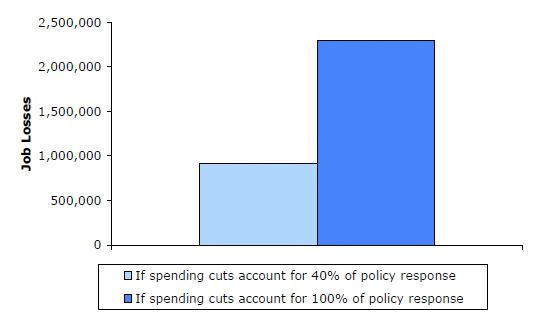

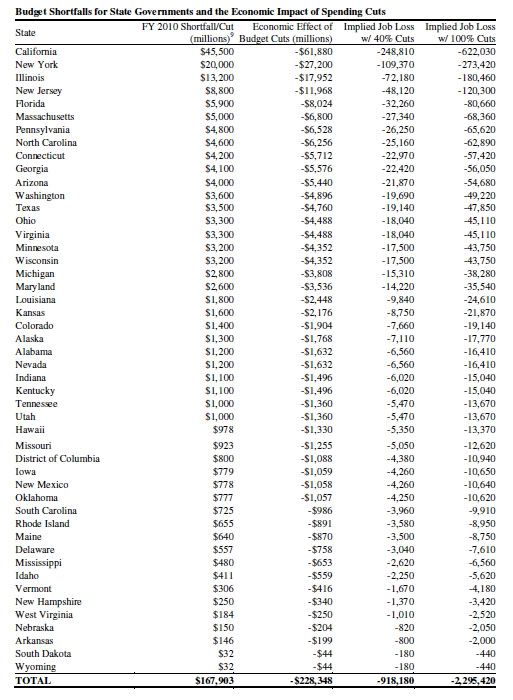

If states react in a similar fashion during the current recession, how would spending cuts affect the national economy? If the states that face budget shortfalls in their current year budgets (FY 2010) utilize spending cuts with a similar frequency (40 percent), we would expect to see over 900,000 jobs lost (see Figure 1 and Table 1 below). This projection may be a conservative estimate, since the current recession has proven to be categorically more painful than the recession of 2001. Also, it should be noted that state and local governments may try to fill the remainder of their budget holes with tax increases, which would ultimately result in job loss that is greater than what is shown in the table, albeit considerably less than if they were to rely solely on spending cuts to eliminate their deficit.

Alternatively, it is entirely possible that governments may choose to enact spending cuts with greater frequency. They may find their “rainy day” funds depleted and their proposals for tax increases too unpopular. In this worst case scenario, if state legislatures remedied their budget shortfalls for the current fiscal year with only cuts in spending (100 percent), then the economic impact would be much worse — about 2.25 million jobs lost.8

Clearly, the outlook for state governments is not good, but the job loss from spending cuts is not necessarily inevitable. Federal fiscal relief, in the form of revenue sharing with state and local governments, provides an effective mechanism for staving off program cuts and workforce reductions. The money can be quickly injected into the economy through important public services such as health care and education. In the current recession, the budget woes of states are projected to get worse; the total budget shortfall is expected to expand even further in FY 2010.9 Accordingly, policymakers would do well to consider fiscal relief for state governments as an effective way to further stimulate the economy.

FIGURE 1

The Projected Impact of State Government Spending Cuts on National Employment

TABLE 1

Budget Shortfalls for State Governments and the Economic Impact of Spending Cuts

1 Lav, Iris J. and Elizabeth McNichol, “New Fiscal Year Brings No Relief From Unprecedented State Budget Problems,” Center on Budget and Policy Priorities, September 3, 2009.

2 Silverblatt, Rob, “States Draw Down Rainy Day Funds,” Stateline.org, August 27, 2009.

3 Gramlich, John, “State Tax Hikes Take Aim at Top Earners,” Stateline.org, September 2, 2009.

4 Dillon, Sam, “Recession Stalls State-Financed Pre-Kindergarten, But Federal Money May Help,” New York Times, April 8, 2009.

5 Vu, Pauline, “States Make Deep Cuts to Health,” Stateline.org, August 5, 2009.

6 Sherman, Matt and Nathan Lane, “Cut Loose: State and Local Layoffs of Public Employees in the Current Recession,” The Center for Economic and Policy Research, September 2009.

7 McNichol, Elizabeth, “States Heavy Reliance on Spending Cuts and One-Time Measures to Close their Budget Gaps Leaves Programs at Risk,” Center on Budget and Policy Priorities, July 29, 2004.

8 For this calculation, we first determined the hypothetical economic effect of closing each state’s budget shortfall with spending cuts (in dollars). We used a multiplier coefficient that economist Mark Zandi referenced in his testimony before Congress in July 2008 (available at Economy.com). Zandi estimates that federal fiscal aid to state and local governments has a multiplier effect of 1.36, that is, for every $1 lent to state and local governments, we should expect a $1.36 boost to the national economy in the following year. For our purposes, we used the negative of this coefficient (-1.36) as an estimate of the contractionary impact of government spending cuts that would result from withholding such relief. Then, in order to convert this economic effect (in dollars) into an employment number (in number of jobs lost), we divided by the total value of national GDP and multiplied by the total value of national employment. (Data on national GDP is available via the Bureau of Economic Analysis at bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm; data on national employment available via the Bureau of Labor Statistics at bls.gov/news.release/empsit.nr0.htm.)

9 Data on state budget shortfalls made available by the Center on Budget and Policy Priorities. Lav, Iris J. and Elizabeth McNichol, “New Fiscal Year Brings No Relief From Unprecedented State Budget Problems.”

Matt Sherman is a Research Assistant at the Center for Economic and Policy Research in Washington, D.C. This article was first published by CEPR in September 2009; it is reproduced here for educational purposes.