Shortly after the 1967 Middle East War, many economic boundaries for transactions between the Occupied Palestinian Territory (OPT) and Israel collapsed: both labor and goods could flow freely from the OPT to Israel and vice versa.

At the same time Israel started to control the external borders of the OPT. A customs union was imposed, meaning that Israel designed both internal and external economic policies without negotiating or consulting the Palestinians. These economic policies were designed to “serve Israeli political, military and economic interests as perceived at the time.”1 Furthermore, there was no agreement on who would receive which share of tariff revenues.2

In the 1990s the Oslo Accords resulted in a customs union that was no longer imposed on the OPT by Israel, but one that was mutually agreed upon.3 The economic protocol of the Oslo Accords, the Paris Protocol, gives the Palestinian Authority “all powers and responsibilities in the sphere of import and customs policy and procedures” with regard to certain goods and limited to certain quantities. The Israeli government has powers over the rest, meaning the vast majority of products. The way in which the economic relations between the OPT and Israel are stipulated in the Paris Protocol demonstrates that the OPT has a dependent position. This article will outline how the Palestinian economy is not only dependant on Israel de jure because of the Paris Protocol, but also de facto.

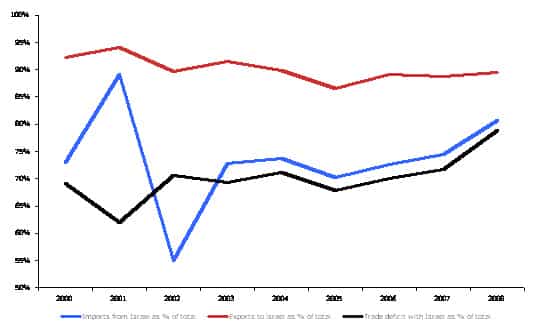

Although the Palestinian Authority has free trade relations with the EU, the EFTA, the US, Canada, and Turkey, and the Arab League agreed to preferential treatment of Palestinian products in 2004, approximately 90% of Palestinian exports go to Israel. Imports from Israel represent an increasing share of total imports to the OPT and reached around 80% in 2008. The share of the total trade deficit that represents trade with Israel is also increasing and was around 80% in 2008 (see Figure 1). This shows that, in its international trade, the OPT is very dependent on the Israeli economy.

Figure 1. Trade with Israel as Percentage of Total Palestinian Trade

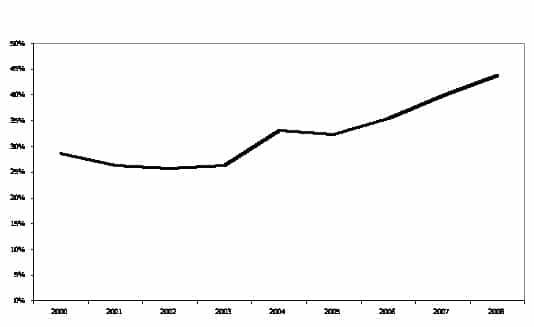

A good estimate for how deeply the Palestinian economy is actually dependent on the Israeli economy can be achieved through a simple calculation: measuring the Palestinian trade deficit with Israel as a percentage of the Palestinian gross national income (GNI).4 This shows how much of what is earned by Palestinians ends up in the Israeli economy. The results are shown in Figure 2.

Figure 2. Palestinian Trade Deficit as Percentage of Palestinian GNI

The Palestinian Central Bureau of Statistics (PCBS) trade data are used to calculate the Palestinian trade deficit with Israel. Palestinian GNI data from the PCBS website are also used. GNI is used rather than gross domestic product (GDP) because GNI also includes income from sources abroad, such as budget support for the Palestinian Authority and Palestinians working in Israel, which is not included in the GDP. So, GNI provides a more complete overview of the Palestinian economy than the GDP does.5 The trade deficit is used because that shows the difference in the money flows from the Palestinian economy to the Israeli economy and vice versa.6 It should also be noted that the PCBS data excluded East Jerusalem, which creates a significant distortion because East Jerusalem is the city with the highest per-capita income in the Occupied Palestinian Territories. Furthermore, because of the complex nature of the occupation, many transactions between Israelis and Palestinians are not registered and not recorded by the bureaus of statistics. Things like Israelis who shop or buy services in the West Bank and Palestinian workers in Israel who spend money in Israel while they are there are not included in the calculation and could alter the figures. Nevertheless, the figures from the Palestinian Central Bureau of Statistics can serve as an approximation of the dependency levels.

Figure 2 shows that Palestinian dependency on the Israeli economy increased by 52% between 2000 and 2008. The figure also shows that, during the Second Intifada, dependency decreased between 2000 and 2003. On the eve of the Second Intifada, which started at the end of 2000, Israel used economic pressure to hurt the Palestinians. One of these means of pressure by the Israeli government was the imposition of different sorts of distortions in the OPT, such as the closure of borders, curfews, and checkpoints. Another way to hurt the OPT economically was issuing only a vastly reduced amount of working permits for Palestinians to work in Israel and the Israeli settlements. The only way in which Palestinians could hurt the Israeli economy was through military attacks, which caused a recession in Israel. As a result of these hostilities, both economies were damaged. According to Arnon, the Israeli GNP was damaged by 8% during a three-year recession.7 This means that, without the Second Intifada, the Israeli GNP would have been 8% higher than it was in reality. In the West Bank and Gaza Strip, poverty and unemployment increased drastically.8 Between 1999 and 2002 the Palestinian GNI decreased by 34%. In the period 1994-1999 the average annual increase in GNI was about 9%. If this growth had continued until 2002, the GNI would have reached almost US $7 billion in 2002. This means that the Israeli attacks on the Palestinian economy actually resulted in a GNI that was 49% lower than without the Intifada. Even if a more modest growth rate of 4% per year is assumed, the actual GNI is 41% lower than it would have been without the Intifada.

Obviously, due to the closures imposed by Israel, trade between the OPT and Israel declined. Trade decreased relatively more than income in both the OPT and Israel. During the Second Intifada, Israel enforced stricter movement restrictions and border closures, making trade between the OPT and Israel difficult. According to the World Bank, movement of commercial trucks between the West Bank and Israel was only half of its pre-Intifada level.9 This, together with the imposed “back-to-back” system10 and sieges, resulted in a decrease in employment and income.

One of the reasons for the initial decrease in dependency on Israel during the Second Intifada might be that in 2001 official development aid declined “only” by less than 9%, while the indicators regarding trade between the OPT and Israel decreased by more than 20%. Another reason might be that the increased restrictions forced Palestinians to look for substitutes for their imports from Israel and some of the goods that were usually exported to Israel could function as these substitutes. For instance, certain types of vegetables that were usually imported from Israel might have been replaced by other locally produced vegetables that were usually exported to Israel. What is also possible is that the internal economy was not affected as much as trade. Since both imports and exports to Israel as a percentage of total imports and exports respectively grew between 2000 and 2001, it can be said that the OPT did not substitute its trade with Israel with trade with other countries, e.g. Jordan and Egypt. Israel also imposed closures on borders between the West Bank and Jordan and between the Gaza Strip and Egypt.

In 2002 the GNI reached a level only slightly above its 1994 level, while the GNI per capita was about $450 lower than in 1994. Trade between the OPT and Israel also reached its lowest value of the period for which data are available. In 2002 the main Palestinian cities, towns, and villages were reoccupied by Israel, while 24-hour curfews were imposed.11 This severely affected the economic situation in the OPT. Another negative influence on the Palestinian economy was the (administrative) detention of 15,000 Palestinians, as well as the killing and injuring of 1,970 and 21,500 Palestinians in 2000 and 2002.12

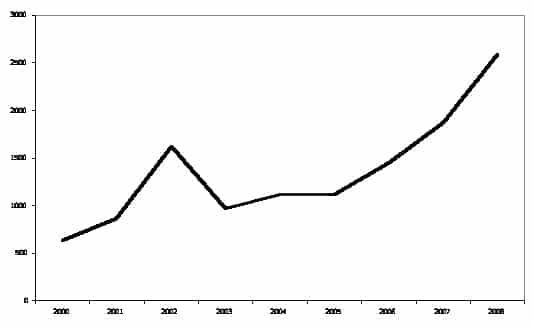

In order to prevent a humanitarian crisis, the international community decided to drastically increase aid to the Palestinians (see Figure 3). Net official development assistance,13 which is documented by the World Bank, increased 85% between 2001 and 2002. This was mainly in humanitarian aid, providing food and other basics to Palestinians who did not have the means to buy (sufficient quantities of) these goods. At the end of 2002 Israel issued more work permits for Palestinians who wanted to work in Israel or the illegal settlements. However, the still existing closures within the OPT and between the OPT and Israel resulted in only half of the issued permits actually being used. In the same period employment within the OPT increased. The majority of the newly created jobs were only temporary or seasonal, e.g. rehabilitation of destroyed/damaged buildings and olive harvesting. The rest of the created jobs were in the form of unpaid family labor.14

Figure 3. Net Official Development Assistance (in million US$)

In 2003, violence modestly declined while there were fewer imposed restrictions. The Israeli government had previously refused to transfer the taxes it collected on behalf of the Palestinian Authority to the PA, but paid the withheld money in 2003.15 This eventually resulted in a 14% increase of GNI and an increase in trade with Israel of approximately 17% in 2003, which led to an increase in dependency on the Israeli economy of 2%. The increase in GNI was probably the result of the huge increase in international aid in 2002.

In the beginning of 2004, military activity escalated significantly, particularly in the Gaza Strip.16 However, in 2004, the GNI increased by about 418 million dollars. The economy as a whole grew slightly because more economic activity took place in the West Bank, while the Israeli attacks were relatively more concentrated against the Gaza Strip. What also contributed to the increase in GNI is that ODA increased by 14% in 2004. In the same year, imports from Israel increased by about 438 million dollars and the trade deficit with Israel increased by about 413 million dollars. So, nearly the entire increase in national income was spent in the Israeli economy. This means that the Israeli economy actually gained from the decline in imposed restriction as begun in 2003. The trade deficit with Israel reached one third of Palestinian GNI in 2004.

In August 2005, Israel withdrew its settlers from the Gaza Strip and four smaller settlements in the West Bank, but continued to put pressure on the Palestinians. Israel obstructed economic activities, leading to a constant feeling of risk and uncertainty for the Palestinians.17 Restrictions and the ongoing construction of the Separation Wall still make trade within the OPT and between the OPT and Israel inefficient and expensive. However, according to PCBS data, the GNI per capita increased by 7% between 2004 and 2005. Dependency on the Israeli economy decreased slightly. ODA remained at the same level and was still an important source of stimulation of the Palestinian economy.

In January 2006, elections were held in the OPT. Hamas won a clear majority in the Legislative Council. Israel and the United States did not accept this democratic decision and decided to boycott the OPT. Budget support to the Palestinian Authority was cut, and the VAT, customs, and tariffs transfers from the Israeli government to the Palestinian Authority were frozen. By doing so, the Israeli government violated its obligations under the Paris Accords. The European Commission decided to make some direct money transfers to poor individuals and civil servants, while the World Bank transferred money directly to certain projects, both without using the Hamas government as an intermediary.18 As a result of the financial boycott, the GNI per capita decreased by 6%, falling further below its pre-Intifada level, and dependency on the Israeli economy increased further to 35%.

In 2007 the Fayyad government was installed in the West Bank. This led to a change in the way in which EU money was funneled into the Palestinian economy in the West Bank. This new mechanism started functioning in 2008. Fayyad designed a program to attract foreign investors to invest in the West Bank, the Palestinian Reform and Development Plan (PRDP) for 2008-2010. Being a former World Bank economist, most of his plans are in line with World Bank policies. At the donor conference in December 2007, donors pledged to donate 7.7 billion dollars, 2.1 billion dollars more than Fayyad asked for. Donors from the West are very interested in the PRDP because of its neoliberal agenda.19 The fact that a non-Hamas government was installed in the West Bank and that its prime minister was a former World Bank and IMF economist with a neoliberal agenda led to an increase in international trust in the West Bank economy, or at least in its government. ODA to the Palestinians increased by almost 80% between 2006 and 2008 to more than 2.5 billion dollars in 2008, while the GNI and the GNI per capita increased only by 11% and 5% respectively. In the same period the trade deficit with Israel increased by almost 40%, while dependency on the Israeli economy increased by 23%, to 44% of the GNI, in 2008.

So, in the period 2000-2008, dependency on the Israeli economy has increased by 52%, from 29% to 44% of the GNI in 2008. Over the years, at least part of the increase in GNI ended up in the Israeli economy, because, with GNI, dependency on the Israeli economy increased during those years. Since ODA has increased in this period as well, it seems that this has covered (part of) the trade deficit with Israel. This is a disturbing situation, because it means that a large part of foreign aid to Palestinians in practice actually benefits the Israeli economy.

1 Arnon, A. and J. Weinblatt, (2001), “Sovereignty and Economic Development: The Case of Israel and Palestine,” The Economic Journal, Vol. 111, No. 472, p F292.

2 Arnon, A., (2001), “Israeli Policy towards the Occupied Palestinian Territories: The Economic Dimension, 1967-2007,” Middle East Journal, Volume 61 Number 4 Aut 2007, p 575.

3 The Palestinians preferred a free trade agreement to a customs union, but Israel would not agree to a free trade agreement and told the Palestinians that Israel would only allow Palestinian workers to work in Israel if the Palestinians agreed to a customs union. Since many Palestinians worked in Israel, the Palestinians had no choice but to agree to the customs union.

4 In its 2003 Report on UNCTAD’s assistance to the Palestinian people, the United Nations Conference on Trade and Development (UNCTAD) has made a similar calculation, but with different data. UNCTAD used gross domestic product (GDP) rather than GNI, used a different period and used estimated data for 2001 and 2002.

5 The difference between GNI and GDP is between 200 and 600 million US dollars a year. So, when using GDP instead of GNI the Palestinian dependency on the Israeli economy is a couple of percentage points higher.

6 Because it is difficult to make exact calculations for the Gaza Strip, the PCBS data might not be as reliable as we would want. However, the PCBS data are the best data available. The PCBS is the only institution publishing data regarding total imports from and exports to Israel.

7 Supra 1, at p 593.

8 Ibid.

9 The World Bank, (2003), “Twenty-seven Months — Intifada, Closures and Palestinian Economic Crisis,” The World Bank, p 3.

10 Transport of goods between the OPT and Israel and within the OPT is subject to this system, meaning that goods crossing the Green Line or certain checkpoints in the West Bank have to be reloaded from one truck to another. This system is time-consuming and resulted in empty trucks driving from one place to another and is therefore quite expensive and inefficient.

11 Ajluni, S., (2003), “The Palestinian Economy and the Second Intifada,” Journal of Palestine Studies, Vol. 32, No. 3, p 66.

12 Ibid, at p 70.

13 This includes only a share of total aid to the OPT. This excludes for instance budget support for the Palestinian Authority. It also excludes the aid sent to Islamic charities by Arab states, because this is not reported to the World Bank or the UN. No organization documents all aid provided to the Palestinians. See Hever, S., (2008), “The Economy of the Occupation. Political Economy of Aid to Palestinians under Occupation,” The Alternative Information Center.

14 Supra 8.

15 The World Bank, (2004), “Four years — Intifada, Closures and Palestinian Economic Crisis”, The World Bank, p. 11.

16 Ibid, at p. 1.

17 Hever, S., (2008), “The Economy of the Occupation. Political Economy of Aid to Palestinians under Pccupation”, The Alternative Information Center, p. 15, 20-21.

18 Ibid.

19 Ibid, at p. 22-23.

This article was first published by the Alternative Information Center on 23 September 2010 under a Creative Commons license.

| Print