In most states in the United States, the rich have enjoyed ever lower rates of taxation while working people have suffered from inadequately funded public services. Calls for an end to this situation are more often than not met with statements by state officials and the wealthy themselves that higher taxes on the rich will prove counterproductive; the rich will just move to lower-tax states. In fact, research by the sociologist Christobal Young shows that this is largely an empty threat. The rich rarely move to escape high taxes.

The threat

Oregon offers one example of this threat. In 2009, the Oregon Legislature passed two measures (66 and 67) in an effort to boost funding for education, health and public safety. Measure 66 would raise taxes on high income Oregonians—couples earning over $250,000 a year and individuals earning over $125,000 a year. Measure 67 would raise taxes on profitable corporations.

Opponents of the measures succeeded in placing them on the ballot, hoping that they could scare voters into rejecting them. Almost all major business leaders threatened calamity if they passed. For example, Phil Knight, the CEO of Nike, not only gave $100,000 to the anti-measures campaign, he also wrote an article published in the Oregonian newspaper in which he said:

Measures 66 and 67 should be labeled Oregon’s Assisted Suicide Law II.

They will allow us to watch a state slowly killing itself.

They are anti-business, anti-success, anti-inspirational, anti-humanitarian, and most ironically, in the long run, they will deprive the state of tax revenue, not increase it.…

Reputable economists forecast 66 and 67 will cost the state thousands—maybe tens of thousands—of jobs, and that thousands of our most successful residents will leave the state.

Knight ended his letter with his own threat to leave the state if the measures passed. However, voters approved both measures, and Nike and Phil Knight remain in Oregon.

Young provides other examples of threats of “rich flight”:

As California considered similar taxes [to Oregon], policymakers cautioned “nothing is more mobile than a millionaire and his money”. In New Jersey, governor Chris Christie simply stated: “Ladies and Gentlemen, if you tax them, they will leave.”

The reality

Young studied tax return data, which shows where people live, for every million-dollar earner in the United States over the years 1999 to 2011. His data set included, “3.7 million top-earning individuals, who collectively filed more than 45 million tax returns.”

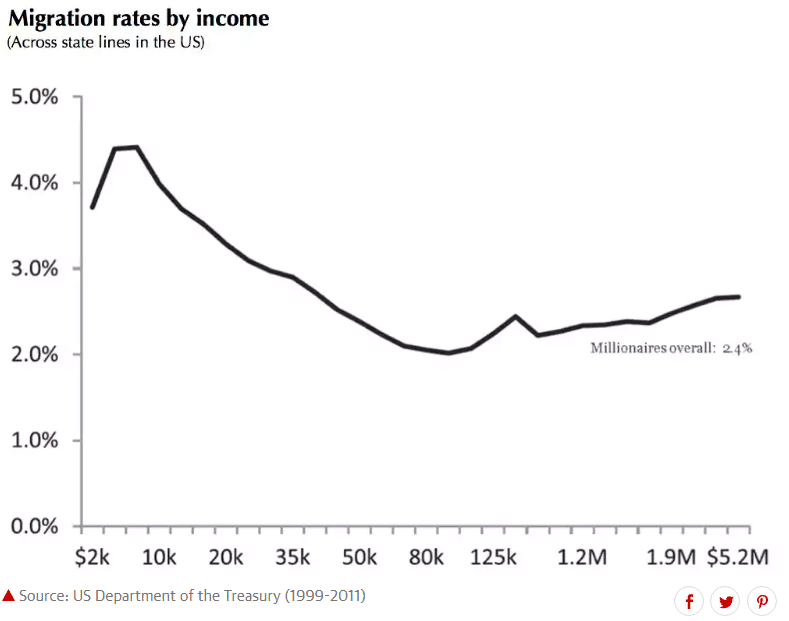

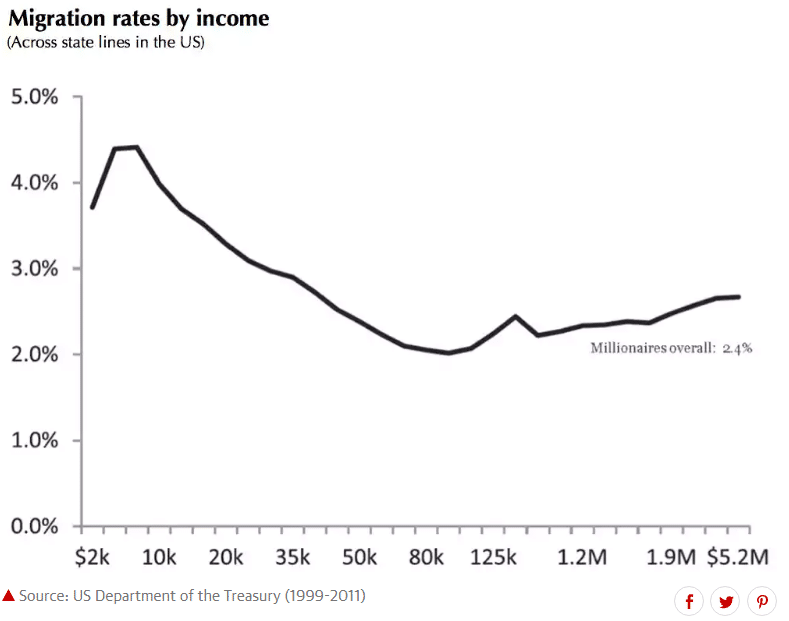

What he found was that the migration rate of millionaires was relatively low, with only 2.4 percent of millionaires changing their state residence in a given year. Perhaps not surprisingly, as we see below, poorer people tend to move from one state to another more often than do millionaires.

Young does note that “When millionaires do move, they admittedly tend to favor lower-tax states over higher-tax ones–but only marginally so. Around 15 percent of interstate millionaire migrations bring a net tax advantage. The other 85 percent have no net tax impact for the movers.”

Moreover, almost all the movement by millionaires to lower-tax states is accounted for by moves to just one state, Florida. Other low-tax states, like Texas, were not net-recipients of millionaires fleeing high-tax states. In short there is no real evidence that millionaires systematically move from high-tax states to low-tax states.

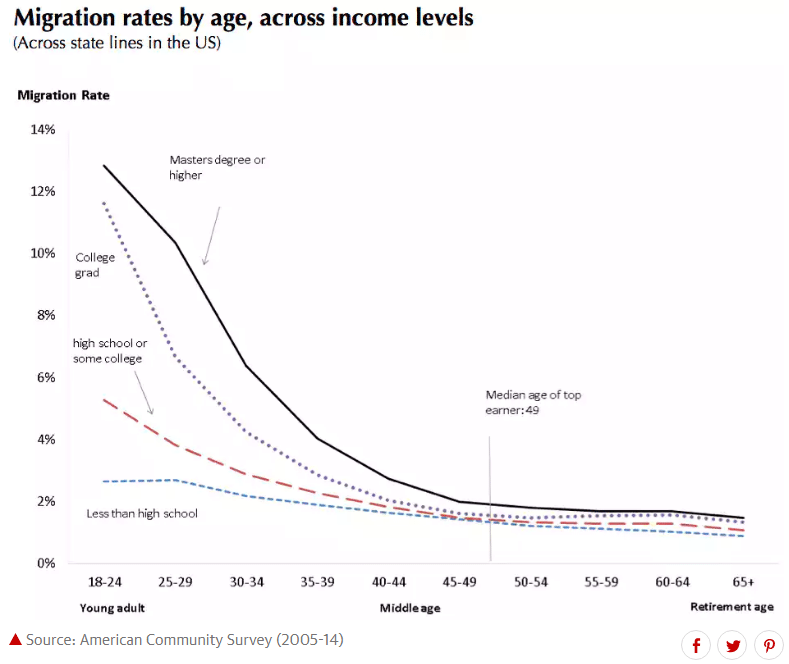

Young believes that one major reason for the lack of migration by the rich is that “migration is a young person’s game.” As the figure below shows, people tend to move for education and early in their careers. Thus:

By the time people hit their early forties, PhDs, college grads and high school drop-outs all show the same low rate of migration. Typically, millionaires are society’s highly educated at an advanced career stage. They are typically the late-career working rich: established professionals in management, finance, consulting, medicine, law and similar fields. And they have low migration because they are both socially and economically embedded in place.

The global story

Young finds the global story is much the same. He examined the 2010 Forbes list of world’s billionaires and found that approximately 85 percent still lived in their country of birth. Moreover, as he explains:

among those who do live abroad, most moved to their current country of residence long before they became wealthy–either as children with their parents, or as students going abroad to study (and then staying)…. Only about 5% of world billionaires moved abroad after they became successful.

The take-away

The rich have both increased their share of income and reduced their share of state taxes over the last decades. This has left most states unable to provide the critical public services working people need. Young’s study demonstrates that we should not allow fears of “rich flight” to keep us from building “tax the rich movements” across the United States.