As readers will notice, this is an excellent piece of work by our comrades at Tricontinental: Institute for Social Research. We have done our best to layout the Notebook in HTML format but we highly recommend the PDF version (click here to download), which has been laid out beautifully for the purpose of education and discussion.

Karl Marx (1818-1883), like many of his sensitive contemporaries, was concerned with the wretched condition of factory workers and their trade union activity. It was evident that workers who produced goods in factories found themselves unable to save money and improve their lot, while factory owners grew richer. The inequality between owner and worker increased as the years went by.

Much the same kind of situation as that depicted by Marx exists today. Companies such as Apple thrive while workers in Chinese factories that make Apple products earn low wages and difficult working conditions. A liberal glance at these numbers would suggest that the worker needs to be paid more, that they need a fair day’s wage for a fair day’s work. Marx called that a ‘conservative motto’ since it pleased the liberal to quote it but it at the same time was utterly impracticable as a solution within the bounds of the capitalist system. Higher wages are necessary, but wages cannot be increased to a ‘fair’ level without undermining the necessity for capital to squeeze as much profit from workers in the production process. The demand for higher wages—or a living wage—is necessary and urgent. But this demand is incapable of liberating the workers from the subordination of human potential to the compulsion of earning a wage. The demand for a living wage will only intensify the struggle between the classes. The outcome of the struggle must not be higher wages, but the abolition of the wage system. As Marx wrote in Value, Price and Profit, the workers ‘ought to inscribe on their banner the revolutionary watchword—abolition of the wages system!’.

In Notebook 2 from Tricontinental: Institute for Social Research, we sketch out the outlines of the contemporary production process that results in Apple’s iPhone. We move from a look at the iPhone’s production to the inner workings of profit and exploitation. We are interested not only in Apple and the iPhone, but more particularly in the Marxist analysis of the rate of exploitation at play in the production of such sophisticated electronic devices. It is necessary, we believe, to learn how to measure the rate of exploitation so that we know precisely how much workers deliver into the total social wealth produced each year.

Part 1: Welcome to the iPhone

What If the iPhone X Were Made in the United States?

If the iPhone X were made in the United States, it would be unaffordable for the vast mass of the world’s population. One estimate suggests that if the iPhone were made in the United States, it would cost at least $30,000 per phone. [All dollar amounts in this Notebook refer to the U.S. dollar].

The current (2019) price for an iPhone X varies from about $900 in the United States to about $1900 in Brazil and Turkey.

At $30,000, the iPhone is simply unaffordable. A minimum wage worker in India would have to work for sixteen and a half years, each day, to afford one phone. A minimum wage worker in South Africa would need to work for fourteen and a half years for one phone.

Almost all of the 70 million iPhones currently in circulation—as well as the 30 million iPads and 59 million other Apple products—are made outside the United States.

What Jobs did not mention is that Apple benefits from the low taxes along the Global Commodity Chain. If the iPhone were produced in the US, Apple would pay 35% in taxes. Currently, it pays nearly 2% along the Chain.

The iPhone is made outside the United States for several interrelated reasons. The first (and most obvious reason) is the cost of labour. The cost of labour within the United States is higher than that in certain parts of the world—notably in the People’s Republic of China, where many of these products are manufactured. The second reason is the adverse working conditions (no trade unions, long hours) in many parts of the world, particularly in export-processing zones that explicitly ban unions and have almost no State regulations. The retreat of the State from regulating workplaces and resource extraction has led to an increase in the negative externalities of production—namely, to the dumping of toxic waste without treatment, the use by mining companies of harsh chemicals that pollute water sources, and—as a consequence—the destruction of agriculture. This pushes more and more of the billions of small farmers and peasants off the land and towards waged labour in the industrial production process. At the centre of these change is disarticulated production along the Global Commodity Chain. This Notebook will focus attention on disarticulated production and on the Global Commodity Chain.

The Global Commodity Chain?

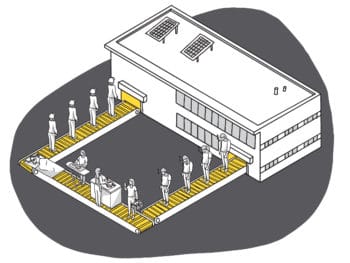

Factories were once located in a single place. Land was either rented or bought, and upon this land was built a building—the factory. The owner of the factory—the capitalist—would then rent or buy machinery that was housed inside the four walls of the factory. Electricity would be wired into the factory to run the machines and to provide electricity; this allowed for longer workdays, with a third shift working late into the night. Raw materials would be purchased, out of which would be produced the commodity to be sold. Then, the capitalist would hire workers to bring their skills and energy to the factory and work for a set number of hours to make commodities. Better machinery and advances in cooperation, as well as the division of labour amongst workers, made the factories more and more productive. But what defined these older factories was that they were—by and large—in one location. Even when the factory was in one place, raw materials were sourced from a variety of locations. Factories, therefore, were always linked globally to places from where their raw materials came and to places where their products were sold.

Gradually, by the 1960s, three technological changes and three major political and economic changes enabled factories to alter their basic structure.

The three interlinked technological changes were:

- Telecommunication networks. By the mid-1960s, a large number of satellites were launched for commercial purposes. These satellites allowed for easier communication between different parts of the world.

- Computerisation. The use of computer databases allowed firms to maintain their inventory—their raw materials and their stock of finished products—on a computer rather than in a large ledger. If two computers—one based in Hong Kong and the other based in California—could be linked across the satellite network, then the business headquarters in California could be informed immediately about drops in inventory and could reorder raw materials and products as soon as possible.

- Efficient logistics and standardisation. It used to take dockworkers days to unload a ship, whose cargo could easily be misplaced in the warehouses that abutted the quays. But dockworkers, through their radical unions, would often go on strike not only to increase their wages and working conditions but also for political issues. Their political unity needed to be broken. In the mid-1950s, container ships began to carry goods in large, standard-sized metal containers which could be removed—within hours—from a ship by cranes and placed immediately on the back of a truck or on a railway flatcar. What this meant was that it became less time-consuming to move goods around the world, and it meant that the dockworkers’ union was substantially weakened. This process reduced both the overall transportation cost and the risk of strikes. But containerisation is just one part of a revolution in logistics. Highly sophisticated logistical systems have allowed firms to track raw materials and finished products, making sure that they do not get lost and that they arrive at their destinations on time. None of this would be possible without standardisation (driven by the International Organisation of Standardisation), which means that any input to production can be sourced from anywhere in the world. A grade of electrical cable or a type of glass is no longer arbitrarily measured. It is now produced to a certain precise standard. Thus, it allows firms that source goods to play off one producer against another and drive down prices. If workers in one locality successfully win better working conditions, standardisation and efficient logistics allow capital to route their production process away from this ‘trouble’ and towards a more pliant workforce.

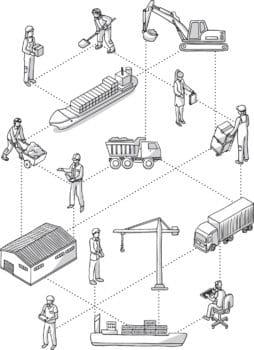

These three technological changes allowed firms to imagine breaking up the factory into several components, each located either near raw materials or near inexpensive but skilled labour. Even as the production process was fragmented across continents, firms controlled the entire process through the integrated management of data about production, transportation, and inventories. Efficient logistical systems and better transportation techniques made sure that components and products could move rapidly across the world. A capacitor could be made in one place, the screen for the phone in another, and the various components could then be brought to a third place to be assembled into an iPhone. This disarticulation of production intensified the old pattern for the movement of raw materials from one country to another for final production. It created a new system that undermined labour rights and national development projects and enabled global capital to increase exploitation as a consequence.

We call this new system the Global Commodity Chain (it is also known as the Global Value Chain). What defines this Global Commodity Chain is that production (as well as marketing and distribution) of the commodities is broken up among multiple firms in different territories. The Global Commodity Chain allowed firms to manage inventory through a process known as ‘just-in-time’ production, where firms did not hold a large inventory but ordered commodities to meet market demand. What is also key here is that the multinational firms—such as Apple—rarely produce anything beyond the brand for the phone and yet they control the process and earn the lion’s share from it. For more discussion on disarticulated production and the Global Commodity Chain, please see our Working Document #1: In the Ruins of the Present.

The push for the creation of the Global Commodity Chain and ‘just-in-time’ production was a structural crisis that struck capitalism in the 1970s. Why did global capitalism enter a long-term—and as yet unresolved—structural crisis?

Individual capitalist firms strive to maintain or increase their profits. That is their goal. In order to maintain or increase their profits, firms do a number of things:

- Create new products, which give them a monopoly over the market. However, other firms will soon copy these products and the innovation advantage will be eroded. To protect their innovations and their monopoly advantage, firms seek to maintain patents on their products for as long as possible.

- Compete with other firms to enlarge their markets either through advertising and brand development or through bribery and espionage. If the brand is able to develop an emotional linkage to consumers, then the firm can dominate the market even if other firms make the exact same product. Theft of new designs or payments to retail firms can also advantage the firm against its competitors.

- Use new technology for production and for the management of labour so as to increase labour productivity. This concept—labour productivity—means that firms will make workers intensify their labour in order to produce more commodities in a set period than before. If technology or management can make the workers labour harder for the same pay, then the firm is able to earn the productivity advantage. In other words, firms earn greater profits for the same number of hours that workers produce goods.

The most effective weapon in the war between firms is to reduce the cost of production through mechanisation. But firms must invest in machines and technology as well as in advertising and brand management if they intend to increase the productivity of labour and to enlarge their market share. In Marxist terms, this means that firms must increase the capital-labour ratio to reduce the unit cost and stay competitive. One of the categories that Marx suggests observing in order to analyse the change is the capital-labour ratio (the value composition of capital). To increase the value composition of capital, the capitalist will have to invest more in constant capital, which includes both fixed capital (e.g. machines) and circulating capital (e.g. raw materials) than in variable capital (the cost incurred by hiring labour power).

For Marx, the value composition of capital allowed him to determine the relationship in the production process between investments in the plant, equipment, and materials (constant capital) to investment in labour power (variable capital). This relationship allowed Marx to specify the productivity of labour (by mechanisation) and the creation of surplus value. Large investments in constant capital by firms led to an increase in the value composition of capital, which in turn produced a long-term decline of profitability in economies. In the United States, for instance, over the period 1947-1985, the value composition of capital increased by 103%, while the profit rate declined by 53%. It was this crisis of profitability—a built-in and ongoing problem for capitalism—that drove investors to move their productive activities to areas with a lower cost of labour, namely in the Global South.

The shift of production to the Global South would not have been possible without three major political changes that took place in the 1980s:

- The collapse of the Soviet Union and the Socialist Bloc in Eastern Europe. When the USSR and the Eastern European socialist bloc collapsed, the shield that had prevented multi-national capitalism from its desired global footprint was removed. The USSR had given the Third World bloc the power to assert itself on the world stage. The Third World bloc had used that shield to push for a New International Economic Order (NIEO) that included a sovereign trade and development policy. The collapse of the socialist shield meant that the Third World bloc’s ability to argue for sovereignty had now been dented.

- The Third World debt crisis and the opening up of China. National sovereignty and the need to build national economies after centuries of colonialism were important to the post-colonial states, including China. But, the debt crisis of the late 1970s and the 1980s forced these countries to surrender their independence to a world trade system. This new world trade system—geared around new intellectual property laws and the World Trade Organisation (1994)—favoured multinational corporations and the idea of a global, rather than a local factory. China’s market reform era, which began in 1978, was a major contributor to the Global Commodity Chain. In the period since 1978, hundreds of millions of Chinese workers were available for hire into the circuits of disarticulated production, which had a large base along the Chinese coastline.

- The detachment of government policy in North America, Europe, and Japan from the needs of their Citizens. Governments in the Triad—North America, Europe, and Japan—unleashed new policies that allowed firms based on their shores to go overseas. This allowed finance almost total freedom to go in and out of their countries. Policies such as tariffs and subsidies that helped build national economies and a national development project—essential elements of the Third World Project, the project of the new post-colonial states—fell by the wayside. The new policy space—neoliberalism—allowed firms to abandon the old, local factories and build a factory across continents, with bits and pieces of the commodity built across time zones.

The iPhone in the Global Commodity Chain

The Apple iPhone would not be possible without the Global Commodity Chain. The raw materials and the components in the iPhone come from over thirty countries. There are two types of inputs in the iPhone:

- Raw materials.

- Manufactured components.

An additional factor here is the intellectual property that goes into making the iPhone. Intellectual property is not an input such as raw materials or manufacturing components; it is merely a legal entitlement given by the State, which can become the basis for rent. Firms that claim intellectual property on pharmaceutical products or on electronic technology charge rent for the use of the rights given to them by the State and they block the use of these by others based on this monopoly right. One assumption is that Apple did the work of creating the technologies, and therefore deserves to claim intellectual property rent from the sale of these phones. But, nearly all technologies that make up the iPhone—the Internet, the GPS systems, the touch screen, the voice-activated assistant (Siri)—were developed almost entirely with public money given to universities and to research laboratories. In other words, Apple used government-developed technologies to produce the iPhone. The State allowed private firms—such as Apple—to claim intellectual property rights for these technologies. The profits from these publicly-financed innovations went—and continue to go—into private hands. Firms such as Foxconn that both manufacture parts of the iPhone and assemble them cannot cut out Apple and sell these phones because of the protections of intellectual property and because Apple has built a powerful brand. And, since it is the case that Apple did not create these technologies, we are left with the question: who deserves to profit from publicly funded technology?

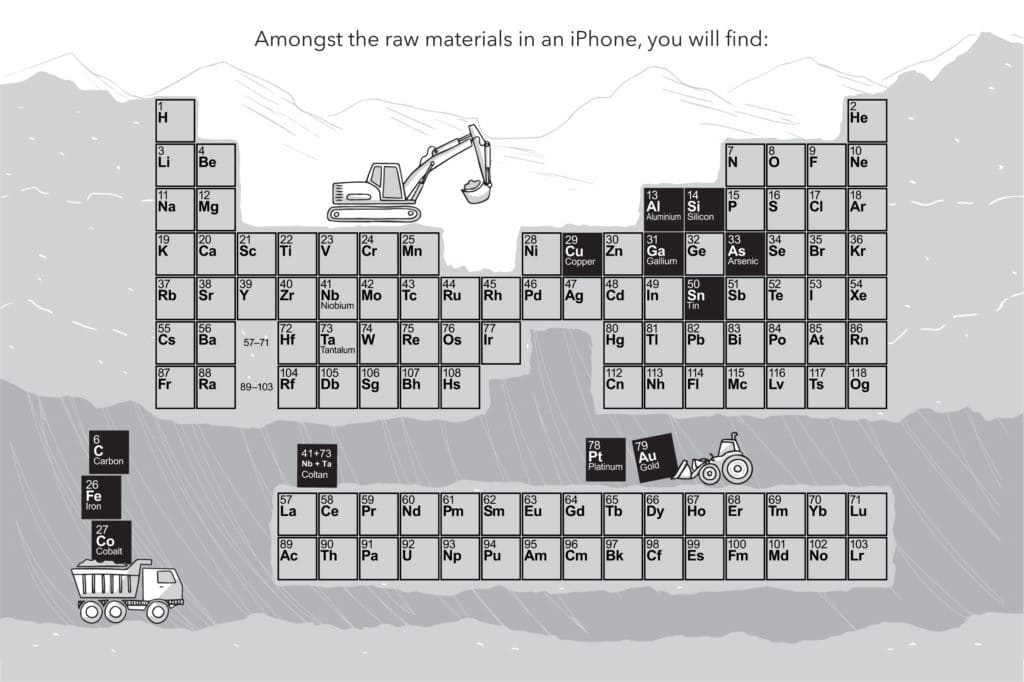

Amongst the raw materials in an iPhone, you will find:

- Aluminium

- Arsenic

- Carbon

- Cobalt

- Coltan (Niobium and Tantalum)

- Copper

- Gallium

- Gold

- Iron

- Platinum

- Silicon

- Tin

These raw materials come from a variety of sources, from the Democratic Republic of the Congo to Bolivia. Reports from reputed agencies—such as UNICEF (the United Nations’ Children’s Agency) and Amnesty International—have revealed over the years that the suppliers of the iPhone use child labour to extract these minerals from the mines and that they pay the miners starvation wages. Amnesty International’s report showed, for instance, that 40,000 children work in very dangerous conditions in mines in the Democratic Republic of the Congo that extract raw materials. Death, dismemberment, and long-term health problems are routine. The children, who work twelve hours a day, carry heavy loads out of the deep mines for $1 to $2 per day. Besides, child labour is forced labour, with mining companies well aware that the cost of bringing rare earth minerals and crucial raw materials is so low because militia groups force workers down the mines by the barrel of the gun. This is now a familiar sight in central Africa. These forms of labour discipline bring essential elements and minerals for the iPhone out of the earth and yet are treated as the most disposable part of the Global Commodity Chain.

Apple’s Supplier Code of Conduct (updated regularly, most recently in 2019) says unequivocally that

Apple believes all workers in our supply chain deserve a fair and ethical workplace. Workers must be treated with the utmost dignity and respect, and Apple suppliers shall uphold the highest standards of human rights.

These words seem to mean little to Apple and to the subcontractors who source their raw materials from places that are distant from the imaginations of those who buy these phones.

The raw materials then enter manufacturing units in at least thirty countries, from Europe to China. Many iPhone components are manufactured by factories in China. To get an idea of the diversity of suppliers of manufactured components, take a look at the origin of these parts of the iPhone 5s and iPhone 6:

- Accelerometer: Bosch in Germany. Invensense in the United States.

- Audio Chipsets and Codec. Cirrus Logic in the United States (outsourced for manufacturing).

- Baseband processor. Qualcomm in the United States (outsourced for manufacturing).

- Batteries: Samsung in South Korea. Huizhou Desay Battery in China.

- Cameras: Sony in Japan. OmniVision in the United States produces the front-facing FaceTime camera chip but subcontracts TMSC (in Taiwan) for manufacturing.

- Chipsets and Processors: Samsung in South Korea and TSMC in Taiwan. Alongside their partner GlobalFoundries in the United States.

- Controller Chips. PMC Sierra and Broadcom Corp in the United States (outsourced for manufacturing).

- Japan Display and Sharp in Japan. LG Display in South Korea.

- TSMC in Taiwan. SK Hynix in South Korea.

- Alps Electric in Japan.

- Fingerprint sensor authentication. Authentec makes it in China but outsources it to Taiwan for manufacturing.

- Flash memory. Toshiba in Japan and Samsung in South Korea.

- STMicroelectronics in France and Italy.

- Inductor coils (audio). TDK in Japan.

- Main Chassis Assembly. Foxconn and Pegatron in China.

- Mixed-signal chips (such as NFC). NXP in Netherlands.

- Plastic Constructions (for the iPhone 5c). Hi-P and Green Point-Jabil in Singapore.

- Radio Frequency Modules. Win Semiconductors (module manufacturers Avago and RF Micro Devices) in Taiwan. Avago technologies and TriQuint Semiconductor in the United States. Qualcomm in the United States for LTE connectivity.

- Screen and Glass (for the display). Corning (Gorilla Glass) in the United States. GT Advanced Technologies produces the sapphire crystals in the screens.

- Texas Instruments, Fairchild and Maxim Integrated in the United States.

- Touch ID sensor. TSMC and Xintec in Taiwan.

- Touchscreen Controller. Broadcom in the United States (outsourced for manufacturing).

- Transmitter and Amplification Modules. Skyworks and Qorvo in the United States (outsourced for manufacturing).

Among these firms, the most significant is Foxconn (Hon Hai Precision Industry), a manufacturing company from Taiwan. It generated an annual revenue of $160 billion in 2017. About 1.3 million workers are on its payroll in China, where it is the largest private-sector employer in the country. Worldwide, only Walmart and McDonald’s employ more workers than Foxconn.

Scandals are routine at these manufacturing plants. There is now a phenomenon known as ‘Foxconn Suicides’ because of a spate of deaths by workers in protest of the low wages and bad working conditions at Foxconn City in Shenzhen, China. The Chinese media called this the ‘suicide express’. Two Chinese academics (Pun Ngai and Jenny Chan, 2012) studied the phenomenon at Foxconn. In their searing report, they quote several workers from a mobile phone assembly plant:

We get yelled at all the time. It’s very tough around here. We’re trapped in a concentration camp of labour discipline—Foxconn manages us through the principles of ‘obedience, obedience and absolute obedience!’ Must we sacrifice our dignity as people for production efficiency?

To get a sense of the speed of the work, listen to this worker’s description of ten seconds of her workday:

I take a motherboard from the line, scan the logo, put it in an antistatic-electricity bag, stick on a label, and place it on the line. Each of these tasks takes two seconds. Every ten seconds, I finish five tasks.

One worker told Brian Merchant (2017) that 1,700 iPhones pass through her hands every day. She was in charge of wiping a special polish on the phone’s display. She polishes three screens a minute for twelve hours a day. Other work—such as fastening chip boards and assembling back covers—take a few minutes apiece. The pressure on the workers is extraordinary.

From 2010 to 2012, Steve Jobs made consistent claims of Apple’s awareness of the high suicide rates at Foxconn (‘Foxconn suicides’) and that the problem was under control—‘we are all over this’, he announced regularly. The problem, however, lingers. It cannot be measured by the suicides alone. Low wages and bad work conditions—including daily humiliation—define the lives of the workers. On several occasions, up to 150 workers went to the roof of a building and threatened to jump. They used the ‘Foxconn suicide’ as a bargaining tactic. That is the level of the production process for the iPhone.

Part 2. A Marxist Analysis of the iPhone

If you are outraged by what you have read so far, then you can rest assured that you are a human being. No human being should be cavalier about the working conditions that produce the iPhone—whether in the mines of South America and Africa or in the factories of East Asia.

But this Notebook goes further than outrage. We are interested in looking at the production of the iPhone—a commodity—through the framework of a Marxist analysis. We are interested not in being angry at Apple and Foxconn alone, but in being able to measure how much workers are exploited to produce this commodity. In other words, we are interested in measuring the rate of exploitation.

The rate of exploitation is one of the most important concepts in Marx’s theory. This measurement allows us to show how much the worker contributes to the increase of value in the production process. It shows that even if the worker is paid more, by the special magic of mechanisation and of efficient management of the production process, the rate of exploitation increases. The rate expresses quantitatively the contradictory interests of the capitalists and of the workers. There is a radical politics implicit in the analysis of the rate of exploitation. It enables workers to see how much of the share of the value produced is appropriated from them by the capitalists, and to therefore make the case for a different way to organise production and to end exploitation.

To understand the rate of exploitation, we have to first grasp what Marx means by the commodity itself and what he means by value, a key term in the Marxist system of economic thought.

What is a commodity? Marx begins his epic work Capital (1867) with a discussion of the commodity. ‘A commodity’, he notes, ‘is an object outside us, a thing that by its properties satisfies human wants of some sort or another. The nature of such wants, whether, for instance, they spring from the stomach or from fancy, makes no difference. Neither are we concerned to know how the object satisfies these wants, whether directly as a means of subsistence, or indirectly as means of production’. The commodity is a useful object. But it is more than a useful thing that serves a purpose to a consumer. It is also something that can be sold—something that enables the person who has it made to realise a profit. Inside the commodity, then, is both use value and value.

The use value of the commodity is merely its utility, something that is left to the consumer. An iPhone is a good example, because it can be used for many things: to make a phone call, to watch a video, to use as a compass, to hold onto when you are feeling awkward (or even to improve your image).

The expression of the value of the commodity (i.e. exchange value) is the price of the commodity. We are aware that there is a rich and long debate amongst Marxists over the relationship between prices and the value of a commodity. This debate is known as the transformation problem—namely the problem of the transformation of values to prices of production. Nevertheless, for our iPhone example, we believe that this level of concreteness need not detain us. We are still able to capture something significant. In the case of the iPhone X, the expression of its value is $999. The value is merely what the commodity is able to command in the market. But behind that price is a mass of crystallised values, which can be grouped into three parts of the total value: constant capital, variable capital, and surplus value. These are key concepts for Marxist analysis.

Constant capital

Various raw materials are brought on to the factory floor that are to be transformed by the actions of labour and machines into commodities. These raw materials—and other auxiliary materials, including the instruments of labour (machines, tools, etc.)—have already been fashioned from nature elsewhere. Inside these raw materials, which are not really ‘raw’ any longer, is embodied labour. The values of the various raw materials and instruments of labour are quantitatively fixed in terms of their labour content. This fixed amount of value is now transferred to the newly produced commodities in the process of production. Its value enters into the new commodities. Karl Marx calls the values of the raw materials and the instruments of labour constant capital.

The constant capital for the iPhone includes all of those minerals and metals that appear on the assembly line as well as the depreciated parts of machines that work those raw materials. These are then collectively transformed into the iPhone. In the process of transformation, the minerals, metals, and machines do not alter their value. Their value is preserved in the iPhone. The value remains constant.

At the end of the process of production, the total transferred value of those means of production—the raw materials, the machines, the buildings—cannot be more than what they originally contained in themselves. Their value, which remains constant, is in the iPhone.

Variable capital

The capitalist firm makes an initial investment in the production process:

- Wages and salaries for workers.

- Expenses on all non-human inputs, notably tools, machinery, buildings, energy, and so on.

The latter expense—the expense on all non-human inputs—is known as constant capital, as explained above.

The former expense—the expense on wages and salaries—is known as variable capital. To simplify our calculation, we assume that all workers are productive in the Marxist sense (namely, that they produce surplus value and do not merely distribute surplus value—as do ‘unproductive’ workers, such as those who are involved in trade).

In the capitalist system, people are ‘free’ in two ways. They are free from bondage and free to starve. The freedom from bondage and from the means to feed themselves forces people to sell their capacity to labour to those with capital (land or money). What the person sells is not themselves (since they are free from bondage), but they sell their labour power in exchange for wages. The wages correspond to a certain amount of money—representing a certain amount of value—that is necessary to satisfy the consumption needs of the workers.

Marx called labour power a peculiar commodity. Like other commodities, this one must have two aspects—a use value and a value. Wages are the exchange value of labour power, whereas labour is the use value of labour power. This distinction between the use value of labour power and the exchange value of labour power is fundamental to a Marxist understanding of surplus value and its production.

In a given working day, workers transform their capacity to labour into an act of labour. Their various skills are utilised to transform raw materials and machines into commodities.

During the working day and given the conditions of work, the total amount of value produced by the workers exceeds what is needed for their own consumption and reproduction. The value they require for their consumption and reproduction—represented in wages—is only a part of the value that they make during the working day.

Workers produce more value than they are paid in wages. This extra value is called surplus value. If the management of labour changes or if the machines work at a different speed, then either more or less value is produced in a day, which means that the surplus value can be increased (or decreased). The fact that labour power—this peculiar commodity—has the quality of producing an extra amount of value than what is needed for its own reproduction makes it variable capital.

Surplus Value

The various raw materials that are on the assembly line, the machines, and the electricity that help fashion the raw materials, would all be idle without the necessary work of the labour power put into the system by the workers. The workers take the raw materials and the tools and shape them into a commodity. It is the input of the labour power that is crucial. Unlike any other commodity, the labour power purchased from the worker has to produce these new values. When the workers tire, they go home and reproduce their labour power to be sold again.

The workers sell their labour power for a set amount of money. When they start to work on the production of commodities, it takes them only a fraction of their working day to make enough commodities to cover their own wages. Marx called that the necessary labour time. It was ‘necessary’ because in different epochs and in different countries it takes different amounts of goods and services to reproduce the worker’s depleted labour power. In some countries, the standard of living is lower than that of others, which means the necessary labour time is also shorter. The remainder of the working day—after the necessary labour time—is the surplus labour time. It is the time that the worker spends producing commodities that are above and beyond the amount needed to be produced to pay the wage bill of the worker.

Rate of Surplus Value

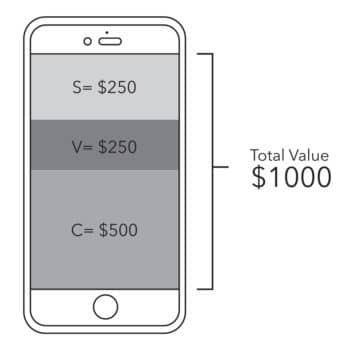

Marx’s concept—the rate of exploitation—is measured by using the categories of variable capital and surplus value. Variable capital is the share of the values produced in the process of production that goes to the workers. Surplus value, on the other hand, is the share of the values that goes to the capitalist. The ratio of surplus value to variable capital—or s/v—can be seen as a quantitative expression of the exploitation of workers, also called the rate of surplus value.

Take a hypothetical commodity whose total value is $1,000. The constant capital is worth $500. That capital—raw material, tools and energy—goes into the process of production and remerges in a different form but with the value intact. There is no change in its value. The variable capital—what the worker earns—is $250. The surplus value—what the capitalist appropriates—is the amount of value created during the surplus labour time, which in our example happens to be $250.

The rate of exploitation is measured by s/v, or the surplus value divided by the variable capital. The numbers for this hypothetical commodity provide us with the following definitional equation:

s/v = $250/$250 = 100%

The rate of exploitation of labour here is 100%. For every dollar that the worker earns, the capitalist appropriates surplus value of $1.

We now have the conceptual tools to measure the rate of exploitation of the workers who produce the iPhone. It should be pointed out that any attempt to empirically calculate Marx’s labour theory of value must necessarily make assumptions that simplify reality. In our view, however, these assumptions—such as that prices reflect values—can be justified and that these simplifications do not exaggerate the results (Shaikh and Tonak, 1994).

We begin with the sale price of the iPhone X in the United States—$999. This amount, we believe, roughly represents the total value embodied in the commodity. In any commodity produced in a capitalist production process, the mass of embodied values contains three value parts: constant capital, variable capital, and surplus value. Therefore, we must estimate the value of those segments of the total value of the iPhone X.

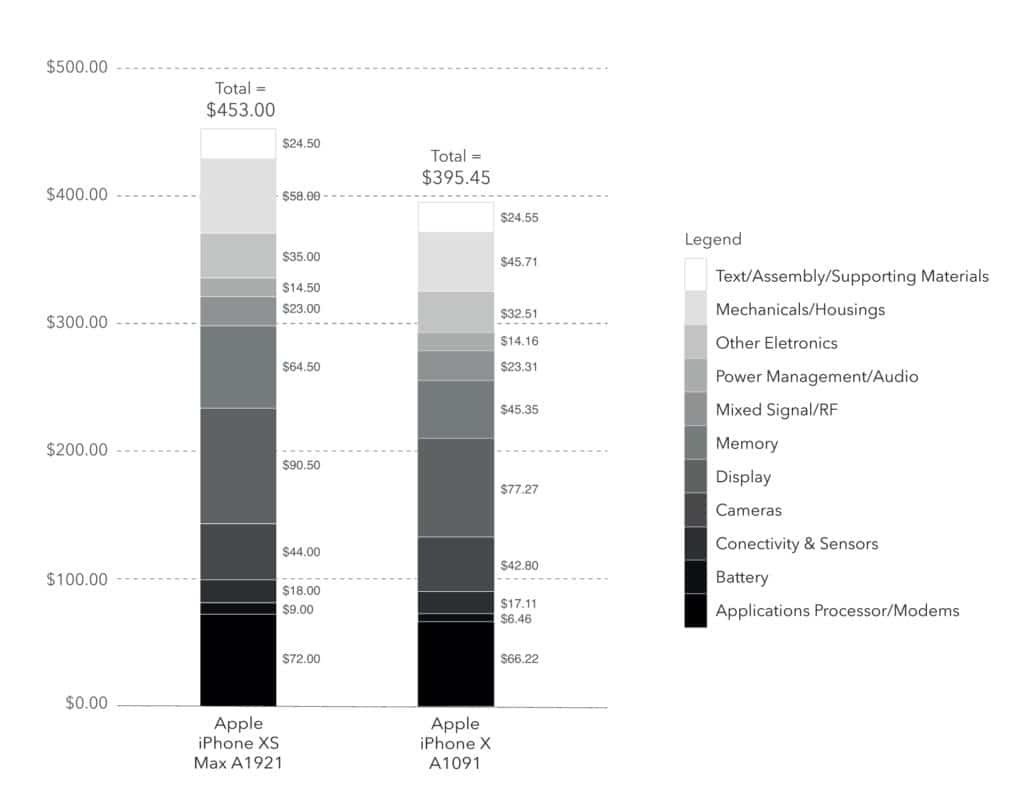

Constant Capital. Data from TechInsights gives us a detailed and specific look at the prices of components of both the iPhone XS Max and the iPhone X.

The total component prices of these two models are respectively $453 and $395.44. The first bar in the columns, however, includes the cost of ‘test/assembly/supporting materials’. This confuses the data for the analytical distinctions made by Marx. ‘Test/Assembly’ belongs to the variable capital, since, in both, labour power must be purchased to do those jobs. However, ‘supporting material’ is merely another part of the raw materials and belongs to the constant capital. To make matters simple, we exclude this portion of the top item from our estimation of the constant capital. Hence, the amounts that roughly represent the constant capital would be $428.50 ($453 – $24.50) and $370.89 ($395.44 – $24.55).

Drawing upon the iPhone X, we will consider the amount for constant capital to be $370.89.

Note: The procedure used in this Notebook to calculate the rate of surplus value in the Apple iPhone X is similar to the way Karl Marx calculated the rate of surplus value in yarn production. In Capital (vol. I), Marx wrote, “The constant portion of the value of the week’s product is £52. The price of yarn is…£510. The surplus value is, therefore, in this case, £510 – £430 = £80. The rate of surplus value is therefore 80/52 = 153 11/13%.”

Variable Capital. The estimation of the variable portion of the total value of the iPhone is more problematic. We are faced with the secretiveness of Apple, which does not release wage data. Two additional problems of the data need to be acknowledged. First, we do not have complete information on the expenditure by Apple for the initial research and design of the iPhone. We believe that the initial research and design labour costs can be ignored since these costs have been spread out over different models of the iPhone and the contribution of the research and development cost is increasingly negligible for the newer iPhones. Second, we do not have clear data on the wage differentials between workers who produce different components of the iPhone in different countries. This wage differential can be ignored because most of the companies that produce components for the iPhone are located in wage zones where this differentiation is not substantial. In fact, since we are estimating the wage bill based on the manufacturing side and leaving out the extraction of raw materials, we are inflating rather than deflating the wage bill.

We find these assumptions to be acceptable on the grounds that our figure of variable capital ($24.55) is based on ‘test/assembly/supporting materials’, which probably overestimates the extent of productive labour used in the process of making the iPhone X.

Total value of iPhone = $999

Constant capital = $370.89

Variable capital = $24.55

What is the surplus value?

Surplus value = (total value) – (constant capital + variable capital).

$999 – ($370.89 + $24.55) = $603.56

Each time an iPhone X is sold for $999, Apple receives $603.56 of surplus value in money form.

What is the rate of exploitation?

s/v = 603.56/24.55 = 2458%

The rate of exploitation is 2458%. This is 25 times the rate of exploitation that is gleaned from Marx’s examples in Capital, published in 1867. Workers who make iPhones in the 21st century, in other words, are twenty-five times more exploited t han textile workers in England in the 19th century.

What does the number—2458%—tell us? It tells us that an infinitesimal part of the working day is devoted to the value needed by the workers as wages. The bulk of the day is spent by the worker producing goods that enhance the wealth of the capitalist. The higher the rate of exploitation, the greater the enhancement of the capital’s wealth by the worker’s labour.

Appendix

Kenneth L. Kraemer, Greg Linden and Jason Dedrick (2011) analyse the geographical distribution of the gross profits received by first-tier suppliers of the iPhone 4. In their study, they break down the cost of inputs into materials and labour. From a non-Marxist perspective, they attempt to identify approximate portions of surplus value (gross profits), constant capital (materials), and variable capital (labour) in the total value of the iPhone 4.

Based on the data in this chart, we can do a back of the envelope calculation to determine the rate of exploitation of the iPhone 4.

- The approximate portion of surplus value in the total value of the iPhone 4 is 73% (Apple profits + non-Apple U.S. profits + EU profits + Taiwan profits + Japan profits + S. Korea profits + Unidentified profits).

- The share of the total cost of materials is 21.9%.

- The share of the total labour cost is 5.3%, in which non-China based labour is 3.5%. Assuming that a large portion of the non-China labour cost represents the salaries of managerial and supervisory employees (unproductive workers, whose salaries are paid out of the share of surplus value), then we can legitimately consider only 1.5% of that cost to be variable capital. The total variable capital is the share of the China-based labour (1.8%) and the non-China based productive labour (1.5%). The share of total variable capital in the total value of the iPhone 4 is therefore 3.3%

- Given these figures, the rate of exploitation of the iPhone 4 is 75/3.3 = 2273%.

This Notebook is based on an analysis by our economist, E. Ahmet Tonak. An earlier version of this analysis appeared as ‘iPhone 6’daki sömürü orani?’ (Sendika, 30 November 2014).

References

- Anwar M. Shaikh and E. Ahmet Tonak, Measuring the Wealth of Nations. The Political Economy of National Accounts (Cambridge: Cambridge University Press), 1994.

- Baruch Gottlieb, A Political Economy of the Smallest Things, New York: ATROPOS Press, 2016.

- Brian Merchant, The One Device: The Secret History of the iPhone (New York: Little, Brown and Company), 2017.

- Kenneth L. Kraemer, Greg Linden and Jason Dedrick, ‘Capturing Value in Global Networks: Apple’s iPad and iPhone’, Personal Computing Industry Center, July 2011.

- Karl Marx, Capital, volume 1 (New Delhi: LeftWord Books), 2014.

- Pun Ngai and Jenny Chan, ‘Global Capital, the State, and Chinese Workers: The Foxconn Experience,’ Modern China, vol. 38, no. 4, 2012.

- Tricontinental: Institute for Social Research, In the Ruins of the Present, Working Document no. 1, 2018.