Apologies for the delay in publishing – I was tied up with organising this conference on progressive economics (follow link for the recordings!), and am still trying to get the book finished. In the meantime, here is the text of a talk I planned to deliver at Contra El Diluvio’s meeting in Madrid last month. I ended up not really sticking to this script at all, and talking a lot more about the politics than the theory, but I thought it might be of interest, anyway – looking in particular at how generalised environmental instability is a theoretical and methodological challenge to economic theory and practice.

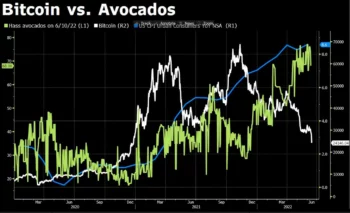

I wanted to start with this quick illustration of our current predicament–the chart below, showing recent movements in the price of bitcoin in U.S. dollars, and U.S. avocado prices in U.S. dollars. As you may have seen, Bitcoin–heralded by its army of true believers as the route out of capitalism dominated by “fiat” currencies and the beastly central banks that sustain them–has recently plummeted in value. Far from acting as a “hedge” against inflation in fiat currencies, bitcoin, like other cryptocurrencies is now working in almost exactly the same way as other assets: declining at the same time–indeed significantly more than–the value of fiat currencies and other assets.

The reason is not too hard to spot: the bigger crypto currency has got, the more it has escaped from its beginnings as a peculiar form of near-money experimentation and increasingly attracted major investors–including the inevitable Elon Musk, with Tesla remaining amongst the largest single holders of cryptocurrencies on the planet–it has attracted the attention of increasingly conventional financial institutions, from major banks to hedge funds.

That, in turn, has meant an integration of crypto into the conventional functioning of the financial system, and the loss of its assumed claim to act as a hedge against financial turmoil appearing elsewhere. To the extent that cryptocurrencies are themselves increasingly leveraged, they are liable to act as a transmission mechanism between different parts of the financial system, and actively magnify instability appearing elsewhere in the system across different parts of it. There have been some spectacular crypto blowouts in recent months, notably the so-called “stablecoins” that are supposed to act precisely as the link from cryptoland back into the rest of the economy, but these crises have not, yet, turned into a 2007 or 2008-style feedback into the wider system.

But I want to look at the second part of the graph, where we find a true hedge against losses in financial products in the form of the humble avocado. Avocado demand has, it is true, risen substantially in recent years–those endless articles bewailing Millennial consumption of the fruit aren’t completely without foundation–but over the last two months the price has shot up to a 24-year high. This isn’t anything to do with a sudden, renewed appetite amongst the world’s hipster for guacamole, but comes as a result of two restrictions on the supply-side.

The first, rather brief, was a week-long ban on Mexican avocado imports to the U.S. after a U.S. agricultural inspector was threatened. The second, more fundamentally, is due to worsening conditions for the production of avocados. In Mexico, deforestation in the western state of Michoacan has been severe. Around 20,000 acres of forest are estimated to be lost, on average, each year to avocado growing. But the increased supply of the fruit in turn brings more marginal land into production, reducing the quality and consistency of the output and sparking the kinds of disputes that see food inspectors threatened. Elsewhere in the world, harvests in Kenya have been particularly poor this year, attributed to extreme weather. Aside from growing global demand, avocados have been promoted as a climate-resilient crop, leading to rapid expansion of their planting in places like Kenya where climate change is already damaging harvests.

It’s the last that I particularly want to draw attention to here, since it is the presence of climate change and–especially–the volatility that it brings in its wake that most seriously challenges our conventional understandings of how capitalism operates.

Not just the Green New Deal

You can say something like this to a left audience and get some sage nodding of heads and broad agreement that yes, of course, capitalism is driving us into climate change and of course we need collective solutions, like the so-called Green New Deal, to get ourselves out of it. But I think there’s a serious danger of underestimating not so much how serious the situation is–if anything, we tend towards an unhelpful catastrophism–as failing to think through just how utterly novel it is. The current bout of inflation, across the globe, is, in economics terms, another obvious indicator we have yet been given that irreversible break with the past is in place.

Rapidly rising prices at present are variously attributed to short-term factors: the war in Ukraine, the aftershocks of the first lockdowns, maybe sometimes assorted freak environmental issues: the drought in the U.S., or floods in Brazil damaging crop production, say. What all of these short-term explanations ignore is that the background stability of the earth’s climate, on which both our conventional understanding of capitalism and capitalism itself have built upon, has broken down.

There will now be no return to a kind of pre-1950s planet: that the “Anthropocene”, the new geographical age we have opened up, with some disputes about its dating (and sometimes some disputes about its naming), is acting as a permanent, foundational shift in how human society and economy can operate in the future. Covid acts as something similar: there will be no going back to a world without the virus and, whilst we can maybe imagine future technology that could eliminate it–virus-zapping nanotechnologies, say–these things don’t actually exist at present. Covid is part of a hard, irreversible break with the past, where having tripped over a boundary–or, really, several boundaries–in the biosphere there is no plausible chance of recovering them.

Extinction and fungibility

We are familiar with the concept of extinction: of the elimination, permanently of a species from existence. We are, presently, living through what has been labelled the planet’s sixth mass extinction event, as the rate of species loss accelerates year on year. Yet we have, typically, treated extinctions as discrete events and even, at least implicitly, invented ways to conceptualise extinction and the biodiversity loss as a something that can be valued in monetary terms and so therefore rendered fungible. When William Nordhaus, who picked up the economics “Nobel Prize” in 2018 for his work on climate change, publishes a paper arguing the losses from even 3 degrees of warming will be large, but manageable, he is implicitly making this sort of assumption: that generic economic growth could, in principle, substitute for specific, irreversible loss, meaning a trade-off between the costs of climate change mitigation and the benefits of future growth can reasonably be calculated. This is the secret of financialisation, of course, and of the monetary system in general: that at least in principle there is nothing that cannot be given a price and so converted to an assumed equivalent monetary value in exchange.

We are familiar with the concept of extinction: of the elimination, permanently of a species from existence. We are, presently, living through what has been labelled the planet’s sixth mass extinction event, as the rate of species loss accelerates year on year. Yet we have, typically, treated extinctions as discrete events and even, at least implicitly, invented ways to conceptualise extinction and the biodiversity loss as a something that can be valued in monetary terms and so therefore rendered fungible. When William Nordhaus, who picked up the economics “Nobel Prize” in 2018 for his work on climate change, publishes a paper arguing the losses from even 3 degrees of warming will be large, but manageable, he is implicitly making this sort of assumption: that generic economic growth could, in principle, substitute for specific, irreversible loss, meaning a trade-off between the costs of climate change mitigation and the benefits of future growth can reasonably be calculated. This is the secret of financialisation, of course, and of the monetary system in general: that at least in principle there is nothing that cannot be given a price and so converted to an assumed equivalent monetary value in exchange.

But confronted with two things–irreversible processes, and global environmental instability–the conventional economic conceptualisation of these things breaks down. If something can be converted into a monetary value, it has to be (in principle) capable of meaningful exchange with all other goods that can be converted into a monetary value. But the permanent, irreversible loss of a species can’t function like that: there is no value that can be placed on this species that is meaningfully equivalent to its loss, since its loss is a strictly one-off event.

The more those irreversible processes appear as part of the slide into the Anthropocene–the more it becomes impossible, through species loss and resource use, to plausibly apply the principle of fungibility to assets in the economy–the more constrained and chaotic will the activities of the financial system become. There is an epistemological problem opened up by this reduction in the fungible space for financial activities that is exceptionally difficult to overcome–although this does not prevent efforts being made, as we will see.

That reduction in meaningful fungibility inherent to the irreversibility of environmental change is attendant on a more general shift in the nature and kind of instability we can now expect to suffer from. The period of industrial capitalism’s foundation, rise, and dominance of the world has been one of a generally stable climate–if we take the period from the “Little Ice Age”, which drew to a close no later than the early 19th century, through to the 1980s, the climate has been comparatively warm and comparatively stable. This does not mean the environment was irrelevant, far from it: for example, as Mike Davies’ brilliant Late Victorian Holocausts showed, the conquest of major parts of the globe by the European powers, notably the British Empire, was integrally related to the presence of huge, macro-climatic regularities known as the El Nino oscillations. These helped determine the patterns of crop failures and famines at the end of the nineteenth century, interacting with and reinforcing the ideology and institutions of imperialism, to devastating effect.

What is appearing now is instability of a different order: not of brief, idiosyncratic extreme weather “shocks”, whose effects dissipate over time; not, either, a regularity in the climatic system, like El Nino or the Atlantic Equatorial Mode that regulates Atlantic sea temperatures, with reasonably predictable consequences. But instead a form of instability not known in industrial capitalism–or, arguably, on a global scale since the emergence of writing some 5,000 years ago. It is for this reason that those arguing to call our new geological age the “Capitalocene” in preference to the “Anthropocene” (stressing the direct role of capitalism in driving these changes in the earth’s climate) whilst completely correct about the social system that has brought us to this point, seriously understate the scale of the impacts involved–and overstate the likelihood of seriously overcoming them, a point I’ll return to.

Monetary economics

Radicals aside, conventional economics finds this form of deep, environmental instability particularly hard to deal with. Whilst the money that can be made in finance depends on a certain kind of localised instability, the economic models in use across financial institutions, central banks, governments and universities build in a solid assumption of stability. The assumption, both at the level of the model construction and at the level of the statistical analysis used to support it, is of a deep, structural parameters that guide the economy back to a smooth growth path through time -typically assumed to be an underlying growth rate of around 2% a year. When combined with the assumption of an independent central bank following a “Taylor Rule”–that is, a rule that has the bank adjust interest rates to manage inflation towards some target level–the model overall exhibits a pronounced stability. It is, in statistical terms, ergodic; in economic terms, the shocks that could hit the economy dissipate over time as the agents inside the economy adjust back towards their underlying structural parameters.

This might, arguably, describe a national economy during a period of relative stability. Versions of this macro modelling have been used since the early 1950s, or even before, and the most recent, most sophisticated variants of the basic technique were loudly proclaimed, pre-2008 crisis, to have “solved” the most pressing questions in macroeconomics–“that of depression-prevention”, proclaimed Nobel Prizewinner Robert Lucas as late as 2006. Much of the hard assumptions of stability in the class of “New Keynesian” models that had come to dominate prior to 2008 were swept away by the financial crisis then: critically, assumptions that the net debt positions of agents meant that their debt overall did not matter–so that, for example, it did not matter that households were increasingly indebted, since house prices were rising, and therefore households’ net positions looked healthy–have been abandoned in favour of macroprudential policy and attempts to account for “systemic risk”. Climate change itself gets treated as one such systemic risk amongst many.

But the underlying model here, the deeper construction of a specific kind of stability, has not. The belief that the wider environment would produce only temporary “shocks” that the economy would adjust around, thanks to the miracle of the free market, and then quickly return to a norm has never been opened by the mainstream. If climate change is seen as a major risk, it is assumed to be a risk to underlying stability – not, as it should be, a guarantee of foundational instability from which stability may briefly emerge.

The end of environmental security

In any case, models and systems built on a kind of fundamental environmental security–both at the level of theory, of ideology, and of institutional practice–will no longer hold. Hence, most obviously at present, the severe difficulties posed by the current bout of rapidly rising inflation. This poses a direct challenge, I would argue, to the intellectual basis of the mainstream of modern economics.

The fundamental claim in the mainstream of economics – going back to, say, the Banking School vs Currency School debates that Marx first cut his political economy teeth on in the 1840s, or back, further, to the Bullionist controversy of the 1810s that David Ricardo intervened on, or further yet to the foundational texts of the Physiocrats and, in passing, David Hume–is that monetary factors influence only other monetary factors, and “real” factors only influence other “real” factors, at least in the longer run. So changes in the money supply feed quickly, and exclusively, in the long run, into changes in the price level; whilst changes in long run output only appear as a result of changes in the underlying conditions by which output can be produced–improvements in technology, say, or perhaps some shift in underlying preferences for leisure and consumption.

This has dramatic consequences about how we view the entire economic system, including finance. This “classical dichotomy” means that finance, ultimately, is seen merely derivative of the wider economy, not something distinct from it with its own operations: that the various versions of money-dealing and risk-management that financial practices embody are themselves only derivative of the wider economy. It means, too, that the attempt to impose a “real” vs “monetary” distinction in our economic model can sometimes take a radical colouration–as in the longstanding Keynesian-ish claim that finance should be only the servant of the real economy, as opposed to the more neoclassical version of the same which is that finance is only the servant of the real economy.

Both of these, it should be clear, are versions of the same basic error, but expressed in either (to use the standard distinction) “positive” or “normative” terms – that is, as either a claim about what is, or a claim about what should be. Neither grasps the underlying problem that the distinction between “real” and “financial” activities matters significantly less than the distinction between “human” and “not-human” activities, by which I mean the capacity of humanity to act in any manner at all is itself determined by the wider, non-human environment it finds itself in.

To expand this point: by imposing the real/financial, or real/monetary, distinction, the non-human element of economic life is obscured: we either end up assuming that monetary factors affect only other monetary factors (as in the classical dichotomy), and thus cannot see when the natural environment intrudes into those monetary factors – as in, for instance, today’s confusion over the sources of inflation.

Or, alternatively, we stress the importance of the “real” economy to overcome the monetary or financial, and thus end up with a very similar position: a voluntarism about the capacity of the “real” economy to overcome economic crises now seen primarily as arising in the monetary or financial economy. This is the underlying problem with various editions of the Green New Deal: that it suggests if only the real economy was made to work properly, the ecological damages caused by its financial distortions could be overcome. Either version, dependent on the real/monetary distinction in their own ways, encodes a version of the same anthropocentrism that leads to a downplaying of the not-human factors in the economy.

It means, too, that the disputes over whether fiscal or monetary policy should lead were always somewhat wide of the mark – and are likely to become even more so as ecological instability worsens. The attempt to impose a monetary vs fiscal divide at the level of either theory, or our institutions – the “independent” central bank vs the elected fiscal authority – or policy will fail because of it.

It has, historically, been the radicals and outsiders in economics who have tended to grasp the point that the financial/real distinction matters little for understanding the dynamics of capitalism. The Austrians have their own version of the credit cycle, concisely summarised by Hayek in his Prices and Production, in which extensions of credit above the “natural” rate lead to an overextension of productive processes.

Likewise, the various Marxist schools of thought have tended to try and integrate an understanding of the credit cycle and the financial system with the operations of the wider economy–the “circuit of capital” is built as a process of production mediated by money, and therefore open to financial operations, for instance. In other words, the key question is to understand the dynamics of the whole system, which includes its financial and monetary dynamics, rather than to separate these elements. It is here, in the conceptualisation of the economy as a dynamic totality–and the approaches around ecological economics also tend to operate in this mode–that there may be some prospects of intellectually understanding the worsening crises we face.

But if the dynamic is now one of repeated shocks, each seemingly idiosyncratic, disconnected from the rest, but themselves the product of decaying environmental stability, it is this decay that is the process of interest. Looking instead at either monetary processes in isolation, or trying to find the “real” economic process in isolation–fixating on productivity growth, say–misses this. If our economic models worked for a while it is because their assumption of ecological stability (never actually stated) coincided with a period of actual ecological stability. Take away that fundamental stability, and the models fail; we end up with all sorts of absurdities, central bankers claiming that a “wage restraint” is necessary in Britain when it is plainly obvious there is no wage low enough that will (for example) end the floods in Brazil that have damaged coffee production, or call off the plague of locusts in East Africa, and so on. Similarly for the demands to raise interest rates.

What this highlights, as a core problem in conventional economics, is its anthropocentrism. It tends to overassume the importance of human activity in describing economic outcomes: again, a workable assumption for the relatively brief period where we had high rates of economic growth and stable environments; not so applicable at low rates of growth and an unstable environment.

Anthropocentrism in marxist economics

This isn’t just a conventional economics problem, incidentally. There is a version of this in Marxism, centred on the belief in the “tendency of the rate of profit to fall” (TRPF). Disputes over this idea, one of the mechanisms of crisis in capitalism that Marx introduces in the third volume of Capital, have occupied Marxist economists for the past 150 years or so, to no obvious purpose. The tendency was treated as a sideline for the first century or so after the posthumous publication of Capital, with two generations of Marxist political economists paying little attention to Marx’s suggestion–Rosa Luxemburg, strikingly, largely ignores it. But the notion received a sudden round of fresh attention in the 1970s, as profit rates very clearly turned downwards. Alternative explanations abounded–centred, notably, on the “neo-Ricardian” school instigated by Piero Sraffa, and its theory of a profit squeeze by powerful labour–but for a particular kind of Marxist, the allure of a guarantee of further crisis was irresistible… whatever the record, over the four decades since the 1970s, of fairly dramatic growth in major parts of the world economy, at least until the 2020s.

Debates over TRPF have centred on a (fairly tedious) empirical back-and-forth in which various novel ways to quantify labour and capital in use are given and different rates of profit shown out of the other side. These are fairly irrelevant: the wider problem is that there is no plausible mechanism by which the tendency of the rate of profit to fall also encompasses the ecological collapse–unless we view the ecological collapse as merely a symptom of the tendency itself, thus converting the rate of profit into not only a transhistorical principle but even a transhuman principle, shaping outcomes for the entire earth’s biosphere by reference to a few mathematical equations fortuitously laid down by Marx in the 1860s.

This is, of course, nonsensical: the ecological collapse is bigger than capitalism itself, with capitalism existing merely as a subordinate system in the wider planetary processes–not the other way round. In effect, the TRPF encodes a hard anthropocentrism–placing human organisation and even human-decisionmaking in a permanently superior position to the biological world in which that organisation and decisionmaking occurs. It is not, in any sense, a sustainable position in world where the fundamental structures of the climate are being reshaped and therefore the metabolic relationship between capitalism and the planet being reshaped with them. It encourages two bad sorts of beliefs: that the crises are of a temporary character and that, perhaps worse, there is a species of socio-technical fix available, somewhere, to resolve them.

It is, as a thought experiment that may illustrate the point, possible to imagine a geoengineering project, of immense size and complexity, involving what Marx would have described as an colossal revision of the “organic composition of capital” upwards for the whole globe. The sheer scale of the geoengineering project here would, after all, imply that every single economy affected by it would, therefore, also see its organic composition of capital change, massively substituting capital–now acting on a global scale–relative to labour. The consequences for the classical theory of TRPF, in this case, would be very clear: the organic composition of capital rising globally would produce a determined slide in the rate of profit downwards–without, even, some of the competitive processes and “countervailing tendencies” that Marx suggested might ease the decline. The mechanism would be easy enough to spot: let us assume that the immense costs of this project are borne either by a single capital, or capitals across the world. This is a direct reduction in the surplus value available to capitalism as a whole, whether borne by a single capital, a group organised as a state, or every capital on the planet. That reduction implies a reduction in the rate of profit that can be earned given the radical increase in costs created by the geoengineering project.

But where is the production of crisis, in this case? Would the true crisis of geoengineering occur as an economic crisis, the product of a reduced profit rate, or would it more likely appear as an ecological crisis, the product of failures and unintended consequences from the geoengineering project itself? It’s not obvious that (for example) the cataclysmic failure of a geoengineering project, resulting in–for instance–the poisoning of the world’s oceans and the extinction of most sealife–could reasonably be described as merely a manifestation of the falling rate of profit, though the rate of profit would undoubtedly be somewhat depressed as a result of this.

It is far better, at this point, to pick up on a point that David Harvey has recently highlighted, in that the total mass of profit, rather than its rate of production relative to capital utilised is the more relevant variable–particularly when dealing with the environment, when it is the scale of capital’s operations relative to the size of the planet that matters, rather than (as the degrowthers will tell you) the marginal rate at which the environment is utilised. Capitalism could exist, very easily, with a sufficiently large scale of operation even at extremely low rates of profit: the mobilisation of resources would still occur, profits on a vast scale would still be generated: this is, in fact, quite close to the world we’re living in.

Conclusion: ending anthropocentrism

In any case, the dubious anthropocentrism of the falling rate of profit needs to be dropped, alongside the dubious anthropocentrism of the mainstream. The underlying belief in both, that human society can be understood as analytically (and actually!) superior to its natural environment, is today rapidly becoming unworkable. We need, instead, an economics with a keen appreciation of the relationship of humanity to nature–not simply (as so often in environmental economics) as an “externality”, or even as a slightly sentimental source of affection, but as the primary conditioning factor of both who we are as people, and, therefore how we can relate to each other in an economy. The loss of ecological stability is far worse, in far stranger ways, than our habitual models of economic activity can cope with. It is time, in short, for an economics of the Anthropocene.