-

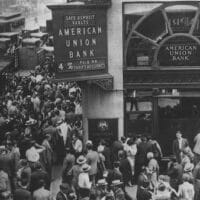

4 U.S. banks crash in 2 months

Economist Michael Hudson discusses the collapse of four U.S. banks in two months, giant JP Morgan Chase taking over First Republic Bank, and how government regulators are in bed with the bankers.

-

U.S. bank bailout benefited billionaires, exposing corruption: ‘I understand why Americans are angry’

Before it collapsed and its billionaire depositors were bailed out by the U.S. government, Silicon Valley Bank successfully lobbied Congress to remove regulations on it. A senator admitted, “I understand why Americans are angry, even disgusted”.

-

U.S. government bailout of Silicon Valley and banks is $300B gift to rich oligarchs

The U.S. Federal Reserve printed $300 billion in a week to save collapsing banks and bail out Silicon Valley oligarchs. 93% of Silicon Valley Bank’s deposits were uninsured, over the FDIC limit of $250,000, but the government still paid them. 56% of SVB’s loans went to venture capitalist and private equity firms.

-

Yes, the U.S. gov’t did bailout the banks. What would a people’s bailout look like?

The U.S. is divesting from working people and investing in banks and venture capitalists, to the tune of hundreds of billions of dollars.

-

Why the U.S. banking system is breaking up

Economist Michael Hudson responds to the collapse of Silicon Valley Bank and Silvergate, and explains the similarities with the 2008 financial crash and the savings and loan crisis of the 1980s.