The end of 2010 brings renewed Washington rhetoric, media hype, and academic me-too declarations about the US economy “recovering.” We’ve heard them before since the crisis hit in 2007. They always proved wrong. But recovery noises are useful for some. Republicans claim that government should do less since recovery is underway (of course, for them, government action is always counterproductive). Likewise, Republicans and many centrist Democrats claim that income redistribution policies are no longer needed because recovery means growth, which means everyone gets a bigger piece of an expanding economic pie. Recovery hype also helps the Obama administration to claim that its policies succeeded.

Yet this is more fantasy than reality. After all, the nearly 20% of the US labor force that became unemployed or underemployed in 2009 remains so as we enter 2011. No recovery there. Worse still, a quarter of those who found work since the crisis began only got temp jobs without benefits. Second, foreclosure actions by banks — including those who got most of the government’s bailouts — continue to eject millions from their homes. No recovery there either (except for the bigger banks). Third, consider why (1) the Federal Reserve decided last month to create another $600 billion of new money and (2) Congress and the President agreed this month on an additional fiscal stimulus (extending Bush’s tax cuts, reducing social security withholding for 2011, etc.). They took those steps because all the previous bailouts, monetary easing, tax cuts, and government fiscal stimulus expenditures had failed to end this crisis. Those immune to hyperecognize that more of the same policies that failed before might do so again.

More importantly, the recovery noise distracts from a more basic failure of our economic system: its fundamental instability. Recurring “downturns” — that neither private nor government actions have ever managed to prevent — impose massive costs on society. They plunge millions of effective, productive workers into unemployment and resulting personal, family. and community disasters. Governments tap the collective purses of their nations chiefly to rescue just those private capitalists who were major contributors to the crisis and whose wealth insulates them from the crisis’ worst effects. Then governments turn on their people to impose austerities (cutbacks in social programs, social security, etc.) needed to restore government budgets busted by that rescue’s huge costs. Like someone convicted of murdering his parents who demands leniency as an orphan, corporate America demands conservative government and austerity on the grounds of excessive budget deficits. Mainstream media and politicians take those corporate demands seriously, reminding us who controls whom.

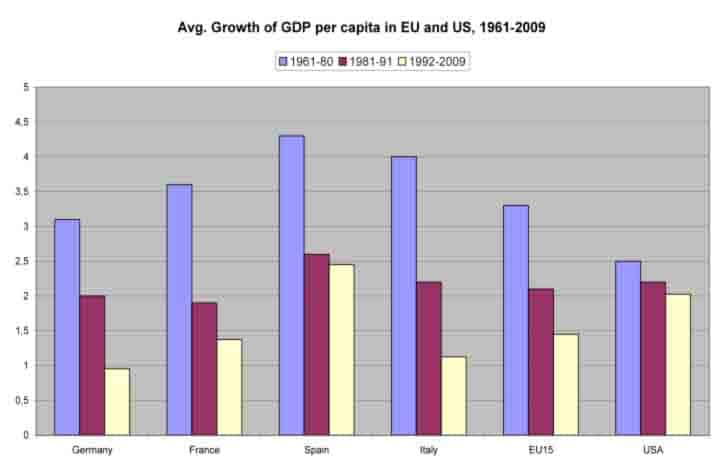

The last half-century suggests a very different analysis of the crisis and a correspondingly different response for 2011. Since the early 1970s, workers’ wage increases came to an end, their benefits and job security shrank, and government supports for average people came under conservative attack. These increasing burdens were justified as absolutely necessary to enable more investment and therefore greater economic growth. A bigger economic pie would then provide more for everyone including workers. In fact, growth in the US and Europe steadily slowed over those years (see graph below by University of Rome Professor Pasquale Tridico):

Source: Eurostat.

While workers’ conditions deteriorated, capitalist surpluses and profits soared and stock markets boomed. Income and wealth were redistributed from poor and middle to the rich. But the promised results never materialized: neither more investment nor greater economic growth. As the graph shows, growth actually slowed and then the whole system imploded into a catastrophic crisis.

Today’s recovery noises accompany government actions that will repeat in 2011 more of the bailouts, monetary easing, and fiscal stimuli that proved insufficient since 2007. None of those actions dare to question, let alone address, how capitalism redistributed income and wealth in the decades leading to the crisis or how that redistribution contributed to the crisis. The recovery being planned and hyped aims at a return to the US economy before it crashed. However, that capitalism was like a train hurtling toward the stone wall of crisis. To return to a pre-crisis capitalism risks resuming our places on a similar train heading for a similar crash.

Republican and Democratic politicians alike dare not link this crisis to an economic system that has never stopped producing those “downturns” that regularly cost so many millions of jobs, wasted resources, lost outputs, and injured lives. For them, the economic system is beyond questioning. They bow before the unspoken taboo: never criticize the system upon which your careers depend.

Thus, this crisis and its burdens will continue until capitalists see sufficiently attractive opportunities for profit to resume investing and hiring people in the US as well as elsewhere. The freedoms of US capitalists to gain immense government supports as needed and yet to invest only when, where, and how they can maximize their private profits are paramount: the first obligations of government. The freedoms from want and insecurity for the US people remain a distant second priority until mass political action changes that.

In good times as in bad, capitalism is a system that places a small minority of people with one set of goals (profits, disproportionally high incomes, dominant political power, etc.) in the positions to receive and distribute enormous wealth. Those people include the boards of directors that gather the net revenues of business into their hands and decide, together with the major shareholders in those businesses, how to distribute that wealth. Not surprisingly, they use it to achieve their goals and to make sure government secures their positions.

No Keynesian monetary or fiscal policies address, let alone change, how that system works and who uses its wealth to what ends. No reforms or regulations passed or even proposed under Obama would do that either. To avoid the instability of capitalism and its huge social costs requires changing the system. That remains the basic issue for a new year and a new generation. Will they break today’s version of a dangerous old taboo: never question the existing system?

Richard D. Wolff is a Professor Emeritus at the University of Massachusetts in Amherst and also a Visiting Professor at the Graduate Program in International Affairs of the New School University in New York. He is the author of New Departures in Marxian Theory (Routledge, 2006) among many other publications. Check out Richard D. Wolff’s documentary film on the current economic crisis, Capitalism Hits the Fan, at www.capitalismhitsthefan.com. Visit Wolff’s Web site at www.rdwolff.com, and order a copy of his new book Capitalism Hits the Fan: The Global Economic Meltdown and What to Do about It.

| Print