The Troika are celebrating the end of negotiations with Greece, proclaiming that thanks to their tireless efforts the Eurozone remains whole. And why wouldn’t they celebrate? They have demonstrated their power to crush, at least for now, the Greek effort to end austerity and its associated devastating social consequences. Tragically, Syriza has not only surrendered, the nature of its defeat is likely to leave the country worse off, at least both economically and very likely politically as well.

At this point, one of the most important things we can do is try to draw lessons from the Greek experience.

Perhaps one of the most obvious lessons is that visions of a more humane Europe are not real. European leaders were more than willing to pursue the complete collapse of the Greek economy in order to break Syriza and the movement that gave it power for fear of the demonstration effect a successful Syriza might have had on broader European politics. Using the lever of a European Central Bank cut off of funding for Greek banks, the Troika pressed Syriza to the wall.

Here is how a Guardian blog post described the nature of the discussions leading up to the final Greek surrender:

Alexis Tsipras was given a very rough ride in his meeting with Tusk, Merkel and Hollande, our Europe editor Ian Traynor reports.

Tsipras was told that Greece will either become an effective “ward” of the eurozone, by agreeing to immediately implement swift reforms this week.

Or, it leaves the euro area and watches its banks collapse.

One official dubbed it “extensive mental waterboarding”, in an attempt to make the Greek PM fall into line.

An unpleasant image that highlights just how far we have now fallen from those European standards of solidarity and unity.

Second, the vicious nature of the European response to the Greek government’s initial offer of moderate austerity, symbolized by the stance of its dominant power Germany, reflects more than ignorance or petty-mindedness on the part of European leaders. It reflects the increasingly exploitive nature of contemporary capitalism everywhere. Capitalists, pursuing profits in an increasingly competitive and unstable global system, demand ever greater power to intensify the exploitation of workers everywhere and that is how dominant states approach social policy in their respective countries and international institutions.

Third, class interests dominate so-called “economic rationality.” A case in point: in the period before the July 5 referendum we learned that IMF staff believed that Greece would be unable to pay its debts under the best of conditions and that therefore any agreement with Greece had to include debt relief while at the very same time the head of the IMF was aggressively joining with European leaders to reject Greek government pleas for just such relief.

Fourth, since dominant powers will do everything in their power to block meaningful social transformation, those seeking to lead it must prepare people as best they can for the expected class struggle and opposition. In this case Syriza can and should be faulted for not engaging people about the difficulty of achieving both an end to austerity and Eurozone membership under current conditions and doing its best to develop the technical and political capacities necessary for a break from the euro on its own terms if and when the situation called for it.

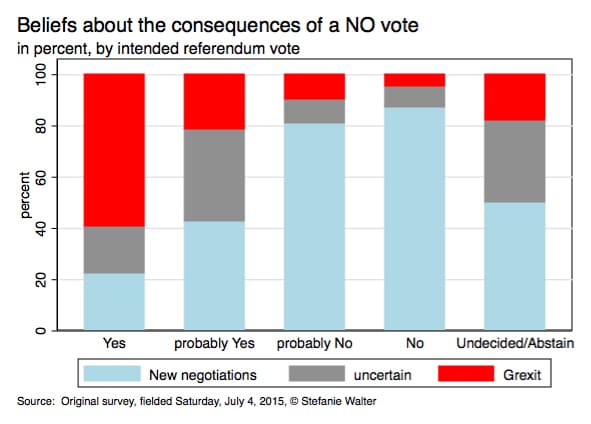

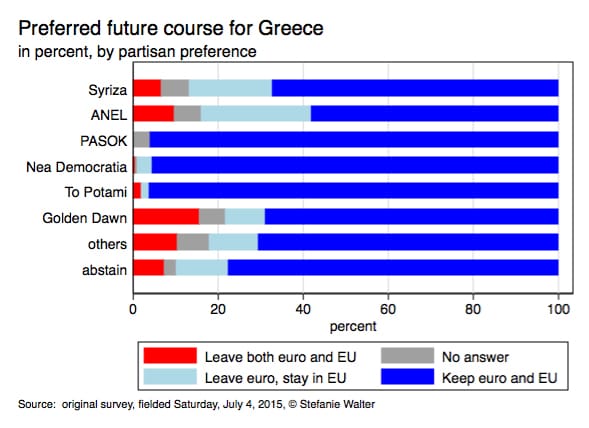

Greeks elected a progressive government, voting Syriza into power in January 2015, on the basis of the party’s commitment to both anti-austerity and continuing Eurozone membership. The leadership of Syriza never wavered from encouraging Greeks to believe that both were possible and most Greeks, for many reasons, were eager to believe that this was true. Although the results of the July 5 referendum showed that the Greek working class has a strong fighting spirit, polling also revealed that most of those who voted No hoped that their vote against the European austerity plan would lead to a better deal from Europe, not a break from the Eurozone. They no doubt felt this way because of government pronouncements.

For example, below are the results of polling done the day before the referendum:

Tragically, immediately after the vote the Greek government surprised everyone by returning to negotiations with the Troika with an offer to accept an austerity program much like the one that had been originally placed before the people and rejected. The only meaningful addition was that it included the long held Greek proposal for debt relief. This decision was a serious mistake for two reasons — it generated serious confusion on the part of the Greek population and perhaps even more importantly convinced the Troika that the Greek government was not prepared to use its new domestic support to challenge the status quo. This only emboldened the Troika to proclaim that the referendum had changed everything and now that trust had been lost between the Troika and Syriza leaders, the austerity demands had to be intensified.

In fact, we have learned that Syriza’s leaders did not expect to win the referendum and were prepared to and in fact perhaps hoped to be able to resign and let more conservative forces negotiate and approve a new austerity package. Here is part of an interview with James K. Galbraith, a strong Syriza supporter:

The recent Ambrose Evans Pritchard piece is very much on the mark (“Europe is blowing itself apart over Greece — and nobody seems able to stop it“). The Greek government, and particularly the circle around Alexis, were worn down by this process. They saw that the other side does, in fact, have the power to destroy the Greek economy and the Greek society — which it is doing — in a very brutal, very sadistic way, because the burden falls particularly heavily on pensions. They were in some respects expecting that the yes would prevail, and even to some degree thinking that that was the best way to get out of this. The voters would speak and they would acquiesce. They would leave office and there would be a general election.

It all went downhill from there. In short, Syriza leadership had no plan B. The Troika knew that Syriza was unwilling to pursue its own break from the Eurozone, which meant that its leadership would do anything to remain in the Eurozone. The following is from an interview with Yanis Varoufakis, the former Greek finance minister, that provides insight into the somewhat self-inflicted weakness in Syriza’s bargaining stance:

The referendum of 5 July has also been rapidly forgotten. It was preemptively dismissed by the Eurozone, and many people saw it as a farce — a sideshow that offered a false choice and created false hope, and was only going to ruin Tsipras when he later signed the deal he was campaigning against. As Schäuble supposedly said, elections cannot be allowed to change anything. But Varoufakis believes that it could have changed everything. On the night of the referendum he had a plan, Tsipras just never quite agreed to it.

The Eurozone can dictate terms to Greece because it is no longer fearful of a Grexit. It is convinced that its banks are now protected if Greek banks default. But Varoufakis thought that he still had some leverage: once the ECB forced Greece’s banks to close, he could act unilaterally.

He said he spent the past month warning the Greek cabinet that the ECB would close Greece’s banks to force a deal. When they did, he was prepared to do three things: issue euro-denominated IOUs; apply a “haircut” to the bonds . . . [Grece] issued to the ECB in 2012, reducing Greece’s debt; and seize control of the Bank of Greece from the ECB.

None of the moves would constitute a Grexit but they would have threatened it. Varoufakis was confident that Greece could not be expelled by the Eurogroup; there is no legal provision for such a move. But only by making Grexit possible could Greece win a better deal. And Varoufakis thought the referendum offered Syriza the mandate they needed to strike with such bold moves — or at least to announce them.

He hinted at this plan on the eve of the referendum, and reports later suggested this was what cost him his job. He offered a clearer explanation.

As the crowds were celebrating on Sunday night in Syntagma Square, Syriza’s six-strong inner cabinet held a critical vote. By four votes to two, Varoufakis failed to win support for his plan, and couldn’t convince Tsipras. He had wanted to enact his “triptych” of measures earlier in the week, when the ECB first forced Greek banks to shut. Sunday night was his final attempt. When he lost his departure was inevitable.

“That very night the government decided that the will of the people, this resounding ‘No’, should not be what energised the energetic approach [his plan]. Instead it should lead to major concessions to the other side: the meeting of the council of political leaders, with our Prime Minister accepting the premise that whatever happens, whatever the other side does, we will never respond in any way that challenges them. And essentially that means folding. . . . You cease to negotiate.”

Of course, it is easy to call for a break with the Eurozone but in reality such a break would not be a walk in the park. For example, Varoufakis makes clear that there were no certainties for what would happen if the government decided on a break:

“He [Tsipras] wasn’t clear back then what his views were, on the drachma versus the euro, on the causes of the crises, and I had very, well shall I say, ‘set views’ on what was going on. A dialogue begun . . . I believe that I helped shape his views of what should be done.”

And yet Tsipras diverged from him at the last. He understands why. Varoufakis could not guarantee that a Grexit would work. After Syriza took power in January, a small team had, “in theory, on paper,” been thinking through how it might. But he said that, “I’m not sure we would manage it, because managing the collapse of a monetary union takes a great deal of expertise, and I’m not sure we have it here in Greece without the help of outsiders.” More years of austerity lie ahead, but he knows Tsipras has an obligation to “not let this country become a failed state”.

To be a bit more specific, a break from the Eurozone would require nationalization of the banks — an act that would immediately draw the country into a serious legal test with Europe since the banks are technically under the control of the European Central Bank. It would require the government to quickly issue new scrip as it prepared a new currency, and aggressively engage in an expanded public works program. At the same time it was unclear whether the new scrip would be accepted and whether the country would have sufficient foreign exchange to maintain minimum purchases of key import items such as food and medicine. Moreover, many businesses, holding debts denominated in euros, would likely be forced into bankruptcy necessitating government takeover. And, all this would take place in a relatively hostile international environment. No doubt some countries would offer words of solidarity, but it appears unlikely that any would or could offer meaningful financial or technical assistance. Still, with proper preparation the possibilities for success could have been greatly enhanced.

Strikingly, Varoufakis mentioned that Syriza had established a small team to think about what a break would mean shortly after their January 2015 election, a team that no doubt was kept small because the government wanted to keep the planning secret. But that was a mistake. Planning should have happened on a large scale and in a visible way. Discussions should have been held with international legal experts as well as with the BRICS countries concerning possible use of their new lending and investment facilities. There was no need to keep this planning quiet, quite the opposite — Eurozone leaders should have been made aware that Syriza was seriously studying its alternatives. And the population should have been brought along — that the government would do all in its power to stay in the Eurozone as long as this was consistent with an end to austerity.

As it was, Tsprias went back into negotiations unarmed, desperate for a bailout. Once the ECB tightened its support for Greece’s banking system it should have been clear, if not before then, that a German-led Europe was only interested in total surrender on the part of Greece. And as far as I can tell total surrender is what they got.

Greece has agreed to an austerity program that is far worse than any previously rejected. Here is the Guardian summary of what was agreed:

Greek assets transfer

Up to €50bn (£35bn) worth of Greek assets will be transferred to a new fund, which will contribute to the recapitalisation of the country’s banks. The fund will be based in Athens, not Luxembourg as Germany had originally demanded.

The location of the fund was a key sticking point in the marathon overnight talks. Transferring the assets out of Greece would have meant “liquidity asphyxiation”, Tsipras said.

As the statement puts it: “Valuable Greek assets will be transferred to an independent fund that will monetise the assets through privatisations and other means.”

The “valuable assets” are likely to include things such as planes, airports, infrastructure and banks, analysts say.

Some of the fund will be used to recapitalise banks and decrease debt, but analysts are sceptical about how much money there will really be to work with.

“Given the experience of the last few years’ privatisation programme, these targets appear overtly optimistic, serving as a signalling mechanism of Greek government commitment to privatisation rather than a meaningful source of financing for bank recapitalisation, growth and debt reduction,” said George Saravelos, a strategist at Deutsche Bank.

Pensions

Greece has been told that it needs to pass measures to “improve long-term sustainability of the pension system” by 15 July.

The country’s pensions system, and its perceived generosity relative to other eurozone states, has been a key sticking point in the past five months of negotiations with creditors.

The so-called troika of lenders believes that Athens can save 0.25% to 0.5% of GDP in 2015 and 1% of GDP in 2016 by reforming pensions.

Greece had wanted to draw out reform of early retirement rules, starting in October and running until 2025, when everyone would retire at 67. The EU wants the process to start immediately, by imposing huge costs on those who want to retire early to discourage them from doing so. The lenders also say Athens must bring forward the reform programme so it completes in 2022.

VAT and other taxes

Another source of contention in the months of failed negotiations that preceded Monday’s tentative deal, VAT is now also on the block for immediate reform.

The latest agreement demands measures, again by 15 July, for “the streamlining of the VAT system and the broadening of the tax base to increase revenue”.

One of the key objections from Greece’s creditors to its VAT system is a 30% discount for the Greek islands. Athens proposed a compromise on 10 July under which the exemptions for the big tourist islands — where the revenue opportunities are greatest — would end first, with the more remote islands following later.

The onus on Greece to “increase revenue” is likely to mean more items will be covered by the top VAT rate of 23%, including restaurant bills, something that had until recently been a red line for Tsipras.

Statistics office

Another demand for legislation by 15 July is on “the safeguarding of the full legal independence of ELSTAT”, the Greek statistics office.

Balancing the books

Greece has been told it must legislate by 15 July to introduce “quasi-automatic spending cuts” if it deviates from primary surplus targets. In other words, if it cannot cut enough to balance the books, it should cut some more.

In the past, the troika has demanded that Greece commit to a budget surplus of 1% in 2015, rising to 3.5% by 2018.

Bridging finance

Talks will begin immediately on bridging finance to avert the collapse of Greece’s banking system and help cover its debt repayments this summer. Greece must repay more than €7bn to the European Central Bank (ECB) in July and August, before any bailout cash can be handed over.

Debt restructuring

Greece has been promised discussions on restructuring its debts. A statement from Sunday night also ruled out any “haircuts”, leaving the €240bn Greece owes to Brussels, the ECB and the International Monetary Fund (IMF) on the books.

Angela Merkel, the German chancellor, said the Eurogroup was ready to consider extending the maturity on Greek loans. She argues that a delay in loan repayments and a lower interest rate act in the same way as a write-off, which is why many analysts point out that the Greek debt mountain is worth the equivalent of 90% of GDP in real terms and not the 180% commonly quoted. Merkel said that for this reason there was no need for a Plan B.

Radical reforms

Tsipras pledged to implement radical reforms to ensure the Greek oligarchy finally makes a fair contribution. The agreement thrashed out overnight would allow Greece to stand on its feet again, he said.

Implementation of the reforms would be tough, he said, but “we fought hard abroad, we must now fight at home against vested interests”.

He added: “The measures are recessionary, but we hope that putting Grexit to bed means inward investment can begin to flow, negating them.”

Liberalising the economy

The new deal also calls for “more ambitious product market reforms” that will include liberalising the economy with measures ranging from bringing in Sunday trading hours to opening up closed professions.

Greece’s labour markets must also be liberalised, the other eurozone leaders say. Notably, they are demanding Athens “undertake rigourous reviews and modernisation” of collective bargaining and industrial action.

Pharmacy ownership, the designation of bakeries and the marketing of milk are also up for reform, all as recommended in a “toolkit” from the Paris-based Organisation for Economic Co-operation and Development.

IMF support

The statement from the euro summit stipulates that Greece will request continued IMF support from March 2016. This is another loss for Tsipras, who had reportedly resisted further IMF involvement in Greece’s rescue.

Energy market

Greece has been told to get on with privatising its energy transmission network operator (ADMIE).

Financial sector

Greece has been told to strengthen its financial sector, including taking “decisive action on non-performing loans” and eliminating political interference.

Shrinking the state

Athens has been told to depoliticise the Greek administration and to continue cutting the costs of public administration.

The Guardian highlights one of the hidden landmines in the agreement:

Our economics editor Larry Elliott has been going through the details of this morning’s deal and concludes it will deepen the country’s recession, make its debt position less sustainable and that it “virtually guarantees that its problems come bubbling back to the surface before too long.”

He continues:

One line in the seven-page euro summit statement sums up the thinking behind this act of folly, the one that talks about “quasi-automatic spending cuts in case of deviations from ambitious primary surplus targets”.

Translated into everyday English, what this means is that leaving to one side the interest payments on its debt, Greece will have to raise more in revenues than the government spends each and every year. If the performance of the economy is not strong enough to meet these targets, the “quasi-automatic” spending cuts will kick in. If Greece is in a hole, the rest of the euro zone will hand it a spade and tell it to keep digging.

This approach to the public finances went out of fashion during the 1930s but is now back. Most modern governments operate what are known as “automatic stabilisers”, under which they run bigger deficits (or smaller surpluses) in bad times because it is accepted that raising taxes or cutting spending during a recession reduces demand and so makes the recession worse.

At least according to press reports, Tsprias put up his greatest fight over inclusion of the IMF in monitoring the agreement and privatization. The IMF is definitely in. As for privatization or what the Guardian calls “Asset Transfer,” gains were minimal. One can question in fact whether at least the latter area is one where Tsprias should have tried to draw lines. At least on the face of it, it would seem that it would have made more sense to fight the demand to “liberalize” labor markets. A victory here would have given the state freedom to encourage the development of a strong labor movement, regardless of ownership.

Moreover, as noted in the summary, Greece is still not guaranteed new loans or debt relief. Its parliament has to pass all of the above and then the government gets to start negotiations again.

As the Guardian reports:

European leaders lined up to say Grexit has been averted, but this snappy soundbite glides over the fact the eurozone has simply agreed to open negotiations on an €86bn (£62bn) bailout. Although this is a step to shoring-up confidence in the euro, it is only a promise to have more talks with no guarantee of success.

Talks on the bailout plan are forecast to last around four weeks. “We know time is critical for Greece, but there are no shortcuts,” said Klaus Regling, the official in charge of the the European Stability Mechanism, the eurozone’s permanent bailout fund that Greece hopes to tap.

But these formal talks can only begin, if eurozone leaders avoid several political and financial tripwires. The Greek government has until the end of Wednesday to ensure that sweeping reforms to its pension system and VAT rates are written into law. If Greek lawmakers meet this eurozone-imposed deadline, the baton will pass to the creditors. At least five countries, including Germany, the Netherlands and Finland, will have to put the idea of opening negotiations on a bailout to a parliamentary vote.

Politics could be overtaken by financial deadlines. Athens faces demands to repay €7bn of debts in July, including €3.5bn due to the European Central Bank on Monday (20 July).

Eurozone officials are working round the clock to come up with emergency funds that will help Greece bridge the gap before a permanent bailout kicks in. “It’s not going to be easy,” said Jeroen Dijsselbloem, the hawkish Dutch politician, who was re-elected chair of the eurozone group of finance ministers on Monday. Several options were being discussed on bridge finance, but no one had found “the golden key to solve the problem”, he said, although he hopes to see progress by Wednesday.

The ECB will also continue to maintain a choke hold on the Greek economy perhaps for months, tightening if any deviations take place.

We suspect the ECB will stall an ELA decision until Greece begins to legislate the new deal later this week.

Greece would still face a tight ELA cap, however. We expect the ELA cap will remain carefully calibrated and controlled at least until the new ESM loan is fully in place. Access to banks could be fully normalised only in the fall.

It is hard to see this agreement as anything but failure. Clearly the main responsibility for this disaster rests with the leaders of Germany and the European Union. They showed that they had no interest in meaningful, honest negotiations, fearing that they would likely lead to a real challenge to their power. But unfortunately Syriza’s leadership did not make the best of the bad hand they were dealt. They needed to talk more truthfully to the population about the political/class nature of and reasons for the difficult challenges they faced and do the maximum possible to strengthen their negotiating position and prepare the population for the failure that they thought likely.

Hopefully, the Greek people will find the time and space necessary to digest and learn the lessons from this struggle and successfully regroup. We all must.

Martin Hart-Landsberg teaches economics at Lewis and Clark College in Portland, Oregon. His latest book is Capitalist Globalization: Consequences, Resistance, and Alternatives (Monthly Review Press, 2013). Read his blog Reports from the Economic Front at <economicfront.wordpress.com>. See, also, Martin Hart-Landsberg, “Lessons from Iceland: Capitalism, Crisis, and Resistance” (Monthly Review 65.5, October 2013).