We must always take heed that we buy no more from strangers than we sell them, for so should we impoverish ourselves and enrich them.

—Thomas Smith(1)

This statement, referring to the relationship of international trading and impoverishment, was published in 1581 in Discourse of the Common Weal of this Realm of England. These issues remain important today. On February 7, 2014, the U.S. Congress passed a new farm bill, with an estimated total cost of $489 billion over five years.(2) This bill aimed to protect U.S. farm commodities, including catfish, and prevent the import of fish products from countries like Viet Nam. In order to continue exporting, Viet Nam would have to devote at least five years to upgrading the production and processing facilities to have its quality standards equivalent to that of U.S. farming.(3) During this period, Vietnamese fish farmers became even more poorer.

This farm bill was just one of the 7,231 protectionist measures imposed on World Trade Organization members by the United States and other G-7 nations (the group of seven major advanced economies) up to that time. Of these measures, 6,819 directly affected Viet Nam and other underdeveloped countries.(4) On a global scale, between 1973 and 2013, the average income gap between the top rich countries and bottom poor nations grew almost twelvefold. Extreme poverty still exists in most underdeveloped countries, including some that have been left behind and excluded from the mainstream of human progress. Capitalism won the Cold War but predictably failed to stop the rise of income inequality and eliminate poverty. Taking all these facts into view illuminates how the United Nations will fail to reach Goal 1 (No Poverty) and Goal 10 (Reduced Inequalities) on its 17 Sustainable Development Goals by 2030.

The Evolution of Monopoly Capitalism

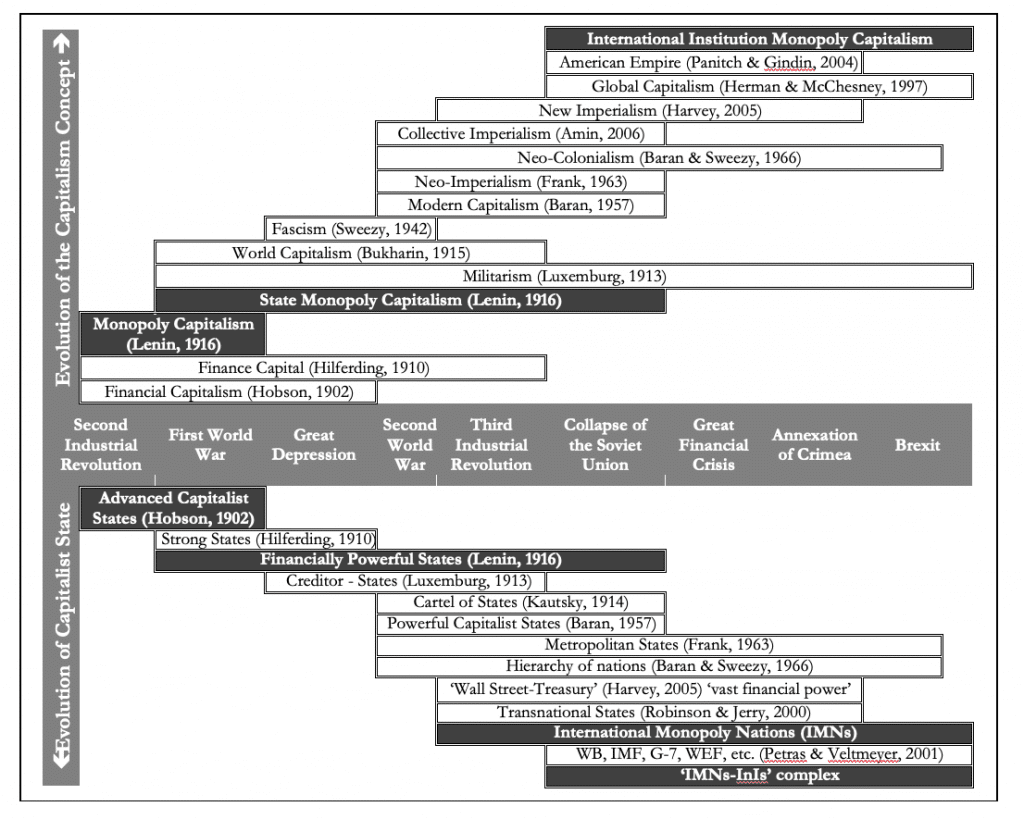

Monopoly capitalism emerged from “laissez-faire” capitalism in the late nineteenth and early twentieth centuries, as described clearly by V.I. Lenin in Imperialism, the Highest Stage of Capitalism, allowing giant corporations to dominate the accumulation process.(5) Since the late 1970s, especially since the collapse of the Soviet Union, this system has reached a new level in its development, forging imperial centralism or “International Institutional Monopoly Capitalism” (IIMC), whereby a handful of powerful nation-states explicitly use international organizations to impose their interests and further expand accumulation. Figure 1 presents a brief overview of the conceptualization of capitalism throughout its history, focusing on the development of monopoly capitalism from the 1870s to the present, including both economic and politic facets. It includes IIMC as the newest term in the evolution of monopoly capitalism.

Figure 1. The evolution of the conceptualization of capitalism from 1870 to the present

Notes: The terms and concepts of capitalism are cited in other scholars’ articles. The years listed reflect the first publication date.

As Karl Marx noted, capitalism has an inherent drive toward endless accumulation through the production of “surplus value.”(6) In relation to this defining characteristic of the system, there have been distinct historical configurations of its operation. IIMC represents the highest form of the imperialism stage of capitalism, given the increasingly coordination between the monopoly capital and the state within core nations. As a state-formed monopoly capitalism, IIMC has been forcing most economies to participate in its system, regardless of whether those economies are capitalist or socialist (except North Korea). This is what Nikolai Bukharin pointed to a century ago.(7)

According to Samir Amin,in the globalization era, the efficiency of economic management by nation-states has changed.(8) Under IIMC, advanced capitalist states are even stronger, as far as their economic-political reach, and are able to control international institutions and organizations. Within these core nations, the state uses its strength to supportthe formation of “super-companies” (the multinational corporations that monopolize one or a number of products/services worldwide), serving the interests of the richest class, while bringing some additional benefits to its broader population. These countries are monopoly nations. Through international institutional settings (e.g., World Bank, International Monetary Fund, World Trade Organization), monopoly capital and monopoly nations extend their influence and power into every corner of the world, even the few remaining socialist strongholds, causing complex conflicts within globalization and regionalization processes.

Capital Concentration and the Establishment of Monopoly Nations

Capital accumulation and the centralization and concentration of capital led to the formation of monopolies (cartels, syndicates, trusts, consortiums, and conglomerates).(9) This fundamental law of capitalism continues to take effect in the IIMC period, albeit at a very high level. However, the following organic processes contributed to the formation of monopoly nations:

- The concentration and centralization of capital in super-companies: The increasing strength and expansion of super-companies, especially over the last five decades, have advanced economic internationalization and globalization. Globally, the 500 largest companies generated $31.1 trillion in 2014.(10) They accounted for nearly 40 percent of world income–up 20 percent from less than 20 percent in 1960.(11) Super-companies not only have a monopoly within one country’s borders but also are dominant in other countries worldwide. The overseas assets of the world’s 100 largest non-financial super-companies in 2011 accounted for 63 percent of their total assets, whereas foreign sales reached 65 percent of their total.(12) This is reflected in the intensification of foreign direct investment (FDI); the significant transfer of employment, technology and international financial operations; and the strong rise of financial systems, bank credit, and insurance. Many super-companies with powerful finances (assets, revenues) can far exceed the gross domestic product (GDP) of many economies. For example, Procter & Gamble (ranked 100th in the list of the largest companies), as noted in Table 1,has revenues that are higher than the GDP of Oman,which is the largest economy in a group of 124 small- and medium-sized economies, with $81.8billion in 2014.(13) Super-companies can dramatically influence small and/or poor countries as they pressure governments to condone environmental degradation, violation of national labor laws, and abuse of labor rights.(14) They can force these governments to tender incentives, which maximize their profits by allowing extremely poor working conditions and low wages.(15) Some super-companies actively destroy local agriculture and kill marine life, which has sparked mass protests.(16) They often hire military personnel to open fire on peaceful protestors and make assassinations.(17)

- The mass exploitation of workers: The division of labor extends throughout the world. In 2011, the employment of foreign affiliates worldwide reached sixty-nine million jobs, up by 8 percent from 2010.(18) Specifically, the total number of employees of the ten largest companies worldwide in 2014 exceeded 9.8 million, which is more than the population of many independent nations.(19) This international division of labor is a product of monopoly capitalism, seeking to avoid the “law of declining rate of profit” and striving to increase the rate of profit.(20) John Bellamy Foster and John Smith have clearly presented this trend, using archetypical examples of the labor and production associated with iPhones, T-shirts, and coffee, which involve super-exploitation overseas by super-companies.(21) As a result, over the last three decades, an enormous amount of surplus value has been produced in the periphery, but captured by super-companies within monopoly nations.(22) Through the international division of labor and expansion of branches worldwide, super-companies promote alliances in the form of complex cooperation among themselves and between themselves and small- and medium-sized companies. They adopt a “divide and rule” approach to control labor worldwide.(23) These super-companiestake advantage of the economies of scale to increase their market shares and influence. Once they are in place in peripheral countries, they influence habits and traditional customs. Workers re-align themselves to earn a living wage.

- The symbiotic growth of monopoly nations and super-companies: Both the state and capital rely on each other to exploit existing internal natural resources (e.g., OECD with its oil); control major production resources throughout the world (e.g., the United States in regard to Iraq’s oil, China influence on its neighbors’ sea routes and exclusive economic zone in the East and South China Seas); and possess key technologies, such as weapons, cell cloning, artificial intelligence robots, patent medicine develop, or media and communication.

In other words, monopoly nations are the products of “five monopolies.”(24) Super-companies and monopoly nations exert their technological and economic powers to dominant the world market, leading to both positive and negative impacts. Super-companies like capitalists to have control over mass destructive weapons, in order to defeat competitors and to destroy commoners’ benefits.

The first and most outstanding monopoly nation is the United States, which has only two companies that reached a turnover in excess of $5 billion in 1955: General Motors ($9.82 billion) and Exxon Mobil ($5.66 billion). However, by 1990, the number of large companies (over $5 billion of turnover) had reached more than 100. In 2013, the smallest company (Exelon: energy sector) of the 132 largest companies had a turnover of $23.5 billion.(25) On a global scale, the company that has the lowest ranking in the top 500 list of largest companies (ranked by Fortune in 2013) is Ricoh (office-equipment sector), reaching sales of over $23.2 billion.(26) Also included in this list are eighty-nine companies from China, which is a rapid increase, compared to its thirty-four companies in 2008.(27) As of 2015, the Global 500 are represented by 36 countries, but nearly 472 of the Global 500 are from only 16 countries: Canada, the United States, France, Germany, Italy, the Netherlands, Switzerland, the United Kingdom, China, Japan, South Korea, Taiwan, Australia, Brazil, India, and Russia. Of these 16 countries, 13 are the world’s largest economies. Table 2 lists the typical monopoly nations in the world in 2015.

The combining of super-companies and states that Lenin analyzed nearly 100 years ago, in which capitalists pivot around political agencies and monopolies, led to the integration of monopoly nations and international institutions/organizations. Thus, under the conditions of IIMC, this integration has crucially influenced the globalization process of the world economy, specifically for the peripheral countries. Although these monopoly nations dominate at different levels and their income is not equivalent, they do not conquer other nations; nonetheless, they help transfer a vast surplus of value from peripheral countries into the core countries.

Monopoly Nations Monopolize International Institutions

The rise of super-companies has not meant the end of competition, which is globally more intense today than ever before. Simultaneously, monopoly nations do not displace super-companies or prevent their monopolistic power; on the contrary, these states directly and indirectly provide super-companies with advantages and benefits. As Harry Braverman explained, “the state is guarantor of the conditions, the social relations, of capitalism, and the protector of the ever more unequal distribution of property.”(28) The role of the state has changed in monopoly nations: it not only regulates the domestic economy, exploits the state capital, and protects monopolies on the international market, but it also represents and supports the allies of domestic monopolies to affect the activities of international institutions/organizations in its favor and increase its competitiveness. The role of the state and its various imperial alliances with local politicians is facilitated through the discourse of national and international competitiveness.(29) Thus, the rise of monopoly nations has not killed competition in all of its forms. In fact, rivalry is more frequent and fierce between monopoly nations and other economies.

The formation of monopoly nations and the emergence of a number of new industrialized countries have caused problems for individual economies to address and settle the issues related to international economic activities. For example, the legal systems and the legal provisions of nations have become a barrier to the circular flow of resources and limited the mobilities of the super-companies. These can range from the agricultural protection policies that were severely opposed by the Cairns Group at the Uruguay Round in 1986 (the first time developing countries had played an active role) to the restriction regulations in immigration.(30) They are also associated with cultural or political issues such as Internet censorship in China, Euroscepticism trend in European Union and Brexit in the United Kingdom, the opposition of the Trans-Pacific Partnership (TPP), and new protectionism in the United States.

Meanwhile, the international institutions had just proved their consistency in their role of coordination and international arbitration among new member economies in the beginning phase. Subsequently, the competitiveness among countries has moved to a higher level and continued to increase, which manifested itself in many forms such as disputes of commerce, technology, and finance, etc. The recent disputes include: batteries (solar) between the United States and India; beef among the United States, Indo, and Japan; steel pipes between Japan and China; auto parts between the United States and China; catfish, frozen shrimp, and garments between Viet Nam and the United States; and rare earths among the United States, the European Union, Japan, and China. There is a severe conflict among the United States, the European Union, Ukraine, and Russia on the recent issue of annexing Crimea.

Since its establishment, the World Trade Organization has witnessed many disputes over dumping, anti-subsidy, and safeguarded trade among member economies. Most of these arguments are related to monopoly nations. The number of quarrels is growing rapidly: over the last twenty years in particular, the World Trade Organization has had to resolve hundreds of cases. Specifically, the United States is a typical monopoly nation that is associated with the majority of the commercial disputes in the world (344 cases), followed by the European Union (316 cases), Japan (180 cases), and China (155 cases).(31)

In the context of the multitude of interlocking and complicated disagreements, the dispute settlement mechanism of World Trade Organization constitutes the basic cornerstone maintaining the multilateral trading order. However, monopoly nations have been controlling this mechanism. If there are disputes among the strongest monopoly nations, this makes them direct competitors (these include the United States, Japan, Western Europe, Russia, and China). Thus, monopoly nations tend to compromise and align with others to monopolize the World Trade Organization. Otherwise, super-companies always plan well to avoid a devalued competition. In the case of Ford, Toyota, and the other leading auto firms, the companies did not try to undersell each other in their prices.(32) Instead, they competed for the low-cost position by making reductions in prime production (labor and raw material) costs that could be implemented in peripheral regions.

Monopoly nations monopolize not only the World Trade Organization but also other international institutions/organizations or forums, such as the World Bank, International Monetary Fund, and regional banks. Furthermore, monopoly nations monopolize political forums like G-7, the European Union, and even the most powerful United Nations. Monopoly nations also monopolize most other regional organizations, from Asia-Pacific Economic Cooperation to the Organization of Petroleum Exporting Countries to the North Atlantic Treaty Organization and most recent the Asian Infrastructure Investment Bank. Below is a list of typical international institutions/organizations and mechanisms that the monopoly nations are monopolizing:

- United Nations: Founded in 1945, it was monopolized at its founding by the five permanent members of the United Nations Security Council. These five members not only have the responsibility to maintain international peace and security in accordance with the principles and purposes of the United Nations but also have the power to veto, thus enabling them to oppose or prevent any proposed resolution of the other members.(33) As a rule, as these five members become stronger, the United Nations is weaker. The weakness of the United Nations is expressed not only in the handling of the South China Sea dispute, but also in events such as Ukraine’s political crisis, the East China Sea quarrels, and its ability to eliminate wars and serious conflicts since the fall of Soviet Union, specifically wars for economic purpose. For instance, the U.S. war machine engaged in Afghanistan (2001-14) and Iraq (2003-11); the Russia annexation of Crimea (2014); and the threat of a Chinese war in the South China Sea. The key motivation of the current aggressive and strongest monopoly nations is to gain control over vital strategic resources.(34)

- World Bank: Founded in 1944, an international institution was originally dominated by the United States and the United Kingdom.(35) The domination of monopoly nations is evident in the voting rights of the member economies in the World Bank. Of the members, in 2013 the United States had highest voting rights at 17.69 percent, followed by Japan (6.84 percent), China (4.42 percent), Germany (4.00 percent), the United Kingdom (3.75 percent), and France (3.75 percent).(36)

- International Monetary Fund: Established in 1944, the International Monetary Fund’s funding is contributed by the member economies. Since its inception, the United States has always been the largest contributor (17.69 percent) and has been dominant through the majority of the voting rights, followed by other members with large holdings in 2010, such as Japan (6.56 percent), Germany (6.12 percent), the United Kingdom (4.51 percent), France (4.51 percent), and China (4.00 percent).(37)

- World Trade Organization: The World Trade Organization was established in 1995 to replacethe General Agreement on Tariffs and Trade that had been in effect since 1948. Its mission is to eliminate or minimize trade barriers to free trade. The majority of its decisions are based on negotiation and consensus. However, the negotiation process does not always reach consensus among all of its members. This process is often criticized by many developing economies because they are not welcome in the negotiations and because, according to Richard Steinberg, the trade negotiations are actually promoted and end at a negotiating position that provides special benefit for the European Union and the United States.(38)

The formation of the regional institutions/organizations, the multilateral economic cooperation forums, and bilateral negotiations are an expression of the ever-increasing conflict between the regionalization and globalization processes. Such examples include the conflicts between the European Union and World Trade Organization on agricultural policy; between North American Free Trade Agreement and World Trade Organization on juridical and political issues; and between Organization of Petroleum Exporting Countries and World Trade Organization on oil price/supply management.(39) These processes lead to very complicated overlapping and interlocking regional and international organizations because a monopoly nation can be a member of several organizations simultaneously. Thus, these organizations become the direct or indirect means to facilitate the monopoly nations in exploiting other countries. It is inevitable that the activities of powerful international institutions (such as the World Bank, International Monetary Fund, and World Trade Organization) have not really brought equal benefits to all.

The IIMC built a complex called the “IMNs-United Nation: Specialized Agencies, International Institutions/Organizations, and Region Organizations” (IMNs-InIs). This organization is beyond the scope of previous international institutions.(40) In other words, the IIMC is a combination of the power of super-companies, monopoly nations, and the juridical capacity of the international institutions. Under IIMC, capital globalization has not only strengthened the power of monopoly nations but has simultaneously created the dependence of other states/nations on the world market and finance system, which are dominated by monopoly nations. This relationship among states/ nations reflects the development of monopoly nations at the expense of the peripheral regions.(41) In addition, “IMNs-InIs” is different from “transnational capitalism class – transnational state” structure in quality, in which the former has instrumentalized the latter.(42) In IMNs-InIs, the international organizations have progressively been the “instrumental institutions” in the hands of monopoly nations to favor them and hinder other economies. This is typically the case when the United Nations Security Council members impose sanctions against other nations, trumping any efforts that could weaken their veto power.(43) It is true in how monopoly nations dominate the WTO through the Doha Development Agenda to hinder agricultural economies of peripheral countries.(44) It is evident in how the International Monetary Fund serves wealthy countries but increases poverty and environmental degradation in poor countries.(45) The establishment of the Beijing-based Asian Infrastructure Investment Bank has raised concerns for both the United States and Japan regarding whether the bank will have high standards of governance and safeguards, which will prevent damage to other creditors.(46) The IIMC is the final stage of “state-formed monopoly capitalism,” the new form of capitalist production that maintains the existence of capitalism and adapts it to new historical conditions.

Monopoly NationsExport Poverty and Income Inequality

Exporting capital to seek additional surplus value is a vital feature of monopoly capitalism. A key feature of modern imperialism involves exporting class struggle and civil war to the peripheral regions.(47) However, in IIMC, its essential features are poverty and income inequality exports. While the export of poverty and income inequality are new concepts, they can be traced to numerous ideas, including the “Singer-Prebisch thesis” in 1949, which served as a major pillar of the “dependency theory.”(48) As Olanike Deji concluded in his Gender and Rural Development in 2012, “Poor nations provide natural resources, cheap labor, a destination for obsolete technology, and markets for developed nations, without which the latter could not have the standard of living they enjoy.”(49) The exporting of poverty and inequality is also associated with Arghiri Emmanuel’s conception of “unequal exchange.” He explained that “History has proceeded, too, as if the industrialized countries had succeeded in exporting impoverishment so effectively that the forecasts of Marxism.”(50) The principal mechanisms for the repatriation of surplus value are foreign direct investment, in which the relocation of industry to the global South over the past three decades has resulted in a massive increase of transferred value to the North.(51) Additionally, as reported in the New York Times, “According to the United Nations, in 2006 the net transfer of capital from poorer countries to rich ones was $784 billion, up from $229 billion in 2002…. Even the poorest countries, like those in sub-Saharan Africa, are now money exporters.”(52)

In addition to exporting capital for appropriating surplus value and profits from the capital-import countries, monopoly nations also erect trade barriers, such as high taxation, quotas, and subsidies or non-tariffs, to prevent the entry of goods and services from other countries in order to protect domestic producers.(53) Specifically, monopoly nations have created many hurdles in the agricultural sector by establishing food safety and phytosanitary standards on developing countries.(54) The behavior of monopoly nations, which shows clearly in their negotiation on bilateral/multilateral agreements with small/weak economies, is similar to the relationship between the capitalist and the worker. Obviously, most developing countries have to accept their strict regulations. According to the World Bank, tariff and budget-based support to agriculture in the Organisation for Economic Co-operation and Development reached $350 billion in 2004, of which $280 billion went directly to farmers.(55) Doha Round also estimated that if all trade barriers were removed, the annual income of the world economy would increase by approximately $290–460 billion, and a portion would certainly increase the income of the poor in poor countries and reduce global poverty in a sustainable way.(56)

Thus, trade protection is seen as a means of poverty and income inequality export. The most important resource for poor countries is foreign currency, which increases the commodity export to eliminate and reduce poverty. However, because of protection, the producers of the same products in monopoly nations receive better income, while those in the poorer countries receive less. The following examples clearly demonstrate how the United States has exported poverty and income inequality to Viet Nam and Laos through trade protection policies.

In the several last decades of the twentieth and early twenty-first centuries, most economies have used various forms of protection, in which the number of non-tariff measures imposed by the World Trade Organization’s members in merchandise is booming from 136 in 1986 to 2,456 in 1995, and to 43,268 at the end of 2016.(57) IIMC has been creating favorable conditions for exporting poverty and income inequality worldwide. Every government of a monopoly nation must practice protectionism because it wants to maintain social-political stability and must therefore satisfy its people economically and successfully obtain support at all domestic levels for decisions related to national defense and security. In contrast, peripheral countries that are weak in politics/diplomacy have been pulled into the process of regionalization and globalization. They are dependent on the capital and technology of the monopoly nations, but their domestic market mechanism is not fulfilled. Therefore, they must accept more losses.

Export of poverty and income inequality is conducted as follows:

- Direct export: This is a form of export in which a country (practicing protectionist policies) has direct investment into and/or trade ties with one or a group of countries on one or a certain number of goods and services. For example, in 2014, the United States imported $0.36 million of catfish from Viet Nam. Following the Agricultural Act of 2014, which the former imposed on Vietnamese catfish, Viet Nam faced a decrease of 75.3 percent of its catfish export the following year, totaling $0.09 million.(58)

- Indirect export: This is a form of export in which a country (practicing protectionist policies) has only indirect investment into and/or trade ties with one or several of a group of countries on one or a certain number of goods and services, but has a direct relationship with one another or several others of this group. For example: the above-mentioned farm bill and the decrease of 75.3 percent of the catfish export of Viet Nam led to a similar percent decrease of the catfish feed import from Thailand, Indonesia, and India. In another case, in 2004, the United States imposed anti-dumping duties ranging to nearly 200 percent on the wooden bedroom furniture imported from China.(59) Therefore, a decrease of the export of Chinese wooden bedroom furniture to the United States inevitably lead to a negative impact on the exports of Viet Nam and Laos (both nations generally have the same political system as in China and were not members of the World Trade Organization at that time) because they were exporters of woods to China. Thus, this decreased the possibility of wood export of Viet Nam and Laos and reduced the income of their farmers.

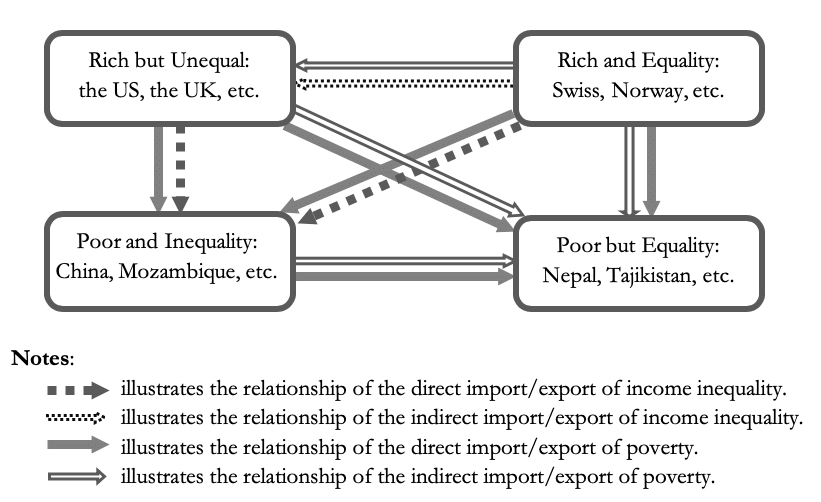

The two foregoing protocols have been present throughout the history of international trade, but they took distinct, complicated forms following the 1980s. Increasingly nations throughout the world were integrated into these international institutions, dominated by monopoly capital and the interests of super-corporations. Monopoly nations and small/weak economies export poverty and income inequality among themselves. The United States is a typical monopoly nation both exporting poverty/income inequality and importing income inequality. China exports poverty and imports income inequality. Even the relatively egalitarian Nordic nations have been exporting income inequality and poverty around the world since 1995. Figure 2 presents these relationships. It illustrates a generalization of the poverty and income inequality export among the world economies.

Figure 2. The relationships of import/export of poverty and income inequality among the economic groups

In 1995, Norway and Switzerland both imposed protectionistmeasures—231 by Norway and 36 by Switzerland. In 2016, these measures increased to 340 by the former and 416 by the latter.(60) Major protectionist measures were applied in relation to agricultural products, such as fresh fruits and cereals that had affected on the U.S. and EU in the phase of 1995 to 2012. That means the Norwegian and Swiss farmers would get higher income, while those in the United States and the European Union would receive less. However, the income of latter did not decrease because their governments were able to subsidize them for exporting to other countries and/or shifting to other industries such as catfish feeding and/or wooden furniture manufacturing.

These relationships, which are very complex and diverse, occur simultaneously in all countries within or outside of any international and regional organizations. Within the capitalist world system, there will always be strong and disadvantaged economies. Che Guevara, nearly half a century ago, summarized the exploitative nature of capitalism as follows:

Ever since monopoly capital took over the world, it has kept the greater part of humanity in poverty, dividing all the profits among the group of the most powerful countries. The standard of living in those countries is based on the extreme poverty of our countries.(61)

Currently, it can be concluded thaton a global scale, each one percent of GDP growth and/or reduction in the income inequality level of a country/region will result in a proportionate reduction of GDP and/or the growth of income inequality of another. This is similar to the concept of “matrix of zero-sum relations,” in which the wealth of the metropolis is a direct function of surplus extraction from the satellites.(62)

At the global level, the nature of the relationships among nations in the IIMC is a very complicated “competition and ally matrix,” but they are always under the law of “big fish eat small fish,” in which rivalry prevails among the strongest monopoly nations. The United States has consistently been at the top of the “pyramidal structure.”(63) Stated differently, the state-formed monopoly capital system associated with the IIMC is a three-tier system: (1) the upper monopoly nations dominate the lower monopoly nations in the core and most other nations in the world; (2) the lower monopoly nations also dominate peripheral nations; and (3) the industrialized nations within the periphery dominate the weakest nations.

The matrix of the three-tier system was formed world-wide in the 1980s and 1990s after the collapse of Soviet Union and Eastern European countries, the capitalization of the economies in China and Viet Nam, and the outsourcing of production to India, Indonesia, Brazil, Mexico, and other newly industrializing countries.(63) In these countries and the other poorest countries, the local capitalized richest class has been emerging due to several main causes such as popularized corruption among politicians and bureaucrats, the process of public asset and common privatization, illegal business by private individuals, and the financial mafia. They have been organizing and vying for control of local state and public administration agencies. The result is that under IIMC, there is a gap between the capitalized richest class and the weakest populations of the weakest countries and the divide between countries is rapidly widening. The income gap between the rich and poor country groups in absolute numbers can be seen in Table 3.

Table 3. The average GNI per capita (atlas method; unit: current US$) of the low-income group and the elite Monopoly Nations group from 1973-2013

| No. | Countries/group |

Years |

|||||

|

1973 |

1982 |

1991 |

2000 |

2008 |

2013 |

||

| 1 | Norway | 5,260 | 15,550 | 27,310 | 35,860 | 85,580 | 102,700 |

| 2 | Switzerland | – | 19,100 | 37,510 | 43,490 | 63,020 | 90,680 |

| 3 | Luxembourg | 4,390 | 12,540 | 29,690 | 39,100 | 83,240 | 69,880 |

| 4 | Sweden | 7,050 | 15,760 | 29,110 | 31,220 | 55,600 | 61,710 |

| 5 | Denmark | 5,600 | 12,980 | 25,720 | 32,660 | 60,260 | 61,670 |

| 6 | United States | 7,340 | 14,270 | 24,720 | 35,740 | 49,680 | 53,470 |

| 7 | Finland | 4,030 | 11,700 | 25,090 | 26,420 | 49,880 | 48,820 |

| 8 | Germany | 4,680 | 11,140 | 22,910 | 26,170 | 43,910 | 47,250 |

| 9 | Japan | 3,570 | 10,380 | 28,290 | 34,980 | 37,760 | 46,330 |

| 10 | France | 4,700 | 12,070 | 21,550 | 25,150 | 43,510 | 43,520 |

| 11 | United Kingdom | 3,670 | 10,000 | 18,080 | 27,230 | 46,870 | 41,680 |

| 12 | Russian Federation | – | – | 3,420 | 1,710 | 9,640 | 13,850 |

| 13 | China | 160 | 220 | 350 | 930 | 3,050 | 6,560 |

| World | 1,174 | 2,569 | 4,338 | 5,420 | 8,937 | 10,683 | |

| E | Elite Monopoly Nation Group | 4,586 | 12,143 | 22,596 | 27,743 | 48,615 | 52,932 |

| L | Low-income Group | 152 | 287 | 278 | 267 | 481 | 728 |

| Income Gap (E-L) | 4,434 | 11,856 | 22,318 | 27,476 | 48,134 | 52,204 | |

Notes: Elite group comprise 1) Permanent U.N. Security Council members; 2) two nations were defeated in the Second World War: Germany and Japan; 3) four typical Nordic nations: Norway, Sweden, Finland and Denmark; and 4) Switzerland and Luxembourg. Calculated by author.

Source: World Bank, “World Development Indicators: GNI per capital,” (2014), accessed April 2, 2014.

The GNI per capita is not sufficiently accurate to reflect the living standard of each citizen but it is a key factor. At the world level, Table 3 shows that the living standard of citizens in the elite group and the elite monopoly nation group (not including Russia and China) is very high and that the highest group in the world is increasingly significantly greater than the world average. Compared to the group of poor countries, the absolute gap of GNI increased from $4,434 in 1973 to $52,204 in 2013 (the GNI per capita of the low-income group increased from $152 to $728 in the same period).(64) Following this trend, the poor group will never reach the standard of living of the elite group. Although the poor group also has an increased GNI per capita, its gap with the elite group is continuing to widen. This means that the level of “global income inequality” (inequality among countries and among strata/classes within a country) will never cease under the system of capital.

The dominance of super-companies in various fields has been creating antagonism between the extremes of the richest and the poorest, and the monopoly nations’ dominance of international institutions pushes the conflicts among nations to the brink of war. In addition, it is a source of rising extreme nationalism and international terrorism.The uneven expropriation of natural resources and unequal wealth are leading to serious crises of environment, energy, and economics; crises of politics, security, and defense; and finally, crises of faith and humanity.

Notes

- ↩ Thomas Smith, William Stafford, John Hales, Mary Dewar, and Folger Shakespeare Library, Discourse of the Common Weal of this Realm of England (Publisher: Charlottesville, Published for the Folger Shakespeare Library [by] the University Press of Virginia [1969]).

- ↩ Renée Johnson and Jim Monke, “What Is the Farm Bill? Congressional Research Service (February 2017). June 18, 2017.

- ↩ “U.S. Farm Bill will impact Vietnam’s catfish exports,” AmCham Vietnam, cited June 26, 2017.

- ↩ WTO (World Trade Organisation), “Integrated Trade Intelligence Portal (I-TIP),” (detailed query of measures imposed by the U.S. and G-7 in 2014), cited June 26, 2017.

- ↩ Vladimir I. Lenin, “Imperialism, the highest stage of capitalism,” Selected Works,Volume 1 (Moscow: Progress Publishers, 1963), 667–766.

- ↩ Karl Marx, “Theories of Surplus-Value,” Volume IV of Capital(Moscow: Progress Publishers, 1971).

- ↩ Samir Amin,Capitalism in the Age of Globalization(London: Zed Books, 1997): 32, 55.

- ↩ Lenin, Selected Works,Volume 1, 667–766.

- ↩ “Revenues and profits of the world’s 10 largest companies in 2014,” Global 500 (2015). January 31, 2016.

- ↩ John Bellamy Foster and Robert W. McChesney, The Endless Crisis: How Monopoly-Finance Capital Produces Stagnation and Upheaval from the USA to China(New York: Monthly Review Press, 2012), 71, 76–77.

- ↩ UNP (United Nations Publication), World investment report 2012: towards a new generation of investment policies(New York and Geneva: UN Publication, 2012), 25.

- ↩ WB (World Bank), “World Development Indicators: GNP (current US$),” (2015), cited January 31, 2016.

- ↩ Leon Grunberg, “The IPE of Multinational Corporations,” in David N. Balaam & Micheal Vaseth, Introduction to International Political Economy (New Jersey: Pearson Education, 2001), 320-345; Rohit Singh, Alex Schwarz, April Anderson, and Danhua Zhang, “The World of Wal-Mart,” Carnegie Council for Ethnics in International Affairs, May 08, 2013, https://www.carnegiecouncil.org/publications/ethics_online/0081; Aruna Kashyap, “Work Faster or Get Out,” Human Rights Whatch (2015). March 28, 2017, https://www.hrw.org/report/2015/03/11/work-faster-or-get-out/labor-rights-abuses-cambodias-garment-industry.

- ↩ Erick Kabendera, “In Turkey, China caught up in rail tender confusion,” Daily Nation, January 23, 2017; Matt Wilsey and Scott Lichtig, “The Nike Controversy,” (2000), cited March 28, 2017.

- ↩ Shannon Tiezzi, “It’s Official: Formosa Subsidiary Caused Mass Fish Deaths in Vietnam,” The Diplomat, July 01, 2016.

- ↩ Global Exchange, “The 14 Worst Corporate Evildoers,” International Labor Rights Forum (2005). March 28, 2017.

- ↩ UNP, World investment report 2012, 23.

- ↩ “Employment of the world’s 10 largest companies in 2014,” Global 500 (2015a). January 31, 2016.

- ↩ Marx, Volume IV of Capital (1863).

- ↩ John Bellamy Foster, “Introduction to the Second Edition of The Theory of Monopoly Capitalism,” Monthly Review, Volume 65, Number 3 (July-August 2013); John Smith, “The GDP Illusion,” Monthly Review Volume 64, Issue 03 (July-August 2012).

- ↩ John Bellamy Foster, “The Theory of Monopoly Capitalism: An Elaboration of Marxian Political Economy,” Monthly Review Press, new edition (New York: 2006a), 179.

- ↩ John Bellamy Foster, Robert W. McChesney and R. Jamil Jonna, “The Global Reserve Army of Labor and the New Imperialism,” Monthly Review, Volume 63, Issue 06 (November 2011).

- ↩ Samir Amin,Capitalism in the Age of Globalization, 3-5.

- ↩ “Top ranking of American companies in 1955, 1990 and 2013,” Global 500 (2014). June 09, 2014.

- ↩ “Revenues and profits of the world’s 10 largest companies in 2014.”

- ↩ “World’s 500 Largest Corporations In 2013: The Chinese Are Rising,” Forbes (April 2014). June 08, 2014.

- ↩ Harry Braverman,Labor and Monopoly Capital: The Degradation of Work in the Twentieth Century, 25th Anniversary Edition (New York: Monthly Review Press, ([1974]) 1998), 197.

- ↩ Leslie Sklair, “The Transnational Capitalist Class and the Discourse of Globalization,” Cambridge Review of International Affairs, Global policy forum (2000), cited Feb 04, 2016.

- ↩ The Cairns Group was founded in August 1986 and included 14 original member countries—Argentina, Australia, Brazil, Canada, Chile, Colombia, Fiji, Hungary, Indonesia, Malaysia, New Zealand, the Philippines, Thailand, and Uruguay. The Uruguay Round began in 1986 and was the most ambitious round hoping to expand the competence of the GATT to important new areas, such as services, capital, intellectual property, textiles, and agriculture.

- ↩ WTO (World Trade Organisation), “DISPUTE SETTLEMENT: Disputes by country/territory,” (2014), cited June 14, 2014.

- ↩ “The Global Reserve Army of Labor and the New Imperialism.”

- ↩ Richard Matthew, “Environment, conflict, and peacebuilding,” Handbook of global environmental politics (United Kingdom: Edward Elgar Publishing, Cheltenham, 2012); “UN Reform,” Global Policy Forum. February 05, 2016.

- ↩ John B. Foster,Naked Imperialism(New York: Monthly Review Press, 2006b), 31–38.

- ↩ Michael Goldman, Imperial nature: The World Bank and struggles for social justice in the age of globalization(New Haven, CT: Yale University Press, 2005). ISBN 978-0-30-011974-9.

- ↩ “Developing nations get more say in World Bank affairs,” The Times of India. (April 2010). April 26, 2016, http://www.timesofindia.indiatimes.com/india/Developing-nations-get-more-say-in-World-Bank-affairs/articleshow/5858176.cms.

- ↩ IMF (International Monetary Fund), “IMF members’ quotas and voting Power, and IMF board of governors,” (2011). June 11, 2014, http://www.imf.org/external/np/sec/memdir/ members.aspx.

- ↩ Richard H. Steinberg, “In the shadow of law or power? Consensus-based Bargaining and Outcomes in the GATT/WTO,” International Organization, 56, 2 Spring (2002), 339–374.

- ↩ Christina L. Davis, “A Conflict of Institutions? The EU and GATT/WTO Dispute Adjudication,” Princeton University (2007), April 02, 2017; Huang Xian Yu, “The Study of the Conflicts between the European Union (Regional Economies) and the World Trade Organization,” International Journal of Social Science and Humanity, Vol. 3, No. 3 (2013); Frederick M. Abbott, “North American Economic Integration: Implications for the WTO, the EU and Asia,” Regional and Global Regulation of International Trade (Oxford and Portland: Oregon, 2002): 90-91; Melaku G. Desta, “OPEC And The WTO: Petroleum As A Fuel For Cooperation In International Relations,” OPEC VOL. XLVII, No 10 (2004). April 04, 2017.

- ↩ John B. Foster, “The Imperialist World System: Paul Baran’s Political Economy of Growth After Fifty Years,”Monthly Review, Volume 59, Issue 01 (May 2007).

- ↩ Anthony Brewer, Marxist Theories of Imperialism A Critical Survey, Second Edition (London: Routledge, 1990), 161.

- ↩ William I. Robinson and Jerry Harris, “Towards a Global Ruling Class? Globalization and the Transnational Capitalist Class,” Science & Society, 64 (1) (2000): 11.

- ↩ Edward C. Luck, “Reforming the United Nations: Lessons from a History in Progress, Who Decides?” International Relations Studies and the United Nations Occasional Papers, No. 1 (2003): 15.

- ↩ “Has the World Trade Organisation failed poor countries?” (2015). April 04, 2017.

- ↩ “Top Ten Reasons to Oppose the IMF,” Global Exchange, cited April 04, 2017.

- ↩ “Minutes of the Panel Discussion on “AIIB and Japan’s Pathway Forward”,” Sasakawa Peace Foundation, July 13, 2015.

- ↩ Michael Hardt and Antonio Negri, Empire(Cambridge: Harvard University Press, 2000), 309.

- ↩ In economics, the Prebisch–Singer hypothesis (also called the Prebisch–Singer thesis) argues that the price of primary commodities declines relative to the price of manufactured goods over the long term, which causes the terms of trade of primary-product-based economies to deteriorate.

- ↩ Olanike F. Deji, Gender and Rural Development, Volume 2: Advanced studies (Berlin: 2012), 20.

- ↩ Arghiri Emmanuel,Unequal Exchange: A Study of the Imperialism of Trade (with additional comments by Charles Bettelheim), Second Printing (New York and London: 1972), 303.

- ↩ Torkil Lauesen and Zak Cope, “Imperialism and the Transformation of Values into Prices,” Monthly Review, Volume 67, Issue 03 (July-August 2015).

- ↩ Tina Rosenberg, “Reverse Foreign Aid,” www.nytimes.com, March 25, 2007.

- ↩ Keith E. Maskus, J.S. Wilson, and T. Otsuki, “Quantifying the impact of technical barriers to trade: a framework for analysis,” Trade Development Research Group, the World bank (2000): 46.

- ↩ Spencer Henson, R. Loader, A. Swinbank, M. Bredahl, and N. Lux, Impact of sanitary and phytosanitary measures on developing countries (Center for Food Economics Reseach, University of Reading, Reading, UK, 2000).

- ↩ Richard Newfarmer,Trade, Doha, and development: a window into the issues, Trade Department, (the World bank, 2005), 16.

- ↩ Newfarmer,Trade, Doha, and development: a window into the issues, 17.

- ↩ WTO, “Integrated Trade Intelligence Portal (I-TIP),” (detailed query of measures imposed by the by the WTO’s membersin 1986, 1995, and 2016), cited April 6, 2017, i-tip.wto.org.

- ↩ “Standard Query,” Foreign Agricultural Service (2017). April 09, 2017.

- ↩ “US to slap tariffs on Chinese furniture,” China Daily, June 20, 2004l.

- ↩ WTO, “i-tip.wto.org,” (detailed query of measures imposed by Norway and Switzerland in 1995 and 2016), cited April 6, 2017.

- ↩ Che Guevara, “www.marxists.org” (Spoken: February 24, 1965). Source: The Che Reader, Ocean Press, © 2005.

- ↩ Michael Howard and John King, A History of Marxian Economics, Volume 2, 1929-1990 (Houndmills: Macmillan, 1992), 177.

- ↩ Hardt, Empire; Gérard Duménil and Dominique Lévy, “The Economics of U.S. Imperialism at the Turn of the 21st Century,” Review of International Political Economy, 11(4) (2004): 657–76. doi:10.1080/0969229042000279757.

- ↩ “Imperialism and the Transformation of Values into Prices.”

- ↩ According to World Bank classifications, poor country’s GNI per capita less than $1,035, data.worldbank.org.