China has an unemployment problem. There are lots of articles and commentary about the Chinese economy, especially recently with attention focused on China’s declining rate of growth. But have you noticed that there is rarely any mention of China’s unemployment rate?

Chinese growth is falling

China’s fourth-quarter 2018 GDP growth fell to 6.4 percent year-on-year, the slowest rate of growth since the global financial crisis. It brought full-year growth down to 6.6 percent, the slowest yearly rate of growth since 1990. And predictions are for a significantly slower rate of growth in 2019, perhaps down to 6.3 percent.

The government has certainly pursued a number of policies over the last decade in an attempt to keep growth robust. This includes the massive post-crisis, investment-heavy stimulus program; the more recent Belt and Road Initiative, and on-going highly expansionary monetary policy. But, the growth-generating effects of these and other government policies has steadily diminished. As Victor Shih points out in a recent New Left Review interview:

In 2016, China needed three times as much credit to call forth the same amount of growth as in 2008. The scale of debt creation required to keep the economy moving forward has increased massively, and People’s Bank of China loans to domestic financial institutions rocketed from 4 trillion renminbi at the end of 2010 to 14 trillion renminbi by November 2017, a three-and-a-half-fold increase in the space of seven years. Total debt has grown from 163 per cent of GDP around 2009 to 328 per cent of GDP today, and this figure will likely continue to grow for the foreseeable future.

Strikingly few discussions of China’s declining growth trajectory include mention of the country’s unemployment rate. One possible reason is that China’s official unemployment rate has been remarkably stable at roughly 4 percent for decades, seemingly unaffected by the economy’s ups and downs. Unfortunately, this official rate is worthless as an indicator of the China’s labor market conditions. In reality, China likely has a serious and growing unemployment problem.

China’s faulty measure of unemployment

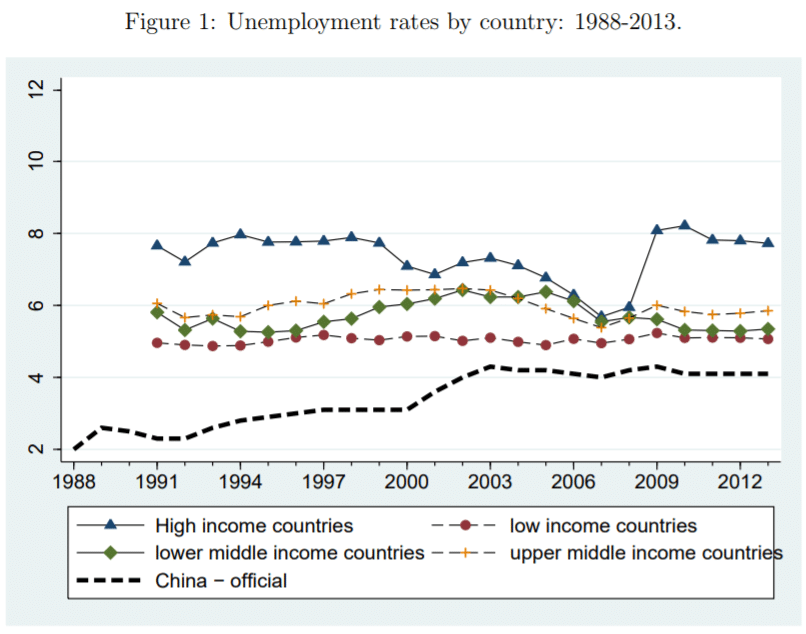

As we can see from the chart below, taken from a National Bureau of Economic Research (NBER) report on trends in unemployment in China, the country’s unemployment rate has been low and quite stable. It rose gradually from the early 1990s to the early 2000, as the government pursued a program of privatization and marketization, and then remained largely unchanged, hovering around 4 percent, from the early 2000s to 2013.

In fact, the official rate has remained much the same over the following years. In April 2018, the government introduced a new measure of unemployment, one that it said would be more accurate. According to the new measure, the country’s unemployment rate fell to 3.82 per cent at the end of September, from 3.83 per cent at the end of June.

This stability is rather startling, considering that over the period 2002 to 2018 China’s growth rate has fluctuated considerably. It is why Christopher Balding, in a Bloomberg article, captured the opinion of most analysts when he said:

China has long been criticized both for its obsession with GDP statistics and their quality: Pressuring cadres to meet growth targets has encouraged a risky buildup of debt and, at times, the outright fabrication of numbers. If anything, though, the quality of China’s official employment data is even worse—and the inaccuracies could have equally dangerous repercussions.

There are many problems with the government’s past and current measure of unemployment. Perhaps the most important is that it is a really an “urban registered jobless rate.” The urban designation is significant because of China’s household registration system (Hukou), which identifies a person by their place of birth. Migrant workers who come to an urban area in search of work do not have an urban registration and are thus denied the benefits enjoyed by the urban Hukou population, including subsidized housing, health insurance, unemployment insurance, and minimum living standard subsidies. China’s unemployment rate only measures the rate of unemployment of those with an urban registration.

Another problem with the official measure is that until the April 2018 revision, an unemployed urban worker had to register with their local employment service agency to be counted as unemployed. Unemployed workers often skipped registering because the process is time consuming and the benefits small and time limited to a maximum of two years. The revised measure is said to be based on government surveys rather than registration, but the reliability of the surveys is in doubt.

In addition, as the authors of the NBER report point out:

the total labor force, which is the denominator in the calculation of unemployment rate, is also subject to error for many reasons. One recent article that reviewed the quality of Chinese labor statistics claimed that the official unemployment rate is “almost useless.” Another important and related labor market indicator–the labor force participation rate–is not even reported in official statistics.

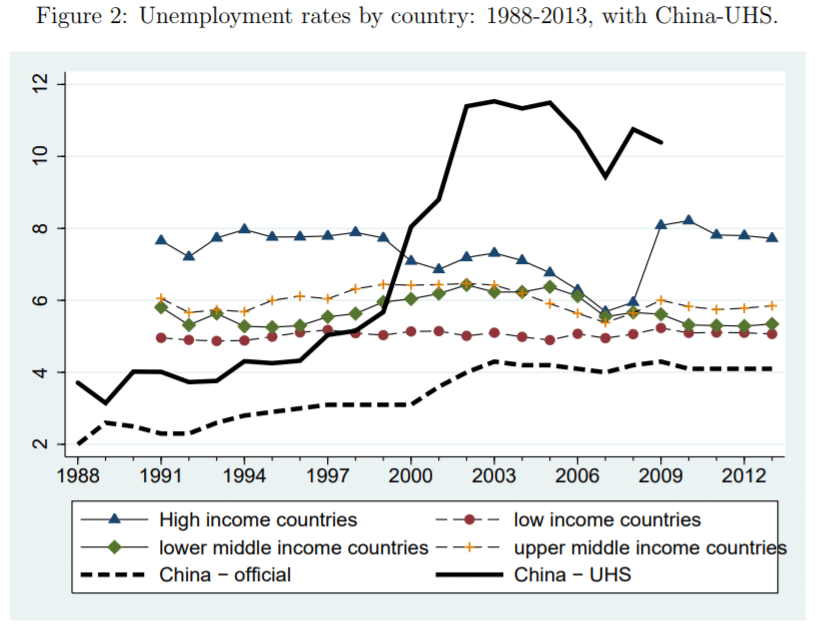

Accepting the urban Hukou framework, the authors made their own calculation of urban unemployment using China’s Urban Household Survey (UHS) which covers all of urban China and has been administered by China’s National Bureau of Statistics since the 1980s. Their calculations yield, as shown by the sold dark line in the following figure, an urban rate of unemployment that is far higher than the government’s official measure (dotted black line).

The authors summarize their results as follows:

The rate averaged 3.9 percent in 1988-1995, when the labor market was highly regulated and dominated by state-owned enterprises, but rose sharply during the period of mass layoff from 1995- 2002, reaching an average of 10.9 percent in the subperiod from 2002 to 2009.

What is striking is that the high rates of unemployment from 2002 to 2009 occurred in years when official GDP growth was over 9 percent a year.

Of course, any meaningful measure of unemployment has to include all urban workers, not just the ones with an urban registration classification. China’s migrant workforce tops 280 million according to official estimates. The country’s four megacities, each with a population of over 10 million–Shanghai, Beijing, Guangzhou and Shenzhen—have huge migrant populations. For example, migrants make up more than 40 percent of Shanghai’s population, 37 percent of Beijing’s population, 38 percent of Guangzhou’s population, and 67 percent of Shenzhen’s population.

While not all migrant workers are in the labor force, most are since their migration was, more often than not, motivated by a search for employment. And as the Chinese economy transitioned away from one anchored by state production for domestic use into one rooted in private production, increasingly for export, migrant workers became central to its operation. For example, migrant workers dominate the manufacturing workforce at most foreign-owned export firms. They also comprise the majority of urban construction workers.

While it is true that the period of privatization was harder on state workers than migrant workers, the more recent years, marked by the country’s post-crisis slowdown in growth and exports, have definitely taken their toll on the migrant workforce. In light of the high NBER unemployment estimates for urban Hukou workers highlighted above, it is not unreasonable to imagine an overall urban unemployment rate close to 15 percent if we include migrant workers.

It’s getting worse

As noted above, Chinese growth is slowing. Adding to policymakers’ worries is the fact that export growth has also been trending down; exports in December 2018 fell 4.4 percent from a year earlier, with demand in most major markets weakening. And these trends are definitely reflected in changes in company payrolls and hiring plans.

According to a report in The South China Morning Post,

Demand for labor at China’s importers, exporters, and related manufacturers fell by 40 per cent in the last quarter of 2018 from a year earlier, showing the trade war with the U.S. has taken its toll, a survey released on Friday revealed.

The China Institute for Employment Research (CIER) at the Renmin University of China in Beijing found jobs in export-oriented regions, including Dongguan in the Pearl River Delta and Suzhou in the Yangtze River Delta, were hit hard.

A CNBC story highlights survey results showing planned layoffs in manufacturing but goes on to add:

The job losses don’t appear to be relegated to just the manufacturing sector.

“We haven’t seen this degree of jobs weakness since the (stock) market panic of Q1 2016,” Leland Miller, chief executive officer of China Beige Book, said in an email. The firm publishes a quarterly review of the Chinese economy based on a survey of more than 3,300 Chinese firms.

“In Q4 employment growth weakened across every major sector, with the ‘new economy’—retail and services—seeing the most substantial deterioration,” Miller said. “To call it broad-based is an understatement: job growth slowed in every region we track except the Northeast.”

Regardless of official unemployment figures showing stable and even declining rates of unemployment, all signs point to the fact that unemployment is high and trending upwards. And, that, certainly from a worker perspective, means that China has a serious unemployment problem. Whether Chinese leaders have the commitment or capacity to offer a meaningful response, given the interests they represent and the constraints within which they operate, remains to be seen.