Now that the U.S. and the NATO allies have taken from the Russian oligarchs their cash in foreign banks, their mansions, their boats and planes, and blocked the export of all private and corporate Russian capital abroad, Russia is freer to decide how to organize the capital investment of the economy. Freer, that’s to say, than Russia was when the Clinton Administration installed Boris Yeltsin and his cronies in the Kremlin at the end of 1991; destroyed the parliament in 1993, and rigged Yeltsin’s re-election in 1996.

Now that the U.S. and the NATO allies have taken from the Russian oligarchs their cash in foreign banks, their mansions, their boats and planes, and blocked the export of all private and corporate Russian capital abroad, Russia is freer to decide how to organize the capital investment of the economy. Freer, that’s to say, than Russia was when the Clinton Administration installed Boris Yeltsin and his cronies in the Kremlin at the end of 1991; destroyed the parliament in 1993, and rigged Yeltsin’s re-election in 1996.

Freer too than Russia has been under Vladimir Putin’s policy of deoffshoreization–that policy fell through a loophole in 2015. The price of their combined failures over thirty years has been more than one trillion dollars. That’s the sum of Russian capital outflow which started in 1992 and accelerated since 2000.

In the calculation of the International Monetary Fund (IMF), Russia has been the only example in the world of an economy in which domestic economic growth has failed to reverse capital outflow, and to attract capital to return. Privatization in Russia has also been unique because it has accelerated the rate of outflow of domestic funds, enlarging the gap between domestic outflow and foreign inflow. Predictably, this has led to the accumulation of a bigger Russian capital economy offshore than the domestic capital economy (except for housing); and a level of inequality of incomes which is today worse for Russians than it was during the last decade of tsarist rule ending in the world war and the revolution of 1917.

The Tsargrad headline on April 4, 2022, says: “WEEP, EUROPE! MISHUSTIN RETURNS THE RUSSIAN STOCK MARKET TO THE RUSSIANS”. Source: https://tsargrad.tv/

Not so predictably, under the conditions of the war of the U.S. and its allies to confiscate the offshore economy and destroy the domestic economy entirely, the Russian revolution of 2022 has commenced. It has begun with the passage through the State Duma last week of the new law to terminate all Russian share listings on foreign exchanges, and reorganize the Moscow stock exchange accordingly. Entitled “On Amendments to the Federal Law On Joint Stock Companies and Certain Legislative Acts of the Russian Federation”, and running for 22 pages, the revolution doesn’t start until Article 4 on page 14, buried under a series of articles revising the regulations for public company audits and accounts.

Also buried in the revolutionary new law is Section 9 of Article 6 on page 20. This provides the Russian government with the discretionary power to issue exceptions to the new law and allow foreign share listings, circulation and trade of securities for Russian companies which apply.

The Russian revolution of 2022 has a gaping loophole.

The Russian revolution of 2022 has a gaping loophole.

The third reading version of the new law which was voted by the State Duma last week can be read here. The bill had initially been presented to parliament last November when it was an uncontroversial, unnoticed measure dealing with auditors and accountants. It was then substantially revised in March to become the vehicle for a capitalist revolution.

The Tsargrad headline on April 4, 2022, says: “WEEP, EUROPE! MISHUSTIN RETURNS THE RUSSIAN STOCK MARKET TO THE RUSSIANS”. Source: https://tsargrad.tv/

“The government of [Prime Minister] Mikhail Mishustin,” reported Tsargrad, the popular internet and video news broadcaster,

has prepared a bill that will become truly epoch-making in the history of the development of the domestic stock market. According to the Cabinet’s idea, Russian companies will lose the right to place their shares on foreign exchanges. Those which are still trading there will be obliged to return their securities to Russia. At the same time, there is no monetary compensation for foreigners. The only chance for them to keep their shares is to get a similar number on the Moscow Stock Exchange.

And there is one important nuance here. After making amendments to the legislation, it is no longer possible to withdraw dividends abroad. Most likely, in the very near future we will witness the decolonization of the domestic stock market. Hardly anyone doubts that Mikhail Vladimirovich’s proposals will be passed in the State Duma–the liberal monetarists have practically no support left.

This appeared on April 4. Asked that day to confirm what they knew of Mishustin’s stock market legislation, Anataoly Aksakov, chairman of Duma Committee on Financial Markets (Just Russia, Chuvashia) said he hadn’t heard of it. The spokesman for the Duma’s Communist Party faction said the same thing. Two days after the Tsargrad bulletin, the text of the new legislation was published.

Tsargrad, owned by Konstantin Malofeev (Malofeyev), announced it, not as a revolution but as a “complete reformatting”–полное переформатирование. Malofeev (Malofeyev) is a committed supporter of the Donbass republics since 2014 and of the special military operation. He is also anti-Communist and advocates the restoration of the monarchy.

As backers of Novorussia go, Malofeev (right) was sanctioned a little later than the others by the U.S. in November 2014. Last week he became the first major Russian sanctions target to be hit by a U.S. criminal prosecution, announced by the Justice Department and the Manhattan prosecutor on April 6. The indictment charges:

Konstantin Malofeyev is closely tied to Russian aggression in Ukraine, having been determined by OFAC to have been one of the main sources of financing for the promotion of Russia-aligned separatist groups operating in the sovereign nation of Ukraine. The United States sanctions on Malofeyev prohibit him from paying or receiving services from United States citizens, or from conducting transactions with his property in the United States. But as alleged, he systematically flouted those restrictions for years after being sanctioned. The Indictment unsealed today shows this Office’s commitment to the enforcement of laws intended to hamstring those who would use their wealth to undermine fundamental democratic processes. This Office will continue to be a leader in the Justice Department’s work to hold accountable actors who would support flagrant and unjustified acts of war.

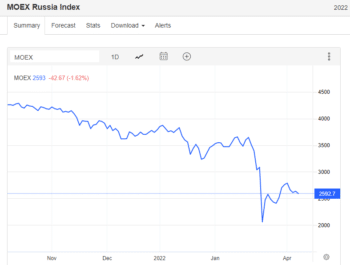

Tsargrad was interpreting the potential of the new law as a permanent revolution. The reality, as interpreted by the market media, was different–a temporary fix by Central Bank and government officials for the collapse of share prices of listed Russian companies on international and Moscow stock exchanges on February 24, at the start of the military operation.

There was a partial recovery of share prices on the Moscow exchange the next day, but on February 28 the Central Bank suspended share trading altogether. In the U.S. on the same day the New York Stock Exchange and NASDAQ announced a temporary halt to trading for Russian companies listed on those exchanges.

There was a partial recovery of share prices on the Moscow exchange the next day, but on February 28 the Central Bank suspended share trading altogether. In the U.S. on the same day the New York Stock Exchange and NASDAQ announced a temporary halt to trading for Russian companies listed on those exchanges.

On March 28 the Moscow stock exchange reopened for limited trading hours restricted to thirty companies.

Days earlier, the Russian edition of Forbes had reported Central Bank sources as saying “the Russian stock market may open in a new format. The Bank of Russia is discussing the possibility of creating two markets–for residents inside Russia and for non-residents outside of it, sources told Forbes.”

In short, Forbes was told, a temporary measure under Central Bank control.

The Central Bank is discussing the possibility of creating two equity markets–onshore for residents and offshore for non-residents. Three financiers told Forbes about this. According to one of the interlocutors of Forbes, this is necessary in order to prevent panic among Russian investors after the opening of exchanges, when foreign holders of securities of Russian issuers will massively withdraw from assets.

According to a second Forbes source, Type C accounts will be used to implement this mechanism, to which non-residents’ securities will be credited. At the same time, non-residents, according to the source, will include all foreign ‘subsidiaries’ of Russian brokers. Another Forbes interlocutor familiar with the discussion says that the decision on whether to recognize the ‘subsidiaries’ of Russian brokers as residents or non-residents has not yet been made. They can be recognized by both, he says. ‘This measure is currently being discussed and will probably be implemented,’ Alexey Timofeev, president of the National Association of Stock Market Participants (NAUFOR), told Forbes. He believes that it is bad to divide the market, but in conditions of limited transactions between residents and non-residents there is no other way out. ‘If the market is open right now, then most likely it will open without non-residents at all. So the market has a choice–to leave non-residents without trading at all or give them the opportunity to trade in a separate compartment. In any case, the solution of this problem should not delay the opening of the market for residents. When the market feels more confident, the currency control measures can be lifted and there will be no need to divide the market,’ Timofeev stressed.

‘They will actually create a safe haven for Russian investors, which will be cut off from the raging sea of a real market where foreign investors will trade. This is very much like the so-called Forex kitchen, where quotes are formed no one know’s how–they are invented by a dealer without reference to the real market,’ says financial adviser Natalia Smirnova. ‘Who will be found in this backwater, who will provide liquidity and maintain quotes, is unknown,’ she continues, defining the situation as an ‘artificial coma’. In her opinion, this means the absence of foreign shares as a class, since they are difficult to imagine in such a market. On the other hand, it is better than that the market will not open at all, since in this case only deposits and real estate will remain, and we will return to the 1990s, and in their first half,’ Smirnova sums up.

Vladimir Kreindel, Executive Director of FinEx Plus Management Company, is not so pessimistic. ‘This is a forced measure, which is being taken due to the fact that the markets are broken and there is no way to function in the usual old mode, given that the market is divided into completely local securities and ADRs [American Depositary Receipts], the issuers of which are Russian companies registered abroad. The temporary fragmentation of the market is not so much a plan as an inevitability. However, a working market with a reduced number of issuers is in any case better than a frozen market,’ he says. Kreindel believes this may be a positive result for the allocation of capital and the release of liquidity. He also concluded that the single market is still far away.

Forbes and its stock market sources had not read the text of the new law which did not appear until April 6. Vedomosti, the Moscow business newspaper, reported that day that the proposed law had been fully passed by the Duma and was awaiting an upper house vote and then presidential signature. In its interpretation, the law required Russian companies to list their shares in Moscow, and to cancel parallel listings in international markets through depositary receipts.

The text of the new law appears to be clear and categorical. At Article 6 Section 1 it declares that “placement and (or) organization of circulation of shares of Russian issuers outside the Russian Federation by means of placement of securities of foreign issuers certifying rights in respect of shares of Russian issuers in accordance with foreign law is not allowed.” Section 2:

Unless otherwise provided by Section 9 of this Article, from the date of entry into force of this Article, circulation of shares of Russian issuers outside the Russian Federation, the organization of circulation of which before the date of entry into force of this Article was carried out by placing securities of foreign issuers certifying rights in respect of shares of Russian issuers, in accordance with foreign law, is terminated.

Section 3 adds:

No later than five working days from the date of entry into force of this article, Russian issuers are obliged to take necessary and sufficient actions aimed at terminating contracts on the basis of which, prior to the date of entry into force of this article, securities of foreign issuers certifying rights in respect of shares of Russian issuers were placed in accordance with foreign law, and no later than five working days after the commission of such actions to submit to the Central Bank of the Russian Federation information on the commission of such actions with the attachment of supporting documents.

This appears to end the Russian company practice of raising capital on foreign markets and selling shares through offshore depositary receipts, linked to the original Russian shares. Initial public offerings (IPOs) outside Russia and secondary trading of the depositary receipts are now banned. Also prohibited by the new law are issues of Russian company debt through bonds or debt notes which are sold to the public or through financial institutions and traded on international exchanges.

One of the conventional evasions or loopholes in the existing market legislation has been for Russian operating companies to issue foreign shares and debt through offshore subsidiaries, and for their debt obligations and dividends to be channelled through these entities. Although the language of the new law refers to “Russian issuers”, the intention of the new measure appears to close the foreign subsidiary channel. Added to the bans on foreign currency payments abroad already introduced at the beginning of March–read for the details–the new law seems to have put an end to capital outflow and the offshore Russian economy.

Except for the small print of Section 2, which mentions Section 9, and Section 9 itself.

The Government of the Russian Federation shall establish the procedure according to which a decision may be taken to continue circulation outside the Russian Federation of shares of Russian issuers whose circulation before the date of entry into force of this Article was carried out by placing, in accordance with foreign law, securities of foreign issuers certifying rights in respect of shares of Russian issuers.

In other words, the operation of Russian offshore capital flows will be allowed to continue without the new restrictions so long as a government official issues an exemption lifting the ban, according to a “procedure” which hasn’t been regulated in the new law, and may never be published.

The only guarantee that this loophole will not be opened by the Russian oligarchs to continue their business as usual is not Russian law but the Justice Department in Washington.