Economist Michael Hudson explains the inflation crisis and the U.S. Federal Reserve’s “austerity program to reduce wages.” Western so-called economics experts are openly calling to boost unemployment.

Hudson warns a “long depression” is coming, in which the poor will suffer so the rich can get richer, in order to advance Washington’s new cold war on Russia and China.

Transcript:

BN: Hey, everyone, this is Ben Norton, and you are watching or listening to the Multipolarista podcast. I am always privileged to be joined by one of my favorite guests, Michael Hudson, one of the greatest economists living today.

We’re going to be talking about the inflation crisis. This is a crisis around the world, but especially in the United States, where inflation has been at over 8%. And it has caused a lot of political problems. It’s very likely going to cause the defeat, among other factors, of the Democrats in the mid-term elections in November.

And we’ve seen that the response of the U.S. government and top economists in the United States is basically to blame inflation on wages, on low levels of unemployment and on working people.

We’ve seen that the chair of the Federal Reserve, Jerome Powell, has said that inflation is being caused by wages supposedly being too high. We’ve also seen that the top economist and former Clinton administration official Larry Summers has claimed that the solution to inflation is increasing unemployment, potentially up to 10%.

So today I’m joined by economist Michael Hudson, who has been calling out this kind of neoliberal snake oil economics for many years. And Professor Hudson has an article he just published that we’re going to talk about today. You can find this at his website, which is michael-hudson.com. It’s titled “The Fed’s Austerity Program to Reduce Wages.” and I’m going to let Professor Hudson summarize the main points of his article.

Professor Hudson, as always, it’s a pleasure having you. Can you respond to the decision by the Federal Reserve to increase interest rates by 0.75%? It doesn’t sound like a lot–it’s less than 1%–but this was the largest rate hike since 1994.

And now we’ve already seen reports that there’s going to be a depression. The Fed chair is blaming this on wages. Can you respond to the position of the Fed and the inflation crisis in the U.S. right now.

MH: For the Fed, the only two things that it can do is, number one, raise the discount rate, the interest rate; and number two, spend $9 trillion buying stocks, and bonds, and real estate mortgages to increase real estate prices, and to increase the amount of wealth that the wealthiest 10% of the population has.

To the wealthiest 10%, especially the 1%, it’s not only inflation that’s a problem of wages; every problem that America has is the problem of the working class earning too much money. And if you’re an employer, that’s the problem: you want to increase your profits. And if you look at the short term, your profits go up the more that you can squeeze labor down. And the way to squeeze labor down is to increase what Marx called the reserve army of the unemployed.

You need unemployment in order to prevent labor from getting most of the value of what it produces, so that the employers can get the value, and pay that to the banks and the financial managers that have taken over corporate industry in the United States.

You mentioned that while the Fed blames the inflation it on labor, that’s not President Biden’s view; Biden keeps calling it the Putin inflation. And of course, what he really means is that the sanctions that America has placed on Russia have created a shortage of oil, gas, energy, and food exports.

So really we’re in the Biden inflation. And the Biden inflation that America is experiencing is the result basically of America’s military policy, its foreign policy, and above all, the Democratic Party’s support of the oil industry, which is the most powerful sector in the United States and which is guiding most of the sanctions against Russia; and the national security state that bases America’s power on its ability to export oil, or control the oil trade of all the countries, and to export agricultural products.

So what we’re in the middle of right now isn’t simply a domestic issue of wage earners wanting higher salaries–which they’re not particularly getting; certainly the minimum wage has not been increased–but you have to put this in the context of the whole cold war that’s going on.

The whole U.S. and NATO confrontation of Russia has been a godsend, as you and I have spoken before, for the oil industry and the farm exporters.

And the result is that the U.S. dollar is rising against the euro, against sterling, and against Global South currencies. Well, in principle a rising dollar should make the price of imports low. So something else is at work.

And what’s at work, of course, is the fact that the oil industry is a monopoly, that most of the prices that have been going up are basically the result of a monopolization, in the case of food, by the marketing firms, like Cargill and Archer Daniels Midland, that buy most of the crops from the farmers.

The irony is that while food prices, next to oil prices, are the major factor that is soaring, farmers are getting less and less for their crops. And yet farmers’ costs are going up–up for fertilizer, up for energy, up for other inputs–so that you’re having enormous profits for Archer Daniels Midland and the food monopolies, of the distributors, and enormous, enormous gains for the oil industry, and also of course for the military-industrial complex.

So if you look at what’s happening in the overall world economic system, you can see that this inflation is being engineered. And the beneficiaries of this inflation certainly have not been the wage earners, by any stretch of the imagination.

But the crisis that the Biden policy has created is being blamed on the wage earners instead of on the Biden administration’s foreign policy and the basically the U.S.-NATO war to isolate Russia, China, India, Iran, and Eurasia generally.

BN: Professor Hudson, I want to talk about the increase in interest rates by the Fed. There has been a lot of attention to this, although, again, it’s 0.75%, which is not that big. But it’s of course going to have an outsize impact on the economy.

In your article, again, this is your column at michael-hudson.com, “The Fed’s Austerity Program to Reduce Wages,” you talk about the Fed’s “junk economics,” and you say that the idea behind raising interest rates by 0.75% is that:

raising interest rates will cure inflation by deterring borrowing to spend on the basic needs that make up the Consumer Price Index and its related GDP deflator. But banks do not finance much consumption, except for credit card debt, which is now less than student loans and automobile loans. Banks lend almost entirely to buy real estate, stocks and bonds, not goods and services.

So you argue that one of the effects of this is that it’s actually going to roll back homeownership in the United States. You note that the rate of homeownership has been falling since 2008.

So can you expand on those arguments? What will be the impact of the increase of the interest rates by the Fed?

MH: Well, in order to get an economics degree which is needed to work at the Fed or at the Council of Economic Advisors, you have to take economics courses in the universities, and all of the textbooks say just what you quoted me as saying they say.

The pretense is that banks actually play a productive role in society, by providing the money for factories to buy machinery, and build plants, and do research and development, and to hire labor; and that somehow the money that banks create is all lent out for industrial economy, and that that will enable companies to make more money that they’ll spend on labor; and of course, as they spend more money on labor, that supports to bid prices up as the reserve army of the unemployed is depleted.

But that’s all a fiction. The textbooks don’t want to say that banks don’t play a productive role like that at all. And the corporations don’t do what the textbooks say.

If you look at the Federal Reserve balance sheet and statistics that it publishes every month, you’ll see that 80% of bank loans in the United States are mortgage loans to commercial real estate and mostly for home real estate. And of course the home mortgage loans have been nothing, like under 1% for the last 14 years, since 2008.

Only the banks and the large borrowers, the financial sector, have been able to borrow at these low rates. Homeowners all along have had to pay very high rates, just under 4%, and now it’s going above 4%, heading to 5%.

Well, here is the situation that the Federal Reserve has created. Suppose that you’re a family right now going out to buy a home, and you find out that in order to borrow the money to buy the home–because if the average home in America costs $600,000 or $700,000, people haven’t saved that much; the only way you can buy a home is to take out a mortgage.

Well, you have a choice: you can either rent a home, or you can borrow the money to buy a home. And traditionally, for a century, the carrying charge for financing a home with the mortgage has been about the equivalent of paying a rent. The advantage is, of course, that you get to own the home when it’s over.

Well, now let’s look at what’s happening right now. All of a sudden, the carrying charge of mortgages have gone way, way up. The banks are making an enormous gap. They can borrow at just around 1%, and they lend out at 4.5%. They get a windfall gain of the markup they have in mortgages, lending to prospective homeowners.

And of course, the homeowners don’t have enough money to be able to pay the higher interest charged on the mortgages that they take out. So they are not able to buy as expensive a home as they wanted before.

But they’ve been a declining part of the population. At the time Obama took office, over 68% of Americans owned their own home. Obama started the great wave of evictions, of 10 million Americans who lived in homes, essentially to throw them out of their homes, especially the victims of the junk mortgages, especially the lower income and racial minorities who were redlined and had to become the main victims of the mortgages.

America’s homeownership rate is now under 61%. What has happened? You’ve had huge private capital firms come into the market thinking, wait a minute, we can now buy these properties and rent them out. And we can buy them for all cash, unlike homeowners, we’re multibillionaires, we Blackstone, BlackRock.

You have these multibillion-dollar funds, and they say, well, we can’t make much money buying bonds or buying stocks that yield what they do today, now that the Federal Reserve has ground down interest rates. What we can do is make money as landlords.

And so they’ve shifted, they’ve reversed the whole shift away from the 19th-century landlordism to an economy based on financialization, and the wealthy classes making money on finance, to go back to making money as landlords.

And so they are buying up these homes that American homeowners can’t afford to buy. Because when you raise the mortgage rate, that doesn’t affect a billionaire at all. Because the billionaire firm doesn’t have to borrow money to buy the home. They have the billion dollars of their own money, of pension fund money, of speculative money, of the money of the 1% and the 10% to spend.

So what you’re having by increasing the interest rates is squeezing homeowners out of the market and turning the American economy into a landlord-ridden rental economy, instead of a homeowners economy. That’s the effect.

And it’s a windfall for the private capital firms that are now seeing that are making money as landlords, the old fashioned way, it worked for 800 years under feudalism. It’s coming back in style.

BENJAMIN NORTON: Professor Hudson, you point out in this article at your website that more than 50% of the value of U.S. real estate already is held by mortgage bankers. And of course, that percentage is increasing and increasing.

Now, you, Professor Hudson, have argued a point that I haven’t seen many other people make, although it’s an obvious, correct point, which is that there has actually been a lot of inflation in the United States in the past several years, but that inflation was in the FIRE sector: finance, insurance, and real estate.

We see that with the constant increase in real estate prices; they go up every single year; rent goes up every single year. The difference now is that there’s also a significant increase in the Consumer Price Index.

And there is an interesting study published by the Economic Policy Institute, which is, you know, a center-left think tank, affiliated with the labor movement; they’re not radicals, they’re progressives. And they did a very good study.

And they found–this was published this April–they found that corporate profits are responsible for around 54% of the increase of prices in the non-financial corporate sector, as opposed to unit labor costs only being responsible for around an 8% increase.

So they showed, scientifically, that over half of the increase of prices in the non-financial corporate sector, that is in the Consumer Price Index, over half of that inflation is because of corporate profits.

Of course, that’s not the way it’s discussed in mainstream media. That’s not the way the Fed is discussing it all. We see Larry Summers saying that we need to increase unemployment. Larry Summers, of course, was the treasury secretary for Bill Clinton.

He’s saying that the U.S. has to increase unemployment; the solution to inflation is increasing unemployment. Even though these studies show that over half of inflation in the Consumer Price Index is because of corporate profits.

I’m wondering if you can comment on why so many economists, including people as revered as Larry Summers, refuse to acknowledge that reality.

MH: Most economists need to get employment, and in order to be employed, you have to give a picture of the economy that reflects how well your employer helped society at large. You’re not allowed to say that your employer is acting in ways that are purely predatory. You’re not allowed to say that the employer does not earn an income.

You talked about corporate profits and the classical economists. If you were a free-market economist like Adam Smith, or David Ricardo, or John Stuart Mill–these are monopoly rents. So what you call corporate profits are way above normal corporate rates of return, normal profits. They’re economic rents from monopoly.

And that’s because about 10 or 15 years ago, the United States stopped imposing its anti-monopoly laws. It has essentially let monopolies concentrate markets, concentrate power, and charge whatever they want.

And so once you’ve dismantled the whole legal framework that was put in place from the 1890s, from the Sherman Antitrust Act, down through the early 20th century, the New Deal, once you dismantle all of this state control, saying–essentially what Larry Summers says is, we’re for a free market.

A “free market” is one in which companies can charge whatever they want to charge for things; a free market is one without government regulation; a free market is one without government; a free market is a weak enough government so that it cannot protect the wage earners; it cannot protect voters. A “democracy” is a country where the bulk of the population, the wage earners, have no ability to affect economic policy in their own interests.

A “free market” is one where, instead of the government being the planner, Wall Street is the planner, on behalf of the large industries that are basically being financialized.

So you’ve had a transformation of the concept of what a free market is, a dismantling of government regulation, a dismantling of anti-monopoly regulation, and essentially the class war is back in business.

That’s what the Biden administration is all about. And quite frankly, it’s what the Democratic Party is all about, even more than the Republican Party. The Republican Party can advocate pro-business policies and pro-financial policies, but the Democratic Party is in charge of dismantling the legacy of protection of the economy that had been put in place for a century.

BN: Yeah, and this is an article in Fortune that was originally based on an article in Bloomberg: “5 years at 6% unemployment or 1 year at 10%: That’s what Larry Summers says we’ll need to defeat inflation.” That’s how simple it is, you know, just increase unemployment, and then inflation will magically go away!

Now, I also wanted to get your response, Professor Hudson, to these comments that you highlighted in a panel that was organized by the International Manifesto Group–a great organization, people can find it here, their channel here at YouTube. And they held a conference on inflation. And you were one of several speakers.

And you highlighted these comments that were made by the Fed chair, Jerome Powell. And this is according to the official transcript from The Wall Street Journal. So this is not from some lefty, socialist website. Here’s the official transcript of a May 4 press conference given by the Fed chief, Jerome Powell.

In this press conference, he said, discussing inflation, he said, in order to get inflation down, he’s talking about things that can be done “to get wages down, and then get inflation down without having to slow the economy and have a recession and have unemployment rise materially.”

So this is another proposal. Larry Summers says 6% unemployment for five years, or 10% unemployment for one year. The Fed chair, Jerome Powell, says the solution is “to get wages down.” I’m wondering if you can respond to that as well.

MH: Well, the important thing to realize is that President Biden re-appointed Jerome Powell. President Biden is a Republican. The Democratic Party is basically the right wing of the Republican Party, the pro-financial, the pro-Wall Street wing of the Republican Party.

Why on earth, if the Democrats were different from the Republicans, why would would Biden re-appoint an anti-labor Republican, as head of the Federal Reserve, instead of someone that would actually try to spur employment?

Imagine, here’s a party that is trying to be elected on a program of, “Elect us, and we will create a depression and we will lower wages.” That is the Democrat Party slogan.

And it’s a winning slogan, because elections are won by campaign contributions. The slogan is, “We will lower wages by bringing you depression,” is a tsunami of contributions to the Democratic Party, by Wall Street, by the monopolists, by all the beneficiaries of this policy.

So that’s why the Supreme Court ruling against abortions the other day is a gift to the Democrats, because it distracts attention from their identity politics of breaking America into all sorts of identities, every identity you can think of, except being a wage earner.

The wage earners are called deplorables, basically. And that’s how the donor class thinks of them, as sort of unfortunate overhead. You need to employ them, but it really it’s unfortunate that they like to live as well as they do, because the better they live, the less money that you will end up with.

So I think that this issue of the inflation, and what really causes it, really should be what elections are all about. This should be the economic core of this November’s election campaign and the 2024 election campaign. And the Democrats are leading the fight to lower wages.

And you remember that when President Obama was elected, he promised to increase the minimum wage? As soon as he got in, he said the one thing we cannot do is raise the minimum wage. And he had also promised to back card check. He said, the one thing we must not do is increase labor unionization with card check, because if you unionize labor, they’re going to ask for better wages and better working conditions.

So you have the Democratic Party taking about as hard a right-wing position as sort of Chicago School monetarism, saying the solution to any any problem at all is just lower wages and somehow you’ll be more competitive, whereas the American economy is already rendered uncompetitive, not because wages are so high, but because, as you mentioned before, the FIRE sector, the finance, insurance, and real estate sector is so high.

Rents and home ownership, having a home is too expensive to be competitive with foreign labor. Having to pay 18% of GDP on medical care, privatized medical care, prices American labor out of the market. All of the debt service that America has paid is pricing America out of the market.

So the problem is not that wages are too high. The problem is that the overhead that labor has to pay in order to survive, for rent, for medical care, for student loans, for car loans, to have a car to drive to work, for gas to drive to work, to buy the monopoly prices that you need in order to survive–all of these are too high.

None of this even appears in economic textbooks that you need to get a good mark on, in order to get an economics degree, in order to be suitably pliable to be hired by the Federal Reserve, or the Council of Economic Advisers, or by corporations that use economists basically as public relations spokesmen. So that’s the mess we’re in.

BN: Professor Hudson, in your article at your website, michael-hudson.com, you have an important section about the quantitative easing policies. We were talking about how there has been inflation in the past decade, but then inflation was largely in the FIRE sector, pushing up, artificially inflating the prices of real estate and stocks.

You note that:

While home ownership rates plunged for the population at large, the Fed’s “Quantitative Easing” increased its subsidy of Wall Street’s financial securities from $1 trillion to $8.2 trillion–of which the largest gain has been in packaged home mortgages. This has kept housing prices from falling and becoming more affordable for home buyers.

And you, of course, note that “the Fed’s support of asset prices saved many insolvent banks–the very largest ones–from going under.”

I had you on to discuss, in late 2019, before the Covid pandemic hit, we know that the Fed had this emergency bailout where it gave trillions of dollars in emergency repo loans to the biggest banks to prevent them from from crashing, trying to save the economy.

I do want to talk about this as well, because sometimes this is used by right-wingers who portray Biden hilariously as a socialist. You were just talking about how the Democrats have a deeply neoliberal, right-wing economic program.

But of course, there is this rhetoric that we see from Republicans and conservatives claiming that Biden is a socialist. They claim that the reason there is inflation is because Biden is just printing money and giving money to people.

Of course, that’s not at all what’s happening. What has happened is that the Fed has printed trillions of dollars and given that to stockholders, to big corporations, and to banks.

And this is a point that I saw highlighted in that panel I mentioned, the conference on inflation that was organized by the International Manifesto Group. A colleague of yours, a brilliant political economist, Radhika Desai, she invited everyone to go to the Fed website and look at the Fed balance sheet.

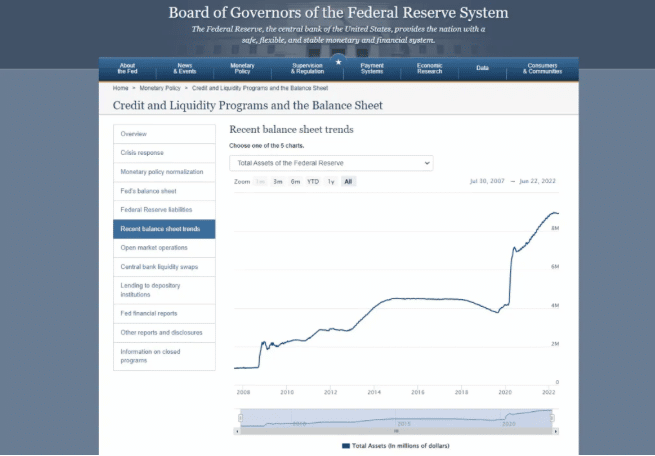

And this is the Fed balance sheet from federalreserve.gov. This is the Board of Governors of the Federal Reserve System website. And it is pretty shocking to see this graph, which shows the total assets of the U.S. Federal Reserve.

Back in 2008, the Federal Reserve had around $900 billion in assets. Now it’s at nearly $9 trillion in assets.

And we can see, after the financial crash, or during the financial crash, it increased to around $2 trillion. And then around 2014, it increased to around $4.5 trillion. And then especially in late 2019 and 2020, it skyrocketed from around $4 trillion up to $7 trillion. And since then, it has continued skyrocketing to $9 trillion in assets.

Where did all of that money go? And what was the impact on the economy, of course?

MH: Well, the impact on the economy has been to vastly increase the wealth of the wealthiest 1% of Americans who own most of the stocks and bonds.

Sheila Bair, the former head of the Federal Deposit Insurance Corporation, pointed out that a lot of this $8 trillion is spent to buy junk bonds.

Here’s the problem. The problem really began with President Obama. He inherited a system where you had the largest wave of commercial bank fraud in American history.

As my colleague Bill Black at the University of Missouri at Kansas City has pointed out, everybody knew that there was a bank fraud on. The newspapers referred to junk mortgages and “NINJA” borrowers: “no income, no jobs, no assets.”

So banks had written mortgages way above the actual value of homes, especially to racial and ethnic minorities, without any ability of the borrowers to actually pay.

And then these banks had packaged these mortgages, and sold them to hapless pension funds, and other institutional investors and to the European banks that are always very naive about how honest American banks are.

You had this whole accumulation of what the 19th century called fictitious capital. Mortgages for property that wasn’t worth anywhere near as much as the mortgage is for.

So if the mortgage was defaulted, if homeowners had jingle mail–in other words, you just mail the keys back to the bank and say, ok, take the house, I find I can buy a house now at half the price that Citibank or one of these other banks lent out.

Well, normally you’d have a crash of prices back to realistic levels, so that the value of mortgages actually reflected the value of property, or the value of junk bonds issued by a corporation reflected the actual earning power of the corporation to pay interest on the junk bonds.

So by the time Obama took over, the whole economy was largely fictitious capital. Well, Obama came in and he said, my campaign donors are on Wall Street. He called in the Wall Street bankers and he said, I’m the guy standing between you and the crowd with the pitchforks, the people who voted for me. But don’t worry, I’m on your side.

He said, I’m going to have the Federal Reserve create the largest amount of credit in human history. And it’s all going to go to you. It’s going to go to the 1% of the population. It’s not going to go into the economy. It’s not going to build infrastructure. It’s not going into wages. It’s not going to reduce the price of homes and make them more affordable to Americans.

It’s going to keep the price of these junk bonds so high that they don’t crash back to non-fictitious values. It’s going to keep the stock market so high that it’s not going to go down. It’s going to create the largest bond market boom in history.

The boom went from high interest rates to low interest rates, meaning a gigantic rise in the price of bonds that actually pay interest that are more than 0.1%.

So there was a huge bond market boom, a huge stock market, a tripling of stock market prices. And if you are a member of the group that owns 72% of American stocks, I think that’s 10% of the population, you have gotten much, much richer.

But if you’re a member of the 90% of the population, you have had to go further and further into debt just in order to survive, just in order to pay for medical care, student loans, and your daily living expenses out of your salary.

So if American wages were at a decent level, American families would not be pushed more and more into debt. The reason the personal debt has gone up in the United States is because families can’t get by on what they earn.

So obviously, if they can’t get by on what they earn, and they have to borrow to get by, they are not responsible for causing the inflation. They’re being squeezed.

And the job of economists, and of Democratic Party and Republican politicians, is to distract attention from the fact that they’re being squeezed and blame the victim, and saying, you’re doing it to yourself by just wanting more money, you’re actually creating the inflation that is squeezing you.

When actually it’s the banks, and the government’s non-enforcement of the monopoly policy, and the government support of Wall Street that is responsible for what is happening.

BN: Very, very well said.

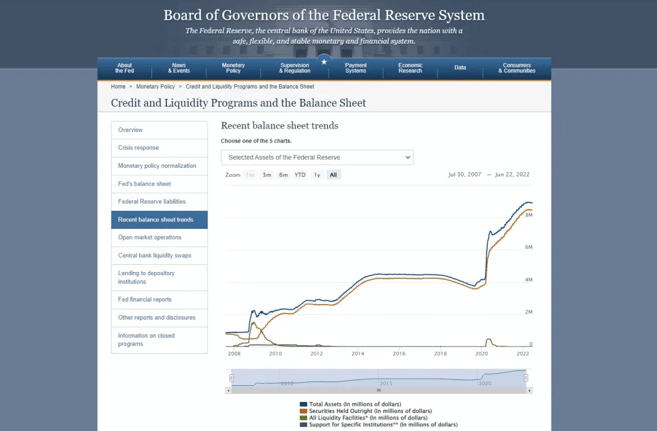

Professor Hudson, I should have highlighted another part of this graph here. This is, again, this is at the Federal Reserve Board website. It’s even more revealing when you look at the selected assets of the Fed, and you see that all of these assets basically are securities, securities held outright by the Fed.

We see that around 2008, the Fed had less than $500 billion in securities. And you have this policy of quantitative easing. And since then, basically all of the increase has been in securities. Of the roughly $9 trillion in assets the Fed holds, about about $8.5 trillion is in securities.

I’m wondering if you can compare this to central banks in other countries. We’ve seen, for instance, that the Western sanctions on Russia were aimed at trying to destroy the Russian economy.

President Biden claimed they were trying to make the ruble into rubble. In fact, the ruble is significantly stronger now than it was before the sanctions. To such a degree that the Russian government and Russian national bank are actually trying to decrease the value of the ruble, because they think it’s a little overvalued; it makes it a little harder to be competitive.

So how does this policy of the U.S. Fed having $8.5 trillion worth of securities compare to the policies of other central banks?

You have experience working with the Chinese government as an advisor. Do other governments’ central banks have this policy?

And and that $8.5 trillion in securities, what are those securities? Even from the perspective of these neoliberal economics textbooks that you were talking about, that people are taught in universities, this seems to me to be totally insane. I don’t see how there is even an academic, neoliberal textbook explanation for this policy.

MH: Very few people realize the difference between a central bank and the national treasury. The national treasury is what used to perform all of the policies that central banks now do. The national treasury would be in charge of issuing money and spending it.

Central banks were broken off in America in 1913 from the Treasury in order to shift control of the money supply and credit away from Washington to New York. That was very explicit.

The original Federal Reserve didn’t even permit a Treasury official to be on the board of directors. So the job of a central bank is to represent the interest of the commercial banks.

And as we just pointed out, the interest of the commercial banks is to produce their product: debt. And they create their product against existing assets, mainly real estate, but also stocks and bonds.

So the job of the central bank here is to support the financial sector of the economy, and that sector that holds wealth in the form of stocks, bonds, and loans, and especially bank bonds that make their money off real estate credit.

Same thing in Europe, with Europe’s central bank. Europe is going into a real squeeze now, and has been going into a squeeze ever since you had the Greek crisis.

In Europe, because right-wing monetarist designed the euro, part of the eurozone rule is you cannot run a budget deficit, a national budget deficit of more than 3% of gross domestic product.

Well, that’s not very much. That means that you can’t have a real Keynesian policy in Europe to pull the economy out of depression. That means that if you’re a country like Italy right now, and you have a real financial squeeze there, a corporate squeeze, a labor squeeze, the government cannot essentially rescue either Italian industry or Italian labor.

However, the European central bank can, by the way that it creates credit, by central bank deposits, the European central bank can vastly increase the price of European stocks, bonds, and packaged mortgages. So the European central bank is very much like the commercial bank.

China is completely different, because, unlike the West, China treats money and credit as a public utility, not as a private monopoly.

And as a public utility, China’s central bank will say, what are we going to want to create money for? Well, we’re going to want to create money to build factories; we’re going to want to create money so that real estate developers can build cities, or sometimes overbuild cities. We can create money to actually spend in the economy for something tangible, for goods and services.

The Chinese central bank does not create money to increase stock market prices or bond prices. It doesn’t create money to support a financial class, because the Communist Party of China doesn’t want a financial class to exist; it wants an industrial class to exist; it wants an industrial labor force to exist, but not a rentier class.

So a central bank in a Western rentier economy basically seeks to create credit to inflate the cost of living for homebuyers and for anyone who uses credit or needs credit, and to enable corporations to be financialized, and to shift their management away from making profits by investing in plant and equipment and employing labor to produce more, to making money by financial engineering.

In the last 15 years, over 90% of corporate earnings in the United States have been spent on stock buybacks and on dividend payouts. Only 8% of corporate earnings have been spent on new investment, and plants, and equipment, and hiring.

And so of course you have had the economy deindustrialized. It’s this idea that you can make money financially without an industrial base, without a manufacturing base; you can make money without actually producing more or doing anything productive, simply by having a central bank increase the price of the stocks, and bonds, and the loans made by the wealthiest 10%.

And of course, ultimately, that doesn’t work, because at a certain point the whole thing collapses from within, and there’s no industrial base.

And of course, when that happens, America will find out, wait a minute, if we close down the economy, we’re still reliant on China and Asia to produce our manufacturers, and to provide us with raw materials, and to do everything that we need. We’re really not doing anything but acting as a world–well, people used to say parasite–as a world rentier, as getting something for nothing, as a kind of financial colonialism.

So America you could look at as a colonial power that is a colonial power not by military occupation, but simply by financial maneuvering, by the dollar standard.

And that’s what’s being unwound today as a result of Biden’s new cold war.

BN: Professor Hudson, you criticized the strategy of simply trying to increase the interest rates to bring down inflation, noting that it’s going to lead to a further decline in homeownership in the United States. It’s going to hurt working people. I think that’s a very valid criticism.

I’m curious, though, what your take is on the response of the Russian central bank to the Western sanctions. We saw that the chair of the Russian central bank, Elvira Nabiullina, she–actually this is someone who is not even necessarily really condemned a lot by Western economists; she is pretty well respected by even, you know, Western neoliberal economists.

And she did manage to deal with the sanctions very well. She imposed capital controls immediately. She closed the Russian stock market. And also, in a controversial move, she raised the interest rates from around 9% up to 20%, for a few months. And then after that, dropped the rates.

MH: A few days, not a few months. That was very short. And now she has moved the interest rates way down.

BN: Back to 9%.

MH: She was criticized for not moving them further down.

BN: Yeah, well go ahead. I’m just curious. So she immediately raised it to 20%, and then has dropped the interest rates since then. I’m curious what you think about that policy. Yeah, go ahead.

MH: There is very little that a central banker can do when the West has declared a war, basically, a war on a country that is completely isolated.

The response has come from President Putin and from Foreign Secretary Lavrov. And they pointed out, well, how is Russia going to going to trade and get what it needs. And this is what the recent meetings of the BRICS are all about.

Russia realizes that the world is now broken into two halves. America and NATO have separated the West. Basically you have a white people’s confederation against all the rest of the world.

And the West has said, we’re isolating ourselves from you totally. And we think you can’t get along without us.

Well, look at the humor of this. Russia, China, Iran, India, Indonesia, and other countries are saying, hah, you say we we can’t get along without you? Who is providing your manufacturers? Who is providing your raw materials? Who is providing your oil and gas? Who is providing your agriculture, and the helium, the titanium, the nickel?

So they realize that the world is breaking in two, and Eurasia, where most of the world’s population is concentrated, is going to go its own way.

The problem is, how do you really go your own way? You need a means of payment. You need to create a whole international system that is an alternative to the Western international system. You need your own International Monetary Fund to provide credit, so that the these Eurasian countries and their allies in the Global South can deal with each other.

You need a World Bank that, instead of lending money to promote U.S. policies and U.S. investments, will promote mutual gains and self-sufficiency among the countries.

So already, every day in the last few weeks, you have had meetings with the Russians about this, who said, ok, we’re going to create a mutual trading area, starting among the BRICS: Brazil, Russia, India, China, and South Africa.

And how are we going to pay? We can’t pay in dollars, because if we have money in a dollar bank, or a euro bank in Europe, they can just grab the money, like they grab Venezuela’s money. They can just say, we’re taking all your money because, essentially, we don’t want you to exist as an alternative to the finance capital world that we are creating.

So essentially, Russia, China, and these other countries are saying, ok, we’re going to create our own international bank. And how are we going to fund it? Well, every member of the bank will contribute, say, a billion dollars, or some amount of their own currency, and this will be our backing. We can also use gold as a means of settlement, as was long used among countries.

And this bank can create its own special drawing rights, its own bank order, is what Keynes called it. It can create its own credit.

Well, the problem is that, if you have Brazil, for instance, or Argentina, joining this group, or Ecuador, that sells almost all of its bananas to Russia, how is it going to get by?

Well, if there is a BRICS group or a Shanghai Cooperation Organization bank, obviously the Western governments are not going to accept this.

So Russia realizes that as a result of Biden’s Cold War Two, there is going to be a continued rise in energy prices. You think gasoline prices are not high now? They’re going up. You think food prices are not high now? They’re going up more.

And Europe is especially the case, because Europe now cannot buy Russian gas to make the fertilizer to make its own crops grow.

So you’re going to have a number of countries in the Global South, from Latin America to Africa, being squeezed and wanting to trade with the Eurasian group.

And the problem is Russia says, all right, we know that you can’t afford to pay. We’re glad to give you credit, but we don’t want to give you credit that you’re going to simply use the money you have to pay your dollar debts that are coming due.

Because one of the effects that I didn’t mention of the Federal Reserve raising interest rates is there is a huge flow of capital from Europe and England into the United States, so that if you’re a billionaire, where are you going to put your savings? You want the highest interest rates you want. And if the United States raises interest rates, the billionaires are going to move their money out of England, out of the euro, and the euro is going back down against the dollar. It’s almost down to a dollar a euro.

The British pound is heading downwards, towards one pound per dollar.

This increase in the dollar’s exchange rate is also rising against the currencies of Brazil, Argentina, the African countries, all the other countries.

So how are they going to pay this summer, and this fall, for their food, for their oil and gas, and for the higher cost of servicing their dollar debts?

Well, for Eurasia, they’re going to say, we want to help you buy our exports–Russia is now a major grain exporter, and obviously also an oil exporter–saying we want to supply you and give you the credit for this, but you’re really going to have to make a decision. Are you going to join the U.S.-NATO bloc, or are you going to join the Eurasian bloc?

Are you going to join the White People’s Club or the Eurasian Club? And it really comes down to that. And that’s what is fracturing the world in these two halves.

Europe is caught in the middle, and its economies are going to be torn apart. Employment is going to go down there. And I don’t see wages going up very much in Europe.

You’re going to have a political crisis in Europe. But also you’ll have an international diplomatic crisis over how are you going to restructure world trade, and investment, and debt.

There will be two different financial philosophies. And that’s what the new cold war is all about.

The philosophy of U.S.-sponsored finance capitalism, of making money financially, without industrialization, and with trying to lower wages and reduce the labor force to a very highly indebted workforce living on the margin.

Or you’ll have the Eurasian philosophy of using the economic surplus to increase productivity, to build infrastructure, to create the kind of society that America seemed to be growing in the late 19th century but has now rejected.

So all of this is ultimately not simply a problem of interest rates and central bank policy; it really goes beyond central banks to what kind of a social and economic system are you going to have.

And the key to any social and economic system is how you treat money and credit. Is money and credit going to be a public utility, or will it be a private monopoly run for the financial interests and the 1%, instead of a public utility run for the 99%?

That’s what the new cold war is going to be all about. And that’s what international diplomacy week after week is trying to settle.

BN: Very, very well said. And I really agree about this increasing kind of bipolar order, where the U.S.-led imperialist system is telling the world they have to pick a side. You know, as George W. Bush said, you’re either with us or you’re against us; you’re with us or you’re with the terrorists.

That’s what Biden is saying to the world. And we see the West has drawn this iron curtain around Russia. And now they’re threatening to do the same around China.

Now, of course, the difference is that China has the largest economy in the world, according to a PPP measurement. It’s even larger than the U.S. economy. I don’t know how they can try to sanction the Chinese economy, considering China is the central factory of the world.

But this is related to a question I had for you, Professor Hudson, and this is from a super chat question from Manoj Payardha, and it’s about how Chinese banks say they’re not ready yet to develop an alternative to the SWIFT. He asked, how will the Third World pay Russia for resources?

And we’ve seen, maybe you can talk about the measures being implemented. India has this rupee-ruble system that they’ve created.

But I want to highlight an article that was published in Global Times. This is a major Chinese newspaper, and this is from April. And it quotes the former head of China’s central bank, who was speaking at a global finance forum in Beijing this April.

And basically he said, we need to prepare to replace Swift. He said the West’s adoption of a financial nuclear option of using SWIFT to sanction Russia is a wake up call for China’s financial development. And he said, “We must get prepared.”

So it seems that they’re not yet prepared. But this is something that you’ve been talking about for years. Or maybe you disagree and maybe you think they already are prepared with the SWIFT alternative?

MH: Well they’re already using an alternative system. If they weren’t using an alternative system–Russia is adopting part of the Chinese system for this–they wouldn’t be able to have banks communicate with each other.

So, yes, they already have a rudimentary system. They’re making it a better system that can also be immune from U.S. computer espionage and interference. So yes, of course there’s already a system.

But I want to pick up on what you said about Biden, how Biden characterizes things.

Biden characterizes the war of the West against Eurasia as between democracy and autocracy. By “democracy,” he means a free market run by Wall Street; he means an oligarchy.

But what does he mean by autocracy? What he means by autocracy, when he calls China an autocracy, an “autocracy” is a government strong enough to prevent an oligarchy from taking power, and taking control of the government for its own interests, and reducing the rest of the economy to debt peonage.

An “autocracy” is a country with public regulation against monopolies, instead of an oligarchic free market. An “autocracy” uses money and credit, essentially, to help economies grow. And when debts cannot be paid in China, if a factory or a real estate company cannot pay debts, China does not simply say, ok, you’re bankrupt, you’re going to have to be sold; anybody can buy you; the Americans can buy you.

Instead, the Chinese say, well, you can’t pay the debts; we don’t want to tear down your factory; we don’t want your factory to be turned and gentrified into luxury housing. We’re going to write down the debt.

And that’s what China has done again and again. And it’s done that with foreign countries that couldn’t pay the debt. When a debt that China has come due for China’s development of a port, or roads, or infrastructure, it says, well, we understand that you can pay; we will delay payment; we will have a moratorium on your payment. We’re not here to bankrupt you.

For the Americans, to the international funds, they’re saying, well, we are here to bankrupt you. And now if we lend you, we the IMF, lends you money to avoid a currency devaluation, the term is you’re going to have to privatize your infrastructure; you’re going to have to sell off your public utilities, your electric system, your roads, your land to private buyers, mainly from the United States.

So you have a “democracy” supporting bankruptcy, foreclosure, financialization, and privatization, and low wages by a permanent depression, a permanent depression to keep down wages.

Or you have “autocracy,” seeking to protect the interests of labor by supporting a living wage, to increase living standards as a precondition for increasing productivity, for building up infrastructure.

You have these two diametrically economic systems. And, again, that’s why there’s a cold war on right now.

BN: And there’s another super chat question here, Professor Hudson. You mentioned the International Monetary Fund, the IMF. We have talked about that many times. This is from Sam Owen. He asked, why do countries continue to accept bad IMF loans when they have such a poor track record? Is it just the U.S. government meddling in the national politics? Are there cases of good IMF loans?

MH: Well, what is a country? When you say a country to most people, people think, ok, let’s talk about Brazil; let’s talk about all the people in Brazil; you have a picture in the mind of the Amazon; you have a big city with a lot of people in it.

But the country, in terms of the IMF, is a group of maybe the 15 wealthiest families in Brazil, that own most of the money, and they are quite happy to borrow from the IMF, because they say, right now there’s a chance that Lula may become president instead of the neo-fascist Bolsonaro. And if Lula comes in, then he is going to support labor policies, and he may stop us from tearing down the Amazon. So let’s move our money out of the country.

Well, normally this would push the exchange rate of the cruzeiro (real) down. So the IMF is going to make a loan to Brazil to support the cruzeiro (real), so that the wealthy 1% of Brazil can move their money into dollars, into euros, into foreign currency and offshore bank incentives, and load Brazil down with debt, so that then when there is an election, and if Lula is elected, the IMF is going to say, well, we don’t really like your policies, and if you pursue a pro-labor, socialist policy, then there’s going to be a capital flight. And we’re insisting that you pay all the money that you borrowed from the West right back now.

Well, that’s going to lead Lula either to sit there, follow the IMF direction, and let the IMF run the economy, instead of his own government, or just say, we’re not going to pay the foreign debt.

Well, until now, no country has been in a strong enough position not to pay the foreign debt. But for the first time, now that you have the Eurasian group–we’ll call it BRICS, but it’s really Eurasia, along with the Southern groups that are joining, the Global South–for the first time, they can say, we can’t afford to stay in the West anymore.

We cannot afford to submit the economy to the IMF demands for privatization. We cannot submit to the IMF rules that we have to fight against labor, that we have to pass laws banning labor unions, that we have to fight against laborers’ wage, like Western democracies insist on. We have to go with the Chinese “autocracy,” which we call socialism.

And of course, when America accuses China being an “autocracy,” autocracy is the American word for socialism. They don’t want to use that word. So we’re back in Orwellian double-think.

So the question is what, will the Global South countries do when they cannot afford to buy energy and food this summer, without an IMF loan? Are they going to say, ok, we can only survive by joining the break from the West and joining the Eurasian group?

That is what the big world fracture is all about.

And I described this global fracture already in 1978. I wrote a book, “Global Fracture,” explaining just exactly how all of this was going to happen.

And at that time, you had Indonesia, you had Sukarno taking the lead, the non-aligned nations, India, Indonesia, were trying to create an alternative to the financialized, American-centered world order. But none of these countries had a critical mass sufficient to go their own way.

Well, now that America has isolated Russia, China, India, Iran, Turkey, all these countries, now it has created a critical mass that is able to go its own way. And the question is, now you have like a gravitational pull, and will this Eurasian mass attract Latin America and Africa to its own group, away from the United States? And where is that going to leave the United States and Europe?

BN: And we saw one of the clearest examples yet of this bipolar division of the world between, you know, the West and the rest, as they say, with this ridiculous meeting that was just held of the G7.

Of course, the G7 are the white, Western countries. And then they’ll throw in U.S.-occupied Japan in there, to pretend they’re a little more diverse.

But we saw that the G7 just held a summit, and basically the entire summit was about how can we contain China? How can we expand the new cold war on Russia into a new cold war on China?

And here’s a report in BBC: “G7 summit: Leaders detail $600bn plan to rival China’s Belt and Road initiative.” Now, I got a chuckle out of this. The idea that the U.S. government is going to build infrastructure in the Global South, I mean, it’s pretty laughable.

It’s also absurd considering that China’s Belt and Road Initiative, which involves over half of the countries on Earth, is estimated at many trillions of dollars in infrastructure projects. So the U.S. and its allies think that they can challenge that with $600 billion in public-private partnerships.

I should stress, of course, what they announced is going to be a mixture of so-called public initiative and then contracts for private corporations.

So it’s yet another giveaway to the private sector, in the name of building infrastructure.

But I’m wondering if if you can comment on the G7 summit that just was held.

MH: Well, nothing really came out of it. They all said that they could not agree on any more sanctions against Russia, because they’re already hurting enough. India, in particular, stood up and said, look, there’s no way that we’re going to join the sanctions against Russia, because it’s one of our major trading partners. And by the way, we’re getting a huge benefit from importing Russian oil, and you’re getting a huge benefit by getting this oil from us at a markup.

So the G7 could not get any agreement on what to do. It is already at a stalemate. And this is only June. Imagine the stalemate it’s going to be in September.

Well, next week, President Biden is going to Saudi Arabia and saying, you know, we’re willing to kill maybe 10 million more of your enemies; we’re willing to help Wahhabi Sunni groups kill more of the Iranian Shiites, and sabotage Iraq and Syria. We’ll help you back al-Qaeda again, if you will lower your oil prices so that we can squeeze Russia more.

So that’s really the question that Saudi Arabia will have. America will send give it more cluster bombs to use against Yemen. And the question is, is Saudi Arabia going to say, ok, we’re going to earn maybe $10 billion less a month, or however much they’re making, just to make you happy, and so that that you will kill more Shiites who support Iran?

Or are they going to realize that if they throw in their lot with the United States, all of a sudden they’ll be under attack from Iran, Russia, Syria, and they’ll be sitting ducks? So what are they going to do?

And I don’t see any way that Biden can actually succeed in getting Saudi Arabia to voluntarily earn less on its oil prices. Maybe Biden can say it’s only for a year, only for one or two years. But as other countries know, when America says only for a year or two, it really means forever. And if you don’t continue, then somehow they have a regime replacement, or a regime change and a color revolution.

So Biden keeps trying to get foreign countries to join the West against Eurasia, but there is Saudi Arabia sitting right in the middle of it.

And all that Europe can do is watch and wonder how it’s going to get by without without energy and without much food.

BN: Yeah, in fact, Venezuela’s President Maduro just confirmed that the Biden administration has sent another delegation basically begging Venezuela to try to work out some deal because, of course, the U.S. and the EU have boycotts of Russian energy.

So it’s really funny to me that, after years of demonizing Venezuela, portraying it as a dictatorship and all of this, the U.S. had to decide, well, the war in Venezuela is not as important as the war on Russia right now; so we’re going to temporarily pause our war on Venezuela to stick the knife deeper into Russia.

But on the on the subject of the the G7 meeting, this was the hilarious comment made by the European Commission President Ursula von der Leyen, in an article in Reuters titled “Europe Must Give Developing Nations Alternative to Chinese Funds.”

So echoing the same perspective that we hear from Biden, U.S. government officials constantly say that the U.S. needs to challenge China in the Global South. So Europe pledged €300 billion–however, once again, important asterisk–“in private and public funds over five years to fund infrastructure in developing countries.”

So once again, we see another neoliberal private-public partnership. It’s going to be another public giveaway to private corporations.

And “she said that this is part of the G7’s drive to counter China’s multitrillion-dollar Belt and Road project.”

Now, this is really just tying everything together that we have been talking about today, Professor Hudson–in your article “The Fed’s Austerity Program to Reduce Wages,” you conclude the article noting that the depression that people in the United States are on the verge of facing because of these neoliberal policies–telling workers in the U.S. that they need to decrease their wages and be unemployed in order to stop inflation–you point out that:

Biden’s military and State Department officers warn that the fight against Russia is just the first step in their war against China’s non-neoliberal economy, and may last twenty years. That is a long depression. But as Madeline Albright would say, they think that the price is “worth it.”

And you talk about the new cold war against the socialist economy in China and the state-led economy in Russia.

So you predict not only a depression is coming. We have seen that in mainstream media outlets. Larry Summers said, you know, a depression could be coming for a few years. But you say, no, not only is a depression coming; it’s going to be a long depression. We could be seeing 20 years.

And basically the U.S. government and other Western leaders, as we see Ursula von der Leyen from the EU, they’re basically telling their populations, tighten your belts; we have decades of depression coming, because we have collectively decided, as Western leadership, that we are going to force the world through a long depression economically, or at least forced the West through a long economic depression, in order to try to halt the rise of China and Russia.

They’re basically telling their populations, suck it up, tighten your belts for decades, because in the end, the price is worth it in order to prevent the collapse of our empires.

MH: That’s right. When they’re talking about private-public initiatives, they’re talking about Pentagon capitalism. That means the government will give trillions of dollars to private firms and ask them to build infrastructure.

And if they build a port or a road in a Global South country, they will operate this at a profit, and it will be an enormously expensive infrastructure, because to make financial money off this infrastructure, you have to price it at the cost of production, which is Pentagon capitalism, hyper inflated prices; you have to pay management fees; you have to pay profits; you have to pay interest rates.

As opposed to the Chinese way of funding as equity. The Western mode of funding is all debt leverage. China takes as collateral for the infrastructure that it pays, an equity ownership in the port or whatever infrastructure in the Belt and Road that it’s building.

So you have the difference between equity ownership, debt-free ownership, where if it can afford to pay, fine; if it doesn’t make an income, there are no dividends to pay.

Or you have the debt leverage that is intended that the government cannot pay it, so that the government that will be the co-signer for the debt for all of this infrastructure will somehow be obliged to tax its whole population to pay the enormous super-profits, the enormous monopoly rents, the enormous debt charges of von der Leyen’s Margaret Thatcher plan.

Von der Leyen thinks that she can do to Europe and to America what Margaret Thatcher did to England. And if she does, then then America and Europe deserve it.

BN: And Professor Hudson, as we start wrapping up here, I know you have to go pretty soon, just a few short questions here at the end.

I’m wondering if what we’re also seeing is not only this fundamental crisis in the Western neoliberal, financialized economies, but it’s also this bubble that has burst, or at least this phase that is over.

At least this is my reading, I’m curious if you agree. In the 1990s, the peak of, you know, the so-called golden age of neoliberalism; we had Bill Clinton riding this wave, and it was the “end of history,” in Francis Fukuyama’s nonsense prediction and all that.

How much of that was not only based on this exorbitant privilege, as the French call it, of the dictatorship of the U.S. dollar–we talked about that based on your book “Super Imperialism,” how the U.S. was given this massive global free lunch economically because of dollar hegemony–but how much of it was not just that, but also the fact that in the 1990s and the first decade of the 2000s, the U.S. and Western Europe had access to very cheap consumer goods from Asia and very cheap energy from Russia?

To me, it seems like those two factors are some of the most important reasons why this golden age of neoliberalism in the ’90s and early 2000s was even possible.

It was on the back of low-paid Asian workers, and based on this idea that Russia would permanently be, what Obama called it: a gas station.

Well, we’ve seen that, one, East Asian economies have lifted themselves up of poverty, especially China has ended extreme poverty and raised median wages significantly.

And now, of course, the West has sanctioned itself against buying Russian energy, massively increasing the cost of energy around the world.

So do you think that that bubble, or that brief moment of the end of history, the golden age of neoliberalism, that can never come back?

Because unless the West can succeed in overthrowing the Russian government and imposing a new puppet like Yeltsin, and overthrowing the Chinese government, it seems like that that the golden in the 1990s is never going to come back.

MH: Well, you’ve left out the key element of the golden age: that is military force, and the willingness to assassinate any foreign leader that does not want to go along with U.S. policy.

BN: Of course.

MH: You’re neglecting what America did to [Salvador Allende]; you’re neglecting how America took over Brazil; America’s meddling and control, and in Europe, the wholesale bribery and manipulation of Europe’s political system, to put in charge of the [German] Green Party a pro-war leadership, an anti-environmental leadership, to put in charge of every socialist party of Europe right-wingers, neoliberals.

Every European socialist and labor party turned neoliberal largely by American maneuvering and meddling in their foreign policy.

So it’s that meddling that was intended to prevent any alternative economic philosophy from existing to rival neoliberalism.

So that when you talk about the end of history, what is the end of history? It means the end of change. It means stop; there will be no reform; there will be no change in the neoliberal system that we have locked in.

And of course, the only way that you can really end history is by what Biden is threatening: atomic war to blow up the world.

That is the neoliberal end of history. And it’s the only way that the neoliberals can really stop history. Apart from that, all they can try to do is to prevent any change that is adverse to locking in the neoliberal order.

So the “end of history” is a declaration of war against any country that wants to go its own way. Any country that wants to build up its own economy as a way that will keep the benefits of its economic growth in its own country, instead of letting it go to the global financial class centered in the United States and Britain.

So we’re talking about, neoliberalism was always a belligerent, implicitly military policy, and that’s exactly what you’re seeing in the proxy war of U.S. and NATO in Ukraine today.

BN: Yeah, very well said. That’s the other key ingredient: overthrowing any government that is a challenge, that shows there is an alternative, to try to prove the maxim that “there is no alternative.”

MH: Yes.

BN: Here’s an interesting comment from Christopher Dobbie. He points out that in Australia, the average age for their first homeowner was 27 in 2001; now it’s 35, and increasing more and more by the year.

Now, in the last few minutes here, Professor Hudson, here’s another brief question that I got from someone over at patreon.com/multipolarista–people can go and support this show. One of my patrons asked this question: who who is hurt most by the Fed or other central banks raising interest rates? People, average consumers, or companies?

And obviously, you talked earlier about how the U.S. Federal Reserve is different from other central banks, but it’s kind of an open question. Who is hurt more by raising interest rates?

MH: Well, companies are certainly hurt because it means that any possibility of getting productive credit is raised. But they’re also benefited, because if interest rates raised go up high enough, then it will not pay corporate raiders to borrow money to take over and raid companies and empty them out, like they did in the 1980s.

So everything cuts both ways. Raising the interest rates have given commercial banks an excuse to raise the interest charges on credit card loans and mortgage debts.

So raising interest rates, to the banks, have enabled them to actually increase their margin of monopoly profits on the credit that they extend.

And that certainly hurts people who are reliant on bank credit, either for mortgages or for consumer debt, or for any kind of loans that they want to take out.

Basically, raising interest rates hurts debtors and benefits creditors.

And benefiting creditors very rarely helps the economy at large, because the creditors are always really the 1%; the debtors are the 99%.

And if you think of economies, when you say, how does an economy benefit, you realize that, well, if the economy is 1% creditors and 99% debtors, you are dealing with a bifurcation there.

And you have to realize that the creditors usually occupy the government, and they claim we are the country. And the 99% are not very visible.

Democracy can only be afforded if they population’s voting has no effect at all on the government, that it’s only symbolic. You can vote exactly which oligarch you want to rule your country. Ever since Rome that was the case, and it’s the case today.

Is there really any difference between the Republicans and Democrats in terms of their policy? When you the same central bank bureaucracy, the same State Department blob, the same military-industrial complex, the same Wall Street control, what does democracy mean in a situation like that?

The only way that you can have what democracy aims at is to have a government strong enough to check the financial interests, to check the 1%, acting on behalf of the 99%. And that’s what socialism is.

BN: Very well said.

Here is another brief question from patreon.com/multipolarista–people can become a patron and help support the show over there.

This question, Professor Hudson, is about the proposal of an excess profits tax as an alternative to try to contain inflation. What do you think about the proposal of an excess profits tax?

MH: Well, only the little people make profits. If you’re a billionaire, you don’t want to make a profit; you want to essentially take all of your return in the form of capital gains. That’s where your money is.

And the way you avoid making a profit is you establish an offshore bank or creditor, and you pay out all of your profits in the form of interest, which an expense. You expense all of what used to be, what really is, income. And you show no profits at all.

I don’t think Amazon has ever made a profit. You have huge, the biggest corporations, with all the capital gains, have no profits. Tesla is a gigantic stock market presence, and it doesn’t make a profit.

So the key is capital gains, is financial gains, stock market gains, gains in real estate prices, unearned income. That’s what the free lunch is.

You want to prevent profits being paid out in the form of interest. So I would vastly increase profits, by saying you cannot deduct interest as a business expense. It’s not a business expense. It’s a predatory parasitic expense. So you’re going to have to declare all of this as profit, and pay interest on it.

Pricing your output from a foreign offshore banking center, so that you don’t seem to make any profit, like Apple does, pretending to make all its money in Ireland, you can’t do that anymore. You’re going to have to pay a real return.

So the accounting profession has made profits essentially tax free. So the pretense of making money by taxing profits avoids talking about capital gains and all of fictitiously low profits that are simply pretended not to be profit, like interest, depreciation, amortization, offshore earnings, management fees.

All of these should be counted as profits, and taxed as such as they were, I’d say back at the Eisenhower administration levels.

BN: And finally, the last question here, Professor Hudson, someone asked about the U.S. government pressuring countries in Africa not to buy Russian wheat. And the U.S. is, of course, claiming that this wheat is supposedly stolen from Ukraine.

This article, this headline at Newsweek, it summarizes pretty well: “U.S. Warns Starving African Nations to Not Buy Grain Stolen by Russia.” Again, that “stolen” is alleged by the U.S.

But you actually have a really good column about this over at your website, which again is michael-hudson.com: “Is U.S./NATO (with WEF help) pushing for a Global South famine?”

I know this could be a long point of discussion; it could be the entire interview. And I know you have to go soon. But just concluding here, I’m wondering if you could comment.

The United Nations itself has warned that there could be a famine, especially in Global South nations.

What do you think the role of these neoliberal policies and Western sanctions are in fueling that potential crisis?

MH: Well, the wealthiest families in the world used to go every year, now they go every few years, to Davos, to Klaus Schwab’s Davos World Economic Forum. And they say, the world is overpopulated; we need about 2 billion human beings to starve, preferably in the next year or two.

So it’s as if the wealthy families have got together and say, how can we thin out the population that really we, the 1%, don’t need?

And in all of their policies, it is as if they’ve decided to follow the World Economic Forum and deliberately shrink the world population, especially in Africa and Latin America.

Remember, these are white people at the World Economic Forum, and that is their idea of how to retain equilibrium.

They’re always talking about “equilibrium,” and equilibrium is going to be for countries that cannot afford to grow their own food, because they have put their money into plantation crops and cotton to sell to the West, instead of feeding themselves–they’re just going to have to starve to contribute to world “equilibrium.”

BN: And while we’re on the subject of the World Economic Forum, I guess I should just briefly add–we’ve talked about this a little bit, but I just feel remiss not mentioning it–it’s interesting to see how right-wingers have seized on the World Economic Forum and begun criticizing it a lot.

Obviously, it’s worth criticizing. It’s a horrible neoliberal institution that represents the Western capitalist class. But we’ve even seen, you know, Glenn Beck, the right-winger, former Fox News host, he published a book about the Great Reset and the World Economic Forum.

I’m just wondering really quickly if you could respond to the idea that the World Economic Forum is like some “socialist” organization. Obviously, it’s the exact opposite.

But what do you say to these conservatives who have a right-wing critique of the World Economic Forum, and think it’s like secretly socialist, and Biden is a socialist.

MH: They look at any government or managerial power as socialist, not drawing the distinction between socialism and oligarchy.

The question is government power can be either right-wing or left-wing, and to say that any government power is socialist is just degrading the word.

However, as I mentioned before, almost all of the European “socialist” parties are neoliberal. Tony Blair was the head of something that called itself the British Labour Party. Gordon Brown was the head of the British Labour Party.

You can’t be more neoliberal and oligarchic than that. And that’s why Margaret Thatcher said her greatest success was creating Tony Blair.

You have the same thing in France; the French “socialists” are on the right-wing of the spectrum. The Greek “socialist” party, on the right-wing of the spectrum.

You have “socialist” parties around the world being neoliberalized.

So what does the word socialism mean? You want to go beyond labels into the essence.

And the question is, in whose interest is the government going to be run for? Will it be run for the 1% or the 99%?

And the right wing wants to say, well, the 1% can be socialist, because they’re taking over the government and that’s the big government, and we’re against it.

Well, the right-wing is taking over the government, but it’s not really what the world meant by socialism a century ago.

BN: Yeah, very well said. I just always laugh when I see these right-wing critiques of the World Economic Forum. I mean, the World Economic Forum is the embodiment of capitalism. It is the group of the elite capitalists who get together to talk about how they can exploit the working class and help monopolize the global economy on behalf of Western capital.

So with that said, there still are many questions, but I know you have to go, and we’re already at an hour and a half.

I do want to thank everyone who joined. We’re at 1200 viewers right now, so it has been a really good response.

Professor Hudson, you’re very popular. You should do your own YouTube channel. Maybe we can talk about that, because every time I have you on, it’s always an amazing response that I get. And hopefully we can do this again more in future.

Aside from people going to your website, michael-hudson.com, is there anything else that you want to plug before we conclude?

MH: Well, the book that I just wrote, “The Destiny of Civilization,” is all about what we’ve been talking about. It’s about the world’s split between neoliberalism and socialism. So that was just published and is available on Amazon. And I have two more books that are coming out very shortly.

BN: Yeah, for people who are interested, I did an interview with Professor Hudson here at Multipolarista a few weeks ago about his new book, The Destiny of Civilization: Finance Capitalism, Industrial Capitalism or Socialism.”

And of course, anyone who wants to support this show, you can go to patreon.com/multipolarista. And as always, this will be available as a podcast, if you want to listen to the interview again. I’m certainly going to listen to this discussion again. You can find that anywhere there are podcasts.

Professor Hudson, it’s always a real pleasure. Thanks so much for joining me.

MH: I enjoyed the discussion.

BN: And like I said earlier at the beginning, for me, I truly think it’s always a privilege, because I do think you’re one of the greatest living economists. So I always feel very privileged to have the opportunity to pick your brain about all of these questions.

And I want to thank everyone who commented, who watched, and who listened. I will see you all next time.