When current U.S. Treasury Secretary Janet Yellen served as chair of the Federal Reserve in 2017, she confidently predicted that there would not be another financial crisis “in our lifetimes”.

Less than six years later, in March 2023, three U.S. banks collapsed in just one week.

Silicon Valley Bank and Signature Bank were the second- and third-largest banks to go under in U.S. history. And after they crashed, the government immediately bailed out their wealthy depositors.

Among the main beneficiaries of this bailout were billionaires and big corporations.

The government’s Federal Deposit Insurance Corporation (FDIC) insures U.S. bank deposits up to $250,000 per customer.

More than 93% of Silicon Valley Bank’s deposits and 90% of Signature Bank’s deposits exceeded this FDIC-insured limit.

The average deposit at Silicon Valley Bank (SVB) was around $5 million.

The 10 largest accounts at SVB, together, held a staggering $13.3 billion.

Despite the fact that these billionaire accounts were thousands of times larger than the FDIC-insured limit, the U.S. government paid all of the uninsured deposits.

The oligarchs and huge corporations who knowingly held billions of dollars of uninsured funds in the banks were not forced to take a haircut; they didn’t lose a cent.

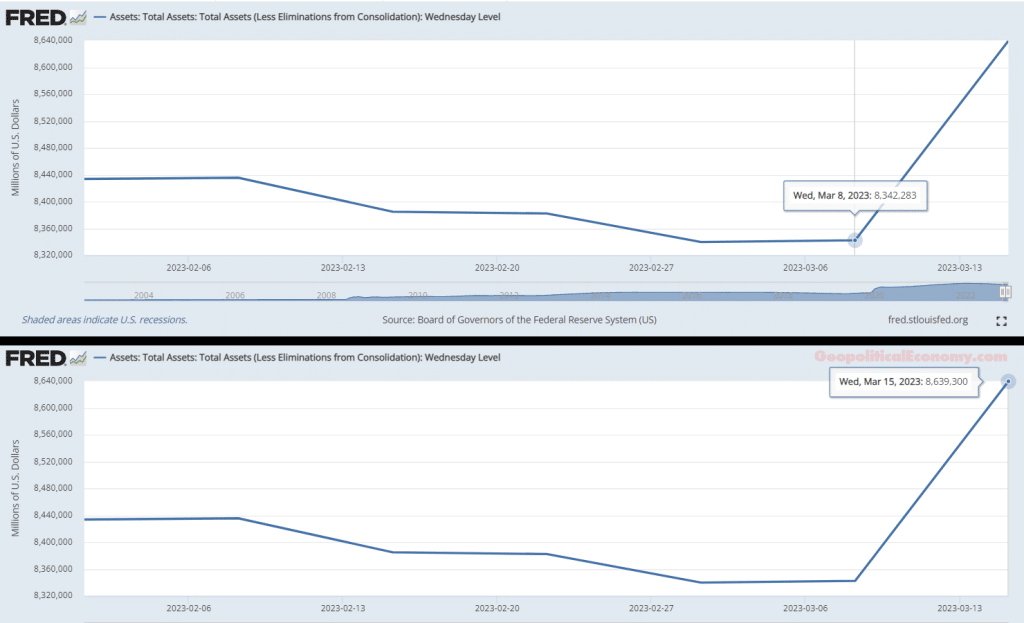

Geopolitical Economy Report previously noted how the US Federal Reserve printed $300 billion in one week to stabilize the banking system. According to the Associated Press, $143 billion of that $300 billion was borrowed by FDIC-managed holding companies for SVB and Signature Bank and used to pay their uninsured depositors.

On March 28, a hearing organized by the Senate Committee on Banking, Housing, and Urban Affairs provided even more information about this scandal.

In written testimony for the hearing, the chairman of the FDIC, Martin Gruenberg, revealed (emphasis added):

At SVB [Silicon Valley Bank], the depositors protected by the guarantee of uninsured depositors included not only small and mid-size business customers but also customers with very large account balances. The ten largest deposit accounts at SVB held $13.3 billion, in the aggregate.

…

The FDIC estimates that the cost to the DIF [Deposit Insurance Fund] of resolving SVB to be $20 billion. The FDIC estimates the cost of resolving Signature Bank to be $2.5 billion. Of the estimated loss amounts, approximately 88 percent, or $18 billion, is attributable to the cost of covering uninsured deposits at SVB while approximately two-thirds, or $1.6 billion, is attributable to the cost of covering uninsured deposits at Signature Bank.

As journalist David Dayen noted, this means that more than $13 billion of the $18 billion (over 72%) that the U.S. government paid to bail out uninsured Silicon Valley depositors went to these 10 huge billionaire accounts.

"The Billionaire Bailout" pic.twitter.com/SgACS6uNgb

— david dayen (@david_dayen) March 28, 2023

The chair of the committee, Senator Sherrod Brown, a relatively progressive Democrat from Ohio, stated in the hearing, “I understand why Americans are angry, even disgusted, at how quickly the government mobilized when a bunch of elites in California were demanding it. People have a pretty good sense of whose problems get taken more seriously than others in this town [Washington]”.

Brown noted that Silicon Valley Bank went nearly a year without a chief risk officer, and Signature Bank allowed fraudster Sam Bankman-Fried of the failed cryptocurrency exchange FTX to open multiple accounts.

“It’s all just a variation of the same theme, the same root cause of most of our economic problems: wealthy elites do anything to make a quick profit and pocket the rewards. And when their risky behavior leads to catastrophic failures, they turn to the government asking for help, expecting workers and taxpayers to pay the price. And too often, workers do”, Brown said.

“It appears that, when there is a bank crash, there are no libertarians in Silicon Valley”, he added.

In 2018, U.S. Congress deregulated banks that are collapsing today

The populist rhetoric in the Senate today stands in stark contrast to the Congress of just six years ago, which happily gave in to lobbyists and cut regulations on some of the very same banks that are failing today.

In 2018, both Republicans and Democrats passed legislation that deregulated medium-sized banks. This was a partial reversal of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, which was approved in response to the financial crash of 2008.

Former President Donald Trump had criticized the increased post-2008 regulation of the financial sector and pledged to “do a big number on Dodd-Frank”.

Breaking News: Congress voted to repeal part of the Dodd-Frank law passed after the 2008 financial crisis. The move eases rules on all but the biggest banks. https://t.co/2TDxCEhk51

— The New York Times (@nytimes) May 22, 2018

Although the 2018 regulatory rollback was pushed largely by the Republican Party, which controlled the government at the time, it also had the support of many neoliberal Democrats.

The New York Times described the “rare demonstration of bipartisanship” as “a substantial watering down of” Dodd-Frank, noting the “legislation will leave fewer than 10 big banks in the United States subject to stricter federal oversight, freeing thousands of banks with less than $250 billion in assets from a post-crisis crackdown”.

In an Shakespearean twist, one of the banks that had successfully lobbied Congress for the lifting of these regulations was none other than Silicon Valley Bank.

Today, many of the neoliberal Democrats who joined with Republicans in rolling back Dodd-Frank in 2018 are opposing calls for new regulations in the wake of the latest banking crisis.

Moderate Senate Democrats who voted to loosen regulations on midsize banks in 2018 are standing by their votes in the wake of Silicon Valley Bank’s collapse, joining Republicans in resisting enhanced scrutiny for those financial institutions. https://t.co/RenU7PgNzs

— NBC News (@NBCNews) March 16, 2023

Blatant corruption and regulatory capture

Perhaps the most shocking symbol of the systemic corruption in Washington is the namesake of the Dodd-Frank law himself: former Democratic House Representative Barney Frank.

In 2015, two years after he left Congress, Frank accepted a lucrative position on the board of Signature Bank, which crashed this March in the third-biggest bank collapse in U.S. history.

The Financial Times interviewed Frank after the collapse, and reported that “the Democrat said he had no regrets about joining Signature’s board“.

Frank defended his decision by simply stating, “I need to make some money”. The newspaper calculated that Frank made $2 million for sitting on the bank’s board.

The Times added, “While Frank never officially registered as a lobbyist, he had publicly argued that Dodd-Frank’s $50bn threshold for triggering greater regulatory oversight was too low”. The 2018 legislation that his Congressional successors approved axed that $50 billion threshold.

Barney Frank defends role at Signature Bank: ‘I need to make money’ https://t.co/Ed5U4ODDmP

— Financial Times (@FT) March 15, 2023

In the March 28 Senate Banking Committee hearing, Democratic Senator Elizabeth Warren acknowledged the cozy relationship between the government’s Federal Deposit Insurance Corporation and the banks it is supposed to regulate.

Warren fumed at the FDIC chairman, Martin Gruenberg, “Once the Fed began torching rule after rule in 2018 for big banks, the FDIC under your predecessor [Jelena McWilliams] joined in on the fun and also started weakening FDIC rules across the board, capital and liquidity requirements, stress tests, you name it”.

“In fact, your predecessor explicitly told these banks that if FDIC bank examiners were asking too many questions that they should ‘let us know’”, Warren added. “Now there’s a banking regulator who makes it clear that she is there to serve the big banks instead of the American public”.

Warren was referencing information disclosed in a 2018 Wall Street Journal report, titled “Banks Get Kinder, Gentler Treatment Under Trump“.

The article revealed that the Trump administration had appointed two top officials, FDIC chair Jelena McWilliams and Federal Reserve vice chair for supervision Randal Quarles, who aimed “to change policy in a subtle but significant way and reshape regulators’ relationship with banks, which officials have said was too contentious”.

McWilliams and Quarles “spent several months touring the country, visiting bank examiners in regional offices and asking them to adopt a less-aggressive tone when flagging risky practices and pressing firms to change their behavior”, the Journal wrote.

Foreshadowing the crisis that would come just over four years later, the report noted, “Critics say friendlier examiners could blunt the effect of postcrisis rules, giving banks more freedom to engage in riskier practices”.

Trump-appointed regulators have asked bank examiners to adopt a less aggressive tone when working with firms https://t.co/9PqSfYQ89U

— The Wall Street Journal (@WSJ) December 12, 2018

In another ironic twist, the Journal added in the December 2018 article that the “Fed plans to remove a key liquidity requirement for midsize banks with $100 billion to $250 billion in assets”.

Commenting on this scandalous example of regulatory capture in the wake of the March 2023 banking crisis, the Yale University School of Management’s Program on Financial Stability wrote (emphasis added):

The failure of Silicon Valley Bank (SVB) after a run by uninsured depositors has focused attention on bank liquidity regulation in dramatic fashion.

Less than four years ago, the U.S. bank regulators, following an Act of Congress, ruled that most banks with between $50 billion and $250 billion in assets would no longer be subject to the liquidity coverage ratio, or LCR, or other enhanced prudential standards that they apply to the most systemically important banks. …

The LCR rule requires banks to hold sufficient high-quality liquid assets (HQLA) to manage expected net cash outflows in a 30-day stress scenario. Under the original 2014 version of the rule, banks with $250 billion in assets or $10 billion in foreign exposures had to maintain their LCR ratios above 100%. SVB would have been subject to that ratio because its foreign exposures met the threshold.

We reviewed SVB’s public financials and concluded that its LCR would have been 75% at the end of 2022, substantially below the threshold. This result suggests that the [Federal Reserve’s] 2019 tailoring rule was complicit in the run and failure at SVB.

Of course, if the bank were subject to the rule, its supervisors would not have allowed its LCR to fall so far. Supervisors shouldn’t just react when a bank breaches a limit—they should act when limit breaches become foreseeable. Even under its existing regulatory framework, SVB’s supervisors should have identified the liquidity risks the company faced due to its high concentration to, and run-inducing dependence on, a specific type of corporate depositor.

In response to the March 2023 U.S. banking crisis, the former chief of the UK’s central bank, Mark Carney, said the scandal will “require some rethinking of the assumptions behind liquidity coverage ratio, the net stable funding ratio”.

Reuters noted that the Basel III international regulatory banking standards that were put in place after the 2008 crash were only applied to the largest banks in the United States.

Carney commented,

It’s a good idea to actually put in place the net stable funding ratio. That was one of the reforms not applied fully in the U.S. and, you know, with some cost.

Bailing out the rich

Geopolitical Economy Report previously showed how supporters of the U.S. government bailout of Silicon Valley Bank, such as right-wing tech oligarch David Sacks, cynically tried to portray the institution as a kind of community bank.

According to their narrative, the bailout was necessary to save regional banks and the small businesses they supposedly serve. But SVB’s main clients were in reality venture capitalists, not mom-and-pop stores.

More than half of SVB’s loans (56%) went to venture capitalist and private equity firms. Analysts Pam Martens and Russ Martens at the financial news website Wall Street on Parade described SVB as “a Wall Street IPO pipeline in drag as a federally insured bank”.

Like SVB, among Signature Bank’s most important clients were venture capital and private equity firms, as well as cryptocurrency companies, which made up roughly 20% of its total deposits.

An example of a billionaire oligarch who benefited from the U.S. government bailout was far-right Donald Trump donor Peter Thiel, who said “I had $50mn of my own money stuck in SVB” when the bank went down.

Ironically, Thiel helped initiate the bank run on SVB in the first place, but he reportedly did not think it would collapse.

While his administration bailed out these wealthy depositors, U.S. President Joe Biden claimed it was not a bailout, stating “no losses will be borne by the taxpayers. Let me repeat that: No losses will be borne by the taxpayers. Instead, the money will come from the fees that banks pay into the Deposit Insurance Fund”.

This claim is misleading. The FDIC’s Deposit Insurance Fund (DIF) is based on fees paid by all FDIC-insured banks (not just SVB and Signature Bank)—essentially taxes that the banking system pays in order to have the backing of the U.S. government.

But where does the money come from that those banks pay to fill the DIF? Ultimately it is the banks’ customers who pay for it—that is to say, mostly average working people, who are the taxpayers.

So while this DIF money used to bail out SVB’s billionaire depositors is not direct taxpayer money, it still ultimately comes from the taxpayers.

It’s not like commercial banks in the United States are losing money. On the contrary, since 2021, banking profits have been at record highs.

The FDIC reported that the banks that it insures made a staggering $263 billion in net income in 2022, and an even more stratospheric $279.1 billion in 2021.

(Net income is a firm’s profits after subtracting all taxes and other expenses from revenue. It is even higher than a firm’s gross profits, which do not include taxes or other expenses.)

These massive profits are not only made by investing depositors’ money in interest-bearing securities; they are also made through a growing number of fees.

U.S. banks suck billions of dollars per year out of poor people through overdraft fees. As Bloomberg reported in 2022,

Customers who pay overdraft fees again and again—who typically have no more than a few hundred dollars in the bank—are responsible for over half the profits from mass-market consumer checking accounts at the biggest U.S. lenders.

Even smaller banks make hundreds of millions of dollars per year in overdraft fees. By 2008, the year of the financial crash, U.S. banks made roughly $34 billion annually just in overdraft and related fees.

Commercial banks in the United States make so much money, the fees they have to pay into the FDIC’s Deposit Insurance Fund are minor. It’s just part of the cost of doing business.

Workers also end up paying the costs of the U.S. government bailout in terms of inflation. Banks have been the beneficiaries of the Fed’s 15 years of quantitative easing and loose monetary policy, which fueled record asset-price inflation, making the capital gains-earning rich even richer and leading to a skyrocketing increase in rent, the burden of which is borne by wage-earning workers.

Although the Fed has restricted its monetary policy and raised interest rates since March 2022, ostensibly in order to combat consumer price index inflation (but mostly to try to “get wages down” and decrease the economic power of workers), the U.S. central bank interrupted its quantitative tightening in March 2023 by printing $300 billion in one week to save the banking sector.

The U.S. “banking crisis is far from over”

The fall of SVB and Signature Bank could be the beginning of an even bigger collapse.At the financial news website Wall Street on Parade, veteran analysts Pam Martens and Russ Martens warned that “the banking crisis is far from over“.

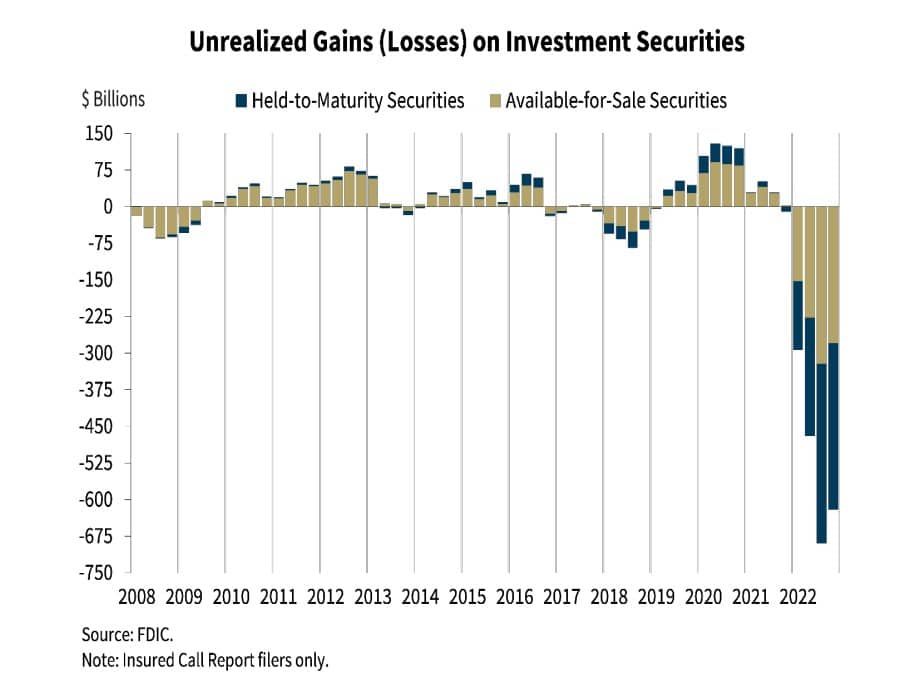

They cited a “stunning” graph that FDIC chair Martin Gruenberg included in his written testimony for the Senate Bank Committee hearing:

The Martens explained:

[The graph] shows that the unrealized losses on investment securities at federally-insured U.S. banks during the 2008 financial crisis were less than $75 billion while at the end of the fourth quarter of 2022 they were over $600 billion.You are no doubt asking yourself how 2008 could have been the worst financial crisis since the Great Depression if banks had less than $75 billion in unrealized losses on their investment securities. That’s because the mega banks on Wall Street were highly interconnected, understood how highly leveraged each one was, and backed away from extending credit as the panic started to spread.

Gruenberg admitted that these “elevated levels of unrealized losses on investment securities” constitute “a key weakness” in the banking industry, and he contributed it to a “rapid increases in market interest rates”.

This is a clear demonstration of how the Fed’s rising interest rates have popped the asset-inflation bubble it fueled through 15 years of quantitative easing.

As economist Michael Hudson explained:

Now, the rising interest rates have created a systemic crisis because the Federal Reserve, by saving the banks’ balance sheets by inflating the prices for capital assets, by saving the wealthiest 10% of the economy from losing any of their money, by solving that problem, they’ve boxed themselves into a corner. They cannot let interest rates rise without making the entire economy look like Silicon Valley Bank.