One of the latest covers of the magazine The Economist carries a headline “Peak China”. This, as its name suggests, is a claim that while during the last seven decades China’s has enjoyed a peaceful “rise”, specifically in relation to the U.S., this has now ended:

One of the latest covers of the magazine The Economist carries a headline “Peak China”. This, as its name suggests, is a claim that while during the last seven decades China’s has enjoyed a peaceful “rise”, specifically in relation to the U.S., this has now ended:

Whereas a decade ago forecasters predicted that China’s GDP would zoom past America’s during the mid-21st century (at market exchange rates) and retain a commanding lead, now a much less dramatic shift is in the offing, resulting in something closer to economic parity… One view is that Chinese power will fall relative to that of its rivals… The Peak China thesis rests on the… observation that certain tailwinds are turning to headwinds… All of this is dampening long-run forecasts of China’s economic potential. Twelve years ago Goldman Sachs thought China’s GDP would overtake America’s… and become over 50% larger by mid-century. Last year it revised that prediction, saying China would… peak at less than 15% bigger. Others are more gloomy. Capital Economics, a research firm, argues that the country’s economy will never become top dog, instead peaking at 90% of America’s size in 2035… the most plausible ones [of these projections] seem to agree that China and America will approach economic parity in the next decade or so—and remain locked in this position for decades to come.

The first reaction, was really to literally laugh at what, as will be seen, was the latest of decades long wildly inaccurate predictions by The Economist regarding China. Indeed, the record shows that probably a good working guide to what will happen in China is to take what The Economist says and assume that the opposite will occur! Second, to reflect on what are the deep reasons for such a combination of ignorance and arrogance that it leads to a refusal to make any balance sheet of entirely wrong analyses repeated for these decades but when it still claims to be taken seriously on an issue on which it has such a provenly lamentable record. As the latter applies not only to The Economist but to many other Western publications that make similar claims it will be returned to at the end of this article.

The first reaction, was really to literally laugh at what, as will be seen, was the latest of decades long wildly inaccurate predictions by The Economist regarding China. Indeed, the record shows that probably a good working guide to what will happen in China is to take what The Economist says and assume that the opposite will occur! Second, to reflect on what are the deep reasons for such a combination of ignorance and arrogance that it leads to a refusal to make any balance sheet of entirely wrong analyses repeated for these decades but when it still claims to be taken seriously on an issue on which it has such a provenly lamentable record. As the latter applies not only to The Economist but to many other Western publications that make similar claims it will be returned to at the end of this article.

The Economist on China and the Asian Financial Crisis

First, however, in order to avoid any suggestion that we are misrepresenting The Economist, let us factually establish its prolonged inaccuracies on China. Similarly, to avoid any suggestion of seizing on incidental or secondary remarks, taken out of context, which do not represent the central views of the publication, only front pages, and special supplements, that is the journal’s most important publications, on China will be used.

A suitably distant starting point is to go back 25 years to The Economist’s analysis of China and the Asian Financial Crisis of 1997-98. The Economist’s front page on 24 October 1998, referring to this, was “Will China be next?” Inside it posed the question: “whether China’s growth is slowing or even grinding to a halt… yes”. It then posed the question:

A suitably distant starting point is to go back 25 years to The Economist’s analysis of China and the Asian Financial Crisis of 1997-98. The Economist’s front page on 24 October 1998, referring to this, was “Will China be next?” Inside it posed the question: “whether China’s growth is slowing or even grinding to a halt… yes”. It then posed the question:

whether the resulting unemployment will prompt political unrest, or a power struggle among the leadership… yes.

In fact, as is well known, China was fundamentally economically stable during the Asian financial crisis. There was no unemployment leading to political unrest, let alone a “power struggle”. In short, The Economist was completely inaccurate.

The Economist “out of puff”

Moving ahead four years, on 15 June 2002 The Economist published a special supplement on China. This had the title “A Dragon Out of Puff”—a self-explanatory analysis. Its conclusion on China was the following:

the economy still relies primarily on domestic engines of growth, which are sputtering. Growth over the last five years has relied heavily on massive government spending. As a result, the government’s debt is rising fast. Coupled with the banks’ bad loans and the state’s huge pension liabilities, this is a financial crisis in the making… In the coming decade, therefore, China seems set to become more unstable. It will face growing unrest as unemployment mounts. And if growth were to slow significantly, public confidence could collapse, triggering a run on banks.

Turning from The Economist’s analysis to reality, what actually happened in the decade that followed was simple. China’s economy from 2002-2012 expanded by a total of 173% or an annual average of 10.5%. For comparison, in the same decade world GDP grew by a total 37%, or an annual average 3.2%. The U.S. grew by 21% or an annual average of 1.9%. In summary, China’s GDP grew 4.7 time as much as the world average and 8.4 times as time as much as the U.S.

Turning from The Economist’s analysis to reality, what actually happened in the decade that followed was simple. China’s economy from 2002-2012 expanded by a total of 173% or an annual average of 10.5%. For comparison, in the same decade world GDP grew by a total 37%, or an annual average 3.2%. The U.S. grew by 21% or an annual average of 1.9%. In summary, China’s GDP grew 4.7 time as much as the world average and 8.4 times as time as much as the U.S.

And this is supposed to be China “out of puff”? It is just known as The Economist being hilariously wrong.

The Economist wrong on China and India

Let us now turn to another major sortie of The Economist into analysing China. Its front cover headline of 2 October 2010 was “How India’s Growth Will Outpace China’s”—also self-explanatory. The analysis this headline referred to stated: “Chetan Ahya and Tanvee Gupta of Morgan Stanley, an investment bank, predict that India’s growth will start to outpace China’s within three to five years… For the next 20-25 years, India will grow faster than any other large country, they expect. Other long-range forecasters paint a similar picture.” The Economist approvingly quoted that India would “outpace” China because socialist “China’s growth has been largely state-directed. India’s, by contrast, is driven by 45m entrepreneurs.”

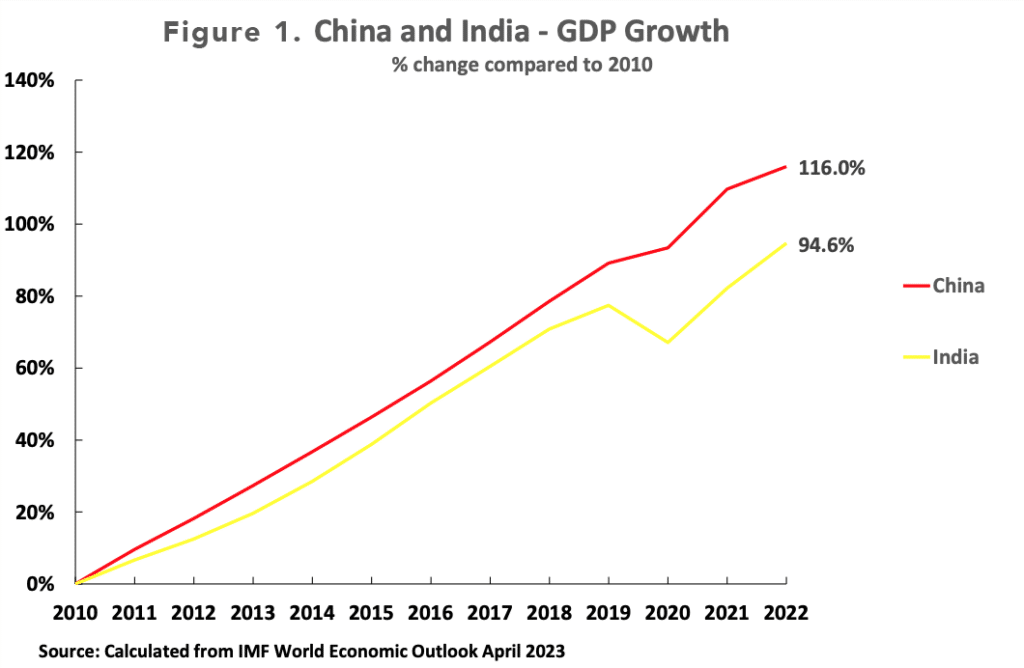

Once more, turning from a comparison of what The Economist predicted to what happened, the reality was clear and is shown in Figure 1. Taking the data from the Economist’s prediction in 2010 up to the present, that is to the end of 2022, China’s economy grew by 116.0% and India’s by 94.6%. Far from India “outpacing” China, China’s total economic growth in this period was 23% greater than India’s. China’s annual average GDP growth was 6.6% compared to India’s 5.7%.

Regarding the supposedly negative features of China’s socialist “largely state-directed” economy even more striking, because it is an index of overall economic efficiency, was the result in terms of per capita GDP growth. From 2010-2022 China experienced an average annual population increase of 0.4% and India of 1.2%. So, China’s more rapid growth of total GDP than India was despite the fact that India had significantly more rapid population increase.

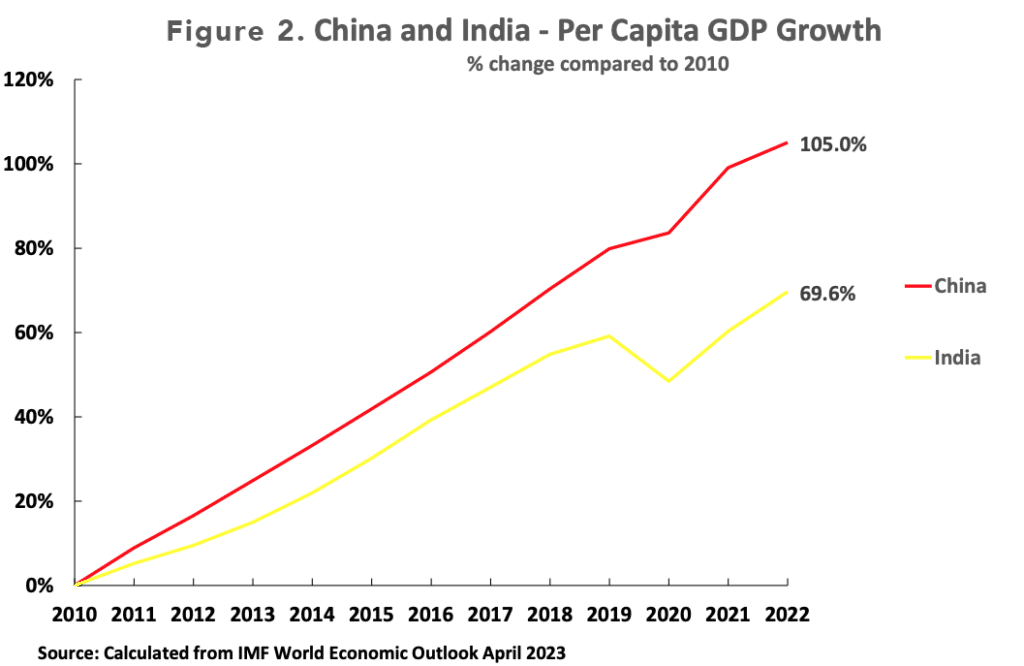

In terms of per capita GDP, as Figure 2 shows, China’s total growth from 2010 to 2022 was 105% and India’s 69.6%. That is, China’s per capita GDP growth was 51% higher than India. China’s annual average per capita GDP growth was 6.2% compared to India’s 4.5%. It turns out that China’s socialist “state directed growth” was far more effective at producing per capita GDP growth than India’s “45 million entrepreneurs”. Once more The Economist was not wrong on details but got the entire course of events wrong.

The significance of population trends in China’s economic growth will be considered in more detail below.

The current claims by The Economist

Having established the successive previous errors of The Economist on China let us now turn to its claims in its most recent issue. This, as already noted, is summarised in the front cover issue with the headline “Peak China?”—that is the claim that China’s rise has stopped. Regarding the details of this inside we read supposedly regarding the “certain tailwinds are turning to headwinds” that:

The first big gust comes from demography. China’s working-age population has been declining for about a decade. Last year its population as a whole peaked… Wave goodbye to the masses of young workers who once filled ‘the world’s factory’.

The Economist then goes on to claim: “China has this year liberated its economy from the lockdowns, quarantines and other strictures of its ‘zero-covid’ regime. But it has not freed itself from longer-term worries about its growth prospects. Its population is shrinking. Its epic housing boom is over.” Supposedly China has problems from “a regulatory crackdown on e-commerce firms.” Regarding comparison with the U.S.: “Some ask how much longer China’s economy can grow faster than America’s.” Quoting works which it considers notable, and which coined the “peak” claim:

Hal Brands and Michael Beckley, two American political scientists, argue that China’s rise is already coming to a halt. The age of ‘peak China’, as they call it, is upon us.

As already noted, The Economist justifies these claims in particular with reference to population trends—the bogus claim, promoted for several years, that “China will grow old before it grows rich.” More precisely: “What accounts for the lower expectations for China’s economy?… Start with population. China’s workforce has already peaked, according to official statistics. It has 4.5 times as many 15- to 64-year-olds as America. By mid-century it will have only 3.4 times as many, according to the UN’s ‘median’ forecast.” It then goes on to discuss issues such as productivity—which are analysed below.

The Economist then goes on to conclude:

It also seems safe to say that China and America will remain in a position of near-parity for decades. In Goldman Sachs’s scenario, China maintains a small but persistent lead over America for more than 40 years… in Capital Economics’s projection, China’s GDP will… be over 80% of America’s as late as 2050…. if China’s peak is more Table Mountain [a flat-topped mountain in South Africa only slightly over 1,000 metres high] than K2 [Qogir Feng, the world’s second highest mountain at 8,611 metres] its leaders will have little incentive to rush to confrontation before decline sets in.

Leaving aside that China’s leaders have not shown any desire whatever to “rush to confrontation” let us dissect this evaluation of The Economist.

Elementary reality checks

Because no angle should be ignored in dealing with this analysis by The Economist, we will discuss below its assertions using technical methods of economic “growth accounting”. But actually, elementary reality checks and calculations, which can be understood by almost anyone (apparently apart from The Economist’s writers), shows their falsity.

Start with the question of population, on which The Economist lays such emphasis. China’s average annual population growth from 1978-2022, that is since the start of “Reform and Opening Up” is 0.9%. China’s annual average GDP growth in the same period is 9.0%. So, 8.1% a year GDP increase, that is 90% of the growth, could not possibly be accounted for by population changes. In summary, even before doing detailed growth accounting, it is clear that population growth could have played only a very small role in China’s economic development. This will be fully confirmed by the growth accounting data.

Turn to the second feature. According to The Economist we ae entering “the coming age of superpower parity”. What this means in GDP terms is that China and the U.S.’s economies will be roughly the same size—one possible a little bit bigger than the other. Let us analyse the implications of this claim.

Of course, no one doubts that after the “century of humiliation” China’s economic starting point was far behind the U.S. In 1950, in purchasing power parities (PPPs), on the calculations of Angus Maddison, who was the world’s leading expert on long term economic growth, China’s per capita GDP was slightly under 5% of the U.S.. By 2022, measured in PPPs by the IMF, China’s per capita GDP was 28% of the U.S.. That is, since the creation of the People’s Republic in 1949, China has improved its per capita GDP position relative to the U.S. by more than five times.

What is the overall implication of this? In 2022 Mainland China’s population was 4.24 times that of the U.S.—put in other terms, the U.S. population was less than 24%, approximately a quarter, that of China. That means, in turn, that for China to remain having the same, or a smaller, GDP than the U.S. its per capita GDP would have to remain less than one quarter of the U.S..

Why should China be incapable of reaching anything more than one quarter the per capita GDP, with therefore roughly one quarter the living standards, of the U.S.? Is it some xenophobic illusion that the average Chinese person is only one quarter as smart, or only works one quarter as hard, or cannot work out a way to achieve more than a quarter of the living standard of an average American? Or to put it the other way round, that the average American works more than four times as hard, or is four time as smart, or can work out a way to remain living more than four times as well as the average Chinese person?

That type of thinking is delusional and is also leaving the U.S. open to a terrible shock not only in regard to China but a second one later in this century when it finds out that the average member of the more than 1.4 billion Indian people is just as smart, just as hard working and just as capable of working out how their country can develop as the average American.

In fact, China’s development has come from successful policies by the Communist Party of China (CPC) and work by the Chinese people—not from economic “miracles”. China is perfectly aware that, given its extremely low economic starting point after a century of foreign intervention in 1949, it has set its goal of becoming a “strong, democratic, civilized, harmonious, and modern socialist country” to be achieved only by 2049. In the more immediate term, at the 20th Party Congress, its goal was stated as reaching the level of a “medium-developed country by 2035”. Slightly earlier, in 2020’s discussion around the 14th Five Year plan, it was concluded that by 2035 for China: “It is entirely possible to double the total or per capita income”. These two goals are essentially the same. This target requires an average annual growth of GDP of at least 4.6% a year by 2035. That this target can be achieved will be shown in detail below.

But the size of China’s population, and the speed of its economic development, does have an inevitable consequence. Those who believe that China will never significantly exceed one quarter of the per capita GDP of the U.S. and therefore that China’s GDP will never become significantly greater than the U.S., are deluding themselves. It is only necessary to be able to multiply by four to know what will be the final result.

Growth accounting

So far only issues that can be understood by anyone, whether or not they are an economist, regarding the elementary errors of the thesis of “peak China” have been dealt with—that is, the facts that the very slow growth of China’s population compared to its GDP growth shows that increase in labour supply plays only a very small role in its economic growth, and the consequences of the fact that China has over four times the population of the U.S. Actually, these are quite sufficient to understand why the theory of “peak China” is false. The fact that these false arguments can ignore such elementary realities shows how blinded people can be by their own propaganda. But nevertheless, it is also useful to analyse more detailed issues of economics—it should not be thought that any questions are being avoided. Therefore, more detailed issues of economic growth will now be examined. Analysing these, furthermore, does cast a light on important questions and further clarifies the fundamental errors of the theory of “peak China”—and what lies behind it.

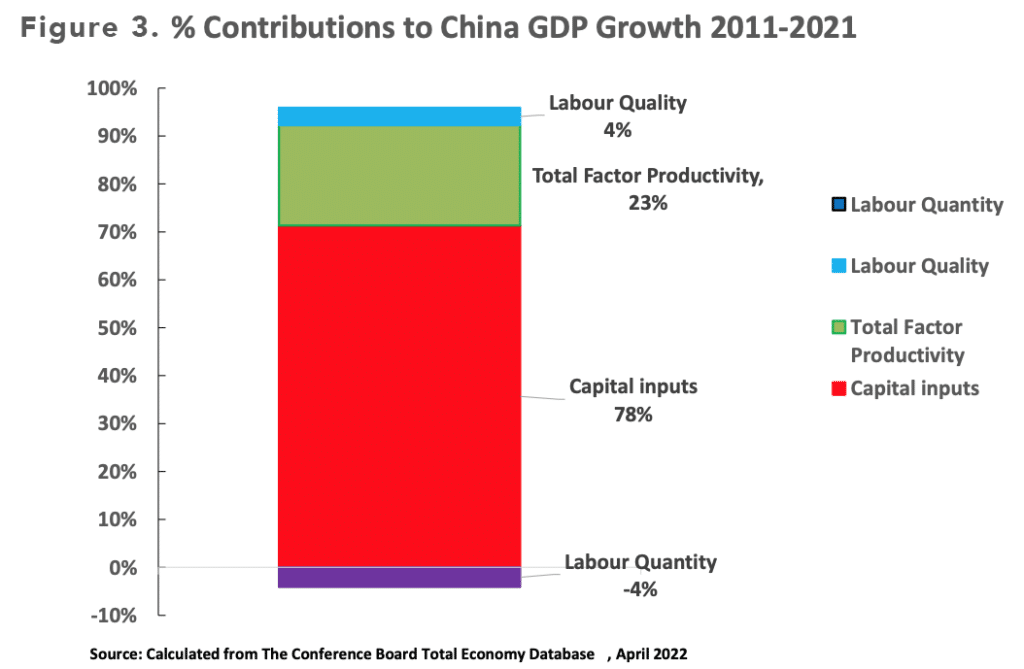

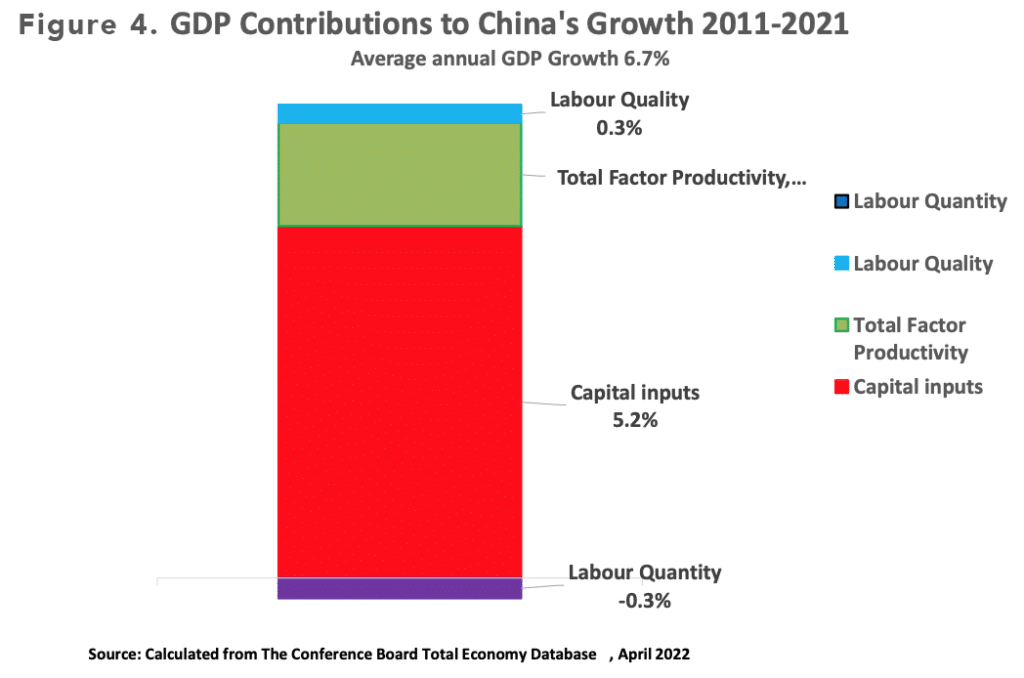

Turning from the most fundamental trends to detailed growth accounting the most recent data will be examined in order to avoid any accusations that what is really being analysed is the effects of the period immediately after 1978—which almost no one would dispute brought gains but which some claim have now disappeared. Figure 3 therefore shows the latest 10 years, 2011-2021, for which detailed growth accounting data exists—it is not yet available for 2022.

Changes in labour inputs in China

As labour is the aspect most concentrated on in the theory of “peak China” it will be dealt with first. Initially, to get these out of the way, some elementary conceptual mistakes of the “peak China” brigade will be dealt with and then their most fundamental fallacy will be shown.

The detailed data on labour inputs in Figure 3 immediately shows one of the first elementary arithmetical fallacies of the old “China will get old before it gets rich” argument—which is essentially the same as that of “peak China”. This is that this fails to distinguish between the “quality” of labour inputs (that this their level of education, training etc) and the “quantity” of labour inputs—that is simply the number of hours worked.

This fallacy can be easily illustrated for non-specialists in economics. Take an hour of labour in South Korea—this country is chosen because today it has one of the highest levels of higher education in the world. In 1945 85% of South Korea’s population lived in rural areas and Illiteracy was 88%. Today 85% of South Korea’s population lives in urban areas and enrolment in tertiary education is equivalent to the entire population of the relevant age groups. China’s is passing through the same historical process from its own extremely rural past—with urbanisation reaching 65% by 2021, and enrolment in higher education reaching 60% by 2022.

The value produced by an hour’s labour by someone with a university degree in Korea, very possibly a PhD in engineering or computing, in 2022 is obviously far higher than that of a peasant who was illiterate in 1945. Similarly, as China’s population becomes more and more highly educated and trained the inputs of “labour quality” (to use the technical economic term) will rise even if “labour quantity” (the total number of workers and therefore the number of hours worked) goes down.

This is precisely what occurred in China from 2011-2021. As Figure 3 shows, the total number of hours worked (labour quantity) fell, reducing GDP growth by 0.4%. But the contribution of labour quality, that is better training and education, increased GDP growth by 0.4%. Therefore, the actual change in total labour inputs was zero. (As a side note for technical economists, calculating labour inputs simply by hours worked, without taking into account labour quality, was an error in Solow’s original formulation of growth accounting which has been replaced in modern growth accounting. For non-technical economists the difference between the value created by an hour of labour by someone who is illiterate with someone who has an engineering PhD makes the point clear).

But even leaving aside this basic distinction, actually regarding labour quantity itself China’s position is not remotely as bad as claimed by “peak China”. For example, approximately a quarter of China’s working population is still in the countryside—the passing of a substantial part of this into urban areas, as will occur over the coming decades, will increase productivity, China’s current retirement age, of 60 for men and 50-55 for women, is extremely low by international standards and is bound to gradually increase given China’s great increase in life expectancy—which will produce an increase in available labour quantity compared to if the retirement age had not been raised .

In short, because they make the elementary mistake of failing to distinguish between labour quantity and labour quality, because they do not take into account the consequences of shift of labour from the countryside to urban areas, and because they do not note that China’s very low retirement age is bound to gradually increase with growing life expectancy, claims about the reduction of labour inputs in the theory of “peak China” are greatly exaggerated even in their own terms.

The small role of increases in labour inputs in China

But actually, even all the above issues are secondary to the main one which was already analysed in fundamental terms above—the point that China’s average annual population growth from 1978-2022 is 0.9% and China’s annual average GDP growth in the same period is 9.0%. Therefore, 8.1% a year GDP increase, that is 90% of the growth, could not possibly be accounted for by population changes. What this shows is that the increase in labour inputs has played a very small role in China’s economic growth.

Turning to analyse this in detail, it was already noted that in 2011-2021 the contribution of labour inputs to GDP growth was zero—a 0.4% annual increase in GDP due to improvements in labour quality, offset by a 0.4% of GDP fall caused by a reduction in labour quantity (hours worked). Even if the longer period from 1990-2021 is taken, the contribution of labour inputs to GDP growth was only 0.7% a year out of an average of 8.7% annual GDP growth—that is 92% of GDP growth was due to factors other than increase in labour inputs.

The reason that a slowdown in labour inputs will not produce a very sharp fall in China’s economic growth is therefore very simple. Because the detailed growth accounting data naturally confirms what was already obvious from the most fundamental facts on China’ population and GDP changes since 1978. That population and labour input changes have only played a very small role in China’s economic growth!

The fundamental factors which really do affect China’s economic growth, and their consequences, will be analysed below.

The reasons for China’s rapid economic growth

Turning from what has not made a large contribution to China’s economic growth, labour inputs, to those which have made a big difference, again the latest period 2011-2021 will be taken. China’s annual average GDP growth in that period was 6.7%. The detailed contributions to growth of the different inputs are shown in Figure 4. This chart is simply a different way of presenting the facts given in Figure 3—which showed the relative weight of different inputs into China’s economy. Figure 4 is merely more convenient for present purposes because by showing how much of China’s GDP growth is due to different inputs it makes it easy to see which changes would, and which changes would not, seriously affect China’s economic growth. That is, what would, and what would not, create a real situation of “peak China”. It also allows an easy calculation of whether China can or cannot achieve the 4.6% annual average economic growth necessary to achieve its target of doubling per capita GDP by 2035.

The role of labour inputs

The first reality from these facts which is obvious, as already noted, is the relatively small effect that changes in labour supply will make. Assume that no changes are made to offset the decline in labour quantity, for example there is no increase in the retirement age, and this continues to deduct 0.4% a year from GDP growth. Assume also that the increase in the beneficial effect of increases in labour quality is eliminated and therefore this deducts the 0.4% a year from GDP growth due to this factor—there is no justification for making such an assumption as China’s education and training growth will continue, but it is hypothetically assumed here just to analyse a “worst case” scenario. What then happens? It means that China’s GDP growth would fall from 6.7% a year to 6.3%—easily enough to surpass the 4.6% a year growth required to achieve the doubling of per capita GDP by 2035.

The role of Total Factor Productivity

Now consider productivity, more precisely Total Factor Productivity (TFP)—for non-economists, TFP measures all processes raising the output of the economy which are not due to increases in capital or labour (for example, improvements in technology, the benefits of larger scale of production, improvements in management techniques, scientific discoveries, benefits of increased specialisation in production etc). Assume a catastrophic case that China’s rate of TFP increase fell to zero—once again there is no justification for such an assumption and China’s rate of TFP growth is one of the fastest in the world, but it is analysed here just to demonstrate the effects of the most extreme negative assumptions. What then happens is that China’s GDP growth would fall by 1.5% a year—from 6.7% to 5.2% a year. China would then still achieve the 4.6% a year target to double per capita GDP by 2035.

Even if the ludicrous assumption is made both that China achieved no increase in labour quality, deducting 0.4% of GDP growth a year, and that its rate of TFP growth collapsed to zero, deducting 1.5% a year from GDP growth, then the combined slowdown of 1.9% a year would still leave China growing at 4.8% a year—enough to achieve its 2035 target.

These negative assumptions are of course themselves ridiculous—there is no reason China’s improvement in labour quality will fall to zero, on the contrary it is pouring resources into education and training, and there is equally no reason why its TFP growth will fall to zero. But these extremely unrealistic assumptions have the benefit that even with them the thesis of “peak China” will not work.

Cutting China’s investment

It is factually clear that only one assumption would justify the argument of “peak China”—i.e. that a drastic slowdown in China’s economy will occur. This is that there is a huge fall in China’s level of investment in GDP—that is, in technical terms, in capital inputs into the economy (it should be understood that by “capital” in this sense is simply meant fixed investment—it is irrelevant whether this investment is carried out by the state, private capitalists, or any other form of ownership). This is, indeed, an inevitable result of the fact that 78% of China’s economic growth is due to capital/investment inputs—or in other terms that these account for 5.2% annual GDP growth out of a total of 6.7% growth. China’s dependence on capital inputs for economic growth is furthermore fairly standard, the average percentage contribution of capital inputs to economic growth of the world’s 20 largest economies in 2011-2021 being 81%. This is indeed why reductions in the level of investment in GDP do produce very large slowdowns in economic growth. This was analysed in the earlier article 它曾成功“谋杀”了德国、日本、四小龙,现在想要劝中国“经济自杀” and is dealt with in detail below.

In reality, although they spend large amounts of space discussing other issues which would have no great effect even if true, the statistics of those arguing for the theory of “peak China” show that they arrive at their claims because they assume that China will drastically cut the percentage of its economy devoted to investment. The reasons this claim is made will be analysed below, but first, to clarify the issue, the arithmetic of those who present serious quantified justifications for the “peak China” arguments will be examined—although, it is striking, that some who makes such claims don’t even bother to attempt to quantify them.

Taking first, among those studied by The Economist, an analysis by Roland Rajah and Alyssa Leng for the Lowy Institute with the self-explanatory title “Revising down the rise of China”. This concludes regarding China that: “our projections suggest growth will slow sharply to roughly 3% a year by 2030”. This analysis precisely assumes a huge fall in the percentage of China’s economy devoted to fixed investment/capital inputs:

total investment falls from the current 43% of GDP to 33% of GDP on average over the coming decades.

The same assumption is made by Goldman Sachs, which projects that China’s GDP growth will fall from an annual average 6.0% in 2013-2022 to 3.4% in 2023-2032—that is a decline of 2.6%. The reason for this alleged slowdown is because of the overwhelming effect of a single fact that the annual increase in GDP growth created by capital investment is projected to fall by 2.4%—from 4.8% to 2.4%. As this fall in capital investment accounts for 92% of the decline in the GDP growth rate, only 8% of the decline the Goldman Sachs report projects, or 0.2% GDP growth a year, is attributable to factors other than the decline in investment. Without the investment decline, the Goldman Sachs report’s data shows that China’s annual GDP growth would only fall from 6.0% to 5.8%—a level which would easily allow China to exceed its own targets for 2035. In short, Goldman Sachs shows that only the decline in investment makes a decisive difference to China’s growth rate, and therefore, to use The Economist’s terms, accounts for “peak China”.

Of course, these calls for, or predictions that, China will cut the level of investment in its economy are put forward in a concealed way. They are presented as calls for China to increase the percentage of consumption in its economy. But as consumption and capital creation/investment combined necessarily add up to 100% of China’s economy the call for China to increase the percentage of consumption in its economy is necessarily to call for it to reduce its level of investment. This would indeed, of course, for the reasons already given, lead to a drastic slowdown in China’s economy—to “peak China”. But it would simply be a case of China deciding to commit economic suicide.

While the studies published by the Lowy Institute and Goldman Sachs at least have the virtue of being clear, others don’t—so these will be examined below.

A leader is certainly different

There is no doubt that from the facts already given that if China drastically cuts its level of investment its rate of economic growth would indeed substantially fall—as capital inputs account for 78% of China’s economic growth that is inevitable. But why should China make such a drastic cut in its level of investment in GDP?

The alleged reason for this is because China is different from other “Western” economies. For example Capital Economics, which unlike the Lowy Institute or Goldman Sachs studies, does not even properly quantify its findings, but is nevertheless cited by The Economist as a source, argues: “we expect China’s trend rate of economic growth to fall to around 2% by 2030.” It notes:

China… has an unusually large capital stock…. If China’s capital stock to GDP ratio were to continue to rise at the rapid pace of the past decade, it would soon be much higher than in other major economies.

Similarly, Goldman Sachs argues that China’s level of investment in its economy will fall sharply: “Investment as a share of GDP is forecast to decline from 42% in 2022 to 35% by 2032.” The reason that this will happen is apparently because China is at present an upper middle-income economy, although approaching the level of a high-income economy by World Bank standards, and:

Investment as a share of GDP in upper-middle-income countries is 34%.

Well certainly China is different from other economies. Why? For the simple reason that its economy is growing much more rapidly than they are! Therefore, it is producing a more rapid increase in average living standards than they are, it has produced a more rapid reduction in poverty than they have etc. Naturally the leader is different to those who are further behind£ The economy with the most rapid economic development is different to the countries with slower economic development.

Why should the more rapidly developing copy the less rapidly developing

But then it is a completely bizarre logic that says that the economy which is most rapidly developing should change to become like the less successful ones! What would a client of Goldman Sachs, or any other bank or consultancy, say if it argued “We notice that you are developing more rapidly than your competitors—so you need to stop that and reduce yourself to their level.” Or if they said to a company: “We notice that in this field one company is developing much more rapidly than the others. Therefore, you should ignore that company and copy the less successful ones. Incidentally we are advising this most successful company to abandon its advantages and instead accept the approach of its less successful competitors.” Anyone who made such a proposal would be laughed at—in the few seconds before the contract with them was immediately terminated.

But that is exactly what those who are arguing the case for “peak China! are doing. They are saying: “We note that China’s economy is developing more rapidly than others. Therefore, it should abandon the reasons for this success and adopt the methods of the less rapidly developing.” Instead, of course, what any sensible person would argue is: “China is different because it is the most rapidly developing. Therefore, other countries should learn from the reasons for China’s success (which is not, of course, to pursue the impossible course of mechanically copying it).” This entirely logical argument is, of course, what other countries are doing. It explains the increasing international interest in China’s socialist development strategy.

Instead, what those arguing the case for “peak China” propose is that China should voluntarily commit economic suicide. That it should abandon the methods that have made it the most rapidly developing economy in the world and adopt the methods of the less successful. If China decides to commit economic “suicide” then that certainly would produce “peak China”—if someone decides to commit suicide they will undoubtedly be dead. But it would be very bizarre for China and the CPC to adopt such a logic! Why, having brought China from almost the poorest country in the world in 1949, after a century of foreign intervention, to achieve the most sustained rapid economic growth of any major country in world history should the CPC decide to adopt a less successful approach? Gorbachev may have decided that the USSR should commit suicide, bringing ruin to his country, by adopting Western approaches, but the CPC has shown no similar inclination.

The reasons for blind arrogance

Turning from these specific economic points to more general considerations, these factual issues are so obvious to anyone who thinks about them seriously, that it takes us back to a point made before the discussion of detailed analysis of growth accounting. That is, what is the explanation of the blindness to reality, to facts, that is created by unconscious arrogance?

The Economist, Goldman Sachs etc note that China’s economy differs from their capitalist ones. But instead of drawing from the more rapid development of China’s economy than theirs the conclusion that China’s system shows its superiority, they conclude that necessarily China must be wrong—and that they are right! The reason is because to accept the facts would be to overturn their, conscious or unconscious, arrogant way of looking at the world. It is worth looking at just a few of these implications to understand the reasons for the blindness.

The first is the role of CPC. It is the CPC, no other political force, which created the socialist market economy, an economic system which had never before existed in history, which has created the most rapid economic growth of any major country in human history, which has produced the most rapid increase in living standards or any country, which has produced the greatest reduction in poverty in any country in human history, and which overall has produced the most rapid sustained improvement in the living standards of any country in human history. The idea that such gigantic achievements could occur by “accident”, that is without thought or theory leading it, is laughable. What it means is that the CPC not only produced better practical results for its people than any other political force but that the CPC out thought every other political force.

Second, it means that China has achieved what every country that was once dominated by imperialism dreams of—that China, and China alone, will decide its destiny. This is indeed the greatest of all the CPC’s national achievements. That after a “century of humiliation”, in which China was simply trampled on by other states, only China will now decide its own fate. If China takes wise decisions it will prosper. If China takes foolish decisions it will suffer. But no one else will decide the outcome. In a fundamental sense that is precisely the basis of the “great rejuvenation of the Chinese nation”..

Third, China’s success, brought by the CPC, brings to an end an entire centuries long epoch in human history—perhaps this is particularly to be commented on by someone from Europe? During approximately the last 500 years, “white” European countries, and their offshoots, became the most powerful in the world. That 500 years is certainly a short period in the approximately 5,000-year history of human civilization. For most of that time it was Asia’s people—China, India, West Asia/parts of North Africa (falsely labelled the “Middle East” in Eurocentric worldviews) who were the most advanced. But, of course, 500 years is far longer than the life of anyone alive today. And during that 500 years these “white” countries built into the foundations of their capitalist system the vile dregs of racism—this is a point particularly emphasised in recent material produced by the Tricontinental Institute for Social Research which should be regarded as of fundamental importance. Slavery, the treatment of non-“white” people as not equal in order to justify colonialism, were built into the foundations of that European originated capitalist system.

China’s rise, that of almost one fifth of humanity, which it should be remembered is more than the population of all “advanced” economies in the world put together today, not only creates a socialist society but completely destroys the entire cultural basis and assumptions of that 500-year-old epoch in human history. A long time Afro-Caribbean friend of mine, knowing I followed China as closely as I could, once said to me “but what does China’s rise mean for the rest of us?” I said: “Well among other things it destroys the myth of the ‘superiority’ of the white race”. To which their reply was “well that’s a victory for everyone.”

Indeed, in terms of the entire moral dignity of humanity, China’s success is playing an indispensable role in putting an end to the shameful traits of an entire period of human history. It is in large part because of that entire 500 year history that those proclaiming “peak China” can continue to write views that are so completely out of touch with the facts and with reality and why they refuse to draw any lessons even when they are repeatedly shown to be wrong—as was shown with the test case of The Economist at the beginning of this article (and many more examples could be taken). The stubborn blindness of the refusal of Western reporters and analysts to face the fact they have repeatedly been proven entirely wrong reflects not only bad journalism or a love of capitalism. It reflects the blindness to reality produced by 500 years of an unconscious cultural arrogance produced by a system which is fortunately now progressively disintegrating.

Xi Jinping noted carefully at his first press conference after becoming General Secretary of the CPC that China directly sees its own national rejuvenation as a part of the overall progress of humanity:

Throughout 5,000 years of development, the Chinese nation has made significant contributions to the progress of human civilization… Our responsibility is… to pursue the goal of the rejuvenation of the Chinese nation, so that China can stand firmer and stronger among the world’s nations, and make new and greater contributions to mankind.

This is not simply a goal for the future. This is a process that is underway today. It is a part of China’s great achievement, brought about by the extraordinary struggle of its people for national rejuvenation, that the rest of humanity benefits from it. That certainly involves economics. But it goes far beyond it.

[This article was originally published in hinese at Guancha.cn.]