Today many countries, including those formerly colonised by European powers, are trapped in global debt. Decolonisation remains impossible while debt stifles the possibility of genuine emancipation and sovereignty. Meanwhile, for individuals and households across the globe, stagnant incomes force people to turn to cheap credit while elites continue to accrue unprecedented levels of wealth. First published in 2011, the late David Graeber’s Debt: The First 5000 Years was transformative in understanding what debt is and why we should push for debt cancellation. A number of people close to David told Red Pepper what his work meant to them…

Debt is bollocks

‘We should always pay our debts’: that’s the self-evident moral foundation of our economic and political relations. And it’s total bollocks. In the first four pages of Debt, David Graeber leaves it for dead. What if, David posits, debt was forced on a people to pay for the invasion of their own country by a colonial power, and, a hundred years later, the repayment costs caused the cessation of a malaria eradication programme that subsequently led to the death of ten thousand citizens? True story.

To make matters worse, the law of ‘Always Pay Your Debts’ doesn’t even apply to any of society’s most destructive actors: imperial powers, of course, but also bailed out banks, extractive, polluting industries and tax-avoidant billionaires and transnationals.

There is a critical distinction here between debt and obligation. Obligation is what we feel towards our neighbours after they invite us to dinner or lend us their printer. Debt is what we feel towards the bank for our loan-funded education or towards our employers after taking their pay-cheque.

As David wrote: ‘The difference between a debt and an obligation is that a debt can be precisely quantified.’ Whereas debts are impersonal financial instruments, obligations trigger a chain of generosity: gifts and favours of similar, but not identical value, to be granted, not immediately, but at some appropriate time in the future, according to the needs of the recipient and resources of the obliged. Obligations bring us together; debts divide us. Systems of credit and debt have been used to manage our economic affairs for millennia. But David showed us that we are perhaps the first civilisation to orgy in the credit system without having in place the checks and balances that protect the poor from catastrophe.

If David had lived long enough to witness the death of Queen Elizabeth II last summer, I’m sure he would have pointed out that, for much of the past 5,000 years, the accession of a new monarch has been celebrated by wiping the slate clean, cancelling all debts and returning bonded labourers to their families. I guess he’d also say that, historically speaking, the longer we’re forced to wait for a debt amnesty, the more likely we’ll take matters into our own hands and strike.

David Charles is a writer and instructor at Thighs of Steel.

The anti-humanism of debt

Debt: The First 5,000 Years highlights the essential role that debt has played in shaping social relationships across societies. The book continues a long conversation in the field of anthropology about the role of economics in everyday life. Claude Levi-Strauss, for example, argued that culture consisted of three realms: language, kinship, and economics, each of which tied people together. Marcel Mauss, who deeply influenced Graeber’s thinking, further proposed that ‘gift economies’ and their concern for communal welfare provided an alternative to modern market extraction and individual profit. Yet Mauss’s model proved to be flawed for Graeber, since gift exchange incurred a debt that must be repaid.

Where, then, is economic justice to be found? Graeber proposed the notion of ‘everyday communism’ as one solution, an idea that redefined communism as a moral principle rather than a political ideology. Everyday communism entailed competitive generosity, rather than competitive accumulation. Moving beyond material exchange or reciprocity, it fostered mutual expectations and responsibilities. Graeber saw this potential rooted in all societies.

In sum, debt used to be seen as a private matter, an invisible issue of personal accountability. No longer. Debt: The First 5,000 Years provides a panoramic look at how debt has informed numerous interactions at local and global levels from colonialism to slavery, to inequalities of the present, all of which have dehumanised the debtor. Debt is not purely economic but is embedded with feeling and imbued with moral implications. Graeber awakened us to this enduring feature of human society—this anti-humanism—which, once confronted and abandoned, can open new ways of relating to one another and new societies to be born.

Christopher J. Lee is an academic.

Humans are the creators of value

David Graeber described, in the 2014 afterword to Debt, wanting to shape debate around money. He has done precisely that. The Bank of England agrees that money is not currency or coins. Money are promises, and, for a small sliver of the world and for a small sliver of time, those promises have come from emperors or kings. Emperors and kings, however, are not the creators of value. Humans, all humans, are the creators of value. That basic fact—that the basic building block of social life is mutual aid—has been corrupted by the confluence of maths and violence. Creative refusal is our best guide. Mutual aid is the means and ends.

Steven Bachelor is housekeeper at the Museum of Care.

Debt freedom

The English word ‘free’ derives from a Germanic term meaning ‘friend’— unlike free people, slaves cannot have friends, because the enslaved cannot make commitments or promises. One of the earliest words for ‘freedom’ recorded in any human language is the Sumerian term ama(r)-gi, which literally means ‘return to mother’—because Sumerian kings would periodically issue decrees of debt freedom. They would cancel all non-commercial debts and in some cases allow those held as debt peons in their creditors’ households to return home to their kin.

The Museum of Care is a nomadic collective that hosts educational and art projects around David Graeber’s work. You can find out more here.

How the book was written

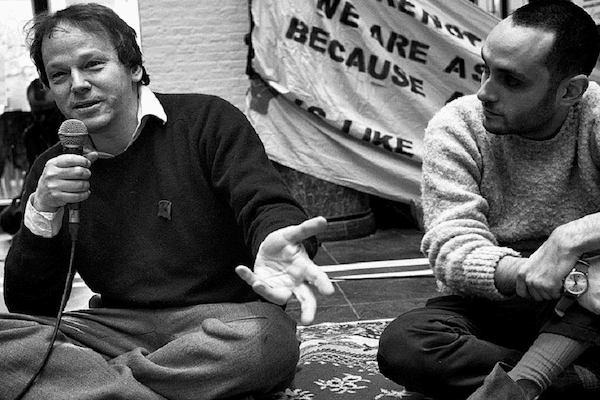

As David Graeber’s partner, I often get messages from people who tell me that reading Debt has had a profound impact on their lives. The same is true for me. When I first met David, I was living in New York and running a blog in Russian. He was working on Debt and used to send me chapter by chapter via email. I was translating excerpts from the book and would forward readers’ comments to David; sometimes he would answer them.

Debt’s publication was delayed by the publisher (the book was eventually published in 2011). Sometimes the editor was unavailable, or the small illustration that David originally wanted to insert required searching for the designer. He worked quite alone on a huge book. As we waited for publication, David was increasingly nervous; he complained to me he needed to publish the book to change public discourse and the time was right now. He was right: the book, published in the aftermath of the 2008 global financial crisis, provided a new vocabulary needed to explain a changed world.

Today this new language—on how we understand debt—is used by everyone, including by power itself. This is what David called a revolution. He said revolution is not when palaces are seized or governments are overthrown, but when we change the ideas of what is common sense.

Nika Dubrovsky is an artist and author.