SEVERAL major economists have put forward theories predicting a falling tendency of the rate of profit under capitalism; Marx had seen in this fact an awareness on their part of the essential transitoriness of the capitalist system. But while some of these theories have logical validity, others do not. Among the latter is Adam Smith’s theory.

Adam Smith had attributed the falling tendency of the rate of profit to the fact of “excessive” capital accumulation. His argument was that in any particular industry, if more and more capital accumulates and more and more is produced, there would be a fall in the price relative to the cost of production; the profit-margin per unit of output therefore would fall, and since the output per unit of capital stock is given, this would mean a fall in the rate of profit, that is, profit per unit of capital stock. Exactly the same, he thought, would hold for the economy as a whole; as more and more capital accumulates in the economy, here too there would be an analogous decline in the rate of profit.

This reasoning however is obviously wrong. What is true of an individual sphere of production cannot be true of the economy as a whole: in an individual sphere of production, as capital accumulates and more labour is employed, the additional demand that is generated for the extra output comes from within that sphere alone, for ex hypothesi output and income in other spheres are not changing. And since a unit increase in income in any given sphere does not give rise to a unit increase in expenditure for the product of that sphere alone, the increase in demand for the product of that sphere must be less than the increase in the value of its output (at the base price) that occurs because of accumulation. It is this which causes a lowering of price compared to the base level, and hence in the profit-margin and the rate of profit.

When we look at the economy as a whole, however, this reasoning ceases to hold. The demand in the economy as a whole is obviously for the totality of the output produced in that economy (we are ignoring issues like trade which are not germane here); if accumulation occurs in the economy, then more outputs of all goods are produced, just as more outputs of all goods are demanded. There could of course be excess demand for some goods and excess supply of others at the base prices, but that per se is entirely irrelevant to the issue of the rate of profit in the economy as a whole. There is no reason at all why the rate of profit in the economy should fall because of accumulation of capital, for the reasons suggested by Adam Smith. Smith’s argument is valid for a single sphere of production, but the analogy between the single sphere and the economy as a whole breaks down.

While Smith’s original argument was incorrect, there has of late been an attempt by some American Left writers to revive a Smithian argument to the effect that capital accumulation, purely because of the fact of competition, creates a tendency towards a falling rate of profit. This states that technological progress accompanying capital accumulation causes a rise in labour productivity, and hence, for any given level of money wages, a fall in prices that is large enough to cause a lowering of the rate of profit.

This however would happen only if the fall in price is greater than the fall in the average unit of labour cost, that is, if the fall in price at any given money wage rate, owing to technological progress, is such that the share of wages rises, so that for any given output per unit of capital stock, the rate of profit falls. But there is absolutely no reason why such a rise in the share of wages should occur, that is, why the fall in prices should be greater than the fall in average unit labour cost. To say that the wage-share rises with technological progress is just an assertion, with little theoretical or empirical support.

Leaving aside this neo-Smithian argument, there are three basic arguments advanced in economics why there should be a falling tendency of the rate of profit, each of which is logically perfectly sound and theoretically plausible; one can contest the empirical validity of one or the other of these at any given time, but not of all of them.

The first is Ricardo’s argument, which asserts that as accumulation proceeds, the demand for the wage-good, corn, keeps increasing; since the available land of any given quality is limited, raising the production of corn involves moving cultivation to increasingly inferior land which therefore increases the difficulty of producing corn, causing a fall in the rate of profit. This is usually misleadingly called “diminishing returns to scale”; it is more correctly called diminishing returns to a variable input with the given amount of a fixed input (of a given quality).

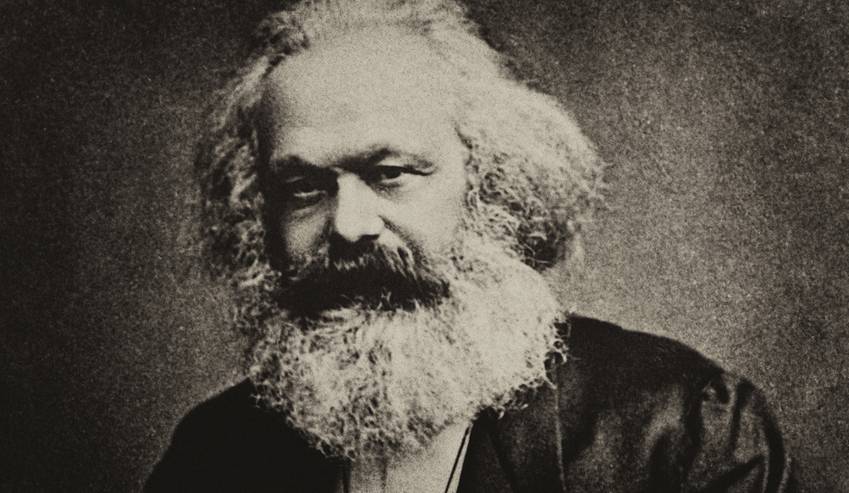

The second is Marx’s theory according to which as accumulation proceeds the organic composition of capital (the ratio of constant to variable capital) increases; alternatively stated, a rise occurs in the capital-output ratio as accumulation proceeds, and with it technological progress, raising labour productivity. With a given ratio of wages to profits in net output, therefore, there is a fall in the rate of profit.

Of course if the ratio of profits to wages increases over time (that is, if the workers are exploited more intensively over time), then this fall in the rate of profit can be kept in check, but if the organic composition of capital keeps increasing, then this falling tendency is bound to assert itself eventually (since there is a lower bound to the share of wages, given by the fact that it can never become negative).

The fact that with accumulation there is a rise in the mass of raw materials and fixed capital worked by each labourer, or what may be called a rise in the technical composition of capital, is indubitable. But this would translate itself to a rise in the (value) organic composition of capital only if the pace of introduction of labour-productivity-raising technical progress is greater in the consumption goods sector than in the capital goods sector (both raw material and fixed capital goods). This no doubt may happen in certain periods, but Marx is usually interpreted as holding the view that it necessarily occurs secularly as an immanent and spontaneous tendency of the system; for this however there is no compelling reason (just as there is no compelling reason for it not to happen). Marx’s too is a logically sound theory, unlike the Smithian one.

The third logically sound theory states that there is a tendency for the rate of profit to fall, because of an insufficient growth in aggregate demand as accumulation proceeds. This inadequate growth in aggregate demand would translate itself, other things remaining the same, as a decline over time in the degree of capacity utilisation, and hence, at any given profit-margins, in the rate of profit. And if profit-margins are deliberately raised, that is, if the distribution between wages and profits is altered in favour of profits, then that, instead of removing the tendency towards a falling rate of profit, only accentuates it further.

Any tendency towards a falling rate of profit, it must be noted, is only a tendency that does not actually manifest itself (economists call it an ex ante tendency); it forces the system to adopt countervailing measures to keep the tendency at bay. The falling tendency of the rate of profit therefore is not a prediction of what would happen over time in a capitalist economy, but an analytical tool for investigating its dynamics.

In fact from the falling tendency of the rate of profit, no matter what theory we invoke to explain it, one can discover an economic motive for imperialism. Any secular tendency for a rise in the organic composition of capital can be kept at bay by obtaining raw materials cheap or gratis from the colonies and semi-colonies. Likewise, any tendency towards over-production because of inadequate aggregate demand can be kept at bay by accessing colonial and semi-colonial markets. And any Ricardian tendency towards growing difficulties in producing essential inputs, can be kept at bay by obtaining these inputs through a reduction in their domestic absorption in colonies and semi-colonies.

Even after decolonisation in a political sense, domination indirectly exercised over the “outlying regions” (for instance through the imposition on them of neo-liberal policies) can play the same role as played earlier by political domination.