Introduction

This research paper focuses on corporate profits, gleaned from information in the corporations’ own accounts. We ‘follow the money,’ insofar as company annual reports allow us to do so. The main questions we seek to answer are:

-

- Who are the main corporate players in South African mining?

- What are the extent and degree of corporate profits?

- Who profits from mining in South Africa?

- What is the London connection?

The principal data source is thirteen company annual reports for 2022, especially their main financial indicators. These have been supplemented by relevant reporting and more analytical literature.

The specific focus of the study also requires a couple of reservations as to scope:

- We only give the briefest indication of labour as a resource, and do not include what is clearly significant, that is labour’s perspective. Likewise, the study is limited on both community concerns and the environmental impacts of mining in South Africa, both of which are considerable, especially from the perspective of women.1

Given the nature of data collection from mining company reports, we are following their declared profits. Transfer pricing and the illicit flow of profits from legal operations have both rightly been flagged as ongoing concerns, but here we seek to map only what is reported in open sight, the licit flow of profits.2 These undisguised profit flows are, as will be seen, of concern enough.

Sector Overview

We start with some basic aggregate data about companies mining in South Africa.

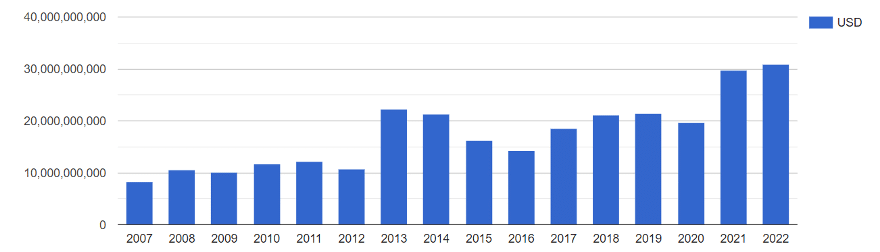

The first chart from Labour Research Service (LRS) shows that revenues peaked in the previous commodity cycle in 2013, followed by a trough, then the beginnings of a new uptick in demand that was affected by Covid in 2020, then in the two most recent years 2021 and 2022 making a strong recovery in revenues received, indeed to record levels.

Figure 1: Average Revenues in South Africa Mining Sector 2007–2022

Source: LRS 2023a (Statistics South Africa, “PGM Sales Surge Due to Higher Prices,” 2021 at statssa.gov.za)

The greater revenues are mostly due to higher prices, rather than significant changes in volumes of production. Therefore, the effect of greater sales revenue is accentuated in the more volatile movement of profits, as in Figure 2.

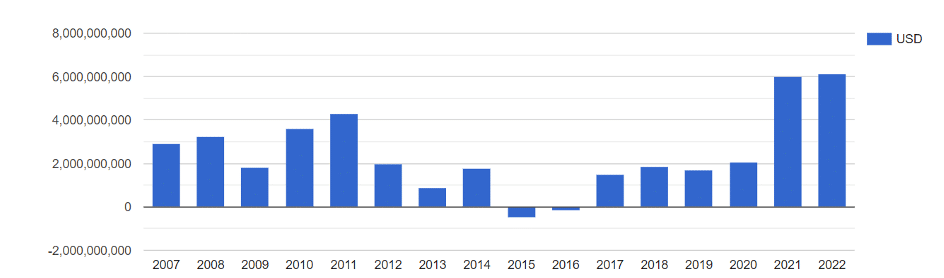

Figure 2: Average Profits Before Tax in South Africa Mining Sector 2007–2022

Source: LRS 2023a

Note also the great sensitivity of profits to changes in revenue, with a sharp fall in 2012 from the previous peak, and then losses in 2015 and 2016 in the trough of the cycle. Mining corporations plan for these cyclical changes in profitability, and typically they will set profit targets accordingly, such as a cycle average of 15% rate of profit (Return of Capital Employed).

The trough years occasion major movements, as corporations reorganise their asset portfolios and seek out the strategically most profitable market sectors and projects going forward. Mining projects are typically planned over a 30-year time span.

It is important to note from the outset the significance of international currency movements for the relations between revenues and costs. Insofar as the South Africa Rand depreciates against the US dollar, it is generally to the advantage of producers that export minerals. This is because most of their costs are in South African Rand (ZAR), whereas their sales prices are usually in US dollars. So as the dollar appreciates, any given dollar price converts into more Rand, thus increasing the margin against cost base mostly in Rands. This effect is demonstrated in the following example.

In 2021 the mining sector’s total profit before tax was US $72,010 million that converts to 1,081,303 million ZAR at an annual average exchange rate of 15.02 ZAR to the US $. The US dollar appreciated against the Rand in the following year, the Rand depreciated against the dollar so that the conversion was 16.58 in 2022. In 2022 profits before tax were US $79,483 million that convert to 1,317,920 million ZAR.3 The year-on-year increase in profits in dollar terms was 10.4%, whereas in ZAR it was even greater at 21.9%.

Another point is that in the survey we look at profit before tax, as the point of comparison that is widely used as the indicator of the profitability generated by corporate activities. However, the profit income available for the companies to disburse or retain is of course net profit after tax. LRS reports that in 2022 this was 914,817 million ZAR for the South African mining sector.4 Drawing on these figures the effective corporate income tax rate on these thirteen mining companies’ profits in 2022 was 30.6%.5

Prior to 1994 mining was a bastion of what was then called ‘white monopoly capital,’ although it may have been more accurately designated imperialist capital. Since 1994 ANC governments have legislated for Black Economic Empowerment (BEE). The Chamber of Mines, which represents corporate mining, lobbied hard against any extension of BEE provisions.6 BEE originally stipulated 26% share ownership by historically disadvantaged groups, that was increased to 30% shares in companies formed in 2019 and thereafter.7 In practice, workers and communities only benefit marginally from these arrangements, that have in reality acted as a form of legalised corruption recruiting a layer of enriched new bourgeoisie, who act as allies for the existing corporate power, as exemplified by Cyril Ramaphosa ’s meteoric rise to become a multi-millionaire who urged state action against striking miners that led to their massacre in Marikana on 16 August 2012.8

Moeletse Mbeki has called out the BEE pay offs as ‘legalised corruption,’ they are neocolonial arrangements embedded within corporate governance.9

As far as the operating environment provided by the state is concerned, mining operations, especially the smelters, require colossal quantities of electricity, and the bulk materials (coal, metal ores) require significant transport infrastructure. The Economist Intelligence Unit is the mouthpiece of their concerns, “Disruptions took their toll. The woes of transport and energy parastatals—Transnet and Eskom—imposed on mining operations severe rail and port constraints, load-shedding and electricity shortages.”10 But this pro-business framing of the problem does not take into account the acute financial stresses put on state corporations by the World Bank neoliberal ‘electricity for profit’ paradigm, obliging them to serve the interests of private capital rather than the general public.11

The size and nature of the mining workforce is another important consideration. The sector employs half a million workers. The three biggest employers are: platinum group metals (39%); coal (21%) and gold (20%). With the other sectors (iron ore, chrome ore, manganese, diamonds and others) the total is reported as 514,859 employees in 2019 and 475,561 in 2021.12 An increasing proportion, about one third, of the mining workforce are not direct employees, but either employed by sub-contractors, labour brokers, or capital employees “working on projects that fall outside the daily scope of business.”13

Initial Breakdown by Companies

One entry point is to take a look at the Price Waterhouse Coopers (PwC) table surveying the market capitalisation of the Top Ten mining companies with stocks traded on the Johannesburg Stock Exchange (JSE) as of 30 June 2022. Market capitalisation is the overall capital valuation of the company, derived by simply multiplying the trading share price by the number of shares. This method is a strong indicator of the company’s current and expected future profits, in effect the capitalisation of expected returns to shareholders.

Table 1: Market Capitalisation of the Top Ten Mining Companies on the Johannesburg Stock Exchange (JSE)14

| Company | Main HQ | Market capitalisation JSE (ZAR billion) | Proportion of mining capitalisation on JSE |

| Anglo American Platinum | UK | 378 | 29.0% |

| Kumba Iron Ore | UK | 169 | 13.0% |

| Impala Platinum | South Africa | 154 | 11.8% |

| Gold Fields | South Africa | 136 | 10.4% |

| Sibanye Stillwater | South Africa | 115 | 8.8% |

| Exxaro Resources | South Africa | 69 | 5.3% |

| Northam Platinum | South Africa | 68 | 5.2% |

| African Rainbow Minerals | South Africa | 48 | 3.7% |

| Royal Bafokeng Platinum | South Africa | 43 | 3.3% |

| Harmony Gold | South Africa | 32 | 2.5% |

| Others 19 companies15 | Mostly South Africa | 91 | 7.0% |

| Total | 1,303 | 100.0% |

Source: (PwC, 2022)

It is clear from Table 1 that Anglo American is the leading player, with its two subsidiaries comprising 42% of the mining capital traded on the JSE.

This summary is an incomplete overview however, as it includes only a subset of the corporations actively mining. Because the criterion for selection is a primary listing on the JSE, PwC’s data misses several international companies with South African operations.16 To get a fuller picture requires surveying the activities of the super-majors BHP, Glencore and Rio Tinto, plus any subsidiaries of the Anglo American group not traded on the JSE, and any other international corporations active in South Africa.

The Super-Majors Current Presence in South Africa

The LRS reported in 2018 that the three super-majors Glencore Xstrata, BHP Billiton and Anglo American dominated South African mining revenues received from 2013 to 2017.17

In the subsequent five years to date there has however been a significant shift, with Glencore and BHP Billiton reducing their positions in South African production considerably, although both companies retained assets outside South Africa obtained from their acquisitions of Xstrata and Billiton respectively.

The result was to leave Anglo American as the last super-major taking outstanding profits from mining in South Africa.

Anglo American

Anglo American was by some distance the biggest mining group operating in South Africa in 2022. The company traces its roots back to the notorious imperialist Cecil Rhodes who founded the DeBeers diamond conglomerate in 1887, and the Oppenheimer family’s Witwatersrand gold interests, which came together in 1925. For over a century Anglo has been the single greatest beneficiary of the super-exploitation of African workers, in the migrant labour system first constructed by British colonialism, and then further segregated under apartheid.18

Within five years of majority rule in South Africa (1994), the corporation moved its headquarters to London in 1999, close by Buckingham Palace, and since 2021 it is now ensconced in the original DeBeers London office in Charterhouse.19 This corporate machine of colossal wealth extraction is truly Rhodes’ legacy.

Anglo American’s global HQ in the old De Beers building in Charterhouse Street, London (author photo).

Anglo made huge profits in 2022, largely due to the success of its operations in Southern Africa. Gross profits (Earnings Before Interest Tax Depreciation and Amortisation – EBITDA) of $14.5bn. This was down from a record breaking $20.6bn in 2021, yet still the ‘second highest ever achieved.’

There are various indicators of corporate profitability. The profit indicator used here is the corporation’s Earnings Before Interest and Tax (EBIT), that is the net operating profit with deductions for depreciation and amortisation. By this standard measure Anglo reaped $11.96bn profits in 2022. A further deduction for non-controlling interests’ share leaves Anglo’s attributable profit before tax of $9.7bn. Against its attributable capital employed of $32.0bn, this renders the corporation’s underlying rate of profit (Return on Capital Employed – ROCE) of 30% for 2022. Very high, albeit down from its own record 43% in 2021.20

Anglo American’s South African operations generate the major part of the group’s profits. The underlying EBIT profit in 2022 from Anglo’s South Africa platinum group mines were $4.05bn; it profited $1.90bn from its 69.7% owned subsidiary Kumba iron ore; $0.31bn from manganese mines and $0.32bn from De Beers diamonds. That is a $6.58bn combined, i.e., 55% of Anglo’s total profits of $11.96bn came from production in South Africa. With another $0.79bn profit from De Beers in neighbouring Botswana and Namibia, Anglo’s Southern Africa mines combined contribute 58% of its total profits. Australian coal mines provided nearly 24% and Latin American copper and iron mines provided just under 19% of group profits in 2022.21

During the apartheid years Anglo American used its South African base and London connection to extend its operations into Africa. Kwame Nkrumah, the first President of Ghana, complained bitterly against the corporation’s role in thwarting his efforts to effect real independence after the formal end of British colonial rule in 1960. Such was the extent of Anglo and other international mining companies’ economic power, that Nkrumah pointed out their interests effectively constrained his government’s scope for sovereign rule on behalf of the people. Nkrumah called this relation of disguised dominance, neo-colonialism.22

The pattern Anglo set in Ghana proliferated, and was replicated globally and managed through an inner circle of holding companies. Charter Consolidated based in London, oversaw Anglo’s investments in Africa, Australia and elsewhere. In the 1970s Anglo set up MINORCO as a Bermuda tax haven to funnel out its profits from copper mining in Zambia. MINORCO became a second international holding company, channelling Anglo’s investments into the Americas, and of course the reflux flow of profits.23

Now all of Anglo’s assets are controlled out of London, and it maintains a considerable presence in mining production in Africa 24 and Latin America.25

The following table summarises data provided by Anglo that relate its 2022 profits with the number of employees by region (Table 2). Several caveats are required in considering these figures. For example, that remunerations to management as well as to workers are included. The contribution of sub-contracted workers as part of the workforce as well as employees is not evident. Perhaps the biggest caution concerns the treatment of harms due to the mining operations damaging the environment and societies around them. The profit figures given do not yet include the deductions of corporate income tax; but these taxes do not cover the profound ‘external costs’ involved, some of which by their character are unquantifiable.

Nonetheless, the figures do indicate the general pattern which is that employees in the producing areas generate, on average, about four times more profits per head than their remuneration.26 The source of these super-profits is the tremendous yields of the mineral resources that employees mine at significant volumes, a combination of labour and nature that are the basis of the huge revenues. The Australian mines combine both high yielding resource and high degrees of mechanisation, allowing the corporation to reap even higher profits per employee even when they are better paid. This points to the most profitable combination of all, production at volume of a mineral in demand with low unit costs. The lowest cost combination is: exploitation of a high yielding resource, with high degree of mechanisation, limited ‘external costs’ and, by international standards, low wages. It is just this combination that the corporation plans for Quellaveco, its new copper mine in Peru.27

Table 2: Anglo American’s 2022 Pre-Tax Profits by Region and Per Employee

|

Region |

Number of Employees | Wages and Benefits Paid

US$m |

Wages Benefits Per Employee

US$ |

Pre-tax Profits (EBIT)

US $bn |

Prop of Total EBIT | Profits per Employee

US$ |

Profits / Wages Per Employee | Sectors |

| South Africa | 41,100 | 1,681 | 40,900 | 6.573 | Platinum, Iron, Manganese, Diamonds | |||

| Other Africa | 6,650 | 330 | 49,624 | 0.686 | Diamonds | |||

| Africa Subtotal | 47,750 | 2,011 | 42,115 | 7.259 | 57.6% | 152,021 | 361% | |

| Brazil | 4,000 | 165 | 41,250 | 1.385 | Iron, Nickel | |||

| Chile | 4,400 | 398 | 90,455 | 1.387 | Copper | |||

| Peru | 1,000 | 132 | 132,000 | 0.208 | Copper | |||

| Latin America Subtotal | 9,400 | 695 | 73,936 | 2.978 | 23.6% | 316,809 | 428% | |

| Australia | 3,000 | 517 | 172,333 | 2.369 | 18.8% | 789,667 | 458% | Coal |

| North America | 850 | 68 | 80,000 | |||||

| Europe | 3,000 | 639 | 213,000 | |||||

| Northern Subtotal | 3850 | 709 | 184,156 | -0.638 | -165,714 | -90% |

Source: Author calculations based on Anglo American (2022)28

Anglo presents itself as “Building strategic advantage” according to a standard business logic of big volumes and wide margins between costs and revenue: “The primary source of competitive advantage in the mining industry is to own high quality, high margin, long life mineral assets of scale, with positions that can be further enhanced if those assets deliver products into structurally attractive markets.”29

Anglo’s production profile is selective industrial scale operations extracting high yielding ores. As with the other mining super-majors, this results not so much in worldwide production as a geographical network pattern across different countries, punctuated at its nodes by a series of mining enclaves. Or rather ‘black holes,’ nuclei of intensely focussed deep extraction that suck in capital and labour to pump out commodified minerals, whilst bending and warping the social and environmental space around them.

Not content with admitting to its frankly economic logic, and following its historic pattern, the corporation is seeking against all the evidence to position itself as a progressive business. Yet its horrendous history has continued into the post-apartheid era. As recently as 2006 Anglo engaged the police to shoot down the Matimatsasi people at Maandagshoek, in an unarmed protest against taking their land for the Modikwa mine, a joint venture between Am Plats and African Rainbow Minerals.30 Community resistance to Modikwa has continued for over two decades.31

5,000 people protest against Anglo’s Mokiwa mine in 2007. Source: ejatlas.org

Today Anglo emphasises with a ‘future enabling portfolio’ with 85% of its production geared towards the transition to low carbon economy.32 In fact, the figures do not add up, as in 2022 Anglo drew nearly 19% of its total profits from steel making coal.33 This was even after it sold off its seven South African coal mines in 2021.34

Not forgetting the spectacular profits that Anglo enjoyed over three decades from its one third share in the El Cerrejón coal mine in Colombia, sold to Glencore in 2021, but leaving behind a trail of environmental and community destruction.35

A comprehensive study of emissions of carbon dioxide and methane found that in 2010 Anglo American was the twentieth biggest polluter of the planet’s atmosphere, with 272 mtCO2 equivalent that year, and was responsible for 7,242 272 mtCO2 equivalent historically.36

Glencore (and Xstrata)

The shares of Swiss based super-major Glencore are primary listed on the London Stock Exchange. It is one of the three mining companies that figure in the FTSE Top 20, as do Rio Tinto and Anglo American.37

Of the London connected super-majors, Glencore is the most engaged in coal mining. Glencore has profited hugely from coal more than doubling in price between 2021 and 2022. The group’s global EBIT profits in 2022 were US $ 26.7bn, up from $14.5 bn in 2021.38

The group reported underlying EBIT profit from its thermal coal mines in South Africa as US $1,194m in 2022. That year it made $3,171m from the now wholly owned El Cerrejón mine in Colombia, and $11,131m from its coal and coking operations in Australia.39

It was Glencore’s purchase of Xstrata in 201340 that brought it seventeen mining operations in South Africa; mostly in coal and chrome, with other metals.41 Xstrata took out a quarter (24.9%) stake in Lonmin in 2009, and it was in reality its controlling shareholder at the time of the Marikana massacre in 2012. Although they hid behind the scenes, its executives are just as responsible as Ramaphosa. Indeed, the emails surrendered to the Farlam Commission reveal that Lonmin’s hardline was endorsed by Xstrata’s hands-on chief executive Mick Davis. Two days before the massacre, on 14 August 2012 when its planning was already underway, Lonmin Chairman Roger Phillimore briefed Ramaphosa and Lonmin executives “My attempts to speak with the Minister have not yet succeeded (!!!) but I was able to brief a very supportive Mick Davis.”42

There is a pattern here of repression and stigmatisation. Just three months earlier there occurred a similar shooting at the Tintaya mine in Peru owned by Xstrata. In May 2012 community protests against the mine’s contamination had been met by police beatings, and on 28 May they shot dead two villagers, Reducindo Puma and Walter Ancca. A claim was brought to the UK’s High Court in 2017 by lawyers Leigh Day. Xstrata denied it was causing pollution and denied responsibility for the actions of the police, yet the company had paid £700,000 for the services of about 1,300 officers, and it ‘“covertly monitored” community meetings and employed informants, sharing its intelligence,’ with the police.43

The court papers revealed that Davis had emailed fellow directors to say the protests were “fermented (sic) by the mayor of Espinar (who attended our AGM) and a nexus of neo Marxist anti-mining/capitalist agitators.”44

Davis went on to be Treasurer and Chief Executive of the Conservative Party in the UK.45

Xstrata had grown rapidly in the ten years from its formation in 2001 with a market capitalisation of $500m to $56bn by 2012.46 More than any other single group, the executives leading Xstrata profited hugely from brutal repression of mineworkers and communities. In more than one sense they had made a killing, then moved on escaping public censure.

Xstrata (later Glencore) was the major shareholder in Lonmin at the time of the Marikana Massacre. Source: Forslund (2015)

Glencore’s combined greenhouse gas emissions, mostly from its coal production, were 370 mtCO2 equivalent in 2022.47 This is nearly as much as the entire UK emissions of 417 mtCO2 equivalent. 48

Finally, it is a matter of public record and that Glencore has been found guilty of grand corruption, making bribes across Africa (DRC, Cameroon, Côte d’Ivoire, Equatorial Guinea, Nigeria and South Sudan), as well as “market manipulation in the US and additional bribery offences in Brazil and Venezuela.”49 The corruption syndrome is certainly not limited to this company, nor even the notorious Lonrho under Tiny Rowland, who blazed the trail of neocolonial deal making, perfecting it into a veritable continental industry.50 While it is not the focus of this study, it is striking how comprehensive these corrupt arrangements have run as business as usual.

South32, Spin off from BHP

The Australia based miner South32 was spun off from the world’s largest mining corporation BHP-Billiton in 2015. BHP is an Australian corporate group, originally formed in 1885 as the Broken Hill Proprietary company. The BHP corporation purchased Billiton in 2001 to form BHP-Billiton.51

The Billiton side came from Gencor, the second biggest mining corporations under apartheid in South Africa. Gencor traces its roots back to the formation of the General Mining and Finance Corporation in 1895, the gold mine boom in Johannesburg. Gencor was formed in 1980 by merging with Union Corporation and Federale Mynbou, with the support of Anglo American. The result was second biggest mining group in South Africa after Anglo, and the biggest under Afrikaner control, i.e., the Dutch speaking wing of the white minority, rather than the English speaking settlers that predominate in mining. Gencor was a corporate funder of the ruling Nationalist Party during apartheid.52 Like Anglo, in the 1980s while operating under apartheid, Gencor had already set up international holding companies, quietly to avoid sanctions. In Gencor’s case in Australia and Jersey (UK), as vehicles through which to expand its international assets.

Gencor purchased Billiton, the mining arm of Royal Dutch Shell, for US $2bn, in 1994. Gencor subsumed its own assets into Billiton as vehicle and then in 1997 moved its primary listing to the London Stock Exchange.53 When Billiton was in its turn purchased by merger with BHP, it was effectively sold for $12bn, realising a purchase price six times more than just seven years earlier; quite spectacular gains for the Billiton shareholders.54 BHP-Billiton then soon became the world’s largest mining corporation.

But two trails of destruction lay behind these international corporate deal makings. The first trail is the ever more dire situation of electricity supply cuts, known as load sharing, by state corporation Eskom that bedevils people’s lives in South Africa.55 The Marikana Massacre took place under an aerial network of high voltage supply lines and cables, next to a sub-station, the material reminders that the mining industry draws on massive amounts of electricity.56 Meanwhile most of the Marikana mineworkers still live in shacks without even basic electricity supply or sanitation.57

Back in 1992, just before the transition to majority rule, Eskom executives (including the same Mick Davis noted above) agreed a 40 year long sweetheart deal with Gencor to supply electricity to its aluminium smelters at cut price rates, R0.09 per kilowatt hour, one tenth that the public pays. Thus, a cross subsidy from the general population drastically reduced smelter costs and what became corporate profits of BHP-Billiton.58 This was just another poisoned chalice legacy left by the corporate functionaries of apartheid.

The second trail of destruction is environmental. In 2021 South32 completed the sale of its considerable portfolio of South African coal mines to black-owned Seriti Resources.59 The Financial Times commented this sale was because “Miners are facing increasing pressure from investors to take firmer action on climate change and exit thermal coal, a dirty and polluting fossil fuel.”60 But while South32 made its exit the polluting and destructive coal mining, and its awful legacy, continues.61

South32’s assets operating in South Africa are in aluminium and manganese, that in 2022 made US $724 m in profits (by the underlying EBIT measure). This comprised 18.3% of the corporation’s global profits.62 South32 has mines in Australia, Brazil, Chile, Colombia, and the US.

Source: unibolojep.com

Rio Tinto

London based Rio Tinto (formerly Rio Tinto Zinc) is one of the biggest global mining corporations, raking in US $14.0 bn underlying profits earnings in 2022, with $11.2 bn of this coming from its iron ore production.63

Historically Rio Tinto played a hugely significant role in mining uranium in South African occupied Namibia that fuelled the UK’s nuclear bombs and energy production.64

Today Rio Tinto’s principal asset in South Africa is majority ownership in the Richards Bay Minerals complex in Kwa Zulu Natal. The mines and smelter are designed to extract zircon and titanium from mineral sands, operations that have huge environmental impacts on the coastal dunes. Operations were shut down at times in 2021 and its profit/loss is not revealed in subsequent company reports.

The South African based Mining Corporations

Four South African based mining companies each made over $1bn profits in 2022. Of these the two most profitable, Impala Platinum and Sibanye Stillwater, make most of their profits in the platinum group metals sector; with coal companies also gaining much profits much higher than expected.

Platinum Group Metals sector

Platinum production is dominated by a big three, these two and Anglo’s platinum subsidiary Amplats.

Impala Platinum, Implats, has a holding company with operating mines through subsidiaries in Rustenburg and Marula in South Africa, as well as mines in Zimbabwe and in Quebec, Canada. According to the platinum industry reference, Implats was formed by Union Corporation, the forerunner of Gencor, in 1969.65 The company itself reports that “a company called Bishopsgate Platinum Limited, of which Impala Platinum Ltd was a wholly-owned subsidiary, was listed on the JSE on 26 January 1973.”66

“Implats Confirms Strike by NUMSA Members Employed at Rustenburg Mine Contractors,” MiningMx, June 20, 2022.

Implats reports its profit before tax as 45,239 million Rand.67 Adding back in interest payments and converting to US computes an operating income (EBIT) profit for the entire enterprise of $2.97 billion, of which an estimated 70%, i.e., US 2.08 billion, was generated in South Africa.

The significant shareholdings, those over 3%, reported by Impala constitute 45% of its total share ownership. Of these South Africa’s Public Investment Corporation (PIC) holds 15%; US asset managers Blackrock, FMR and Vanguard hold between them15%; South African asset managers Ninety One (formerly Investec), Fairtree and Coronation hold 10% and Singapore’s GIC sovereign wealth fund holds 3%.68

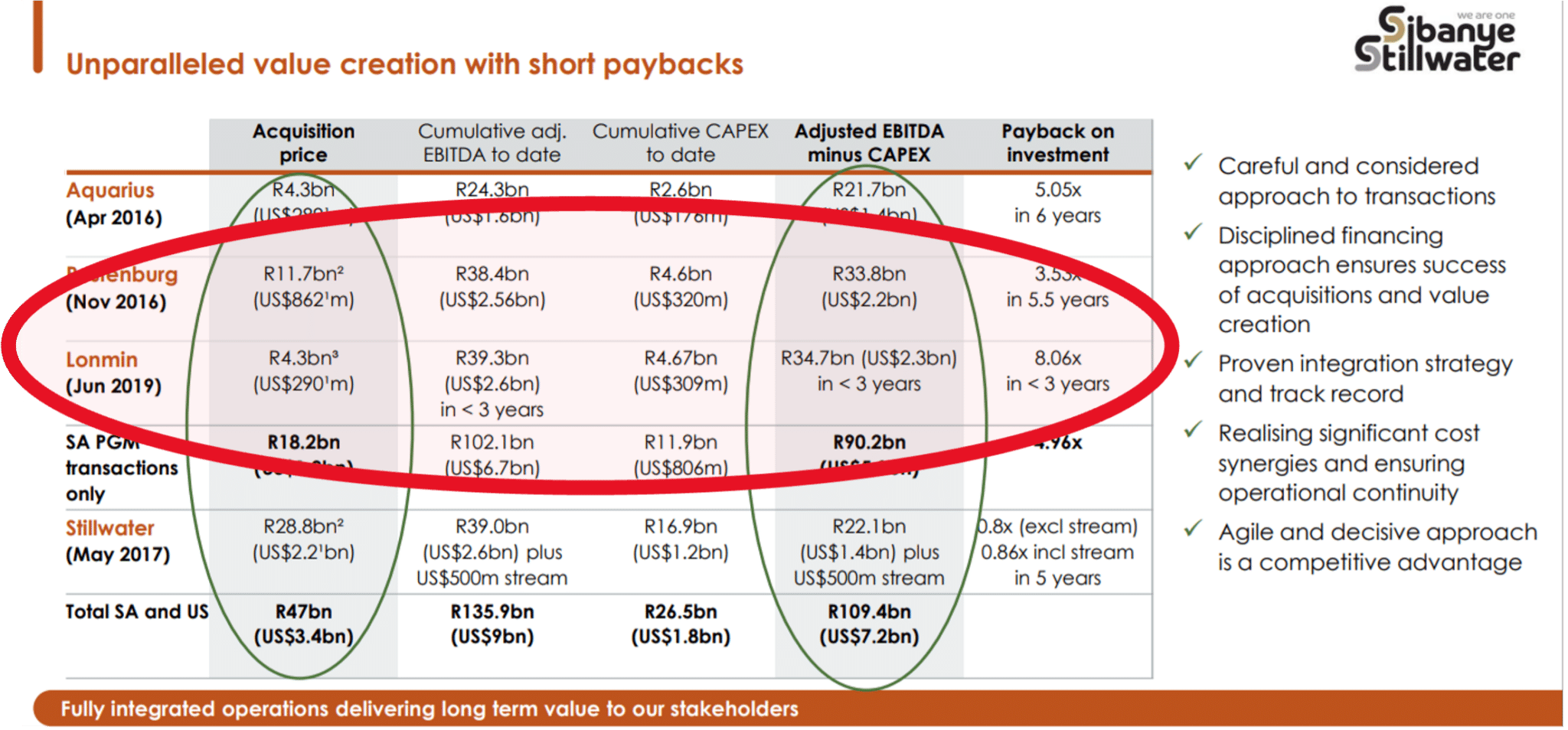

Sibanye Stillwater was originally set up as Sibanye Gold by Gold Fields in 2013, since when it has expanded aggressively into platinum metals with its takeover of US producer Stillwater in 2017, and then Sibanye Stillwater bought out Lonmin in 2019. The Lonmin purchase was originally motivated to gain access to its smelter, facilities that Sibanye did not then have; but it has become clear since that at a price of $290 million, Lonmin’s mining operations were severely undervalued.

Sibanye Stillwater, “Well Positioned for Ongoing Value Creation,” Resource-Capital, 2022.

It is clear that Lonmin’s mining assets were worth much more than either company let on at the time. The real reason that Lonmin’s managers sold is that they wanted to close down the company as the entity responsible for the Marikana Massacre. Working with the AMCU trade union, Alternative Information & Development Centre (AIDC) economist Dick Forslund argued against the takeover, and the threatened job cuts. He pointed out that once the associated minerals are taken into account, the company would have increasing revenues and hence would be viable as a stand-alone operation.69

In the event, Sibanye has indeed expanded production in the Lonmin mine, especially the K4 shaft that it expects to be taking significant returns from for the next 50 years. Within just 3 years Sibanye has drawn R34.7bn (US $2.3bn) profits from Lonmin production, eight times its purchase price.70

Royal Bafokeng Platinum is growing fast, making a net operating profit (EBIT) of US $355 million in 2022. The breakdown of revenue by mineral was 37.4% rhodium, 24.8% platinum, 22.7% palladium. RBP is jointly owned by Impala 41% and Northam Platinum 35%.71

African Rainbow Minerals was originally ARMGold founded in 1997 by Patrice Motsepe. ARM has rapidly acquired and diversified, it has ten mines in South Africa and one in Malaysia. The group’s profits, by commodity are PGMs 42%; Iron Ore 39%; Manganese 12%; Coal 4% and Other 3%. Profit before taxation and capital items less finance costs (EBIT) was 16,262 million ZAR; i.e., US $1,069 million in 2022. The Return on Capital Employed was 30.5%.72

Motsepe continues as ARM’s Executive Chairman. He is the brother-in-law of Cyril Ramaphosa and the fourth richest man in South Africa after Johann Rupert (luxury brands); Nicky Oppenheimer (Anglo American) and Koos Bekker (Naspers).73

Table 3: Mining Companies Operating in South Africa Ranked by 2022 Profits

| Company | Main HQ | Sector | Profit from SA (EBIT)

$US million74 |

Proportion of total SA Mining profits | Proportion of company Worldwide profits | Comment |

| Anglo American Group | UK | Diverse | 6,573 | 41% | 57% | South Africa remains crucial to Anglo |

| Impala Platinum | SA | PGM | 2,080 | 13% | 70% | Share calculated from gross profits. |

| Sibanye Stillwater | SA | Gold, PGM, | 1,885 | 12% | 84% | Share in proportion to EBITDA. |

| Glencore | Switzerland | Coal | 1,194 | 8% | 8% | Listed on London Stock Exchange. |

| Exxaro Resources | SA | Coal, some diverse | 1,087 | 7% | 100% | Benefitted from high price coal |

| African Rainbow Minerals | SA | PGM, iron, diverse | 1,069 | 7% | 100% | |

| South32 | Aus | Coal, Mang | 724 | 5% | 18% | Manganese via 60% share in Samancor |

| Harmony Gold | SA | Gold | 578 | 4% | 92% | New mine in Papua New Guinea |

| Royal Bafokeng Platinum | SA | PGM | 355 | 2% | 100% | Owned by Impala 41% and Northam 35% |

| Petra Diamonds | UK | Diamonds | 156 | 1% | 87% | In proportion to production. |

| Gold Fields | SA | Gold | 148 | 1% | 11% | In proportion to free cash flow by region. |

| Others75 | Not included | |||||

| Provisional Total | 15,849 | 100% |

Source: Author calculations from relevant annual reports.

Coal Sector

As already noted, the South African coal industry has been marked by a big shift to nationally based corporations, that rather fortuitously made windfall profits in 2022 as a result of Europe’s sharply increased demand in the wake of the war in Ukraine.

Exxaro Resources is a Black Empowerment corporation. It owns six coalmines supplying Eskom, the domestic market and for export. It owns other mineral interests. The company’s EBIT profit in 2022 is calculated as 16,545 million ZAR, that is US $1,087 million. The company reports a staggering Return on Capital Employed (ROCE) of 45%, surpassing even its own target of 20%. Ben Magara, appointed the CEO of Lonmin after the massacre, is an independent non-executive director.76

Seriti picked up the thermal coal mines that Anglo disposed of in 2017,77 and then purchased South Africa Energy Coal (SAEC) from South32 in 2021, and as a result owns seven coal mines in South Africa, including three of the five biggest.78 It is a major supplier to Eskom power stations. Seriti is controlled by a consortium of investment corporations, it is 91% black owned.79

Gold Sector

In contrast to coal producers’ recent great good fortune, the gold mining companies have been struggling to make a profit from the ever deeper underground mines in South Africa, in which nearly a hundred thousand mine workers still toil.

Their margins between cost and revenue have been tight, although the counter cyclical demand for gold as a ‘safe haven’ asset means that its dollar price will trend up in any worsening global crisis, an incentive for profit seeking producers to play for the longer term.80 In the meantime, South Africa’s gold mining corporations have been especially resistant to workers’ demands for a living wage. There is an increasing tendency to seek out more profitable operations overseas using large scale open cast methods.

Gold Fields of South Africa Limited was formed in London in 1887 by Charles Rudd and Cecil Rhodes. By 1897 it acquired three working goldmines on the Rand for its investors and, the company reports, was ‘rated as the most valuable company in the world.’81 Consolidated Gold Fields was, like Anglo American, a major beneficiary of the cheap labour system.82

Gold Fields current incarnation was established in 1998, with headquarters in Johannesburg, where its shares are listed, as well as on the New York Stock exchange. The company owns nine operating gold mines, all but one outside of South Africa. The group assigned its total US $1, 140 million Free Cash Flow in 2022 as follows: Australia 59.1%; Ghana 22.9%; South Africa 11.3%; Peru 6.7%. It has started new projects in Canada and Chile. Gold Fields considers ‘resource nationalism’ as a political risk. The group’s EBIT profit for 2022 is calculated from its accounts as US$1,347 million.83

Harmony Gold traces its history to 1950.84 Today it is the biggest gold producer in South Africa where it has nine underground mines, one open pit and ‘several tailings retreatment operations.’ It has an open pit mine in Papua New Guinea and has started a project in Australia.85 In 2020 Harmony Gold bought the last remaining gold mine assets of Anglo Gold Ashanti in South Africa for 4.4 billion ZAR.86 Its production profit in 2022 was US$ million 628; 92% of which came from South Africa.87

Anglo Gold Ashanti no longer has any production in South Africa but fifteen gold mine assets overseas that generated operating cashflows as follows: Americas $129m (8%) Africa $1,108m (72%) Australia $300m (20%).88 Anglo Gold was formed in 1998 as the gold mining arm of Anglo American. It merged with Ashanti Goldfields in 2004 to acquire production in Ghana. Net operating profit (EBIT) was around $1.8bn in 2022. The company’s chair states “The focus of the business will be to lower costs and ensure profitability at lower gold prices.”89

We include two ambitious companies seeking to maximise their profits from Africa, whilst levering shareholder returns through the London stock market.

Randgold Resources was founded in 1995, with headquarters in Jersey (UK) and listed on the London Stock Exchange. By 2017 it achieved operating profits of US $335 million from mines in Mali, Cote D’Ivoire, Senegal and Democratic Republic of the Congo.90 In 2018 Randgold merged with the Canadian Barrick Gold for $6.5 billion to become the world’s largest gold producer, with six of the ten lowest cost mines in the world. Randgold’s chief executive Mark Bristow became CEO of the new Barrick.91 The Financial Times reported that “Randgold Resources into the best performing stock in London this century, with total returns of more than 7,000 per cent before its takeover.” The paper celebrated Bristow as an adventurer, a big game hunter, one who “did active service in the South African army in what is now Namibia and Angola.”92 It had nothing to say about the costs of those wars nor on the conditions for African workers in Randgold’s mines.

As a postscript we add Endeavour Mining has mines in Cote d’Ivoire and Senegal, and four in Burkina Faso, emulating Randgold’s focus on extraction from West Africa countries formerly colonised by France. Its operations are characterised by very low costs in dollar terms, averaging $928 an ounce against realised sale price of $1,807.93 Endeavour relocated its head office from Paris to London in 2017. Since 2021 Endeavour’s shares have been listed on the London Stock Exchange. Endeavour Mining is being touted as ‘the next Randgold.’94

Summary of Findings

What are the extent and degree of corporate profits?

The South Africa operations of mining corporations generated at least US$15.7bn net operating profits (earnings before interest charges and tax) for them in 2022. Coal, platinum group metals other than platinum (i.e., palladium and rhodium) and diamonds achieved especially high prices and were particularly profitable for their producers during the financial year.

Who are the main corporate players in South African mining?

Anglo American stands out as the major player, with Glencore a highly profitable coal producer. The dip in demand for raw materials around 2015 and 2016 saw the other two of the four biggest super-major mining corporations reduce their investments in South Africa especially in the coal sector. BHP spun off its interests to South32.

There is a cluster of significant South African based corporations that have picked up the disposed assets of multinationals and are expanding rapidly as epitomised by Sibanye Stillwater.

Who profits from mining in South Africa?

Foreign based multinationals received around 55% of the mining profits generated in South Africa in 2022. Of this Anglo American alone took 41%, Glencore took 8%, South32 took 5% and Petra took 1%. The converse of this is that South African based capital invested in mining is considerable, taking 44% of all profits generated in the sector.

However, the distinction between foreign and domestic based capital is often somewhat blurred in several respects, for example:

- Multiple share listings, e.g. Anglo American is quoted on the Johannesburg as well as London Stock Exchange.

- Both Impala and Sibanye Stillwater have attracted the interest of the giant US based asset managers. They have significant share ownership by globally operating asset managers such as Blackrock and Vanguard (although the ultimate beneficiaries are opaque).

- Mixed international composition of board level personnel and principal executives. There is significant black executive leadership and appointment to managerial and senior technical positions, due to the BEE programme, as well as increased ownership.

- Several of the South African based companies have extensive overseas operations. The extreme example of this is Anglo Gold Ashanti. The move to projects outside of South Africa is also a material shift in mine design from underground to open pit mining.

What is the London connection?

The London connection was evidently foundational to the South African mining industry at the end of the nineteenth century. It has passed through distinct chapters, but with significant continuities. Post-apartheid, there remains a considerable London connection in the investment and profit relation.

This study demonstrates that half of all the profits generated by mining in South Africa pass through to London corporations and capital markets.

This is a similar result to the findings of our survey of mining in Chile, held up as the success story of neoliberalism in Latin America, where again half of the mining industry’s entire profits flow into and through London based companies and finance.95

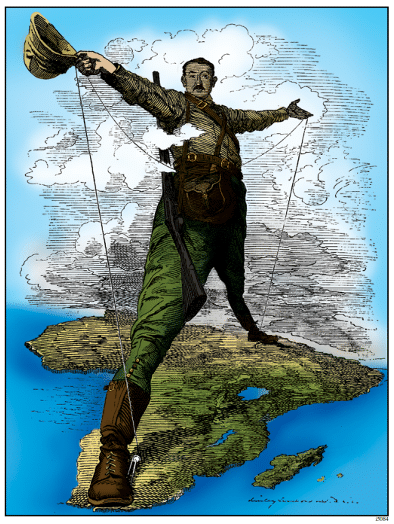

Rhodes as Colossus, dominating Africa from the Cape to Cairo. Source: Punch 1892.

Conclusions

There is a nexus of collaboration between the internal and externally domiciled wings of mining capital which still revolves around the London Johannesburg axis, although today it is part of a wider network. This relation has a long history from the late nineteenth century when Britain created modern South Africa around its interest in mining exploitation. The relation between London finance and South Africa production was capital investment in one direction and the flow of profitable returns to that investment in the other. The apartheid regime years from 1948 saw little change in this economic connection, UK corporations widened their involvement and indeed flourished.96

Even now, a generation after nominal majority rule was gained in 1994, the reality of collusive close relations with the South African state was starkly revealed by the 2012 Marikana Massacre.97

With some variations, the migrant labour system set up by Cecil Rhodes and his cohort of Randlords, the openly imperialist mining magnates that so determinedly stomped themselves to riches, remains in place even still, albeit these days in neo-colonial forms. Our study shows that Rhodes legacy runs much deeper than his prominent statue at Oxford University, insulting as that is.98 Behind the symbol there is a continuing structural economic legacy. Neither have fallen, yet.

The crimes of the powerful and their legally accepted activity are in fact two aspects of one and the same nexus of exploitation that links back to the economic beneficiaries. Nkrumah ends his foundational critique of neocolonialism with this warning:

The danger to world peace springs not from the action of those who seek to end neo-colonialism but from the inaction of those who allow it to continue. To argue that a third world war is not inevitable is one thing, to suppose that it can be avoided by shutting our eyes to the development of a situation likely to produce it is quite another matter. If world war is not to occur it must be prevented by positive action.

This positive action is within the power of the peoples of those areas of the world which now suffer under neocolonialism, but it is only within their power if they act at once, with resolution and in unity.99

Kwame Nkrumah. Source: LSE blog.

Suitably modified to take account of its role as one of the BRICS, these prescient words apply fully to mining corporations in and from South Africa today. The international pattern of collaboration extends to Australia and Canada; and the producer locations across Africa, Latin America, South East Asia and, again, Australia.

The mining super-majors are keen to walk away from their legacy responsibilities, that in the case of South Africa date back to colonial times under British rule, continuing under apartheid (a kind of white supremacist neocolonial rule), and indeed in the last generation since 1994. Anglo American in particular is keen to present itself as forward looking and a progressive agent for the energy transition. Yet Anglo is a serial offender, that has never been brought to account for its crimes. The end of apartheid Truth and Reconciliation Commission (TRC) hearings on the corporations’ profiting from apartheid let them walk free with no obligations.100

“Impala Platinum Workers End Strike After Police Fire Rubber Bullets,” Spring Advertiser, October 4, 2016.

Certainly, Anglo American has been the greatest financial gainer, indeed architect, of a system of racialised exploitation that has lasted more than a hundred years.101 While the profiteering, super-exploitation and structural violence continue, the so must we. Rhodes legacy must fall.

The demand for reparations that justifiably stems from the times of African enslavement, applies with closer proximity to destructive extractive capitalism today. This raises the issue of not only holding the super-major mining corporations to account, but to go further and take preventative positive action.

The time has come for combined effort to prevent such mega corporations from lying their way through ever greater destruction in the cause of profit. They must be stopped. For this we will need to coordinate across continents. We must act at once, as Nkrumah said, with resolution and in unity.

Notes

1. Asanda-Jonas Benya and Crispen Chinguno, Waiting For Justice: Marikana’s Continuities and Discontinuities A Decade After the Massacre, Brot für die Welt, 2022.

2. See Patrick Bond and Christopher Malikane, “Inequality caused by macro-economic policies during overaccumulation crisis,” Development Southern Africa 36, no. 6 (2019): 803–820; Ludwig Wier, “Tax-motivated transfer mispricing in South Africa: Direct evidence using transaction data,” Journal of Public Economics 184 (2020): 104153. The most revealing case study of illicit flows is Dick Forslund The Bermuda Connection: Profit shifting, inequality and unaffordability at Lonmin 1999-2012 (2015).

3. LRS (2023b), Sector Performance.

4. LRS (2023b).

5. Calculation: (1,317,920,396,115 – 914,817,049,849) / 1,317,920,396,115 = 403,103,346,266/ 1,317,920,396,115 = 0.306

6. Chamber of Mines of South Africa, Chamber Deeply Concerned Following Reports To Parliament On Draft Reviewed Mining Charter, 2016, mineralscouncil.org.za.

7. Estelle Hayes, The Mining Law Review: South Africa, 2022.

8. Andy Higginbottom (2018) The Marikana Massacre in South Africa: The Results of Toxic Collusion. See page 13 for analysis of Ramaphosa’s 9% shareholding.

9. Magnus Taylor, “Moeletsi Mbeki on South Africa: ‘Black Economic Empowerment is Legalised Corruption,’” African Arguments, September 13, 2012.

10. Economist Intelligence Unit, South Africa: African mining sector looks to the future, 2023.

11. Alternative Information & Development Centre (AIDC) Transnational Institute (TNI), and Trade Unions for Energy Democracy (TUED), Eskom Transformed: Achieving A Just Energy Transition For South Africa, 2020. See also Brian Kamanzi, The Crisis In South Africa’s Energy Sector, 2021.

12. Statistica, Number of people employed by South Africa’s mining industry in 2021 by commodity.

13. Statistics South Africa (2021); Four facts about the mining industry (2019).

14. Data as of 30 June 2022. PwC (2022) SA Mine 2022: Level up or Reset, p27 at https://www.pwc.co.za/en/publications/sa-mine.html

15. Listed at PwC (2022, p42)

16. PwC (2022, p33)

17. LRS (2018) MNC Trend Report 2018 at https://lrs.org.za/wp-content/uploads/2021/01/MNC-Trend-Report-2018.pdf , pp12-14.

18. See Innes, Duncan (1984) Anglo American and the Rise of Modern South Africa by Duncan Innes Heinemann; Magubane, Bernard Makhosezwe (1979) The Political Economy of Race and Class in South Africa Monthly Review Press and First, Ruth (1983) Black Gold: The Mozambican Miner, Proletarian and Peasant Harvester Press.

19. Donald G. McNeil Jr. (1998) ‘South African Industrial Giant Moving to London’ New York Times Oct. 16, 1998 at https://www.nytimes.com/1998/10/16/business/international-business-south-african-industrial-giant-moving-to-london.html

20. Anglo American (2022) Integrated Annual Report 2022 pp80, 83, 164, 301, 314.

21. Anglo American (2022) pp98, 101, 219, 299.

22. Nkrumah, Kwame (1965) Neocolonialism, the Last Stage of imperialism. Especially chapters 7 to 11, at https://www.marxists.org/subject/africa/nkrumah/neo-colonialism/neo-colonialism.pdf

23. Innes 1984, pp233-6

24. See Curtis, Mark (2016) The New Colonialism: Britain’s Scramble for Africa’s Energy and Mineral Resources War on Want at https://www.waronwant.org/sites/default/files/TheNewColonialism.pdf

25. Curtis, Mark (2019) The Rivers are Bleeding: British Mining in Latin America at https://waronwant.org/sites/default/files/the-rivers-are-bleeding-updated.pdf and London Mining Network (2022) Should Do Better: Anglo American’s mining operations and affected communities in Latin America at https://londonminingnetwork.org/project/should-do-better/

26. This is corroborated by the ‘Cash Value Distributed to Stakeholders’ figures at Anglo American (2022) p54.

27. Higginbottom, Andy (2023) Peru and capitalist extraction–the imperial mining powers behind the throne https://mronline.org/2023/01/10/peru-and-capitalist-extraction-the-imperial-mining-powers-behind-the-throne

28. Anglo American (2022) pp 2, 98, 101, 219, 299.

29. Anglo American (2022) p30.

30. Moody, Roger (2007) Rocks and hard places: The globalization of mining Zed Press pp 59-62.

31. ‘Anglo American Platinum Modikwa Mine in Maandagshoek, Limpopo, South Africa’ Environmental Justice Atlas at https://ejatlas.org/conflict/modiwa-platinum-mine-in-maandagshoek-limpopo-south-africa

32. Anglo American (2022) p30.

33. Anglo American (2022) p81.

34. Anglo American (2022) p318.

35. London Mining Network (2022) ‘Blockade by communities affected by Cerrejón Coal Mine, Colombia’ 1 September at https://londonminingnetwork.org/2022/09/blockade-by-communities-affected-by-cerrejon-coal-mine-colombia/

36. Heede, Richard (2014) ‘Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers, 1854–2010’ Climatic Change 122:229–241 at https://link.springer.com/article/10.1007%2Fs10584-013-0986-y , p237.

37. Top 20 Biggest Companies in the UK at https://admiralmarkets.com/education/articles/shares/list-of-the-biggest-uk-companies-by-market-cap

38. Glencore Annual Report 2022 at https://www.glencore.com/.rest/api/v1/documents/ded10fa92974aa388a43aa9f86f483e9/GLEN-2022-Annual-Report.pdf, p67.

39. Glencore (2022), p82.

40. Blas, Javier (2013) ‘Glencore finishes takeover of Xstrata’ Financial Times 2 May 2013.

41. Solly, Imogen (2013) Glencore Xstrata – the birth of a mining monster. London Mining Network at https://www.banktrack.org/download/glencore_xstrata_the_birth_of_a_mining_monster/glencorexstratamergerfinal131004.pdf

42. Farlam Commission (2014) Lonmin Bundle: Exhibit VVVV1 at http://www.marikana-conference.com/images/Exhibit_VVVV1.pdf , p44.

43. Bowcott, Owen (2019) ‘UK mining firm in court over claims it mistreated environmental activists’ Guardian 31 October at https://www.theguardian.com/business/2017/oct/31/uk-mining-firm-in-court-over-claims-it-mistreated-environmental-activists

44. Millard, Rachel (2017) ‘Tory Party treasurer Sir Mick Davis blamed fatal protests at one of his company’s mines on “neo Marxist anti-capitalist agitators”’ 25 October at https://www.thisismoney.co.uk/money/article-5013443/Mining-court-battle-engulfs-Tory-party-Treasurer.html

45. Higginbottom (2018), p12; London Mining Network, Wall of Shame https://londonminingnetwork.org/lonmin-wall-of-shame/

46. Xstrata (2012) Annual Report 2011 at https://www.glencore.com/dam/jcr:59c1399e-1052-4acb-9251-0942ada05e32/xta-ar2011-en.pdf

47. Glencore (2022) pp 40, 42.

48. UK Department for Energy Security and Net Zero (2023) 2022 UK greenhouse gas emissions, provisional figures at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1147372/2022_Provisional_emissions_statistics_report.pdf

49. Namubiru, Lydia; Assad Mugenyi; Pelumi Salako and Clifford Tankeng (2022) ‘African governments silent after Glencore pleads guilty to grand corruption’ Mail & Guardian 14 July at https://mg.co.za/africa/2022-07-14-african-governments-silent-after-glencore-pleads-guilty-to-grand-corruption/

50. Cronjé, Suzanne, Maraget Ling and Gillian Cronjé (1976) Lonrho: Portrait of a Multinational; Marinovich, Greg (2016) Murder at Small Koppie: The Real Story of the Marikana Massacre pp45-47; Open Secrets (2017) ‘Declassified: Apartheid Profits – Tiny Rowland, a very British spy?’ Daily Maverick 16 October at https://www.dailymaverick.co.za/article/2017-10-16-declassified-apartheid-profits-tiny-rowland-a-very-british-spy/

51. BHP Billiton Shareholder Circular 16 March 2015 at https://www.bhp.com/-/media/project/bhp1ip/bhp-com-en/documents/investors/demerger-taxation-information/210601_demergerofsouth32shareholdercircular.pdf and Shareholders approve BHP Billiton spin-off of South32 James Wilson and Jamie Smyth ‘Shareholders approve BHP Billiton spin-off of South32’ Financial Times 6 May 2015

52. van Vuuren, Hennie 2018 Apartheid Guns and Money: A tale of profit pp78-79.

53. Hattingh, Shawn (2007) BHP Billiton and SAB: Outward Capital Movement and the International Expansion of South African Corporate Giants at https://www.taxjustice.net/cms/upload/pdf/Ilrig_0809_South_African_giants.pdf pp11-13.

54. Russel, Clyde (2014) BHP Billiton demerger shows how good a deal Billiton got at https://www.reuters.com/article/column-russell-bhp-billiton-deals-idINL4N0QO10020140818

55. Kamanzi, Brian (2021) The Crisis in South Africa’s Energy Sector: Towards a Just Transition at https://thetricontinental.org/wp-content/uploads/2021/04/Eng_working-document-SA-Electricity.pdf

56. The industrial infrastructure connection between the state and mining is analysed in Fine, Ben and Rustomjee, Zavareh (1997) The Political Economy of South Africa: From Minerals-Energy Complex to Industrialisation

57. Benya, Asanda-Jonas with Crispen Chinguno (2022) Waiting For Justice: Marikana’s Continuities And Discontinuities A Decade After The Massacre Brot für die Welt

58. Bond, Patrick (2012) ‘In South Africa, the poor pay the electricity bill of the world’s largest mining company’ City Press 27 October at http://www.ejolt.org/2012/10/in-south-africa-the-poor-pay-the-electricity-bill-of-the-worlds-largest-mining-company/

59. South32 (2022) Annual Report 2022 at https://www.south32.net/docs/default-source/annual-general-meetings/2022/annual-report-2022.pdf , p164.

60. Dempsey, Neil and Neil Hume ‘South32 exits thermal coal with sale to Seriti Resources’ November 6 2019 Financial Times

61. Human Rights Watch (2022) The Forever Mines: Perpetual Rights Risks from Unrehabilitated Coal Mines in Mpumalanga, South Africa at https://www.hrw.org/report/2022/07/05/forever-mines/perpetual-rights-risks-unrehabilitated-coal-mines-south-africa

62. South32 Annual Report 2022 pp77,114,115.

63. Rio Tinto Annual Report 2022 at https://www.riotinto.com/en/invest/reports/annual-report , p270.

64. See London Mining Network https://londonminingnetwork.org/2021/04/rio-tinto-alternative-timeline/?highlight=Namibia

65. Black, William (2000) The Platinum Group Metals Industry Woodhead, pp 4/11, 4/16.

66. Implats (2005) Annual Report 2005 at https://www.implats.co.za/pdf/annual-reports/archive/2005/implats-ar2005.pdf , p8.

67. Implats (2022) Audited Annual Financial Statements 2022 at https://www.implats-ir.co.za/results/2022/annual-results-2022/pdf/afs.pdf, p29.

68. Implats (2022) p15.

69. Forslund, Dick (2018) The Sibanye Lonmin Big Retrenchment Merger Report to the Competition Commission. See also the role of finance analysed in Bond, Patrick (2019) Lonmin’s murder, by money at https://www.pambazuka.org/economics/lonmin’s-murder-money

70. Sibanye Stillwater (2022)

71. Royal Bafokeng Annual Report (2022) at https://www.bafokengplatinum.co.za/reports/integrated-report-2022/pdf/full-integrated.pdf pp 9, pp 50, 129.

72. ARM (2023) Integrated Annual Report 2022 at https://arm.co.za/wp-content/uploads/2022/10/2022-Integrated-Annual-Report.pdf pp 4,5,7,40, 48.

73. ‘South Africa’s billionaires as of 2023’ at https://www.statista.com/statistics/1230448/billionaires-in-south-africa-by-net-worth/

74. Currency conversion based on ZAR 15.21 to the US dollar, as the annual average to 30 June 2022.

75. Includes Rio Tinto at Richards Bay (but the profits not disclosed) and Northam (formerly Northern Platinum) whose website was not available on 25 July 2023.

76. Exxaro Resources (2023) Integrated Report 2022 at https://investor.exxaro.com/integrated-reports2022/index.php

77. ‘Anglo American announces sale of Eskom-tied thermal coal operations in South Africa’ https://www.angloamerican.com/media/press-releases/archive/2017/10-04-2017

78. Mining Technology (2023) ‘Five largest coal mines in South Africa’ https://www.mining-technology.com/marketdata/five-largest-coal-mines-south-africa/

79. Seriti https://seritiza.com/about/who-we-are/

80. ‘The new gold boom: how long can it last?’ Financial Times 25 May 2023

81. Goldfields (2023) ‘Our history 1887-1902’ https://www.goldfields.com/1887-1902.php

82. Flynn, Laurie (1992) Studded with Diamonds and Paved With Gold: Miners, Mining Companies and Human Rights in Southern Africa London: Bloomsbury

83. Goldfields (2022) Integrated Annual Report 2022 at https://www.goldfields.com/pdf/investors/integrated-annual-reports/2022/iar-2022-full-new.pdf , pp7, 12

84. ‘The Early Years’ https://www.harmony.co.za/about/history/

85.Harmony Gold (2023) INVESTOR BRIEF June 2023 https://thevault.exchange/?get_group_doc=165/1687510498-investor-brief-june-2023-london.pdf, p4.

86. ‘End of an era as AngloGold exits SA’ Business Day 12 February 2020 at https://www.businesslive.co.za/bd/companies/mining/2020-02-12-end-of-an-era-as-anglogold-exits-sa/

87. Harmony Gold (2022) Integrated Annual Report https://www.har.co.za/22/download/HAR-IR22.pdf , p87.

88. Anglo Gold Ashanti Annual Report 2022 at https://reports.anglogoldashanti.com/22/wp-content/uploads/2023/04/AGA-IR22.pdf , p7.

89. Ibid., p34.

90. https://en.wikipedia.org/wiki/Randgold_Resources

91. ‘Canada’s Barrick Gold to buy Randgold for $6.5 billion’ Reuters September 24, 2018 https://www.reuters.com/article/us-randgold-rsrcs-m-a-barrickgold/canadas-barrick-gold-to-buy-randgold-resources-in-18-3-billion-deal-idUSKCN1M40NU

92. ‘Barrick Gold chief sets sights on conquering mining world’ Financial Times, March 1, 2019

93. Endeavour Mining (2023) Annual Report 2022 at https://www.endeavourmining.com/sites/endeavour-mining-v2/files/2023-03/Annual%20Report/Endeavour%20Mining%20Annual%20Report%202022%20web.pdf

94. King, Ian (2022) ‘Endeavour Mining’s quarterly results will comfort those looking for the next Randgold’ Sky News 5 May https://news.sky.com/story/endeavour-minings-quarterly-results-will-comfort-those-looking-for-the-next-randgold-12606106

95. Martinez, Javiera, Fernando Toro and Andy Higginbottom (2019) Chile’s Copper for the Chilean People at https://londonminingnetwork.org/2019/12/chiles-copper-for-the-chilean-people/

96. First, Ruth, Jonathon Steele and Christabel Gurney (1973) The South African Connection: Western Investment in Apartheid Penguin; Flynn, Laurie (1992) Studded with Diamonds and Paved With Gold: Miners, Mining Companies and Human Rights in Southern Africa. See also the important study Lanning, Greg and Marti Mueller (1979) Africa Undermined: A History of the Mining Companies and the Underdevelopment of Africa Penguin.

97. Desai, Rehad (2015) Miners Shot Down documentary at https://www.youtube.com/watch?v=g2GbCoKioEs. For bibliography see Higginbottom (2018).

98. Bolton, Richard (2020) ‘The Architect of Apartheid, Cecil Rhodes, Falls At Oxford’ 24 June at https://www.tcsnetwork.co.uk/the-architect-of-apartheid-cecil-rhodes-falls-at-oxford/

99. Nkrumah (1965) p259.

100. Fig, David (2005) ‘Manufacturing amnesia: Corporate Social Responsibility in South Africa’ International Affairs 81(3), pp.599–617; Nattrass, Nicoli (1999) ‘The Truth and Reconciliation Commission on Business and Apartheid: A Critical Evaluation African Affairs,’ 98 (392), pp. 373-391; Terreblanche, Sampie (2013) Lost in transformation: South Africa’s search for a new future since 1986, p137

101. Jones, Saul (2023) The Troubling Past of Anglo American: South African Apartheid Profiteers at https://londonminingnetwork.org/2023/07/anglo-american-apartheid/

102. ‘Impala Platinum workers end strike after police fire rubber bullets’ Spring Advertiser 4 October 2016 at https://dwu32cgxelq1c.cloudfront.net/local_newspapers/sites/28/2016/10/40srstrikecg3_76142.jpg