Rich nations have contributed most to the current climate crisis. They are primarily responsible for the historical emissions and greenhouse gas (GHG) accumulation of the last two centuries.

Developing countries, especially in the tropics and sub-tropics, are the main victims of global warming today. Most need finance and other means to build resilience and to develop in the face of the climate crisis. But the rich have resisted major efforts to help developing nations better cope with the crisis.

Climate finance lacking

But recent international climate finance flows fall far short of developing countries’ needs, not only in the aggregate, but also due to their restrictive terms. Nonetheless, increasing demands have been made of the global South to stem the growing crisis.

Meanwhile, climate finance has become increasingly commercial, not concessional. After all, most international agreements tend to be poor compromises reflecting corporate and political power in the world. They fail to address the crisis, let alone advance climate justice.

Rich nations have fallen far behind on their $100 billion annual finance commitment for the 2009 Copenhagen climate conference. This modest commitment was supposed to increase significantly after 2020, but there have been no signs of progress, e.g., at French President Macron’s recent summit.

Instead of helping developing countries cope with more funds for adaptation, most available resources have been earmarked for mitigation. Finance for mitigation is over ten times more than the $56bn (8.4%) available for adaptation in 2020.

Meanwhile, official development assistance (ODA) has long fallen short of the promise of 0.7% of rich nations’ national incomes made over half a century ago. This fell further after the end of the first Cold War, over three decades ago, to barely 0.3%!

Much ODA has gone to climate finance, resulting in double counting. As concessional finance – especially its grant content – declines, developing countries have no choice but to turn to commercial loans as ‘debt-pushers’ gain influence the world over.

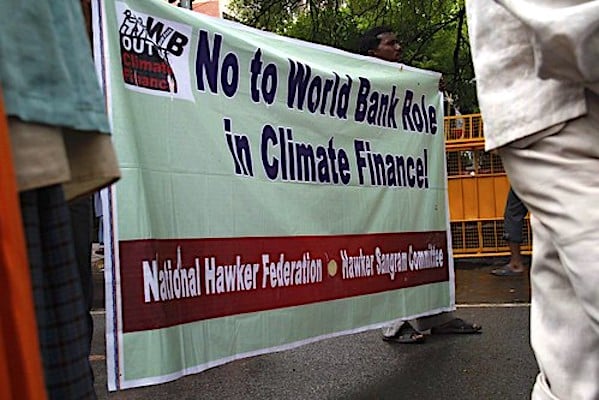

Meanwhile, the USA, the dominant World Bank (WB) shareholder, has blocked increasing WB capitalization, to avoid China gaining more influence with a greater capital share.

WB subsidizes private finance

The WB has revised its earlier failed ‘playbooks’ as global warming accelerates, with worsening consequences, especially for the global South. Its new plan–Evolving the World Bank Group’s Mission, Operations, and Resources–was issued in early 2023.

Eurodad warns, while it “seeks to incorporate climate considerations, the Roadmap does not address the continuing contradictions in its operations”. Most worryingly, ever more private commercial finance is being touted as development and/or climate finance.

Despite being among the world’s largest public lenders, the WB has been slow to provide climate finance, and is already years behind schedule. It is not even aligned with the non-binding 2015 Paris Agreement goals, with new operations only scheduled to become aligned from mid-2023!

Worse, WB subsidiaries–the International Finance Corporation and the Multilateral Investment Guarantee Agency–will only become aligned from mid-2025, a decade after Paris! Also, its climate finance definition, data and corporate strategy remain controversial and unhelpful.

Meanwhile, the WB has worsened the climate crisis, e.g., by providing $16 billion of project finance for fossil fuels since 2015. Its involvement in Clean Development Mechanism projects involves a ‘serious conflict of interests’, profiting from the climate crisis while worsening it!

The WB Group (WBG) intends to mobilize private capital with de-risking strategies, such as blended finance. Instead of using public finance to provide concessional terms to the deserving, public funds will thus make commercial finance more profitable.

Despite much cause for concern and caution, the WB’s problematic 2017 Maximizing Finance for Development promotes commercial finance as the main source of development and climate funding.

The WBG claims to want greater development and climate impacts from private commercial finance. This is undoubtedly in line with the WB creed that only the private sector can overcome the climate crisis despite being its major enabler, if not cause.

Such initiatives by former WB president Jim Kim and former Bank of England governor Mark Carney are considered ‘much ado about nothing’ by many in the global South. Enabling profit-seeking businesses to call the shots can hardly be the solution, and may instead worsen the problem.

Way forward?

Developing country leaders have long appealed for a new ‘international financial architecture’ to better address development and climate challenges, drawing support from civil society, especially in the global South.

Without any agreed multilateral definition of climate finance, governments and corporations are ‘greenwashing’ their financial abuses by labelling their financial operations as constituting climate and development finance.

As poor nations in the tropical zone suffer the worse consequences of accelerating global warming, only multilateral recognition of the need for financial reparations to address historical and contemporary losses and damages.

It is unlikely the needed climate financing will be voluntarily provided by those most responsible for the climate crisis. At the very least, rich nations should support regular issue of IMF Special Drawing Rights in the near term within the constraints imposed by likely US Congressional disapproval.

These should be urgently reallocated for concessional climate finance in the coming years prioritizing the adaptation needs of developing nations, prioritizing cumulative losses and damages due to the climate crisis.

Meanwhile, Eurodad urges penalizing “the private sector of the developed global north for failure to meet its carbon emission reduction” promises as it is responsible for over 90% of excess GHG emissions.

It has also called for “providing developmental space for developing countries” to progress, and re-orienting “the bank’s developmental model towards climate reparations”, especially for Africa, the least developed countries and small island developing states.

But the WB plan offers no major improvements, only more of the same. Instead, the WB should help the UN design and implement a comprehensive monitoring and reporting framework for all development and climate finance, including private finance.

By recognizing the international and intergenerational inequities of global warming, the WB can become far more equitable by ensuring all nations develop sustainably while addressing the climate crisis.

To do so, it will need to uphold ‘polluters pay’ and ‘common, but differentiated responsibilities’ principles, enshrined in international climate agreements.

Related IPS Articles

· Will Glasgow Fix Broken Climate Finance Promises?

· IMF, World Bank Must Urgently Help Finance Developing Countries

· World Bank Urges Governments to Guarantee Private Profits

· World Bank Urges Governments to Guarantee Private Profits

· World Bank’s ‘Mobilizing Finance for Development’ Not Financing Development

· Coping With World Bank-Led Financialization

· World Bank Financialization Strategy Serves Big Finance