Dear friends,

Greetings from the desk of Tricontinental: Institute for Social Research.

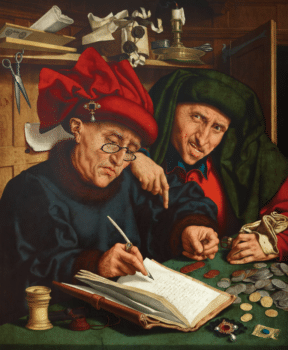

Quentin Matsys (The Netherlands), The Tax Collectors, c. 1525—1530.

Within the United Nations, there is a little-known debate about the status of global tax regulation. In August 2023, UN Secretary-General António Guterres released a draft document called ‘Promotion of Inclusive and Effective International Tax Cooperation at the United Nations’. This document comes out of a long debate led by the Global South about the unregulated behaviour of transnational corporations (especially the ways in which they avoid taxation) and about the fact that discussions regarding regulations have been dominated by Global North countries (notably those in the Organisation for Economic Cooperation and Development, or OECD, an intergovernmental platform largely made up of the richest countries in the world). In October of last year, the government of Nigeria spearheaded a resolution in the UN General Assembly (UNGA) that advocated for an international tax cooperation treaty and proposed that the UN take over jurisdiction of the debate about tax regulation. In December 2022, the UNGA passed the resolution, which asked Guterres to move forward with a report on the topic and develop a new international tax agenda.

Guterres’s August 2023 report affirmed the need for an ‘inclusive and effective’ tax treaty, arguing that the two-pillar solution laid out in the OECD and G20’s Inclusive Framework on Base Erosion and Profit Shifting is insufficient. The second pillar in this solution discusses the development of a global minimum effective tax on ‘excess profits’. However, this tax would be levied on a jurisdiction-by-jurisdiction basis, which would open the entire process to chaos. Furthermore, even though the OECD-G20 policy has been developed by a minority of countries, it is intended to become the global norm for all countries. Even when the OECD and G20 ask for inputs from other countries, Guterres writes, ‘many of those countries find that there are significant barriers to meaningful engagement in agenda-setting and decision making’. This, Guterres said, is unjust. The UN should be the site where a new international taxation treaty is created—not a site for arbitrary bodies such as the OECD and the G20 to impose their agendas.

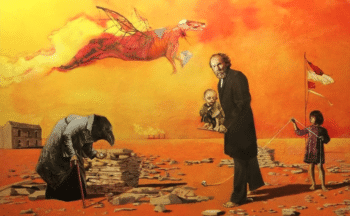

Arturo Rivera (Mexico), El Encuentro (‘The Meeting’), 2016.

To be fair, the OECD has developed a number of important proposals, including a global tax deal in 2021 that was agreed upon by 136 countries. However, due to pressure from transnational corporations (and the United States government), the implementation of this agreement was delayed until 2026. Nonetheless, leaks from illicit tax havens (such as the Paradise Papers, beginning in 2017, and the Luxembourg Leaks, beginning in 2014) brought the issue of regulating of financial flows to the fore, pressuring the OECD and the G20 to act on its promises. An outcome statement from the OECD in July 2023 put the issue back on the table, with the two-pillar tax regime coming into effect in 2024. This regime institutes a global tax of at least 15% on transnational corporations’ profits that exceed €750 million in each jurisdiction. Even here, the regulations offer transnational corporations a safe harbour until June 2028 through practices such as a simplified effective tax rate, a routine profits test, and a de minimis test—all instruments that require some accounting training to properly understand. In other words, the system designed to regulate transnational corporations merely creates business opportunities for global accounting firms that help these companies continue to shield their profits. In 2022, the main four accounting firms earned between $34 and $60 billion each in revenues, and Deloitte alone earned $64.9 billion in 2023 (a 9.3% increase since last year).

Wifredo Lam (Cuba), El Tercer Mundo, 1965—1966.

The Tax Justice Network’s annual report, published in July 2023, noted that the entire debate over taxes ‘boils down to one number: $4.8 trillion. That is how much tax we estimate wealthy corporations and individuals will avoid and evade over the next decade under the current direction of OECD tax leadership’. The data shows that ‘higher income countries lose the greatest amounts of revenue in absolute terms and also that they are responsible for the greatest share of the problem, globally’. The top ten contributors to global tax theft are, in descending order, the United Kingdom, the Netherlands, the Cayman Islands, Saudi Arabia, Luxembourg, Bermuda, the United States, Singapore, Ireland, and Hong Kong (it is worth noting that both the Cayman Islands and Bermuda are British territories). Lower income countries, however, ‘incur the most intense losses, losing by far the greatest share of their current tax revenues or public spending needs’. For instance, as the OECD report Tax Transparency in Africa 2023 shows, the continent loses up to $88 billion each year due to illicit financial flows. In its report, the Tax Justice Network issued a clarion call:

Countries have a choice to make: forfeit the money now, and with it our future, to the wealthiest handful of people in the world, or claim it, and with it a future where the power of the wealthiest corporations and billionaires, like the kings and barons before them, is reined in by the march of democracy. A future where tax is our most powerful tool for addressing the challenges our societies face and for building a fairer, greener, and more inclusive world.

In 1975, the United Nations established the Information and Research Centre on Transnational Corporations (UNCTC). Two interconnected events led to its inception: first, the UNGA’s passage of the New International Economic Order (NIEO) in 1974, and second, the coup against the Popular Unity government of Chilean President Salvador Allende in September 1973. By 1972, Allende had taken leadership of the process to create the NIEO to allow countries such as Chile sovereignty over their raw materials. Allende spoke forcefully on these issues at the UNCTAD III meeting in Santiago in April 1972 and at the UNGA in December 1972 (which we discuss in more depth in our dossier The Coup Against the Third World: Chile, 1973). The coup against Allende strengthened the will in the Third World to oversee and regulate transnational corporations such as the former telecommunications giant International Telegraph and Telephone Company (ITT) and copper firm Anaconda, both of which played a decisive role in the coup in Chile. The UNCTC was, therefore, the child of both the NIEO and the coup.

The UNCTC’s mission was straightforward: build an information system about the activities of transnational corporations, create technical assistance programmes that help Third World governments negotiate with these firms, and establish a code of conduct that these firms would need to abide by with respect to their international activities. The UNCTC, with thirty-three employees, did not begin its work until 1977. From the start, it found itself under pressure levied by the International Chamber of Commerce as well as various U.S.-based think tanks, which lobbied the U.S. government to prevent it from functioning.

Nonetheless, in its fifteen years of existence, UNCTC staff produced 265 documents that covered areas such as bilateral investment treaties and the social impact of transnational corporations. The UNCTC’s work was slowly inching toward creating a code of conduct for transnational firms, which would have hampered the ability of these firms to create a system of financial plunder through illicit financial flows (including transfer pricing and remittance of profits). In 1987, the UNGA urged the UNCTC to finalise the code of conduct and hold a special session to discuss the code.

That same year, the Heritage Foundation, based in the U.S., argued that the UNCTC had a ‘deliberate anti-West and anti-free enterprise motive’. In March 1991, the U.S. State Department sent a démarche to its embassies to lobby against the code of conduct, which it saw as a ‘relic of another era, when foreign direct investment was looked upon with considerable concern’. The session to finalise the code of conduct never took place. The U.S. pushed the incoming UN Secretary-General Boutros Boutros-Ghali to abolish the UNCTC, which he did as part of a broader UN reform agenda. This was the sunset of tax regulation. When the OECD picked up the mantle, it did so almost to ensure that a patina of liberalism would remain in place while transnational corporations operated in a largely lawless global environment.

In 1976, the radical Peruvian poet Magda Portal (1900—1989) wrote ‘A Poem for Ernesto Cardenal’ (a Nicaraguan poet). The poem acknowledged that inequality and misery had been in our towns for centuries, but that what the ‘transnational corporations and their henchmen’ are doing is worse. As she wrote:

In 1976, the radical Peruvian poet Magda Portal (1900—1989) wrote ‘A Poem for Ernesto Cardenal’ (a Nicaraguan poet). The poem acknowledged that inequality and misery had been in our towns for centuries, but that what the ‘transnational corporations and their henchmen’ are doing is worse. As she wrote:

On this side of America, you can feel the nauseating and toxic breath of those who only want our mines, our oil, our gold, and our food.

…

Never was more torment spread over the sleepless earth.

It was not more execrable to continue living without shouting at the top of

our lungs in a howl, the protest, the rejection, the demand for

justice. To whom?How can we continue living like this on a daily basis,

ruminating on food, loving and enjoying life when

hundreds of thousands of condemned people on

Earth are drowning in their own blood? And in Black Africa, with its apartheid

and its Sowetos, and in Namibia and Rhodesia, and in Asia,

in Lebanon and in Northern Ireland, on the rack

of the executed? Can we continue living like this

when a single scream of horror runs through

the vertebrae of the world?

Warmly,

Vijay