US lawmakers have introduced a bill that would bar U.S. mutual funds from investing in indexes that track Chinese stocks (Bloomberg). According to Bloomberg “The legislation targets mutual funds that invest in indexes tracking primarily Chinese stocks, rather than those investing in indexes that only include some Chinese companies, according to Sherman’s office. However, the lawmakers left it to the Securities and Exchange Commission to write rules that’d ultimately determine which products are impacted.”

In both Emerging Market and Asian (ex-Japan) share funds (e.g. VanEck MSCI Multifactor Emerging Markets Equity ETF and Fidelity’s MSCI All Country Asia ex-Japan Fund) Chinese stocks are the biggest component (between 25% and 35%). That’s more than just “some Chinese companies”.

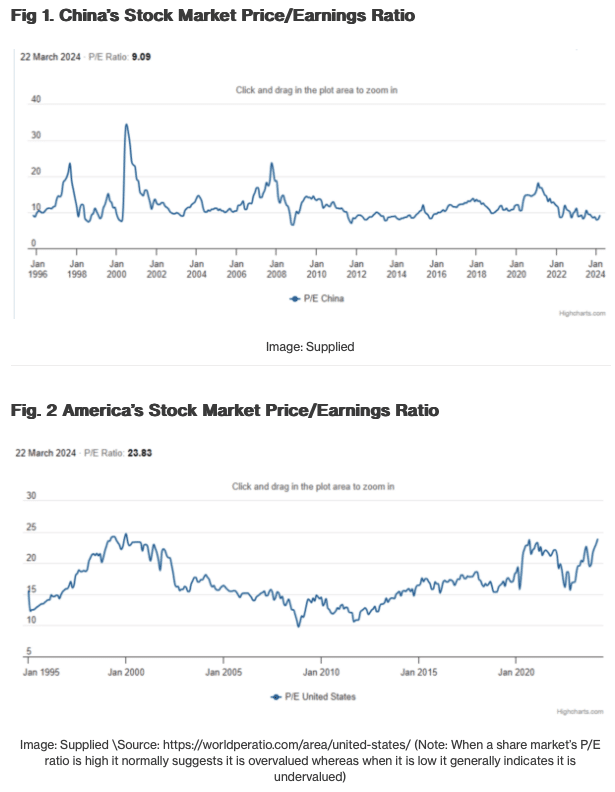

At present Chinese stocks are depressed so several analysts see them as good value on fundamentals such as share price to earnings and return on equity ratios. See Fig.1 below. To omit Chinese shares from a share fund portfolio would be to exclude the companies of the world’s second largest economy after the USA. It would also make global share indices more U.S. share oriented at a time when the U.S. share market looks extremely overvalued by historic standards. See charts below. See Fig.2 chart below.

Stopping U.S. mutual funds from having a major exposure to Chinese stocks would have a spillover effect globally including Australia because a lot of locally registered Asian stock funds are simply offshoots of U.S. based funds or are based on Asian asset allocation indices devised by MSCI, FTSE, S&P, Down Jones, and Morningstar. Also, global share funds allocate a portion of their assets to Chinese listed companies based on such indices.

The U.S. has clearly declared economic war against China by wanting to bar or hinder interaction with it on trade, investment, and technology. It cites security grounds, but most Chinese companies are involved in electronics, pharmaceuticals, energy, construction, finance, consumer goods, and transportation not defence industries.

Should the U.S. Congress approve the new bill (which seems likely since Sinophobia unites both Democrats and Republicans) it could affect both institutional and private investors such as industry and retail super funds, self-managed super funds, and private investment portfolios that use indexed funds to obtain investment exposure to large and profitable Chinese companies like Tencent, Alibaba, PetroChina, Bank of China and China Construction Bank. Since Australia’s prosperity depends on China’s economic growth not being interrupted, America’s move to stop investors buying a stake in successful Chinese multinational companies is not in our best interests.

Except for Australian owned Beta Shares Asia Technology Tigers ETF (exchange traded fund) which seems to use its own Asian share allocation index, other Asian share funds seem to base their share investment allocations on U.S. designed and proprietary share indices except for the FTSE indices. The FTSE Group is owned by the London Stock Exchange, but since it sells its portfolio indices to U.S. funds managers it could buckle to pressure to stop including Chinese shares in them.

Existing Australian based global share funds (ASX listed or unlisted) that invest in Chinese shares include Schroder All China Equity Opportunities Fund, iShares China Large-Cap ETF (ASX: IZZ), Van Eck’s China A50 ETF (ASX: CETF) and Magellan High Conviction (ASX: MHHT). Global share funds also allocate a portion of their share mix to Chinese companies—for example Vanguard Global Value Equity Active ETF (Managed Fund) (ASX: VVLU), Claremont Global Fund, Forager International Shares Fund, Hyperion Global Growth Companies Fund, and Munro Global Growth Fund. Should the bill pass, and the Securities and Exchange Commission deem any share fund or index with a significant exposure to Chinese companies to be illegal then the net would be cast wider than just specific China share funds.