Introduction

Despite the fact that China’s economy continues to far outgrow all major Western economies the Western media is energetically promoting a myth of “peak China”—i.e., that China’s economy either has or is about to drastically slow down. But examination of such assertions shows that they are either:

- “Fake news,” claims which are factually false or are alleged to be about to occur due to completely unexplained processes, or,

- Are based on the hope that China will commit “economic suicide”—by adopting policies which will drastically slow China’s economy.

This article analyses the errors in both claims. This then allows well-known genuine issues which face China’s economy to be assessed in a balanced way—these are real, and must be dealt with, but unless major economic mistakes are made will not lead to a sharp slowdown and failure of China to achieve its economic goals.

The real facts of international economic performance

Starting with the current situation, the fundamental facts of China’s economic growth in terms of international comparisons in early 2024 are the following—the details were given in an earlier article, “China’s economy far outgrew the U.S in 2023—but the United States was world leader in creating ‘fake economic news.’”

- In 2023 China’s economy grew more than twice as fast as the United States and around five times as fast as most G7 economies.

- In the period since the beginning of the pandemic China has far outgrown all other major economies—growing two and a half times as fast as the United States, five times as fast as Canada, and around seven times as fast as the other G7 economies.

- China’s growth is on target to achieve its strategic goal of doubling GDP and per capital GDP between 2020 and 2035.

Evidently the facts of this economic growth situation have not only domestic but huge international strategic implications. If the present medium/long term GDP growth rates of China and the United States continue—China’s at around 5 percent a year and the United States, at slightly over 2 percent—then between 2020 and 2035 China’s economy will grow by 100 percent and the U.S. economy by approximately 40 percent. In that case, China will become both a high-income economy by World Bank international standard and by 2035 a significantly larger economy than the United States. For the U.S. capitalist class, which thinks of the world economy as zero-sum game in which the United States must maintain unilateral domination, such outcomes are completely unacceptable.

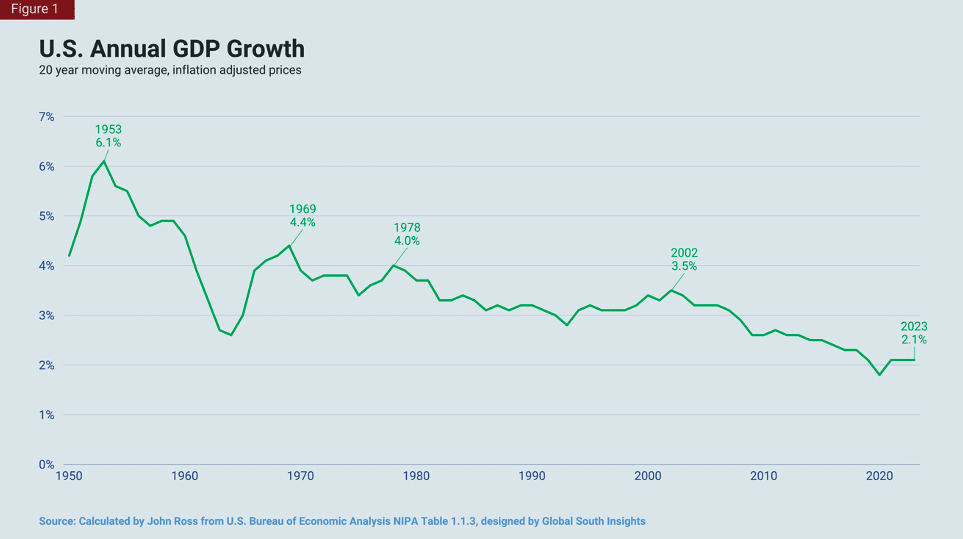

But, in dealing with this this peaceful economic competition, the United States has proved incapable of raising its own long-term growth. On the contrary, as Figure 1 shows, annual U.S. economic growth has been falling for seventy years, declining from 6.1 percent in 1953, to 4.4 percent by 1969, to 3.5 percent by 2002, and 2.1 percent by 2023. Therefore, as the United States has demonstrated inability to raise its own growth rate, the only way that it can outcompete China is by slowing China’s economy. This is, therefore, the purpose of the United States launching anti-China tariff wars, chip wars, the intense propaganda campaigns of “fake news” to attempt to dissuade foreign companies from investing in China etc. This U.S. response against China was predicted in advance in my book 一盘大棋:中国新命运解析.

The United States Slowed Germany, Japan, and the Asian Tigers

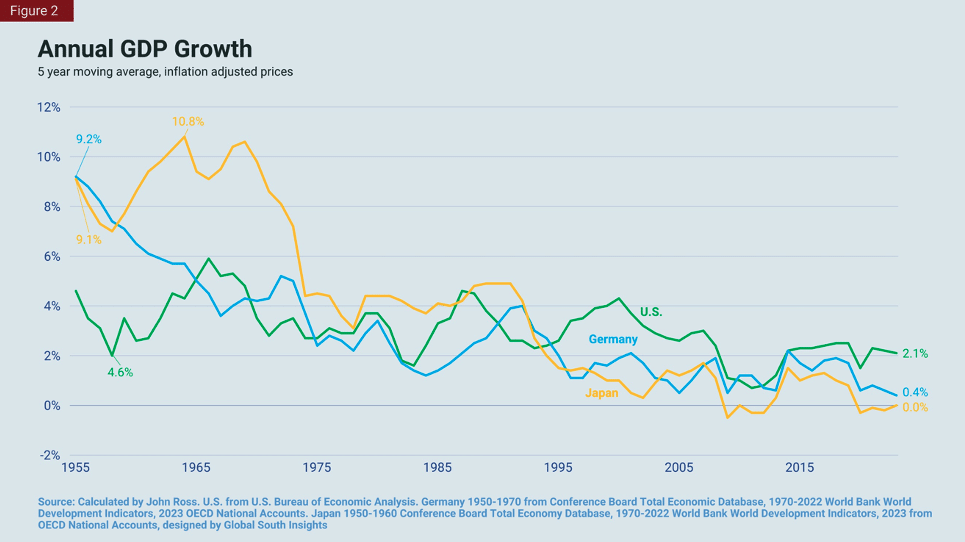

The reason it was possible in advance to predict the U.S. response was because it not only flowed from the fundamental features of the international economic situation but because the United States has great experience in maintaining its economic lead not by speeding up its own economy but by slowing competitors. To take the most important cases, in the 1960s the United States slowed Germany, in the 1970s and 1980s it slowed Japan, and at the end of the 1990s it slowed the Asian Tigers. As by far the most serious of those challenges to the United States was from Germany and Japan this development is shown in Figure 2—the Asian Tigers were too small to pose a significant overall competitive threat to the United States.

Taking a five-year moving average, to allow the timing of economic shifts to be seen more precisely, between 1955 and 2023 annual average U.S. economic growth fell by more than half, from 4.6 percent to 2.1 percent. But, nevertheless, despite its own economic slowdown, the United States succeeded in comprehensively defeating Germany and Japan by slowing their economies from annual average GDP growth rates of over 9 percent to 0.4 percent and 0.0 percent respectively. The precise means the United States used to slow Germany and Japan was analysed in detail in “The United States is trying to persuade China to commit suicide” and is considered again below.

Given this previous success, therefore, despite its own economic slowdown, the United States can try to have the same success by outcompeting China not via speeding up the U.S. economy but by slowing China’s.

The United States Can’t Murder China So It Has to Persuade it to Commit Economic Suicide

But, the strategic problem for the United States is that there is a fundamental difference between the way that it economically defeated Germany, Japan and the Asian Tigers and the way that it is forced to attempt to defeat China. Germany, Japan, South Korea etc were all militarily dependent on the United States. By threatening to reduce that military support, unless U.S. demands were complied with, the United States could force these countries to adopt policies which slowed their economies below the U.S. growth rate. In the case of the Asian Tigers this was supplemented by U.S. control of the IMF—which imposed extremely damaging policies on them when they fell into the United States could therefore use these external means of pressure to “murder” the economies of Germany, Japan, and the Asian Tigers.

But China is not subordinate to the United States militarily, and it faces no debt crisis forcing it to rely on a United States-controlled IMF—on the contrary, as analysed below, China international financial position is extremely strong, including having the world’s largest foreign exchange reserves. The tariff and chip wars launched by the United States, while they cause some short-term problems, are far too weak to slow China’s economy in the way that was done to Germany, Japan and the Asian Tigers—as will be demonstrated. Therefore the United States has no equivalent way to “murder” China. Instead, the United States can only attempt to persuade China to commit “suicide”—that is, to persuade China to adapt damaging policies that will drastically slow down its economy. The character of policies that would cause China’s to commit “economic suicide” are analysed below.

Western Claims That China’s Economy Is About to Drastically Slow Down

These facts of economic growth up to the beginning of 2024 therefore show clearly that claims made in the Western media—such as in the Financial Times that China’s economy is “losing share to its peers,” the Wall Street Journal’s that “China’s economy limps into 2024” whereas the United States was marked by a “resilient domestic economy,” the Daily Telegraph’s China has a “stagnant economy,” or the Washington Post’s “in the United States… the surprisingly strong economy is outperforming all of its major trading partners”—are all “fake news.” Literally factually untrue and merely false propaganda.

But because such claims on the present performance of China’s economy cannot stand up to factual examination, there is another long-practiced line of attack which is being attempted in the West to claim “peak China.” This is to assert that China’s economy is “soon” to enter a very sharp slowdown—the “soon” always being in the future of course! There is indeed an entire minor industry of such claims symbolised by Gordon Chang’s notorious 2001 book “The Coming Collapse of China”—i.e., predictions that China is “soon”/”about” to enter a deep crisis resulting in a collapse in its growth rate. Such predictions are invariably then carefully forgotten about when they do not occur—which does not prevent the Western media hailing the person who made such entirely inaccurate predictions as being a “China expert.” The latest rash of such predictions, analysed below, are therefore nothing new but are part of a long factually false record.

“Fake News” and “Economic Suicide”

As will be seen, when such Western claims are examined what is striking is their lack of coherence and in some cases, once again, their straightforward factual falsification. More specifically, such claims can be divided into two broad types:

- First are assertions about the objective situation—claims that forces exist that will compel a sharp slowdown in China’s economy. But, as will be seen, examination shows such assertions about the objective situation are simply forms of “fake news”—factually false or factually unsubstantiated. For example, such “fake news” regarding objective processes include: (i) claims that China’s economy faces the risk of deep financial crisis, made by Moody’s rating agency; (ii) claims of major economic slowdown due to processes which, when they are factually analysed, are not nearly powerful enough to produce such a deceleration—those regarding demography, made by Moody’s and others, and sometimes echoed in the claim that “China will grow old before it grows rich”; (iii) claims that for entirely unexplained reasons, a collapse in the efficiency of China’s investment is about to occur—made by the IMF.

- The second type of claims are not those regarding objective trends but regarding subjective decisions which will allegedly be taken by China which will drastically slow its economic development. In one sense these are more coherent than the pure factual “fake news,” as they describe processes which if they did occur would actually produce a serious slowdown in China’s economy. But examination reveals the strange situation that such analyses are based on “self-fulfilling prophecies”—that is, China’s alleged coming economic slowdown turns out to be caused by the policies which these reports propose should be adopted! However, why China would adopt policies drastically slowing it own economy, that is China should commit economic suicide, is never coherently explained.

In the analysis which follows, to avoid any suggestion that merely peripheral voices in the West are being examined, that is a “straw man” is being demolished, only reports and analyses by central Western institutions or media will be analysed. These will be by the Moody’s rating agency, the IMF, Martin Wolf, chief economics commentator of the Financial Times and Goldman Sachs—the arguments of all of these are, unfortunately, sometimes echoed in some sections of China’s media.

While some of these issues may sometimes appear “dry” and “numerical,” as will be seen they in fact analyse the questions which will determine whether China will achieve its strategic goals. This is because no country, including China, nor Western economic commentators, has the power to escape either the laws of economics or those of arithmetic.

In what follows:

- In Part 1 “fake news” claims that objective factors will force a drastic slowdown China’s economy will be analysed.

- In Part 2 proposals for China to commit economic suicide will be examined.

- In Part 3 the motivations and consequences for these attacks on China will be considered.

Part 1. Fake News Claims That China Will Not Achieve Its Economic Targets

Moody’s False Claim of the Risk of a Major China Financial Crash

Turning to specific assertions that China’s economy will sharply slowdown, one of the most recent major attempts to claim that is by the Moody’s rating agency, allegedly related to the risk of a serious financial crisis in China—Moody’s recently downgraded China’s government credit rating from “stable” to “negative.”

Unfortunately for Moody’s, to attempt to justify its position it is forced to make factual statements which allow its claims to be tested and therefore its own credibility to be judged. Specifically, it states in the release justifying its position: “Moody’s expects that China’s annual GDP growth will be 4.0 percent in 2024 and 2025, and average 3.8 percent from 2026 to 2030, with structural factors including weaker demographics driving a decline in potential growth to around 3.5 percent by 2030.” As this is a clear and specific prediction, and as will be seen a wrong one, it allows Moody’s analysis to be tested against the facts as they unfold.

Moody’s prediction is evidently in direct contradiction to the positions of China’s government of doubling GDP between 2020 and 2035. But clearly a major financial crisis, lying behind a claim that China’s government would be unable to pay its debts, would drastically slow China’s economy. But is there in fact any credible risk of this?

To assess this, before dealing with Moody’s other errors, first consider the legitimate activity of a credit rating agency such as Moody’s. This should be to conclude whether the institution being evaluated, in this case China’s government and its debts, will meet the commercial terms it has agreed to. Regarding debt this means that the debt will be paid in full, at the specified time, and with the conditions agreed to when the contract was entered into.

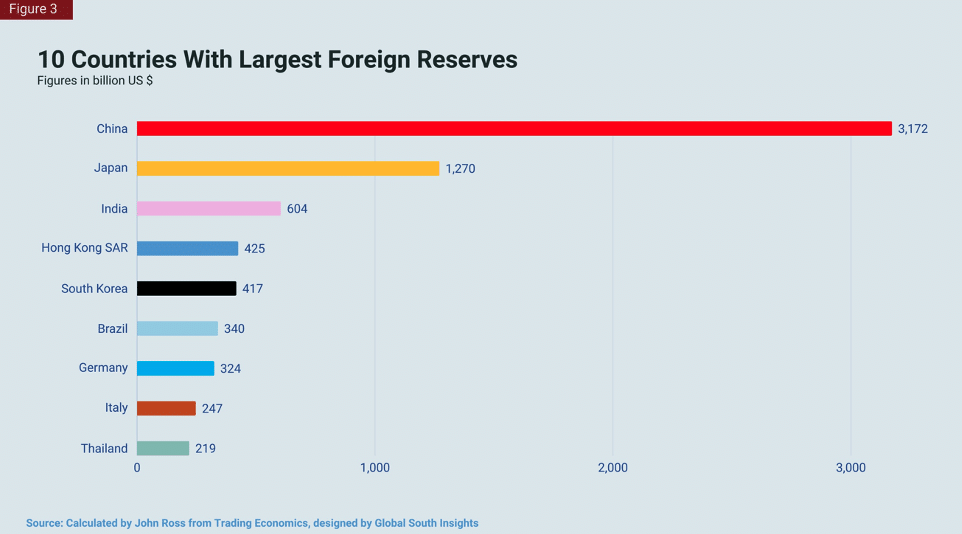

To judge China’s government’s ability to service debts in this fashion consider its financial position. Starting with the possibility to service international payments, China’s state foreign exchange reserves are, at the time of writing, $3.2 trillion, by far the world’s largest—second placed Japan having $1.3 trillion and India’s $0.6 trillion (See Figure 3). In comparison, Germany, given Moody’s highest rating of Aaa, has only $0.3 trillion foreign exchange reserves.

With such reserves China’s government has not the slightest problem in meeting any foreign debt—any lender to China’s government can be paid in full, on the date specified, on the terms agreed.

Nor is there any significant competitive downward pressure on China’s foreign exchange reserves—in the first nine months of 2023 China’s balance of payments surplus was $209 billion.

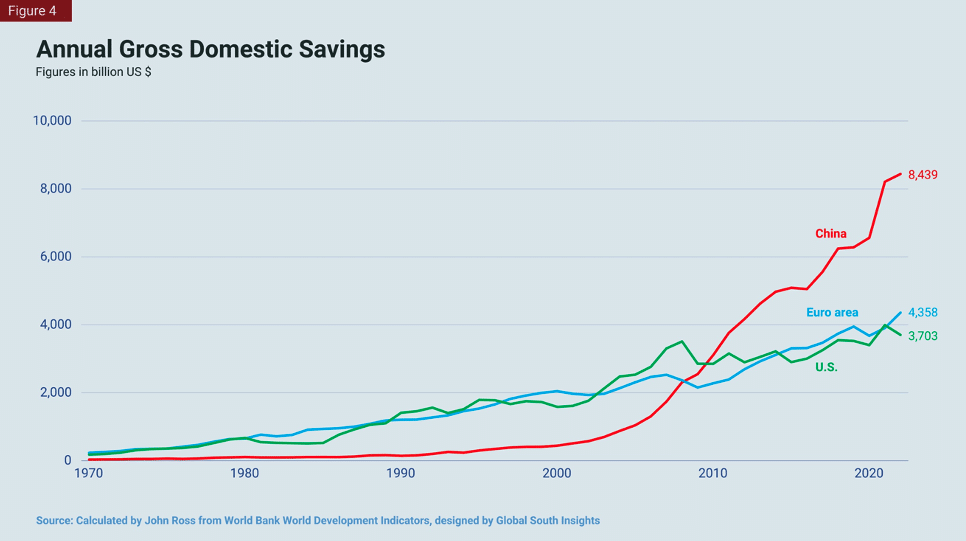

Domestically, complementing these international reserves is the gigantic lead of China compared to any other country in domestic savings—i.e., capital creation. Figure 4 shows that the annual pool of capital creation in China has no even near equal in any other country. Taking the latest available World Bank data, China’s $8.4 trillion annual savings were more than twice the United States’s $3.7 trillion. China’s annual pool of capital creation is greater than that of the United States plus the Euro area’s $4.4 trillion combined.

In summary both the foreign and domestic capital and financial resources of China are unequalled by other countries.

Put in fundamental qualitative terms, as as well as the quantitative ones above, as Martin Wolf who, as will be seen is a critic of China, noted: “The danger is not one of a huge financial crisis,” because, in addition to the points above, “China is a creditor country; its debts are overwhelmingly in its own currency; and its government owns all the important banks.” Moody’s therefore produces no serious evidence whatever that that there will be a major financial crisis capable of slowing China’s economy in the way that it predicts.

The Fallacy of Moody’s Claims on the Effects of China’s Demographics

Turning to Moody’s other claims regarding the alleged coming sharp slowdown in China’s economy, it clearly has to give some explanation of why this will occur. Apart from the (non-existent) threat of a major financial crisis, the other specific reason which Moody’s mentions, population change (demographics), doesn’t add up, as anyone who has looked at the figures can easily find out. This is because, contrary to factually unfounded claims, increases in labour inputs play an extremely small role in China’s growth. As Moody’s is the factually false thesis known in China as “China will grow old before it grows rich” it is worth analysing this in detail.

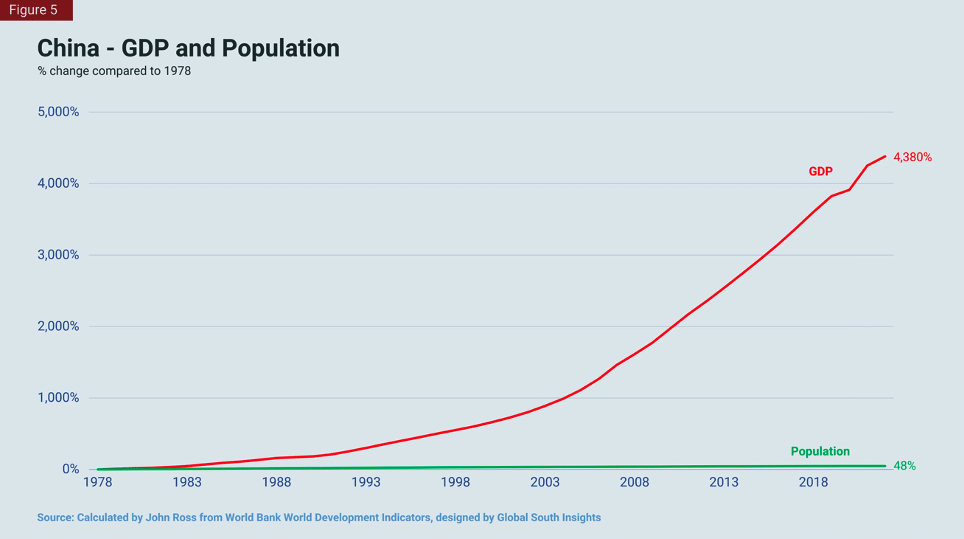

To understand clearly the quantitative realities, first make a fundamental “back of an envelope” qualitative calculation. From 1978 to 2022, as Figure 5 shows, China’s GDP increased by 4,380 percent while its population increased by 48 percent. China’s annual average GDP growth in 1978 to 2022 was 9.0 percent while China’s annual average population increase was 0.9 percent. In summary, annual GDP growth of 8.1 percent, that is 90 percent of the total, was not accounted for by population growth.

Turning to future forecasts, the UN estimates that China’s internationally defined working age population will decline by 0.4 percent a year between 2022 and 2035. Even if no countervailing measures were taken then this would clearly not produce the decline in GDP growth rate of 1.5 percent a year—from 5.0 percent in 2023 to 3.5 percent by 2030—which Moody’s projects. But, in reality, there are quite clearly countervailing measures which can be taken of which China’s government is quite aware.

Most directly, China has one of the world’s lowest retirement ages—60 for men, 55 for white-collar women workers and 50 for blue collar women workers. This is because these ages were set soon after the establishment of the People’s Republic of China—and in 1949 China’s life expectancy was less than 50 whereas now it is over 78. This retirement age is bound to increase, as the government has indicated—a measure raising the number of hours worked in the economy.

Labour and Growth Accounting

Turning from these fundamental parameters to more precise measurements, made for the purposes of accurate GDP growth accounting, it is necessary to analyse not only the decline in the total time/hours worked in the economy due to population changes (in technical terms labour quantity) but also the increase in the value of labour output due to increases in education, training etc (in technical terms labour quality).

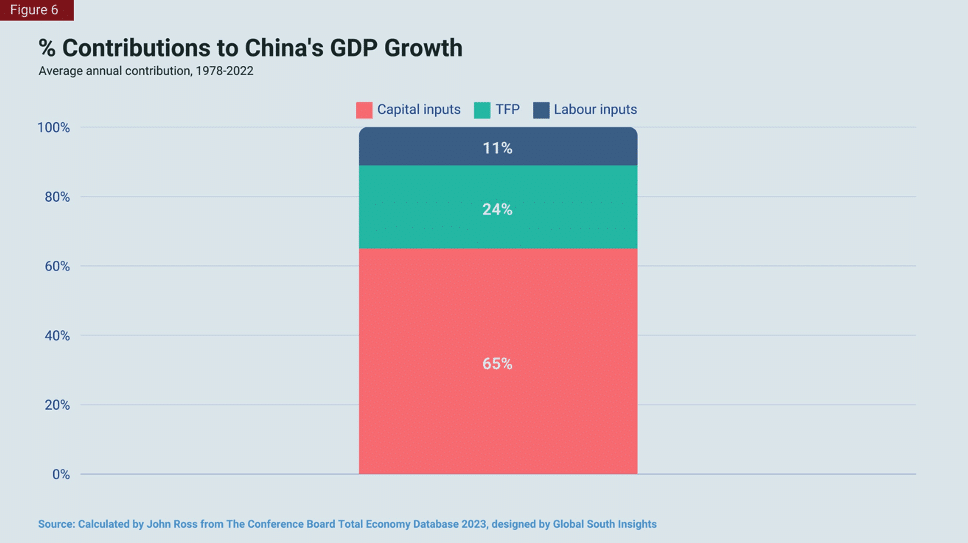

Taking first labour quantity, the Conference Board’s detailed growth accounting study shows that in the entire period since the launching of China’s economic reform in 1978 on average 1.0 percent a year of China’s GDP growth was due to increased labour inputs. But as China’s annual average GDP growth in 1978-2022 was 9.0 percent such detailed study means that only 11 percent of China’s GDP growth came from increased labour inputs and 89 percent from other causes as Figure 6 shows—i.e., precise growth accounting gives only marginally different figures to the qualitative “back of an envelope” calculation already noted.

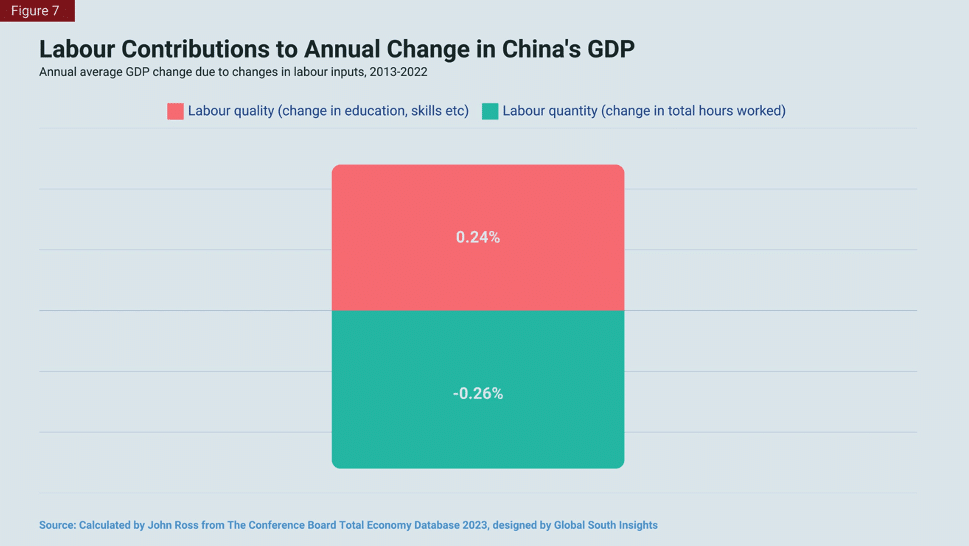

Turning to the most recent period, the last 10 years, the decrease in the contribution to GDP growth caused by the fall in the annual number of hours worked in China, an annual average 0.26 percent, has been almost entirely offset by the increase in the value of labour contribution to GDP growth due to higher education, skills etc—an annual average increase of 0.24 percent. Therefore, in the last 10 years, on average a miniscule -0.02 percent a year of downward pressure on China’s annual GDP growth has been due to a decline in labour inputs—essentially zero percent (see Figure 7).

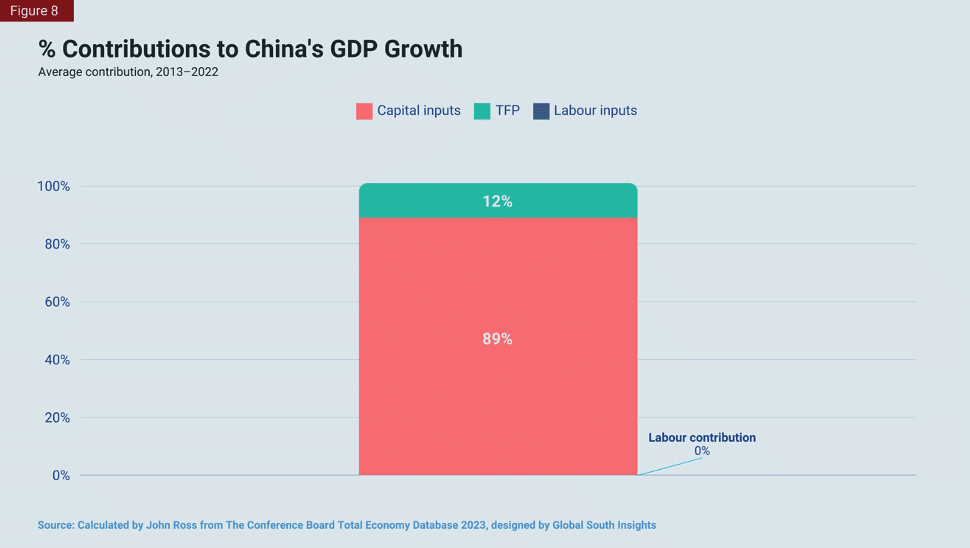

China’s Economic Growth Is Due to Investment and Total Factor Productivity Not Labour Growth

The above data, therefore, makes clear that almost all of China’s growth was due to capital investment and total factor productivity increases, with only a very low percentage being due to labour inputs—as Figure 8 shows. In the last 10 years, from 2013-2022, rounding decimal points, capital inputs accounted for 89 percent of China’s GDP growth, TFP for 12 percent, and labour inputs for 0 percent. As labour inputs play such a small role in China’s growth the fact that they are not growing, or may shrink slightly, will not lead to any slowdown of China’s growth on anything remotely like the scale claimed by Moody’s.

To conclude this point, as Martin Wolf notes, even if China did not take any countervailing measures: “if output per worker rises fast enough, growth in GDP per head could still be quite swift.” And, most immediately regarding present issues:

note that China’s… problem today is high youth unemployment… That indicates too little demand for labour, not those dreaded labour shortages.

Given the arelatively small role played by changes in labour inputs in China’s GDP growth, if its economy is to slow on anything like the scale Moody’s projects, then this must be due to some other factor—a huge decline in investment, productivity, or capital efficiency. For none of these does Moody’s present any evidence justifying a prediction that China’s growth rate will fall to the levels it claims.

Finally, it may be noted that Moody’s has a track record in inaccuracy in ratings. Prior to the U.S. subprime mortgage crisis it rated mortgage-backed securities and collateralized debt obligations (CDOs) based on “non-prime” mortgage loans as investment grade. As was noted even by Bloomberg, the highest ratings, including triple-A, were given to pools of debt that included over three trillion dollars of loans to homebuyers with bad credit and undocumented incomes up to 2007. However, hundreds of billions of dollars’ worth of these triple-A securities were downgraded to “junk” status by 2010, and the write downs and losses amounted to over half a trillion dollars. This contributed significantly to the financial crisis and the subsequent recession.

In summary Moody’s is a totally unserious and unquantified position when claiming that such a major event, not only for China but for the whole world economy, as a huge slowdown in China’s economy is going to take place.

How to Analyze the IMF’s Prediction of a Sharp Slowdown in China’s Economy

Turning from Moody’s unserious, because unquantified, analysis other attempts to claim that China’s economy will undergo a major slowdown at least have the merit of attempting to contain precise numbers. But this then creates the problem that these systematic numbers reveal the lack of realism of the analysis.

The first example of such analyses which will be considered is by the IMF—in the data published accompanying its October 2023, World Economic Outlook (WEO). The database accompanying this projects a sharp deceleration in China’s GDP growth—from 5.0 percent in 2023, to 4.2 percent in 2024 and to 3.4 percent by 2028. Therefore, China’s economy is projected to slow by 1.6 percent a year, that is by almost a third, in the next five years.

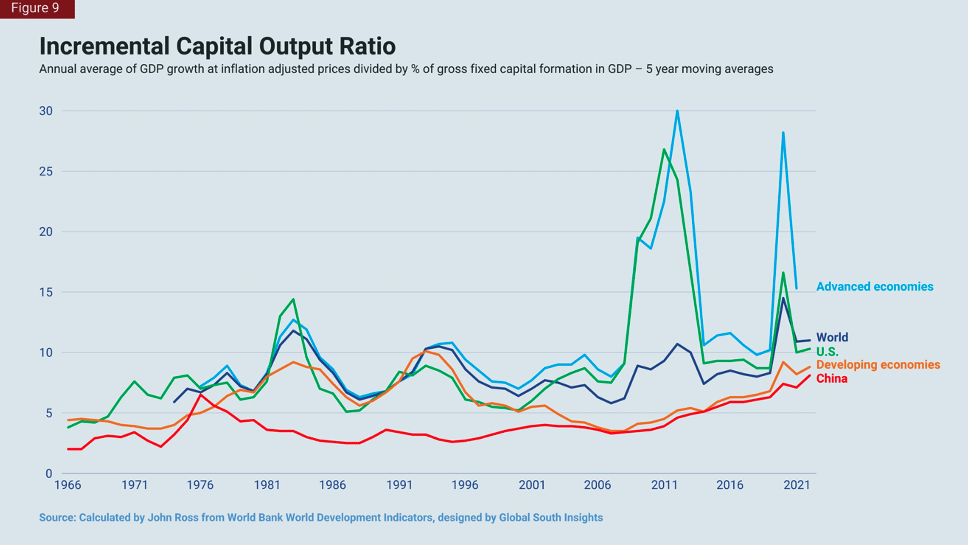

Grasping in the most systematic fashion what the IMF is claiming will occur is made most clear by understanding a little very simple quantitative economics. This notes that every economy’s growth rate is necessarily strictly numerically determined by the interrelation of only two fundamental numbers.

- First, the percentage of fixed investment in GDP.

- Second, the efficiency of that fixed investment in generating GDP growth.

In technical terms the second of these numbers is an economy’s “Incremental Capital Output Ratio” (ICOR)—ICOR is the percentage of fixed investment in GDP which is necessary to create one percent GDP growth. The lower the ICOR, therefore, the more efficient fixed investment is in creating growth. For example, an ICOR of 6, that is 6 percent of GDP has to be invested to generate 1 percent GDP growth, is more efficient than an ICOR of 10—10 percent of GDP must be invested to generate 1 percent GDP growth.

It should also be noted that because economic output fluctuates during business cycles more sharply than does the percentage of fixed investment in GDP this can produce very irregular changes in ICOR in individual years. To understand the medium/long term trends in an economy’s development, therefore, it is better to use averages of years for both GDP growth and the percentage of fixed investment in GDP—here five year averages are used unless otherwise specified.

China’s Current ICOR and Growth Rate

Given these facts, an economy’s growth rate of GDP is inescapably and strictly determined by the relation between the economy’s percentage of fixed investment in GDP and its ICOR in accord with the simple formula:

Annual increase in GDP = percentage of fixed investment in GDP x ICOR.

To give current figures for China, in the five years up to 2022 China’s annual average GDP growth rate was 5.2 percent and its percentage of fixed investment in GDP was 42.4 percent—giving an ICOR of 8.1. Data is not yet available for 2023 to calculate this exactly but, from the data on the composition of GDP growth which has been published, China’s fixed investment will have been around 40 percent of GDP or slightly above and with a GDP growth of 5.2 percent its ICOR will therefore again have been around 8.

As the above are strictly defined relations, which cannot be escaped by any method or by any country, any serious claim that China’s economic growth is going to substantially fall necessarily means that one, or both, of the following must take place

- Either, China’s ICOR will worsen—i.e China’s fixed investment will become much less efficient in producing economic growth, or:

- The percentage of fixed investment in China’s GDP will fall.

If neither occurs then the economy will not slow.

Any projection for growth which does not specify both the figure for the percentage of fixed investment in GDP and the ICOR is therefore not properly quantified and is consequently unserious from the point of view of economic analysis—a feature of most Western reports and those in sections of the Chinese media that repeat them, as will be seen below.

The IMF’s Entirely Unexplained Prediction of a Collapse in the Efficiency of China’s Investment

Noting this necessary and inescapable economic relation, it is then possible to see precisely what the IMF is predicting when it claims China’s economy will sharply slowdown—from the IMF’s projected 5.0 percent annual growth rate in 2023 to 3.4 percent in 2028.

To start assessing this, it should be noted that It is clear that such a deceleration would have not only severe implications for China, meaning that its goal of doubling GDP by 2035 could not be met but also, given China’s role in the international economy, it would have major implications for the world. It is therefore obligatory that such a major event, with global implications, should be given a thorough explanation by the IMF.

It is simple to calculate from the IMF’s database what it is projecting will occur. But whether the IMF itself realises this is an unanswered question—as in the WEO publication itself there is no sustained discussion of such a fundamental prediction not only for China but for the world economy. This is a completely unserious way of making such a major prediction—raising the possibility that the IMF does not even know that it is making it, which is completely unserious

Examining the WEO database, however, makes clear which of the possibilities discussed above the IMF is projecting: the IMF is claiming that in the next five years there will be a tremendous collapse in the efficiency of China’s investment.

It is quite possible to calculate this in precise quantitative terms.The IMF does not publish projections for the share of fixed investment in China’s GDP, but it does publish figures for the percentage of total investment in GDP—i.e., for fixed capital formation plus changes in inventories. However, within this total figure fixed investment is totally dominant—World Bank data shows it accounts for an average 97 percent of China’s total investment in the last 10 years. The IMF’s figure for total investment may therefore be taken as a close proxy for fixed investment.

In precise numbers, the IMF projects China’s annual total investment will fall from 43.5 percent of GDP in 2022 to 41.7 percent in 2028—a decline of 1.8 percent of GDP. Assuming that fixed investment accounts for 97 percent of total investment this then implies only a small fall in the share of fixed investment in GDP—from 42.2 percent to 40.4 percent. This, together with the predicted figure for GDP growth, means that the IMF’s projection for China’s ICOR may easily be calculated. Taking the IMF’s figures:

- For 2023 China’s share of fixed investment in GDP is 42.2 percent. Dividing this by the IMF’s predicted 5.0 percent GDP growth gives an ICOR of 8.4.

- For 2028 the share of fixed investment in GDP is 40.4 percent. Dividing this by the IMF’s projected 3.4 percent GDP growth gives an ICOR of 11.9.

Therefore, the IMF is making a quite unambiguous projection that during the next 5 years the efficiency of China’s fixed investment in creating GDP growth will fall by almost a half—41 percent to be precise. Almost all, 87 percent, of the slowdown in China’s economy projected by the IMF is due to this worsening of ICOR—0.2 percent of the decline in GDP is due to the projected fall of the percentage of fixed investment in GDP and 1.4 percent is due to the worsening of ICOR. Therefore, the IMF is claiming that in the next five years the drastic slowdown in China’s economy which it claims will occur is due to a collapse in investment efficiency.

The High Efficiency of China’s Investment in Creating GDP Growth

The facts show that such a collapse in China’s investment efficiency would represent a complete transformation in the situation of China’s economy—because at present, and in the entire last decades, China’s fixed investment has been one of the world’s most efficient in generating economic growth. Concealing this—it does not matter whether deliberately or by failing to make calculations—is one of the most frequent factual falsifications, the “fake news” made in Western analyses. In contradiction to the clear facts, such reports claim the opposite of reality, and that China’s investment is inefficient in creating economic growth. They are forced to do so for reasons analysed below. So it is necessary to start by clearly establishing the facts against such factual falsifications/”fake news.”

Starting by taking some typical entirely false Western claims:

- Business Week claims: “It takes $5 to $7 of investment to generate a dollar’s worth of gross domestic product in China, versus $1 to $2 in developed regions such as North America, Japan and Western Europe.”1

- Western economic analyst Charles Dumas claims: “China is incredibly good at wasting savings through misallocating investment.”2

- Ruchir Sharma, chair of Rockefeller International asserts: “China now has to invest $8 to generate $1 of GDP growth… the worst of any major economy.”3

- Martin Wolf claims China is engaged in “wasteful investment.”4

- Michael Pettis states China’s system “allows non-productive investment to be sustained”5

The reality is entirely the opposite to such claims. Among the world’s 20 largest economies China ranks second in efficiency of ICOR—the comparative data is listed in “Why China’s socialist economy is more efficient than capitalism.” Even more comprehensively, in order to precisely assess this high efficiency of China’s investment, it should be noted that on average ICOR rises with increasing economic development—due to the increasing capital intensity of production or, in Marxist terminology, due to the rising organic composition of capital. To show this, taking the latest available World Bank data for international income groups and countries, the average ICOR for high income economies was 15.3, for the world 11.0, for developing economies 8.8 (see Figure 9). As Figure 9 shows, given China is one of the world’s most developed developing economies, on the verge of transition to a high income economy, it is therefore particularly striking that China’s ICOR is actually lower not only than the world average but also the average for developing economies—China’s ICOR is 8.1. What is notable, therefore, is the extremely high efficiency of China’s investment in generating economic growth. Further details and wider comparisons of ICOR are in “Why China’s socialist economy is more efficient than capitalism.”

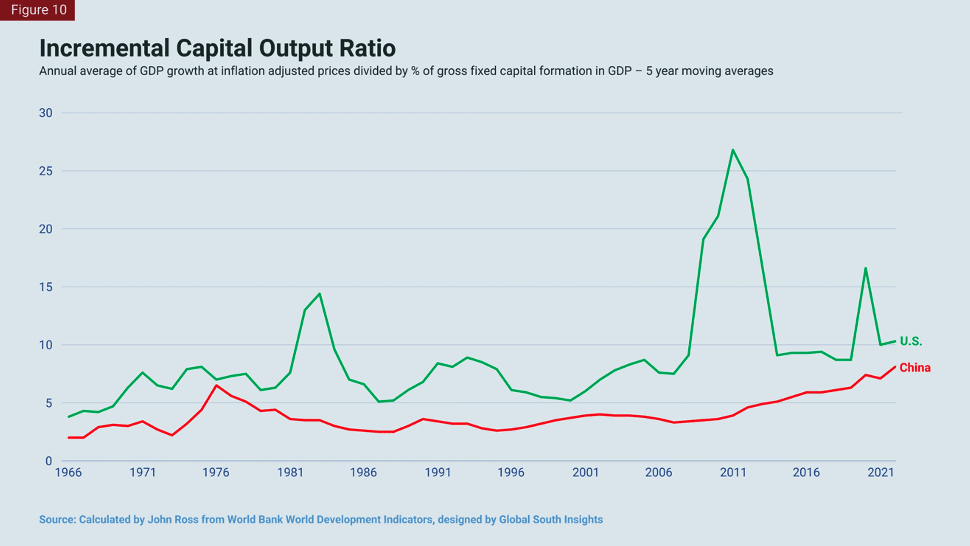

Finally, as an aside on this point, because it is the most frequently made international comparison, it may be noted that China’s ICOR is lower than the United States—with ICORs of 8.1 for China and 10.3 for the United States (see Figure 10). That is, China’s investment is more efficient than the U.S. creation of economic growth—the exact opposite of the claims cited above.

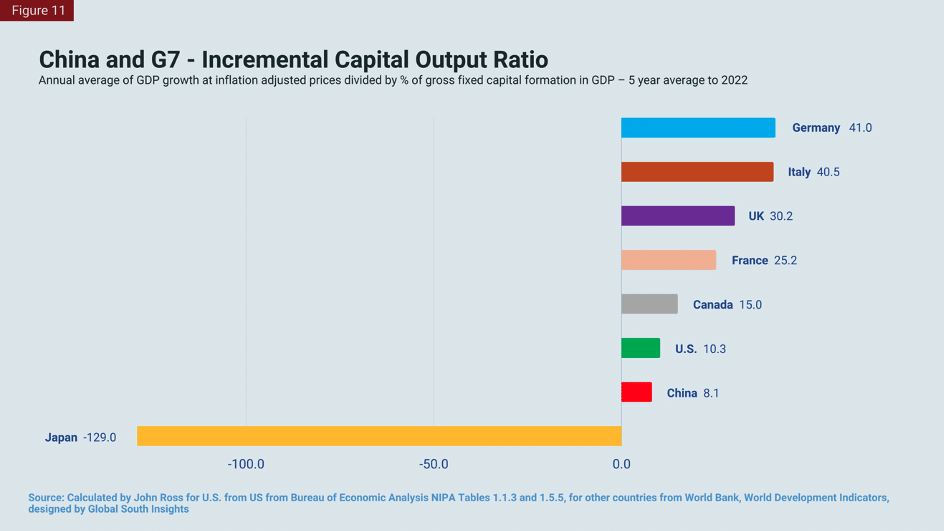

Figure 11 then shows the comparison of China’s ICOR compared to other G7 economies. It may be clearly seen that China’s greater efficiency of ICOR compared to other G7 economies is even greater than its lead over the United States—China’s ICOR is 8.1, the United States’s 10.3, Canada’s 15.0, France’s 25.2, Italy’s 40.5, and Germany’s 41.0 (Japan’s ICOR was negative—that is despite investment its economy shrinks).

In summary, therefore, by predicting, for unexplained reasons a collapse in the efficiency of China’s investment in creating GDP growth the IMF is projecting a total change in the world economy: China would go from having one of the most efficient investments in the world in generating GDP growth to this collapsing. But the IMF gives no explanation of why such an extreme change is going to take place! This is completely unserious.

In summary, the claim that China’s investment is inefficient in creating GDP growth is pure “fake news,” the exact oppositie of the truth, and the IMF’s claim that the efficiency of China’s investment is about to collapse is given no explanation.

Part 2. Western Calls for China to Commit Economic Suicide

Goldman Sachs and Martin Wolf

In Part 1 reasons for the claimed drastic slowdown in China’s economy have been analysed that rely on claims regarding objective forces that are factually unserious—“fake news.” It turns out they are either:

- Factual falsifications—e.g. claims regarding the efficiency of China’s investment in producing economic growth.

- They would not produce the claimed result even if true—e.g. population changes,

- Or they rest on entirely unexplained claims—the IMF’s assertion of a coming collapse in China’s investment efficiency.

None of these claimed objective forces, therefore, would drastically slow China’s economy—they are all “fake news.”

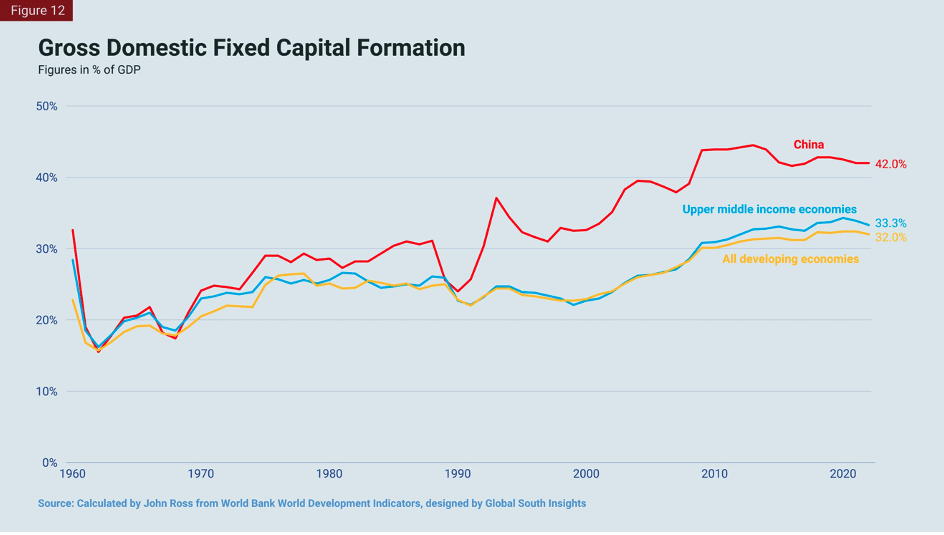

There is, however, an alternative line of attack claiming that China’s economy will drastically down which ascribes this not to objective but to subjective factors—policy decisions. This is a claim that China should and will adopt policies which will drastically slow its economy. Unlike the earlier claims regarding objective processes these are at least seriously quantified—i.e., if they occurred they would lead to a really serious fall in China’s growth rate and failure to reach its economic targets. But to implement them requires China agreeing to adopt policies that would drastically slow its economy—that is, to commit economic suicide. To be precise this is the proposal that there should be major increase in the share of consumption in China’s GDP—the necessary consequence of which, as consumption and investment together make up 100 percent of the domestic economy, is that there be a major reduction in the percentage of investment in China’s economy.

The economic consequences of such a step in slowing China’s economy may be immediately understood through the inescapable economic relations already noted. It was already seen that an economy’s growth rate is necessarily strictly determined by the figure for its ICOR multiplied by its percentage of fixed investment in GDP. Therefore, the alternative way to predict a sharp fall in China’s growth rate, in contrast to the IMF’s mysterious claim that there is going to be a collapse in the efficiency of China’s investment, would be to sharply cut China’s percentage of investment in GDP. This is approach adopted by Goldman Sachs and Martin Wolf.

Goldman Sach’s Prediction of China’s Drastic Economic Slowdown

Starting with Goldman Sachs latest report on China’s economy, this predicts an essentially parallel pattern of slowdown to the IMF: “China’s growth rate will slow to 3.5 percent by 2027 and 2.5 percent by 2032 for a 10-year annualized growth rate of 3.4 percent.”6 Goldman Sachs reasons for predicting this, however, is a claim that the proportion of China’s economy used for fixed investment will be sharply reduced. This was analysed in full detail in detail in “’Peak China’—a new low in Western attempts to persuade China to commit suicide” so simply the main points will be recapitulated here.

According to Goldman Sachs calculations, China’s GDP growth will fall from its annual average 6.0 percent in 2013-2022 to 3.4 percent in 2023-2032—i.e., a decline of 2.6 percent. But this fall is virtually exclusively due to the fact that Goldman Sachs projects that the annual increase in China’s GDP growth created by capital investment will decline from 4.8 percent to 2.4 percent.7 This fall in capital investment accounts for 92 percent of the projected decline in the GDP growth rate.Only 8 percent of the decline the Goldman Sachs report projects, or 0.2 percent GDP growth a year, is attributable to other factors. The reason for this fall in the contribution of capital investment to China’s GDP growth is because Goldman Sachs says that: “Investment as a share of GDP is forecast to decline from 42 percent in 2022 to 35 percent by 2032.”8

A similar claim to Goldman Sachs, that China should lower its level of fixed investment to approximately this, or even lower, levels is made by Martin Wolf who states: “A savings rate of, say, 30-35 per cent of GDP would be enough.” If China’s balance of payments were in rough balance, a position Martin Wolf supports, that would also mean China having an investment level of 30-35 percent of GDP.

From the basic relation already noted determining an economy’s growth rate, certainly a 7 percent of GDP decline in the percentage of investment in GDP, if China’s ICOR remained the same, would lead to a big fall in China’s growth rate. But why should China carry this out? Why should China commit economic suicide by such a huge cut in investment?

Goldman Sachs believes that the reason that China will cut investment in this economically suicidal way, is because average “investment as a share of GDP in upper-middle-income countries is 34 percent.”9 The latest World Bank data on this, an average 33 percent of fixed investment in GDP in upper middle income economies, essentially in line with Goldman Sachs figure, is shown in Figure 12.

But, first, this is a bizarre logic. China’s economic growth has far outperformed other upper-middle-income economies, so why should it wish to abandon a path which has been the most successful among developing countries and adopt one that has been less successful? On the contrary the logical thing would be that other upper-middle-income economies should adopt China’s path.

The Real Macroeconomic Structure of Developing Countries

Furthermore, it is clear Goldman Sachs have not even thought through their international comparisons properly. The reason for this is that China itself, at present, belongs to the ranks of upper middle-income economies. The only reason the level of fixed investment in GDP in upper middle incomes economies is as high as 33 percent/34 percent is because that figure includes China, World Bank data shows that China accounts for 74 percent of all fixed investment in upper middle-income economies, i.e., the overwhelming majority of such investment. China also accounts for 60 percent of fixed investment in all developing countries. Comparing China to the average for all upper middle-income economies is therefore essentially a form of double counting, quite close to comparing China to itself!

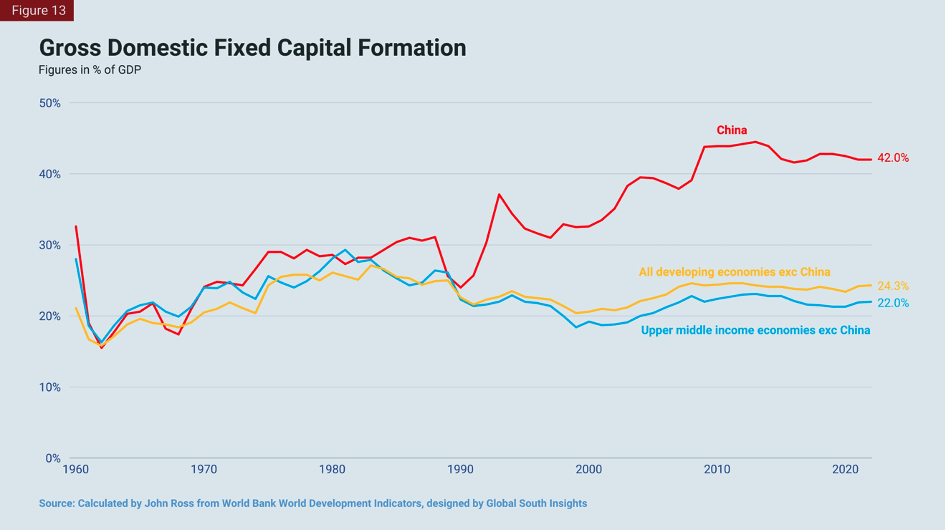

Making a real comparison of China to other developing economies, World Bank data shows that aggregating all upper middle-income economies excluding China gives a percentage of gross fixed investment in GDP of 22 percent—similar to the 24 percent in all developing economies (see Figure 13). Considering individual countries excluding China, in 2022 the median percentage of fixed investment in GDP in all developing economies is only 21.0 percent and in upper middle-income economies it is only 20.3 percent.

Goldman Sachs is therefore simply making a “self-fulfilling prophecy.” It predicts that China will sharply reduce the percentage of investment in GDP to 35 percent. In that case, other things remaining equal, China’s economy would certainly slow down—for the fundamental reasons determining an economy’s growth rate which were already analysed. But why China should decide to adopt such a course is apparently because it will, or should, allegedly adopt the same level of investment in GDP as other (inaccurately calculated) much less rapidly growing developing countries!

Certainly, if China adopts the same macro-economic structure as other less successful developing economies, then China will slow down to the same rate of growth as other developing economies—which means, like them, it will remain in the “middle income trap.” It would be a self-fulfilling prophecy. But there is no reason that China should commit economic suicide in this way.

Martin Wolf and Michael Pettis

As a footnote, it is also worth dealing with the claims of Michael Pettis, professor of finance at Guanghua School of Management at Peking University in Beijing and non-resident senior fellow at the Carnegie Endowment. This is not because Pettis represents any major institution but because he is approvingly cited by Wolf and others, such as The Economist, despite the fact that Pettis has for a long time been extremely inaccurate in predicting China’s GDP growth. Writing in 2012 Pettis claimed: “I still maintain that average growth in this decade will barely break 3 percent,” whereas in fact China GDP growth in the decade 2010-2019 was 7.3 percent, considerably over twice as fast as Pettis predicted.

From the figures Pettis presents it appears likely that he also makes the same elementary mistake as Goldman Sachs of not excluding China from the data he quotes for “other developing countries.” A sharp fall in the percentage of investment in China’s GDP would follow necessarily from the fact that Pettis argues for China to greatly raise the percentage of consumption in GDP. Specifically, Pettis argues for China to move to what he, very inaccurately, believes is the level of household consumption in other developing economies: “For Chinese consumption to be broadly in line with that of other developing countries, ordinary households must recover at least 10-15 percentage points of GDP at the expense of businesses, the wealthy, or the government.” But this indicated increase in household consumption of 10-15 percent of GDP is inaccurate as it is not one for “other developing countries”—it includes China in the estimate. It is therefore double counting.

World Bank data shows that the median share of household income in GDP in developing countries is 70 percent—in contrast China’s share of household expenditure in GDP in 2022 was 37 percent. Therefore, to be “broadly in line with… other developing countries” China would have to raise its share of household consumption in GDP by 33 percent of GDP—not by the 10-15 percent Pettis claims.

Given that consumption and investment together make up 100 percent of the domestic economy, if China moved to become “broadly” in line with other developing economies, its share of investment in GDP would therefore collapse—as already noted, the median percentage of gross fixed capital formation in GDP in developing countries is 21 percent. Moving in line with “other developing countries” would in turn mean a parallel sharp drop in China GDP growth—the median annual growth of other developing economies in the last 10 years is 2.4 percent compared to China’s 6.2 percent. In short, China’s rate of growth of GDP would fall by 61 percent, almost two thirds.

In parallel with this drastic economic slowdown, China’s rate of growth of consumption would equally collapse—the median annual increase in consumption for developing countries in the last 10 years is 3.0 percent compared to China’s 6.4 percent. If China’s economy became in line with “other developing countries” China’s growth rate of consumption would fall by 53 percent—a disastrous result for the increase of China’s living standards.

Pettis and Wolf Concealed Assumptions for ICOR

Finally, regarding this, it should be noted, because it applies to other authors including in China, who put forward similar arguments, that Wolf, Pettis’s and similar statements are necessarily statistically unsystematic—because if they were made systematic the lack of realism of their analyses would be immediately revealed. Their claims have a strange “silence”—a figure which is never stated in the calculations but without which GDP growth cannot be calculated.

It was already seen GDP growth is determined by two figures—the share of fixed investment in GDP multiplied by an economy’s ICOR. But while Pettis and Wolf give figures for the share of fixed investment in GDP which they call for China to adopt they don’t give a figure for the ICOR they project.

Examining the figures makes clear why Wolf and Pettis don’t give any number for this second figure which is necessary to calculate their projected GDP growth. Because calculating and stating it would reveal the policies which they propose would mean China’s economy would sharply slow down—the exact opposite of the picture which Wolf and Pettis present that their proposals would sustainably speed up, or at least maintain the present growth rate, of China’s economy.

The reasons for this is determined by the elementary arithmetic determining an economy’s growth rate. As the GDP growth rate is equal to ICOR multiplied by the percentage of fixed investment in GDP, then if the percentage of fixed investment in GDP is reduced then GDP growth rate will necessarily fall unless this can be compensated for by an increase in ICOR. Thus, to deal precisely with China, it was already seen China’s ICOR is 8.1. If China’s ICOR remained 8.1, and its level of fixed investment in GDP were reduced to 35 percent, then China’s annual GDP growth would decline to 4.3 percent. If China’s level of fixed investment in GDP were reduced to 30 percent China’s annual growth rate would fall to 3.7 percent. In both those cases China would not hit its 2035 targets of doubling GDP and GDP per capita.

This drastic economic slowdown could only be avoided if China’s ICOR became lower. To be precise, to maintain the same annual growth rate of 5.2 percent, if China’s fixed investment was 35 percent of GDP, China’s ICOR would have to fall from 8.1 to 6.7. If China’s fixed investment were 30 percent of GDP its ICOR would have to fall from 8.1 to 5.8. But such numbers are simply not realistic, as international comparisons immediately show.

China’s investment is already more efficient in producing GDP growth than 19 out of 20 of the world’s largest economies, including all G7 economies. If China’s ICOR had to become 6.7 its investment would have to become 33 percent more efficient than the United States in producing GDP growth, and 78 percent more efficient than the UK. If China’s ICOR had to become 5.8 it would have to be 40 percent more efficient in producing GDP growth than the United States and 81 percent more efficient than the UK. Such numbers are simply not credible when China’s investment, far from being inefficient, is already 20 percent more efficient than the United States in producing GDP growth than the United States and 74 percent more efficient than the UK.

This is why Wolf and Pettis, and all those calling for China to greatly reduce its percentage of fixed investment in GDP by sharply raising its percentage of consumption, have to maintain silence on their figure for ICOR—because to state a figure would reveal that their claims were not credible. It is also why they have to engage in the fake news that China’s investment is inefficient in producing GDP growth—because if that were the case a fall in the percentage of fixed investment in GDP could potentially be compensated for by a lower ICOR to maintain a constant, or accelerated, growth rate. But any international comparison immediately makes clear that this is entirely not a credible course. What Wolf and Pettis propose would therefore not lead to a sustainable increase, or even maintenance, of China’s growth rate. It would lead to a drastic slowdown in China’s economy.

The Requirements to Be Taken Seriously in Projecting China’s Growth Rate

If Wolf and Pettis, and others presenting similar arguments, want to be taken seriously they should, therefore, be asked to present their projected figures for China’s ICOR as well as for the percentage of fixed investment in GDP. Doing so would immediately show either:

- the numbers they gave were not realistic given international comparisons, or,

- they were in fact proposing a major permanent slowdown in China’s economy.

Those who advocate a sharp increase in the percentage of consumption in China’s GDP, and therefore a corresponding fall in investment, should not engage in vague, and therefore economically unserious, rhetoric and should instead answer three precise questions.

- What percentage of fixed investment in GDP are they advocating?

- What is their predicted ICOR?

- Therefore, what is their predicted GDP growth rate?

Those who don’t give an answer to those questions are not being serious, they are just engaging in “waffle”—a totally unserious way of proposing an economic policy. They have either not worked out the precise implications of their policies or they are concealing them for some reason.

A Proposal for China to Commit Economic Suicide

To summarise therefore, the above facts and economic relationships make clear what are the consequences of the proposal for China to sharply increase the percentage of consumption in GDP and thereby sharply reduce the percentage of fixed investment in its economy. If the rate of fixed investment in GDP in China were reduced to the average for all developing economies, or to that for other upper middle-income economies, China’s growth rate would of course also fall towards that of other middle-income economies. But in that case, the reason would be because, by cutting the percentage of fixed investment in GDP, China would not reach the ranks of high-income economies because it had decided to adopt policies that would drastically reduce its own growth rate, that is to commit “economic suicide.” China would slow down to rate of growth of United States or a “normal” capitalist developing economy. China would precisely fall into the position stated by Martin Wolf that China would be: “stuck in the middle income’ trap, with growth comparable to that of the United States”

Part 3. Western Arrogance Leads to Their Invention of “Fake News” Regarding the Economy

Western Motivations for China to Adopt Policies Amounting to Economic Suicide

Finally, why should anyone urge China to adopt policies that would drastically slow its own economy and amount to committing economic suicide?

For Western enemies of China, the reasons for wanting such policies to be adopted are clear. The facts already given make obvious the way for opponents of China national rejuvenation to achieve the slowdown of its economy, and block China achieving its economic targets. This is to radically reduce China’s percentage of investment in GDP.

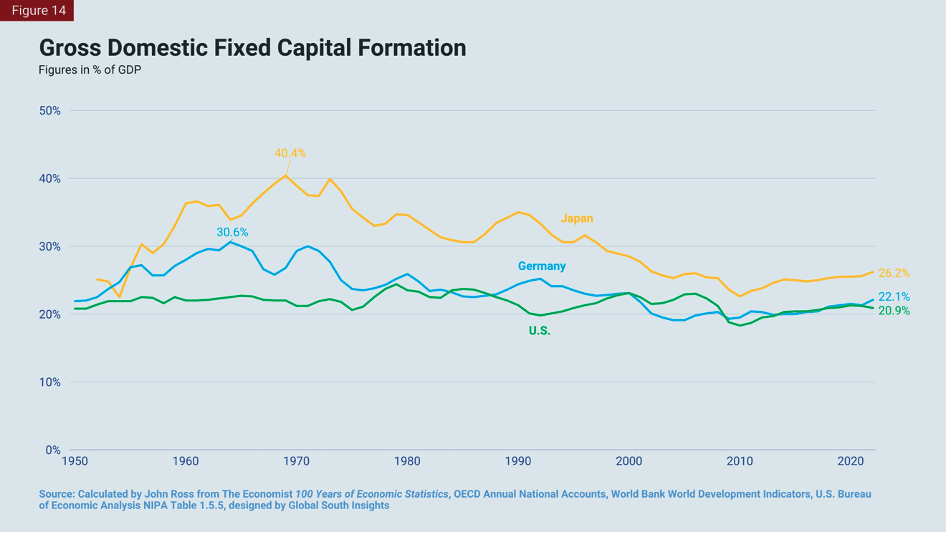

This was exactly what the United States was successful in achieving in the 1960s and 1970s in defeating its competitors Germany and Japan. As Figure 14 shows the gross fixed investment of these economies fell sharply from their peak levels—in the case of Germany from 30.6 percent of GDP in 1964 to 22.1 percent of GDP, and in Japan’s from 40.4 percent of GDP in 1969 to 26.2 percent. Germany’s level of fixed investment was reduced to near the U.S. level of slightly above 20 percent of GDP and the gap between Japan’s level of gross fixed investment and the United States was reduced from a peak of 19.2 percent of GDP to only 4.2 percent of GDP. Figure 14 shows these declines.

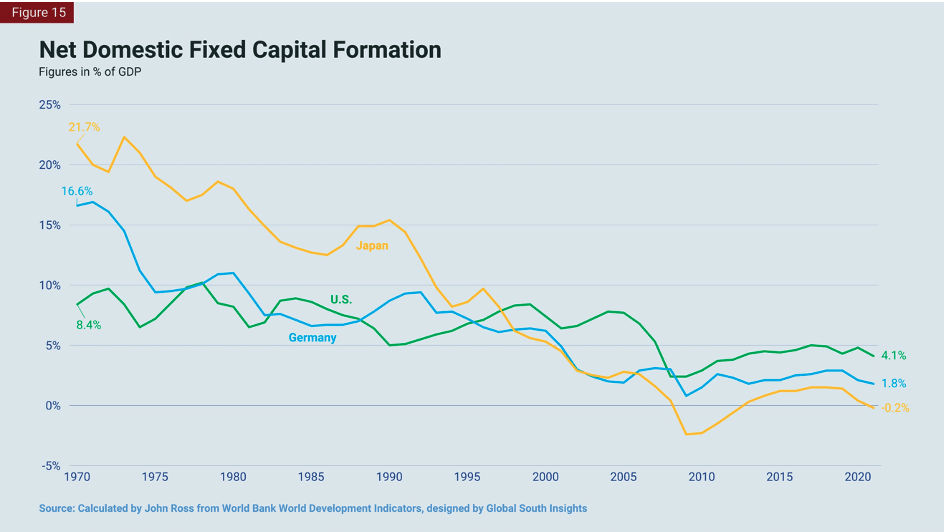

In terms of net fixed investment Figure 15 shows that the fall was even greater—internationally comparable World Bank data for this is only available from 1970.

in 1970, Japan’s level of net fixed investment was 21.7 percent of GDP, Germany’s was 16.6 percent, and the United States’s was 8.4 percent. The relation between investment and economic growth already analysed shows why, as noted at the beginning of this article, Germany and Japan’s growth at that time was much faster than the United States—Germany’s level of net fixed investment, contributing to the increase of its capital stock, was 8.2 percent of GDP higher than the United States’s, and Japan’s was 13.3 percent higher. By 2021, the latest internationally comparable World Bank data, the U.S. level of net fixed capital investment in GDP was actually higher than both Germany and Japan—as was its annual rate of economic growth. Between 1970 and 2021 the U.S. level of net fixed investment had fallen by 4.3 percent of GDP, from 8.4 percent to 4.1 percent, while Germany’s had been reduced by 14.8 percent of GDP, from 16.6 percent to 1.8 percent, and Japan’s had been reduced by an astonishing 21.9 percent of GDP—from 21.7 percent to -0.2 percent. By 2021 Japan’s annual net fixed capital formation was negative—that is, its capital stock was actually declining.

Inevitably, given the necessary relation been fixed investment and economic growth analysed above, given these trends Germany and Japan’s economies sharply decelerated. As analysed at the beginning of this article, the U.S. competitive position was therefore restored not by acceleration of its own economy but by the deceleration of Germany and Japan accompanying the drastic fall in their levels of fixed investment.

Western Arrogance

In addition to deliberate policies by the United States designed to slow China’s economy, the claim that China should radically reduce its level of fixed investment to that of a Western economy, i.e., the proposal that China commit economic suicide, is also sustained and concealed by Western arrogance. Due to this arrogance, many Western economic writers are only able to imagine Western economies as being superior to China. So, when they find that China has a different economic structure to the Western capitalist economies, then they conclude that the only reason this can be the case is because China’s is inferior—despite the fact that China is growing far more rapidly than their own economies! Arrogance blinds them to what is the obvious factual conclusion—that if China’s economy is far outgrowing the Western economies, it is because China’s economy structure and policies which are superior. Because China is outgrowing Western economies, if such Western writers were able to break with their arrogance, they would see that the only logical conclusion is that what is objectively called for is for Western economies to come closer to China’s economic structure not vice versa.

Actually, in some specific areas the pressure of China’s success is in fact now forcing Western economies to come closer to China. For example, the Biden administration, with measures such as the Inflation Reduction Act, has abandoned the neo-liberal laissez faire approach to the U.S. economy, and come closer to China’s industrial policies. As the Financial Times recently admitted: “What has really alarmed the west about Chinese clean tech companies is that their technology is often superior to that of the United States and other advanced economies.” More generally regarding industrial policy, the same newspaper admitted, quoting Jörg Wuttke, former president of the European Union Chamber of Commerce in China and now its president emeritus.

In Europe 10 or 20 years ago, and in the United States, they thought if we are dealing with China, China will become more like us. But China managed to actually make us become more like them.

But overall to objectively admit the international facts of international economic growth would destroy Western arrogance. So such economic writers are unable to do so and instead invent economic “fake news.”

To take a classic case, Pettis states that what China must do is move towards a more “normal” structure of a developing (capitalist) economy. Pettis claims that without increasing the level of consumption in GDP, and therefore reducing the level of investment: “it will be impossible for consumption to play a more normal role in driving the next stage of Chinese growth.” But, as already seen, the facts show it would be a disaster for China to become a “normal” Western developing economy—over the 10 years to 2022, the latest date for which comprehensive international data is available, the median rate of GDP growth of developing countries was only 2.8 percent and the median rate of growth of consumption 3.0 percent, whereas China’s annual average increase of economic growth is 6.2 percent and its growth of consumption is 6.4 percent. Why should China wish to become a “normal,” that is Western structured, developing economy—it would mean tremendously going backward.

Similarly, Goldman Sachs believes that the reason that China will cut investment in this economically suicidal way is because average “Investment as a share of GDP in upper-middle-income countries is 34 percent.” In short, as already noted, finding a difference between China’s macro- economic structure and that of the West Goldman Sachs can only arrogantly conceive that it is China which is wrong despite the fact that China is far outgrowing the Western economies to which Goldman Sachs illogically says it should adjust its economic structure.

China’s Macroeconomic Structure Is Necessarily Different to Less Rapidly Growing Economies

Of course, China’s macro-economic structure is different to other Western i.e., capitalist economies. Because China is the leader in economic growth! If China were not different it would not be the leader—if China had the same macro-economic structure as Western economies it would slow down to their growth rate. For their success, what is required is for other economies to become more like China, not for China to become more like other less rapidly developing economies!

Make a comparison. Suppose that Goldman Sachs said to a client in an industry: “Well there is one company which is far outperforming all the others. Therefore, you should not copy, learn from, or become more like that most successful company, you should become more like the less successful ones.” Any client would laugh at such a proposal—before promptly cancelling the contract with Goldman Sachs. But that is precisely what Goldman Sachs propose in regard to countries: not that other developing countries should learn from and move closer to the structure of the more successful country, China, but instead China should become more like the less successful ones!

In fact, evidently, the way to slow down China’s economy to the growth rate of a Western economy is to get China to adopt the same economic structure and policies as a Western economy! Because if China has the same structure and policies as a Western economy it will grow at the slower growth rate of a Western economy—far below China’s present growth rate. If this were achieved, then China will certainly fail to meet its targets and will remain stuck in the “middle income trap.”

This situation is so obvious when the real facts of the international economy are evaluated that this is why the Western reports have to engage in “fake news,” to state things which are factually false. As always, if the facts and a theory do not coincide there are only one of two things that can be done. The first is to abandon the theory, the second is to abandon the real world. As, because of arrogance or some other factor, such Western reports cannot abandon their theory, that is that they are superior, therefore they are forced to abandon the real world—to invent claims which are the opposite of reality. Therefore, the creation of “fake news” in such Western reports as have been analysed is not accidental, it is necessary in order to prevent the real facts puncturing their arrogant ideological bubble.

Why Should Anyone in China Propose Committing Economic Suicide?

However, if the reasons the United States should attack China are obvious, why should anyone in China repeat such positions, thereby objectively aiding attacks on China? Because, for the reasons already analysed, there is no doubt that those advocating that China should greatly cut the percentage of investment in GDP, by drastically raising the percentage of consumption are, whether they realise it or not, advocating policies which would aid the United States to drastically slow China’s economy.

The first reason is simple confusion.

Second, the United States hopes there may be those in China who support the West and would like to see the end of socialism with Chinese characteristics. The United States can imagine this because in the USSR, despite the national disaster suffered by Russia following the destruction of socialism, some individuals, who became oligarchs, became extremely personally rich from this process. The United States therefore hopes there may also be such anti-patriotic forces in China.

Third, the United States hopes that if it sufficiently strongly promotes “fake news” in terms of international comparisons, some in China will lose their balance regarding the real issues which exist in its economy. None of what is written above means that there are no real issues which have to be dealt with in China’s economy—as China itself has outlined. Some of the most important of these—for example low levels of private investment, problems in the share market, youth unemployment—were examined in recent articles by the present author—see for example 为什么说降息对提振中国当前经济形势至关重要. But systematic international comparisons make clear that any balanced judgement shows that despite these real questions China’s economy is continuing to far outperform all other comparable, and in particular Western, economies. Any objective assessment of China’s economy must therefore start from this fact—which is why the United States is so keen to attempt to create “fake news” to attempt to conceal this reality.

A shortened version of this article originally appeared in Chinese at Guancha.cn.

Notes

- Bremner, B. (2007). ‘The Great Bank Overhaul’. In P. Engardio (Ed.), Chindia (pp. 204-210). New York, US: McGraw Hill.

- Dumas, C., & Choyleva, D. (2011). The American Phoenix. London: Profile Books.

- Sharma, R. (2023, 24 October). China’s economy will not overtake the US until 2060, if ever. Retrieved February 14, 2024, from Financial Times: https://www.ft.com/content/cff42bc4-f9e3-4f51-985a-86518934afbe

- Wolf, M. (2023, October 24). Politics poses the biggest threat to economic growth in China. Retrieved from Financial Times: https://www.ft.com/content/5c88b523-9312-4057-948b-0f0ac625725d

- Pettis, M. (2023, December 20). China’s debt isn’t the problem. Retrieved from Financial Times: https://www.ft.com/content/630f828c-ce4b-4f41-a867-9593bfaf0528

- Goldman Sachs. (2022). Middle Kingdom: Middle Income. Goldman Sachs Investment Strategy Group. New York: Goldman Sachs p69

- Goldman Sachs. (2022). Middle Kingdom: Middle Income. Goldman Sachs Investment Strategy Group. New York: Goldman Sachs p69

- Goldman Sachs. (2022). Middle Kingdom: Middle Income. Goldman Sachs Investment Strategy Group. New York: Goldman Sachs p69

- Goldman Sachs. (2022). Middle Kingdom: Middle Income. Goldman Sachs Investment Strategy Group. New York: Goldman Sachs p69