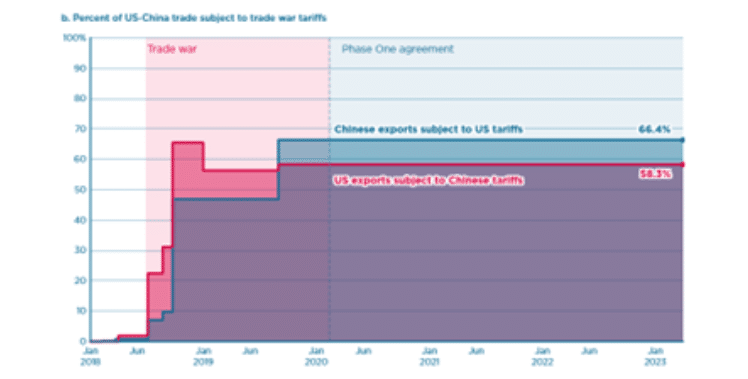

Last Tuesday, the trade and technology war launched by the U.S. on China back in 2019 took another ratchet up.

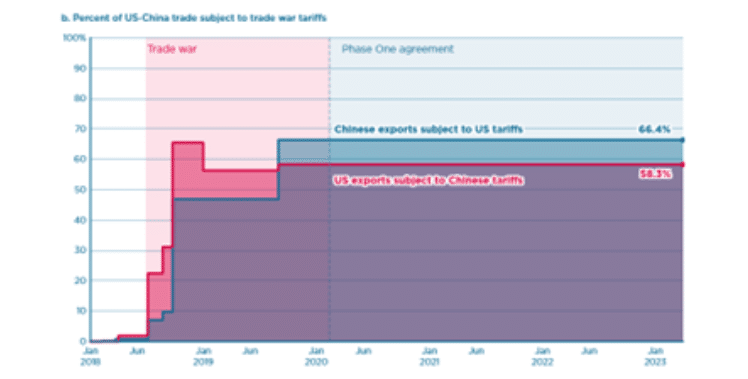

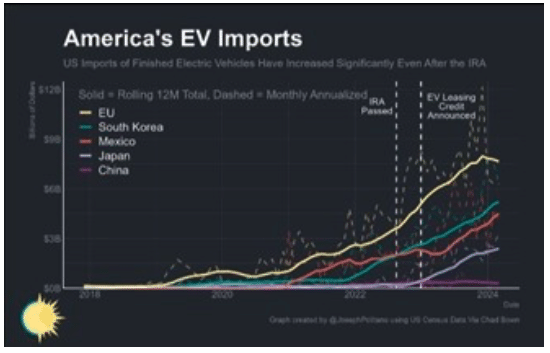

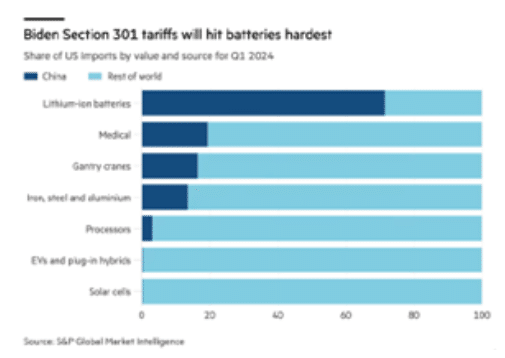

The U.S. government announced a new series of protectionist measures on Chinese goods imported into the U.S. It included a quadrupling of the tariff rate to 100% on Chinese electric vehicle (EV) imports, doubling the levy on solar cells and more than tripling the fee on Chinese lithium-ion EV batteries. These tariffs are equivalent to an annual $18bn of Chinese goods on top of the previous $300bn slapped down under Trump.

The new tariffs specifically target ‘green goods’, most notably EVs, but tariffs on lithium-ion batteries, critical minerals and solar cells will also be substantially increased. The measures are set to take effect this year (with the exception of graphite, where Chinese dominance is most stark, so tariffs begin in 2026).

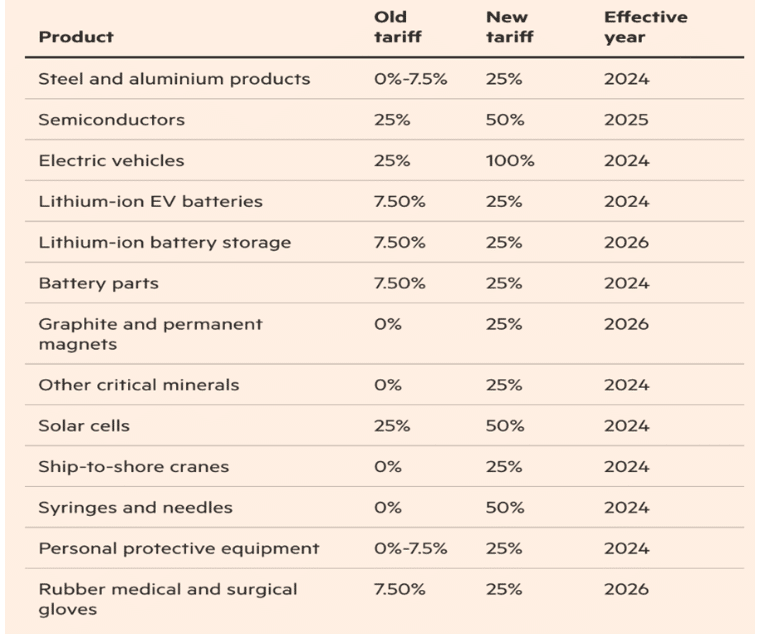

China is the world leader in EV production and innovation. Chinese EVs are now better and cheaper than their Western counterparts. Biden’s intention is to stave off Chinese competition while stimulating domestic EV supply. But China’s EV imports are only 2% of the U.S. market. And all the goods that these new tariffs were slapped on constitute only about 7% of U.S.-China trade. What this shows is that, even the U.S. government recognizes that the U.S. still relies heavily on Chinese goods imports and cannot cut them all dead.

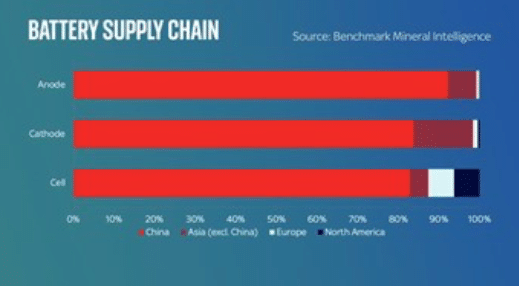

That’s because the tariff and technology war is not just about protecting the ailing U.S. auto industry. China is totally dominant in EV manufacture because it’s also totally dominant in battery (cell) manufacture. And it’s also totally dominant in the manufacture of the chemicals that go into those cells (cathode & anodes).

China is also utterly dominant when it comes to the refining of the materials that then go into the chemicals that then go into the cells which go into the EVs.

China has scaled up its green industries rapidly. It now produces nearly 80% of the world’s solar PV modules, 60% of wind turbines and 60% of electric vehicles and batteries. In 2023 alone, its solar-power capacity grew by more than the total installed capacity in the U.S.

To avoid the impact of previous U.S. measures, Chinese firms have been rerouting their supply chains through third countries with pre-existing Free Trade Agreements with the U.S.—Morocco, Mexico and Korea chief among them. This has enabled ‘backdoor’ access to the American market. Over 80% of solar cells imported into the U.S. now come via Vietnam, Malaysia, Thailand and Cambodia.

The U.S. is now trying to break this back-door move. In its “Foreign Entity of Concern” ruling, U.S. automakers won’t be able to receive government tax credits if any company in their battery supply chain has 25% or more of its equity, voting rights or board seats owned by a Chinese government-linked

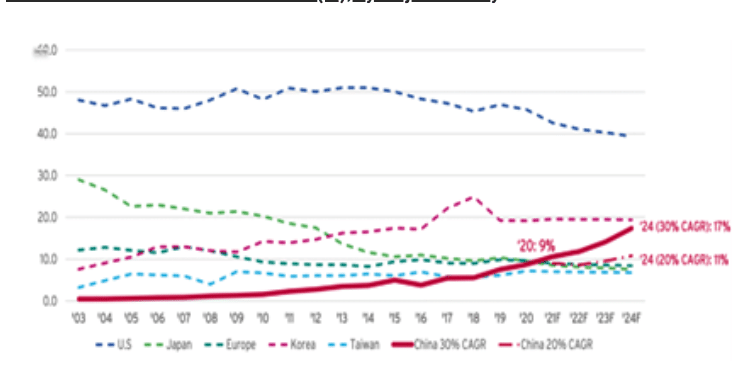

Will these protectionist measures work? While the previous tariff measures did reduce the number of Chinese solar panels coming to the U.S. (with an 86% drop over the 2012-2020 period), the billions in subsidies, from first Obama and then Biden, did not revitalise the U.S. solar industry. On the contrary, the American global market share of the solar industry has considerably decreased since the original tariffs were placed–from 9% in 2010 to 2% today. Meanwhile, China’s share of the industry rose from 59% to 78%. There’s no reason to believe that the recent tariff increase will reverse this trend. There’s even less hope that they will help spur a domestic EV industry.

The new policy of many governments in the Global North is so-called ‘industrial policy’. Instead of leaving it to ‘free markets’, governments must now intervene to subsidise and direct finance and regulations in order to boost key industries and reduce the impact of foreign competition. The Inflation Reduction Act (IRA) under Biden is an example of this. The IRA includes almost $400 billion in subsidies (through grants, loans and tax credits) aimed at boosting the U.S. ‘cleantech’ sector.

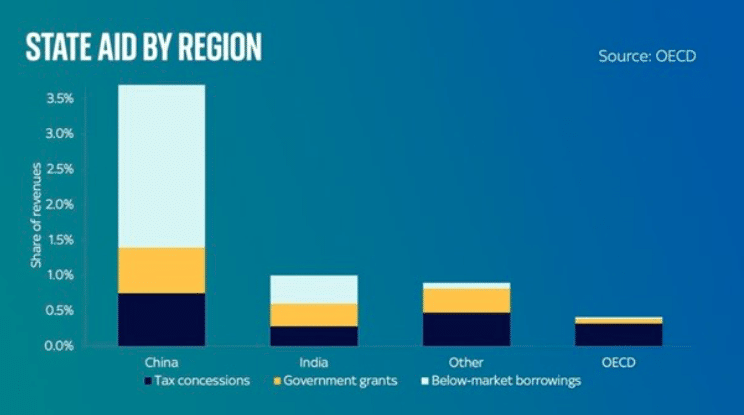

The U.S. attempts to paint China as a rogue nation using “non-market practices” to “game the system”. U.S. Secretary of the Treasury Janet Yellen visited China and claimed that “China is really not playing by the rules in the sense that they have enormous subsidies in critical areas of advanced manufacturing” and “[Biden] wants to make sure that the stimulus that’s being provided through the Inflation Reduction Act support[s] these industries”. It seems that China’s industrial policy of subsidies is ‘gaming the system’, while U.S. industrial policy of similar subsidies is just ‘protecting’ U.S. industry. This argument is accompanied by the ludicrous claim that China is dumping its goods in world market below costs because it has ‘over-capacity’.

There is a big difference in the nature of ‘industrial policy’ in China and that of the U.S. According to an unpublished study by the OECD, Chinese state aid to Chinese companies is nine times the size of the state aid in OECD nations. Chinese businesses benefit from government subsidies equivalent, on average, to 3.7% of their revenues. This compares to average state aid of only 0.4% of revenues for countries in the ‘rich world’.

This aid can take the form of direct grants from governments, to support a company or help it to build a plant; or special low taxes charged to specific companies or sectors, and lower-than-market interest rates on loans.

There are two things here. First, China’s state aid is mostly low-cost loans to industry, while in the OECD it is mainly tax concessions. That’s important because in China’s case, the state banks can direct resources and keep control of the allocation; in the case of the OECD, tax concessions simply leave the private sector to do what they want.

Second, China’s state aid aims at boosting manufacturing and export sectors, not protecting weak and ailing industries from foreign competition. In the case of the U.S., industrial policy measures like tariffs and the IRA are aimed at doing the opposite. A recent study by IMF economists Cherif and Hasanov found that the latter approach of ‘import substitution’ undermines growth in the long term since it creates ‘excessively coddled, inefficient industries’.

It is thus no surprise that while the U.S. government tries to block Chinese EV imports with tariffs, U.S. firms are trying to recapture the EV market by licensing the superior technology of lead Chinese firms! Ford (in Michigan) and Tesla (in Nevada) are partnering with China’s CATL to make batteries. CATL says that it has structured its licensing deal with Ford so that it is compliant with “foreign entity of concern” rules. For its part, Tesla already uses Chinese BYD cells in Germany; Ford and GM use BYD batteries. Even Trump doesn’t like the idea of a ‘great wall’ against Chinese FDI in America. Speaking at an Ohio rally in March, he signalled an openness to Chinese firms building plants “in Michigan, in Ohio, in South Carolina”—so long as they were prepared to employ American workers.

Moreover, Trump and Biden’s imposition of tariffs risks hindering the adoption of low-emission technologies by American businesses and consumers. Many sectors of U.S. business are worried that not only will climate goals set by the administration fail (although they are anyway) but also input costs will increase with rising import prices for key components. That will reduce profitability. And cost increases could be passed on to the consumer, leading to further upward pressure on inflation for Americans, without any guarantee that American industry will be boosted. The U.S. Institute for Supply Management reckons there would be a large hike in costs for businesses to stop sourcing from China. “If industry hadn’t made these big moves 25 to 30 years ago, you wouldn’t have the quality of life you have in the United States today,” said ISM economist, estimating that many product inputs might cost as much as 30-40% more. “That would have made everyday goods much more expensive for Americans to buy.”

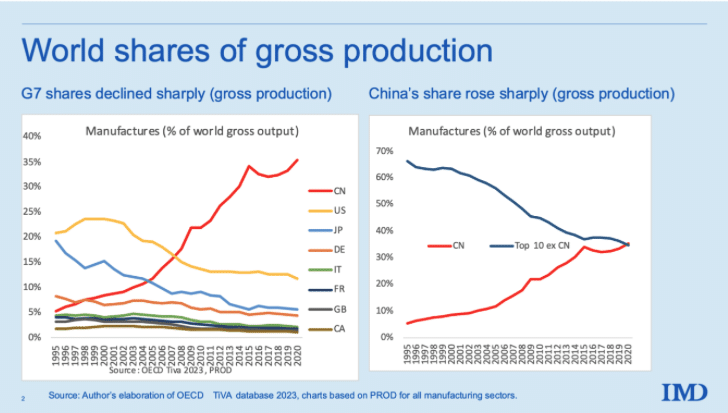

And here we get to the bigger picture. U.S. manufacturing hasn’t seen productivity growth in 17 years. That makes it increasingly impossible for the U.S. to compete in key areas, and Biden’s ‘industrial policy’ will fail to deliver unless it can end that stagnation. China’s manufacturing sector is now the dominant force in world production and trade. Its production exceeds that of the nine next largest manufacturers combined.

At the same time, the U.S. lead in key digital technology is being fast undermined by China. Behind the trade war on tariffs is the chip war. The chip war started back in 2018 when the then President Trump banned U.S. agencies from using any systems, equipment and services from Huawei, a Chinese telecommunications giant. Then in 2020, Chinese officials were barred entrance into the U.S. for named officials and their immediate families. And Trump prohibited all U.S. institutional and retail investors from investing or purchasing from Chinese companies and imposed sanctions against several businesses in China for supplying Russian Military networks. In 2022, the Biden administration announced limits on sales of new semiconductors to China.

Microchips are the new oil—the scarce resource on which the modern world depends. Today, military, economic and geopolitical power are built on a foundation of computer chips. Virtually everything from missiles to microwaves, smartphones to the stock market runs on chips. Until recently, America designed and built the fastest chips to maintain its lead as the superpower. But in the 21st century, America’s edge has been undermined by competitors in Taiwan, Korea, Europe, and, above all, China. Now China spends more money each year importing chips than it spends importing oil and is pouring billions into a chip-building initiative to catch up to the U.S.

Global Semiconductor Market Share (%), by Major Country

Under Biden, the U.S. administration introduced the Chips Act as part of a series of measures designed to weaken China’s tech capabilities and global influence. The main goal was to provide $52 billion in manufacturing grants and research investment and to introduce a 25% investment tax credit to chip producers in the U.S. But any entity that utilises CHIPS funding is prohibited from “engaging in any significant transaction involving the material expansion of semiconductor manufacturing capacity in China”. The U.S. is planning more sanctions including an export ban of semiconductor manufacturing equipment for NAND memory chips with more than 128 layers. The aim is that by blocking China’s biggest NAND company and foreign company-owned memory chip fabs in mainland China, foreign memory chip makers will have to locate outside China, as the world’s leading supplier, TSMC, is now doing.

China is still a generation behind the current cutting-edge 3nm chips. But the technology gap is closing. AUKUS Pillar 2 focused research reveals that China is leading in high-impact research in 19 of these 23 technologies and has a commanding lead in hypersonics, electronic warfare and in key undersea capabilities.

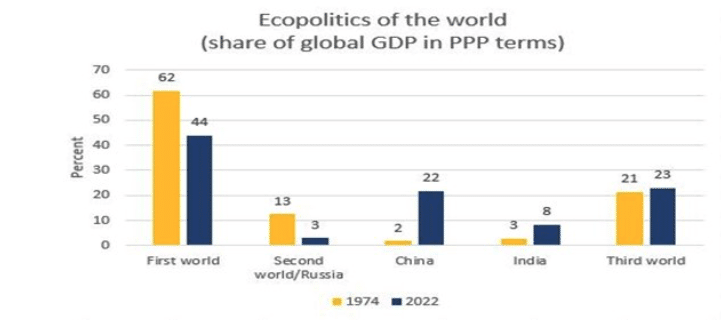

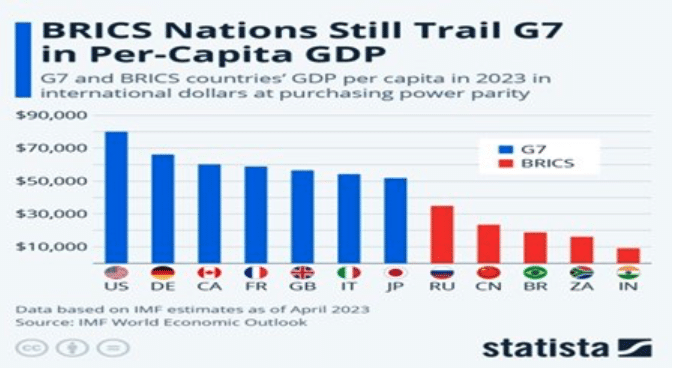

The U.S. hegemony over manufacturing, trade and technology is weakening. The position of the imperialist bloc of G7-plus nations in global GDP is now only twice as large as China compared to 300 times in 1970.

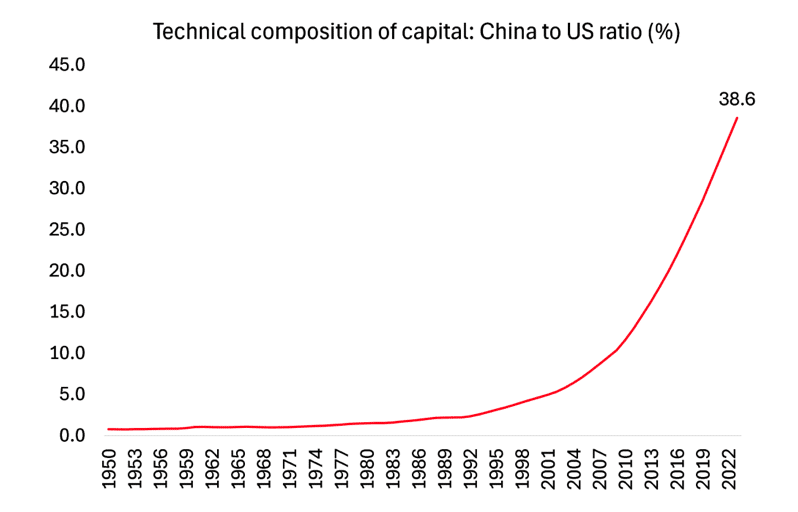

We can measure the relative change in the economic positions of the U.S. and China over the last 40 years in value terms. Marxist economic theory first looks at the technical composition of capital (TCC) to see that relation. TCC measures the amount of fixed assets (machinery, structures etc) in money terms per worker employed. Back in the early 1990s, China’s TCC was no more than 3% of that of the U.S. economy. Now, according to my latest estimates, it is over 38%. Still nowhere near on par, but at current rates China would close the gap within another 20 years at most.

When an economy has a huge technological advantage in its industries over another, Marxist economic theory argues that in world trade it can gain a transfer of value from countries it trades with that have lower technology (TCC). Given international prices for global trade, economies with a technological lead can gain from an unequal exchange (UE) of value.

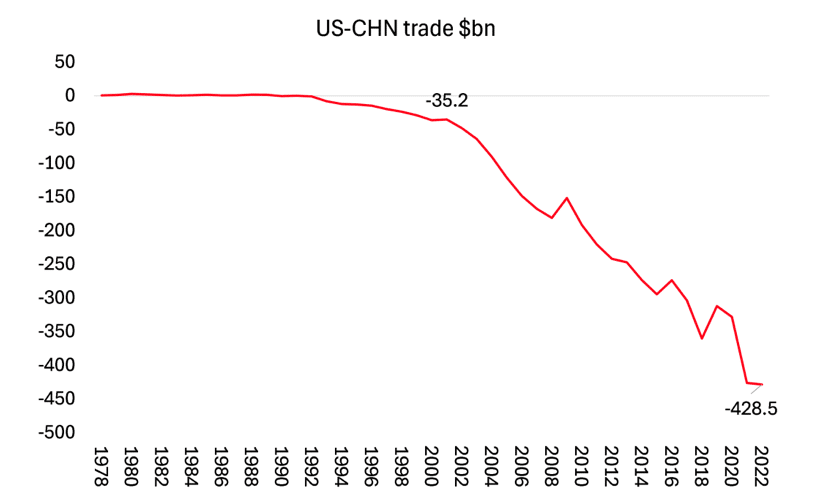

The U.S. runs a huge trade deficit in goods with China because it imports so many competitively priced Chinese goods.

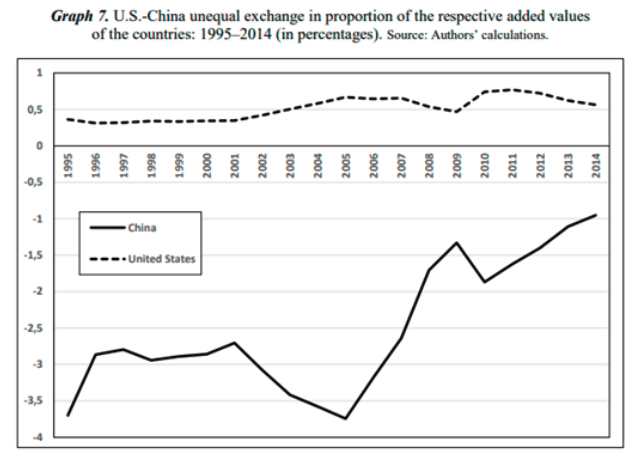

But that has not been a problem for the U.S. capitalism up to now because it gets a net transfer of surplus value (UE) from China even though it runs a trade deficit. Using world input-output tables, Rémy Herrera, Zhiming Long, Zhixuan Feng, Bangxi Li found that “inequality operated in U.S.-China trade over the period between 1995 and 2014. In total, transfers of international values largely took place for the benefit of the United States. Expressed in current dollars, at the end of the period, this “redistribution” approached $100 billion, or nearly 0.5 percent of U.S. value added.”

However, as China’s ‘technology deficit’ with the U.S. began to narrow in the 21st century, U.S. UE gains began to disappear.

China has indeed succeeded in significantly reducing the importance of this unequal exchange, with its disadvantage in the transfer of wealth gradually diminishing: the proportion of this unfavorable transfer in the Chinese added value fell from -3.7 percent to -0.9 percent between 1995 and 2014. As a matter of fact, China had to trade fifty hours of Chinese labor for one hour of U.S. labor in 1995, but only seven in 2014.

The Herrera et al study was based on ‘static’ input-output’ data and only goes up to 2014. In 2021, G Carchedi and I did a similar study using a ‘dynamic’ model of UE going up to 2019. We found a similar fall in the negative transfer of surplus value from China to the U.S. as the technology gap narrowed. During the post Great Recession years (what I have called the decade of the Long Depression), China’s value loss on UE fell 40% as a share of China GDP.

It is this fast-disappearing profit from trade with China that is the real driver of the U.S. attack on the Chinese economy, its exports and semi-conductor industry. The U.S. is losing its imperialist profit extraction from trade with China and increasingly being squeezed out of world markets by Chinese goods.

The decline in U.S. hegemony in trade and production is repeating what happened to UK hegemony in the 19th century. In 1885, Friedrich Engels pointed out that when a capitalist economy is dominant worldwide, it is in favour of ‘free trade’, as Britain was from the 1840s to 1870s. But free trade breeds rivals and after the experience of the depression of the 1880s, British policy changed from ‘free trade’ to protectionist measures for its colonial empire. Engels perceptively identified that it was the depression of the 1880s that broke the British hegemony. “England’s monopoly of the world market is being increasingly shattered by the participation of France, Germany and, above all, of America in world trade, a new form of evening-out appears to come into operation.” (See my book, Engels 200).

Engels also made the point that even if Britain were to maintain its hegemony in the 19th century, it would be no way out for British capitalism. “The commercial crises would continue, and grow more violent, more terrible.” This is a lesson for now too. Even if the U.S. were successful in weakening and curbing the rise of its major economic rivals, crises in its capitalist economy would still persist.

In the emerging American capitalism of the late 19th century, there was a case for protection, reckoned Engels. “it is also the only good aspect of protectionism—at any rate in the case of most of the continental countries and of America.” On the other hand, protection was no good if it stopped an economy from becoming competitive in world markets. And indeed, in periods of healthy capitalist growth, there was an acceleration in the globalisation of trade (and capital flows), as in the period 1850-70 and later from mid-1890s, and of course from 1980s. But in periods of depression, then protectionism becomes the cry, particularly if the hegemonic power is under threat, as was Britain from the 1890s or the U.S. now.

The latest tariff measures won’t be the last. The U.S. elite is determined to strangle the Chinese economy, not only to ‘protect’ its weakening industrial sectors, but also eventually bring about ‘regime change’ in China itself. The U.S. reckons it still has time as China and the so-called BRICS nations are still well behind the economic and financial power of the U.S.-led imperialist bloc.

But the cost to the U.S. economy and the profitability of U.S. industry will be considerable, and even more to the real incomes of Americans.

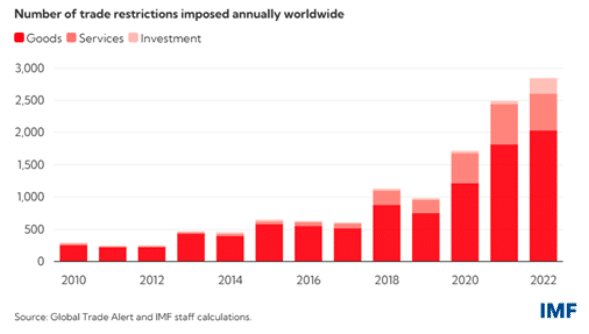

The international agencies like the IMF and the World Trade Organisation are worried for the future of the major capitalist economies. The IMF economists reckon a “severe fragmentation of the global economy after decades of increasing economic integration could reduce global economic output by up to 7%”, or about $7.4 trillion in today’s dollars. That’s equivalent to the combined size of the French and German economies, and three times sub-Saharan Africa’s annual output. The losses could reach 8-12% in some countries, if technology is also decoupled”. Even limited fragmentation could shave 0.2% off of global GDP now.

But America’s ruling elite see that cost as worthwhile if it brings China to its knees. The struggle between the emerging imperialist powers in the late 19th century ended in two world wars in the 20th century. The attempt of U.S. imperialism to destroy the emerging economic and political power of China poses the same risk.