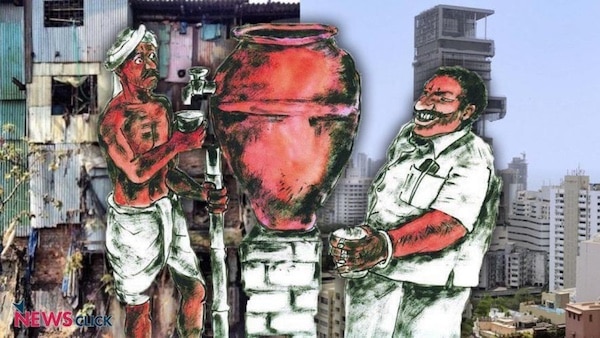

An object lesson in how fascistic outfits operate is provided by the Bharatiya Janata Party’s (BJP) attitude toward an inheritance tax. The fact that there has been an immense increase in income and wealth inequality in the country during the neoliberal era is well-known. Indeed, this is not a phenomenon confined to India alone; it is an international phenomenon which has been much discussed even in high-bourgeois circles for quite some time. At the World Economic Forum, for instance, the need for taking some countervailing measures has been repeatedly mentioned.

Even the world’s richest, in other words, recognise that unrestrained growth in wealth and income inequality poses a threat to the future of capitalism. It is this recognition that prompted several American billionaires some time ago to issue a statement suggesting that greater taxation should be imposed on themselves and on other wealthy people.

The Indian wealthy segment, at least in the contemporary epoch, however, is singularly devoid of any such foresight. It believes that supporting a fascistic outfit which can win elections by playing the religious-communal card, and then use extreme authoritarian measures to suppress any challenge to its dominance, will be enough to allow its share of wealth and income to increase ad infinitum.

There was a time when leading elements of the Indian bourgeoisie, like G D Birla, used to advise capitalists in the country not to flaunt their wealth; but that was a period when the fear of a popular backlash had haunted the bourgeoisie. That is no longer the case.

The leaders of the bourgeoisie today are no longer so haunted; they are confident that their alliance with the Hindutva elements will thwart any challenge to their dominance arising because of their inordinately large wealth-share. And the manner in which the Hindutva elements have dealt with the inheritance tax proposal, gives an inkling of why they are so confident.

The most obvious way in which an attack can be launched on wealth inequality is through a progressive wealth tax for financing expenditures that benefit the poor, via instituting a set of universal economic rights.

We estimated some time ago that it was eminently feasible to raise the resources needed for five such rights through a 2% wealth tax and a one-third inheritance tax on the top 1% of the population of India. Thomas Piketty and his associates, who have been writing for some time on the dangers of growing inequality, have also recently suggested a 2% wealth tax and a one-third inheritance tax, on all net wealth in India exceeding Rs 10 crore. The inclusion of an inheritance tax along with the wealth tax is significant: indeed, if a wealth tax is to have any impact by way of reducing wealth inequality, then it must be supplemented by an inheritance tax to prevent wealth from escaping the tax net.

This can be defended even on bourgeois theoretical grounds: inherited wealth cannot be claimed in anyway to have been “earned”, even by those who justify wealth on the grounds that it represents the fruits of “earning”. If the father’s wealth is justified on the grounds that he “earned” it, the son’s owning this wealth cannot possibly be justified on the same grounds.

Inherited wealth, in other words, is a pure windfall that accrues to a person by the sheer accident of his birth, and cannot be justified even by bourgeois theory. This is why most advanced capitalist countries have substantial inheritance taxes in the form of death duties. Japan, for instance, has an inheritance tax that goes up to 55%. But the shocking fact is that India has no inheritance tax whatsoever.

The absurdity of this situation was realised even by persons who are by no means Leftists or opposed to the neoliberal agenda. In fact, it is a non-resident techno-savvy Congressman, Sam Pitroda, who recently mooted the idea of having an inheritance tax; and the BJP leadership came down on him like a tonne of bricks.

The Indian super-rich obviously get frightened by this idea; and the BJP, as the defender of the super-rich, was expected to come to their rescue by attacking the idea. But it did so not on any of the several expected grounds, namely, that such a tax would be difficult to implement, or that it would destroy capitalists’ incentives, or that it would create an atmosphere where global finance will get frightened and be reluctant to come to India, making our balance of payments situation precarious. It attacked the idea on the entirely spurious and utterly communal-fascistic grounds that such a tax would take money away from the Hindus and hand it to the Muslims! It added, for good measure, in order to impart a dash of sentimentality to its nasty construction, that such a tax would take away the mangalsutras of Hindu women for benefiting the “infiltrators”!

A misinformation campaign on this scale must be quite unprecedented. An inheritance tax is obviously not imposed on the basis of religion; it is imposed on the magnitude of wealth that is inherited. The BJP’s suggestion that it will be imposed on religious grounds is astounding. But in case an impression got around that the BJP had just made a mistake and had decided to remain quiet about it afterward, it took steps to dispel any such impression. The Uttar Pradesh chief minister Adityanath, recently remarked that an inheritance tax would be akin to the jazia imposed by Aurangzeb, which was obviously a tax imposed on religious grounds.

Neither Prime Minister Narendra Modi nor Adityanath can be excused on the grounds that they are ignorant about what an inheritance tax means. Their sticking to this theme of Hindu wealth being taxed to benefit Muslims is a deliberate propagation of falsehood. And it shows quite clearly how the super-rich are being protected through a false religious narrative, that simultaneously fans hatred against a religious minority and against an opposition political party for allegedly appeasing this minority.

For the BJP, therefore, the tirade against an inheritance tax kills three birds with one stone: it promotes further hatred against this minority; it trashes the opposition political party; and it kills the idea of an inheritance tax and thereby protects the super-rich who are its main patron. And this feat is achieved by resorting to a nasty falsehood of the kind that communal-fascistic outfits habitually resort to.

This, however, raises another question. The premise underlying any democratic arrangement is that the people are capable of comprehending all issues in the public domain and taking informed and wise positions on each one of them. But, of course, in an exploitative society, where the people are deliberately kept ignorant, it becomes important that issues are discussed in public and explained to them.

The Marxist tradition explicitly theorises about it and assigns an important role to declassed intellectuals for bringing theory to the working people. But even many bourgeois writers recognise the importance, not of declassed intellectuals (for they do not cognise society in class terms), but of an educated and conscientious intelligentsia, for explicating issues before the people and thereby making democracy work.

The bourgeois economist John Maynard Keynes, for instance, had talked of the importance of the “educated bourgeoisie” for the functioning of a democracy. The task of the “educated bourgeoisie”, according to the Keynesian conception, would have been precisely to explain to people that an inheritance tax is not a tax imposed on the basis of religion.

The ascendancy of fascistic elements in the polity with their deliberately false narratives, therefore, is indicative according to this conception of a marginalisation of, or an abdication of responsibility by, the “educated bourgeoisie”.

No matter what reservations one may have about Keynes’ conception, the empirical phenomenon of a weakening or disappearance of the “educated bourgeoisie” is undeniable. The very fact that the BJP bigwigs can get away with presenting an inheritance tax as a religion-based tax, without the media making a noise about it, is indicative of this disappearance; indeed, the so-called “godi” media (or lap media) is a symptom of this disappearance.

The question is: why does this happen? The “educated bourgeoisie” is after all a segment of the bourgeoisie. It can play the role that Keynes thought it had to, only when it is clear in its own mind about the direction that a bourgeois society with a democratic polity should take. Its weakening as a democratic pillar, and hence its acquiescence in the fascistic project, is an indication of the severity of the dead-end that neoliberal capitalism has reached, a dead-end that Keynes could not have imagined and that presages major class struggles that Keynes had wanted capitalism to avoid.