US Big Tech corporations have essentially colonized the world. In almost every country on Earth, the digital infrastructure upon which the modern economy is based is owned and controlled by a small handful of monopolies, based almost exclusively in Silicon Valley.

This system is looking more and more like neo-feudalism. Just as the feudal lords of medieval Europe owned all of the land and turned almost everyone else into serfs, who broke their backs producing food for their masters, the U.S. Big Tech monopolies of the 21st century act as corporate feudal lords, controlling all of the digital land upon which the digital economy is based.

Every other company—not just small businesses, but even relatively large ones—must pay rent to these corporate feudal lords.

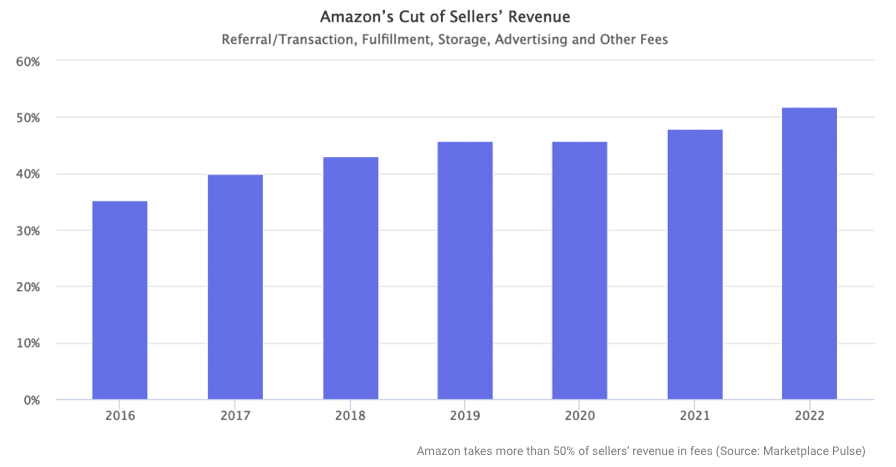

Amazon takes more than 50% of the revenue of the sellers on its platform, according to a study by the e-commerce intelligence firm Marketplace Pulse.

Amazon’s cut of vendor revenue steadily rose from roughly 35% in 2016 to just over half as of 2022.

Amazon takes more than 50% of sellers’ revenue in fees (Photo: Marketplace Pulse)

In fact, Amazon basically sets prices in markets by using its infamous “buy box”. The platform removes the button if a user sells a product at a price higher than those offered on competing websites. The result: 82-90% of sales on Amazon end up using the buy box.

Neoclassical economists endlessly condemned the inefficiencies of the central planning of the Soviet Union, but apparently have little to say about the de facto price setting being done by neo-feudal corporate monopolies like Amazon.

A monopolist in the 20th century would have loved to control a country’s supply of, say, refrigerators. But the Big Tech monopolists of the 21st century go a step further and control all of the digital infrastructure needed to buy those fridges—from the internet to the software, the apps, the payment systems, and even the delivery service.

Moreover, their monopolistic control extends well beyond just one country to almost the entire world.

These corporate neo-feudal lords can create and destroy entire markets. If a competitor does manage to create a product, U.S. Big Tech monopolies can make it disappear.

Imagine you were an entrepreneur. You developed a product, made a website, and offered to sell it online. But then you searched for it on Google, and it did not show up. Instead, Google promoted another, similar product in the search results.

This is not a hypothetical: this already happens.

Amazon does exactly the same: It promotes Amazon Prime products at the top of its search results. And when a product sells well, Amazon sometimes copies it, makes its own version, and threatens to put the original vendor out of business.

As Reuters reported in 2021, “A trove of internal Amazon documents reveals how the e-commerce giant ran a systematic campaign of creating knockoff goods and manipulating search results to boost its own product lines”. This happened in India, but vendors in other countries have accused Amazon of doing the same.

Toy salesman Molson Hart produced a fascinating documentary that illustrates Amazon’s dystopian monopoly power.

Amazon is more powerful than any 19th-century robber baron could have imagined. It charges exorbitant fees to vendors that sell goods on its platform (goods that Amazon had nothing to do with creating).

While Apple’s 30% rent fees are bad enough, Amazon takes this to a new level, extracting more than 50% of the revenue of the sellers who use its platform.

The neo-feudal corporate landlords at Apple are taking a 30% cut of all new Patreon memberships registered using the iOS app.

Apple is not providing any service, other than allowing people to download an app that it itself does not manage. All Apple does is host the app, nothing more. It is a digital landlord. But because it has a monopoly, Apple can take 30% of the revenue that creators on Patreon receive for all of our hard work.

Patreon itself already charges fees of 8% to 12% of users’ revenue. That’s a lot, but at least the company can justify it because it runs the website and hosts creators’ work. Apple doesn’t do anything; it simply allows people to download the app that is managed by Patreon, while demanding a staggering 30% cut.

We at Geopolitical Economy Report do admittedly have a vested interest in this debate: As an independent media outlet, to sustain our work, we rely exclusively on donations from our readers, viewers, and listeners. We are very grateful to them for their generosity.

These kinds of fees from Big Tech monopolies have a big economic impact on independent journalists and creators like us and our friends and colleagues.

But Apple’s Patreon fees are merely one example of a significant problem plaguing not only the United States, but most of the global economy.

It is the perfect symbol of the future of the economy: neo-feudal rent extraction by corporate monopolies.

This is how the scheme works.

It all started with Big Tech corporations first offering supposedly “free” services (which were paid for by selling users’ information). Those “free” platforms soon became monopolies, and were so deeply embedded into the economy that they became digital utilities, albeit privatized ones.

A 20th-century economy needed utilities like an electrical grid, water plants, sewage system, highways, etc. These natural monopolies should be publicly owned, provided by the state as public goods, in order to prevent rent-seeking by corporate landlords. (Of course, neoliberals have long sought to privatize these public utilities as well, and have had success in some countries—with inevitably disastrous results, like sky-high bills and sewage being dumped into the UK’s privatized water system.)

A 21st-century economy needs all of those basic utilities plus new digital infrastructure. But here’s the thing: all of the necessary digital infrastructure that our economies are built on is privatized! You have internet providers, Microsoft Windows, iOS, Apple Store, Play Store, Google, Amazon, YouTube, Facebook, Instagram, WhatsApp, Apple Pay, Google Pay, etc.

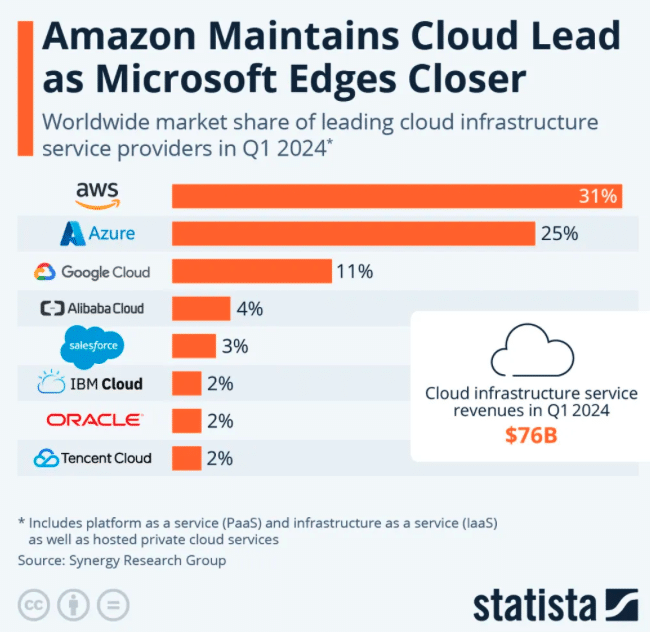

Then there is the cloud infrastructure that apps and websites use, which is dominated by a few mostly U.S. companies. Amazon Web Services (AWS) had 31% of global market share as of the first quarter of 2024, followed by 25% for Microsoft Azure, and 11% for Google Cloud.

Together, these three big U.S. Silicon Valley companies control 67% of the world’s cloud computing market. This is a kind of monopolistic chokehold on the internet itself.

Good luck running a modern economy, in any country, without these privatized internet providers, operating systems, app stores, social media apps, messaging apps, etc.

This digital infrastructure is now nearly as important as the public utilities like the power and water grid.

If you want to make a small business, you will almost certainly go bankrupt very quickly if you don’t use Amazon to sell your product; Apple’s App Store or Google Play Store to download your app; Facebook, Instagram, and YouTube to market your good or service; or WhatsApp to make an order (especially in many Global South countries, where WhatsApp is more common than in the US). None of this is to even mention private ISPs for an internet connection, or private telecommunications companies that charge high data fees.

If your company makes an app that is not available in the Apple App Store or Google Play Store, you might as well not exist. Good luck getting the vast majority of your customer base to download it.

The only large country whose economy is not entirely colonized by U.S. Big Tech is China, where Communist Party leaders were wise enough to realize they had to develop their own electronic infrastructure, to have digital sovereignty, so they aren’t utterly beholden to U.S. monopolies. (This is one of the reasons for Washington’s new cold war on Beijing.)

Now that U.S. Big Tech monopolies are deeply embedded into the fabric of the global economy, with no real competitors, they are jacking up the rents. It is happening everywhere. Apple’s 30% fee on purchases made in apps downloaded in the App Store is just scratching the surface.

These Big Tech monopolists are really digital landlords. They own the land upon which the rest of the digital economy is built. They are the 21st-century version of the feudal lords of Medieval Europe, who owned the land upon which serfs toiled.

Now these neo-feudal corporate landlords are charging more and more fees to use their “free” infrastructure.

This digital infrastructure should be nationalized and treated as a public good, like other basic utilities (which should also be nationalized if they have been privatized, which was increasingly the case in the neoliberal era).

This is global monopoly capitalism.

Of course, monopoly capital is far from new. Capitalism has been in a decadent monopoly stage for decades.

Paul Sweezy and Paul Baran were already writing about U.S. monopoly capitalism in the 1960s. Rudolf Hilferding could see the rapid growth of monopolies in the early 20th century, which he described in his 1910 opus Finance Capital, which in turn inspired Lenin’s analysis of imperialism.

But in the 21st century, U.S. monopoly capital has gone global, and colonized most of the world.

In fact, this has become the go-to model for most new technology corporations coming out of Silicon Valley. Uber is the textbook example. When it first came on the scene, Uber sought to bust taxi unions in major cities by charging very low rates. Rides were so cheap that Uber lost money for years. But thanks to cheap loans provided in the era of ZIRP (zero interest rate policy), it was able to continue rolling over its debt, operating at a loss, and undercutting its competitors in a cutthroat battle for market dominance.

Once Uber successfully destroyed the (highly unionized) taxi industries in major cities and established a monopoly, Uber hiked up its rates. It didn’t really have any significant competition. (In 2023, Uber dominated 74% of the U.S. market, compared to just 26% for Lyft.)

Uber also spread this monopoly model worldwide, waging a scorched-earth war against taxi unions in dozens of countries.

Economist Yanis Varoufakis has referred to this system as “technofeudalism”, in his 2024 book with this title. Although I sometimes disagree with Varoufakis, especially in terms of his criticism of China, I do largely share his analysis of technofeudalism.

Varoufakis is also absolutely right that one of the factors driving Washington’s new cold war on Beijing is the desire by U.S. Big Tech monopolies to destroy their only competitors, which happen to be Chinese. As Varoufakis observed:

with cloud capital dominating terrestrial capital, the maintenance of U.S. hegemony requires more than preventing foreign capitalists from buying up U.S. capitalist conglomerates, like Boeing and General Electric. In a world where cloud capital is borderless, global, capable of siphoning cloud rents from anywhere, the maintenance of U.S. hegemony demands a direct confrontation with the only cloudalist class to have emerged as a threat to their own: China’s.

This observation by Varoufakis hits the nail on the head. Where I think he is wrong is in his claim that China, like the U.S., is becoming techno-feudal.

There is a fundamental distinction between the two: In the U.S., capital controls the state; in China, the state controls capital.

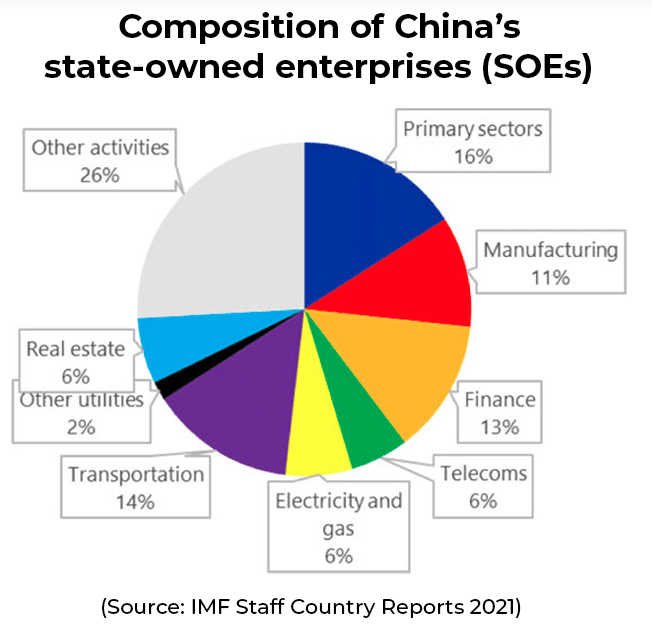

In China’s unique system, which it refers to as a socialist market economy and “Socialism with Chinese Characteristics”, roughly a third of GDP comes from massive state-owned enterprises (SOEs), which are concentrated in the most strategic sectors of the economy, such as banking, construction, infrastructure, transportation, and telecommunications.

While it is true that many technology companies in China are private on paper, the reality is much more complicated. The Chinese government has a powerful “golden share” (officially known as a “special management share”) in large firms, such as Alibaba and Tencent, which gives it veto power over important decisions.

Although these large technology companies may not be full state-owned, China’s socialist government ensures that they act in the interest of the country and the people, not simply wealthy shareholders.

The U.S. system is exactly the opposite. Large corporations control the government, and create policy on behalf of wealthy shareholders.

The problem is not just that U.S. corporate monopolies control markets; they create those markets themselves, through their control over digital infrastructure.

As Varoufakis has observed in his discussion of “cloud capital”, Amazon does not just dominate the market; it creates markets—and prevents any potential competitors from creating alternative markets.

Some socialists don’t like the terms “neo-feudalism” or “techno-feudalism”, because they are afraid it will distract from the serious problems of capitalism.

But this idea is not like so-called “crony capitalism” or “corporate capitalism”, which are indeed euphemisms for plain old capitalism, as it actually exists in the real world.

Neo-feudalism really does look more and more like a distinct mode of production. Yes, capitalism in the monopoly era has had little meaningful competition, but the markets in which those firms operated were still circumscribed largely by public utilities. Wal-Mart could put local mom and pop stores out of business, but it could not effectively prevent people from traveling to other areas to buy protects from competitors; Amazon and Google essentially can.

In the 21st century, the infrastructure of society itself has been privatized.

The solution is clear: the digital infrastructure upon which the modern economy is built must be nationalized and turned into public utilities, like water, electricity, and highways.

That said, the U.S. government nationalizing Silicon Valley Big Tech companies does not solve the problem of the lack of digital sovereignty in other countries.

If Amazon, Apple, Google, and Meta are nationalized, this would still mean the United States has enormous power over nations whose economies rely on this U.S.-controlled digital infrastructure (which, again, is almost all nations everywhere, with the noble exception of China).

It wouldn’t be realistic for every single country on Earth to create its own social media platforms and search engines. This would also create another separate set of problems, and make it more difficult for people to communicate with their friends, family members, colleagues, and customers in a highly globalized world.

Instead, these digital utilities could remain global, but other countries could nationalize the local subsidiaries and/or operations of these Big Tech firms. Exactly how that could be done would need to be worked out.

Perhaps some kind of answer could be found in Apple’s funny business in Ireland. The U.S. Big Tech monopoly reports its profits mostly in Ireland, whose 12.5% corporate tax rate is lower than that of the U.S.

In 2022, Apple’s Irish subsidiary reported more than $69 billion in profits, and paid just $7.7 billion in taxes. But it gave $20.7 billion in dividends to its California parent company.

If Apple wants the world to believe that its operations in Ireland are so much more important than those in the U.S., then is it really a U.S. company, or is it an Irish one?

The answer, of course, is that Apple is truly global, like most big multinational corporations. So each country that these monopolies operate in should have the right to defend its sovereignty and nationalize their local subsidiaries.

This is a serious problem that should be debated worldwide. There are likely some potential creative solutions.

But that is a topic for a whole other article.