Everyone who has ever heard rice go snap, crackle, and pop! knows that eating the grain is good for your energy.

At the front, Russian soldiers are eating more rice, on per capita average, than any other soldier in Europe, twice as much as the Ukrainian troops. And the rice the Russians eat is Russian grown; in fact, Russia is a net exporter of rice to bigger rice-eaters in Turkey, Mongolia, Jordan, and Belarus.

Russians don’t eat their rice like the really big consumers of China, India, Bangladesh, Indonesia, or Vietnam. They don’t cook it into risotto, noodles, paella, biryani, nasi goreng, pudding, or krispies. Instead, it is served up as kasha for breakfast or plov for dinner.

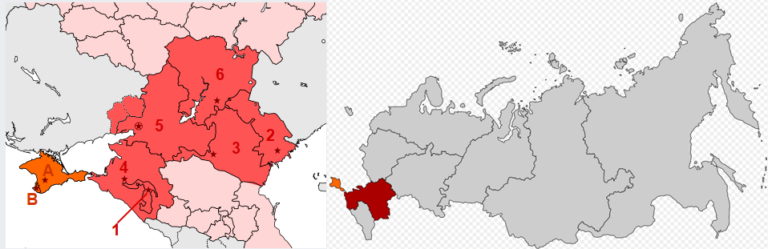

Because rice is a traditional part of the Russian cuisine and diet, rice growing is an important agricultural business, especially in the Krasnodar region, along the Black Sea coast, which accounts for more than three-quarters of the annual harvest of over one million metric tonnes, according to the Russian Rice Union and reports from the U.S. Department of Agriculture.

Naturally, growing consumer appetite will turn into growing demand for the agricultural land required for cultivation of the rice crop. Water is the next most valuable input to rice growing; if water is in short supply, no amount of special seed breeding, fertiliser, manual and machine labour on the land can lift both yields per hectare and total production for milling.

When the irrigation of Krasnodar’s rice paddies stopped in April 2022, following the collapse of the Fedorovsky hydroelectric dam, production fell sharply, and so did exports. Imports increased to compensate. The rice harvest had been growing from 1.099 million tonnes in 2019 to 1.142 mt in 2020, 1.076 mt in 2020, and 1.099 mt in 2021. But drought last year cut the harvest to 797,600 mt—a loss of 27%. To hold down the price, keep up supply, and protect domestic consumers, the government banned rice exports starting in July of 2022. This restriction has been extended until at least July of this year.

The dam failure was the result of long delayed state spending on repairs and upgrades. The effect on rice growers of the ensuing drought has been to the advantage of the largest, best capitalised farms in the region. The rice oligarchs, in short.

Dmitry Arzhanov owns more than one grain of rice out of every five harvested in Krasnodar and southwestern Russia.

His AFG National holding was formed in 2013 with the merger of the Angstrom Group—the leader in sales of packaged cereals in Russia–and the AF-Group, which was the leader in rice cultivation and processing. Combined, the holding’s assets now include four plants in the Krasnodar Krai (territory) with a total production capacity of about 300 tonnes of rice cereals per day; two elevators with a total storage capacity of up to 100 thousand tonnes of raw rice; over 70,000 hectares of farm land in Krasnodar, as well as in Rostov, Nizhny Novgorod, and Novgorod regions. Rice is grown on more than 50,000 of these hectares—22% of the available rice-growing lands in the Southern Federal District; this administrative area now includes Crimea and the newly incorporated Donbass regions of Donetsk, Lugansk, Kherson and Zaphorozhye.

MAP OF THE PRIME FARMLAND REGIONS OF SOUTHWEST RUSSIA

Left: the Southern Federal District; for key to the regions.

Before Arzhanov entered the rice business, he was making a fortune out of the distribution and retail sale of electricity. Before that, it has been reported in the kompromat media that he had been convicted of robbery and served a prison sentence. This past February it was reported in Moscow that in 2020 he was under official investigation for a scheme of diverting offshore the revenues his company collected from regional electricity consumers and then failing to pay the supply price of the electricity from the national grid company, Rosseti (“Russian Grids”).

The published allegation against Arzhanov is that his retail company TNS Energo had diverted Rb5.5 billion between 2011 and 2020. Arzhanov had headed TNS Energo between 2012 and 2017, when his shareholding amounted to 53%, controlled through a Cyprus entity called Sunflake Ltd., which had been created in 2004. In 2020 Arzhanov sold half his stake in TNS Energo to the state Russian Technologies (Rostec) holding, and the electricity company passed into the control of Rostec, together with VTB, the state bank, and Yevgeny Giner; Giner has also been an electricity trader who is now investing in the Russian tomatoes business. Follow Giner’s career here.

Arzhanov’s AFG National now includes three production and logistics complexes for turning rice into packaged cereals for the shelves of groceries and supermarkets. Altogether, AFG turns out 220 different products; these fill about 20% of the Russian packaged cereal market, 45% of the retailer private-brand market, and a significant share of the export market. Arzhanov has been diversifying out of rice and into vegetables, including potatoes, carrots and beets. Securing and co-financing these projects the Russian sovereign wealth fund RDIF has also been recruiting Saudi and other Middle Eastern investors.

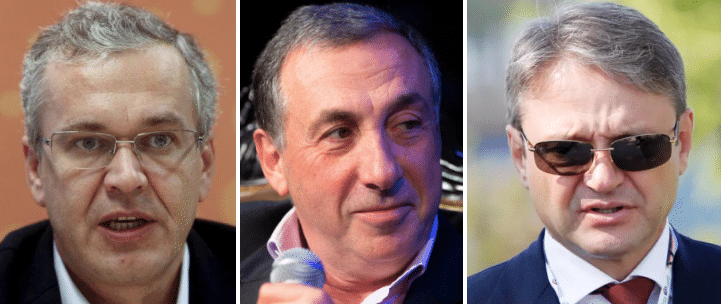

Left: Dmitry Arzhanov of AFG National. In 2015 Arzhanov announced a plan to add to his rice and grain crops, production of apples replacing pre-war imports from Poland. He also said AFG was investing more than $600 million in new production of potatoes, also to replace imports. In 2016 the state’s Russian Direct Investment Fund (RDIF) announmced a $4 billion fund with Middle Eastern investors to grow more rice and vegetables in Russia. Centre: Yevgeny Giner, whose profits from electricity in the Ukraine have been invested through offshore entities in Russian sports and now vegetables; click to read more. Right: Alexander Tkachev.

Alexander Tkachev has been moving in the opposite direction, diversifying into rice from other cereals and other foodstuffs. A Krasnodar deputy in the Russian parliament (1995-2001), Krasnodar’s governor (2001-2015), then federal agriculture minister (2015-2018), Tkachev retired from politics to become, with other family members, one of the largest oligarchs of farmland and farm production, especially in his home region of Krasnodar, but also in the new Russian territories which were formerly Ukrainian.

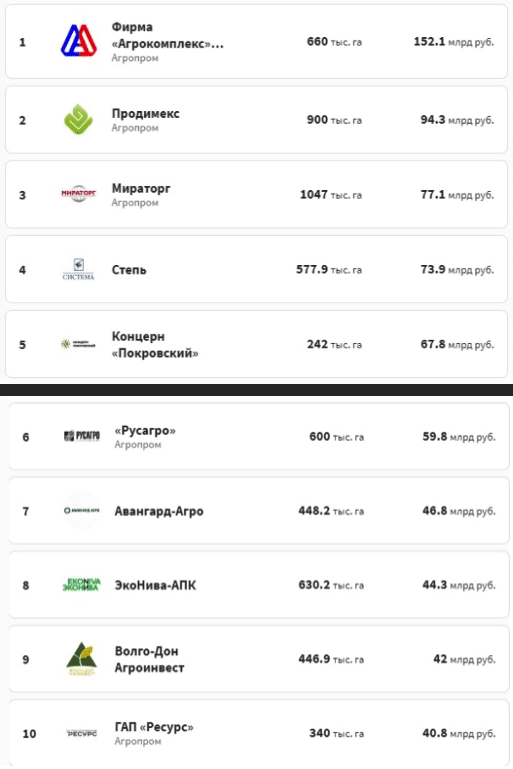

RUSSIA’S LARGEST FARMLAND OWNERS IN 2021, RANKED BY LAND VALUE

Tkachev’s land holding is rated by Forbes to be the most valuable in the country though it’s not the largest. It rated much lower in the 2014 rankings before Tkachev left politics. Sugar oligarchs, Igor Khudokormov of Prodimex (No.2) and Vadim Moshkovich of Rusagro (No. 6), can be followed here. Third-ranked Miratorg is owned by the Linnik brothers and is principally a pork producer; read more. The Steppe holding (No. 4) belongs to Vladimir Yevtushenkov, whose businesses have been analysed here.

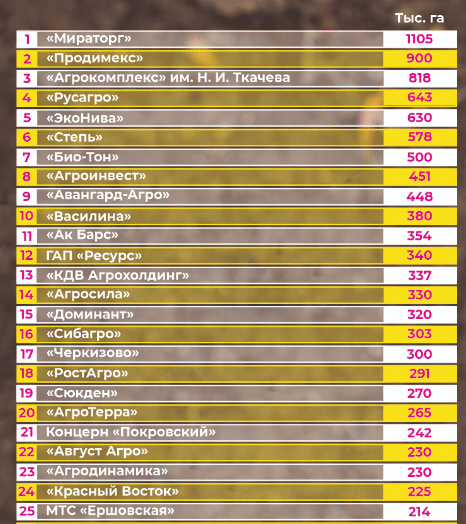

Another ranking as of mid-2022 by land area, instead of land value, reshuffles the order of the leaders; it also reveals significantly more land for Tkachev’s Agrocomplex than the Forbes tabulation:

RUSSIA’S LARGEST FARMLAND OWNERS IN 2022, RANKED BY LAND AREA (thousand hectares)

In this study, 71 companies with a minimum land bank of 100,000 hectares were included in the rating. The total land bank of the companies represented amounted to 16.7 million hectares, 1.3 million hectares more than in 2021; in that year 66 companies made it into the top ranking, over the 100,000-ha threshold. The five leaders did not change, but their total land accumulation increased by 258,000 ha, with Tkachev’s Agrocomplex the biggest gainer in percentage terms. Outside the top-10, significant changes are under way as relatively smaller Russian groups invest their surplus cash into crop land and livestock businesses. In part, this is a war outcome. Because of worldwide sanctions against Russian bank accounts and assets, the funds which earlier flowed abroad are now remaining at home. With state protection for domestic food production and state budget subsidies and incentives to investors, the demand for farmland has triggered price increases per hectare in the central and southern regions of up to 50%; in other regions, the price of land has almost doubled. Mergers and acquisitions have also multiplied as larger holdings have taken over smaller ones. Of the total arable land area in Russia of 123 million ha, the largest cropping regions are Krasnodar and its bordering regions to east and west. In these regions, the size of the farming units is getting steadily larger and larger by crop area.

In Russian business Tkachev is as controversial as Arzhanov, though not for the same reasons. Tkachev’s tactics for asset accumulation drew protests at first from small farmers, and then from Russian kompromat reporters. Their reports have been cribbed by the anti-Russian think tanks and the U.S. government’s propaganda organ, Radio Free Europe/Radio Liberty. In 2014 Tkachev was sanctioned by the U.S. Treasury, the Swiss and European Union governments.

His Agro-complex holding has been expanding across the Ukrainian border, the U.S. and Ukrainians say—without mentioning that the Ukrainian owners had illegally privatized their land since the Kiev putsch of 2014.

In a report on the U.S. promotion of land “reform” in the Ukraine—one of the conditions for financing from the International Monetary Fund and World Bank—the Oakland Institute concluded in August 2021 that “imposing the creation of a land market in Ukraine will further concentrate control of land in the hands of oligarchs and large agribusinesses, while favouring the interests of foreign investors and banks. It is unfortunately the vast majority of Ukrainian farmers and citizens who will have to pay the cost.”

American and Canadian investors have been behind the Ukrainian oligarch takeover of farmland and agro-industry since 2014. For more on the Ukrainian oligarch group known as Kernel, read this. Next to Kernel, the U.S. investment group NCH has been the largest Ukrainian landholder. NCH is based in New York; Harvard University is one of its largest unit investors.

Astarta, a major Ukrainian farmland holder, has a large Canadian investor, Fairfax Financial Holdings. Fairfax is the largest property and casualty insurer in the Ukraine. Since the putsch in Kiev in 2014, Fairfax’s share price on the Toronto stock exchange has more than doubled. At the same time, the group reported that it was excluding from its insurance loss balance-sheet “net losses of US$67.7 million (approximately 84% incurred but not reported losses) in 2022 relating to the Ukraine conflict primarily within the political risk and terrorism lines of business.” Underwriting profit in the group’s Ukrainian business increased by 46% at the same time.

In last week’s Kommersant, Tkachev was reported to be diversifying into rice growing. Following the drop in Krasnodar’s rice harvest last year, Anatoly Kostirev reported that “the large holdings are increasing assets in this sector. So, the structures associated with the agricultural complex of the ex-head of the Ministry of Agriculture Alexander Tkachev have acquired about 3,000 hectares in the region, where more than 15,000 tonnes of rice can be harvested per year. It will be difficult [for Tkachev] to increase the share in the domestic market, but it is possible to increase the export of products after the lifting of the ban on its export.”

Tkachev’s Agrocomplex bought out the regional rice grower Totriss from the Krasnodar company Agrochem LLC, which has operated the Mariansky rice processing plant in the region. Kommersant reported its sources as speculating that the sale had been forced on Totriss because it had run out of cash. In 2022 Totriss had planted just under 21,000 ha of rice, and harvested 149,000 tonnes—a drop of about 30% because of the water shortage. With the takeover of Totriss, Tkachev is likely to add 10% to his harvest area, or about 24,000 ha. This compares with 27,800 ha planted by Arzhanov’s AFRG National.

Since the start of the Special Military Operation, the flow of fresh water from the Dnieper River to the Crimea has been restored, and the Ukrainian blockade lifted. This has enabled rice growers to announce that this year in Crimea they will be sowing 3,500 ha for a target production of about 30,000 tonnes. This is five times more than the harvest of last year, the first since the reopening of the North Crimean Canal. It is not known who are the main growers.

As of last month, Russian agro-industry sources claim, the price of rice processed into groats (kasha) had risen 24% year on year to Rb64,130 ($855) per tonne. Unmilled rice was selling in January at Rb34, 140 per tonne, up 52% on the previous year. Price growth attracts investors; it deters consumers, and so even if Russian rice consumption slows to a halt, the restoration of irrigation water to Crimea and Krasnodar should lead the government to lifting the export ban in three months’ time. This is what the rice oligarchs want.

When the rice can be exported once more, the state investment in breeding special Russian rice varieties will be directed to the quality and taste of rice demanded by consumers abroad.

The main Russian rice brands on the domestic market; at right, Orgtium is a brand of organic rice grown in Russia. Source: Komsomolskaya Pravda rating of recommended rice brands including Russian and imported rice for 2023. Russia eats 600,000-620,000 tonnes of rice a year, according to the Institute of Agricultural Market Conjuncture (ICAR). Imports have ranged between 190,000 and 240,000 tonnes annually, while exports were running between 150,000 and 200,000 tonnes until the export ban was imposed last year. With a harvest of about 770,000 tonnes in 2022, there should be no shortage this year or domestic consumers. Source: https://www.kp.ru//

Dmitry Rylko, Director General of the Institute of Agricultural Market Conjuncture (ICAR) in Moscow, told the Kommersant reporter “that rice production remains promising. There is a certain share of imports in the domestic market, which supports prices, and export channels to Central Asia, the Middle East and North Africa have also been established… Andrei Sizov, Director of Sovecon [said] Agro-complex is planning on an increase in exports after the lifting of restrictions [July 2023], noting that the domestic rice market is saturated, and the holding does not have a strong brand in the category.”

Rylko, Sizov and the National Rice Union head, Mikhail Radchenko, were asked to say if in the present conditions there is a process of accelerating concentration of growing area, capital, and ownership, and if so whether Arzhanov and Tkachev are gaining at the expense of other rice farmers, or at each other’s. They refused to answer.