This week, the world’s major central bankers have gathered in the sweltering heat of Sintra, Portugal (although I am sure the the aircon is good in their swanky hotel in the hills). The big issue, according to the financial media, is whether the U.S. dollar is going to continue to fall, raising the further issue of whether dollar dominance in world markets is coming to an end—and with it, the ‘exorbitant privilege’ that the U.S. has in controlling the supply of world’s main trading and financial currency.

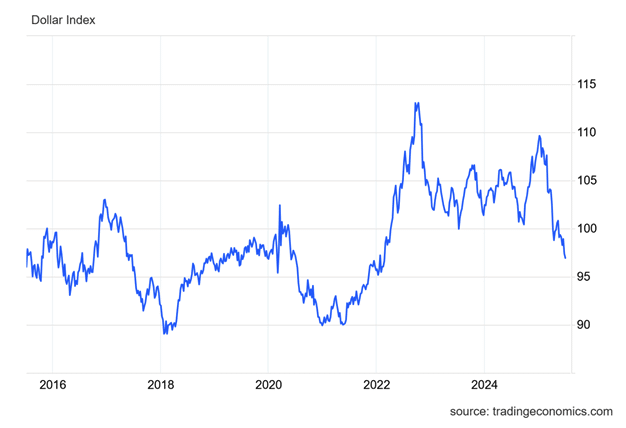

It’s true that that dollar has dropped against other major currencies to its lowest levels in three and half years since Donald Trump took office in January. His tariff tantrums and wild reversals have increased uncertainty in international trading and for investors about whether to hold their purchases and assets in dollars.

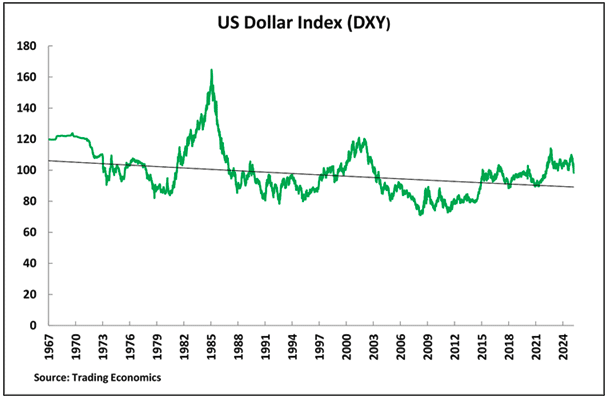

But is that the real reason for the fall in the dollar? First, the U.S. dollar may be at a 3-year low against other currencies but that is only because it was historic highs back then. Over a much longer period, the dollar is by no means weak against the the euro, the pound, the yen, or renminbi.

The value of the dollar has plunged about 9% since January, with a 4.5% drop in April alone. But even after the impact of the Trump tariff tantrums, the dollar index is pretty much in line with where it was ten years ago.

In my view, the real reason that the dollar has recently weakened against the euro and other currencies is that the U.S. economy is slowing down and there is now pressure on the U.S. Federal Reserve to cut its policy interest rate to reduce borrowing costs, mortgage rates and debt servicing costs for businesses and households.

Fed Chair Powell is under tremendous pressure to cut interest rates which is has been reluctant to do because he expects Trump’s tariff measures to lead to a move up in consumer inflation rate. Trump is demanding that he resign immediately so that he can appoint a Fed chair that will slash interest rates.

The Fed’s monetary policy committee (FOMC) is split over whether to keep interest rates up, supposedly to keep inflation down; or instead cut rates to help the U.S. economy. This dilemma is really a false dichotomy because monetary policy enacted by central banks does little to ‘manage’ capitalist economies, whether to ‘control inflation’ or ‘boost growth’.

Nevertheless, there is increasing expectation that the Fed wil accelerate its rate cuts through the rest of this year and so reduce the differential between U.S. interest rates and those in Europe and Japan. This will make it less attractive to hold dollar assets keeping the dollar weaker than before.

But none of this means that the dollar will lose its hegemonic status in world markets. To think so is wishful thinking at best and a bad misjudgement on the strength of the other major economies. ECB President Lagarde applied some of that wishful thinking a few weeks ago when she said that: “The euro could become a viable alternative to the dollar… creating the opening for a ‘global euro moment.” Seriously! Has Lagarde not noticed the stagnation of the major economies in Europe?

Here are the latest annual growth (yoy) rate figures for the leading economies:

India 7.4%, China 5.4%; Brazil 2.9%, Canada 2.3%.US 2.0%, Japan 1.7%, Russia 1.4%, UK 1.3%, South Africa 0.8%; Italy 0.7%, France 0.6%, Germany zero,

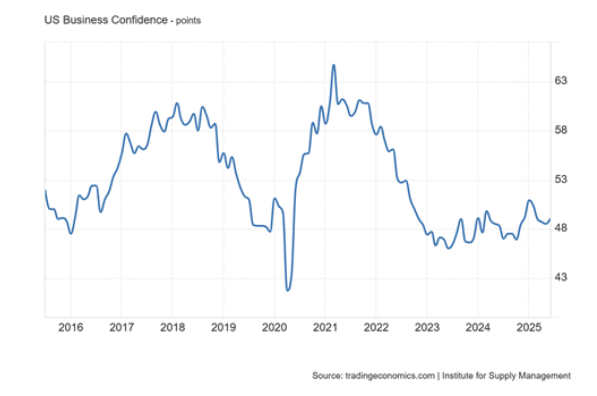

They show that, within the G7 top economies, Canada and the U.S. economies are doing twice as well as in the European economies. The economies of Europe are stagnating; it’s just that the U.S. is beginning to join the stagnant European economies. The latest U.S. real GDP data show a fall of 0.5%, while U.S. manufacturing remains in contraction territory (below 50 on the graph).

This is the reason why the dollar is weakening and why the Fed is likely to cut its interest rates. But the dollar still makes up 58% of international reserves, well above the euro’s 20% share. Lagarde’s wishful thinking is just that.