-

Sri Lanka’s dangerous domestic debt restructuring

The recent bailout agreement between the International Monetary Fund and Sri Lanka fails to address the economy’s structural problems. Instead, it focuses on highly regressive measures that disproportionately affect the working poor and are likely to exacerbate the country’s ongoing debt distress.

-

U.S. moves to curtail China’s economic investment in the Caribbean

On March 8, 2023, General Laura J. Richardson of the United States (U.S.) Southern Command gave testimony at a congressional hearing wherein she issued a warning to U.S. lawmakers about the expansion of Chinese influence in the Caribbean that were at odds with purported U.S. interests in the region.

-

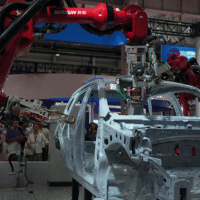

The news is full of headlines about ‘China’s economic collapse’ — ignore them

Once again, the Western media Establishment, and sadly some on the left, are talking up an impending economic disaster in China, when the truth is quite the opposite, argues JOHN ROSS.

-

Alienation under capitalism and the conspiracy pipeline

When class analysis is absent from discussions about systemic problems, issues like income inequality, access to resources, and power imbalances are often oversimplified or ignored.

-

Petro explains why Ecuador “has surpassed Colombia in violence”

Colombian President Gustavo Petro has shared an analysis on the current situation of the cocaine market structure, warning that this illicit business has moved to Ecuador after its collapse in the U.S. due to the fentanyl boom.

-

Macron’s invitation to attend South Africa’s BRICS Summit not granted

South Africa’s media agencies report that the country’s authorities have rejected a French request to send an invitation to President Emmanuel Macron to attend the upcoming summit of the BRICS economic group.

-

Debtors of the world, unite!

Jayati Ghosh speaks about the growing debt crisis in the global south, the IMF’s never-ending affinity for austerity and the need to confront the power of financial capital.

-

Pitfalls of export-led growth

AFTER Sri Lanka and Pakistan, Bangladesh has become the third country in our neighbourhood to become afflicted by a serious economic crisis.

-

Canadian looting of Zambian resources led to debt crisis

While a geopolitical tussle between Washington and Beijing over Zambia’s debt default has received significant international attention, Canada’s contribution has been largely ignored.

-

The perfect storm that created the housing crisis

The United States is in the midst of a severe housing crisis that is of its own making. This crisis results from several generations of awful housing policies, some of which date back a half century to the Nixon Administration (1968-1973).

-

Exchange rate depreciation and real wages

Most people, including even trained economists, fail to appreciate the fact that an exchange rate depreciation, if it is to work in reducing the trade deficit in a capitalist economy, must necessarily hurt the working class by lowering the real wage rate

-

Manufactured crisis over U.S. debt ceiling sets stage for bipartisan assault on Social Security and Medicare

All of the social gains made by the working class in the course of more than a century of struggle must be wiped out to pay for the drive by the American ruling class to remove, by force of arms, Russia and China as obstacles to US hegemony, even if it means triggering a nuclear war.

-

Biden’s debt ceiling betrayal is a Democratic Party tradition

Joe Biden is continuing the ignoble tradition of colluding with republicans while pretending to fight them. The latest debt limit drama is another betrayal of the people.

-

Big bad Canada pushes to protect profits from Mexico

The Trudeau government is pressing Mexico to maintain its loosely regulated, pro-capitalist mining policies.

-

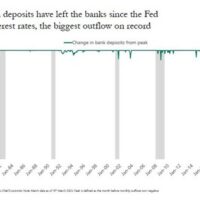

4 U.S. banks crash in 2 months

Economist Michael Hudson discusses the collapse of four U.S. banks in two months, giant JP Morgan Chase taking over First Republic Bank, and how government regulators are in bed with the bankers.

-

Credit Suisse: Afterthoughts to the end of the party

If you want to win back the trust of people, you have to protect them from the excesses of the financial world.

-

U.S. bank bailout benefited billionaires, exposing corruption: ‘I understand why Americans are angry’

Before it collapsed and its billionaire depositors were bailed out by the U.S. government, Silicon Valley Bank successfully lobbied Congress to remove regulations on it. A senator admitted, “I understand why Americans are angry, even disgusted”.

-

The ‘Chinese interference’ story is rooted in xenophobia, economic decline

Ottawa’s anxieties about a power to the East are neuralgic, irrational, and grimly familiar.

-

Banking crisis: is it all over?

Bank stock prices have stabilized at the start of this week. And all the key officials at the Federal Reserve, the U.S. Treasury and the European Central Bank are reassuring investors that the crisis is over.

-

A beginners guide to bank failures

According to a February 2023 Federal Deposit and Insurance Corporation (FDIC) audit, 563 U.S. banks have failed and/or come under regulatory authority since 2021.

![US dollars [Yousuf Khan - Anadolu Agency]](https://mronline.org/wp-content/uploads/2023/05/AA-20220520-27926764-27926757-DOLLAR_HITS_ALL_TIME_HIGH_AGAINST_PAKISTANI_RUPEE-200x200.jpg)

![President Joe Biden and House Speaker Kevin McCarthy of California walk down the House steps Friday, March 17, 2023, on Capitol Hill in Washington. [AP Photo/Mariam Zuhaib]](https://mronline.org/wp-content/uploads/2023/05/4ee85b44efb222c49b58e9a69d5d510923f6a374-200x200.jpg)