-

Why China’s socialist economy is more efficient than capitalism

The difficulty the U.S. faces in its current attempts to damage China’s economy was analysed in detail in the article “The U.S. is trying to persuade China to commit suicide”. Reduced to essentials, the U.S. problem is that it possesses no external economic levers powerful enough to derail China’s economy.

-

TRANSCRIPT: The roots and consequences of African underdevelopment, Walter Rodney, 1979

In May 1979, the Center for Afro-American Studies at the University of California, Los Angeles hosted a symposium titled The Political Economy of the Black World. We are publishing, for the first time, Walter Rodney’s thoughtful presentation at this symposium.

-

Is “de-globalisation” occurring?

The Greek philosopher Heraclitus had said “You cannot step into the same river twice.”

-

Exchange rate depreciation and real wages

Most people, including even trained economists, fail to appreciate the fact that an exchange rate depreciation, if it is to work in reducing the trade deficit in a capitalist economy, must necessarily hurt the working class by lowering the real wage rate

-

Biden’s debt ceiling betrayal is a Democratic Party tradition

Joe Biden is continuing the ignoble tradition of colluding with republicans while pretending to fight them. The latest debt limit drama is another betrayal of the people.

-

Big bad Canada pushes to protect profits from Mexico

The Trudeau government is pressing Mexico to maintain its loosely regulated, pro-capitalist mining policies.

-

Michael Lebowitz, presente! (1937–2023)

Marxist economist Michael A Lebowitz passed away at home on April 19.

-

The IMF and its ideological orphans

There was a time when the International Monetary Fund’s “recommendations” on how to reorganize an economy were read, defended and executed as if they were a divine mandate.

-

Germany: “Craftsmen for peace”

Congress of craftsmen and entrepreneurs in Dessau-Rosslau.

-

Credit Suisse: Afterthoughts to the end of the party

If you want to win back the trust of people, you have to protect them from the excesses of the financial world.

-

Pivotal moment in India-Russia relations

Most relationships undergo transition with the passage of time from appreciation of each other to a “state of having,” a desire to possess or even to control the other. But the present pivotal moment in the Russian-Indian relationship shows that an equal relationship does not fall into that trap.

-

The current state of India’s economy

GOVERNMENT officials never tire of repeating that India is currently the fastest growing major economy in the world.

-

The financial backers of the war on woke

Matthew Goodwin wants us to worry about a ‘new elite’ of media workers and academics, not the actual elite of billionaires—like his backers. SOLOMON HUGHES unveils the trail.

-

The Puzzle of Financialization

In this reprise from October 1993, Harry Magdoff and Paul Sweezy ask: “Isn’t there anyone around here who understands how this capitalist system works?”

-

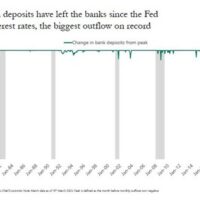

Banking crisis: is it all over?

Bank stock prices have stabilized at the start of this week. And all the key officials at the Federal Reserve, the U.S. Treasury and the European Central Bank are reassuring investors that the crisis is over.

-

Getting ready for the global financial crisis 2.0

We see again that banks have access to the protection of an unlimited nanny state, while others are left to fend for themselves.

-

Sergey Glazyev: ‘The road to financial multipolarity will be long and rocky’

In an exclusive interview with The Cradle, Russia’s top macroeconomics strategist criticizes Moscow’s slow pace of financial reform and warns there will be no new global currency without Beijing.

-

The Washington Post is coming for your retirement benefits

When Jeff Bezos bought the Washington Post for $250 million in 2013, he didn’t transform it into a paper that elevated the perspectives of the wealthy elite—it had already been that for decades.

-

How degrowth can help reduce global conflict

Defined as an equitable and democratic reduction of energy and material throughput targeted at rich nations and the globally wealthy, degrowth has grown in popularity over the last few years with growing political support.

-

Adani’s fraudulent empire exposed

The Hindenburg Research, a short selling firm, brought out a 129-page report on the Adani group marshaling evidence of all the funding operations and offshore activities of the 578 subsidiaries and shell companies linked to the seven listed companies of the Adani group. The report states that this is the “biggest con in corporate history”.

![US dollars [Yousuf Khan - Anadolu Agency]](https://mronline.org/wp-content/uploads/2023/05/AA-20220520-27926764-27926757-DOLLAR_HITS_ALL_TIME_HIGH_AGAINST_PAKISTANI_RUPEE-200x200.jpg)