“What I find a bit reprehensible is the tendency of certain Western voices to . . . raising concerns about China’s attempt to get into the African market because it is a bit hypocritical for Western states to be concerned about how China is approaching Africa when they have had centuries of relations with Africa, starting with slavery and continuing to the present day with exploitation and cheating.”

Kwesi Kwaa Prah (2007)

Open any newspaper and you would get the impression that the African continent, and much of the rest of the world, is in the process of being ‘devoured’ by China. Phrases such as the “new scramble for Africa” and “voracious,” “ravenous,” or “insatiable” “appetite for natural resources” are typical descriptors used to characterize China’s engagement with Africa. In contrast, the operations of Western capital for the same activities are described with anodyne phrases such as “development,” “investment,” and “employment generation” (Mawdsely, 2008). Is China indeed the voracious tiger it is so often portrayed as?

China’s involvement in Africa has three main dimensions: foreign direct investment, aid, and trade. In each of these dimensions China’s engagement is dwarfed by those of US and European countries, and often smaller than those of other Asian economies.

Foreign direct investment (FDI) of Asian economies globally has been growing. The total flow of foreign direct investment (FDI) from Asia to Africa is estimated to have been an annual average of $1.2 billion during 2002-2004 (UNCTAD, 2006). Chinese FDI in Africa has in fact been small in comparison to investment from Singapore, India, and Malaysia, which are the principal Asian sources of FDI in Africa according to UNDP (2007) with investment stocks of $3.5 billion and $1.9 billion each by 2004, respectively. Such investments are greater than those of China. The same report goes on to say, however, that Asian investments in Africa are dwarfed by those of the United Kingdom (with a total FDI stock of $30 billion in 2003), the United States ($19 billion in 2003), France ($11.5 billion in 2003), and Germany ($5.5 billion in 2003). And if China sits in fourth place amongst the Asian “tigers,” the scale of its investments in Africa is miniscule in comparison to the more traditional imperial powers.

Asian FDI flows to Africa have certainly grown 10-fold since the 1980s, but smaller than the 14-fold growth in FDIs globally in the same period. Compared with India, for example, China’s FDI is small. India has a larger investment in oil in Sudan and Nigeria than does China. Of 126 greenfield FDI projects in Africa, Indian companies accounted for the largest number. Indeed, amongst the Asian economies, Malaysian companies dominate in mineral extraction sector in Africa. Africa’s share of total outward flow of Chinese FDI is marginal — only 3 per cent goes to Africa, while Asia receives 53 per cent and Latin America 37 per cent. It should be borne in mind that China is a net recipient of FDI and receives a flow of FDI also from Africa: SAB Miller breweries and SASOL from South Africa and Chandaria Holdings in Kenya, amongst many others.

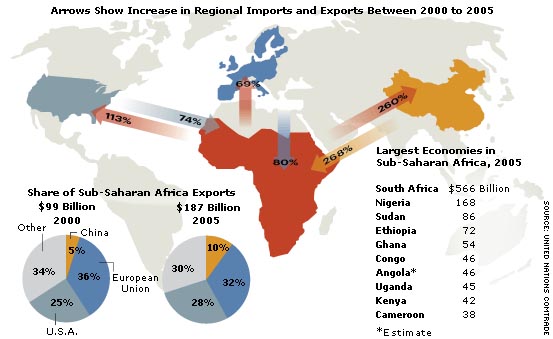

Africa is certainly important trade partner for China, the volume increasing from $11 billion in 2000 to some $40 billion in 2005. China has a growing trade surplus with Africa. According to UNDP (2007), China has become the third largest trading partner of Africa, following the United States and France. China has focused primarily on the import of a limited number of products — oil and “hard commodities” — from a few selected African countries. China’s trade with Africa represents only a small proportion of Africa’s trade with the rest of the world and is comparable to India’s trade with Africa, although both have been growing rapidly.

China imports from Africa five main commodities — oil, iron ore, cotton, diamonds, and logs. The export of these commodities, and in particular oil, has grown significantly in the last ten years. A few African countries (Sudan, Ghana, Tanzania, Nigeria, Ethiopia, Uganda, and Kenya) source a significant share of their imports of manufactured products, mainly clothing and textiles, from China (Kaplisky, McCormick and Morris, 2007). China has been vigorously castigated for its support of repressive regimes. In almost all cases, China’s involvement has been in support of its need for strategic natural resources, especially oil. And it is perhaps here that one finds the reason for the fears expressed in the West about China’s role in Africa. The USA is the world’s largest consumer of oil products, with 25% of its requirements destined to come from Africa. While China sources some 40% of its oil from the Middle East, it currently sources 23% from Africa.

Much attention has been drawn to the negative impact of the cheap Chinese commodities on African economies. Certainly this has contributed to the decline of industrial production and the growing retrenchment of workers. But China has essentially taken advantage of the “opening up” of Africa’s market that has resulted from the adoption of neoliberal economic policies that the international financial institutions, backed by the majority of the international aid agencies, have forced Africa’s governments to comply with. Given that the relative size of Chinese imports is small in comparison to imports from industrialized countries, the blame for the decline in industrial production and growing unemployment in Africa can hardly be place entirely at China’s door. Furthermore, it is important to recognize that some 58% of exports from China are manufactured by foreign-owned companies. The retrenchments and closures of local industries occurring as a result of cheap goods imported from China need to be placed at the door of the multinationals concerned as much as on the Chinese government and Chinese companies.

Just like other Western powers, China has used aid strategically to support its commercial and investment interventions in Africa. Aid has taken the form of financial investments in key infrastructural development projects, training programs, debt relief, technical assistance, and a program of tariff exemptions for selected products from Africa, not dissimilar to the agreements that Africa has had with Europe, the US, and other Western economies. China’s aid is attractive to African governments not only because it offers favorable terms, but in particular because it doesn’t come with the conditionality that has so constrained, and many would argue undermined, the development that would have the potential for bringing about social progress.

The most serious worry for the US was expressed by the spokespersons of the IMF and the World Bank who complained that China’s unrestricted lending had “undermined years of painstaking efforts to arrange conditional debt relief.” There is clearly concern that China can now offer favorable loans to Africa and weaken imperial leverage over African economies (Campbell, 2007). “The US and World Bank claim to be fighting poverty in Africa,” he continues, “but after two decades of structural adjustment the conditions of the African poor have worsened, with indices of exploitation and deprivation increasing by geometric proportions. According to one estimate, at the present pace of investment in Africa from the West, it will require more than one hundred years to realise the Millennium Development Goals. Chinese investment potentially provides an alternative for African leaders and entrepreneurs, while providing long term potential for the development of African economies.”

“China’s official development discourse is explicitly non-prescriptive, employing a language of ‘no strings attached’, quality and mutual benefit. It emphasises the collective right to development over the rights-based approaches focused on individual rights. Once the dust settles on the current China-in-Africa fever, and notions of China’s exceptionalism wear off, all involved will need to harness hopes to realistic vehicles in order to make the most of the current potential” (Large, 2007). Rocha (2007) suggests that Chinese investments in Africa are having and could continue to have some positive impacts. China is helping African countries to rebuild their infrastructure and providing other types of assistance to agriculture, water, health, education, and other sectors. This could have very positive spin-offs in lowering transaction costs and assisting African governments to address social calamities such as poor health services, energy crisis, and insufficient skills development. However, it is true that “Chinese companies are quickly generating the same kinds of environmental damage and community opposition that Western companies have spawned around the world” (Chan Fishel, 2007).

The evidence available suggests that the drive to increase the rate of profit is exhibited as much by Chinese as by Western capital. The West has the advantage in having already established its dominant position that is potentially being threatened by the “new boy on the block.”

But China has the advantage of never having enslaved or colonized the continent. China also has not made any false promises coated with neo-liberalism. While the West, the IMF, and the World Bank put conditions that only aid in their fleecing of Africa, China has so far been willing to provide unconditional aid and invest in infrastructure. At the same time, however, it freely takes full advantage of the opening up of markets that neo-liberal economic policies over the last 25 years have offered, unencumbered.

And so far, unlike the US, China has not sought to establish military bases in Africa to protect its economic interests, which the US has sought to establish through AFRICOM.

References

Campbell, Horace. “China in Africa: Challenging US Hegemony.” Firoze Manji and Stephen Marks, eds. African Perspectives on China in Africa. Oxford/Nairobi: Fahamu, 2007. Pp. 119-137.

Chan-Fishel, Michelle. “Environmental Impact: More of the Same.” Firoze Manji and Stephen Marks, eds. African Perspectives on China in Africa. Oxford/Nairobi: Fahamu, 2007. Pp. 139-152.

Kaplinsky, Raphael, Dorothy McCormick, and Mike Morris. “The Impact of China on Sub-Saharan Africa.” IDS Working Paper, no. 291, 2007.

Large, Daniel. “As the Beginning Ends: China’s Return to Africa.” Firoze Manji and Stephen Marks, eds. African Perspectives on China in Africa. Oxford/Nairobi: Fahamu, 2007. Pp. 153-168.

Mawdsely, Emma. “Fu Manchu versus Dr Livingstone in the Dark Continent? How British Broadsheet Newspapers Represent China, Africa and the West.” Pambazuka News 22 January 2008.

Prah, Kweisi Kwaa. “Africa and China: Then and Now.” Firoze Manji and Stephen Marks, eds. African Perspectives on China in Africa. Oxford/Nairobi: Fahamu, 2007. Pp. 57–61.

Rocha, John. “A New Frontier in the Exploitation of Africa’s Natural Resources: the Emergence of China.” Firoze Manji and Stephen Marks, eds. African Perspectives on China in Africa. Oxford/Nairobi: Fahamu, 2007. Pp. 15-34.

UNCTAD. World Investment Report 2006: FDI from Developing and Transition Economies: Implications for Development. New York and Geneva: United Nations, 2006. Sales no. E.06.II.D.11.

UNDP. Asian Foreign Investment in Africa: Towards a New Era of Cooperation among Developing Countries. New York/Geneva: United Nations Publications, 2007. UNCTAD/ITE/ IIA/2007/1. UNDP (2007).

Firoze Manji is director of Fahamu and editor of Pambazuka News. This article was first published in Pambazuka News on 23 March 2008.

|

| Print