| “Our community is expanding: MRZine viewers have increased in number, as have the readers of our editions published outside the United States and in languages other than English. We sense a sharp increase in interest in our perspective and its history. Many in our community have made use of the MR archive we put online, an archive we plan to make fully searchable in the coming years. Of course much of the increased interest is from cash-strapped students in the metropolis, and from some of the poorest countries on the globe. For those of us able to help this is an extra challenge. We can together keep up the fight to expand the space of socialist sanity in the global flood of the Murdoch-poisoned media. Please write us a check today.” — John Bellamy Foster

To donate by credit card on the phone, call toll-free: You can also donate by clicking on the PayPal logo below: If you would rather donate via check, please make it out to the Monthly Review Foundation and mail it to:

Donations are tax deductible. Thank you! |

The data hugely overestimate jobs created in new firms, which will be corrected next year.

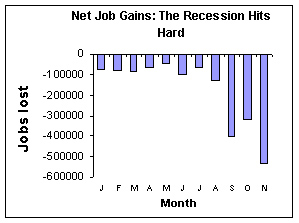

The economy shed 533,000 jobs in November. This loss, combined with sharp upward revisions to the September and October data, brought the three-month job loss to 1,256,000 jobs, the largest three-month loss in any period since the period ending February 1975. (The job losses at the start of the recessions in 1949 and 1958 were larger relative to the size of the labor force.) The private sector lost 1,286,000 jobs over this period, as the public sector continued to add jobs at a modest pace.

The economy shed 533,000 jobs in November. This loss, combined with sharp upward revisions to the September and October data, brought the three-month job loss to 1,256,000 jobs, the largest three-month loss in any period since the period ending February 1975. (The job losses at the start of the recessions in 1949 and 1958 were larger relative to the size of the labor force.) The private sector lost 1,286,000 jobs over this period, as the public sector continued to add jobs at a modest pace.

The job loss was widely spread across sectors, although construction and manufacturing continued to be among the hardest hit. Employment in the construction sector fell by 82,000 in November, or 1.2 percent. The sector has lost 201,000 jobs over the last three months. Employment in the non-residential sector is now dropping as fast as employment in the residential sector, as this bubble has now burst also.

Employment in manufacturing fell by 85,000 or 0.6 percent. The sector has shed 258,000 jobs in the last three months. Production workers have accounted for virtually all of this job loss, with a decline of 253,000 production jobs (2.6 percent of employment). This suggests that firms are keeping supervisory and managerial personnel even as they have mass layoffs of production workers. The job loss was widely distributed across manufacturing sectors.

The employment services sector was an even bigger job loser, shedding 100,700 jobs in the month (3.2 percent of its total employment). This sector has lost 213,500 jobs over the last three months. Employers are dumping temporary employees as a way to keep on permanent staff.

Retail trade lost 91,300 jobs in November (0.6 percent of employment) and has lost 229,100 over the last three months. Transportation lost 31,500 jobs and financial services lost 32,000. Health care is the only sector that continues to expand at a healthy pace, adding 33,800 jobs. Health care has added 87,100 jobs over the last three months.

The actual job numbers are likely somewhat worse than the data in this report. The Bureau of Labor Statistics is imputing more jobs into the data for new firms than it did for the same months last year. The imputation from the firm “birth/death” model for September-November this year is 143,000. It was just 117,000 for the same three months last year. This figure will almost certainly be revised down sharply in the benchmark revision next year, showing an even more rapid rate of job loss for these months.

In addition to cutting workers, firms are also cutting hours. The index of total hours for production workers fell by 0.9 percent in November and is down 2.0 percent over the last three months, the sharpest three-month decline in any period since 1964 when the series began.

The household data are showing an equally bleak picture. The unemployment rate rose to 6.7 percent, with the employment to population ratio falling by 0.4 percentage points to 61.4 percent, the lowest level since March of 1993. The number of workers involuntarily employed part-time grew by 715,000 (11.0 percent) to 7,200,000. This helped to raise the U-6 measure of labor market slack to 12.5 percent, the highest rate since BLS began the measure in 1994.

The effects of the recession continue to be felt disproportionately by men (consistent with job loss in construction and manufacturing) and younger workers. Employment among married men with a spouse present has fallen by 634,000 over the last year, while employment among married women with a spouse present has fallen by 32,000 over the same period. Employment among workers over age 55 has risen by 880,000 over the last year, while employment for workers under age 55 has fallen by 3,242,000.

This report should eliminate any possible doubts about the seriousness of this downturn. The economy is falling at the sharpest rate since the Great Depression. As bad as the employment picture appears in this report, it will almost certainly appear far worse when the BLS adjusts its data in its benchmark revision for the loss of firms not captured by the survey.

Dean Baker is the Co-director of the Center for Economic and Policy Research. CEPR’s Jobs Byte is published each month upon release of the Bureau of Labor Statistics’ employment report. For more information or to subscribe by fax or email contact CEPR at 202-293-5380 ext. 102, or morgavan [at] cepr [dot] net. This article first appeared in the CEPR Web site on 5 December 2008.