Executive Summary

This paper makes projections of wealth for 2009 for the baby boom cohorts (ages 45 to 54 and ages 55-64) using data from the 2004 Survey of Consumer Finance. It updates an earlier paper on this topic from June of 2008 using projections for housing and stock values that are more plausible given the sharp downturn in both markets over the last 8 months, and creates three possible scenarios — from best- to worst-case — for baby boomers’ wealth in 2009.

The projections show:

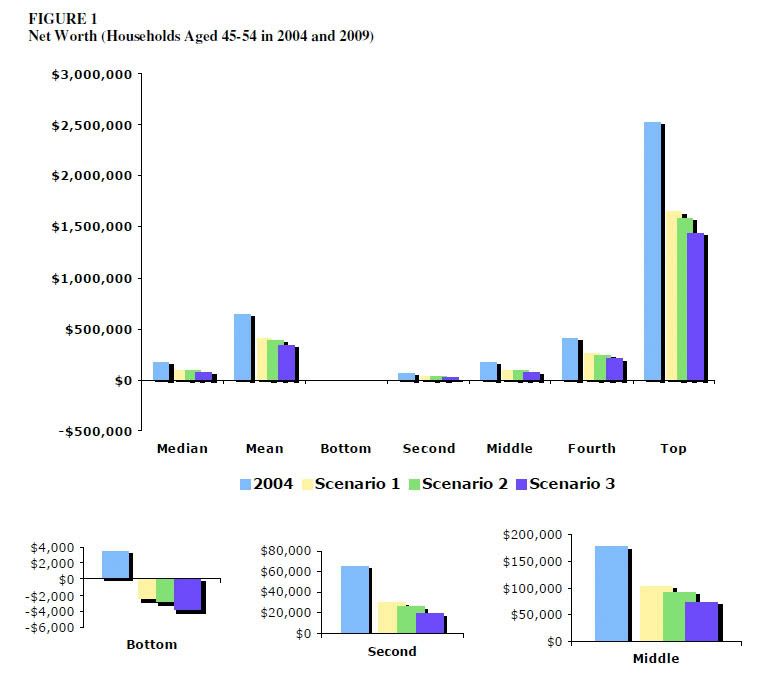

1) The median household with a person between the ages of 45 to 54 saw its net worth fall by more than 45 percent between 2004 and 2009, from $150,500 in 2004 to just $82,200 in 2009 (all amounts are in 2009 dollars). This figure, which includes home equity, is not even sufficient to cover half of the value of the median house in the United States. In other words, if the median late baby boomer household took all of the wealth they had accumulated during their lifetime, they would still owe more than half of the price of a typical house and have no other assets whatsoever.1

2) The situation for early baby boomers is somewhat better. The median household with a person between the ages of 55 and 64 saw its wealth fall by almost 38 percent from $229,600 in 2004 to $142,700 in 2009. This net worth would be sufficient to allow these households, who are at the peak ages for wealth accumulation, to cover approximately 80 percent of the cost of the median home, if they had no other assets.

3) As a result of the plunge in house prices, many baby boomers now have little or no equity in their home. According to our calculations, nearly 30 percent of households headed by someone between the ages of 45 to 54 will need to bring money to their closing (to cover their mortgage and transactions costs) if they were to sell their home. More than 15 percent of the early baby boomers, people between the ages of 55 and 64, will need to bring money to a closing when they sell their home.

These calculations imply that, as a result of the collapse of the housing bubble, millions of middle class homeowners still have little or no equity even after they have been homeowners for several decades. These households will be in the same situation as first-time homebuyers, forced to struggle to find the money needed to put up a down payment for a new home. This will make it especially difficult for many baby boomers to leave their current homes and buy housing that might be more suitable for their retirement.

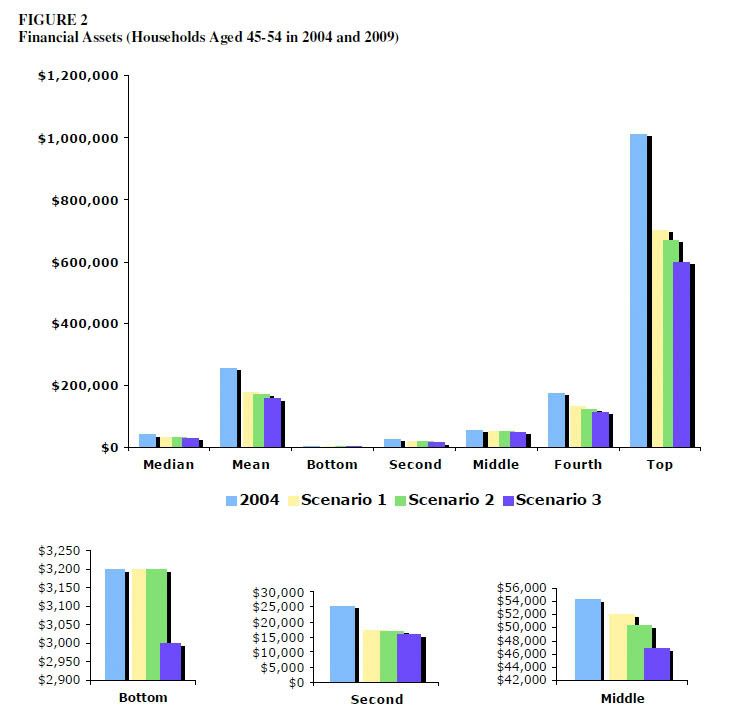

Finally, the projections show that for both age groups, the renters within each wealth quintile in 2004 will have more wealth in 2009 than homeowners in all three scenarios. In the second and third scenarios, renters will have dramatically more wealth in 2009 than homeowners who started in the same wealth quintile. Homeownership is not everywhere and always an effective way to accumulate wealth. For those who owned a home in the last few years, the collapse of the housing bubble led to the destruction of much or all of their wealth.

This analysis indicates that the loss of wealth due to the collapse of the housing bubble and the plunge in the stock market will make the baby boomers far more dependent on Social Security and Medicare than prior generations. While it will be desirable to develop more secure mechanisms for workers to save for retirement in the future, the baby boom generation for the most part has insufficient time remaining before retirement to accumulate substantial savings. Therefore, they will be largely dependent on social insurance programs to support them in retirement.

1 These calculations exclude wealth in defined benefit pensions.

Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC. David Rosnick is an Economist at the Center for Economic and Policy Research in Washington, DC. The text above is the executive summary of David Rosnick and Dean Baker, “The Wealth of the Baby Boom Cohorts after the Collapse of the Housing Bubble,” Center for Economic and Policy Research, February 2009, from which the two charts above are also reproduced. Read the full text of the paper at <http://www.cepr.net/documents/publications/baby-boomer-wealth-2009-02.pdf>.