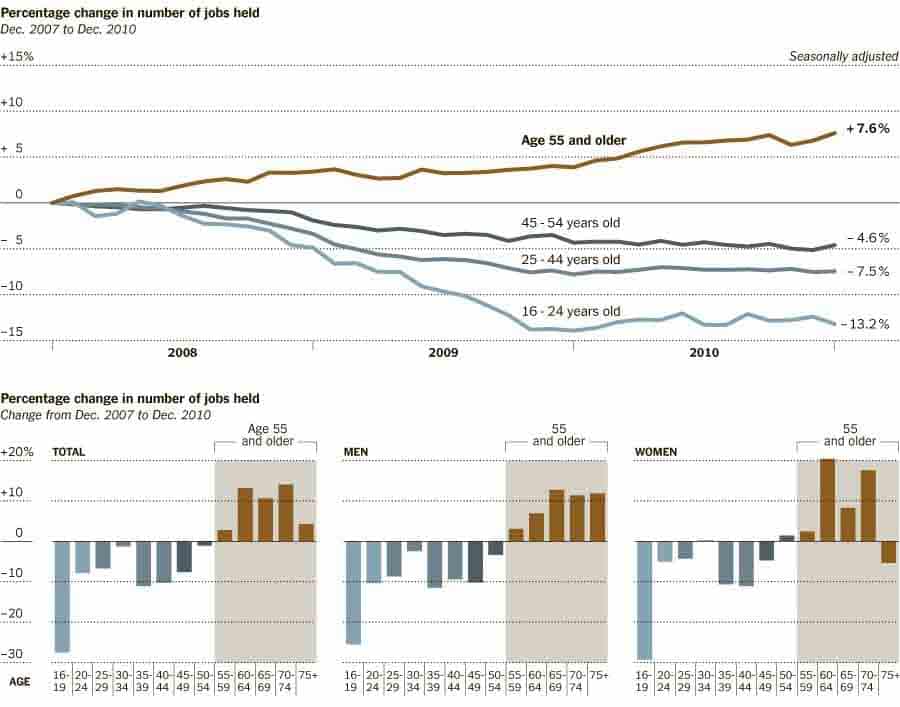

On January 15, the New York Times ran an interesting piece on older workers. According to Bureau of Labor Statistics data cited in the story, the US workforce is a lot older now than it was at the onset of the Great Recession in December 2007. Total employment of workers under the age of 55 is down (way down for 16 to 24 year olds), but the total number of workers age 55 and older is up almost eight percent:

The piece is a good overview of recent developments, but could give readers the misimpression that the labor market is performing well for older workers. In fact, older workers have not been spared in the economic downturn. Indeed, their continued presence in the labor market is more likely a sign of economic stress than of economic success.

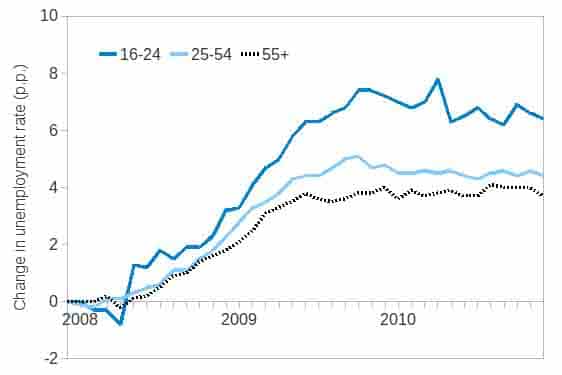

For example, despite the rising number of 55-plus workers, the unemployment rate for workers 55 and older is up almost as much as it is for 25 to 54 year olds:

Source: Analysis of Bureau of Labor Statistics data.

And older workers are far less likely than younger workers to find a job after a layoff.

But wait, how can both employment and unemployment be up for the same group at the same time? Economists divide the working-age population into three groups: the employed, the unemployed, and those “not in the labor force.” To be employed, a person only has to have worked for at least one hour for pay or profit during the preceding week. To be unemployed, a person must be actively looking for work. Everyone else is “not in the labor force” — including retirees. So, employment and unemployment can increase at the same time if the share of those “not in the labor force” — such as those in retirement — falls. Which is exactly what has been happening in the Great Recession.

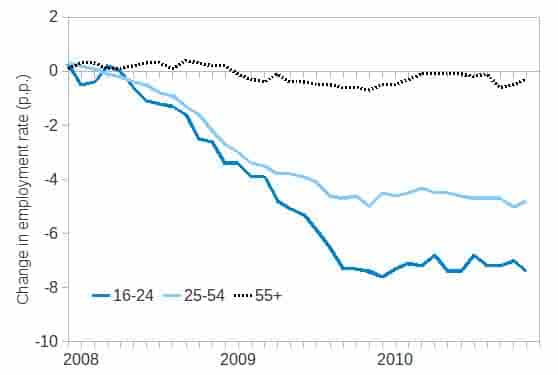

For older workers, the unemployment rate is up, while the employment rate (the employed as a share of the total population) has held steady:

Source: Analysis of Bureau of Labor Statistics data.

But, what looks to be success in the labor market actually reflects the serious setbacks that older workers have experienced in the financial markets. As my colleagues David Rosnick and Dean Baker have demonstrated, many workers nearing retirement have seen their savings implode (pdf) with the collapse of house prices and the stock market. Workers who five or ten years ago would have been retired are holding on to their jobs in the wake of these losses. Many of them are continuing to work, as my colleague Hye Jin Rho has documented, despite being in physically demanding jobs.

In this case, there’s a dark cloud behind the silver lining.

John Schmitt is a Senior Economist at the Center for Economic and Policy Research in Washington, DC. This article originally appeared on John Schmitt’s blog No Apparent Motive and was republished by CEPR on 19 January 2011 under a Creative Commons license.

var idcomments_acct = ‘c90a61ed51fd7b64001f1361a7a71191’;

var idcomments_post_id;

var idcomments_post_url;