This entry begins by setting out the core ideas of Karl Marx (1818–83), with particular reference to the theory of historical materialism and its application to the capitalist mode of production. Marx’s theory of value and distribution receives detailed attention, followed by his models of capital accumulation and economic crisis. Then the post-1883 development of Marxian economics in Germany and Russia is outlined, with particular emphasis on the revisionist controversy, the economic interpretation of imperialist rivalry, and the prospects for the successful establishment of capitalism in Russia. The entry concludes with a brief discussion of the continuing relevance of Marxian economics in the twenty-first century.

Karl Marx was born in Trier on 5 May 1818; he died in London on 14 March 1883. The young Marx studied philosophy at the universities of Bonn and Berlin, receiving his doctorate at the University of Jena in 1841 with a dissertation on the theories of nature found in the work of the ancient Greek philosophers Democritus and Epicurus. Barred from an academic career because of his radical political views, he worked as a journalist in Köln before being exiled, first to Paris and then to Brussels. Marx returned to Germany in 1848, where he was active in the unsuccessful revolution against the Prussian monarchy. He was again forced to leave Germany, and spent the rest of his life in exile in England. There are several good intellectual biographies, including McLellan (1973), Sperber (2013) and Stedman Jones (2016).

He began to work on economics in the mid-1840s, motivated by his political activities and profoundly influenced by his study of German philosophy, above all Hegel, and by contemporary French socialism. Marx was a great admirer (and also a strong critic) of English classical political economy, especially of David Ricardo. Only a small part of his writings on economics was published in his lifetime; they included A Contribution to the Critique of Political Economy in 1859 and the first volume of Capital in 1867. Friedrich Engels (1820–95), his close friend and lifelong collaborator, drew on the extensive manuscripts that Marx left behind to publish the second and third volumes of Capital, in 1885 and 1894 respectively; all three volumes were soon translated into English (Fine and Saad-Filho 2010; Harvey 2010; Howard and King 1985). Three additional volumes devoted to the history of economic thought were published in German in 1905–10, edited by Karl Kautsky, but only appeared in English, as Theories of Surplus Value, in 1969–1972. The 50-volume Marx-Engels Collected Works (MECW) were published by Progress Publishers (Moscow) and International Publishers Co. (New York) between 1975 and 2004. The complete German-language Marx Engels Gesamtausgabe (MEGA), initially published by Dietz Verlag (East Berlin) and continued since 1990 by Akademie Verlag (Berlin), is still a work in progress. By 2016, 62 volumes had appeared, with another 52 planned to come, supposedly by 2025.

Abteilung (Part) II of the MEGA, devoted to Capital, together with preparatory notes and drafts, has finally been completed. Fifteen volumes in 23 separate parts have been published by Akademie Verlag, amounting to several thousand pages that contain all Marx’s surviving writings from the period 1857 to 1881 related to Capital. In particular, Abteilung II contains transcriptions of previously unpublished manuscripts, shedding new light on his work. Among other things, they indicate why, after publishing the first volume of Capital in 1867, Marx never succeeded in completing any further volume.

Marx saw himself as both the heir and the critic of classical political economy, which had focused on the production and distribution of the means of subsistence, and down to about 1830 had constituted a genuine social science (Dobb 1973; Meek 1973). He dismissed subsequent developments in economic theory as ‘vulgar’ (dumbed-down) apologetics. The classical economists, Marx believed, had explained the evolution of modern economies in terms of the fundamental conflict between the different social classes in a predominantly agricultural society where the producers enjoyed a bare minimum standard of living and the surplus product was shared between landlords and capitalist farmers. The size of the surplus, relative to total output, set a maximum limit on the rate of growth; actual growth depended on the relative shares of the surplus that were received by thrifty capitalists and prodigal landlords. Marx himself defined the subject matter of the political economy of capitalism as the production, distribution, consumption and exchange of commodities, which are useful products of human labour destined for sale in the market rather than for direct use by the producers. He privileged production over the other categories, not only in the explanation of distribution, consumption and exchange but also in accounting for the nature of the state and forms of social consciousness.

The fundamental Marxian principle of historical materialism, set out in his well-known ‘Preface’ to the Critique of Political Economy, states that the relations that define the economic system, and the institutions of politics and the law, as well as the dominant forms of social consciousness, are all ultimately determined by the requirements of the productive forces, which consist of means of production and human labour power. The productive relations are relations of ownership over the productive forces, and hence relations of social, economic and political power. Three propositions are central to historical materialism. The development thesis states that human creative intelligence, reacting to scarcity, makes the productive forces develop over time. The primacy thesis asserts that it is the level of development reached by the productive forces that explains the nature of the productive relations, which in turn account for the nature of the superstructure (non-economic institutions such as the legal system and the state). Most important for the dynamic of history, the fettering thesis states that, when the productive relations become a shackle on the development of the productive forces, they will change in order to break the fetters (Marx 1859; Cohen 1978).

Marx distinguished several modes of production, characterised by the different ways in which surplus labour was performed and the resulting surplus product was appropriated. In primitive communism there was little or no surplus and no class stratification. In classical antiquity the critical social relation was that between slaves and slave-owners, while under the feudal mode of production surplus labour was extracted through the serf’s obligation to work, without remuneration, for several days each week on the lord’s land. In classical antiquity and feudalism, the exploitation of the producers was directly observable. In capitalism, where human labour power has itself become a commodity, it appears that every hour of work is paid for, so that there is no exploitation. This conceals the underlying reality of surplus labour, which is now produced in the form of surplus value. Marx believed that the classical, feudal and capitalist modes of production followed each other in chronological sequence, each serving first to develop the forces of production but eventually becoming a fetter upon them. Behind the backs of the capitalists the profitability of the system as a whole would collapse, despite their efforts as individuals to increase profits. Thus capitalism would in its turn give way to socialism/communism, the final stage in the unfettering of human productive potential, with the eventual abolition of the market and the direct regulation of production by society in accordance with genuine human needs.

Most of the central features of the capitalist mode of production were identified by Marx and Engels as early as 1848 in the Communist Manifesto, and their analysis has formed the basis for all subsequent developments in Marxian political economy (Hobsbawm 1998). These core features are: exploitation; alienation and fetishism; compulsion to accumulate; concentration and centralisation of capital; constant revolutionising of the means of production; global expansion; social and economic polarisation; intensification of class conflict; increasingly severe economic crises, accompanied by the growth of a reserve army of unemployed workers; development of socialist relations within capitalism; and the eventual replacement of capitalism by socialism/communism through proletarian revolution.

For Marx, the defining characteristic of capitalism is the relationship between wage labourers and capitalists: capital is defined as a social relation, not primarily as a sum of value or a collection of machines and buildings. In this relationship workers are not only exploited, that is, forced to perform surplus labour, being required to work for longer than would be necessary to produce the means of subsistence that they need to keep them alive and able to work. They are also alienated, since the products of their labour have escaped their control and have instead become external forces that dominate their own producers. Alienation is an objective social condition; its reflection in human consciousness is commodity fetishism, a distorted view of the economic world in which historically contingent social relations are seen as the natural properties of things.

All pre-modern legal, political, religious and cultural constraints on competition are progressively eliminated as capitalism develops and the pressure on individual capitalists intensifies. Machine production drives out the earlier technology of manufacturing (literally, making things by hand), so that the economic advantages of large-scale production are increasingly evident and the processes of concentration and centralisation of capital accelerate. Individual units of capital become larger and the number of capitalists able to survive in any branch of industry diminishes. Hours of work increase, along with the intensity of labour and the workers’ experience of alienation. Real wages may fall, remain constant or even rise somewhat, but relative to profits they continually decline, and the insecurity of proletarian existence grows. This is the material basis for increasingly acute class conflict, which is accentuated by the socialising effects of the factory system. Working class radicalism is further provoked by periodic economic crises, which throw many of them out of work and demonstrate that capitalism has itself now become a fetter on the development of the productive forces. Its own technology and social organisation point unerringly towards the socialist/communist future that will be realised, sooner rather than later, through proletarian revolution.

Marx attempted to formalise his vision of capitalism into a systematic model of accumulation and crisis. For this he needed a theory of value so that the fundamental relationships could be expressed in a clear and coherent manner. This he took from classical political economy, but with some distinctive features of his own making. The qualitative dimension of Marx’s value theory expresses the profound but frequently neglected truth that a social division of labour underpins each individual act of market exchange. Since the physical properties of commodities differ, the only quality that they have in common is that they are products of human labour, and this defines their value. The quantitative dimension of Marx’s theory of value is concerned with the magnitude of value. This, he argued, depends on the amount of labour embodied in a commodity, although this need not and in fact normally will not equal the price at which the commodity is actually sold.

Marx distinguished dead from living labour, where dead labour is contained in the produced means of production (machinery and raw materials) that are used in the course of production. Only part of the workers’ living labour is paid for; their unpaid or surplus labour is what produces surplus value (s), which is in turn the source of profit, interest and rent. Capital has two components. The first is constant capital (c), the value of which is merely transferred from the means of production to the final product without increasing in quantity. The second is variable capital (v), embodied in the wage-goods consumed by the workers, which expands its value during production because of the performance of surplus labour. Thus the value of any particular commodity has three components, c, v and s, and the same is true of the total product of society as a whole.

Some of the difficulties with this quantitative labour theory of value were acknowledged by Marx himself, in particular the transformation problem, which he discussed in volume III of Capital. Competition in the market for labour power tends to equalise the rate of exploitation (e = s/v) in all industries, but there is no reason to suppose that the ratio of constant to variable capital (which Marx termed the organic composition of capital, k = c/v) would also be equalised. This leads to differences in the rate of profit (r) between industries, since r = s/(c+v) = (s/v)/(c/v) + (v/v) = e/k+1. In a competitive capitalist economy, however, such differences are inconsistent with the free mobility of capital. Marx’s solution was to distinguish the labour value of a commodity from the price of production at which it was actually sold, and also to distinguish the profit accruing to individual capitalists from the surplus value produced by their workers. In industries with an above-average organic composition of capital, price of production would exceed value and profits would be greater than surplus value; the reverse would be true if the organic composition was below the average. In aggregate, though, the sum of values would equal the sum of prices and, more importantly, the sum of profits would equal the sum of surplus value. Marx concluded that value determined price, and surplus value determined profit, even though competition inevitably transformed the first of these categories into the second.

In volume II of Capital Marx used his value categories to set out a formal model of capital accumulation and to explain why the process of accumulation necessarily involved cyclical crises. He distinguished two sectors, one producing capital goods and the other consumer goods; sometimes he drew a further distinction between wage-goods and luxuries. His models of simple reproduction (zero growth) and expanded reproduction (positive growth), illustrated by elaborate numerical examples rather than mathematics, reveal that the rate of accumulation depends on the proportion of surplus value that capitalists decide (or are compelled) to devote to accumulation, and also on the rate of profit. Marx’s objective here was not to demonstrate that smooth growth was likely but precisely the opposite: to show why it was not likely to occur. Specific numerical relations between the sectors are necessary (but not sufficient) for smooth growth to occur. Disproportionality between the departments of production will lead to crises, perhaps in the form of underconsumption, which occurs when the incomes of the working class are too small to allow wage-goods to be purchased at prices that realise the surplus value (profit) contained in them.

In volume III of Capital Marx developed a model of the falling rate of profit that was inspired by that of Ricardo but was also very different. Ricardo had relied on diminishing returns in agriculture to generate a falling rate of profit. Marx emphasised rising productivity in industrial production, reflected in a tendency for the organic composition of capital (k) to increase more rapidly than the rate of exploitation (e). Since r = e/k + 1, the rate of profit would therefore tend to fall, unless the ‘counter-acting tendencies’ were sufficiently powerful; these included the ‘cheapening of the elements of constant capital’ due to technical progress in department I, which might prevent k from rising in the first place. If the rate of profit does tend to fall, either because of the volume III arguments, or due to persistent underconsumption, it will eventually result in a falling rate of accumulation, and this will vindicate the fettering thesis that is central to historical materialism.

Why, then, did Marx fail to complete the second and third volumes of Capital? One reason was that various political events and circumstances prevented him from pursuing his analytical work in a consistent manner. Among these were the Franco–Prussian War of 1870–71, and especially the fate of the Paris Commune of 1871, together with his leading role in the International Workers’ Association and his involvement in a major dispute with the anarchist Mikhail Bakunin over its leadership. He also had serious health problems. In addition, he discovered in the course of his analytical labours that he knew too little and that some of his earlier arguments did not stand up to critical scrutiny. He buried himself in mathematics, and differential calculus in particular, and also in the natural sciences, reading works on geology, physiology and chemistry. He also returned to examine Ricardo and other economists. While he had once seen Britain as the leading example of capitalism and its governing law of development, his attention was increasingly drawn to the USA, for which the statistical material was a great deal better and which demonstrated no tendency to stagnation. He sought detailed information on the development of limited liability, the separation of ownership and control, the stock exchange and the periodicity of economic development and whether this could be predicted. Marx was a perfectionist: given the number of unresolved questions, how could he complete his work? The material brought together in MEGA shows clearly that, while Marx was an eminently political person, he was primarily a scholar forced to acknowledge that his work was not yet fully developed.

Before 1914 the influence of Marx’s thinking on economics was greatest in continental Europe, above all in Germany and Russia (see Howard and King 1989, parts I and II). Most but not all of those who debated it were political activists rather than academic economists. Simplified and uncritical accounts of Marx’s theoretical system were provided for a German readership by Engels and also by Karl Kautsky (1854–1938), who was regarded as the main authority on Marx after his death and came to be known as ‘the pope of Marxism’ (Geary 1987). After Engels’s death in 1895 more critical voices came to be heard and the revisionist Eduard Bernstein (1850–1932) challenged many of the fundamental tenets of Marx’s system. Bernstein argued that capitalism had changed, and its internal contradictions had become much less sharp. German society was becoming less polarised, he claimed, not more so as the orthodox Marxists maintained, and there was real scope for an alliance between the working class and the liberal bourgeoisie to implement economic and social reforms in the interests of the workers (Steger 1997).

There was also a substantial debate, this time involving academic economists, on the transformation problem. It was initiated by Engels who, in his ‘Preface’ to volume II of Capital in 1885, had challenged vulgar economists to predict the solution to the problem that Marx had provided in the (as yet unpublished) volume III. The resulting ‘prize essay competition’ lasted until 1894 and involved theorists from Germany, Italy, Switzerland and the United States. Three of them (W. Lexis, Conrad Schmidt and P. Fireman) anticipated much of Marx’s proposed solution, but none of them was able to identify, still less to overcome, its defects (Howard and King 1989, chapter 2).

In the first decade of the twentieth century, important contributions to the literature of Marxian political economy were made in Vienna by the Austro-Marxists, who began to publish a series of Marx-Studien in 1904 (Bottomore and Goode 1978). They included Max Adler (1873–1937), Otto Bauer (1881–1938) and Rudolf Hilferding (1877–1941). The latter two had studied economics at the University of Vienna under Eugen von Böhm-Bawerk, in a graduate class that also included Joseph Schumpeter and Ludwig von Mises. In 1896 Böhm-Bawerk had published a highly critical essay entitled ‘Karl Marx and the close of his system’, attacking the labour theory of value and Marx’s proposed solution to the transformation problem. Eight years later Hilferding responded, providing the first systematic Marxian critique of the marginal utility theory of value, which he denounced as unhistorical and unsocial, focusing on the individual relationship between a thing and a human being rather than the social relations between humans. The individualism of bourgeois economics, he concluded, entailed its suicide as a serious attempt to construct a scientific political economy (Sweezy 1949).

Also in 1904 Bauer made the first of his several attempts to formalise the Marxian theory of crisis that been set out in various places in the three volumes of Capitalbut which Marx had never been able to bring together in a single coherent mode. Bauer’s analysis was based on an explicit repudiation of Say’s law and a detailed discussion of the role of consumption and investment expenditure in a system of credit money. He maintained that the long-run tendency for the organic composition of capital to rise creates a damaging disproportionality between the different departments of production, with crises of underconsumption the inevitable consequence (Orzech and Groll 1991).

Hilferding moved to Germany in 1906. In his Finance Capital, published in 1910 but largely completed four years earlier, he defended Marx’s classic vision of capitalism against Bernstein and the revisionists. In what is generally acknowledged to be the most important text in Marxian political economy to appear in the 30 years after Marx’s death, Hilferding argued that the contradictions of capitalism were becoming more, not less, acute. As a result of the growing centralisation and concentration of capital and the increased power of finance, social polarisation was increasing. Middle-class liberalism in Germany was both weak and in rapid decline, as the growth of finance capital and its imperialist policies strengthened authoritarian, militarist and racist views among the middle class. The revisionists were deluding themselves that piecemeal reform of the system through a class alliance with the capitalists was feasible.

Finance capital, Hilferding argued, was a new stage in the development of the capitalist mode of production and hence also a stage on the road to socialism. Finance was becoming more important, and those who controlled it were becoming more powerful, due to increased economies of scale in industry and the growing need for bank finance to carry out the centralisation of productive capital. Financial capitalists were therefore becoming more influential, relative to industrial and commercial capitalists. As a stage of capitalism, Hilferding maintained, finance capital had its own distinctive properties and its own laws of development, above all the rise of monopoly, growing state involvement in economic life, imperialist expansion and inter-imperialist wars.

The growth of imperialism had enormous political consequences, Hilferding claimed. Global cartels were more difficult to form and even less stable than purely domestic price agreements, so that the struggle for economic territory would lead inevitably to a sharpening of international tensions; the cosmopolitan capitalism of the nineteenth century was giving way to an aggressive nationalism. Moreover, because each national finance capital needed a strong government to defend its interests against foreign interlopers, the traditional bourgeois hostility to the state had become a thing of the past. Hilferding concluded that the increasing danger of war, and the growing tax burden of armaments expenditures, would convert both the proletariat and eventually also the middle classes into enemies of imperialism.

The last major contribution to the German-language literature in this period came in 1913 from the Polish theorist Rosa Luxemburg (1870–1919), whose Accumulation of Capital explored the economic roots of imperialist expansion. She used Marx’s own numerical example of expanded reproduction from volume II of Capital to argue that continually increasing production required a continual growth in demand. This increasing demand, she claimed, could only come from outside the system – from consumers who are outside the capitalist mode of production altogether. Together with the thirst for raw materials, this explained the urge to subjugate and colonise the peasant economies of Africa and Asia, in order to guarantee the necessary markets. But this process was profoundly contradictory, Luxemburg maintained. Once the entire world had been absorbed into the capitalist system, further accumulation of capital would be impossible and the system would break down (Luxemburg 1913). These conclusions were immediately disputed by Otto Bauer, who used an elaborate algebraic example to demonstrate that crisis-free accumulation was indeed possible in principle in a closed capitalist system, albeit very unlikely in practice. Capitalism would not founder on the mechanical impossibility of realising surplus value, he concluded, but would be overthrown by the working class, indignant at the extent of their suffering an increasingly crisis-prone economy (Bauer 1913[1986]).

In Russia Georgy Plekhanov (1856–1918) occupied a similar position to that of Karl Kautsky in Germany as the leading exponent of what had come to be seen as orthodox Marxism. The crucial question facing Marxists in Russia was one that their German comrades did not have to answer: was the advance of capitalism inevitable or could it be avoided (as the Russian Narodniks, or populists argued) through the strengthening of traditional, pre-capitalist economic and social relations in the countryside? Plekhanov saw the abolition of serfdom in the 1860s as an important watershed, which had replaced personal domination by market exchange as the fundamental economic relationship. The ex-serfs were required to make compensation payments in cash to their former feudal lords, and this would inevitably lead first to generalised commodity production and then to the triumph of capitalism in Russian agriculture. Hopes for a peasant-based rural socialism, Plekhanov concluded, were utopian. A similar position on this issue was taken by Vladimir Ilyich Lenin (1870–1924), although he differed radically from Plekhanov on many questions of ideology and political practice (Hussain and Tribe 1983).

Late in his life Marx himself had taken a rather different line. In an 1881 letter to the Russian populist Vera Zasulich he denied that tsarist modernisation must necessarily eradicate the village commune and work irresistibly to generate capitalist relations. As he told Zasulich, his reading of Russian history had led him to realise that the peasant commune combined collectivism and individualism in a complex system of production relations. The land was communally owned, but the production process was individual and moveable property was subject to private exchange. It was possible, Marx suggested, that a populist revolution would be able to build on the communal elements and achieve a socialist reorganisation of the commune, something that he had previously regarded as quite impossible. Authorities differ on the weight that should be attached to Marx’s apparent change of mind on this important question: compare Sperber (2013, pp. 533–5) with Stedman Jones (2016, pp. 568–86, 589–95).

By the mid-1890s it was becoming clear that capitalism was indeed becoming firmly established in Russia, and serious work was beginning to be done there on the Marxian theories of value, distribution and crisis. In 1894, Mikhail Tugan-Baranovsky (1865–1919) used Marx’s reproduction models to formulate a theory of cyclical growth that allowed him to explain the powerful forces that were driving the expansion of capitalist industry in Russia. He was a leading representative of the ‘legal Marxists’ who promoted revisionist ideas in Russia. Tugan-Baranovsky took issue with orthodox Marxian thinking on the falling rate of profit and the immiseration of the proletariat and also proposed a synthesis of the labour theory of value and marginal utility theory. He won the support of Bernstein but was subject to severe criticism from both Kautsky and Lenin.

All of these themes can be found in the work of Marxian economists in the century after 1914 (Sweezy 1970; Howard and King 1989, part III; 1992). The theory of capitalist crisis took on special urgency in the aftermath of the Great Depression of 1919–33. Then, after 1945, the ‘golden age’ (‘30 glorious years’) after 1945 raised again the question of whether capitalism could be (and had in fact been) reformed to eliminate major crises and spread prosperity to the working class, as Bernstein had claimed. The ability of capitalism to conquer the world, establishing itself in regions once dominated by pre-capitalist modes of production, has never ceased to provoke debate among Marxian economists. And the transformation problem has continued to divide them, especially after 1960 when Piero Sraffa’s revival of the Ricardian theory of value led some Marxians to conclude that the labour theory of value was now redundant (Kurz and Salvadori 1998). Controversy on all these issues continues to the present day (Fine and Saad-Filho 2012).

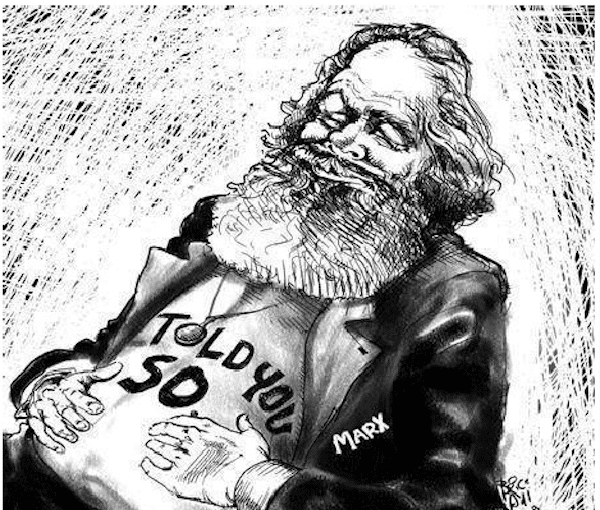

Marx himself would have been both surprised and disappointed to find capitalism alive and kicking a century and a half after the publication of volume I of Capital, and he would also have been saddened by the failure of all attempts to supersede the capitalist mode of production. He would not, perhaps, have been quite so surprised by the transformation of the global world economy in the course of the twentieth century, in both quantity and quality, since he regarded the constant revolutionising of the means of production as part of the very essence of capitalism. Some of the challenges faced by Marxian political economists in the twenty-first century are thus, necessarily, very different from those faced by their predecessors in 1883 or 1914. They include pressing questions of race and gender, the prospect of imminent environmental catastrophe, and the continuing process of the financialisation of capital that was only temporarily slowed by the global financial crisis of 2008–9 (though this was in part anticipated by Hilferding). Other issues would have been more familiar to him. Marx was wrong about very many things, but he was right to insist on the class nature of capitalist society; on the powerful forces that operate to increase inequality in wealth and in political power; on the contradictory and unstable character of the capitalist economy; and on its essentially global reach. This gives Marxian political economy a head start over all its competitors in analysing the truly important problems of our age.

References

- Bauer, O. 1913[1986]. ‘The accumulation of capital’, History of Political Economy18(1), pp. 87–110.

- Bottomore, T. and Goode, P. (eds). 1978. Austro-Marxism. Oxford: Clarendon Press.

- Cohen, G. A. 1978. Karl Marx’s Theory of History: A Defense. Princeton: Princeton University Press.

- Dobb, M. H. 1973. Theories of Value and Distribution since Adam Smith. Cambridge: Cambridge University Press.

- Fine, B. and Saad-Filho, A. 2010. Marx’s ‘Capital’. London: Pluto, 5th edition.

- Fine, B. and Saad-Filho, A. (eds). 2012. The Elgar Companion to Marxist Economics. Cheltenham: Edward Elgar.

- Geary, D. 1987. Karl Kautsky. Manchester: Manchester University Press.

- Harvey, D. 2010. A Companion to Marx’s Capital. London: Verso.

- Hilferding, R. 1910. Finance Capital: A Study of the Latest Phase of Capitalist Development. London: Routledge & Kegan Paul, 1981.

- Hobsbawm, E. J. 1998. ‘Introduction’ to K. Marx and F. Engels, The Communist Manifesto. London: Verso, pp. 3–29.

- Howard, M. C. and King, J. E. 1985. The Political Economy of Marx. Harlow: Longman, 2nd edition.

- Howard, M. C. and King, J. E. 1989. A History of Marxian Economics: Volume I, 1883–1929. London: Macmillan and Princeton: Princeton University Press.

- Howard, M. C. and King, J. E. 1992. A History of Marxian Economics: Volume II, 1929–1990. London: Macmillan and Princeton: Princeton University Press.

- Hussain, A. and Tribe, K. 1983. Marxism and the Agrarian Question. Basingstoke: Macmillan, second edition.

- Kurz, H. D. and Salvadori, N. (eds). 1998. The Elgar Companion to Classical Economics, two vols. Cheltenham: Edward Elgar.

- Luxemburg, R. 1913. The Accumulation of Capital. London: Routledge & Kegan Paul, 1951.

- Marx, K. 1859. ‘Preface’ to K. Marx, A Contribution to the Critique of Political Economy. London: Lawrence & Wishart, 1971, pp. 19–23.

- Marx, K. 1867. Capital: A Critical Analysis of Capitalist Production, vol. I. Moscow: Foreign Languages Publishing House, 1961.

- McLellan, D. 1973. Karl Marx: His Life and Thought. Basingstoke: Macmillan.

- Meek, R. L. 1973. Studies in the Labour Theory of Value. London: Lawrence & Wishart, second edition.

- Orzech, Z. and Groll, S. 1991. ‘Otto Bauer’s business cycle theory: An integration of Marxian elements’, History of Political Economy, 23(34), pp. 745–763.

- Sperber, J. 2013. Karl Marx: A Nineteenth-Century Life. New York: Liveright Publishing.

- Stedman Jones, G. 2016. Karl Marx: Greatness and Illusion. London: Allen Lane.

- Steger, M. B. 1997. The Quest for Evolutionary Socialism: Eduard Bernstein and Social Democracy. Cambridge: Cambridge University Press.

- Sweezy, P. M. 1970. The Theory of Capitalist Development. New York: Monthly Review Press.

- Sweezy, P. M. (ed.). 1949. E. von Böhm-Bawerk, Karl Marx and the Close of his System, and Rudolf Hilferding, Böhm-Bawerk’s Criticism of Marx. New York: Augustus M. Kelley; 2nd edition, London: Merlin Press, 1975.