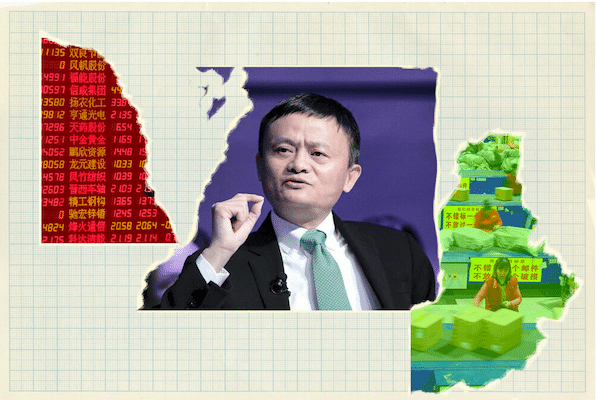

Can financial technology be corralled in service of China’s people-centered development? With Jack Ma’s Ant Group as a case study, Chinese blogger Li Xuran offers a compelling analysis of the role of capital in modern China. The halting of Ant’s bombshell IPO in November 2020, Li argues, must be seen in the context of the socialist state’s role in restraining the “wild beast” of capital for the sake of socialist development and the public good.

Editors’ note: Ant Group’s much-anticipated debut on the Shanghai and Hong Kong stock exchanges was expected to be the largest IPO of all time. But just days before the planned November 5, 2020 opening, Chinese regulators, led by the People’s Bank of China, halted the IPO and summoned Ant founder Jack Ma and other Ant executives to discuss what they called “major issues” with the tech giant’s pending listing. The clash between state regulators and Ant Group—the parent company of China’s largest mobile payment system, Alipay, and a lending service for more than 80 million small businesses—was portrayed in Western media as a “crackdown” evincing the centralized power of the Communist Party under Xi Jinping. These misrepresentations even led to conspiracy theories that Ma had been “disappeared.” But far from a “totalitarian” crackdown on private industry, the freezing of Ant Group’s monster IPO must be understood in the context of China’s socialist market economy, in which traditional banking and financial services operate under state control for the public interest. In contrast to China’s 14th Five Year Plan—which prioritizes sustainable development, rural revitalization, and real economic growth—the growing power of private lenders such as Ant Group poses systemic risks for the sorts of speculation, consumer debt, and financial bubbles responsible for cyclical financial crises in the capitalist nations. As Ant Group continues to work with regulatory authorities towards a future IPO, the question remains: can fintech be corralled in service of China’s people-centered development?

In this context, Li Xuran offers a compelling analysis of the role of capital in modern China. Channeling Marx, Li argues that the control of capital is crucial to the project of socialist development, but that left unrestrained, the “wild beast” of capital will show that its class interests outstrip its national allegiance. Rejecting the billionaire cult of personality which at times surrounds Ma, Li reminds us that the successes of Ma and his ilk are not a reflection of their own abilities, but of the opportunities created by the struggle of the Communist Party and the common Chinese people. Whether Ant Group or otherwise, to control the beast of capital requires the concerted effort of the Party, the state, and the people.

This article was originally published in Chinese in Utopia (乌有之乡). Follow the author’s public page on WeChat (ID: xuranshuo).

I.

The tides are changing.

I have seen several social media posts, mainstream media publications, and vloggers starting to ferociously criticize Jack Ma, as if criticizing him would solve all their problems. I’ve given it some thought, and, risking possible backlash amongst my readers, decided to discuss this issue at length. Because in my opinion, Jack Ma isn’t the problem.

Before you roast me, let me rephrase myself: Jack Ma isn’t the root of the problem. Why? Let’s look at some recent events: the Ant Group IPO halt, Danke (蛋壳) Apartment breakdown,(1) the showdown over community group-buying…

Broadly speaking, beneath these diverse incidents lies a single force. A great teacher and his generation warned of and suppressed it, but it has sprouted once more since the 1980s. After 40 years, it has taken root in multiple facets of our lives, including thought, society, reality and power. Bit by bit, it has shown its immense and power and frightening quality:

Capital.

Not even Marx’s Capital can fully discuss the complexity of capital. So here, I will summarize it into three points, per my understanding:

First: capital and development are inseparable.

Capital accelerates and catalyzes economic development. At a certain stage of social development (from capitalism to the primary stage of socialism), a rapid economic boom necessitates it.

I once read that a modernizing country seeking economic development and industrialization had only three paths: Urban-rural “price scissors,” i.e. setting low prices on rural commodities to support industrial development; plunder, the path taken by Western capitalist countries; and using foreign capital, exemplified by the four “Asian Tigers” which developed by heavily attracting massive foreign investment.

So, we can’t discuss too deeply the primitive accumulation of capital. Like all great fortunes, developmental history needs glorification. Only the rise of modern China has been achieved without plunder, and instead was built up on a barren ground once plundered by invaders.

The first part of New China’s path took place shortly after its founding. It consisted of controlling the price of agricultural products, limiting the movement of rural households, and country-wide restraint on food and consumption. Instead, the Chinese people channeled their energy into construction and accumulated a solid, thorough industrial foundation, summed up as “tightening the belt, to pool our resources to complete major missions.” On the other hand, after reform and opening up, China attracted massive amounts of foreign capital and released state and partially private capital, invigorating the economy.

I bring this up because we must understand that though we consider capital frightening, we need to acknowledge its great power in pushing economic development. We cannot negate China’s last 40 years using its first 30, nor can we negate its first 30 years using the last 40. This is historical materialism.

Second: expansion is capital’s basic instinct.

Capital is like genetic code, whose sole purpose is to populate, duplicate, and grow. In the natural world, a creature without a predator will surely overpopulate, like the Asian carp in the United States. Capital without competition and regulation will lead to large-scale monopoly in all areas.

Liu Cixin, in his sci-fi novel The Wages of Humanity, imagines the ultimate stage of capitalism in which a “final producer” monopolizes all the planet’s resources, including land, air and water. People pay taxes just to breathe. This speculation is based on the recognition of reality.

Isn’t the reoccurring financial recession in capitalist society, at its core, the result of capital expanding to the extreme, while suppressing labor cost to extreme, leading to production capacity far exceeding social need?

In the area of production, since the cycle is relatively long, the re-occurrence of crisis is long. But nowadays, the reason why we feel capitalism will fall into “crisis” once every few years, is because in the current era, the extreme expansion of capital is financial capital, which accelerates the progression of capital rapidly expanding until explosion. Because when capital enters industry, it realizes that it has to go through input, production, sale, re-input and other elements in the cycle, and that is way too slow to gain added value. So, we have financial capital using many dazzling leverages, tools, and products to reach the goal of producing money with money.

A friend in the financial business tells me that once being in the world of finance and having some results, you won’t want to do anything else because other industries make money far too slowly.

To some degree, finance is like drugs. Normally people derive pleasure from action, rewarded by their brains through the release of certain chemicals. But what’s horrifying about drugs is they bypass this reward system and directly stimulate the brain via chemicals to produce pleasure. That’s why people addicted to drugs are so hopeless; everything else becomes meaningless.

Financial capital is just as horrifying. From the early days of winning the stock market, to the recent subprime crisis and P2P lending platforms crisis, it will not stop.

Third, capital’s class attribute is larger than national attribute.

To be honest, I was going to skip this part–for some people, it’s a bit of a soft spot.

When dealing with capitalists, I say spare me the talk of “heart for the country and the world.”

In this world, patriotic capitalists exist, but they are hardly a class that has the self-awareness to limit their capital to national borders. While there are individuals who betray their class, there is no class that betrays its interests and profits. In the eyes of capital, the world is flat. Where there are people, there is profit, it will find its way there by any means necessary.

Much like the East India Company all those years ago; people who know their history will understand: from the standpoint of government alone, the Western powers wouldn’t have necessarily started the Opium War. European capital’s vicious interests and ambitions of expansion necessitated the war. Unlike Japan, Britain didn’t have a direct geopolitical conflict with us.

Since the 1990s, a handful of Western financial crocodiles have been making waves around the world, plundering fortune using financial tools, the result is no less severe than a hot war invasion. Many countries have suffered and have yet to recover.

Capital, once uncontrolled, can exercise enormous influence in a state’s political scene. In some small to mid-sized countries, the government has little authority and easily collapses due to the power play among many forces, including capital.

This is the reason why Sun Yat-sen called for “control of capital” over a hundred years ago.

In modern society, there is no “capital” in a purely commercial sense. All capital is closely tied up with politics, especially big capital and big tycoons. If any mature politician still believes nonsense such as “capital is only a tool,” “capital doesn’t talk politics,” and “when in business, only talk business,” they’re basically out of the game.

II.

I have said a lot already. My core intention is to tell everyone: Jack Ma is fine, Danke Apartment too. Even community group-buy, a recent popular phenomenon, are nothing but embodiments of capital. They themselves are not the problem. The true problem arises if we overlook the issues driving these forces.

Capital is like a wild beast: if we are able to tame it and use it for our needs, it will help with the development of productivity. Uncontrolled and unrestrained, it will bite us and cause great harm. On this point, Ma isn’t the last tycoon, Danke isn’t the last bankruptcy, community group-buy won’t be the last battleground.Because capital is an essential element of production, but it is not production itself. I give you 50 cents, you will try and produce things that are worth 50 cents. It indeed can stimulate creative potential and economic liveliness.

But the problem lies in, who monitors or guarantees that things worth 50 cents get made?

Capital enters the market, increasing its value constantly through finance, stocks and other shiny packages. Every process in the middle would create fortune. But in the end, the product has to get made, or society’s economic system would collapse.

Us producers jokingly call ourselves “da gong ren” (bricklayers, laborers), because people in other positions are not really involved with production, they might be in charge of spreadsheets, sales, marketing, advertising, even holding meetings.

They then wait for manufacturing and production, jobs that, at least theoretically, someone else should be doing.

But this hypothetical “person” can be exhausted, left unable to work.

Then comes insufficient production, advance consumption, then overcapacity, deflation. Next comes the decline and collapse of the whole economic system that was constructed with it.

Remember the famous passage that Marx quotes?

With adequate profit, capital is very bold. A certain 10 percent will ensure its employment anywhere; 20 percent certainly will produce eagerness; 50 percent—positive audacity; 100 percent will make it ready to trample on all human laws; 300 percent—and there is not a crime at which it will scruple, nor a risk it will not run, even to the chance of its owner being hanged.

The periodic crises of capitalist society has led economists to a consensus: uncontrolled capital will definitely lead to mad self-destruction.

The breakdown of Danke Apartment is due to this: they used low rent prices to lure tenants, put their money into financing and repackaged them as financial product (even offering loans to those who couldn’t afford to pay rent), then put this financial product back into financial market, getting more funds, to take more houses…

Using tools of capital, they expanded rapidly in just two years. Theoretically, as long as there are “laborers” who rent houses, pay rents, this game of capital can continue, the market will continue to be “vigorous and energetic”.

But what we didn’t expect is the pandemic. The economy suffered, many people couldn’t afford their rent, breaking the tightrope. In the end, those who suffer the most are always tenants, unable to afford homes.

So, in the face of capital, we must not be blinded by its sugary coat. Like community group-buying, vegetables and fruits that sell for a couple of yuan seem cheap. With a clearer outlook, we see that this is only a means through which capital enters a market where interests are diverse and scattered. Price wars, merely tools to suffocate small businesses, create monopoly and centralize interests.

After the Danke Apartment breakdown, I asked a friend who lost over ten thousand yuan and was then evicted: why did you choose Danke? He said, in his neighborhood, Danke has squeezed other agencies and he had no choice.

I was speechless.

III.

Apart from the risk of freely expanding, capital has another noteworthy hidden effect: capital warps people’s minds.

In the forty years following reform and opening up, our society’s thinking has changed tremendously. While we are more prosperous in a material sense, we also lost many things in terms of philosophy and values.

Consumerism has taken center-stage. A frivolous, anxious and interest-driven mentality has spread. On social platforms such as Douyin (Tiktok for the Chinese market) and Kuaishou, we see many youngsters showing off designer bags, cosmetics, luxury clothing, even expensive cars and houses.

It pains me to imagine how many youth will be influenced by then and become the next ones with bourgeois dreams. Many have been brainwashed by the short-sighted consumerism and interest-driven “way of success”. To fill our desires, we slowly embraced loan services and over-consumption.

Every now and then in the news we see young adults, unable to repay their loans, break the law. What’s more frightening is that this phenomenon and mentality influence the younger generation.

Studying is such a chore, people become more famous and wealthy as influencers rather than admission into Tsinghua or Peking University. Being a celebrity, making money, having plastic surgeries, finding a sugar daddy is the true path to success.

Facing this phenomenon, a netizen asks: “Should 17-year-olds be partying or preparing for the gaokao [the national college entrance exam]?” If you come from a wealthy family and happen to have the freedom of choosing your life, the former option would be beyond reproach. But how many people have the resources to actually indulge in this dream?

In a street interview, when asked “who is your favorite celebrity,” an old man said:

I don’t like celebrities. They contribute nothing to the country, only harm to the next generation. If you ask kids nowadays what they want to be when they grow up, they all say stars, singers, no one say scientists, teachers, or joining the army.…Stars don’t make a country great—scientists, engineers, working people do.

IV.

One more thing.

In contemporary China, what’s most frightening about capital is that after growing wildly for an extended period, it has almost become “too big to fail.” This is also why many spokespersons of capital have the gall to say some outrageous things.

Jack Ma, in his speech at the Bund in Shanghai in October, made remarks that he would probably take back now: financing in China “doesn’t have systemic risks” because there is “no system.

This reminds of a meme: “In every team there is a rookie. If you don’t spot the rookie, you are the rookie.” The most dreaded thing in a financial system is systemic risk. Jack Ma saying that there is no systemic risk in China’s finance only proves that he represents that risk.The following day, the chief of National Economic Committee of the Chinese People’s Political Consultative Conference pointed out in a financial summit: no matter whether we call it financial technology or technological finance, one mustn’t forget the attribute of finance, mustn’t disobey the basic rule of financial running, or one will be punished by the market.

If you still can’t comprehend what’s frightening about Ma’s speech, here I will quote what was stressed in a lecture of the Central Committee’s Political Bureau: Preventing systemic financial risk is the fundamental task of our financial work.

After Ma’s speech, I have seen many bloggers saying he’s “over the clouds.” I think they are blinded by appearance. For Ma, a person who’s shouting about retiring all the time, to have the nerve to speak like that, “over the clouds” is in fact an understatement. I’ll refrain from talking about him further, everyone can contemplate themselves.

V.

I feel fortunate to live in a socialist country.

Most people here grew up with a Marxist-Leninist education. Many lack a clear understanding or have even forgotten our coursework. However, when we grow up, get “beaten up” by society, and encounter all sorts of social problems, we seek answers. We will remember what the textbooks have taught us and will think: our textbooks were so thorough! What a shame we didn’t understand them back then.

What other countries in the world teach students to see capital through “surplus value?” What other countries explain the world with “materialism,” or ask questions beginning with “if capital has 50 percent profit…”?

Because the majority has such fundamental education, a blog like ours, founded at the end of 2019, can earn the support that it has earned. Just like in the discussion of “Xinyu Project,” a student said: “Capitalism will always be capitalism. Luckily, we’re born in China, the country that belongs to the Chinese people. Many times through these events, we can see that China led by Communist Party of China is worth our trust.” This isn’t blind worship. Rather it’s an empirical truth. If China isn’t trustworthy, how did China accomplish in forty years what capitalist countries accomplished in several hundred years?

And just because of this, in China capital will have a very hard time expanding unrestrained. When even youths and ordinary common people understand, do you think the state would not? Not only did the state notice, they responded swiftly. From the Ant Group IPO halt, to the statement of strengthening anti-monopoly and preventing capital’s free expansion, issuing The Guidance of Anti-Monopoly in the Area of Platform Economy, to strengthening the regulation of Internet finance, to the recent statement that capital needs to flow more to the real economy… These decisions are consistent with the Party’s ideology. Designed at the top level, come in prepared, hit the target, think over strategy, and deal with the root of the problem. In areas such as thought, theory, communications, and publication of policy documents, different departments work together, to form a united force.

In Western capitalist countries, anti-monopoly investigations are exceedingly difficult efforts. Big corporations, big capital hire political spokespersons and lobbyists to persuade Congress and drive policy making. There are also legal elites searching for loopholes, rationalizing decisions that would be considered irrational and unethical to any clear-minded person — all to seek excuses for capitalists to snatch profit. Even if a company or a person gets sentenced for monopoly, the long process of investigation would have likely already caused a great enough risk.But in China, a single conference, a single social commentary can change the current. Here, giants walk on ice. This is the strength of the system, and the strength of people’s hearts. In our social system, capital can never seize our country. Why have people been praising and applauding the documents of anti-corruption and re-enforcing regulation? Is this not “representing the fundamental interest of the common people?”

VI.

Last of all, I want to talk about the Fifth Plenary Session of the 19th CPC Central Committee—the most important event in the second half of the year. This meeting, in my opinion, largely revolves around one question: what is the point of development?

Let’s review the essence of socialism: liberate and develop productivity; eliminate exploitation and polarization; and reach common prosperity.

In this respect, no matter Jack Ma or any other tycoon, they’re all “front runners in wealth accumulation” that exist in a specific historical phase. Such people with capability and speciality can establish companies and bring about good management, and gain wealth for their own while helping accelerate the wealth accumulation of the whole society. But one mustn’t forget where one comes from, and where one must go. If our ass sits in the wrong camp, we will find ourselves in greater danger the greater our strength.

A TV drama set in the Qin Dynasty has recently gone popular.

I’d like to share with you a piece of commentary on the Qin state from Han Fei Zi.(2) It’s right on point and has much educational significance to this day. He says:

General Rang of Qin attacked Qi in the east overcrossing Han and Wei. After five years, Qin hasn’t gained an inch of land but General Rang gained the fief of Taoyi. General Ying attacked Han, eight years later he gained the fief of Runan. Since then, many statesmen of Qin have been like Ying and Rang. If a war was won, they were made nobility, expanding their territories and establishing private fiefs.

It means the achievement of one person of high rank is attributed to the many from below.(3) Mobilizing the forces of all of Qin to attack other states merely contributes to the interests of individual bigwig politicians.

We often say: don’t mistake the abilities of a platform for your own. Our own business elite shouldn’t regard the opportunities created from our country’s development as their own. If without a stable political and societal environment, if without tolerant, supporting policies, if without the wide coverage of basic education, if without the steadfast hard work of billions of common people, how did they end up having everything they have today? One must know where one’s ass “sits,” and one must know where one’s feet “stand.”

In the Fifth Plenary Session, great emphasis was placed on interpreting the concept of “common prosperity.” More importantly, in the explanatory draft of the 14th Five-Year Plan illustrated by President Xi, seven important issues that needed explanation were mentioned, each of great importance. One of them was “On the Advancement of Common Prosperity of All People”:

Common prosperity is the essential demand of socialism, it is the common expectation of the people. We push the economy and society to develop, all in the goal of achieving common prosperity of the people.

What’s worth noting is that such expression is a first in the documents of the Party’s plenary sessions. We must think it through: is the goal of development merely creating a “richest person”? Or creating hundreds of rich persons through IPOs? Neither. To 1.4 billion common Chinese people, such actors are an occasional wave in a tumbling river. The wave may astonish and attract attention and adoration, but it’s nothing if without the tumbling water everlastingly running through. Still water runs deep. Those who are quiet, working hard day and night, are the majority of China—it is them for whom we toil, work, and fight.

Notes:

- Danke (蛋壳) is a Chinese startup that serves as a middleman between landlords and tenants. The company rents units from landlords on a long-term basis, then sublets these units to tenants, many of whom are students or young professionals, on a short-term, flexible basis. In late 2020, the company allegedly ran out of cash and couldn’t pay apartment owners, leading some owners to evict tenants and sparking government intervention to settle disputes and issue greater regulatory oversight amidst claims of Danke’s bankruptcy.

- Han Fei Zi (韓非子) is a foundational political text dating to China’s Warring States period (战国时代), attributed to the Legalist philosopher Han Fei (韩非, lived ~280 BCE to 233 BCE), who is also known as Han Fei Zi.

- The original text is “一将功成万骨枯,” a famous quote from a late Tang era poem by Cao Song (曹松, lived 828 to 903). The literal translation would be “a general succeeds while ten thousand bones rot.”