The trade-and-technology war between the U.S. and China effectively began in 2018. On July 6, 2018, U.S. President Donald Trump unilaterally imposed a 25 per cent tariff on Chinese imports of around $34 billion, and further tariffs in 2018 and 2019—claiming that trade between U.S. and China had been unfairly skewed in China’s favour and needed to be rebalanced. The ostensible reason put forward was the persistence of what were called “unfair trade practices” and “technology theft” by China. Thereafter, the trade war has continued into the administration of President Biden, and morphed into a technology war, which is probably what it was always about. The U.S. has made aggressive moves to deny China both the knowledge and the inputs required to produce some frontier goods and services, as well as access to markets—most of all affecting semiconductor production and the 5G technology in which the Chinese company Huawei was becoming a global market leader.

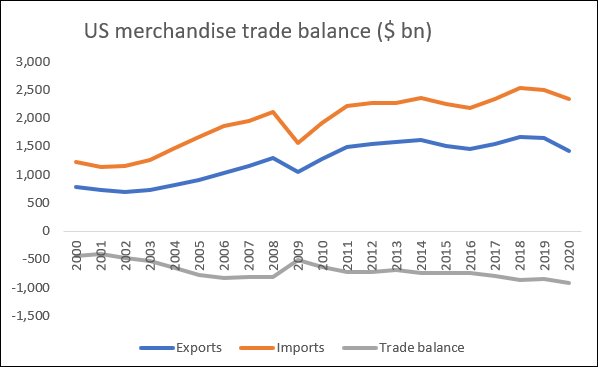

The broader context of the trade war was the growing merchandise trade deficit of the U.S., which was $735 billion in 2016, just before Trump took office. Figure 1 indicates that despite the more protectionist stance, the overall U.S. deficit actually continued to increase thereafter, to as much as $911 billion in 2020.

Figure 1: The U.S. trade deficit continued to increase under Trump

(Source for all figures: https://www.census.gov/foreign-trade/balance/)

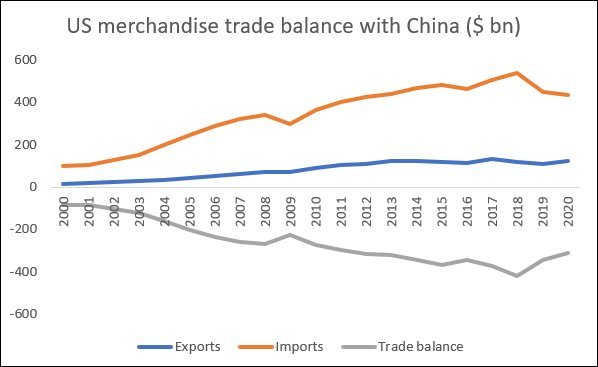

China was seen as the major problem and greater source of the trade deficit, which was “blamed” on China rather than on macroeconomic processes within the U.S. that were likely to generate trade deficits. It is certainly true that that the bilateral U.S. merchandise trade deficit with China had increased significantly since 2000, and especially in the periods 2004-08 and 2011-18, as shown in Figure 2.

Figure 2: Bilateral U.S. deficits with China

Indeed, after the Global Financial Crisis, China began to occupy a major part of the composition of the merchandise trade deficit, peaking at nearly half in 2015 (Figure 3). Yet the contribution of China declined sharply after 2018, to around one-third in 2020, even though its share of U.S. imports fell only marginally. This was essentially because the U.S. trade deficit with other countries grew larger due to declining exports during the pandemic.

Figure 3

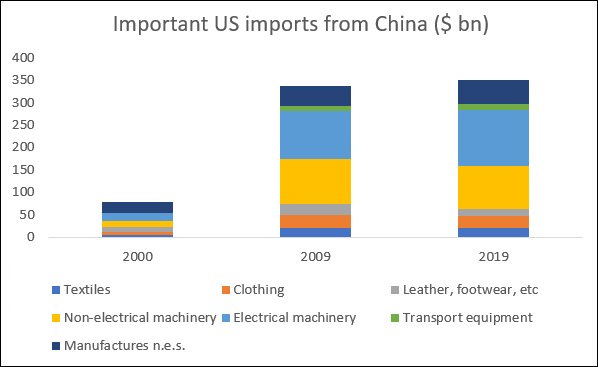

One of the more obvious concerns of U.S. trade policy with regard to China has been not just the overall imports from China, but the growing significance of high-technology imports. China succeeded in diversifying and upgrading its own export basket significantly in the past two decades, through an active policy emphasis on domestic technology development, aided by rules that required foreign investors to set up joint ventures with Chinese counterparts, in which the technology would be shared. This was done voluntarily and even willingly by U.S. multinational companies anxious to enter the fastest growing market in the world and also to use China as a base for further exports. Yet it is this strategy which is now being seen as having created a threat for the U.S. in the form of rapid technological advancement in China.

Figure 4 shows how, over the two decades since 2000, even in terms of manufactured goods exports, China moved away from relying on more traditional developing country export items like textiles, clothing and leather, to electrical and non-electrical machinery and miscellaneous items (like toys) that became the dominant manufactured exports by 2009. In the 2010s, the growth of exports was mainly concentrated in electrical machinery, including electronic products like the smartphones and tablets that have established such a significant market presence all over the world.

Figure 4

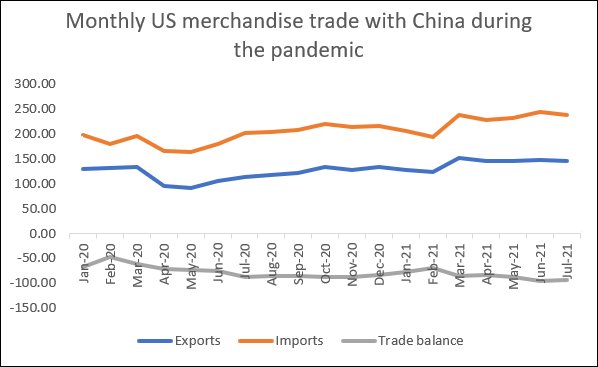

Figure 5

Interestingly, during the pandemic, U.S. reliance on Chinese imports appears, if anything, to have grown rather than declined (Figure 5). Imports into the U.S. from China in the first half of 2021 were on average 46 per cent higher than in the first half of 2020. The supply chain issues because of the pandemic that affected Wuhan and other provinces of China in the early months of 2020 were obviously addressed relatively quickly, to enable renewed production and exports to the rest of the world at a time when other countries still faced renewed waves of the pandemic that affected economic activity and production in particular.

It is also possible that many of these recent U.S. imports from China are in the form of high-tech products that the U.S. now openly sees as a competitive threat. The dangers from China that were earlier described in terms of a different, more protectionist, economic model are now being downplayed by a U.S. administration that is once again discovering the joys of trade protection linked to industrial policy. So the focus has shifted to using concerns about national security to prevent China from being able to access crucial inputs that are necessary for high-tech production.

This explains the recent moves to restrict China’s access to semiconductor chips that are essential for new 5G-enabled smartphones. This is one area in which China’s ability to develop its own domestic suppliers has been limited. Currently, China imports around $300 billion worth of chips in a year, of which more than half is then re-exported in finished electronic products. The most advanced Chinese company making these chips, Semiconductor Manufacturing International Corporation (SMIC) uses imported technology and inputs to make the chips. But now all U.S. equipment suppliers need to apply for a license from the U.S. government before they can sell to SMIC, effectively putting a brake on such sales, and substantially hampering its production. Similarly, fines and sanctions have been imposed on the giant Chinese telecoms giant ZTE, ostensibly for covering up its role in selling U.S. technology to Iran. The problems and sanctions faced by Huawei, for alleged espionage and ties to the “techno-authoritarianism” of the Chinese state, are now too well-known to need further elaboration.

The argument for such an aggressive strategy by the U.S. is typically framed in terms of “national security” considerations, but it is clearly about staking a claim to the economic territory of the future, whether in the form of communication technologies like 5G or renewable energy solutions. It remains to be seen how this will play out over the next few years.

(This article was originally published in the Business Line on October 4, 2021)