This is far from a “hot take”: financial wealth in the United States is highly concentrated, with most households, especially Black and Hispanic households, owning few financial assets. One consequence is that many Americans are likely to face a very challenging retirement. Sadly, if economic and social conditions remain as they are, we can expect to see an ever-growing number turn to for-profit crowdfunding platforms, like GoFundMe, for help in meeting expenses.

The study

A recently published study by the National Institute on Retirement Security, a non-profit research and education organization, using data from the Federal Reserve’s Survey of Consumer Finances, paints a disturbing picture of the distribution of financial assets by generation, net worth and race.

Tyler Bond, the study’s author, looked at the financial assets held by three generational cohorts at different points in time—Baby Boomers (those born between 1946 and 1964), Generation X (those born between 1965 and 1980), and Millennials (those born between 1981 and 1996). His main findings:

- inequality in the ownership of financial assets both persists and deepens over time

- inequality in the ownership of financial assets is consistent across generations

- financial asset ownership is also highly concentrated among white households

The unequal ownership of assets

Baby Boomers have the most unequal distribution of financial assets of the three cohorts. In 2004, the bottom 50 percent of Boomer households owned only 4 percent of total Boomer household financial wealth. On the other hand, the top 5 percent owned 52 percent. In 2010, the share of the bottom 50 percent fell to 3 percent while the share of the top 5 percent rose to 54 percent. In 2016, the share of the bottom 50 percent fell further to 2 percent, while the share of the top 5 percent rose again, to 60 percent. In 2019, the bottom 50 percent continued to hold only 2 percent of Boomer financial wealth, while the share of the top 5 percent fell only slightly to 58 percent.

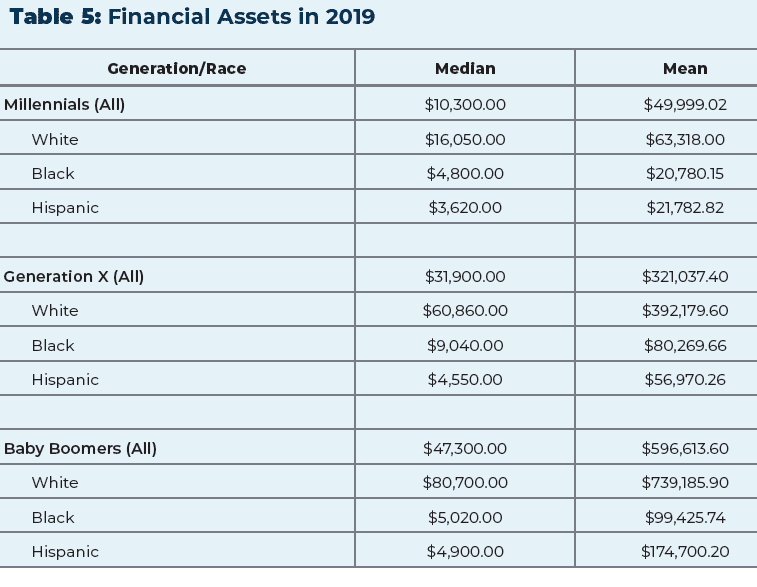

A comparison of the median (which shows the middle value) and mean values of household financial wealth offers a powerful illustration of the huge inequality in Boomer financial wealth ownership. In 2019, the median value of Boomer household financial wealth was $47,300; the mean value was $596,613.60.

The distribution of financial wealth among Generation X households is also strikingly unequal. In 2004, the bottom 50 percent owned only 5 percent of total Generation X household financial wealth, while the top five percent owned 47 percent. In 2010, the respective numbers were 5 percent and 57 percent. In 2016, the share of the bottom 50 percent fell to 3 percent, while the top 5 percent share was 54 percent. The respective numbers in 2019 were 3 percent and 58 percent. In fact, according to Bond,

If anything, Generation X is a more unequal generation than the Boomers when measured at similar ages.

The 2019 median financial wealth of Generation X households was $31,900. The mean value was $321,037.40.

The distribution of financial wealth among Millennials is not as skewed as that of the other two cohorts, largely because Millennials benefited the most from the economy’s strong 2019 growth. Still, in 2016, the bottom 50 percent of Millennial households owned only 6 percent of their cohort’s total financial wealth, while the top 5 percent held 61 percent. In 2019, the respective numbers were 8 percent and 39 percent.

The 2019 median financial wealth of Millennial households was $10,300. The mean value was $49,999.02.

Racial disparities

There are also extreme inequalities in the racial distribution of financial wealth. According to the Survey of Consumer Finances, the share of white, Black and Hispanic Baby Boomer households remained relatively constant over the four survey years at 74 percent white, 15 percent Black, and 8 percent Hispanic. Yet in all four years, white Boomer households owned more than 90 percent of that generation’s financial assets, with Black and Hispanic Boomer households each owning three percent or less.

Generation X is more racially diverse than the Baby Boomer generation, with white households comprising approximately 63 percent of the cohort. Yet, the ownership of financial assets remained concentrated in those households, with white households owning some 80 percent of the cohort’s total financial wealth.

The Millennial generation is the most diverse of the three cohorts. In 2019, only 59 percent of all households were listed as white, with 18 percent Black, and 15 percent Hispanic. Still, that year, white Millennial households owned some three-fourths of all Millennial financial assets.

The following table, which shows median and mean comparisons, highlights the enormous racial gulf in the distribution of financial wealth for all three cohorts.

What can be done

The relative financial insecurity of the great majority of U.S. households, as highlighted above, reflects the broader inequalities of power that shape the workings of our economy. Thus, meaningful social improvement will require a significant transformation of both its organization and aims.

At the same time, there are things we can do now to improve the retirement prospects of most working people and, hopefully, advance the longer-term movement building effort required to achieve the needed transformation. Among the many possibilities, we can redouble our efforts to support worker struggles for higher wages, better health and retirement benefits, and unionization; implement a single-payer national health care system; and strengthen our social security system by, among other things, lifting the cap on taxable earnings and establishing a humane minimum benefit amount.