A specter is haunting the U.S.—the specter of stagflation

Financial Times’ Martin Wolf (2022) is the latest influential voice sounding the alarm bell on ‘the threat of stagflation’ and calling for the Fed to drastically raise interest rates to bring inflation down to its target level. Published on May 24, Wolf’s diagnosis of where the stagflation in the U.S. economy is coming from reflects current establishment opinion: nominal demand, fuelled by over-expansionary fiscal and monetary policies during the COVID-19 crisis, is exceeding U.S. supply. To bring down inflation, these macroeconomic policy errors need to be corrected convincingly and as soon as possible. This is how Wolf puts it:

“U.S. supply is constrained above all by overfull employment […] Meanwhile, nominal demand has been expanding at a torrid pace. [….] The combination of fiscal and monetary policies implemented in 2020 and 2021 ignited an inflationary fire. The belief that these flames will go out with a modest move in interest rates and no rise in unemployment is far too optimistic. Suppose, then, that this grim perspective is correct. Then inflation will fall, but maybe only to 4 per cent or so. Higher inflation would become a new normal. The Fed would then need to act again or have to abandon its target, destabilising expectations and losing credibility. This would be a stagflation cycle–a result of the interaction of shocks with mistakes made by fiscal and monetary policymakers.” (italics added)

Wolf hedges his bets and does not state how strongly the Fed should raise the interest rate in order to avoid the ‘grim’ prospect of a stagflation cycle. Wolf is in the good company of Lawrence Summers who voiced similar concerns already in February. Summers, however, does not hesitate to provide more explicit guidance to monetary policy-makers in the Fed:

“[….] we’re likely to have a need for nominal interest rates, basic Fed interest rates, to rise to the 4 percent to 5 percent range over the next couple of years. If they don’t do that, I think we’ll get higher inflation. And then over time, it will be necessary for them to get to still higher levels and cause even greater dislocations” (Klein 2022).

Summers’ and Wolf’s calls for action are echoed by many observers in the financial sector. Mohamed El-Erian (2022), for instance, argues that

“Also similar to the 1970s, the U.S. Federal Reserve [….] is already dealing with self-inflicted damage to its inflation-fighting credibility. With that comes the likelihood of de-anchored inflationary expectations, the absence of good monetary policy options, and a stark choice for the Fed between enabling above-target inflation well into 2023 or pushing the economy into recession.” (italics added)

Goldman Sachs Group President John Waldron has just one piece of advice for the Fed: “…. bring back Paul Volcker” (Natarajan and Reyes 2022). Wolf, Summers, El-Erian, and Waldron are thus putting serious pressure on the Fed to hike up interest rates more strongly and quickly than it is already doing.

On March 16, 2022, the Fed raised the interest rate by a quarter percentage point, from 0.25% to 0.5%—the first interest rate increase since 2018. And on May 3, 2022, it raised its benchmark rate by another half-a-percentage point. “We have to reassure people we are going to defend our inflation target and we are going to get inflation back to 2%,” St. Louis Federal Reserve President James Bullard stated recently, adding that “our credibility is on the line here” (Egan 2022). Bullard doubled down on his view by recommending that the Federal Open Market Committee (FOMC) should shoot for a policy rate above 3% this year.

Not only the Fed, but central banks all over the globe are raising rates rapidly in the most widespread tightening of monetary policy for more than two decades, according to a recent Financial Times analysis (Romei 2022). To bring down inflationary pressures, central bankers worldwide have announced more than 60 increases in current key interest rates in the past three months. The recent increases are just the beginning of a global monetary tightening cycle (UNCTAD 2022). The Fed, pushed by the likes of Summers, Wolf, El-Erian, and Waldron, is expected to move to a policy rate around 2.5%-2.75% by the end of 2022, but statements in the minutes of the FOMC indicate that its members are prepared to raise interest rates more, if and when deemed necessary.

A soft versus a hard landing

Few doubt that the monetary tightening by the Fed will push the U.S. economy into a recession. This means there is no free lunch: bringing inflation down comes with a considerable societal cost. Opinions are divided over how deep and long-lasting this recession will be. Establishment opinion is that “the time to throttle an inflationary upsurge is at its beginning, when expectations are still on the policymakers’ side,” as Wolf (2022) puts it. That is, the sooner and the more aggressive the Fed acts, the lower will be the collateral damage to the U.S. economy and the more likely the U.S. economy will experience a ‘soft landing’—which is Central Banker Speak for a relatively mild recession.

Channeling former Fed chair Paul Volcker, who has posthumously acquired a near-saintly status with the monetary policy commentariat, Summers adds that the cost of sharply increasing the interest rate to kill off inflation will be temporary increases in unemployment—and he opines that bearing this non-trivial (but temporary) social cost will be preferable to suffering from the permanent cost of inaction, which he predicts, rather ominously, will involve “stagflation and the associated loss of public confidence in our country” (Klein 2022). For Summers, a ‘hard landing’, a cherished euphemism for a deeper, bruising, recession, appears to be preferable to the long-run societal cost of a scenario in which the Fed does not act strongly and quickly enough, loses its inflation-fighting credibility, and cannot prevent the de-anchoring of expectations. Wolf concurs (again) and adds that “the political ramifications [of such a stagflation cycle] are disturbing, especially given a vast oversupply of crazy populists.”

The arguments of Summers and Wolf are fairly typical of the much broader macroeconomic debate within a select in-crowd of Very Serious Economists over how to respond to the recent surge in U.S. inflation. The tone of this debate in newspapers and online fora is dire (“stagflation, after all, is a grim threat”); the arguments are abstract (“monetary tightening is crucial to maintain the Fed’s inflation-fighting credibility and keep inflation expectations anchored”); the analyses are surprisingly ahistorical (“today’s situation is a repeat of the 1970s” and “bring back Volcker”), the discussions are relatively tone-deaf to the very inegalitarian negative impacts of the sharp increases in interest rates, the (social engineering) policy solutions are mechanical and actionable (“raise interest rates to 5% and the inflation will go away”); and the underlying thinking remains firmly within the box of establishment macroeconomics (“the Fed is capable of controlling inflation without killing the economy in so doing”).

A more acute assessment would recognize that interest rates are a socially very costly tool to ‘control’ inflation—especially when the sources of the inflationary surge lie in an unprecedented constellation of (mostly) supply-side bottlenecks which are driving up prices. Similarly, a close look at the past record of monetary tightening shows that the Fed has hardly ever managed to guide the economy to a soft landing with interest rate increases.[1] A key reason is that small interest rate hikes do not reduce inflation (at all). It takes large interest rate hikes, but those come with massive collateral damage to the real economy—and this collateral damage might well be larger than the damage done by allowing inflation to remain high for some, while actively managing its consequences (especially in terms of the distribution of incomes). John Cochrane (2022, p. 9) sums it up rather well:

“The Fed likes to say it has “the tools” to contain inflation, but never dares to say just what those tools are. In recent U.S. historical experience, the Fed’s tool is to replay 1980: 20 percent interest rates, a bruising recession hurting the disadvantaged especially, and the medicine applied for as long as it takes. Will our Fed really do that? Will our Congress let our Fed do that? Can you deter an enemy without revealing what’s in your arsenal and whether you will use it?”

There are reasons to believe that the collateral damage wrought by substantially higher interest rates will be even higher today than in 1980. The key point is that more than a decade of extraordinarily low interest rates have led to a significant increase in corporate and public debts and an unsustainable bout of asset price inflation in the housing market, the stock market, and almost all other financial markets. A large interest rate hike will create a financial crash. The Federal Reserve (2022) recognizes these non-negligible downward risks of monetary tightening to the American economy in its Financial Stability Report of May 2022. Bringing back Volcker might, therefore, not be a good idea. What is to be done?

A new INET working paper on U.S. inflation

In a new Working Paper for INET, I attempt to recover the lost plot, arguing that the recent inflation has mostly supply-side origins, caused by the COVID-19 crisis and the Ukraine war, and has been enabled by mistaken past and current macroeconomic policy choices. The paper takes a close look at the current inflation in the U.S., showing that it is not due to a generalized co-movement of (all) prices, but to a number of sector-specific price increases in industries strongly affected by global commodity-chain disruptions (Section 2). The corona crisis has been seriously stress-testing the resilience of the global supply chains that have developed during three decades of neoliberal globalization—and the system has been found wanting. Section 3 considers the global supply side of U.S. inflation in more detail and investigates how global supply chain disruptions and higher global commodity prices have raised U.S. import prices; I find that higher import inflation has been directly responsible for almost one-third of the increase in the PCE inflation rate during 2021-2022.

Section 4 presents data on accelerating inflation in the rest of the world. These data underline the fact that the rise in U.S. inflation is by no means exceptional: almost all other economies are experiencing similar surges in (consumer price) inflation as the U.S.. Inflation is running well above central bank inflation targets in all advanced economies. In most, central banks have so far reacted to the increase in inflationary pressures with a gradual response, tapering off unconventional monetary policy support introduced during the pandemic and raising policy rates. Interestingly, differences in the magnitude of fiscal relief responses to the corona-crisis between countries are not showing up in (statistically significant) differences in CPI inflation rates. This suggests that fiscal policy is not a key driver of inflation (differences).

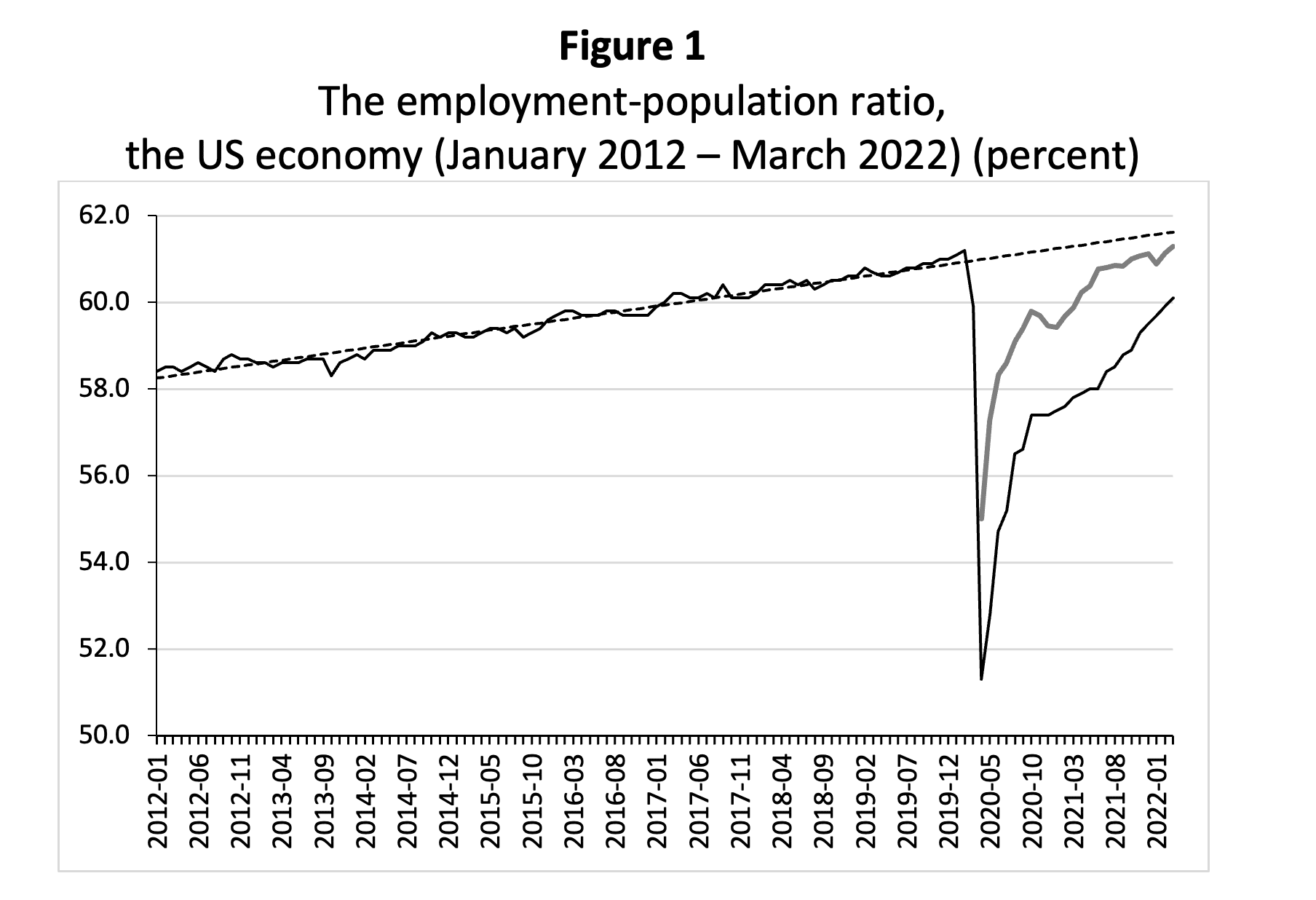

The impacts of the global supply shock were amplified by supply-side bottlenecks within the U.S. economy (Section 5), including inefficiencies in U.S. ports and a shortage of long-haul truck drivers. However, the most important domestic supply constraint triggered by COVID-19 arose from the sharp decline in the (effective) labor force of the U.S.: the employment-population ratio declined by 9 percentage points in early 2020 (Figure 1). The employment-population ratio steadily increased from 58.4% in January 2012 to 61.2% in February 2020, but it sharply dropped to 51.3% in April 2020 and 52.8% in May 2020 in response to the arrival of SARS-Cov-2 in the U.S.. The average monthly employment shortfall was around 8 million persons in 2021.

Source: Bureau of Labor Statistics. Notes: The dashed line is the counterfactual in which it is assumed that the employment-population ratio continues to grow at its trend rate (during January 2012-January 2020). Population is the civilian non-institutional population, i.e., people 16 years of age and older who are not inmates of institutions (penal, mental facilities, homes for the aged), and who are not on active duty in the Armed Forces. The employment shortfall in March 2022 (relative to the counterfactual) is 4 million workers. The grey line indicates the decline in the employment-population ratio due to “persons not in the labor force, who did not look for a job in the last 4 weeks because of the coronavirus pandemic”.

Even though the employment-population ratio climbed up again to 60.1% in March 2022, it continues to remain below what it would have been without the COVID-19 shock. The estimated employment shortfall in March 2022 is 4 million workers (relative to the counterfactual). As elaborated in the paper, BLS data show that during the period May-December 2020, more than 40% of the estimated employment shortfall was caused by “persons not in the labor force, who did not look for a job in the last 4 weeks because of the coronavirus pandemic”. In 2021, around 28% of the employment shortfall must be attributed to persons dropping out of the labor force because of the coronavirus pandemic.

For many workers, the coronavirus outbreak was the main reason for quitting a job—directly, because doing the job had a high risk of getting infected, but also indirectly, because the job offered no or insufficient health insurance, lacked the flexibility to choose when to put in one’s hours, did not allow for working remotely, or did not offer adequate child care support. In Spring 2022, there are still around 1 million “persons not in the labor force, who did not look for a job in the last 4 weeks because of the coronavirus pandemic”, and around 3 million workers decided to retire (temporarily or permanently), primarily because of COVID-19.

As a result, in March 2022, the U.S. labor force still has 4 million fewer workers than in the ‘no-corona’ counterfactual. The sharp decline in the effective labor force has led to a tightness of the U.S. labor market which is showing up in a high vacancy ratio. As millions of workers disengaged from the labor force, by quitting or retiring, the number of job vacancies has risen sharply. The vacancy ratio, the ratio of job vacancies to official unemployment, has increased to 1.94 jobs per unemployed worker in March 2022, which is more than three times its long-run average level. This is what Martin Wolf means when he argues that “U.S. supply is constrained above all by overfull employment.” But overfull employment is caused by the COVID-19 caused drop in the effective labor force of the U.S.. It follows that, as long as COVID-19 continues to pose a significant health risk, the U.S. labor market will remain ‘tight’.

Is there a wage-price spiral?

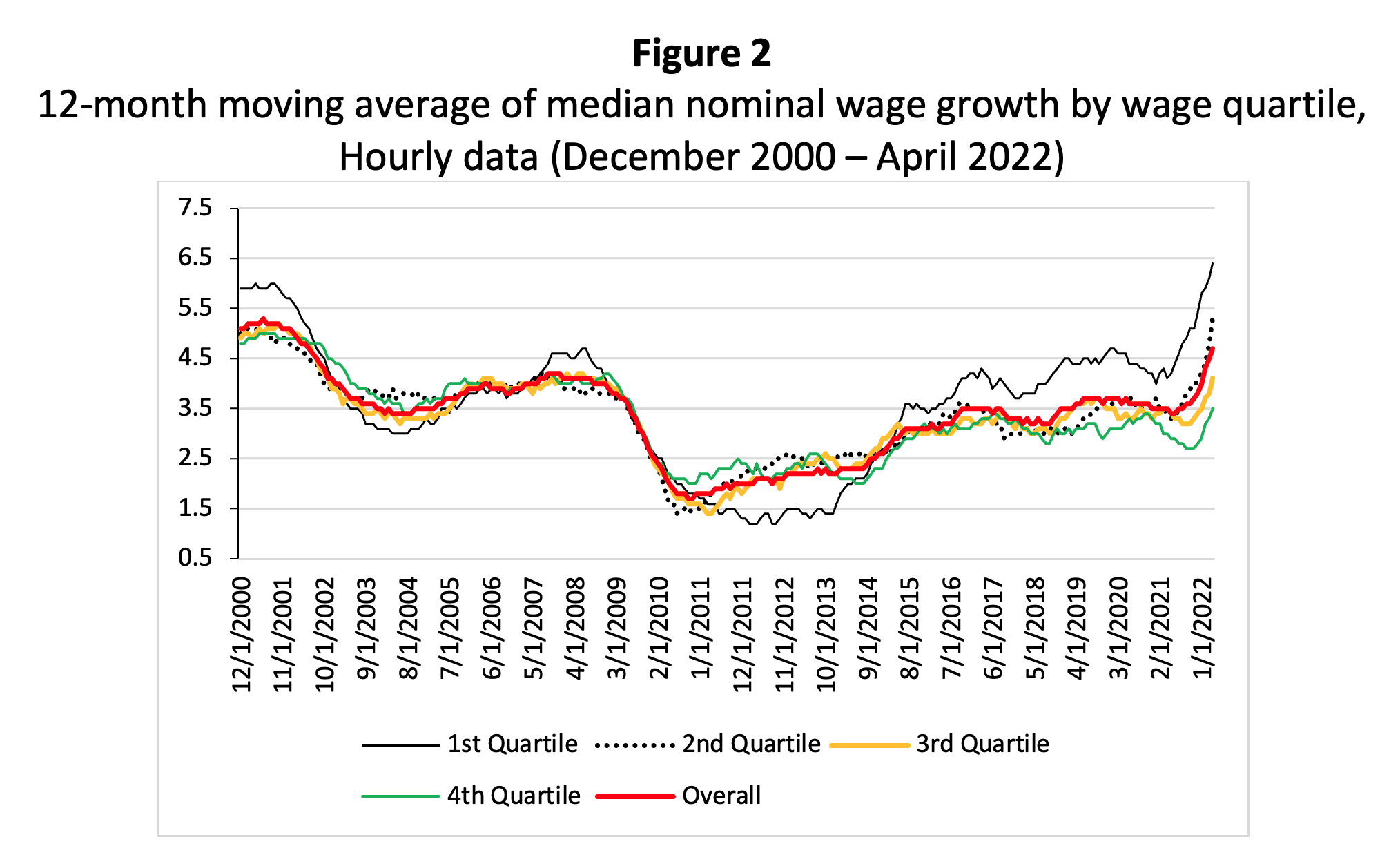

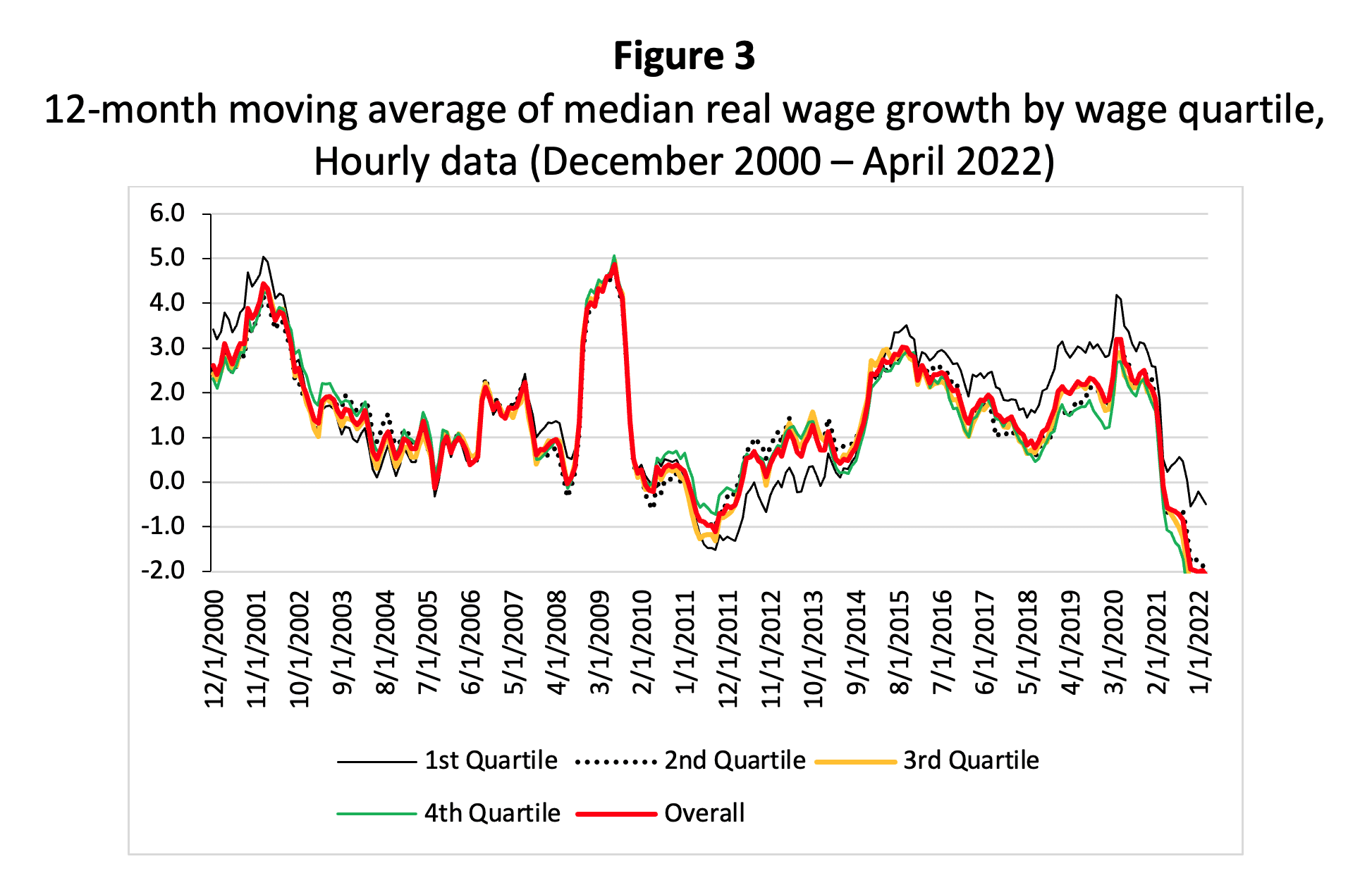

According to Wolf, Summers, and many other observers, U.S. inflation is significantly driven by a wage-price spiral. The empirical case in support of this claim has been made by Domash and Summers (2022a, 2022b, 2022c) who argue that the vacancy and quit rates currently experienced in the U.S. correspond to a degree of labor market tightness previously associated with below-2% unemployment rates. Such tightness, they warn, will make for “extremely rapid growth in nominal wages” (Domash and Summers 2022a, p. 32). Specifically, “nominal wage growth […] is projected to increase dramatically over the next two years, surpassing 6% wage inflation by 2023 ….” (p. 21). This is serious stuff—notice the use of the words “extremely” and “dramatically” in these sentences. So, what is the evidence on nominal wage growth and its impact on U.S. inflation? In response to the tightness of the labor market, nominal wages for the median U.S. worker increased by 4.7% during April 2021 and April 2022 (Figure 2). This may look like relatively good news for U.S. workers, whose median nominal wages increased by around 2.7% per year during 2010-2019 and whose real wages rose by only 1.1% per annum over the same period, but on a closer look, it isn’t. Nominal wage growth of American workers is not keeping up with accelerating PCE inflation, and hence, median real wage growth in the U.S. became negative already in April 2021 (Figure 3). One year later, in April 2022, annual median real wage growth in the U.S. is -2.1%. Real wage growth has been negative in almost all industries and occupations.

Sources: Current Population Survey, Bureau of Labor Statistics, and Federal Reserve Bank of Atlanta Calculations. See https://www.frbatlanta/chcs/wage-growth-tracker

Sources: Current Population Survey, Bureau of Labor Statistics, and Federal Reserve Bank of Atlanta Calculations. See https://www.frbatlanta/chcs/wage-growth-tracker . Nominal wage growth was deflated using the 12-month growth in the PCE price index (FRED series PCEPI_PC1).

In Section 6 of the Working Paper, I identify various reasons why the evidentiary base of Domash and Summers’ (2022a) claim is not robust enough to substantiate their claim that the U.S. is experiencing a wage-price spiral. A key point is that Domash and Summers assume that higher inflation is pushing up nominal wage growth. However, their own regression results show that inflation indexation is far from perfect: in 14 out of 21 regressions, the coefficient of lagged inflation on nominal wage growth in the U.S. is not statistically significant. This means that in two-thirds of their regressions, higher prices are found to reduce real wage one-for-one. In the remaining 7 regressions, the coefficient of lagged inflation on nominal wage growth takes an average value of 0.35. Hence, even when U.S. labor markets are extremely tight, U.S. workers are unable to protect their real wages—as their nominal wages grow only one-third as fast as the general price level. Higher inflation is extremely costly to workers, therefore. To single out higher nominal wages as a main cause of the increase in U.S. inflation is not just incorrect, because wage growth barely manages to partially follow (not leading) inflation, but it is quite a stark example of blaming the victim.

Finally, I estimate a more complete econometric model which also includes supply-side constraints (in addition to the vacancy ratio). The estimation results suggest that, on average, 20.5% of (rising) PCE inflation can be attributed to the (rising) vacancy ratio (as a proxy of labor market tightness). However, global commodity prices and capacity utilization play more prominent roles and account for 67% and 35% of PCE inflation. Hence, labor market tightness does contribute to U.S. inflation indeed, but supply-side constraints play a more important role. Besides, the labor market tightness itself is caused by the fact that labor demand has recovered more quickly than the effective labor force (as I discuss below).

The problem that shall not be named: profit-driven inflation

U.S. inflation is also being driven by the pricing power and higher profits of corporations—a claim that Lawrence Summers rejected on Twitter as a form of ‘science denial’. But there is more than just anecdotal evidence that corporations with pricing power are using the current inflationary environment as a pretext to raise prices more than necessary because they do not have competitors to drive them to keep prices down. For instance, Fed economists Amiti et al. (2021) highlight the importance of (what they call) the strategic complementarity channel, which captures how much U.S. firms adjust their prices in response to changes in the prices charged by their foreign competitors. To illustrate, if the price of imported cars increases, domestic car producers can also increase their prices. The strategic complementarity channel has been estimated to account for circa 30 percent of the effect of higher import prices on U.S. inflation (Amiti et al. 2021).

The strategic complementarity channel does help to explain the profiteering by large U.S. corporations which have been able to raise their profit margins to the highest level in 70 years. Nominal growth of corporate profits (by 35%) during 2021 has vastly outstripped nominal increases in the compensation of employees (10%) as well as the PCE inflation rate (6.1%). Using inflation as an excuse and helped by algorithmic pricing and AI, mega-corporations are choosing to raise prices to increase their profit margins–and they hold enough market power to do so without fear of losing customers to other competitors.

Corporate profiteering is contributing to the inflation problem. According to The Wall Street Journal, nearly two out of three of the biggest U.S. publicly traded companies had larger profit margins this year than they did in 2019, prior to the pandemic (Broughton and Francis 2021). Nearly 100 of these corporations did report profits in 2021 that are 50 percent above profit margins from 2019. Evidence from corporate earnings calls shows that CEOs are boasting about their “pricing power,” meaning the ability to raise prices without losing customers (Groundwork Collaborative 2022; Perkins 2022). Even the Chair of the Federal Reserve, Jerome Powell, has weighed in on this issue, stating that large corporations with near-monopolistic market power are “raising prices because they can.”

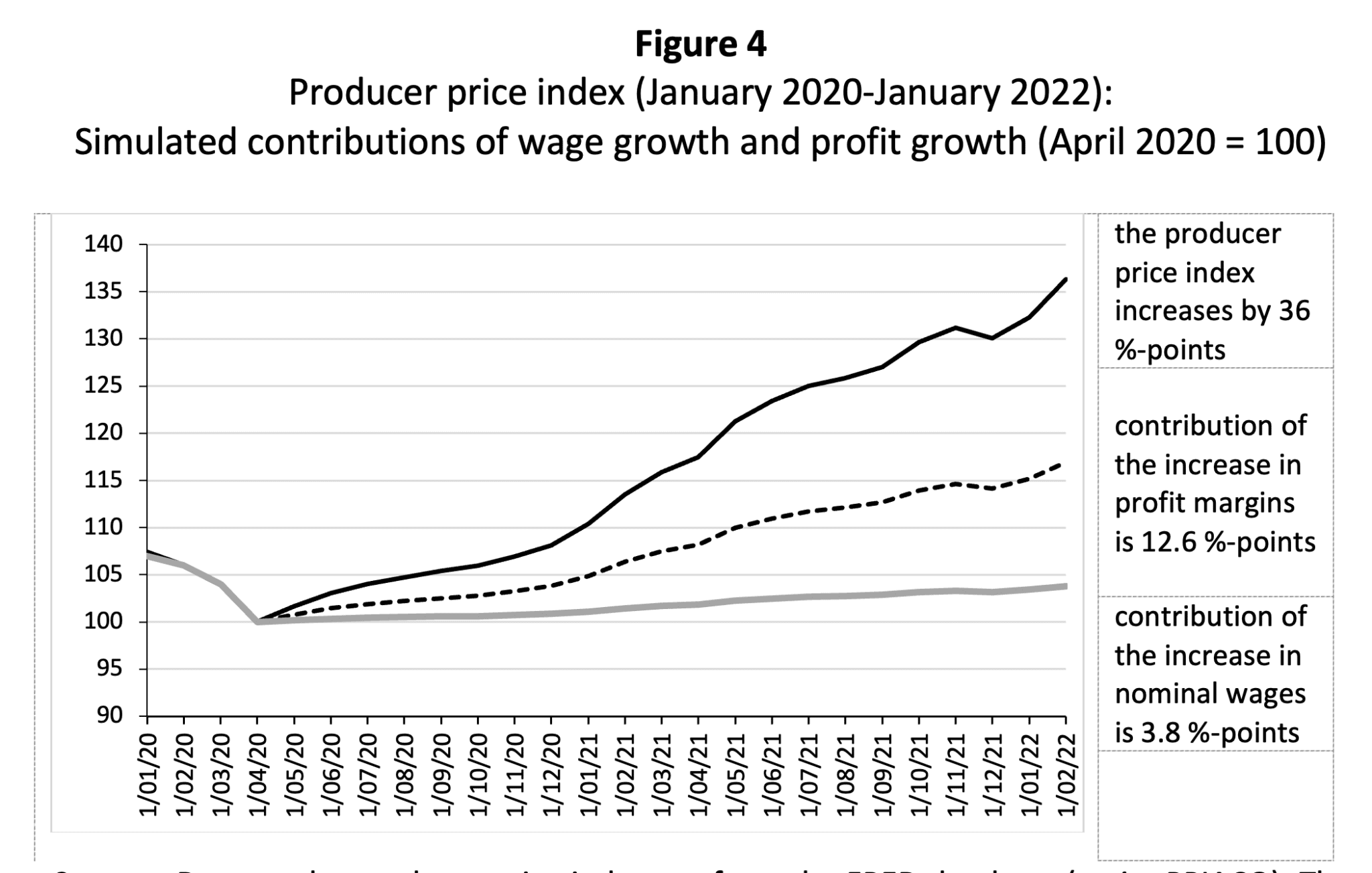

I estimated the inflationary impact of higher profits as well as higher nominal wages, using a simple model in which the producer price is determined by adding a profit mark-up to unit production cost which includes the unit cost of domestic and imported intermediate inputs and unit labor cost. Using BEA data, I find that higher nominal wages accounted for around 10% of the increase in the U.S. producer price during 2020Q2-2021Q3, but the increase in net profits per unit of gross output accounted for more than one-third of the price increase (Figure 4).

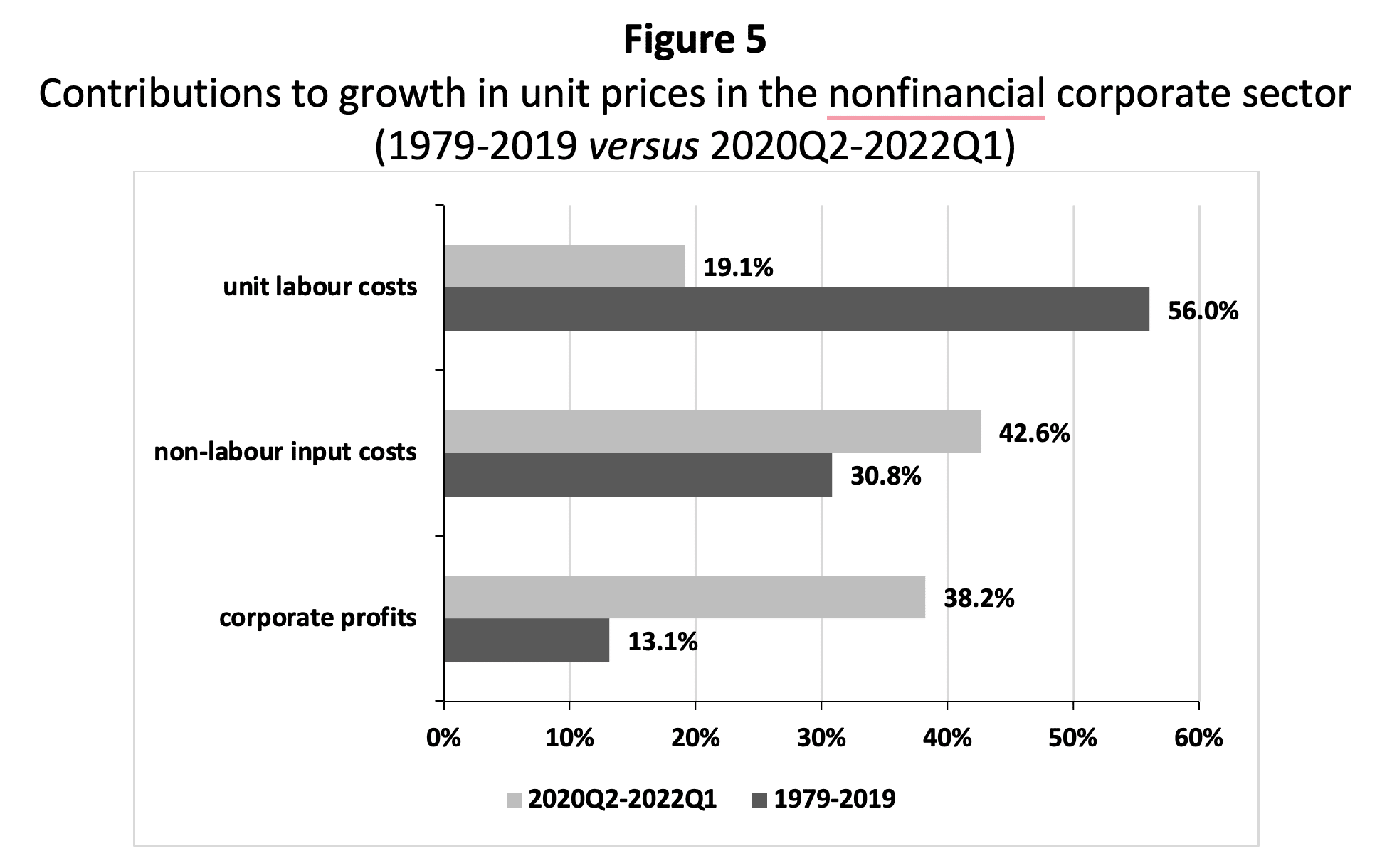

These findings are similar to findings by Bivens (2022) who used a different approach. I have updated Bivens’ analysis to 2022Q1 and the results appear in Figure 5. More than 38% of the rise in the U.S. inflation rate during 2020Q2–2022Q1 has been due to fatter profit margins, with higher unit labor costs contributing around 19% of this increase. Using Bivens’ approach, the contribution to inflation of higher profit margins is found to be two times as large as that of higher nominal wages. As Bivens (2022) notes, this is not normal: from 1979 to 2019, profits only contributed about 13% to price growth and labor costs 56.1%. The historically high-profit margins in the economic recovery from the COVID-19 crisis are difficult to square with explanations of recent inflation based purely on macroeconomic overheating. We have already seen (in Figure 3) that real wages are declining. And what Figures 4 and 5 suggest, is that recent U.S. inflation has been caused more by a profit-price spiral than by a wage-price spiral (as nominal wage growth is lagging behind profit growth).

Sources: Data on the producer price index are from the FRED database (series PPIACO). The contributions of wage growth and profit growth have been estimated by the author; see notes to Table 3.

Source: Based on Bivens (2022). Calculated using data from Table 1.15 from the National Income and Product Accounts (NIPA) of BEA.

The perversity trope: excessive nominal wage growth reduces real wages

Domash and Summers (2022c) take their wage-price spiral argument one step further, claiming that it is not in the interest of U.S. workers to demand higher nominal wages as compensation for the sharply rising costs of living. Their argument is that claiming higher nominal wages is a self-defeating strategy because individual gains in nominal income will be eroded by the consequent increase in aggregate inflation. This claim is a clear instance of what Albert Hirschman (1991) called the ‘rhetoric of reaction’, and more specifically, of the ‘perversity trope’: the claim that some purposive intervention to improve some feature of the political, social or economic order only serves to worsen the condition one wishes to ameliorate (Storm 2019).

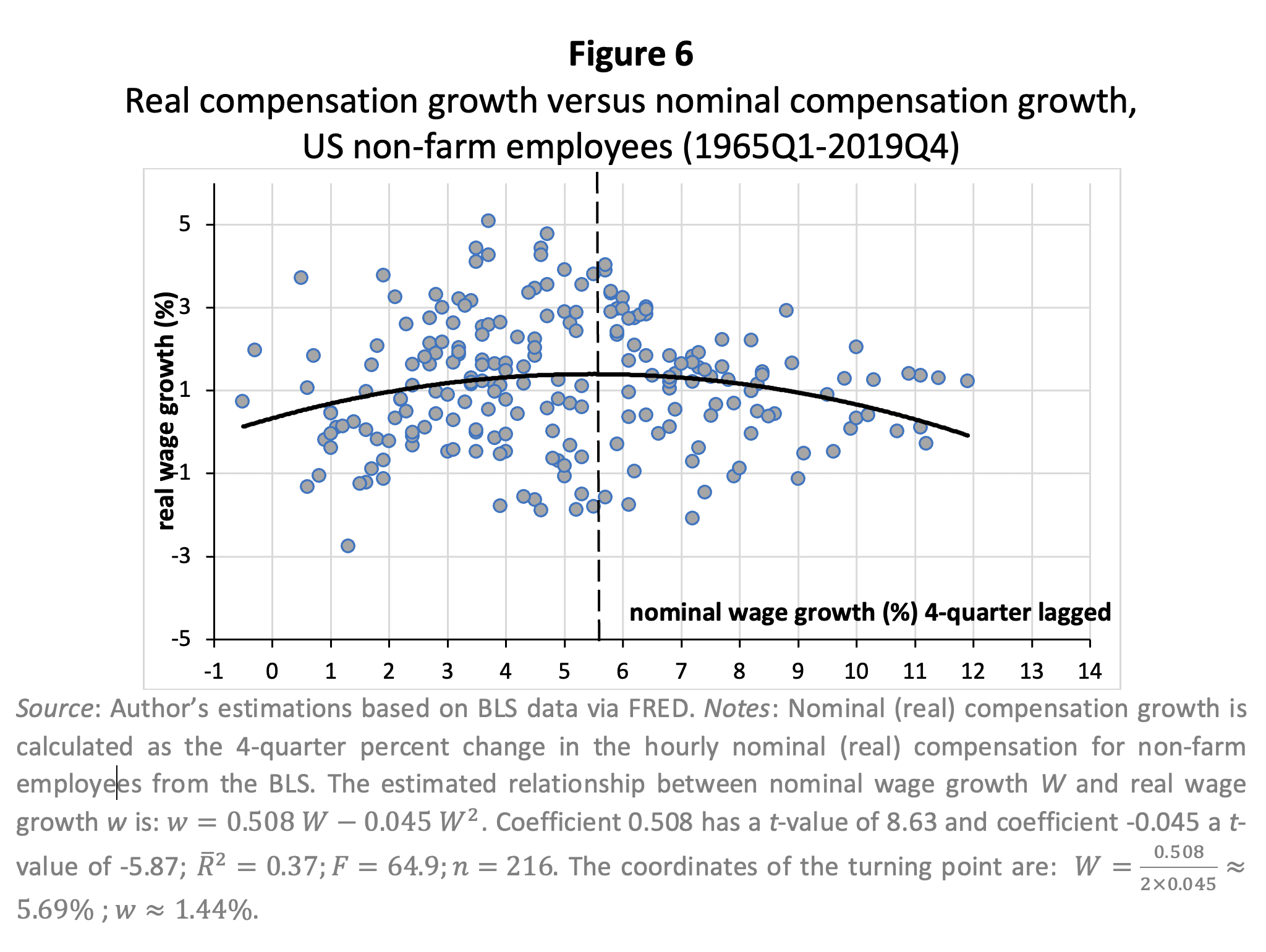

I have replicated the analysis of Domash and Summers (2022c) (see Figure 6) and obtain a similar parabolic—inverse U-shaped—relationship between lagged nominal wage growth and real wage growth in the U.S. during 1965Q1-2019Q4. Domash and Summers use the annual growth rates of ‘average hourly earnings of production and nonsupervisory employees, total private’ as their measure of nominal wage growth; as shown in theAppendix, their measure gives much higher growth rates for nominal wages than alternative measures. Anyway, the fitted parabola has a turning point at a nominal wage growth rate of 5.6%; real wage growth peaks at 1.44%. If we take Figure 6 seriously (which we shouldn’t), this would mean that the average U.S. real wage growth will decline from its peak level of 1.44%, the more U.S. workers manage to push nominal wage growth above the threshold of 5.6%.

U.S. workers be warned: nominal wage growth (calculated as the 4-quarter percent change in the hourly nominal compensation for non-farm employees from the BLS), running at 6.5% in the first quarter of 2022, has already passed the turning point of Figure 6, and hence, U.S. real wage growth will only decline. To Domash and Summers (2022c) U.S. workers act in a non-rational manner, hurting their own interests, by claiming excessively high nominal wage growth. It follows that rational workers would decide to restrain nominal wage growth (below 5.6%) and doing so, their private benefit (obtaining higher real wage growth) will lead, as led by an invisible hand, to a social benefit as well (because it helps cool down the overheated U.S. economy).

The particular ‘perversity trope’ used by Domash and Summers (2022c) can only work, however, if higher nominal wage growth raises the growth of nominal unit labor cost (ULC) and firms shift the higher ULC on to prices. Nominal unit labor cost growth is, by definition, equal to the difference between nominal wage growth and labor productivity growth. It follows that an increase in nominal wage growth that is accompanied by a similar increase in labor productivity growth does not raise nominal ULC growth and inflation. Hence, the correlation between nominal wage growth and real wage growth in Figure 6 is somewhat misleading, because higher nominal wage growth will only impact inflation and real wage growth if it exceeds labor productivity growth and raises ULC growth.

In the Working Paper, I re-do the analysis of Domash and Summers using the 4-quarters lagged growth of nominal ULC instead of nominal wage growth. After all, nominal ULC growth is what matters for inflation. I obtain a (similar) parabolic relationship between ULC growth and real wage growth in the U.S. during 1965Q1-2019Q4. The parabola has a turning point at a nominal ULC growth rate of 6.2%; real wage growth peaks at 2.5%.

What does my finding imply for nominal wage growth and the warning by Domash and Summers? Well, note first that labor productivity growth in the U.S. during 1965Q1 and 2019Q4 was 1.9% on average per year. This implies that a nominal wage growth rate of 8.1% is consistent with a growth rate of nominal ULC of 6.2%. In other words, using nominal ULC growth instead of nominal wage growth, I find that the turning point after which nominal wage growth is associated with declining real wage growth is 8.1% rather than 5.6%. With U.S. (quarterly) nominal wage growth running at 6.5%, it still makes good sense for U.S. workers to push up nominal and real wages—a very different conclusion from the one obtained by Domash and Summers, but nevertheless completely in line with their logic.

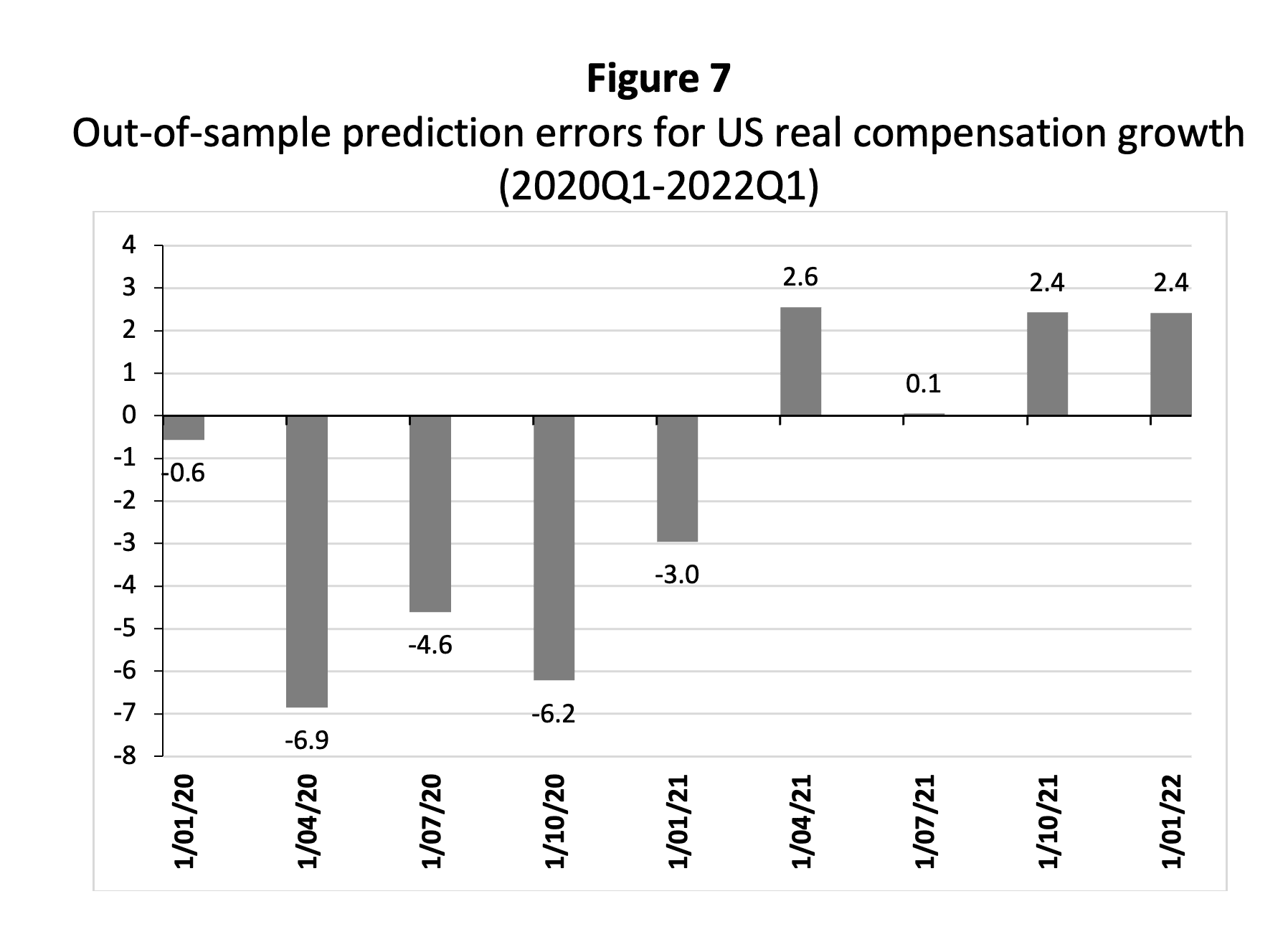

Their logic, or rather the lack of any substantial logic, is the real problem concerning the parabolic relationship between nominal and real wage growth, put forward by Domash and Summers. Let it be said, the two authors duly acknowledge that the parabolic relationship is not meaningful in a causal way, because “nominal wage growth and real wage growth reflect a variety of economic forces.” But they nevertheless quickly proceed with their argument, treating higher nominal wage growth as a cause of lower real wage growth. Empirically, however, the relationship is not strong, as the parabolic relationships explain only around one-third of the variance in real wage growth—which means that two-thirds are left unexplained. To see how this relationship performs out of the sample period (19651Q1-2019Q4), I used the estimated coefficients (reported in the notes to Figure 6) to calculate the ‘predicted’ real wage growth during the nine-quarters period 2020Q1–2022Q1, using actual (realized) 4-quarters lagged nominal wage growth. The out-of-sample prediction errors appear in Figure 7. Clearly, their ‘model’ does a very poor job of forecasting actual real wage growth during 2020Q1-2022Q2. Other factors—unprecedented lockdowns, labor market withdrawals and global supply-side shocks—did upset the U.S. economy. The right conclusion is that past performance provides surprisingly little guidance to foretell the future.

Source: Author’s calculations.

However, ignoring the various empirical smokescreens, the greatest weakness of the argument put forward by Domash and Summers (2022c), is its a-historical nature. The wage-price-spiral claim presupposes that U.S. workers have sufficient bargaining power to obtain higher and higher nominal wage increases. Structural evidence provided by Stansbury and Summers (one wonders whether this is really the same person as the co-author with Domash), shows that this presupposition is empirically incorrect. The reason is, of course, that U.S. workers have suffered a long-term structural loss of bargaining power, due to declining unionization and globalization (outsourcing). As Stansbury and Summers (2020, p. 2) write, strong worker bargaining power “gives workers an ability to receive a share of the rents generated by companies operating in imperfectly competitive product markets, and can act as countervailing power to firm monopsony power.” Stansbury and Summers (2020a, p. 2) identify three main causes for the structural decline in worker power in the U.S.:

“First, institutional changes: the policy environment has become less supportive of worker power by reducing the incidence of unionism and the credibility of the “threat effect” of unionism or other organized labor, and the real value of the minimum wage has fallen. Second, changes within firms: the increase in shareholder power and shareholder activism has led to pressures on companies to cut labor costs, resulting in wage reductions within firms and the “fissuring” of the workplace as companies increasingly outsource and subcontract labor. And third, changes in economic conditions: increased competition for labor from technology or from low-wage countries has increased the elasticity of demand for U.S. labor, or, in the parlance of bargaining theory, has improved employers’ outside option.” (Italics added)

Today, U.S. workers almost completely lack the power to redistribute product market rents from capital owners to labor and, therefore, are in no position whatsoever to kickstart a wage-price inflation spiral. As a result, nominal wages are constantly chasing inflation, which is mostly due to higher import prices, higher energy prices, and higher profit markups—Alice’s Red Queen was wrong: even if workers do all the running they can do, their nominal wages keep lagging behind the inflation rate and their real wages are going down.

In sum: A fair assessment of what has happened during 2020-22 is that U.S. inflation has been driven less by (lagging nominal) wage increases and more strongly by increases in profit mark-ups. Fears of a building wage-price inflationary spiral appear to be misplaced.

Can the Fed safely bring down inflation?

Section 8 of the Working Paper asks the question: can the Fed safely bring down inflation? The answer is a categorical no: the available empirical evidence is clear that small increases in the interest rate do not have much of an effect on inflation. First, the effects of higher interest rates come with a time lag and the gradual impacts (on PCE inflation) will not be felt during the three to four months. Second, an interest rate increase is a generic(blunt) intervention, which will affect inflation by depressing aggregate demand and economic activity but will achieve nothing in terms of lowering the price rises driven by supply-chain disruptions and/or geopolitical tensions, which are responsible for more than half of today’s PCE inflation. Third, empirically, the impact on inflation of an increase in the interest rate is quite limited.

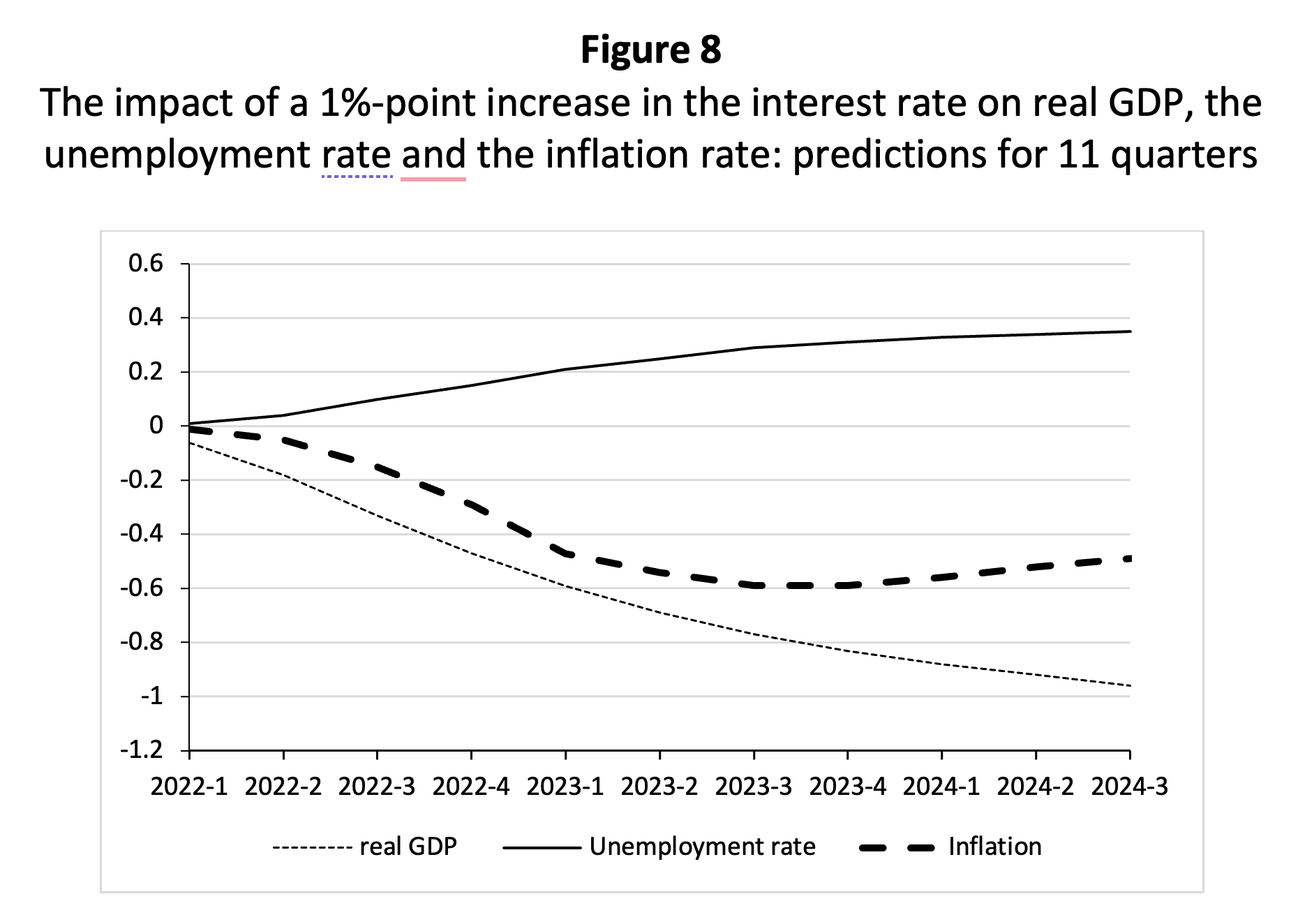

To get a structural sense of how effective monetary policy is in changing the inflation rate, real GDP, and the unemployment rate, we can do no better than consider Figure 8, which presents recent econometric-model forecasts for the U.S. economy of a one-percentage-point increase in the interest rate for the forecast period 2021Q2–2023Q4 by Ray C. Fair. Professor Fair finds that after 11 quarters, a one-percentage-point increase in the interest rate results in a decrease in the inflation rate by 0.5 percentage points, a decline in real GDP of almost 1 percentage point, and an increase in the unemployment rate by 0.35 percentage points. Fair (2021, p. 24) concludes: “The effects on inflation are [….] about a half percentage point fall for a percentage point increase in [the interest rate], but it takes about 5 quarters to achieve this.”

Source: Fair (2021).

Suppose the Federal Reserve follows Summers’ advice and ramps up the interest rate from 1% to (say) 5% in the expectation that this will return the U.S. economy to a stable-inflation equilibrium. Fair’s estimates tell us that this will not happen. Raising the interest rate to 5% will lower PCE inflation by only 2.25 percentage points—from 6.3% in April 2022 to around 4% in July 2022. The collateral damage of this failed attempt at inflation control will be non-negligible: after 11 quarters, real GDP will be lower by 4.5 percentage points and the unemployment rate will be higher by 1.5 percentage points.

There are reasons to believe that the collateral damage wrought by substantially higher interest rates will be even higher than predicted by Fair. The key reason is that more than a decade of extraordinarily low-interest rates has led to a significant increase in corporate and public debts and an unsustainable bout of asset price inflation in the housing market, the stock market, and almost all other financial markets. The Federal Reserve (2022) recognizes these non-negligible downward risks of monetary tightening to the American economy in its Financial Stability Report of May 2022. Ergo: Large—Volcker-like—increases in the interest rate are off the table, because the resulting collateral damage is prohibitively high.

Since inflation cannot be brought down by monetary tightening alone, calls are growing to tighten fiscal policy as well. The idea is that public spending has to be scaled down in order to reduce the excess aggregate demand and excess labor demand, created by the fiscal relief spending that was (arguably) larger than the COVID-19 crisis required. The million-dollar question is whether the collateral damage of renewed austerity is a price worth paying for lowering inflation. If the inflation is driven by supply bottlenecks not directly amenable to fiscal and monetary policy, and sector-specific (in origin), then the fiscal tightening needed to lower inflation will be large and will cause substantial collateral damage, particularly for low-income households and small businesses. Austerity is not a rational solution to rising inflation in a time of corona and war.

The strongest call for fiscal consolidation is coming from proponents of the ‘fiscal theory of the price level’, who argue that the current surge in prices represents ‘fiscal inflation’. In this account, inflation is due to an erroneously overly expansive fiscal policy, which will not be compensated by (promises of) higher tax revenues and/or expenditure cuts in the future. In Section 9 of the Working Paper, I offer a theoretical and empirical critique of the fiscal inflation hypothesis—arguing that it is a fallacious ‘theory’ and empirically empty.

In Section 10, alternative ways to bring inflation down are briefly discussed including the much-maligned strategic price controls, a tightening of position limits and an increase in margin requirements to eliminate commodity-market speculation, measures to remove some of the domestic supply-side bottlenecks in the U.S. itself, and fiscal interventions to shield vulnerable households and firms from the negative impacts of high inflation.

Inflation in the longer run

Finally, in Section 11, I consider the longer-run context and focus specifically on the unavoidable inflationary impacts of global warming, ‘fossilflation’, and ‘greenflation’ (Schnabel 2022). I also discuss inflationary pressures originating from the long-run trends of rising transportation costs, rising commodity prices, fragmenting supply chains, and disorderly de-globalization. These trends are posing new—and daunting—challenges for monetary policymakers. The key issue facing macroeconomic policymakers is: how to deal with rising prices while also accelerating a green structural economic transition? When addressing this issue, central bankers appear to be stuck between a rock and a hard place.

This is because central bankers supposedly have to trade off safeguarding future financial stability (by keeping interest rates low today, supporting the climate transition but allowing for higher inflation in the short to medium run) versus bringing down inflation in the short to medium run (raising interest rates, but at the cost of slowing the transition to a net-zero economy and allowing for higher inflation in the longer run).

The trade-off is a false one, however. The reason is that slowing the climate transition is not an option: another decade of unmitigated global warming will lock the climate system into an unmanageable self-reinforcing process of climate change which risks putting us—humanity as a whole—on a one-way journey to Hothouse Earth (Schröder and Storm 2020). On that road, inflation rates will rise and become completely uncontrollable, while financial stability will be jeopardized.

In other words, in the face of the growing risk of catastrophic climate change, macroeconomic policy needs to be guided by only one principle: it is better to be safe than sorry. Hence, monetary policy should be made to support the transition to a net zero-carbon economy—and inflation control must be unconditionally subordinated to this overriding aim. Green fiscal policy and green industrial policies will have to do the heavy lifting—but these policies must be supported by (and not undermined by) a sufficiently accommodative interest rate policy. A supportive monetary policy will also include tightening risk and accountability regulations for banks and businesses so as to more rapidly phase out funding for fossil-fuel activities; dual interest rates (by offering a preferential discount rate for green lending); tighter regulation to eliminate commodity speculation; and some version of Green QE to help the decarbonization of the economy.

Monetary policy has to be reimagined to make it support the climate/energy transition—rather than obstruct it (as is the case now). Central bankers have to come down or be brought down, from their Olympus and act in alignment with the imperative of the net-zero transition. The clinical, social engineering approach to monetary policy-making that mostly favors financial markets (often at the cost of the rest of society) has to give way to more honest approaches based on the recognition that we are in all this together. One must recognize that a fair sharing of the inflationary and other burdens of the net-zero transition is critical to its viability (“distribution matters”) and acknowledge that the effectiveness of fiscal and monetary policies is overwhelmingly more important than whether their impacts are Pareto optimal or not. Financial markets need to serve the economy rather than live like parasites on it by means of speculation, socially useless regulatory arbitraging, and rent-seeking. There are no quick fixes and the longer macroeconomists continue to treat ‘the economy’ as a mechanical, ergodic, and closed system to which one can apply techniques of optimal control in order to identify some time-consistent monetary policy choice or optimal carbon tax trajectory, the more our economy and society will become locked into irreversible warming “heading for dangers unseen in the 10,000 years of human civilization” (Harvey 2022).

All this may well mean that inflation rates should be allowed to be higher (for some time) than the target of 2% and that alternative measures to control inflation and manage the societal and economic impacts of inflation (as discussed in Section 10 of the Working Paper) have to adapt. A reimagining of monetary policy-making in the face of global warming is long overdue.

Appendix: a note on measuring nominal wage growth

There are different measures of nominal wage growth in the U.S.. Domash and Summers (2002a, 2002c) use the annual growth rates of ‘average hourly earnings of production and nonsupervisory employees, total private’. These two groups of workers account for approximately four-fifths of the total employment on private nonfarm payrolls. Other measures of nominal wage growth include the annual growth rates of ‘average hourly earnings of all employees, total private’ (which also include the wage increases of non-production workers and supervisory employees) and of ‘median hourly earnings of all employees’ (which concerns the growth of the wage ‘in the middle’ of the wage distribution, with 50% of wage earners earning less and 50% of wage earners earning more).

As is shown in Table A, the growth numbers differ depending on the measure of wages used. According to the wage growth measure for production and non-supervisory workers (W1) used by Domash and Summers, nominal wage growth in the U.S. during 2021-Q1/2022-Q1 was 6.7%. But the growth rate of average nominal wages of all U.S. workers (W2) was only 5.4% in 2021-Q1/2022-Q1. Median wage growth of all employees (measure W3), finally, was 4.3% over the previous year. Wage inflation exists, to some extent, in the eye of the beholder.

Table A

Nominal wage growth in the U.S.: different measures

| W1 | W2 | W3 | |

| Average hourly earnings of production and non-supervisory employees, total private

(% change from a year ago) |

Average hourly earnings of all employees, total private

(% change from a year ago) |

Median hourly earnings of all employees

(% change from a year ago) |

|

| 2021-Q1 | 5.1 | 5.0 | 3.5 |

| 2021-Q2 | 2.8 | 2.2 | 3.4 |

| 2021-Q3 | 5.4 | 4.5 | 3.5 |

| 2021-Q4 | 6.4 | 5.2 | 3.7 |

| 2022-Q1 | 6.7 | 5.4 | 4.3 |

Source: FRED database.

References

Amiti, M., S. Heise and A. Wang (2021) ‘High Import Prices along the Global Supply Chain Feed Through to U.S. Domestic Prices.’ Federal Reserve Bank of New York Liberty Street Economics, November 8. https://libertystreeteconomics.newyorkfed.org/2021/11/high-import-prices-along-the-global-supply-chain-feed-through-to-us-domestic-prices

Bivens, J. (2022) ‘Corporate profits have contributed disproportionately to inflation. How should policymakers respond?’ Working Economics Blog, April 21. Washington, DC: Economic Policy Institute. Link: https://www.epi.org/blog/corpo…

Broughton, K. and Th. Francis (2021) ‘What does inflation mean for American business? For some, bigger profits.’ The Wall Street Journal, November 14.

Cochrane, J.H. (2022) ‘Fiscal inflation.’ In Populism and the Future of the Fed, J. Dorn (Ed.). Washington DC: Cato Institute Press, 119-130.

Domash, A. and L. H. Summers (2022a) ‘How tight are U.S. labor markets?’ NBER Working Paper 29739. Cambridge, Mass.: National Bureau of Economic Research. http://www.nber.org/papers/w29…

Domash, A. and L. H. Summers (2022b) ‘A labor market view on the risks of a U.S. hard landing.’ NBER Working Paper 29910. Cambridge, Mass.: National Bureau of Economic Research. https://www.nber.org/papers/w2…

Domash, A. and L.H. Summers (2022c) ‘The relation between nominal and real wage growth.’ Medium.com, April 11. Link: https://medium.com/@alex.domas…

Egan, M. (2022) ‘’People are unhappy’: Fed official warns on high inflation.’ CNNBusiness, February 14. https://edition.cnn.com/2022/0…

El-Erian, M. (2022) ‘Market fallout from Ukraine war combines the risks of past crises.’ The Financial Times, March 15. https://www.ft.com/content/db9…

Fair, R.C. (2021) ‘What do price equations say about future inflation?’ Cowles Foundation. New Haven: Yale University. https://fairmodel.econ.yale.ed…

Federal Reserve (2022) Financial Stability Report May 2022. Washington, DC: Board of Governors of the Federal Reserve System. Link: https://www.federalreserve.gov…

Groundwork Collaborative (2022) ‘The real culprit behind rising prices: Corporate greed.’ Available via: https://groundworkcollaborativ…

Harvey, F. (2022) ‘We cannot adapt our way out of climate crisis, warns leading scientist.’ The Guardian, June 1. Link: https://www.theguardian.com/en…

Hirschman, A.O. (1991) The Rhetoric of Reaction: Perversity, Futility, Jeopardy. Cambridge, MA: Harvard University Press.

Klein, E. (2022b) ‘Transcript: Ezra Klein interviews Larry Summers.’ The Ezra Klein Show, The New York Times, March 29. https://www.nytimes.com/2022/0…

Mason, J.W. (2022) ‘Inflation, interest rates and the Fed: A dissent.’ Available at: https://jwmason.org/slackwire/…

Michell, J. (2021) ‘Inflation Is the symptom, not the disease.’ Tribune, October. Link; https://tribunemag.co.uk/2021/…

Natarajan, S. and M. Reyes (2022) ‘Goldman’s No. 2 Takes Rare Swing at Fed’s Autonomy and Resolve.’ Bloomberg | Quint, 27 January. https://www.bloombergquint.com…

Perkins, T. (2022) ‘Revealed: top U.S. corporations raising prices on Americans even as profits surge.’ The Guardian, 27 April. https://www.theguardian.com/bu…

Powell, J. (2022) ‘Transcript of Chair Powell’s Press Conference, May 4, 2022.’ Washington, DC: Federal Reserve. Link: https://www.federalreserve.gov…

Romei, V. (2022) ‘Central banks launch most widespread rate rises for over two decades.’ The Financial Times, May 29.

Schröder, E. and S. Storm (2020) ‘Economic growth and carbon emissions: The road to “Hothouse Earth” is paved with good intentions.’ International Journal of Political Economy 49 (2): 153-173. DOI: 10.1080/08911916.2020.1778866.’

Schnabel, I. (2022) ‘A new age of energy inflation: climateflation, fossilflation and greenflation.’ Speech given at a panel on “Monetary Policy and Climate Change” at The ECB and its Watchers XXII Conference, March 17. Frankfurt am Main. Link: https://www.ecb.europa.eu/pres…

Stansbury, A. and L.H. Summers (2019) ‘The Declining Worker Power Hypothesis: An explanation for the recent evolution of the American economy.’ NBER Working Paper 27193. Cambridge, Mass.: National Bureau of Economic Research. https://www.nber.org/papers/w2…

Storm, S. (2019) ‘Labor laws and manufacturing performance in India: How priors trump evidence and progress gets stalled.’ INET Working Paper No. 90. New York: Institute for New Economic Thinking.

Summers, L.H. (2021) ‘Opinion: The Biden Stimulus Is Admirably Ambitious. But It Brings Some Big Risks, Too.’ The Washington Post, February 4.

Summers, L.H. (2022) ‘The Fed is charting a course to stagflation and recession.’ The Washington Post, March 15.

UNCTAD (2022) Tapering in a Time of Conflict. Trade and Development Report Update. Geneva: United Nations Conference on Trade and Development. https://unctad.org/system/file…

Wolf, M. (2022) ‘The Fed must act now to ward off the threat of stagflation.’ The Financial Times, May 24.

Notes:

[1] According to Alan Blinder, a former vice-chair of the Federal Reserve, the Fed managed to achieve a soft landing in exactly two out of 11 tightening cycles since World War II: the first one occurred in 1966 and the more recent soft landing happened in 1994. That makes one success story in the past 50 years (Mason 2022).