The difficulty the U.S. faces in its current attempts to damage China’s economy was analysed in detail in the article “The U.S. is trying to persuade China to commit suicide”. Reduced to essentials, the U.S. problem is that it possesses no external economic levers powerful enough to derail China’s economy. The U.S. has attempted tariffs, technology sanctions, political provocations over Taiwan, the actual or threatened banning of companies such as Huawei and Tik Tok etc. But, as always, “the proof of the pudding is in the eating.” Taking the latest period, during the three years following the beginning of the Covid pandemic, China’s economy has grown two and a half times as fast as the U.S. and six times as fast as the E.U..

Therefore, as the previous article put it, in the economy the U.S. cannot “murder” China—even although it can create short term problems. Furthermore, unlike with Gorbachev, whose illusions in the U.S. led to a centralised political collapse of the CPSU, the disintegration of the USSR, and an historical national catastrophe for Russia, the policies of Xi Jinping and the CPC are centrally protecting China and socialism. As the U.S. cannot pursue a course of “murder”, therefore it is forced to attempt an indirect route to get China to commit “suicide”—that is, to try to persuade China to adopt policies which will damage it.

Given that economic development underlies China’s success, one of the most central of all U.S. goals is to attempt to persuade China to adopt self-damaging economic policies. Enormous resources are therefore poured into spreading factually false propaganda regarding China’s economy. This also has the secondary goal of internationally attempting to persuade others not to learn from China’s economic success—because an understanding of the reality that China’s socialist economy is more efficient and successful than capitalism would be a devastating ideological blow to the U.S..

A crucial part of this false propaganda is to try to get accepted as “truth” claims about China’s economy which are entirely false—as basing policies on “facts” which are untrue would naturally lead to wrong policies. One of the most important of these false claims is that China’s socialist economy is “inefficient” compared to capitalism—or, more specifically, that investment in socialist China is inefficient in creating economic growth compared to capitalist America or in general compared to capitalist countries.

Naturally, socialism’s goal is not abstract economic efficiency, it is people’s well-being. But an inefficient economy, in the long term, would be incapable of maintaining the maximum well-being of the people. Therefore, how efficient an economy is constitutes an important issue in economic development. Claims that capitalism is more economically efficient than capitalism, usually put in the form of U.S. claims of the “inefficiency of socialism”, consequently has at least two purposes.

First, most immediately, to attempt to persuade China that as its investment is allegedly “inefficient” it should be reduced. As discussed in the earlier article, “The U.S. is trying to persuade China to commit suicide”, a key U.S. goal to get China to reduce its level of investment in GDP. This is because that same policy was successfully used earlier by the U.S. to derail its competitor economies of Germany, Japan and the Asian Tigers.

Second, more generally and ideologically, this claim that China’s investment is inefficient, and capitalism’s is efficient, is an attempt to undermine and discredit socialism and promote capitalism.

In summary, such propaganda is an attempt to spread two interrelated falsifications.

- First, that China’s investment is inefficient in promoting economic growth.

- Second that this “inefficiency”, which doesn’t actually exist, is due to socialism as opposed capitalism.

As will be systematically factually shown below, the exact reverse of these claims are true. Socialist China’s investment is much more efficient in creating growth than in capitalist countries such as the U.S.. As will be shown, this efficiency of China is integrally linked to the socialist character of its economy.

As usual the method will be used to use the wise Chinese dictum to “seek truth from facts”. The first section of the article will establish the facts showing the greater efficiency of China’s investment. The second section will demonstrate that the reasons for this lie in the socialist character of China’s economy.

Section 1—the high international efficiency of China’s capital investment

Incremental Capital Output Ratio (ICOR)

As an opening aside it may be noted that the present author was taught at an early age that when a theory and the facts, the real world, do not coincide there are only two things that can be done. A sensible person, following the scientific method, abandons the theory: a dangerous one abandons the real world, that is the facts. But as will be seen there is a variant of this second position—that is simply to invent “facts” which are quite untrue!. A typical case can be taken from Business Week, where it was claimed:

It takes $5 to $7 of investment to generate a dollar’s worth of gross domestic product in China, versus $1 to $2 in developed regions such as North America, Japan and Western Europe.1

Similarly Western economic analyst Charles Dumas claims:

China is incredibly good at wasting savings through misallocating investment.2

It is in fact very easy to factually test these claims and show they are false. How much must be invested to generate a dollar’s worth of GDP is a perfectly standard and well-known economic measure—the Incremental Capital Output Ratio (ICOR). ICOR is defined as the percentage of GDP which must be invested to generate one percent GDP growth. Therefore, the lower the ICOR—provided it is a positive number, representing economic expansion and not contraction, the more efficient investment is in generating growth. The results of such standard measurements of ICOR are unequivocal. China has to invest significantly less than the U.S., Japan or Western Europe to generate a “dollars’ worth” of GDP—i.e. China’s investment is more efficient in generating economic growth than the Western economies.

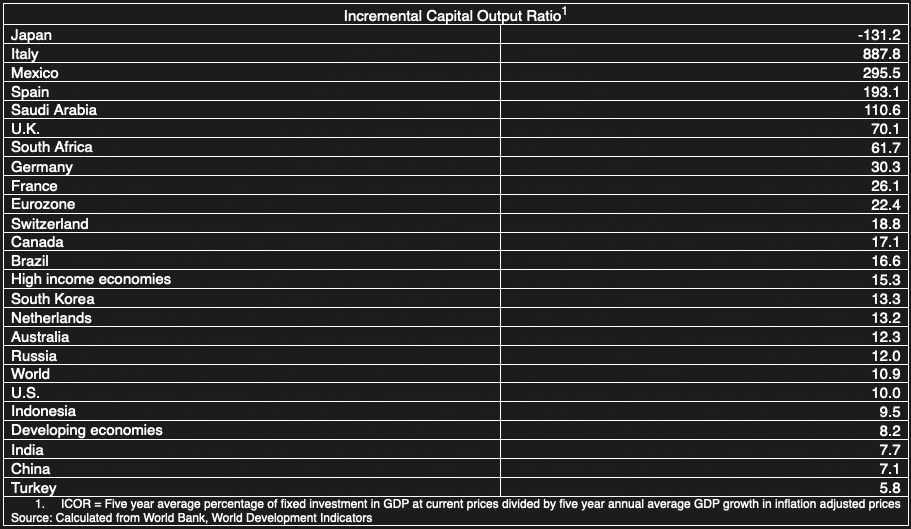

Starting with the most recent results, the factual situation regarding efficiency of fixed investment in generating economic growth is shown in Table 1—which gives ICORs for the world’s 20 largest economies. These together account for 80.4% of world GDP. If the Eurozone as a whole is included, and also South Africa, so as to include all BRICS countries, then the Table shows the ICORs for countries and economic regions accounting for 83.9% of world GDP—i.e. for all economies which have a major impact on world growth.

Taking a five-year average, to avoid the effects of purely short-term shifts in the business cycle, China had to invest 7.1% of GDP to generate 1% of annual GDP growth. It may immediately be seen that China’s investment was characterised by its extremely low ICOR in terms of international comparisons—i.e. its extremely high efficiency in generating economic growth. China was the second best out of the world’s 20 largest economies. In particular, China’s ICOR of 7.1 was more efficient than the US’s 10.0, the Eurozone’s 22.4, Germany’s 30.3, the U.K.’s 70.1—not to speak of Japan’s ICOR which was a negative number, showing that its economy contracted despite its investment.

Therefore, the claim that China’s investment is inefficient in producing economic development is simply a lie. There is nothing secret about the data from which this can be calculated, it is perfectly publicly available. Anyone who spreads falsifications that China’s investment is inefficient is consequently simply engaged in propaganda, not in serous economics.

The implications of this fact that China’s investment is extremely efficient by international standards will be considered below after the facts are further explored.

Table 1

Trends in China’s ICOR

Turning from current international comparisons to historical developments, Chart 1 shows China’s ICOR since 1966, again taking a five-year average for both GDP growth and the percentage of fixed investment in GDP in order to remove inevitable purely short-term fluctuations caused by business cycles. The starting date is taken as 1966 because that is after the end of the period of disruptions caused by the Great Leap forward.

The trends are clear.

- From 1966-76 China’s ICOR rose sharply from 2.0 to 6.5. This was a serious negative development, a more than tripling of ICOR in a 10-year period, meaning China would have had to invest more than three times as high a percentage of GDP to maintain the same economic growth rate—or that if the level of fixed investment in GDP had remained constant China’s economic growth would have fallen to only one third of its previous level. The damaging economic consequences accompanying the political events of this period in the Cultural Revolution is therefore obvious.

- After 1976 China’s ICOR began to improve—it had reached 5.1 by 1978. Following the systematic introduction of Reform and Opening Up in that year a prolonged improvement began and China’s ICOR fell to 2.5 by 1988. This showed the great improvement made by Reform and Opening up to China’s economic efficiency—international comparisons during this entire period are analysed below. This huge rise in the efficiency of investment following Reform and Opening Up launched the beginning of China’s “economic miracle” after 1978.

- China’s ICOR then remained very low for two decades, rising only to 3.3 by 2007. Given the increasing level of China’s economic development in this period, the transition from a low-income economy first to a low-middle income economy and then to an upper middle-income economy, this was an extremely good performance. The reason for this is that, as analysed in detail below, it would be expected that as an economy becomes more developed its ICOR will increase—this is predicted by Marx’s analysis of the rising organic composition of capital. Consequently, an increase in ICOR from 2.5 to 3.3 over a 19-year period, during which China underwent huge economic development, was extremely impressive—as international comparisons analysed below demonstrate. Furthermore, China’s average growth rate did not fall significantly during this period as its percentage of fixed investment in GDP was also increasing, from 31.1% of GDP in 1988 to 37.9% of GDP in 2007. This offset a rising ICOR so China’s GDP growth rate remained essentially the same. This illustrates a simple but crucial point: because as an economy becomes more developed its ICOR will increases it will inevitably slow down if its percentage of fixed investment in GDP remains constant. But this economic slowing is not inevitable as is sometimes argued—if the percentage of fixed investment in GDP rises at least as fast as ICOR then an economy will not significantly slow as it becomes more developed. This is exactly what occurred with China from 1988 to 2007. The slowing of an economy as it becomes more advanced is therefore not inevitable, it is a choice which is determined by a decision not to raise the percentage of fixed investment in GDP in line with the increasing ICOR which occurs with economic development.

- From 2007 China’s ICOR rose sharply to reach 7.4 in 2020. It is this trend that those who claim China’s investment is inefficient by international standards sometimes point to. But unfortunately, they make two fundamental factual errors. First, they fail to make international comparisons—it will be seen that the ICOR of other countries was also rising rapidly after 2007, in most cases by far more than China. That is, China’s worsening ICOR after 2007 was not some specific deterioration in China but a part of a process occurring internationally—one clearly created, given the dates involved, by the international financial crisis which started after 2007 and during which China actually performed better than almost every other major economy. Second, they fail to note the historical dynamic that as an economy becomes more developed its ICOR rises—and China is now approaching a “high income country” level by World Bank standards.

Rising ICOR with economic development

Analysing first the rising ICOR which occurs with economic development, then in the founding work of modern economics, The Wealth of Nations, Adam Smith had already analysed that with increasing economic development fixed investment would play a greater role in economic growth—and that the percentage of fixed investment in the economy would rise. This was repeated by Ricardo. It was made a foundation of Marx’s economics in his analysis of the rising organic composition of capital. It was reiterated by Keynes. Milton Friedman attempted to claim this claim was not accurate, but he made an elementary factual error in analysing only the U.S. economy and not international trends.

One of the manifestations of this increasing capital intensity of production with economic development is that ICOR rises as an economy becomes more developed. Thus Chart 2 shows the historical reality that the ICOR of developed/high income economies is higher than the ICOR of developing economies—to take the latest data, for the five years up to 2021, the average ICOR of developing countries was 8.2 but the average ICOR of high-income economies was 15.3.

This, of course, has clear consequences for China as it undergoes economic development. It means that as China makes the transition to a high-income economy its ICOR should be expected to rise—such a rise would not reflect inefficiency but simply the effects of economic development. Whether China’s fixed investment was inefficient could, therefore, not be established by showing that its ICOR had risen with time—as such a process would naturally occur with economic development. Inefficiency could only be established by a comparison to current economies at a similar stage of economic development—the comparisons, to be valid, would have to be with current economies, and not with historical cases of economies, due to the overall international rise of ICOR which has taken place particularly since 2007 and which is analysed below. This rise in ICOR is the first trend which affects China with economic development and shows why analyses which do not make international comparisons are invalid.

Comparison of China to other developing economies

Given this trend that ICOR will rise with economic development the relevant question is whether China has maintained its advantage in efficiency of investment compared to other countries? Chart 3 shows that the answer to this is clearly yes. Not only is the ICOR of developing countries lower than that for high income economies but China’s ICOR is lower than that for the average of developing countries. For all periods, except for the five years leading to 1976, China’s ICOR was lower than the average for developing countries. Taking the latest data, for 2021, the average ICOR of developing countries is 8.2 and for China 7.1. As China is by now one of the most highly developed of developing countries, and will in only a few years become a high income economy by World Bank standards, this shows the strong efficiency of China’s investment.

The impact of the period since the international financial crisis

While the increasing level of economic development of China would by itself have led to an increase in China’s ICOR a second international process has been taking place since the international financial crisis which has been negative for all countries—in particular high-income economies. Chart 3 shows this clearly. As can be seen the ICOR for both high income and developing economies, and therefore the international average, has worsened since 2007.

- ICOR for developing economies rose from 3.5 in 2007 to 8.2 in 2021.

- ICOR for high income economies rose from 8.0 in 2007 to 15.3 in 2021.

- The world average ICOR rose from 5.8 in 2007 to 10.9 in 2021.

- China’s ICOR rose from 3.3 in 2007 to 7.1 in 2021.

Therefore, the worsening of China’s ICOR from 2007 to 2021 was not some process specific to China, representing part of a specific inefficient process within China, but was part of an overall international process in which ICOR rose globally. However, within this overall deterioration, China’s efficiency of investment in generating growth remained better than the average even for developing countries—whose efficiency of investment in generating growth itself remained better than that for high income economies. Regarding major economies, as noted at the beginning, China’s efficiency of investment in generating growth was ranked second out the world’s 20 largest economies.

Comparison with the U.S.

Because comparisons are frequently most specifically made between China and the U.S., the ICORs for the two countries are shown in Chart 4. As may be seen China outperforms the U.S. in the efficiency of investment in generating growth in all periods. Chart 3 and Chart 4 show clearly that claims such as that by Business Week quoted at the beginning, “It takes $5 to $7 of investment to generate a dollar’s worth of gross domestic product in China, versus $1 to $2 in developed regions such as North America, Japan and Western Europe,” are simply fraudulent—“fake news”. China has to invest less dollars to generate a unit of growth than the U.S.—as well as Europe or Japan.

Explanation of China’s ICOR worsening

Putting these trends together it can be clearly seen why China’s ICOR would have increased since 2007 and why it is entirely misleading not to make international comparisons. Two macro-economic processes were occurring.

- China is making the transition from a developing to a high-income economy, that is to more capital-intensive production, therefore its ICOR will go up.

- There has been a general global worsening of ICOR under the impact of the international financial crisis and China is part of that trend—China cannot completely escape the consequences of the overall international economic situation.

Therefore, a rise in China’s ICOR after 2007 is entirely to be expected. The relevant measure is therefore the international one—that is, how has China’s efficiency of investment in producing economic growth changed relative to other current economies at a similar stage of development. The factual answer is clear. China’s efficiency of investment is in terms of international comparisons extremely high—in particular superior to the U.S. Europe and Japan, as well as compared to other developing countries. What is factually striking is not that China’s investment is inefficient in generating economic growth, that is a propaganda falsification which serious economists should not be taken in by, but how highly efficient China’s economy is in terms of international comparisons.

Having established the facts, as opposed to the myths, the question is then obviously why is China’s investment so efficient?

Section 2—Socialism is why China’s investment is so efficient

Explanation of the facts

Turning from establishing the fact of the high efficiency of China’s investment, in terms of international comparisons, to explaining it, it will become clear that the overwhelming reason for China’s very high efficiency of investment is due to the socialist character of its economy. In particular, it results from China’s extremely strong anti-crisis macro-economic strength which flows from possessing a socialist economy compared to capitalist ones. To clarify this, given that the most frequent international comparison made for China is with the U.S., this will be concentrated on. Furthermore, this automatically deals with the other cases of high-income economies—as, while the U.S.’s efficiency of investment in creating growth is less than China’s, it is superior to the other major capitalist economies such as the EU and Japan.

The fundamental process which is involved, and which particularly creates China’s advantage compared to the U.S. in ICOR, can be seen from Chart 5. This shows that the worsening of U.S. ICOR, that is the efficiency of its investment, was not at all a smooth process. It was characterized by two specific periods of huge deterioration which were so severe that they affected average efficiency of investment over the entire period. These were a more than doubling of ICOR to 26.8 in the period leading to 2011, that is following the international financial crisis, and a rise to 16.8 in the period leading to 2020 in association with the Covid induced recession. In short, economic crises led to a sharp worsening of U.S. ICOR, to a severe fall in the average efficiency of U.S. fixed capital investment.

To illustrate clearly the long-term cumulative effects of such crises, and to smooth out the extreme short-term spikes, Chart 6 shows a longer term, 10-year, average for U.S. and China’s ICOR. The long-term cumulative worsening of U.S. ICOR under the impact of its successive economic crises is clear. In short, the fall in the efficiency of U.S. capital investment was particularly associated with crises in the U.S. economy.

Economic slowdown and rising ICOR

Regarding the more precise explanation of this worsening of U.S. ICOR, it should be recalled that the latter is by definition GDP growth divided by the percentage of fixed investment in GDP. If ICOR has risen therefore one of two processes must have occurred—or both.

- The first is that the rate of GDP growth has slowed.

- The second is that the percentage of fixed investment in GDP has increased.

But while in principle either could have taken place factual examination shows that the worsening of U.S. ICOR since 2007 is entirely due to its economy slowing and none of it is due to an increase in the percentage of fixed investment in GDP. U.S. gross domestic fixed capital formation was 22.3% of GDP in 2007, remained slightly below that level in the entire period after 2007, and was to 21.4% of GDP by 2021. Therefore, zero percent of the worsening of U.S. ICOR after 2007 was due to an increase in the percentage of fixed investment in GDP, and the entire worsening of ICOR was due to the slowdown in the average annual growth of the U.S. economy.

This process of economic slowing is shown in Chart 7. The U.S. went through two sharp recessions with negative growth—economic contraction of 2.6% in 2009 and of 2.8% in 2020. The contraction of the U.S. economy in crisis years sharply slowed its average growth rate and therefore raised its ICOR.

In contrast, while China’s economy slowed since the beginning of the international financial crisis, that is it could not entirely escape the negative consequences of the post-2007 financial crisis and the Covid pandemic, despite these international crises China never experienced in this period a year of economic contraction—unlike the U.S.. Consequently, the U.S.’s much weaker anti-crisis macro-economic capacity than China explains the superiority of China in efficiency of investment compared to the U.S. and is the primary explanation for the deterioration of U.S. ICOR—that is for the worsening of the efficiency of U.S. investment.

The fall in investment

Turning to what explains the much greater weakness of the U.S. than China in anti-crisis capacity it is crucial to understand factually what actually occurs in a major recession and the different behaviours of investment and consumption during it.

Consumption is a much higher percentage of GDP than fixed investment in the U.S.—in 2007, on the eve of the international financial crisis, consumption was 82.5% of U.S. GDP compared to 22.3% for fixed investment. This therefore sometimes leads to the false assumption, formed by not studying the facts, that it is falls in consumption which primarily creates recessions. But this commits a simple arithmetical error. The fluctuations in investment in the U.S. economy are so much more violent than the fluctuations in consumption that, despite the fact that investment is a much smaller percentage of GDP than consumption, it is fluctuations in investment which actually primarily control the U.S. business cycle—and in particular which create its recessions. This may easily be seen by looking at the facts.

Between 2007 and 2009, the latter being the worse year of the U.S. recession created by the international financial crisis, then overall U.S. GDP declined by 2.5% adjusting for inflation. The inflation adjusted fall in U.S. household consumption, which accounts for 82% of total U.S. consumption, was 1.5%. But the inflation adjusted fall in U.S. private fixed investment, which accounts for 82% of U.S. fixed investment, was 27.6%—almost twenty times as severe as the fall in consumption.

Chart 8 shows that, in current prices, between 2007 and 2009 U.S. household consumption rose by $145 billion and U.S. government consumption by $235 billion—a total rise in consumption of $380 billion. But this entire increase in consumption was more than offset by $508 billion fall in gross fixed capital formation. That is, the post-international financial crisis recession was overwhelmingly created by the fall in investment, not in consumption.

Moreover, depreciation of fixed capital during this period was $119 billion. Consequently, the fall in U.S. net fixed investment was even worse than that of gross fixed investment—a decline of $626 billion. Therefore by 2009, the U.S. capital stock was lower than in 2007, lowering U.S. potential for long term growth. In summary, the U.S. recession after 2007, and therefore the worsening in U.S. ICOR, was due to the fall in U.S. fixed investment during the international financial crisis after 2007.

The reason the U.S. was unable to control this fall in investment is equally clear. The U.S. is a capitalist economy. That means, by definition, its dynamic is determined by decisions of private capitalists. If these capitalists decide not to invest the economy goes into recession—which, in turn produces an increase in ICOR. There is no U.S. state sector sufficient to offset this. Private ownership of all the main means of production therefore produces weakness in the U.S. macro-economic crisis mechanisms.

China’s socialist anti-crisis macro-economic mechanisms

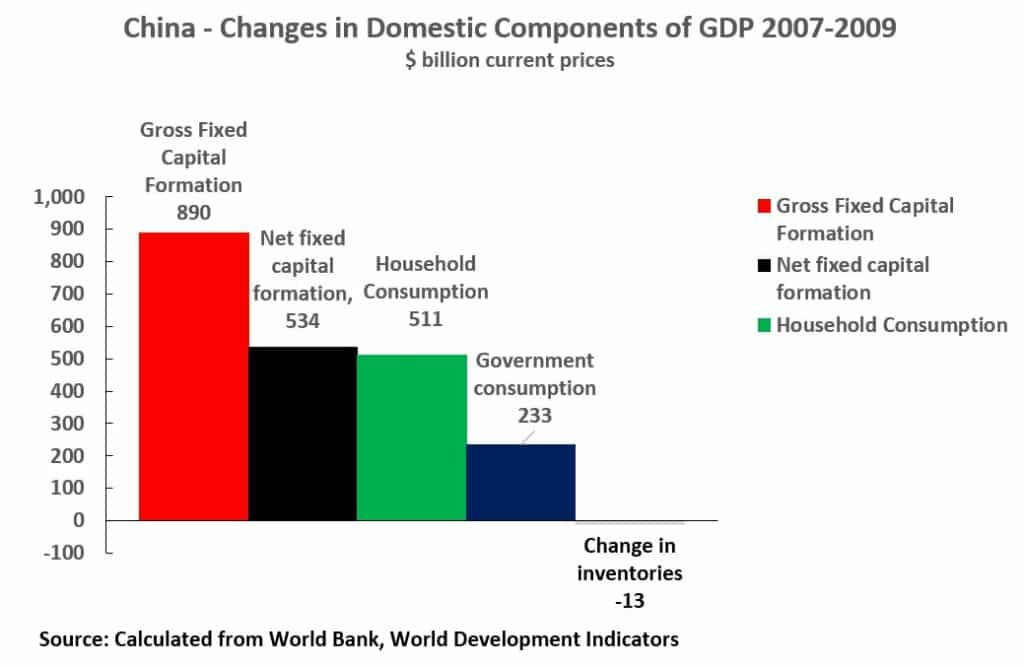

In contrast to the U.S. Chart 9 shows what occurred in China in 2007-09, faced with the international financial crisis. In 2007 to 2009 China’s GDP, in inflation adjusted terms, rose by 20.0%. Looking at current prices, it may immediately be seen that there was no fall in fixed investment of the U.S. type. On the contrary, in current prices, China’s gross fixed capital investment rose more rapidly than any other major component of GDP—increasing by $890 billion. compared to $511 billion for household consumption and $233 billion for government consumption. China’s fixed capital depreciation in this period was $356 billion. Therefore, China’s net fixed investment rose by $534 billion. China’s capital stock was significantly greater in 2009 than in 2007, increasing its potential for long term growth—in sharp contrast to the U.S. trend.

The reason that, unlike the U.S., China’s fixed investment did not fall is also quite clear. China is a socialist economy with a large state sector and state-owned banks which entirely dominate its financial system. Following 2007 state investment, and financing of private investment by state owned banks, could be and was used to prevent a fall in fixed investment. In contrast, the private capitalist U.S. economy had no such anti-crisis mechanism. In summary, China’s large state-owned sector gave it much stronger macro-economic anti-crisis mechanisms than the U.S. The fact that China suffered no decline in output in any year during the international financial crisis, in turn, limited its rise in ICOR. So, it was the strength of China’s state sector, by preventing a fall in investment, which prevented recession and ensured China’s superior ICOR to the U.S. The macro-economic strength given to China by its state sector thereby ensured the high overall efficiency of China’s investment in generating growth.

Economic trends during the Covid pandemic crisis

Turning now to what occurred in economies during the Covid pandemic, not all national accounts data is yet available, but the overall pattern is clear. First, Chart 10 shows that China’s economy far outperformed the U.S. during the pandemic period. In the three years 2019-2022 China’s GDP grew by 13.3% compared to the U.S.’s 5.2%. That is, during the pandemic China’s economy grew by more than two and a half times as fast at the U.S..

Regarding the internal structure of the U.S. economy during this period the changes in current prices in the main domestic components of GDP are shown in Chart 11. As in 2007-2009 there was a substantial increase in household consumption, of $2,970 billion. Government consumption also rose by $581 billion. Gross fixed capital formation also rose, by $838 billion, but this was insufficient to offset fixed capital depreciation of $848 billion. Therefore, U.S. net fixed capital formation fell by $10 billion—given the margin of error, and the small measured contraction, it is probably best to state that the rise in U.S. net fixed capital formation during this period was approximately zero. Clearly there was no significant addition to U.S. capital stock during 2019-2020—and there may have been no addition at all, or even a marginal fall.

Turning to China, complete internationally comparable national accounts data is not yet available for the entire pandemic period. Nevertheless, comprehensive national accounts data is available for part of this period, and the more limited data until the end of 2022 leaves no doubt as to the overall pattern. The fundamental contrast in pattern with the U.S. is the same as in the post 2007 recession.

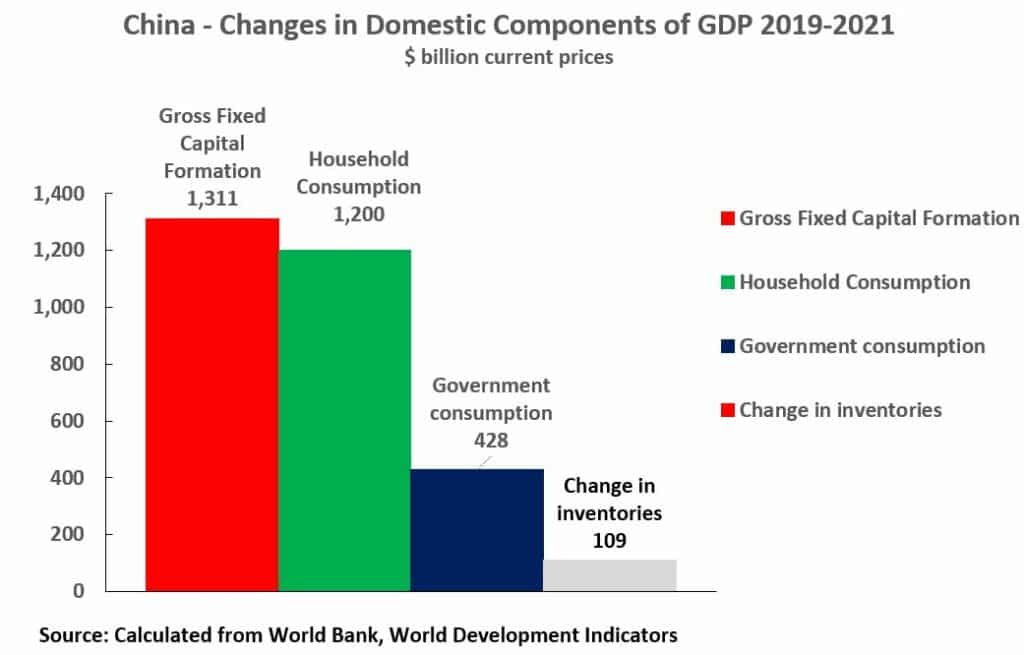

Starting with the comprehensive national accounts data which is available for China for 2019-2021, Chart 12 shows that once again increase in gross domestic fixed capital formation was the single biggest contributor to China’s GDP growth in this period at $1,311 billion—as compared to $1,200 billion for household consumption and $428 billion for government consumption. This contrasts sharply with the U.S. pattern where, in 2019-2021, household consumption rose by $1,510 billion and gross fixed capital formation by $458 billion. Internationally comparable data for depreciation is not available for China after 2020 but given the fact that in 2020 fixed capital depreciation was $333 billion, and there is no reason to suppose it remotely reached almost $1,000 billion in 2021, it is clear that China’s net fixed capital investment was positive in the period 2019-2021.

Turning to 2022, internationally comparable national accounts data for China is not yet published. But it is clear from the data which has been released by the National Bureau of Statistics that the same pattern continued. This shows that in 2022 total consumption accounted for 1.0% of the increase in GDP, gross investment for 1.5%, and net exports for 0.5%. As inventories are only a small part of that figure for total investment, this clearly shows that the contribution of fixed investment to GDP growth remained the leading contributor to China’s GDP growth in 2022 and therefore also for the period 2019-2022 as a whole. This is the exact opposite of the U.S. pattern in which household consumption was the leading contributor and fixed investment low.

The stabilizing role of China’s state investment

The reason for the high contribution of fixed investment to China’s GDP growth during the pandemic period is also clear. Chart 13 shows the way in which China’s state investment, during a crisis, could be used to offset the decline in private investment.

As the Wall Street Journal noted regarding China’s system of a socialist market economy, without understanding the significance of what it was saying in terms of the superiority of China’s socialist system:

Most economies can pull two levers to bolster growth: fiscal and monetary. China has a third option. The National Development and Reform Commission can accelerate the flow of investment projects.3

Examining the detailed pattern during the pandemic in China, in both the peak Covid crisis year of 2020 and during the economic slowdown of 2022, the increase in private investment fell to very low levels—1.0% in and 0.9% in 2022. But overall fixed investment remained significantly higher—2.9% in 2020 and by 5.1% in 2022. The reason for this was that in those years China’s state investment could be and was significantly increased—a rise of 5.3% in 2020 and 10.1% in 2022. This produced a strong anti-cyclical effect in preventing a more severe decline in investment. In contrast, during 2021, when the economy was recovering and private investment was rising relatively strongly, the rate of growth of state investment was reined back to 2.9%.

The reason that China’s overall investment could remain high was only due to the large size of China’s state sector. To be precise in making a comparison to the U.S., in 2022 only 16%, less than one sixth, of U.S. fixed investment was in the state sector, accounting for only 3.4% of GDP. Given this extremely small size of the U.S. state sector even a very high percentage increase in U.S. state investment would be unable to prevent overall U.S. fixed investment from falling—to offset a 10% fall in private investment U.S. state investment would have to rise by 50%.

In contrast, China’s large state sector, means it is possible to stabilize China’s investment level with much lower increases in state investment. In short, China’s large state sector is an extremely powerful anti-crisis mechanism. This, in turn, because it sustains economic growth, prevents the type of severe crisis increases in ICOR seen in capitalist economies such as the U.S.. China’s large state sector, therefore, has a powerful effect in keeping China’s ICOR down and maintaining a high level of investment efficiency.

Seek truth from facts or abandon the real world?

Finally, what are the conclusions that follow from these facts? And why are entirely false claims made that China’s investment is inefficient in generating economic growth which are in fact are the complete opposite of the truth?

This comes back to the point made at the beginning of this article of what happens if the real world, the facts, and a theory do not coincide? According to the theory of those who believe Western capitalism is a superior economic system, a capitalist system must be more efficient than a socialist one. But as the facts contradict this theory then science would demand that the theory be changed or abandoned. But that would lead to a conclusion that was against capitalist ideology—it would have to be accepted that China’s, a socialist country’s, investment was more efficient in producing economic growth than the U.S., Europe, and Japan. That is, it would have to be accepted that China’s socialist system was much more efficient in its investment than the Western capitalists—which is clearly an evidently unacceptable conclusion! Therefore, instead of abandoning the theory the real world has to be abandoned—instead of following “seek truth from facts” Western propaganda has to invent facts and abandon the real world!

[The Chinese version of this article was published at Guancha.cn.]

Notes:

- ↩ Bremner, B. (2007). ‘The Great Bank Overhaul’. In P. Engardio (Ed.), Chindia (pp. 204-210). New York, US: McGraw Hill.

- ↩ Dumas, C., & Choyleva, D. (2011). The American Phoenix. London: Profile Books.

- ↩ Orlik, T. (2012, May 29). Show Me The China Stimulus Money. Retrieved February 11, 2014, from Wall Street Journal: http://online.wsj.com/news/articles/SB10001424052702303674004577433763683515828