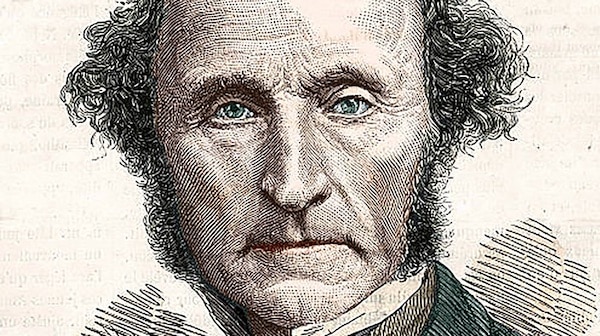

JOHN Stuart Mill was among the foremost liberal thinkers of modern times who wrote extensively on economics and philosophy. Though under the influence of his wife Harriet Taylor Mill, he came closer towards socialism late in his life, it was a kind of cooperative socialism that attracted him; he continues to be regarded primarily as a pre-eminent liberal thinker. Economists of Mill’s time were haunted by the fear of the imminence of a stationary state, that is, a state of simple reproduction or zero growth-rate, in which there would be no further capital accumulation. Mill however viewed a stationary state with equanimity, believing that one should “fix attention upon improved distribution and a large remuneration of labour as the true desiderata” rather than on “mere increase in production” to which “inordinate importance” was usually being “attached”.

Contrast this position of a nineteenth century liberal thinker with that of a solid phalanx of international economic institutions and national governments today, including also the Indian government, which, notwithstanding overwhelming evidence of growing absolute poverty accompanying GDP growth, continue to stress GDP growth, that is, a “mere increase in production”, rather than “improved distribution and a large remuneration of labour” as the true desideratum.

There was a time when a high GDP growth rate was considered necessary for alleviating unemployment and poverty in countries like ours, so that no distinction was drawn, let alone any conflict perceived, between “a mere increase in production” and “a large remuneration of labour”. A high GDP growth, it was argued, would raise the rate of growth of employment, which would reduce the relative size of the labour reserves, create tightness in the labour market, and raise the real wage rate. Even if the real wage rate does not rise as rapidly as labour productivity in such a case, it would certainly increase faster relative to labour productivity than it would otherwise have done; at any rate a faster growth of GDP would make workers better off, both by reducing unemployment and raising real wages compared to what they would have been otherwise.

This argument however lacks substance. The rate of growth of employment that accompanies a particular rate of growth of GDP depends on the nature of that growth process, what commodities and sectors it encompasses, or what class demands it responds to. If the growth is driven by sectors like agriculture and petty production then its employment-generating effects are quite substantial. But in a neo-liberal economy, where the nature of the regime is such that agriculture and petty production are afflicted by a perennial crisis, the location of growth is typically in sectors that cater to the international market and to the consumption demands of those who live off the economic surplus. These however are precisely the sectors, where the employment-intensity of output is low and keeps getting reduced through continuous process and product innovations. Even high rates of GDP growth within a neo-liberal regime therefore generate very little employment growth; or, what is called the observed elasticity of employment with respect to output, that is, the percentage change in employment that accompanies a 1 per cent change in output, is very low, even close to zero (which is often referred to as “jobless growth”). What is more, as the growth rate of output is stepped up, the observed elasticity of employment declines, so that a higher GDP growth brings at best only marginal increases in employment growth.

Since the population, and hence the labour-force, keeps growing, even a high rate of GDP growth under neo-liberalism is accompanied by a growth rate of employment that is so low that it falls below the growth rate of the labour force, and leads not to a reduction in the relative size of the labour reserves but to an increase in this relative size. In such a case while the wage rate scarcely increases, the reduced employment per person leads to an immiserisation of the working population.

This is precisely what has been happening in the Indian economy. While India reportedly has been one of the faster-growing economies in the world, the proportion of its population that lives in absolute poverty has been increasing during the neo-liberal era, and especially in the Modi era which overlaps with the period of crisis of neo-liberalism. Two questions therefore arise in this context: first, why do governments still keep harping on the GDP growth rate, instead of shifting attention to what even a liberal thinker like J S Mill had considered the “true desiderata”? Second, how do we explain high GDP growth rates when not just income inequality but even poverty is increasing, since such growing deprivation should be causing a shrinkage of aggregate demand and hence a choking off of growth?

The simple answer to the first question is that neo-liberalism does not accept the Mill-type desideratum. It is characterised by relatively unrestricted movement of goods and services and of capital, including finance, across country borders, and hence the reduction of the State to a supporting role for capital, rather than an interventionist role for achieving a “large remuneration for labour”. Having any such desideratum as Mill had suggested would legitimise State intervention on behalf of labour, which neo-liberalism abhors. It must therefore pretend both that growth would ensue by giving freedom to capital (and generally getting the State to promote the interests of capital), and that all other desiderata would be achieved automatically through achieving high GDP growth. The point is not whether this is true (it obviously is not); the point is that this is necessarily the ideology of neo-liberal capitalism. And what governments like India’s, and institutions like the IMF and the World Bank, profess is this ideology.

The answer to the second question is that the GDP growth rate has indeed been affected by the growth in inequality and poverty. This is true not just at the level of the world economy where neo-liberalism has run into a dead-end because of the rapidly growing income inequality it has created, which has choked off the growth of aggregate demand and created a tendency towards over-production; it is true even in the case of the Indian economy.

In any case a whole range of authors, from Arvind Subramanian the former chief economic advisor, to Ashoka Mody, to Pronab Sen the former chief statistician of the country, are agreed that India’s GDP growth rate is significantly over-estimated. They mention different reasons for this over-estimation, and each of the reasons has a degree of validity; the fact of overestimation therefore can scarcely be in dispute. The question however remains: by how much? If the overestimation is taken to be by as much as 2 per cent per annum, which is what some authors suggest, then the GDP growth rate in the neo-liberal era would turn out to be just a shade higher than under the preceding dirigiste regime; and that is nothing to write home about.

But our concern here is with the slowing down of the GDP growth rate rather than the level of the growth rate, though of course if the level is overestimated then any estimation of its movement over time becomes somewhat unreliable. Nonetheless a certain slowing down can be established from official statistics. Between 2001-02 and 2011-12, the annual compound rate of growth of real gross value added in the Indian economy, according to official figures, was 6.7 per cent; but between 2011-12 and 2019-20, that is even before the pandemic-induced slowdown in the growth rate had occurred, the annual compound growth rate had fallen to 5.4 per cent. The economy had recovered to this figure by 2022-23: between 2011-12 and 2022-23, the compound annual growth rate was again 5.4 per cent.

Such a slowing down should come as no surprise. With a worsening distribution of income, that is, a rise in the share of economic surplus, an ex ante slowing down of the growth of aggregate demand relative to income growth becomes inevitable. The Russian economist Mikhail Tugan-Baranovsky had contested this proposition by pointing to the possibility of a rise in investment growth to compensate for the decline in consumption growth; but while this is a logical possibility, there is no reason to believe that investment behaviour in a capitalist economy would make this happen, since capitalists invest only when there are prospects of finding a market. The government no doubt can step in to counter the ex ante tendency towards over-production, but it is hamstrung in a neo-liberal economy by the opposition of globalised finance to a larger fiscal deficit and to greater taxes on the rich, which are the only means of financing larger government expenditure that would boost aggregate demand.

This is why fetishising GDP growth neither prevents an increase in poverty under neo-liberalism, nor succeeds in maintaining the GDP growth itself.