Summary

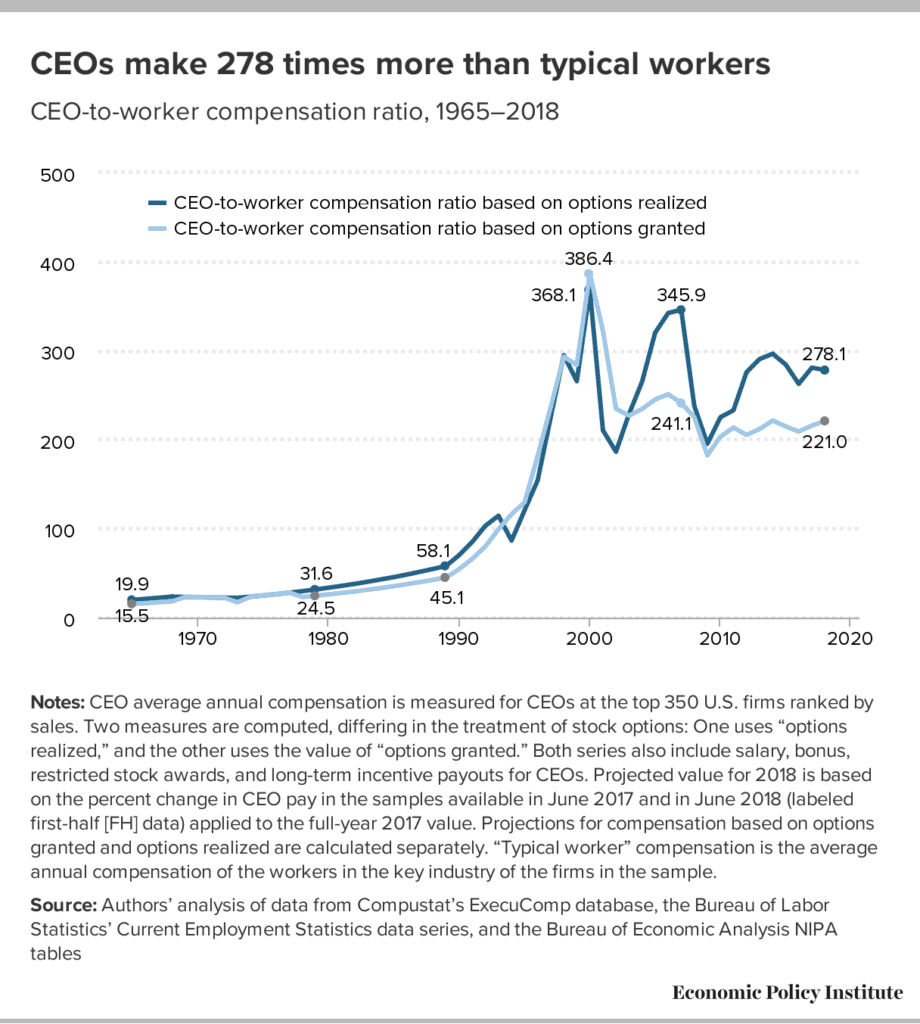

What this report finds: The increased focus on growing inequality has led to an increased focus on CEO pay. Corporate boards running America’s largest public firms are giving top executives outsize compensation packages. Average pay of CEOs at the top 350 firms in 2018 was $17.2 million—or $14.0 million using a more conservative measure. (Stock options make up a big part of CEO pay packages, and the conservative measure values the options when granted, versus when cashed in, or “realized.”) CEO compensation is very high relative to typical worker compensation (by a ratio of 278-to-1 or 221-to-1). In contrast, the CEO-to-typical-worker compensation ratio (options realized) was 20-to-1 in 1965 and 58-to-1 in 1989. CEOs are even making a lot more—about five times as much—as other earners in the top 0.1%. From 1978 to 2018, CEO compensation grew by 1,007.5% (940.3% under the options-realized measure), far outstripping S&P stock market growth (706.7%) and the wage growth of very high earners (339.2%). In contrast, wages for the typical worker grew by just 11.9%.

Why it matters: Exorbitant CEO pay is a major contributor to rising inequality that we could safely do away with. CEOs are getting more because of their power to set pay, not because they are increasing productivity or possess specific, high-demand skills. This escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0% and top 0.1% incomes, leaving less of the fruits of economic growth for ordinary workers and widening the gap between very high earners and the bottom 90%. The economy would suffer no harm if CEOs were paid less (or taxed more).

How we can solve the problem: We need to enact policy solutions that would both reduce incentives for CEOs to extract economic concessions and limit their ability to do so. Such policies could include reinstating higher marginal income tax rates at the very top; setting corporate tax rates higher for firms that have higher ratios of CEO-to-worker compensation; establishing a luxury tax on compensation such that for every dollar in compensation over a set cap, a firm must pay a dollar in taxes; reforming corporate governance to give other stakeholders better tools to exercise countervailing power against CEOs’ pay demands; and allowing greater use of “say on pay,” which allows a firm’s shareholders to vote on top executives’ compensation.

Introduction and key findings

Chief executive officers (CEOs) of the largest firms in the U.S. earn far more today than they did in the mid-1990s and many times what they earned in the 1960s or late 1970s. They also earn far more than the typical worker, and their pay has grown much more rapidly. Importantly, rising CEO pay does not reflect rising value of skills, but rather CEOs’ use of their power to set their own pay. And this growing power at the top has been driving the growth of inequality in our country.

About the CEO pay series and this report

This report is part of an ongoing series of annual reports monitoring trends in CEO compensation. In this report, we examine current trends to determine how CEOs are faring compared with typical workers (through 2018) and compared with workers in the top 0.1% (through 2017). We also look at the relationship between CEO pay and the stock market.

To analyze current trends, we use two measures of compensation. The first measure includes stock options realized (in addition to salary, bonuses, restricted stock awards, and long-term incentive payouts). Because stock-options-realized compensation tends to fluctuate with the stock market (as people tend to cash in their stock options when it is most advantageous to do so), we also look at another measure of CEO compensation, to get a more complete picture of trends in CEO compensation. This measure tracks the value of stock options granted (in addition to salary, bonuses, restricted stock awards, and long-term incentive payouts).1

Trends over the past two years

Using the measure that includes stock options realized, we find that CEO pay fell by 0.5% from 2017 to 2018, to $17.2 million on average in 2018. CEO compensation using another measure, which captures the value of stock options granted (whether exercised or not), grew last year by 9.9% to $14.0 million. Both measures show strong growth in CEO compensation over the last two years, up 7.1 and 9.2%, respectively, for compensation measured with options exercised and options granted. Compensation grew strongly because of increasingly large stock awards given to CEOs; these stock awards averaged $7.5 million in 2018, making up nearly half of CEO compensation.

Long-term trends

CEO compensation has grown 52.6% in the recovery since 2009 using the options-exercised measure and 29.4% using the options-granted measure. In contrast, the typical workers in these large firms saw their annual compensation grow by just 5.3% over the recovery and actually fall by 0.2% between 2017 and 2018.

Average CEO compensation attained its peak in 2000, at the height of the late 1990s tech stock bubble, at $21.5 million (in 2018 dollars) based on either measure—368 or 386 times the pay of the typical worker, depending upon the measure used.2 CEO compensation fell in the early 2000s after the stock market bubble burst, but mostly recovered by 2007, at least for the measure using exercised stock options (the measure using options granted remained substantially below the 2000 level). CEO compensation fell again during the financial crash of 2008–2009 and rose strongly over the recovery since 2009 but still remains below the 2000 peak levels. CEO compensation continues to be dramatically higher than it was in the decades before the turn of the millennium. CEO compensation was 940.3% higher in 2018 than in 1978 using the options-exercised measure and 1,007.5% higher using the options-granted measure. Correspondingly, the CEO-to-average-worker pay ratio, using the options-exercised measure, was 121-to-1 in 1995, 58-to-1 in 1989, 30-to-1 in 1978, and 20-to-1 in 1965.

The relationship between CEO pay and the stock market

CEO pay has historically been closely associated with the health of the stock market, although this connection loosened over the last few years when CEO compensation did not correspond to rapid stock price growth. The generally tight link between stock prices and CEO compensation indicates that CEO pay is not being established by a “market for talent,” as pay surged with the overall rise in profits and stocks, not with the better performance of a CEO’s particular firm relative to that firm’s competitors.

The relationship between CEO pay and the pay of other top earners; the rise of inequality

Amid a healthy recovery on Wall Street following the Great Recession, CEOs enjoyed outsized income gains even relative to other very-high-wage earners (those in the top 0.1%); CEOs of large firms earned 5.4 times that of the average top 0.1% earner in 2017, up from 4.4 times in 2007. This is yet another indicator that CEO pay is more likely based on CEOs’ power to set their own pay, not on a market for talent.

To be clear, these other very-high-wage earners aren’t suffering: Their earnings grew 339.2% between 1978 and 2017. CEO pay growth has had spillover effects, pulling up the pay of other executives and managers, who constitute more than 40% of all top 1.0% and 0.1% earners.3 Consequently, the growth of CEO and executive compensation overall was a major factor driving the doubling of the income shares of the top 1% and top 0.1% of U.S. households from 1979 to 2007 (Bakija, Cole, and Heim 2012; Bivens and Mishel 2013). Income growth has remained unbalanced. As profits and stock market prices have reached record highs, the wages of most workers have grown very little, including in the current recovery (Bivens et al. 2014; Gould 2019).

Key findings

The report’s main findings include the following:

- CEO compensation in 2018 (stock-options-realized measure). Using the stock-options-realized measure, we find that the average compensation for CEOs of the 350 largest U.S. firms was $17.2 million in 2018. Compensation dipped 0.5% in 2018 following a 7.6% gain in 2017. CEO compensation measured with realized stock options grew 52.6% over the recovery from 2009 to 2018.

- CEO compensation in 2018 (stock-options-granted measure). Using the stock-options-granted measure, the average compensation for CEOs of the 350 largest U.S. firms was $14.0 million in 2018, up 9.9% from $12.7 million in 2017 and up 29.4% since the recovery began in 2009.

- Growth of CEO compensation (1978–2018). From 1978 to 2018, inflation-adjusted compensation based on realized stock options of the top CEOs increased 940.3%. The increase was more than 25–33% greater than stock market growth (depending on which stock market index is used) and substantially greater than the painfully slow 11.9% growth in a typical worker’s annual compensation over the same period. Measured using the value of stock options granted, CEO compensation rose 1,007.5% from 1978 to 2018.

- Changes in the CEO-to-worker compensation ratio (1965–2018). Using the stock-options-realized measure, the CEO-to-worker compensation ratio was 20-to-1 in 1965. It peaked at 368-to-1 in 2000. In 2018 the ratio was 278-to-1, slightly down from 281-to-1 in 2017—but still far higher than at any point in the 1960s, 1970s, 1980s, or 1990s. Using the stock-options-granted measure, the CEO-to-worker compensation ratio rose to 221-to-1 in 2018 (from 206-to-1 in 2017), significantly lower than its peak of 386-to-1 in 2000 but still many times higher than the 45-to-1 ratio of 1989 or the 16-to-1 ratio of 1965.

- Changes in the composition of CEO compensation. The composition of CEO compensation is shifting away from the use of stock options and toward the use of stock awards, which now average $7.5 million for each CEO and make up roughly half of all CEO compensation. Stock-related components of compensation—stock options and stock awards—make up two-thirds to three-fourths of all CEO compensation, depending on the particular measure used. The shift from stock options to stock awards leads to an understatement of CEO compensation levels and growth in our measures as well as in other measures, including the measure prescribed in SEC reporting requirements.

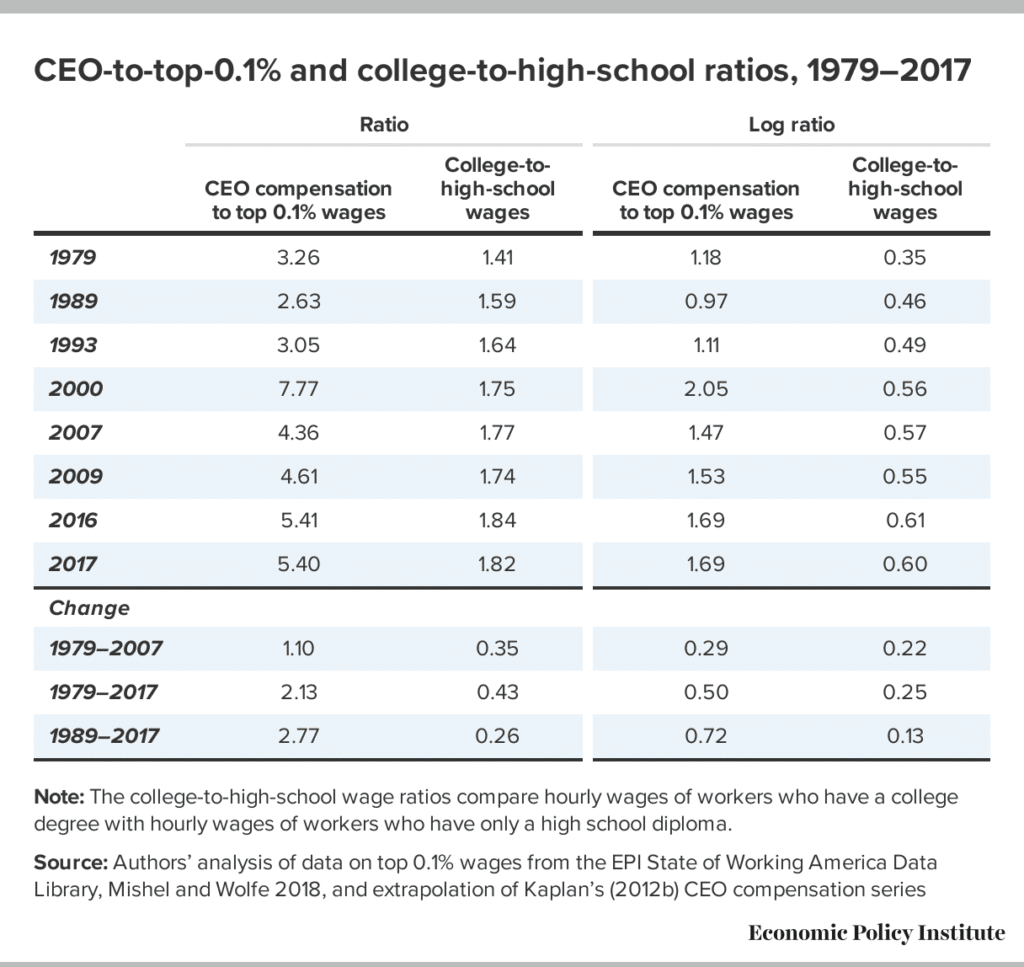

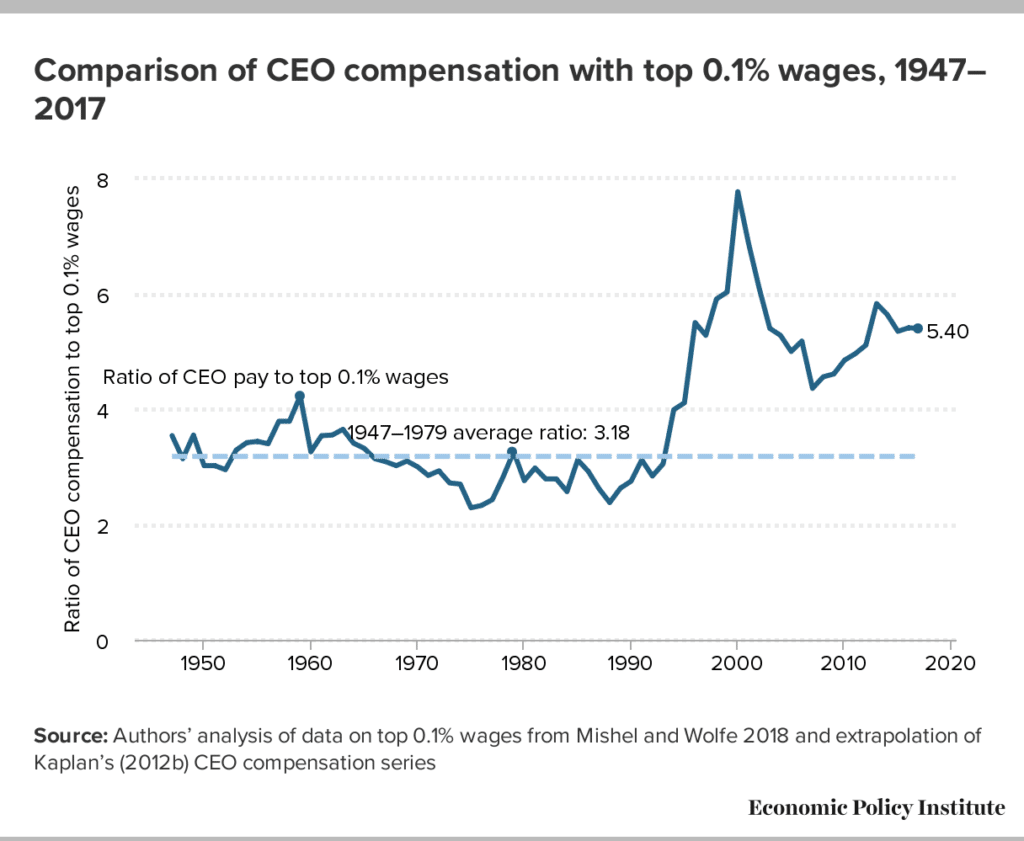

- Changes in the CEO-to-top-0.1% compensation ratio (1989–2018). Over the last three decades, compensation for CEOs based on realized stock options grew far faster than that of other very highly paid workers (the top 0.1%, or those earning more than 99.9% of wage earners). CEO compensation in 2017 (the latest year for which data on top wage earners are available) was 5.40 times greater than wages of the top 0.1% of wage earners, a ratio 2.22 points higher than the 3.18 average ratio over the 1947–1979 period. This wage gain alone is equivalent to the wages of more than two very-high-wage earners.

- Implications of the CEO-to-top-0.1% compensation ratio. The fact that CEO compensation has grown far faster than the pay of the top 0.1% of wage earners indicates that CEO compensation growth does not simply reflect a competitive race for skills (the “market for talent”) that also increased the value of highly paid professionals: Rather, the growing differential between CEOs and top 0.1% earners suggests the growth of substantial economic rents in CEO compensation (income not related to a corresponding growth of productivity). CEO compensation appears to reflect not greater productivity of executives but the power of CEOs to extract concessions. Consequently, if CEOs earned less or were taxed more, there would be no adverse impact on the economy’s output or on employment.

- Growth of top 0.1% compensation (1978–2017). Even though CEO compensation grew much faster than the earnings of the top 0.1% of wage earners, that doesn’t mean the top 0.1% did not fare well. Quite the contrary. The inflation-adjusted annual earnings of the top 0.1% grew 339.2% from 1978 to 2017. CEO compensation, however, grew three times as fast!

- CEO pay growth compared with growth in the college wage premium. Over the last three decades, CEO compensation increased more relative to the pay of other very-high-wage earners than did the wages of college graduates relative to the wages of high school graduates. This finding indicates that the escalation of CEO pay does not simply reflect a more general rise in the returns to education.

Analysis

This section provides detailed analysis of our findings. We examine several decades of available data to identify recent and historical trends in CEO compensation.

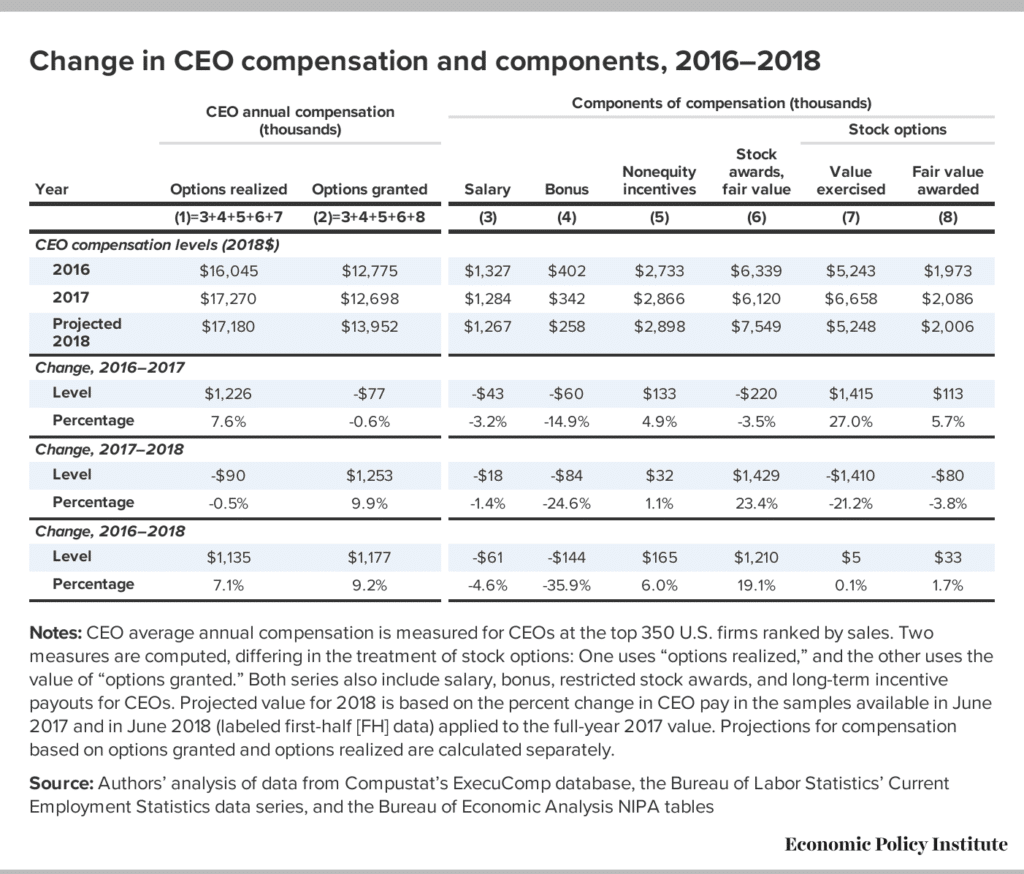

Trends in CEO compensation growth

Table 1 presents recent trends in CEO compensation and for the key underlying components over the 2016–2018 period. It shows the average compensation of CEOs at the 350 largest publicly owned U.S. firms (i.e., firms that sell stock on the open market) based on two different ways to incorporate stock options into compensation. Each measure includes salary, bonuses, stock awards, and long-term incentive payouts, shown in columns (3) through (6).4 The first measure, shown in column (1), tracks how much the average CEO received in a given year by “realizing,” or exercising, his or her stock options (buying stocks at a previously set price and reselling them at the current market price). This options-realized measure, shown in column (7), reflects the value of options exercised that CEOs report on their W-2 form and represents what they actually earned in a given year from exercising those options. The second measure of compensation, shown in column (2), includes the value of the stock options granted in a given year using the fair value of stock options awarded, shown in column (8). This measure is not influenced by the timing of CEO decisions to cash or not cash in their options. (For details on the construction of these measures and benchmarking to other studies, see Sabadish and Mishel 2013.)

Note that Table 1 provides a projection for data for 2018. The data now available for 2018 are limited to the executive compensation disclosed by firms filing proxy statements through June of 2018. To provide data for CEO compensation in 2018 that are consistent with the historical data, we construct our estimates by looking at the growth of compensation from 2017 to 2018 using the first-half-year samples of data available each year and then applying that growth rate to the compensation for 2017 based on the full-year sample. This method corrects for the fact that full-year samples show higher average CEO compensation than samples for the first half of a year. It allows us to avoid artificially lowering the estimated change in this year’s CEO compensation relative to last year’s and earlier years’.5

Using this method, we find that average CEO compensation (based on stock options realized) was $17.18 million in 2018, down $90,000 (0.5%) from the $17.27 million average in the first half of 2017. Using the value-of-options-granted measure reveals a 9.9% increase, from $12.7 million in 2017 to $14.0 million in 2018. The two measures also show changes from 2016 to 2017, though over that year the options-realized measure grew 7.6% while the options-granted measure fell slightly, by 0.6%. Looking at CEO compensation growth over the entire two-year period from 2016 to 2018, avoiding the seesaw growth patterns, one can see that CEO compensation grew strongly, up 7.1 or 9.2% depending on the measure used.6

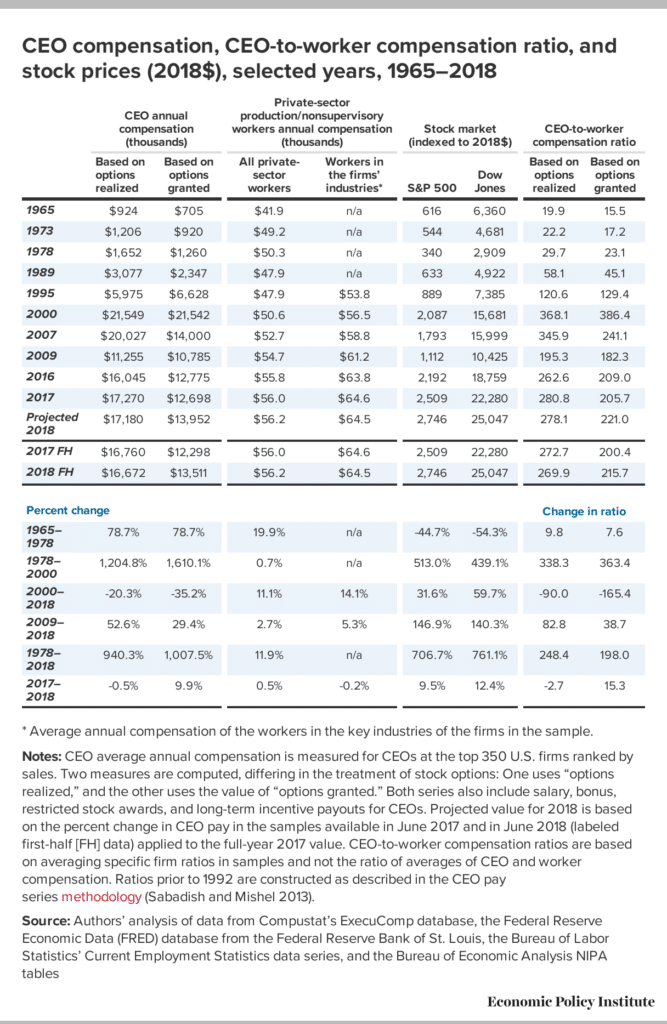

Table 2 presents the longer-term trends in CEO compensation for selected years from 1965 to 2018 using the same two measures used in Table 1.7

For comparison, Table 2 also presents the average annual compensation (wages and benefits of a full-time, full-year worker) of a private-sector production/nonsupervisory worker (a group covering more than 80% of payroll employment), allowing us to compare CEO compensation with that of a typical worker. From 1995 onward, the table also identifies the average annual compensation of the production/nonsupervisory workers corresponding to the key industry of the firms included in the sample. We take this compensation as a proxy for the pay of typical workers in these particular firms and use it to calculate the CEO-to-worker compensation ratio for each firm.

The history of CEO compensation since the 1960s is as follows: Although the stock market—as measured by the Dow Jones Industrial Average and S&P 500 Index and shown in Table 2—fell by roughly half between 1965 and 1978, CEO pay increased by 78.7%. Average worker pay saw relatively strong growth over that period (relative to subsequent periods, not relative to CEO pay or the pay of other earners at the top of the wage distribution). Annual worker compensation grew by 19.9% from 1965 to 1978, only about a fourth as fast as CEO compensation growth.

CEO compensation (realized stock options) grew strongly throughout the 1980s but exploded in the 1990s. It peaked in 2000, at about $21.0 million, a 261% increase over just five years earlier in 1995 and a 1,205% increase over 1978. This latter increase exceeded even the growth of the booming stock market (513% for the S&P 500 and 439% for the Dow) between 1978 and 2000. In stark contrast to both the stock market and CEO compensation, private-sector worker compensation increased just 0.7% over the same period.

The fall in the stock market in the early 2000s after the bubble burst led to a substantial paring back of CEO compensation. By 2007, however, when the stock market had mostly recovered, average CEO compensation reached $20.0 million, just $1.5 million below its 2000 level, using the options-realized measure. However, CEO compensation measured with options granted in 2007 remained down, at $14.0 million, substantially below the 2000 level.

The stock market decline during the 2008 financial crisis also sent CEO compensation tumbling, as it had in the early 2000s. After 2009, CEO compensation measured using options realized resumed an upward trajectory. It stalled from 2013 to 2016 (rising in 2013 but falling in 2015 and 2016), grew 7.6% in 2017, and then remained flat, down 0.5% in 2018. After 2009, CEO compensation measured using options granted also shot up until 2013 and then leveled out over the 2013–2017 period before the 9.9% growth in 2018.

We use the projected 2018 CEO compensation (described above) as the basis for examining changes in CEO compensation over the longer term. For the period from 1978 to 2018, CEO compensation based on options realized increased 940.3%—between one-fourth and one-third faster than stock market growth (depending on the market index used) and substantially faster than the painfully slow 11.9% growth in the typical worker’s compensation over the same period. CEO compensation based on the value of stock options granted grew 1,007.5% over this period. CEO compensation in 2018 remained below its 2000 peak, which occurred at the end of a strong economic boom that included huge growth in the stock market that many believed reflected a technology stock bubble. The run-up in stock prices had a corresponding effect on CEO compensation. When the bubble burst, CEO compensation was deflated as well.

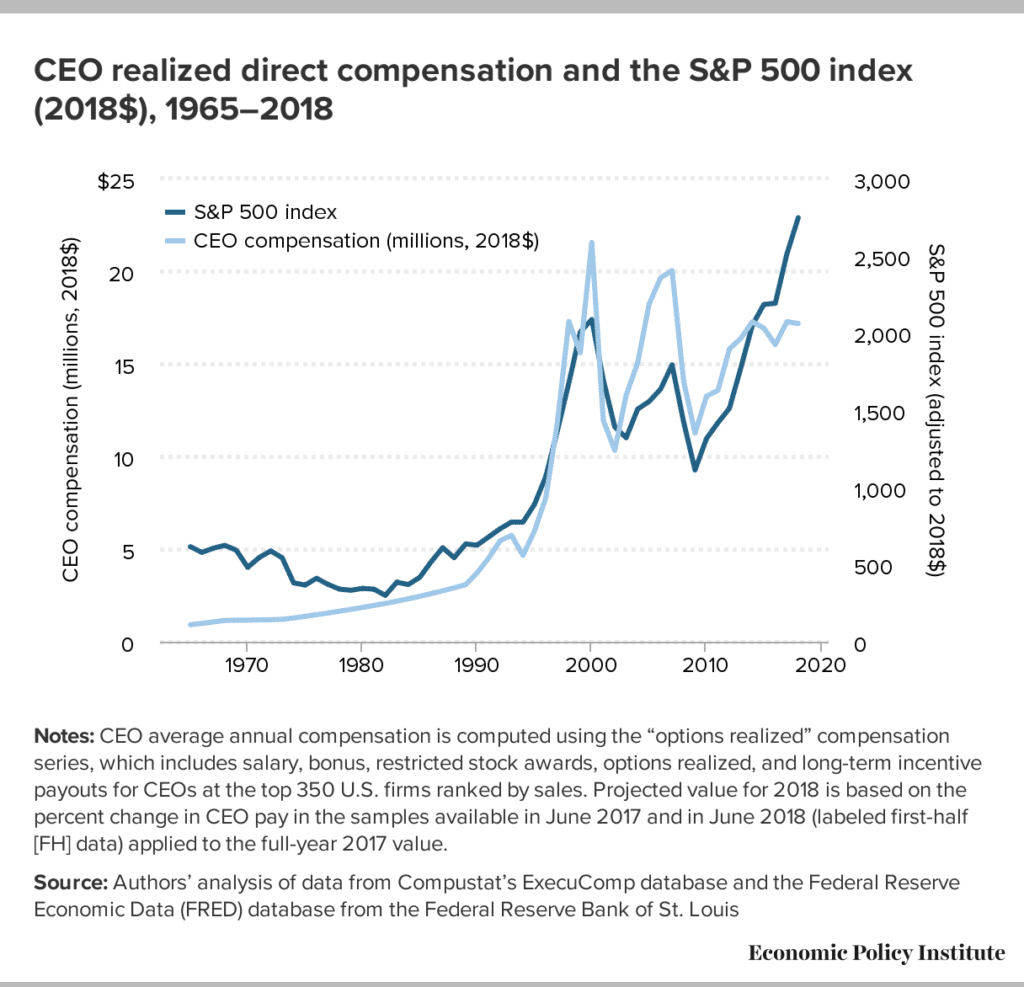

Figure A shows how CEO compensation measured using realized stock options historically fluctuated in tandem with the stock market, as measured by the S&P 500 Index, confirming that CEOs tend to cash in their options when stock prices are high and accumulate unexercised options when stock prices are low. The financial crisis of 2008 and the accompanying stock market tumble knocked CEO compensation based on realized stock options down 43.8% from 2007 to 2009. By 2014 the stock market had recouped all of the ground lost in the downturn. Not surprisingly, CEO compensation based on realized stock options also made a strong recovery. The close connection between stock market growth and CEO compensation has loosened a bit in the years since 2014: As seen in the figure, CEO compensation based on realized stock options has not followed the sharp upward trajectory of the stock market over the past four years, a departure from earlier periods.

FIGURE A

Nevertheless, the normally tight relationship between overall stock prices and CEO compensation, as shown in Figure A, casts doubt on the theory that CEOs are enjoying high and rising pay because their individual productivity is increasing (e.g., because they head larger firms, have adopted new technology, or for other reasons). CEO compensation often grows strongly when the overall stock market rises and individual firms’ stock values rise along with it. This is a marketwide phenomenon, not one of improved performance of individual firms: Most CEO pay packages allow pay to rise whenever the firm’s stock value rises; that is, they permit CEOs to cash out stock options regardless of whether the rise in the firm’s stock value was exceptional relative to comparable firms in the same industry. The slight loosening of the relationship between overall stock market growth and CEO compensation growth does not alter this conclusion.

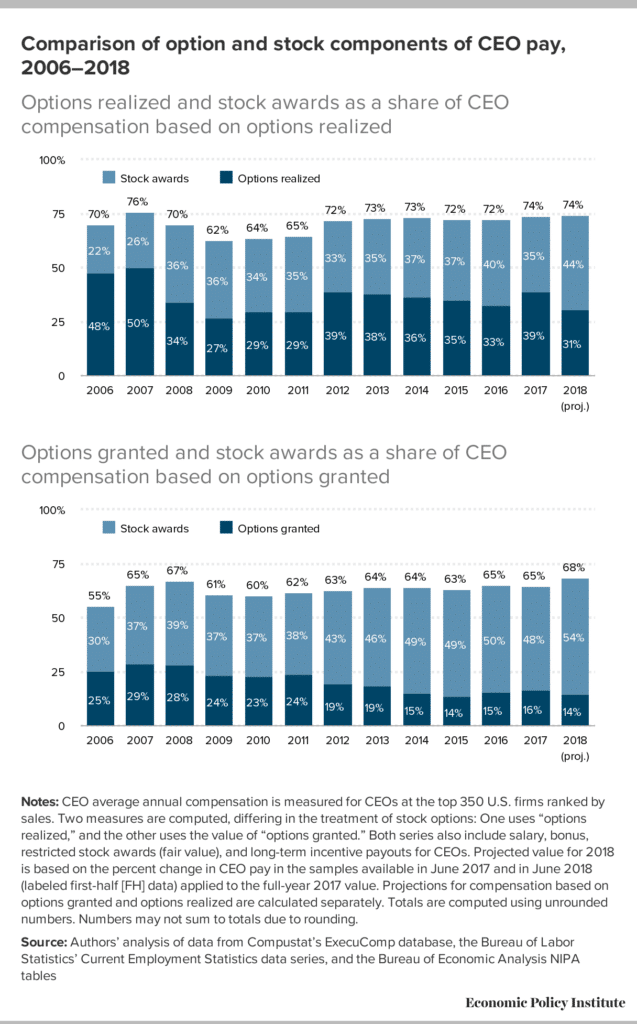

The rising importance of stock awards

Analyses of the underlying components of CEO compensation over the 2016–2018 period in Table 1 showed a strong growth in stock awards, which are simply stocks granted to employees. Stock awards can increase or decrease in value depending on the trend in the firm’s stock price. Stock awards, which are included in both definitions of CEO compensation, rose to $7.5 million in 2018, a substantial amount of income alone. The composition of CEO compensation has been shifting toward stock awards and away from stock options since the end of the last cycle in 2006–2007. These two stock-related items—stock options and stock awards—together still make up the bulk of CEO compensation, at 74% and 68%, respectively, of options-exercised and options-granted CEO compensation measures in 2018.

FIGURE B

Figure B has two stacked graphs: Each shows the contribution of stock awards and stock options to total CEO compensation, the top graph using realized stock options and the bottom graph using stock options granted. Both graphs show the total contribution of stock awards and options in total CEO compensation. Stock awards have risen from about 22–26% of compensation in 2006–2007 to 44% of all compensation in 2018 in the options-exercised measure (top graph) and a rise from 30–37% in 2006–2007 to 54% in 2018 for the options-granted measure (bottom graph). Stock awards now make up about half of all CEO compensation.

The role of stock options has correspondingly declined. The top graph in Figure B shows that exercised stock options (options realized) made up roughly half of CEO compensation in 2006 and 2007 but have fallen to 31% in 2018. The value of stock options awarded has fallen from 25–29% of compensation in 2006–2007 to just 14% in 2018 (bottom graph). It is also important to note that while there has been a shift in the composition of CEO compensation it remains the case that stock-related components (either awards or options) make up between 68 and 74% of all CEO compensation.

An examination of trends in the number and value of unexercised stock options for the same sample of executives confirms that there has been a shift away from options awards rather than an accumulation of unexercised stock options being held to cash in as stock prices rise further. After the tech stock bubble burst in the early 2000s, there was a decline in the value of stock options exercised along with a corresponding increase in the number and value of unexercised stock options. These dynamics suggest a hoarding of options in a down stock market rather than a shift away from options as a compensation tool. Balsam has noted that other factors also led to a reduced use of options: Enron and WorldCom scandals being blamed (incorrectly) on stock options; SOX reporting requirements, which basically took away any opportunity for backdating of options; and then, finally, SFAS 123R (Statement of Financial Accounting Standards No. 123), which required the expensing of options (FASB 2004).8 In contrast to the early 2000s trend, the decline in the role of stock options in the aftermath of the financial crisis of 2008–2009 suggests that firms have shifted composition away from options and toward stock awards: The average decline in the value of stock options in compensation was accompanied by a continued decline in the number of unexercised stock options, from an average of 1,519 in 2007 to just 561 in 2018, and a substantial 31% fall in the inflation-adjusted value of unexercised stock options over the 2016–2018 period to a level just half that of the 2006–2007 period. These trends confirm that there has been a reduction in stock options granted in recent years and not just an accumulating inventory of unexercised options.

There is a simple logic behind companies’ decisions to shift from stock options to stock awards, as Clifford (2017) explains. With stock options, CEOs can only make gains: They realize a gain if the stock price rises beyond the price of the initial options granted and they lose nothing if the stock price falls. The fact that they have nothing to lose—but potentially a lot to gain—might lead options-holding CEOs to take excessive risks to bump up the stock price. Stock awards, on the other hand, promote better alignment of a CEO’s goals with shareholders’ goals. A stock award has the value when given, or vested, and can increase or decrease in value as the firm’s stock price changes. If stock awards have a lengthy vesting period, say three to five years, then the CEO has an interest in lifting the firm’s stock price over that period while being mindful to avoid any implosion in the stock price—to maintain the value of what they have.

As the share of CEO compensation represented by stock options declines, and the share represented by stock awards grows, CEO compensation levels and growth will possibly be increasingly understated in our measures as well as in other measures, including those used by companies to construct the CEO-to-worker ratios reported to the SEC. The reason is this: The exact compensation earned through stock options is measurable—the exercised-options measure of compensation captures any rise in the stock price from the time the options are granted. But for stock awards, the value is determined at the time stocks are granted; any future gains in the value of the stock that accrue to the CEO are not captured by data disclosed by the firms. Nor are they captured in the SEC measure. Because stock awards have become more important, and stock options less important, there is increased likelihood that measures of CEO compensation will not fully capture CEOs’ gains going forward. This increased understatement of CEO compensation in turn tamps down measures of CEO compensation growth.

Unfortunately there are not currently any analyses available that assess the extent of the bias toward lower compensation and less compensation growth. One possible way to assess this would be to use the value of stock awards when vested rather than when granted, as this would capture the growth of the value of the stocks in the three- or four-year window before awards become vested. An analysis of the value of vested stock awards indicates that the stocks awarded do indeed gain value between when they are granted and when they are vested. If these gains were included in a CEO compensation measure, it would show an additional $2 million (in 2018 dollars) in growth of CEO compensation between 2006 and 2018.

Trends in the CEO-to-worker compensation ratio

Table 2 also presents historical and current trends in the ratio of CEO-to-worker compensation, using both measures of CEO compensation. This ratio, which illustrates the increased divergence between CEO and worker pay over time, is computed in two steps. The first step is to construct, for each of the 350 largest U.S. firms, the ratio of the CEO’s compensation to the annual average compensation of production and nonsupervisory workers in the key industry of the firm (data on the pay of workers at individual firms are not available).9 The second step is to average that ratio across all 350 firms.

The last two columns in Table 2 show the resulting ratio for both measures of CEO pay. We adjust the ratio for 2018 to reflect the percentage-point growth between the ratios in the first-half-year samples in 2017 and 2018 and add that growth to the ratio estimated for the full-year sample in 2017 to derive the 2018 ratio consistent with the historical data. Trends before 1995 are based on the changes in average top-company CEO and economywide private-sector production/nonsupervisory worker compensation. The trends are presented in Figure C.

The Securities and Exchange Commission (SEC) now requires publicly owned firms to provide a metric for the ratio of CEO compensation to that of the median worker in a firm, as mandated by the Dodd-Frank financial reform bill of 2010 (SEC 2015). Those ratios differ from those in this report in several ways. First, because of limitations in data availability, the measure of worker compensation in our ratios reflects workers in a firm’s key industry, not workers actually working for the firm. The ratios reported to the SEC will reflect compensation of workers in the specific firm. Second, our measure reflects an exclusively domestic workforce; it excludes the compensation of workers in other countries who work for the firm. The ratios reported to the SEC may include workers in other countries. Third, our metric is based on hourly compensation annualized to reflect a full-time, full-year worker (i.e., multiplying the hourly compensation rate by 2,080). In contrast, the measures firms provide to the SEC can be and are sometimes based on the actual annual (not annualized) wages of part-year (seasonal) or part-time workers. As a result, comparisons across firms may reflect not only pay differences but also differences in annual or weekly hours worked. Fourth, our metric includes both wages and benefits, whereas the SEC metric solely focuses on wages. Finally, we use consistent data and methodology to construct our ratios; our ratios are thus comparable across firms and from year to year. The SEC allows firms flexibility in how they construct the CEO-to-median worker pay comparison; this means there is not comparability across firms—and ratios may not even be comparable from year to year for any given firm, if the firm changes the metrics it uses.

There is certainly value in the new metrics being provided to the SEC, but the measures we rely on allow us to make appropriate comparisons between firms and across time. Box A provides more information on the ratios firms are providing to the SEC.

BOX A

CEO-to-worker pay ratios: The new SEC rule and EPI’s methodology

As of 2018, all publicly traded companies are required to disclose CEO total compensation alongside the median annual total compensation for all employees other than the CEO in annual proxy statements submitted to the Securities and Exchange Commission. In addition, they are to provide the ratio of CEO-to-worker compensation (SEC 2015).

Advocates, investors, and researchers alike have welcomed the disclosure of this information, because these disclosures offer previously unavailable insight into compensation inequality within firms. Historically, constructing a firm-specific CEO-to-worker pay ratio was impossible without the cooperation of the firm, although sector-specific estimates were possible (see Mishel and Schieder 2018). The new CEO-to-worker compensation ratios contained in proxies in 2018 and in 2019 shine a ray of sunlight onto the compensation of the typical worker. According to the authors of a report titled Rewarding or Hoarding? An Examination of Pay Ratios Revealed by Dodd-Frank, from the office of former Congressman Keith Ellison (D-Minn.), “These new data give us a much clearer picture as to which corporations are sharing the wealth and which are not” (Staff of Congressman Keith Ellison 2018).

However, fierce business resistance to the mandate to report the CEO-to-worker compensation ratio has watered down their potential use. Many corporations have implausibly contended that constructing these ratios is too difficult. The SEC has given these claims far too much credence, providing firms tremendous leeway in how to construct the ratios. This SEC capitulation diminished the utility of these new median worker compensation measures for making comparisons across firms and will affect the utility of comparing them over time when additional years of data are available.

Specifically, the SEC’s rule grants firms significant discretion in reporting median worker pay, which makes the reported ratios incompatible across firms. A company’s reported “median worker” may, for example, work part time or full time, reside in the U.S. or abroad, and have worked for the firm for a limited number of weeks during the previous year. The data on median compensation are not provided on a per-hour basis or annualized to that of a full-time, full-year worker. Without such information, or simply the annual hours worked by the median worker, it is not possible to standardize the compensation for comparisons across firms. In addition, firms may not adhere to the same metric each year, limiting the ability to make historical comparisons in the future.

Given the limitations of the metrics used for SEC reporting, the SEC compensation data do not and cannot replace our annual CEO compensation series. Our examination of CEO compensation continues to provide crucial data points for evaluating current CEO compensation trends as well as trends in CEO compensation over time. Our methodology (described in Sabadish and Mishel 2013) has a number of advantages over the SEC-prescribed methodology for constructing ratios. First, our methodology compares CEO compensation to the compensation of the typical worker in the main industry of the CEO’s company rather than just within one specific firm. It thereby eliminates artificial reductions in a company-reported CEO-to-worker pay ratio that could arise from the extensive use of subcontracting.

Second, our worker compensation series reflects annualized compensation (multiplying an estimate of hourly compensation by 2,080 hours), eliminating the ambiguity that arises when weeks worked and hours per week are not specified or when they differ across firms (as can be the case for the SEC ratios). This assumption also likely makes our ratio a more conservative estimate of the true ratio than the ratios reported to the SEC. Third, our analysis captures the ratio of CEO compensation to compensation of U.S. domestic workers only, which makes the ratios comparable in a way that the SEC-required ratios are not (given that they may or may not include workers in other countries). Fourth, our series is able to extend back to 1965, allowing us to analyze trends in executive compensation over time. The consistent basis of the measurement of our ratios permits historical comparisons on a year-to-year basis. These (and other) benefits are why we continue to produce our CEO-to-worker pay series—although it is our hope that with time the ambiguities of the SEC ratio will be addressed and adjusted, to produce a reliable time series for investors and the public to use going forward.

In terms of CEO compensation based on realized stock options, CEOs of major U.S. companies earned 20 times more than the typical worker in 1965. This ratio grew to 30-to-1 in 1978 and 58-to-1 by 1989. It surged in the 1990s, hitting 368-to-1 in 2000, at the end of the 1990s recovery. The fall in the stock market after 2000 reduced CEO stock-related pay (e.g., realized stock options) and caused CEO compensation to tumble in 2002 before beginning to rise again in 2003. CEO compensation recovered to a level of 346 times worker pay by 2007, almost back to its 2000 level. The financial crisis of 2008 and accompanying stock market decline reduced CEO compensation between 2007 and 2009, as discussed above, and the CEO-to-worker compensation ratio fell in tandem. By 2014 the stock market had recouped all of the value it had lost following the financial crisis, and the CEO-to-worker compensation ratio in 2014 had recovered to 296-to-1. The fall in CEO compensation between 2014 and 2016 caused the CEO-to-worker pay ratio to fall. The ratio bumped up in 2017 and basically was stable in 2018, dipping a bit to 278-to-1. Although the CEO-to-worker compensation ratio remains below the value achieved in 2000, at the peak of the stock market bubble, it is far higher than it was in the 1960s, 1970s, 1980s, and 1990s.

The pattern using the CEO compensation measure that values stock options as they are granted is similar. The CEO-to-worker pay ratio peaked in 2000, at 386-to-1, even higher than the ratio with the stock-options-realized measurement. The fall from 2000 to 2007 was steeper than for the other measure, hitting 241-to-1 in 2007. The stock market decline during the financial crisis drove the ratio down to 182-to-1 in 2009. It recovered to 221-to-1 by 2014 and, after dipping a bit over the next three years, ended back up at 221-to-1 in 2018. This level is far lower than its peak in 2000 but still far greater than the 1989 ratio of 45-to-1 or the 1965 ratio of 16-to-1.

Dramatically high CEO pay does not simply reflect the market for skills

This section reviews competing explanations for the extraordinary rise in CEO compensation over the past several decades. CEO compensation has grown a great deal since 1965, but so has the pay of other high-wage earners. To some analysts, this suggests that the dramatic rise in CEO compensation has been driven largely by the demand for the skills of CEOs and other highly paid professionals. In this interpretation, CEO compensation is being set by the market for “skills” or “talent,” not by managerial power or rent-seeking behavior.10 This explanation lies in contrast to that offered by Bebchuk and Fried (2004) or Clifford (2017), who claim that the long-term increase in CEO pay is a result of managerial power.

One prominent example of the “market for talent” argument—based on the premise that “it is other professionals, too,” not just CEOs, who are seeing a generous rise in pay—comes from Kaplan (2012a, 2012b). In the prestigious 2012 Martin Feldstein Lecture at the National Bureau of Economic Research, he claims:

Over the last 20 years, then, public company CEO pay relative to the top 0.1% has remained relatively constant or declined. These patterns are consistent with a competitive market for talent. They are less consistent with managerial power. Other top income groups, not subject to managerial power forces, have seen similar growth in pay. (Kaplan 2012a, 4)

In a follow-up paper for the Cato Institute, published as a National Bureau of Economic Research working paper, Kaplan expands this point:

The point of these comparisons is to confirm that while public company CEOs earn a great deal, they are not unique. Other groups with similar backgrounds—private company executives, corporate lawyers, hedge fund investors, private equity investors and others—have seen significant pay increases where there is a competitive market for talent and managerial power problems are absent. Again, if one uses evidence of higher CEO pay as evidence of managerial power or capture, one must also explain why these professional groups have had a similar or even higher growth in pay. It seems more likely that a meaningful portion of the increase in CEO pay has been driven by market forces as well. (Kaplan 2012b, 21)

However, the argument that CEO compensation is being set by the market for “skills” does not square with the data we analyze. Bivens and Mishel (2013) address the larger issue of the role of CEO compensation in generating income gains at the very top and conclude that substantial rents are embedded in executive pay. According to Bivens and Mishel, CEO pay gains are not the result of a competitive market for talent but rather reflect the power of CEOs to extract concessions. The data presented in Table 3 shows that the evidence does not support Kaplan’s claim that “professional groups have had a similar or even higher growth in pay” than CEOs: The very highest earners—those in the top 0.1% of all earners—had their wages grow far less than the compensation of the CEOs of large firms (note that the gains from exercised stock options are taxed as W-2 wage income and so are reflected in measures of wages in the data we analyze).

Here we draw on and update the Bivens and Mishel (2013) analysis to show that CEO compensation grew far faster than compensation of very highly paid workers over the last few decades, which suggests that the market for skills was not responsible for the rapid growth of CEO compensation. To reach this finding, we use Kaplan’s series on CEO compensation and compare it with the wages of top wage earners, rather than the household income of the top 0.1% as Kaplan did.11 The wage benchmark seems the most appropriate one because it avoids issues of changing household demographics (e.g., increases in the number of two-earner households over time) and limits the income to labor income (i.e., it excludes capital income, which is included in household income measures). We update Kaplan’s series beyond 2010 using the growth of CEO compensation (based on options exercised) in our own series. This analysis finds that, contrary to Kaplan’s findings, the compensation of CEOs has far outpaced that of very highly paid workers, the top 0.1% of earners.

Table 3 shows the ratio of the average compensation of CEOs of large firms (the series developed by Kaplan, incorporating stock options realized) to the average annual earnings of the top 0.1% of wage earners (based on a series developed by Kopczuk, Saez, and Song [2010] and updated by Mishel and Wolfe [2018]). The comparison is presented as a simple ratio and logged (to convert to a “premium,” defined as the relative pay differential between two groups). Both the simple ratios and the log ratios understate the relative pay of CEOs, because CEO pay is a nontrivial share of the denominator, a bias that has probably grown over time as CEO relative pay has grown. If we were able to remove top CEOs’ pay from the top 0.1% category, it would reduce the average for the broader group.12

For comparison purposes, Table 3 also shows the changes in the gross (not regression-adjusted) college-to-high-school wage premium. This premium, which is simply how much more pay is earned by workers with a college degree relative to workers with just a high school diploma, is useful because some commentators, such as Mankiw (2013), assert that the wage and income growth of the top 1% reflects the general rise in the return to skills, as reflected in higher college wage premiums. (The comparisons end in 2017 because 2018 data for top 0.1% wages are not yet available).

CEO pay was 5.40 times the pay of the top 0.1% of wage earners in 2017, similar to 2016 and substantially higher than the 4.36 ratio in 2007. CEO compensation grew far faster than that of the top 0.1% of earners over the recovery since 2009, as the ratio spiked from 4.61 to 5.40. CEO compensation relative to the wages of the top 0.1% of wage earners in 2017 far exceeded the ratio of 2.63 in 1989, a rise (2.77) equal to the pay of almost three very-high-wage earners.13 The log ratio of CEO relative pay grew 72 log points with respect to wage earners in the top 0.1%.

Is this increase large? Kaplan (2012a, 4) concludes that CEO relative pay “has remained relatively constant or declined.” He finds that the ratio “remains above its historical average and the level in the mid-1980s” (2012b, 14). His historical comparisons are inaccurate, however. Figure D compares the ratios of the compensation of CEOs to compensation of the top 0.1% of wage earner ratios back to 1947. In 2017 this ratio was 5.40, 2.27 points higher than the historical average of 3.18 (a relative gain in wages earned by the equivalent of 2.22 very-high-wage earners).

That CEO compensation grew much faster than the earnings of the top 0.1% of wage earners is not because the top 0.1% did not fare well. The inflation-adjusted annual earnings of the top 0.1% grew 339.2% from 1978 to 2017. CEO compensation, however, grew three times faster!

The data in Table 3 also provide a benchmark of CEO compensation to that of the college-to-high-school wage premium. Since 1979, and particularly since 1989, the increase in the logged CEO pay premium relative to other high-wage earners far exceeded the rise in the college-to-high-school wage premium, which is widely and appropriately considered to have had substantial growth: The logged college wage premium grew from 0.46 in 1989 to 0.60 in 2017, a far smaller rise than the logged ratio of CEO-to-top-0.1% earnings, a rise from 0.97 to 1.69. Mankiw’s claim that top 1% pay or top executive pay simply corresponds to the rise in the college-to-high-school wage premium is unfounded (Mishel 2013a, 2013b). Moreover, the data we present here would show even faster growth of CEO relative pay if Kaplan’s historical CEO compensation series (which we use as the basis for the ratios in Table 3) had been built using the Frydman and Saks (2010) series for the 1980–1994 period rather than the Hall and Liebman (1997) data.14

If CEO pay growing far faster than that of other high earners is evidence of the presence of rents, as Kaplan suggests, one would conclude that today’s top executives are collecting substantial rents, meaning that if they were paid less there would be no loss of productivity or output in the economy. The large discrepancy between the pay of CEOs and other very-high-wage earners also casts doubt on the claim that CEOs are being paid these extraordinary amounts because of their special skills and the market for those skills. It is unlikely that the skills of CEOs of very large firms are so outsized and disconnected from the skills of others that they propel CEOs past most of their cohorts in the top one-tenth of 1%. For everyone else, the distribution of skills, as reflected in the overall wage distribution, tends to be much more continuous.

Conclusion

Some observers argue that exorbitant CEO compensation is merely a symbolic issue, with no consequences for the vast majority of workers. However, the escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0% and top 0.1% incomes, generating widespread inequality.

In their study of tax returns from 1979 to 2005, Bakija, Cole, and Heim (2010) establish that the increases in income among the top 1% and top 0.1% of households were disproportionately driven by households headed by someone who was either a nonfinancial-sector “executive” (including managers and supervisors, hereafter referred to as “nonfinance executives”) or a financial-sector worker (executive or otherwise). Forty-four percent of the growth of the top 0.1%’s income share and 36% of the top 1%’s income share accrued to households headed by nonfinance executives; another 23% for each group accrued to households headed by financial-sector workers (some portion of which were executives).

Together, finance workers (including some share who are executives) and nonfinance executives accounted for 58% of the expansion of income for the top 1% of households and 67% of the income growth of the top 0.1%. Relative to others in the top 1%, households headed by nonfinance executives had roughly average income growth; those headed by someone in the financial sector had above-average income growth; and the remaining households (nonexecutive, nonfinance) had slower-than-average income growth. These shares may actually understate the role of nonfinance executives and the financial sector, because they do not account for increased spousal income from these sources in those cases where the head of household is not an executive or in finance.15

High CEO pay reflects economic rents—concessions CEOs can draw from the economy not by virtue of their contribution to economic output but by virtue of their position. Clifford (2017) describes the Lake Wobegon world of setting CEO compensation that fuels its growth: Every firm wants to believe its CEO is above average and therefore needs to be correspondingly remunerated. But, in fact, CEO compensation could be reduced across the board and the economy would not suffer any loss of output.

Another implication of rising pay for CEOs and other executives is that it reflects income that otherwise would have accrued to others: What these executives earned was not available for broader-based wage growth for other workers. (Bivens and Mishel 2013 explore this issue in depth.) It is useful, in this context, to note that wage growth for the bottom 90% would have been nearly twice as fast over the 1979–2017 period had wage inequality not grown.16 Most of the rise of inequality took the form of redistributing wages from the bottom 90% (whose share of wages fell from 69.8% to 60.9%) to the top 1.0% (whose wage share nearly doubled, rising from 7.3% to 13.4%).

Several policy options could reverse the trend of excessive executive pay and broaden wage growth. Some involve taxes. Implementing higher marginal income tax rates at the very top would limit rent-seeking behavior and reduce the incentives for executives to push for such high pay. Another option is to set corporate tax rates higher for firms that have higher ratios of CEO-to-worker compensation. Clifford (2017) recommends setting a cap on compensation and taxing companies on any amount over the cap, similar to the way baseball team payrolls are taxed when salaries exceed a cap. Other policies that could potentially limit executive pay growth are changes in corporate governance, such as greater use of “say on pay,” which allows a firm’s shareholders to vote on top executives’ compensation. Baker, Bivens, and Schieder (2019) review policies to restrain CEO compensation and explain how tax policy and corporate governance reform can work in tandem: “Tax policy that penalizes corporations for excess CEO-to-worker pay ratios can boost incentives for shareholders to restrain excess pay,” but, “to boost the power of shareholders [to restrain pay], fundamental changes to corporate governance have to be made. One key example of such a fundamental change would be to provide worker representation on corporate boards.”

Acknowledgments

The authors thank the Stephen Silberstein Foundation for its generous support of this research. Steven Balsam, an accounting professor at Temple University and author of Equity Compensation: Motivations and Implications (2013), has provided useful advice on data construction and interpretation over the years. Steven Clifford, former CEO compensation consultant and author of The CEO Pay Machine: How It Trashes America and How to Stop It (2017), has also provided technical advice.

About the authors

Lawrence Mishel is a distinguished fellow and former president of the Economic Policy Institute. He is the co-author of all 12 editions of The State of Working America. His articles have appeared in a variety of academic and nonacademic journals. His areas of research include labor economics, wage and income distribution, industrial relations, productivity growth, and the economics of education. He holds a Ph.D. in economics from the University of Wisconsin at Madison.

Julia Wolfe is a research assistant at the Economic Policy Institute. Prior to joining EPI, Wolfe worked at the Bureau of Labor Statistics as the retail and manufacturing employment analyst for the Current Employment Statistics program. She holds a B.A. in political science and international development from Truman State University.

Endnotes

1. We use Compustat estimates of the fair value of options awarded; these estimates are determined using the Black Scholes model. See Sabadish and Mishel 2013 for more information about our data sources and methodology.

2. It may seem counterintuitive that the two ratios for 2000 are different from each other when the average CEO compensation is the same. It is important to understand that (as we describe later in this report) we do not create the ratio from the averages; rather we construct a ratio for each firm and then average the ratios across firms.

3. There were 38,824 executives in publicly held firms and 9,692 people in the top 0.1% of wage earners in 2007, according to the Capital IQ database (tabulations provided by Temple University professor Steve Balsam).

4. Each year’s sample includes the largest 350 firms for which ExecuComp provides data.

5. Most Fortune 500 companies release annual financial data in early spring; the data are included in samples limited to the first half of the year. However, the data we present for previous years include all of the data that were released during each calendar year. This creates a bias in comparing data for the first half of the year relative to the full year’s data in the prior or earlier years: Compensation levels for the full year’s data are higher than compensation in the data limited to the first half. A comparison of data available in June thus shows a smaller increase when compared with the previous year’s full data than a comparison with the data that were available at the same time a year earlier. We analyze the impact of this bias and find that the vast majority of top firms remain unchanged between the samples for the first half and the full year. However, there is churn among the smaller firms in the sample. Among firms with lower net annual sales, average CEO compensation tends to be higher in the full-year sample. Additionally, in recent years firms reporting later in the year have tended to be firms with lower worker compensation levels and therefore higher CEO-to-worker compensation ratios.

6. ExecuComp had flaws in the measure of fair value measure of stock awarded in the data used in our last report (as detailed in Box A in Mishel and Scheider 2018) that required an adjustment to the data. The data have now been corrected by ExecuComp. We reported that compensation using options realized grew 17.5% over 2016–2017, far more than the corrected data show—a rise of 5.2%. Similarly, our reported growth of the options-granted measure of 1.7% exceeded that in the corrected data, where this measure of compensation fell 4.9%.

7. We chose which years to present in the table in part based on data availability. Where possible, we chose cyclical peaks (years of low unemployment).

8. Email communication on July 10, 2019. Balsam also reviewed these trends in his earlier book (Balsam 2007).

9. There are a limited number of firms, which existed only for certain years between 1992 and 1996, for which a North American Industry Classification System (NAICS) value is unassigned. This makes it impossible to identify the pay of the workers in the firm’s key industry. These firms are therefore not included in the calculation of the CEO-to-worker compensation ratio.

10. The managerial power view asserts that CEOs have excessive, noncompetitive influence over the compensation packages they receive. Rent-seeking behavior is the practice of manipulating systems to obtain more than one’s fair share of wealth—that is, finding ways to increase one’s own gains without actually increasing the productive value one contributes to an organization or to the economy.

11. We thank Steve Kaplan for sharing his CEO compensation series with us. The series on the income of the top 0.1% of households that Kaplan used is no longer available. Moreover, as we discuss, the appropriate comparison is to other earners, not to households, which could have multiple earners and shifts in the number of earners over time.

12. Temple University professor Steve Balsam provided tabulations from the Capital IQ database of annual wages of executives exceeding the wage thresholds (provided to him) that place them in the top 0.1% of wage earners. The 9,692 executives in publicly held firms who were in the top 0.1% of wage earners had average annual earnings of $4.4 million. Using Mishel et al.’s (2012) estimates of top 0.1% wages, we find that executive wages make up 13.3% of total top 0.1% wages. One can gauge the bias of including executive wages in the denominator by noting that the ratio of executive wages to all top 0.1% wages in 2007 was 2.14 but the ratio of executive wages to nonexecutive wages was 2.32. We do not have data that would permit an assessment of the bias in 1979 or 1989. We also lack information on the number and wages of executives in privately held firms; to the extent that their CEO compensation exceeds that of publicly traded firms, their inclusion would indicate an even larger bias. The Internal Revenue Service Statistics of Income (SOI) Bulletin reports that there were nearly 15,000 corporate tax returns in 2007 of firms with assets exceeding $250 million, indicating that there are many more executives of large firms than just those in publicly held firms (IRS 2018).

13. A one-point rise in the ratio is the equivalent of the average CEO earning an additional amount equal to that of the average earnings of someone in the top 0.1%.

14. Kaplan (2012b, 14) notes that the Frydman and Saks series grew 289% whereas the Hall and Liebman series grew 209%. He also notes that the Frydman and Saks series grows faster than the series reported by Murphy (2012).

15. The tax data analyzed categorizes a household’s income according to the occupation and industry of the head of household. It is possible that a “secondary earner,” or spouse, has income as an executive or in finance. If the household is in the top 1.0% or top 0.1%, but the head of household is not an executive or in finance, then the spouse’s contribution to income growth will not be identified as being connected to executive pay or finance sector pay. The discussion in this paragraph draws on Bivens and Mishel 2013.

16. This follows from the fact that over 1979–2017 annual earnings rose by 22.2% for the bottom 90%, while the average growth across all earners was 40.1% (Mishel and Wolfe 2018). That means that the bottom 90% would have seen their earnings grow 17.9 percentage points more over the 1979–2017 period if they had enjoyed average growth (i.e., no increase in equality, 40.1 less 22.2).

References

Baker, Dean, Josh Bivens, and Jessica Schieder. 2019. Reining in CEO Compensation and Curbing the Rise of Inequality. Economic Policy Institute, June 2019.

Bakija, Jon, Adam Cole, and Bradley Heim. 2010. “Job and Income Growth of Top Earners and the Causes of Changing Income Inequality: Evidence from U.S. Tax Return Data.” Department of Economics Working Paper 2010-24, Williams College, November 2010.

Bakija, Jon, Adam Cole, and Bradley Heim. 2012. “Job and Income Growth of Top Earners and the Causes of Changing Income Inequality: Evidence from U.S. Tax Return Data.” Department of Economics Working Paper, Williams College, February 2012.

Balsam, Steven. 2007. Executive Compensation: An Introduction to Practice and Theory. Washington, D.C.: WorldatWork Press.

Balsam, Steven. 2013. Equity Compensation: Motivations and Implications. Washington, D.C.: WorldatWork Press.

Bebchuk, Lucian, and Jesse Fried. 2004. Pay Without Performance: The Unfulfilled Promise of Executive Remuneration. Cambridge, Mass.: Harvard Univ. Press.

Bivens, Josh, Elise Gould, Lawrence Mishel, and Heidi Shierholz. 2014. Raising America’s Pay: Why It’s Our Central Economic Policy Challenge. Economic Policy Institute Briefing Paper no. 378, June 2014.

Bivens, Josh, and Lawrence Mishel. 2013. “The Pay of Corporate Executives and Financial Professionals as Evidence of Rents in Top 1 Percent Incomes.” Economic Policy Institute Working Paper no. 296, June 2013.

Bureau of Economic Analysis. Various years. National Income and Product Accounts (NIPA) Tables [online data tables]. Tables 6.2C, 6.2D, 6.3C, and 6.3D.

Bureau of Labor Statistics. Various years. Employment, Hours, and Earnings—National [database]. In Current Employment Statistics [public data series].

Clifford, Steven. 2017. The CEO Pay Machine: How It Trashes America and How to Stop It. New York: Penguin Random House.

Compustat. Various years. ExecuComp [commercial database].

Federal Reserve Bank of St. Louis. Various years. Federal Reserve Economic Data (FRED) [database].

Financial Accounting Standards Board (FASB). 2004. Statement of Financial Accounting Standards No. 123: Share-Based Payment. Revised December 2004.

Frydman, Carola, and Raven E. Saks. 2010. “ Executive Compensation: A New View from a Long-Term Perspective, 1936–2005.” Review of Financial Studies 23: 2099–2138.

Gould, Elise. 2019. State of Working America Wages 2018: Wage Inequality Marches On–and Is Even Threatening Data Reliability. Economic Policy Institute, February 2019.

Hall, Brian J., and Jeffrey B. Liebman. 1997. “Are CEOs Really Paid Like Bureaucrats?” National Bureau of Economic Research Working Paper no. 6213, October 1997.

Internal Revenue Service (IRS). 2018. “SOI Bulletin Historical Table 12: Number of Business Income Tax Returns, by Size of Business for Income Years, Tax Years 1990–2016, Expanded Version” (data table). Excel file downloadable at https://www.irs.gov/statistics/soi-tax-stats-historical-table-12 (web page last updated December 13, 2018).

Kaplan, Steven N. 2012a. “Executive Compensation and Corporate Governance in the U.S.: Perceptions, Facts, and Challenges.” Martin Feldstein Lecture. National Bureau of Economic Research, Washington, D.C., July 10, 2012.

Kaplan, Steven N. 2012b. “Executive Compensation and Corporate Governance in the U.S.: Perceptions, Facts, and Challenges.” National Bureau of Economic Research Working Paper no. 18395, September 2012.

Kopczuk, Wojciech, Emmanuel Saez, and Jae Song. 2010. “Earnings Inequality and Mobility in the United States: Evidence from Social Security Data since 1937.” Quarterly Journal of Economics 125, no. 1: 91–128.

Mankiw, N. Gregory. 2013. “Defending the One Percent.” Journal of Economic Perspectives 27, no. 3: 21–24.

Mishel, Lawrence. 2013a. “Greg Mankiw Forgets to Offer Data for His Biggest Claim.” Working Economics (Economic Policy Institute blog), June 25, 2013.

Mishel, Lawrence. 2013b. “Working as Designed: High Profits and Stagnant Wages.” Working Economics (Economic Policy Institute blog), March 28, 2013.

Mishel, Lawrence, Josh Bivens, Elise Gould, and Heidi Shierholz. 2012. The State of Working America, 12th Edition. An Economic Policy Institute book. Ithaca, N.Y.: Cornell Univ. Press.

Mishel, Lawrence, and Jessica Schieder. 2018. CEO Compensation Surged in 2017. Economic Policy Institute, August 2018.

Mishel, Lawrence, and Julia Wolfe. 2018. “Top 1.0 Percent Reaches Highest Wages Ever—Up 157 Percent Since 1979.” Working Economics Blog (Economic Policy Institute), October 18, 2018.

Murphy, Kevin. 2012. “The Politics of Pay: A Legislative History of Executive Compensation.” University of Southern California Marshall School of Business Working Paper no. FBE 01.11.

Sabadish, Natalie, and Lawrence Mishel. 2013. “Methodology for Measuring CEO Compensation and the Ratio of CEO-to-Worker Compensation, 2012 Data Update.” Economic Policy Institute Working Paper no. 298, June 2013.

Securities and Exchange Commission (SEC). 2015. “SEC Adopts Rule for Pay Ratio Disclosure: Rule Implements Dodd-Frank Mandate While Providing Companies with Flexibility to Calculate Pay Ratio.” Press release no. 2015-160, August 5, 2015.

Staff of Congressman Keith Ellison. 2018. Rewarding or Hoarding? An Examination of Pay Ratios Revealed by Dodd-Frank. May 2018.