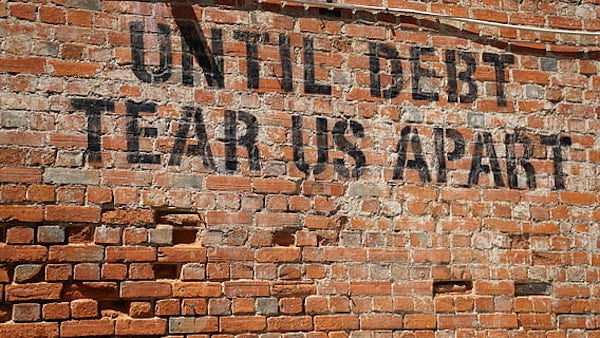

Developing country governments are being blamed for irresponsibly borrowing too much. The resulting debt stress has blocked investments and growth in this unequal and unfair world economic order.

Money as debt

Myths about public debt are legion. The most pernicious see governments as households. Hence, a ‘responsible’ government must try to run a surplus like an exemplary household head or balance its budget.

This analogy is simplistic, unfounded and misleading. It ignores the fact that governments and households are not equivalent monetary entities. Unlike households, most national governments issue their currencies.

As currency is widely used for economic transactions, government debt and liabilities influence households’ and businesses’ earnings and wealth accumulation.

The standard analogy also ignores principles of double-entry bookkeeping, as one entity’s expenditure is another’s income, one entity’s debit is another’s credit, and so on. The government deficit equals the surplus of the non-government sector, which includes households, businesses, and the ‘rest of the world’.

Thus, when a government budget is in deficit—spending exceeds revenue—the government has created net financial wealth for the non-government sector. Government deficits, therefore, increase private savings and the money supply.

Since only the government issues the national currency, its spending does not ‘crowd out’ private-sector spending but complements it. As the currency is debt issued by the state, no money would be left in an economy if the government paid off all its debt!

Hence, media hysteria about public debt is unjustified. Instead, attention should be paid to the macroeconomic and distributive impacts of public spending. For example, will it generate inflation or negatively impact the balance of payments? Who would benefit or lose?

Debt-to-GDP ratio useless

Another widespread myth maintains that public debt beyond a certain level is not sustainable or negatively impacts economic growth. Allegedly supportive studies have been discredited many times, including by IMF research. Yet, the myth persists.

Mimicking eurozone criteria, many West African governments have set policy targets, including public deficits of less than 3% of GDP and debt-to-GDP ratios of less than 70%.

The debt-to-GDP ratio undoubtedly shows relative levels of indebtedness. But otherwise, this ratio has no analytical utility. After all, public debt is a ‘stock’, whereas GDP or output is a ‘flow’.

Suppose a country has an annual income of $100 and zero debt. Suppose its government issues debt of $50 over 25 years, with annual repayments of $2. Its public debt-to-GDP ratio will suddenly increase by 50%.

This poses no problem as GDP will likely increase thanks to increased investments while repaying the $50 debt. With an annual economic growth rate averaging 3%, GDP will more than double over this period.

Second, public debt is always sustainable when issued and held in domestic currency, and the central bank controls interest rates.

With a debt-to-GDP ratio of 254%, the Japanese government will never lack the means to pay off its debt. Unlike developing countries that take on foreign currency debt at rates they do not control, it will always be solvent. Thus, Peru defaulted in 2022 with a debt-to-GDP ratio of 33.9%!

Monetary ‘Berlin Wall’

Thus, there is a significant difference between the governments of the North—mainly indebted in their own currencies—and those in the South, whose debt is at least partly denominated in foreign currencies.

But governments in the South are not indebted in foreign currencies due to inadequate savings.

They can always finance any spending requiring local resources, including labour, land, equipment, etc. Objectively, no country issuing currency can lack ‘financing’ for what it has the technical and material capacity to do.

The chronic indebtedness of most developing countries and the ensuing crises are thus manifestations of the international economic and financial system’s unequal and unfair nature.

Global South countries have been required to accumulate ‘hard currencies’—typically dollars—to transact internationally. This monetary ‘Berlin Wall’ separates two types of developing countries.

First, net exporting countries that accumulate ‘enough’ dollars usually invest in low-yielding U.S. Treasury bonds, allowing the U.S. to import goods and services virtually free.

Second, those which do not earn ‘enough’ hard currencies resort to transnational finance, typically increasing their foreign indebtedness. Most eventually have to turn to the IMF for emergency relief, inadvertently deepening their predicament.

However, as they have to cope with prohibitive terms and conditions for access to emergency foreign financing, it is difficult to escape these external debt traps.

Paradoxically, countries of the South with chronic dollar deficits are often rich in natural resources. Bretton Woods institutions typically demand protracted fiscal austerity and economic denationalisation, undermining developing countries’ chances of getting fair returns for their resources and labour.

Abuses and mismanagement may aggravate Global South governments’ indebtedness in foreign currencies, but these should always be understood in the context of the unequal world economic and financial order.