China and India are generally regarded as the two large countries in the developing world that are the “success stories” of globalisation. This success has been defined by the high and sustained rates of growth of aggregate and per capita national income; and the substantial reduction in income poverty. Further, both China and India are seen as heralding a major shift in the international division of labour through changes in their own output and employment patterns: thus, China is typically described as becoming the “workshop” or “factory” of the world through the expansion of manufacturing production, and India as becoming the “office” of the world, in particular because of its ability to take advantage of IT-enabled services off-shoring. These results, in turn, are viewed as the consequences of a combination of a “prudent” yet extensive programme of global economic integration and domestic deregulation, as well as sound macroeconomic management. Consequently, the presumed success of these two countries has been used to argue the case for globalisation and to indicate the potential benefits that other developing countries can reap. The importance of these two countries spills over into discussions of international inequality as well.1 This makes comparison of the extent of poverty reduction in India and China, and the possible causes of the revealed patterns, of particular current relevance.

It should be noted, however, that despite the similarity of the current international hype about their future economic prospects and also despite their obvious differences, both China and India face rather similar economic problems at present, especially with respect to the sustainability of growth and the emerging inequalities. These concerns actually predate the current global financial crisis and the associated slowdown in many economies, which have obviously also affected growth prospects in China and India. In both countries, the strategy of development had delivered relatively high income growth without commensurate increases in employment, especially in the organised sector; the bulk of new employment has been in lower productivity activities under uncertain and often oppressive conditions. In both countries, the growth has been associated with sharp increases in spatial and vertical inequalities, greater fragility of incomes among marginalised groups and adverse shifts in certain human development indicators. In both countries, 2004 marked a shift in declared political priorities towards more inclusive growth, with varying effects.

This paper is organized as follows. In the remainder of this introductory section, the important economic differences and similarities of the two countries are briefly outlined. The second section deals with trends in growth and poverty reduction in China, considering the trends in poverty and the factors determining these trends, while the third section deals with the same issues for India. The final section draws some conclusions and considers the prospects for poverty reduction in both countries in the context of the still unfolding global financial crisis and economic slowdown.

Differences and Similarities

The two economies are fundamentally dissimilar in some important ways. Although there are superficial attributes in common, such as large populations covering substantial geographical areas, regional diversity, relatively high rates of growth over the recent period and so on, the institutional conditions in the two economies remain very different. India was a traditional “mixed” developing economy with significant private sector participation (including a large private corporate sector) from Independence onwards, and even during the “dirigiste” period, the emphasis was predominantly on the regulation of private capital. Indeed, one of the problems of the so-called “planned economy” in India was the inability of the state to make the private sector behave in ways that fit in with the plan allocations of the state, leading to mismatches between production and private demand as well as periodic macroeconomic imbalances. The neo-liberal reforms undertaken during the phase of globalisation have further expanded the scope for private activity and reduced regulation. Essentially, in India, macroeconomic policies have occurred in contexts similar to those in other capitalist economies, where involuntary unemployment is rampant and fiscal and monetary measures have to be used to stimulate effective demand. The inability to undertake land reforms or other strategies that would have involved substantial redistribution of assets not only meant that wealth and income inequalities continued to be very high, but also affected the ability of the Indian state to undertake economic policies that would be perceived as going against the interests of the landed and other elites.

However, China, by contrast, has had a very different economic structure for most of this period, where the basic elements of a command economy have been much more in evidence. The most important difference to be noted here is that after the revolution of 1949, the Chinese state embarked on comprehensive and sweeping land reforms that dramatically altered asset distribution in the country and changed the political economic landscape that determined subsequent policies. While land relations have undergone numerous changes since then, from collectivization to more dependence on independent small holder peasants, the dominance of landlordism was clearly eliminated and greater equality of access to land and other assets also affected the conditions of access to other forms of wealth and avenues for economic and social mobility. They also meant that economic policies had very different results than they would have had in a more economically unequal context.

Even after the quite sweeping economic reforms that have taken place since 1979, state control over macroeconomic balances remains substantial. Furthermore, because of the significance of state-owned enterprises and the township and village enterprises (TVEs) in total production, the ability of the state to influence aggregate demand does not depend only on fiscal policy in terms of purely budgetary measures, since many “off-budget” expenditures can be increased or reduced. Further, monetary policy, as it is generally understood in capitalist economies, has very little meaning in China where private financial activity is limited and state-owned banks still overwhelmingly dominate the provision of credit. Rather, macroeconomic adjustment has typically taken the form of “administrative measures”, such as moving to slow down an overheating economy through a squeeze on credit provision to regional and provincial governments and public and private corporations ensured through administrative fiat, rather than the use of traditional macroeconomic measures. It is true that the Chinese economy is currently in a phase of transition to one where more traditional “capitalist macroeconomics” is applicable. But the Chinese government’s continuing ability to quickly ensure macroeconomic correction when required is because that transition is still limited.

The control over the domestic economy in China has been most significant in the financial sector. In India, the financial sector was typical of the “mixed economy”, and even bank nationalisation did not lead to comprehensive government control over the financial system; in any case, financial liberalisation over the 1990s has involved progressive deregulation and further loss of control over financial allocations by the state in India. But the financial system in China still remains heavily under the control of the state, despite recent liberalisation and the sale of some shares to foreign investors. Four major public sector banks handle the bulk of transactions in the economy, and over the past several decades, the Chinese authorities have essentially used control over the consequent financial flows to regulate the volume of credit (and thus manage the economic cycle) as well as direct credit to priority sectors. Off-budget official finance (called “fund-raising” by firms) has accounted for more than half the capital formation in China even in recent years, and that, together with direct budgetary appropriations, has determined nearly two thirds of the level of aggregate investment.

Another difference has been becoming less evident in recent years — the dramatically high rate of GDP growth in China compared to the more moderate expansion in India. The Chinese economy has grown at an average annual rate of 9.8 per cent for two and a half decades, while India’s economy has grown at around 5-6 per cent per year over the same period. Chinese growth has been relatively volatile around this trend, reflecting stop-go cycles of state response to inflation through aggregate credit management. The Indian economy broke from its average post-Independence annual rate of around 3 per cent growth to achieve annual rates of more than 5 per cent from the early 1980s. It is only in the four-year period before the global economic crisis starting late 2008 that the Indian economy grew at rates in excess of 8.5 per cent per annum, coming close to the Chinese average.

The higher growth in China has essentially occurred because of the much higher rate of investment in China. The investment rate in China (investment as a share of GDP) has fluctuated between 35 and 45 per cent over the past 25 years, compared to 20 to 26 per cent in India (very recently increasing to 35 per cent). Aggregate incremental capital-output ratios (ICORs) have been around the same in both economies. Within this, there is the critical role of infrastructure investment, which has averaged 19 per cent of GDP in China compared to 2 per cent in India from the early 1990s.2 It is sometimes argued that China can afford to have such a high investment rate because it has attracted so much foreign direct investment (FDI), and is the second largest recipient of FDI in the world at present. But FDI has accounted for only 3-5 per cent of GDP in China since 1990, and at its peak was still only 8 per cent. In the period 2000-07, FDI accounted for only 6 per cent of domestic investment. In fact, in recent times, the inflow of capital has not added to the domestic investment rate at all, macroeconomically speaking, but has essentially led to the further accumulation of international reserves, which have been increasing by more than $100 billion per year.

In terms of economic diversification and structural change, China has followed what could be described as the classic industrialisation pattern, moving from primary to manufacturing activities in the past 25 years. The manufacturing sector has doubled its share of the workforce and tripled its share of output, which, given the size of the Chinese economy and population, has increasingly made China “the workshop of the world”.3 In India, by contrast, the move has been mainly from agriculture to services in terms of share of output, with no substantial increase in manufacturing, while the structure of employment has been stubbornly resistant to change. The share of the primary sector in national income has fallen from 60 per cent in the early 1950s to 25 per cent in 2001-03, but the share of the primary sector in employment continues to be more than 60 per cent, indicating a worrying persistence of low productivity employment for most of the labour force. The higher rates of investment in India over the past two decades have not generated more expansion of industry in terms of share of GDP, but have instead been associated with an apparent explosion in services, that catch-all sector of varying components. The recent expansion of some services employment in India has been at both the high and low value added ends of services sub-sectors, reflecting both some dynamism and some increase in “refugee” low productivity employment.

Another major difference relates to trade policy and trade patterns. Chinese export growth has been much more rapid, involving aggressive increases in world market shares. This export growth has largely been based on relocative capital which has been attracted not only by cheap labour, but also by excellent and heavily subsidised infrastructure, resulting from the high rate of infrastructure investment. In addition, since the Chinese state provision of basic goods in terms of housing, food and cheap transport facilities for registered urban dwellers has played an important role in reducing labour costs for employers. In India, cheap labour has been because of low absolute wages rather than public provision and underwriting of labour costs, and infrastructure development has been minimal. So it is not surprising that it has not really been an attractive location for export-oriented investment, its rate of export growth has been much lower, and exports were not an engine of growth until relatively recently. This difference was also reflected in employment patterns: in China until the late 1990s, the rapid export growth generated employment which constituted a net addition to domestic employment, since until its WTO accession, China had undertaken much less trade liberalisation than most other developing countries. This is why manufacturing employment grew so rapidly in China until the mid-1990s, because it was not counterbalanced by major losses of employment due to the effects of displacement of domestic industry because of import competition. This is unlike the case in India, where increases in export employment were outweighed by employment losses especially in small enterprises because of import competition.

In terms of inequality, the recent pattern of growth has been disequalizing in both economies. In China, the spatial inequalities — across regions — have been the sharpest. In India, vertical inequalities and the rural-urban divide have become much more marked. In China recently, as a response to this, there have been some top-down measures to reduce inequality, for example through changes in tax rates, greater public investment in western and interior regions and improved social security benefits. In India, it is political change, through electoral verdicts, that has forced greater attention to redressing inequalities, though the process is still very incipient.

In terms of future prospects, surprisingly both economies end up with very similar issues despite these major differences. There are clear questions of the sustainability of the current pattern of economic expansion in China, since it is based on a high export-high accumulation model which requires constantly increasing shares of world markets and very high investment rates. This model is obviously directly challenged by the global economic and financial crisis starting from mid-2008, which very quickly had adverse effects on manufacturing exports. Similarly, the hope in some policy quarters in India — that IT-enabled services would become the engine of growth for the entire economy — raises questions of sustainability, quite apart from questions about whether it will be enough to transform India’s huge labour force into higher productivity activities. The most important current problems in the two economies are also rather similar — the agrarian crisis and the need to generate more employment. These are in addition to the need to deal with the effects of the global financial crisis, which have been evident in the real economies of both countries and especially marked in India’s financial sector. In both economies, public intervention in the social sectors has been neglected until recently. In both countries, therefore, despite the very different institutional conditions and other dissimilarities, even in the way that recent economic trends have played out, the crucial policy concern is still that of ensuring sustainable productive employment generation for the majority of the labour force.

Poverty Reduction in China

China’s spectacular growth performance — an annual trend rate of growth of real GDP of just under 10 per cent for slightly longer than the past quarter century — is primarily a reflection of the high investment rates that have characterised the economy over this period. Capital formation as a share of GDP has been very high by international standards, varying between 32 per cent and 44 per cent of GDP. The most recent data indicate that the investment rate in China is above 45 per cent currently. These imply rates of domestic savings which are exceptional by international standards, particularly for an economy at China’s level of per capita income. Such high and rising rates of domestic savings in turn imply a suppression of domestic consumption out of incremental income, which reflects a combination of the sheer rapidity of the growth itself, as well as growing income inequalities, especially in the functional distribution of income.

Increasing Inequalities

Obviously, the extent to which high aggregate income growth translates into poverty reduction depends upon income distribution. The available evidence clearly suggests worsening inequality in China, as shown in Table 1.

| 1978 | 1988 | 1997 | 2002 | |

| National | 0.30 | 0.38 | 0.34 | 0.45 |

| Rural | 0.21 | 0.30 | 0.34 | 0.38 |

| Urban | 0.16 | 0.23 | 0.29 | 0.34 |

It is evident that in the post-reform period (as indeed, was also true before) the national Gini has been generally higher than both rural and urban Ginis, indicating that rural-urban differences have dominated economic inequality. It is estimated that 42 per cent of the aggregate income inequality in China in 2002 was because of the rural-urban gap. But this could actually be an underestimate because registered urban residents enjoy a variety of subsidies, ranging from free medical care and subsidised schooling to pensions, insurance and living allowances, which are not available to most rural residents. Some analysts (Kanbur and Zhang 2003, Khan and Riskin 2004, Li and Yue 2004) have argued that if these subsidies are taken into account, the ratio of urban to rural incomes may exceed four times. Others note that living costs tend to be lower in rural areas, which would somewhat counterbalance this, and that including migrant incomes in urban areas would reduce the gap further.

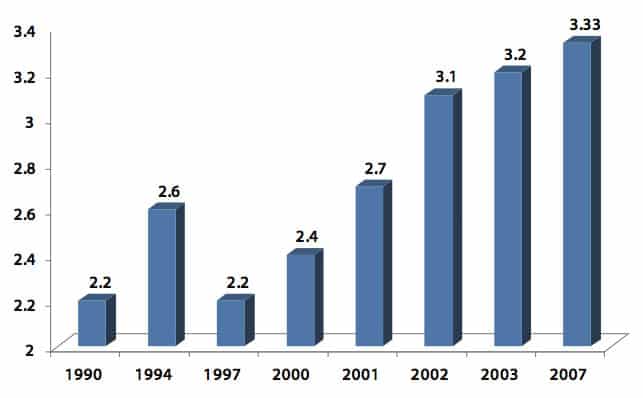

Official statistics suggest that the rural-urban income gap increased significantly between 1990 and 2007, as indicated in Chart 1, and that the most significant differentiation occurred after 1998. The reduction in the rural-urban income gap in 1997 (which, incidentally, was also associated with a significant reduction in rural poverty in that period) was very much a result of the shift in terms of trade — higher agricultural prices play a direct role in reducing inequalities because of the equitable distribution of agricultural land already noted. While rural-urban income inequalities are high, the rate of urbanisation is high and has increased recently in China: the share of the urban population increased from 18 per cent in 1978 to 26.4 per cent in 1990, 36.2 per cent in 2000 and 45 per cent in 2007 (China Statistical Abstract 2008).

Chart 1: Ratio of urban to rural per capita income in China

Source: CASS and UNDP 2005, 2008

Table 1 also shows that the urban Gini was substantially lower than both the rural and national Ginis at the start of the period under consideration, but increased much more sharply, indicating that the process of differentiation was especially rapid in urban China. Indeed, urban inequality is likely to be even higher in the most recent period for two reasons: the survey data generally do not include rural-urban migrants without residence permits (hukou) who constitute the poorest section of urban population, and the consumption of the richest households tends to be underestimated in such household surveys. Rural-urban migrants — currently estimated to be between 150 and 200 million — play a huge role in the urban economy even though they are not included in the calculations of urban income distribution or poverty, except in some recent (and exceptional) estimates. Riskin (2006) suggests that including them would increase the estimates for urban inequality and poverty, but lower the national-level Gini coefficient.

Between 1995 and 2002, income inequality in both rural and urban China declined as a result of a decline in regional inequality, improvement in the distribution of both farm and wage incomes, housing reform and the reform of public finance. But the Gini coefficient for China as whole did not change between the two years because of a rise in the already high gap between average urban and rural incomes. In fact, the increase in the rural-urban income gap would have been even larger, but for a substantial decline in rural population after 1995, when the absolute size of the rural population peaked.

In rural areas, regional inequalities account for a large part of overall inequality. The slower pace of income growth in the central and western regions, compared to the eastern coastal region, has widened the income gaps among regions. This, in turn, is related to structural changes in output and employment: the coastal regions have provided more opportunities for non-agricultural employment and income. By contrast, the distribution of agricultural income across regions has been more equal, reflecting the greater equality of control over agricultural land.

Urban inequalities are also affected by regional differences, one manifestation of which is in wage disparities across provinces. In 2003, the highest average provincial wage was 2.6 times the lowest (UNDP 2005). But vertical income inequalities in urban China have also increased sharply, particularly after 1992, when market-oriented reforms were accelerated in the southern and eastern parts of the country.

In contrast to income inequalities, estimates of wealth inequality suggest stability or even a slight decrease. One major reason for this in rural China has been the relatively equitable distribution of land, which has tended to offset other inequalities. While this has been a major factor in poverty reduction as well, as discussed below, there are some areas of concern relating to recent tendencies in displacement of the peasantry as land is converted for non-agricultural uses. Provincial and local governments in some of the more economically dynamic provinces have played a growing role in this. In urban China too, access to residential housing has been an important equalizing factor, as the policy of providing title deeds to residents of public housing has led to a more equal wealth distribution. However, actual wealth inequality is likely to be higher because of the underestimation of other forms of wealth among the rich.

Changes in Poverty Incidence

The Chinese case has often been cited as an example of how rapid aggregate growth and industrialisation are associated with poverty reduction. Yet, in fact, it illustrates quite sharply the crucial importance of growth in agricultural incomes for poverty reduction, in a context of relatively equitable distribution of land. What is striking about the post-reform Chinese experience with growth and its effects on poverty reduction is that while Chinese growth was consistently high across time (except in 1989), poverty reduction was concentrated in particular periods. The relationship between poverty reduction and growth has varied over time, being strong at the beginning of the “reform” period and somewhat weaker afterwards.

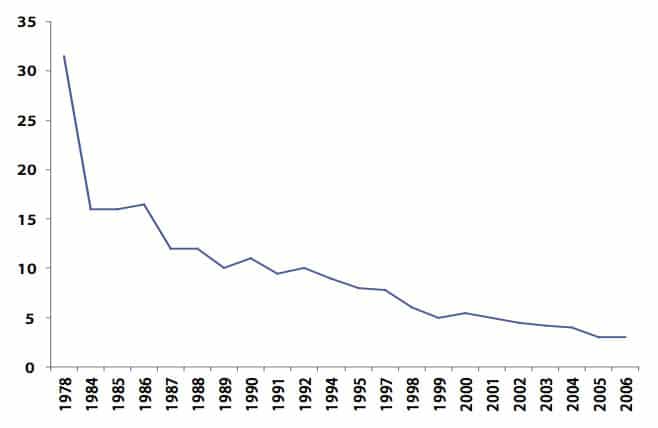

Chart 2 indicates changes over time in the incidence of rural poverty, based on official Chinese estimates. These are likely to underestimate poverty for several reasons. Unlike for most other developing countries, Chinese poverty estimates are based on income rather than expenditure data, while the latter typically show greater absolute poverty. Chen and Wang (2001), using an expenditure-based line, find the proportion of rural poor to have been 25 per cent in 1999, compared to only around 5 per cent according to the official income-based estimate. Similarly, Hussain (2003) found that for 1998 survey data, estimates of urban poverty increased by two and a half times (from 14.7 million to 37.1 million) using expenditure data than income data.

Chart 2: Rural poverty ratio in China

Source: CASS and UNDP 2005, 2008

Further, the poverty line is derived on the basis of a basket of foods, and before 1998, food grains dominated this bundle, amounting to 88 per cent of the total value of the bundle, even though they were only 70 per cent of the total food expenditure of poor households. This gave disproportionate significance to grain prices, which have been kept from increasing as rapidly as other food prices (Riskin 2004). In any case, the official poverty line has not kept pace with consumer price inflation, and it has been estimated (Park and Wang 2001) that in 2000, this caused the poverty line to be at least 13 per cent lower than in the mid-1980s. Subsequently, too, the increase in prices of many essential goods has not been adequately captured by the official poverty line. Non-food items have been given only 17 per cent weight after 1998, even though they account for between 27 and 49 per cent of the total expenditure of poor households across the various provinces.

Even so, it can be seen that much of the reduction in rural poverty was concentrated in two relatively brief periods: the first five years of the reform period, 1979-1984; and the period 1995-1997. (This has also been noted by Bouche and Riskin, 2004; Riskin 2004.) This change had much to do with the nature of the growth, which began by being centred on agriculture and the rural economy where most of the poor lived, and then shifted to the industrialisation of the coastal cities where the poor were less evident except as migrants.

The first period 1979-1984 was when policies of economic reform focused on the countryside. Over these years, the “reorganisation” and dismantling of the rural people’s communes led to the parcelling out of land to households on a broadly egalitarian basis, with peasant households being given control over the use of land without having the right to sell. Instead of the previous “grain first” policy, farmers were encouraged to diversify production to more high-value produce. At the same time, crop prices were raised 30 per cent over the five-year period. In addition, supplies of agricultural inputs, including chemical fertilizers, were sharply increased and provided to farmers at subsidised rates. All this led to significant increases in agricultural incomes, and this translated directly into reduced poverty because most cultivators were net sellers of both cash crops and food grains.

The second period of substantial decline in rural poverty occurred in the middle years of the 1990s. Once again, this was driven by the inter-sectoral terms of trade: specifically, a steep rise in farm purchase prices, especially of food grain, which doubled in the middle of the decade. After a long time, rural per capita incomes increased faster in real terms than urban incomes, leading to the decline in urban-rural income gap described in Chart 1. It is evident that in the period 1994-1997, poverty reduction proved to be highly income-elastic, as a 21 per cent increase in rural income was accompanied by a 40 per cent decrease in rural poverty (Chen and Wang, 2001). However, this was essentially because of the forces driving the increase in rural incomes (higher returns to cultivation) in a context of egalitarian land distribution and the dominant role of agriculture in rural livelihood.

Hu and Chang (2004) have argued that notwithstanding China’s substantial poverty reduction since 1978, the pace of poverty reduction has decelerated and new forms of poverty have arisen. This is explained by the authors in terms of two factors: the deteriorating quality of growth in terms of its employment generation potential and increased inequality. Trends in poverty have also been closely linked with trends in employment (Sengupta and Ghosh 2005). In rural areas, slow growth in the agricultural sector resulted in almost stagnant rural employment after the mid-nineties. Rising unemployment was a major driver of urban poverty in the post-1985 phase, a scenario further strengthened by migrants from rural areas.

It is known that reforms in China impacted adversely on urban poverty by generating unemployment through restructuring the state-owned sector in a context where the social security system was weak or absent. Bouche and Riskin (2004) argue that urban poverty is closely associated with inability to find work, and that the increase in urban unemployment, as a result of market-oriented reforms and withdrawal of financial support for ailing state enterprises, had been a prime cause of the increase in urban poverty. Prior to restructuring the state-owned enterprises (SOEs), there was no great variation in urban poverty among regions due to guaranteed employment and the ubiquitous urban welfare system. This regional pattern changed when market-oriented reforms restructured the SOEs, led to significant closure of SOEs, privatisation and large-scale lay-offs of workers, and also weakened the urban social welfare system. Changes in the regional distribution of urban poverty were highly correlated with the original structure of industry and with regional economic growth. The incidence of urban poverty tends to be higher in those regions where the heavy industries set up during the era of central planning were concentrated, and lower in the towns and cities of the south-eastern coast which have experienced more dynamic growth.

Moreover, financial stringency also limited the poverty reduction effort. In China, most poverty reduction programs financed by the central government and by international donors required counterpart funds from local governments, but most local governments in poor counties faced severe budgetary constraints. As a result, a report by the State Auditing Bureau indicated that 370 out of 592 poor counties had not provided any counterpart funds from 1997 to 1999. The problem was similar in urban areas, since many city and town governments lacked the fiscal resources to provide counterpart funds for financing the new unemployment, pension and medical insurance systems.

Despite high growth, the most important and urgent economic problem China has been facing is unemployment. According to Yu Yongding, in every year of the early 2000s, 10 million more were thrown onto the job market. In addition, more than 5 million redundant workers from former state-owned enterprises have sought re-employment. Finally, there are hundreds of millions of migrant farmers constantly moving around the country seeking jobs. As a result, even the high rate of growth in China, if not accompanied by structural and other changes ensuring more job creation, cannot meet the pressure for jobs. For example, in 2003, with a 9.1 per cent aggregate GDP growth rate, 8 million jobs were created, but even this was inadequate given the continuously growing “backlog” of labour force increases and reduced demand for labour in many traditional activities including agriculture.

While income poverty in rural areas has been reduced by rural-urban migration, in urban areas, most of the poor are recent migrants, who tend to be much worse off than other urban residents. For example, Hussain (2003) found that the incidence of poverty among migrants was 50 per cent higher than among non-migrant urban residents in 1998. Migrant workers typically experience high turnover of employment, and also suffer from the disadvantages of being excluded from the formal labour market, public housing and access to health services and schooling for children at low cost that urban residents are entitled to.4 In addition, the urban poor who have urban resident status are also entitled to a subsistence allowance, the incidence of which has spread in recent years. In the early 1980s, the official urban poverty rate was about 2 per cent and the total urban poor population was 4 million. This decreased to about one million in 1989 according to official estimates, though unofficial estimates are much higher. For example, according to a 1994 survey by the Social Survey Centre of the People’s University, there were then about 50 million impoverished urban residents (Hong Dayong, 1997). The number would be even larger if the estimate were to be based on the actual place of residence of individuals, rather than their registered permanent residence. More recent estimates (ILO 2006) also suggest much higher actual poverty in urban areas than indicated by official estimates. This is essentially because of the gap in incomes and benefits accruing to migrants compared to “full status” or registered urban residents. Recently the Chinese government has announced some measures to provide some facilities to unregistered migrants, but the impact of these on urban poverty has yet to be assessed.

Indicators of Human Poverty in China

Income poverty is now widely accepted to be an inadequate indicator of actual conditions of life, as it does not capture various other forms of deprivation, including the fulfilment of various social and economic rights. The concept of human poverty is wider, and many of its elements are worth considering in this context.

The most important alternative indicator to consider is that of nutrition and calorie intake. Income poverty estimates in both China and India are implicitly based on calorie intake, since the poverty lines are derived from the income/consumption expenditure level associated with the ability to purchase sufficient food to meet some specified calorie intake. In both countries, the per capita requirements on which the original poverty lines were based were 2400 kcal per day in rural areas and 2100 kcal per day in urban areas, and these lines have been subsequently adjusted with consumer price indices.

The extent of “food poverty” has generally been higher than income poverty, and the divergence has grown over time. Using household survey data from rural areas of 19 provinces in 1995, Zhu (2001) found that while official poverty incidence was only 5 per cent, the proportion of the rural population with calorie intake below 2400 kcal per day was 28 per cent, and that receiving less than 2100 kcal per day was 17 per cent. Using a much lower norm does obviously reduce the extent of apparent nutritional deprivation, but the debate still rages on as to whether this is justified by the nutritional requirements for a healthy rural life. Even so, there is clear evidence that calorie intake has improved over time and the extent of severe food deprivation has fallen. FAO (2000) estimated that the share of China’s population with insufficient calorie intake (based on a lower norm of 1920 kcal per day per capita) fell from 30 per cent in 1979-1981 to 17 per cent in 1990-1992 and 11 per cent in 1996-1998.

Stunting is an indicator of long-term under-nutrition in children. Here too, while the rates for rural China are high, they have declined over time (from 41.4 per cent in 1990 to 22 per cent in 1998). They are now significantly better than for India or countries in sub-Saharan Africa.

On the health front, morbidity indicators in China indicate a clear shift towards life-style diseases away from communicable diseases, which is usually a feature of development and increasing incomes. Chronic non-communicable diseases now account for an estimated 80 per cent of total deaths (Wang, et al. 2005), with the major causes of death being cardiovascular disease, cancer and chronic respiratory disease. Only the last is disproportionately associated with poverty, but in China, it is also strongly linked to smoking which is still widely prevalent. Indeed, the most common health problems in China today relate to tobacco use, blood pressure and obesity, which are not typical of poor populations.

However, health indicators vary widely between rural and urban locations and across provinces. In 2000, the average life expectancy of rural residents was 69.6 years, 8 per cent lower than the average for urban residents of 75.2 years. In 2005, child mortality rates in rural China (at 25.7 per 1,000 live births) were 1.4 times the urban rate of 10.7. Maternal mortality in rural areas in 2006 was nearly double that in urban China, at 45.5 per 100,000 live births compared to 24.8.

One important point to note is that conventional estimates of poverty do not take into account out-of-pocket expenses for health care, and that where these are high, this can lead to a “medical poverty trap”. This issue is important for China where the extent of public provision of health and the degree of subsidy involved both declined in the 1990s, especially for rural Chinese. Van Doorslaer, et al. (2006) have identified the impact this has on estimates of poverty in eleven developing countries, including China and India. They conclude that out-of-pocket expenses for health care exacerbate both the prevalence and the depth of poverty. In China, they were found to increase the incidence of poverty in 2000 by nearly 20 per cent, causing an increase from 13.7 per cent (using the World Bank’s head count ratio based on $1.08 PPP per day) to 16.2 per cent. In India, the corresponding numbers for 1999-2000 were 31.1 per cent and 34.8 per cent.

A more detailed study using official poverty lines for China (Gustafsson and Li 2004) based on household survey data for 1988 and 1995 not only found that education and health expenditures in rural China increased rapidly between 1988 and 1995, but also that they constituted a much higher share of expenditure in poor households. They argue that once these expenditures are taken into account, it is no longer possible to state that poverty decreased during this period of rapid economic growth. Clearly, therefore, greater public funding of health care and basic education expenses become important poverty reduction measures.

Poverty Reduction Strategies in China

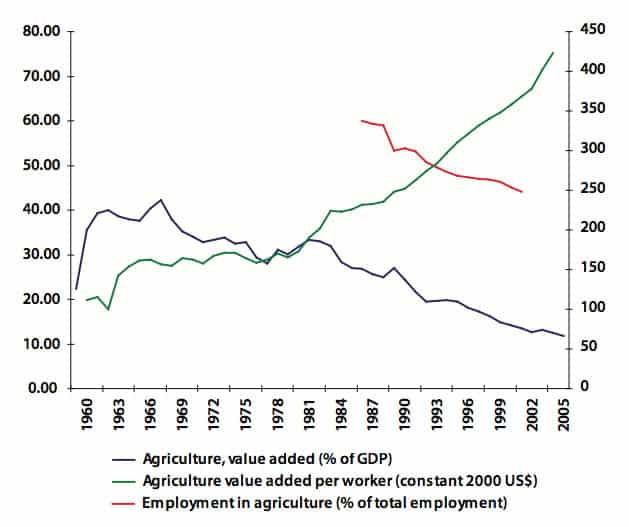

One of the most important tendencies with a direct bearing on poverty reduction is the overall pattern of growth and structural change. As noted in the first section, China’s recent growth has been along the classic Kuznets-style trajectory, with an increase in the share of the manufacturing sector in both output and employment. A crucial feature of such a positive tendency is agrarian transformation. It is evident from Chart 3 that the share of agriculture in both output and employment has declined since the early 1980s. This is different from a number of other developing countries (including India) where the share of agriculture in employment remains high. So, the ability of the Chinese growth pattern to generate more productive and remunerative employment outside agriculture played an important role. In addition, per worker output in agriculture increased dramatically from the early 1980s, reflecting the institutional changes described earlier. What is significant is that it continued to increase at a rapid rate thereafter, such that it nearly doubled in the decade after 1995. This has clearly played a very important role in rural poverty reduction, dwarfing the effect of particular poverty alleviation schemes, but it is necessary to remember that it is the specific pattern of agricultural growth in China that mattered. The growth was broad-based and widely shared because of the egalitarian land distribution as well as the simultaneous creation of non-agricultural employment opportunities.

Chart 3: China: Agriculture in GDP and employment

Source: Groningen Total Economy Database, www.conference-board.org/economics/database.cfm

On the basis of an econometric study on the variables influencing rural poverty, Fan, Zhang and Zhang (2002) argued that increasing agricultural output remains the key to poverty reduction, and this is significantly positively influenced by public investment, in agricultural research as well as in rural infrastructure and education. They found that government expenditure on education had the largest impact on reducing both rural poverty and regional inequality, and a significant impact on boosting production. Increased rural non-farm employment accounted for a significant part of the reduction in both poverty and inequality, and the large positive impact of rural infrastructure spending was found to come mainly from improved non-farm employment opportunities. Interestingly, they found low poverty reduction impacts of both public irrigation spending and loans (micro-credit) provided as part of anti-poverty programmes.

Rozelle, Zhang and Yuang (2000) argued, on the basis of an econometric study, that poverty alleviation in China can be largely attributed to economic growth; also, it is the pattern of growth, rather than its rate, that has been crucial. According to them, the effectiveness of poverty programmes has been limited by problems related to targeting (associated with errors of unfair exclusion and undeserved inclusion) and inappropriate project design along with inefficient fund allocation. They also found that of such programmes, those that are household-based, with funds reaching local agencies, have been more successful.

Huang and Yang (2004: 77) note that poverty reduction strategies need to focus on the country as a whole, rather than deal separately with rural and urban poverty through targeted schemes. According to them, “it is important to enhance government intervention in income distribution, and adjust and regulate income distribution policies. One of the most important reasons for the formation of the present poverty problems in China is the disorder of income distribution and existence of unfairness.”

An important factor may be the lag in ensuring redistributive fiscal policy. Until recently, the tax system was not based on the principles of a market economy and did not encompass the now widespread possibility of individual wealth accretion. Wages and salaries have been the only taxable incomes (Wu 2002) even though property-based incomes of different sorts and newer types of remuneration for highly paid professional workers have both become more quantitatively significant. According to Huang and Yang (2004), a large portion of individual income tax is collected from average workers and employees, while high-income individuals find all sorts of ways to avoid taxes. Rural residents were, until recently, taxed much more heavily than urban residents, even though the incidence of poverty is still acknowledged to be much higher in rural China. The scrapping of the agricultural tax in 2006 may not only have contributed to overall agricultural incomes, but also contributed to the reduction of rural poverty, although the impact is not yet clear from the data. Tax rates have been low overall and more dependent on indirect taxes. All this has reduced the potential for redistributive expenditures, including on social security that would directly have a bearing on poverty alleviation. The poor — in both rural and urban areas — are those who are largely outside the coverage of the social security system, including not only minimum livelihood guarantee, but also livelihood protection for laid-off workers of state-owned enterprises, unemployment protection, subsistence allowances for urban residents, basic old age pension, unemployment insurance, medical insurance, working injury insurance and birth insurance for females.

The fiscal system operated in another way to impact upon the extent of inequality and poverty, by reducing incomes of communes in poorer parts of the country. Decentralisation had the effect of reducing fiscal transfers especially to provincial governments, municipalities and communes in the central and western parts of the country, and this in turn meant a cutback in their health and education provision and social security benefits. Also, there was inequality in the distribution of such fiscal transfer as did occur in the 1980s and early 1990s, reinforcing the inequality in growth that disproportionately favoured the eastern region. However, this seems to have been reversed from the mid-1990s, and especially after 2002. During the period 1994-2005, only 10 per cent of the central fiscal transfers went to eastern provinces, but 44 per cent went to central provinces and 46 per cent to western provinces. Therefore it is likely that in the more recent period, central fiscal transfers have helped reduce both vertical and horizontal fiscal imbalance and thereby regional inequalities.

Obviously, increasing public expenditure on health and education services is likely to have significant effects on poverty reduction, as noted above. It is therefore heartening to note that since the early part of this decade, such expenditures have been increasing, both in terms of share of total government expenditure and share of GDP. As a result, the share of out-of-pocket expenses in total spending on health care fell from around 60 per cent in 2002 to just above 50 per cent in 2005 (Wang Shaoling 2006).

Overall, it could be argued that poverty reduction in China has been more strongly related to changes in economic structure and in inequality than to GDP growth per se. If so, China’s ability to sustain the pace of poverty reduction will depend on its ability to keep in place recent policies aimed at reducing inequality as well as ensuring that structural change remains positive and dynamic. This is in keeping with lessons from the pre-reform experience as well. China was served well by a combination of egalitarian land distribution and experience with commune, collective and cooperative forms of organisation, which ensured a degree of income equality and helped release and pool labour resources for undertaking non-agricultural activities jointly managed with State support. To the extent that economic reform undermines such egalitarianism and adversely affects the growth of the TVEs, it would set back poverty reduction as well.

Poverty Reduction in India

While India’s recent economic growth experience has been less spectacular than China’s, it has still been extremely impressive by the standards of most other developing countries in the same period and in comparison to its own past. Table 2 shows that real GDP growth rates increased to a higher level in the last two decades. Increases in per capita income were even more marked because of the fall in the rate of population growth.

|

Period (average of years) |

Rate of growth of real GDP (over previous period) per cent |

Share of GDP |

|||

| Investment rate | Primary | Secondary | Tertiary | ||

| 1950-52 | 15.5 | 59.0 | 13.4 | 27.6 | |

| 1960-62 | 3.9 | 19.4 | 53.1 | 17.3 | 29.6 |

| 1970-72 | 3.5 | 23.8 | 46.6 | 20.4 | 33.0 |

| 1980-82 | 3.5 | 22.0 | 41.3 | 21.8 | 36.9 |

| 1990-92 | 5.6 | 26.0 | 34.4 | 24 | 41.6 |

| 2000-02 | 5.6 | 26.2 | 26.1 | 24.7 | 49.2 |

| 2004-06 | 7.1 | 29.3 | 22.0 | 24.0 | 54.0 |

| 2006-08 | 9.3 | 35.9 | 17.8 | 26.4 | 55.8 |

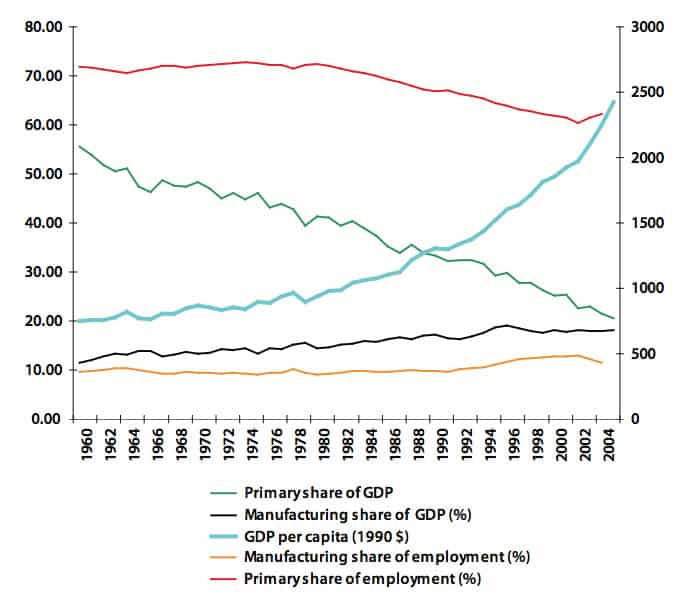

This has been associated with some amount of structural change, although perhaps not as much as might be expected. Investment rates have increased over time, which is only to be expected in a developing economy achieving higher rates of per capita income growth, and have moved up especially rapidly in the current decade, to around 36 per cent now. Meanwhile, the share of agriculture in GDP has fallen along predictable lines in the course of development, but there has been little increase in the share of the secondary sector, which has not changed at all since the early 1990s. Rather, the share of the tertiary sector has increased dramatically, to the point where it now accounts for around half of national income.

Such changes in output shares were not accompanied by commensurate changes in the distribution of the workforce. The proportion of all workers engaged in primary activities as the main occupation has remained stubbornly around 60 per cent, despite the collapse in agricultural employment generation in the most recent decade and the fall in agriculture’s share of national income. The higher rates of investment of the last two decades have not generated more expansion of industry, but have instead been associated with an apparent explosion in services, a ‘catch-all’ sector combining both high-productivity and low-productivity activities. These tendencies, and particularly employment patterns, have had major effects on the incidence of poverty.

Chart 4: Structural change in India

Source: World Bank. World Development Indicators online. www.worldbank.org/data/wdi2005/index.html

Income Inequality and Poverty in India

The evidence suggests that economic inequalities have increased in India in the post-reform period. Most studies have used various rounds of NSS consumption expenditure survey statistics to calculate per capita incomes and Gini coefficients. As regards inequality, it is well known that the NSS surveys, with a relatively low lower bound for its highest expenditure range, do not capture upper income group consumption adequately. With regard to consumption estimates, there is a problem of lack of comparability of NSS statistics between the quinquennial large-sample consumption survey for 1999-2000 (55th Round) and the earlier ones.5 According to Sen and Himanshu (2005), this lowered the measured rural poverty in India by almost 50 million and also affected inequality measures.

Revised estimates of rural inequality have been calculated by Deaton and Dreze (2002), Sundaram and Tendulkar (2003a, 2003b) and Sen and Himanshu (2005). General observation of these studies show that though unadjusted data show inequality was reduced between rounds 50 and 55, if one uses (comparable) adjusted data, rural inequality in fact went up in India between 1993-94 (50th Round) and 1999-2000 (55th Round). Striking evidence about increased inequality in India in the post-reform period comes from Sen and Himanshu (2005). Based on indices of real mean per capita expenditure (MPCE) on a uniform reference period (URP) basis by fractile groups, whereas the consumption level of the upper tail of the population, including the top 20 per cent of the rural population, has gone up remarkably during the 1990s, the bottom 80 per cent of the rural population has suffered during this period. This graph clearly shows that the income/consumption disparity among the rich and poor and among urban and rural India has increased during the 1990s.6

There has been both increased rural-urban inequality in per capita expenditure at an all India level and greater rural-urban inequalities within states between 1993-1994 and 1999-2000 (Deaton and Dreze 2002, CSO 2007). Urban per capita NDP in 1999-2000 was estimated to be around 3 times that in rural India. The ratio of urban to rural per capita consumption, based on National Sample Survey data, has been increasing continuously from 1.55 in 1987-88 to 1.63 in 1993-94 to 1.75 in 1999-2000 to 1.9 in 2004-05. While this trend is similar to that in China, what is striking is that, unlike China, the rate of urbanisation appears to have decelerated in the period of high growth, with cities and towns becoming less welcoming of rural migrants (Kundu 2007).

Regional income differences have intensified, with the Gini coefficient for per capita incomes across the states of India increasing. Sen and Himanshu (2005) also find that state-wise rural and urban Gini coefficients, adjusted for changes in estimates, increased for a majority of states between 1993-94 and 1999-2000. For all-India, the rural Gini increased from 25.8 per cent to 26.3 per cent, and the urban Gini increased from 31.9 to 34.8 per cent. This is generally accepted to be an underestimate because the data cover consumption expenditure, rather than income, and because the survey is known to underestimate the tails of the distribution. The lowest decile of the population accounts for only 3.6 per cent of estimated aggregate consumption, while the top decile accounts for 31.1 per cent (NSSO 2006).

Rural-urban income differentials are large: urban per capita consumption is more than twice that in rural areas (NSS 2006) and per capita GDP gaps are even larger, with urban per capita income estimated to be around three times rural per capita income in 2004 (Sen and Himanshu 2005). Regional differences are also significant and have increased recently: the ratio of the per capita State Domestic Product of the richest major state (Punjab) to that of the poorest major state (Bihar) increased from 2.2 in 1980 to 4.8 in 2004 (Pal and Ghosh 2007).

Official estimates of the extent of poverty, i.e. the head count ratio below the official poverty line, have been the subject of much debate. One commonly cited recent problem relates to the comparability of consumption expenditure estimates over time, especially given the problems with the 1999-2000 survey. However, concerns have also been expressed with the determination of the poverty line itself (Utsa Patnaik 2005, 2008). The current poverty line is based on the line first determined in the 1970s, based on the consumption expenditure level at which a household was procuring sufficient food to meet the average calorie requirement of 2400 kcal per day in rural areas and 2100 kcal per day in urban areas. This line, determined in 1973, has been extended for subsequent years based on the consumer price indices for agricultural labourers in rural areas and for industrial workers in urban areas.

Several criticisms can be directed against such a method: that it does not take into account the changing consumption basket of explicit and implicit necessities, including health care costs and energy costs; that it no longer bears any relation to actual calorie intake, which was the basis for deriving the original line; that it does not even always ensure that households at or above the poverty line can purchase sufficient food to meet the calorie requirements at prevailing prices.

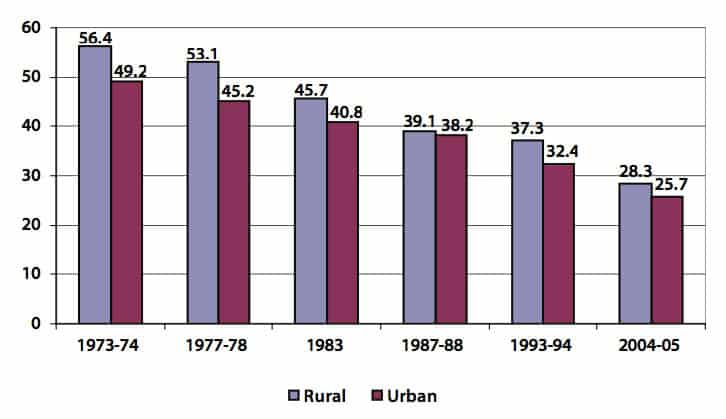

Nevertheless, even these official data provide some cause for introspection on the slower rate of poverty reduction in the recent period of fast economic growth. Chart 5 provides evidence on the head count poverty ratios in rural and urban India. It is clear that poverty, as officially defined, has been declining continuously since the early 1970s. However, what is remarkable is that in the recent period, which is when growth rates picked up, the rate of poverty reduction decelerated, especially in rural India.

Chart 5: India: Official poverty estimates (% of population below poverty line)

Source: Planning Commission, Government of India

This is confirmed by Table 3, which shows the actual rates of poverty reduction according to official estimates over the two periods that can be broadly described as pre and post-economic liberalisation. It is evident that rural poverty reduction in particular was much more rapid in the earlier period, characterised by relatively slower growth and continued state intervention in the productive sectors of the economy.

| Rural India | Urban India | |

| Annual poverty reduction in percentage points | ||

| 1973-74 to 1987-88 | -1.24 | -0.79 |

| 1987-88 to 2004-05 | -0.64 | -0.74 |

| Annual poverty reduction normalised to initial year, per cent | ||

| 1973-74 to 1987-88 | -2.19 | -1.60 |

| 1987-88 to 2004-05 | -1.62 | -1.92 |

Other estimates of the incidence of poverty also find that it has been remarkably persistent, especially in rural India, and also much higher than the official Indian estimates. The most recent World Bank estimates (Chen and Ravallion 2008, using a cut-off of $1.25 per day at revised 2005 PPP$) estimated the number of absolutely poor people in India in 2005 to be 456 million, significantly more than the Indian government’s own estimate of 301 million in 2004-05. According to these estimates, the aggregate head count poverty ratio in India declined from 59.8 per cent in 1981 to 51.3 per cent in 1990 and 41.6 per cent in 2005. So, according to the World Bank, the rate of poverty reduction slowed from 0.94 percentage points per annum during 1981-1990 to only 0.65 percentage points per annum during 1990-2005. On these trends, India would not meet the MDG of halving poverty by 2015.

The Asian Development Bank (2008) estimate of the number of poor in India in 2005 is well over double the official Indian estimate, at between 622 to 740 million. The higher estimate is because the ADB used a higher Asian poverty line of $1.35 PPP per day per person rather than the $1.25 per day per person used by the World Bank. It also made an attempt to improve upon the World Bank by using price data for goods and services purchased by the poor rather than the usual ICP comparison relating to an overall consumption bundle (Himanshu 2008). This gives India the second highest poverty ratio (at 54.8 per cent) among all the Asian countries considered by the ADB, next only to Nepal (55.8 per cent) and higher than Bangladesh (42.9 per cent), Cambodia (36.9 per cent), Philippines (29.5 per cent), Pakistan (24.9 per cent) and Indonesia (24.1 per cent). It should be noted, of course, that the determination of both the poverty line and the PPP measures employed by both the World Bank and the ADB have been criticized (Reddy and Pogge 2002, Reddy 2008) on the grounds that they do not anchor the line on any defined set of requirements for human life, and that the PPP conversion factors are themselves problematic, based on inadequate data and an unchanging perception of consumption needs over time. Nevertheless, the different sets of data all point to the same conclusion: that Indian poverty reduction has been relatively slow, and certainly much below what would be expected given the rapidity of income growth in the past fifteen years.

Human Poverty in India

Human poverty measures suggest even worse outcomes than for income poverty in India. India has never been a good performer in human development terms, despite the much better indicators in some states, particularly Kerala. Overall, both health and education indicators have lagged well below those in other countries at similar levels of development and with similar per capita incomes. But food poverty has been of particular concern. Recent studies have shown alarming levels of hunger, especially in certain states of India. Studies by IFPRI and ISHI quoted in Banerjee (2008) suggest that most states in India rank somewhere among the poor Sub-Saharan countries: Punjab, Kerala, Andhra Pradesh and Assam have a ‘serious’ level of hunger; Madhya Pradesh fares worst in the ‘extremely alarming’ cohort of hunger. All the other states record an ‘alarming’ level of hunger, which is also the general ranking for the whole country. More appallingly, the situation appears to have worsened in the recent period of rapid economic growth. National Sample Surveys point to declining per capita calorie consumption, not only among the entire population, but also among the bottom quartiles, for which consumption was already very inadequate by international standards, as shown in Table 4.

| Rural | Urban | |||

| 1999-2000 | 2004-05 | 1999-2000 | 2004-05 | |

| 2400 Kcal per day | 74.5 | 87 | ||

| 2200 Kcal per day | 58.5 | 69.5 | ||

| 2100 Kcal per day | 20.0 | 25.0 | ||

Other indicators of both nutrition and health are also extreme. The latest National Family Health Survey for 2005-06 shows that the proportion of underweight children below the age of five years was 45.6 per cent in rural India and 32.7 per cent in urban India, indicating hardly any change from the previous survey undertaken eight years previously. More than one-third of the rural population was also underweight. Anaemia — often a good indicator of nutritional deprivation — was also widespread: 79.2 per cent of children aged 12-23 months and 56.2 per cent of ever-married women between 15 and 59 years were found to be anaemic.

Health has also become a greater source of inequality and also poverty. Health care services in India are increasingly characterised by extreme duality, with the rich opting for deluxe institutions with “world class” infrastructure. The poor are either forced to avail of very overcrowded and under-funded public facilities, or to access medical shops where they are routinely exploited and often provided with inadequate care. The inadequate contribution of the government has meant that out-of-pocket expenses for health in India account for 85 per cent of total health expenditure, one of the highest ratios in the world. Van Doorslaer, et al. (2006), using the NSS data for 1999-2000, found that accounting for health costs increased the incidence of poverty by 3.7 percentage points, or 12 per cent.

The role of public intervention, in terms of ensuring clean, safe water and immunisation, is obvious for communicable diseases which are passed either directly among humans or indirectly through the physical environment. Nevertheless, both central and state governments in India have become increasingly remiss about ensuring such minimal expenditure and taking basic precautions. Health expenditure of central and state governments taken together declined from more than 1 per cent of GDP in the mid-1980s to only 0.9 per cent in the mid-2000s. Central government expenditures on health alone have been completely flat at only 0.1 per cent of GDP, which is one of the lowest ratios in the developing world. A number of state governments have actually shown declines — sometimes significant — in per capita health expenditures, especially for public health such as immunisation. Rates of immunisation of children aged 12-23 months also remain very low: in 2005-06 only 58 per cent of urban children and 39 per cent of rural children had received all the necessary vaccinations, which was almost the same as in 1997-1998. The rates had even come down in some states, including fast growing states like Gujarat. In three of the richest states of India — Maharashtra, Punjab and Gujarat — per capita public spending on health declined in constant price terms after 2000. And the NFHS results indicate that in these three states, immunisation rates of children in the 12-36 months age group actually fell in 2004-2005 compared to 1998-1999. In some cases the decline is dramatic– from 78 per cent to only 59 per cent in Maharashtra, for example.

In addition to other sources of inequality, social groups — particularly caste and community — remain important sources of economic differentiation, and within households, gender differences remain high and have even grown (in terms of rising gender wage gaps). Social divisions extend beyond religious and ethnic groups to caste divisions, which in India are not confined to Hindus, but are also implicitly recognised and practised in other religious communities. There were hopes and expectations that such divisions would decrease or disappear in the course of economic development. This has not really happened to the anticipated extent, even in the more advanced urban areas. Instead, caste awareness is increasingly reflected in identity politics that has led the political process to emphasise affirmative action such as reservation. Scheduled Castes (16.2 per cent of the population) and Scheduled Tribes (8.2 per cent) were explicitly recognised in the Constitution as being particularly deprived, and were given reservations in official employment and higher education (15 per cent for SCs and 7.5 per cent for STs). Nevertheless, their actual shares of both remain low, well below their mandated levels, largely because reservations have not been effectively enforced, and affirmative action has not taken any other forms such as asset redistribution or ensuring good quality school education that would more than proportionately benefit such groups. More recently, Other Backward Castes (OBCs) have been awarded reservations in both government employment and higher education, although this policy remains hotly contested. There are proposals to extend such reservation to the private sector, although this has not yet been legislated. In addition, it has been noted that Muslims are also significantly deprived educationally and marginalised occupationally, and there may be attempts to rectify this through official policy in future — indeed, some states already have some measures in place.

Factors behind the Poverty Trends in India

What explains this persistence of poverty and the apparently paradoxical divergence between growth rates and poverty reduction? Clearly, increasing inequality is an important factor, since it has meant that the benefits of the growth have been concentrated and have not “trickled down” sufficiently to ensure improved consumption among the lower income groups. But the pattern described here also emphasises the crucial importance of the nature of the growth. Thus, the period 1973-1974 to 1987-1988 witnessed faster reduction in rural poverty because the pattern of growth, especially in the 1980s, involved a shift of public expenditure at the margin to rural areas, and this generated multiplier effects and more employment that benefited the rural poor to some extent (Sen and Ghosh 1994).

Unlike in China, the terms of trade play a more complex role in changing levels of poverty: the presence of a large mass of landless labourers as well as marginal peasants who are often net purchasers of food means that rising agricultural (especially food) prices actually increase poverty even in rural India. In fact, several earlier studies relating to the 1960s have had a direct link between food prices and poverty incidence. The relevant variable is not the nominal food price level, but the relative price of food and the rate of increase of nominal food prices. A faster rate of increase of agricultural prices can have two contradictory effects on poverty. First, to the extent that agricultural growth is stimulated by a shift in terms of trade in favour of agriculture, and assuming that inequality does not increase, the rise in agricultural prices would contribute to a reduction in rural poverty to some extent. Second, since a large part of the rural population consists of agricultural labourers, small farmers and non-farm workers, who are all net purchasers of food, a sharp increase in the price of food would squeeze real incomes and worsen poverty.

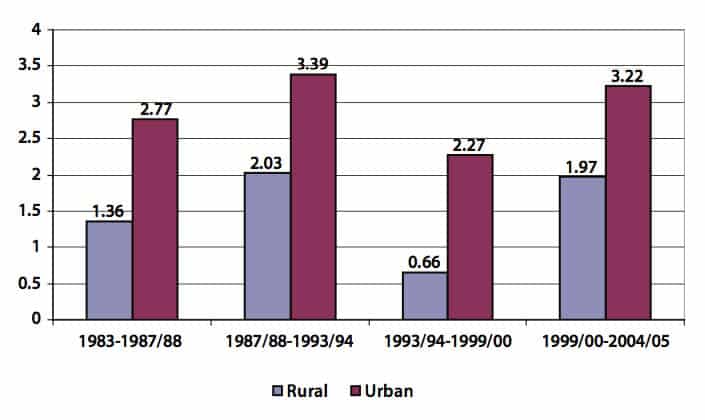

In recent years, the relationship between food prices and poverty has become more complex due to the effect of other factors, especially employment and wages. In general, productive employment generation is a crucial link between growth and poverty (although the link is not automatic, as the remuneration for work is critical). The recent economic growth process in India has exhibited a problem which is increasingly common throughout the developing world: the apparent inability of even high rates of output growth to generate sufficient opportunities for “decent work” to meet the needs of the growing labour force. As Chart 6 indicates, the period of rapid GDP growth has not been accompanied by significantly higher rates of net employment generation, with the employment growth in the most recent period still slower than the rates of expansion achieved in the period 1987-88 to 1993-94.

In addition, employment growth has been accompanied by significant increases in the rate of open unemployment, as aggregate and age-specific labour force participation rates have increased, especially for women. Further, more detailed data reveal that the quality of employment has deteriorated significantly, with less days worked per year and more reliance on precarious low-remuneration self employment. There has been a significant decline in the proportion of all forms of wage employment. While regular employment had been declining as a share of total usual status employment for some time now (except for urban women workers), the share of wage employment had continued to grow because employment on casual contracts had been on the increase. But the latest survey round suggests that even casual employment has fallen in proportion to total employment.

Chart 6: Annual rates of employment growth for usual status workers (percentages)

Sources: 1. NSSO, various rounds of Survey of Employment and Unemployment in India, for employment rates 2. Census of India for population figures

So, the official data also suggest that despite rapid economic growth, there has been increasing difficulty among the working population in finding paid jobs, whether in the form of regular or casual contracts. Agricultural employment showed the sharpest deceleration of all, with absolute declines in the number of people employed in agriculture over the 1990s. Part of this was due to technological and cropping pattern changes that reduced labour demand in agriculture. In addition, the growing land alienation by the peasantry (as cultivation became less viable given the squeeze on the peasantry because of rising input costs and falling or stagnant crop prices) also had an impact, since peasants using family labour tend to use labour more intensively than farmers using hired labour.

For urban India, the growth deceleration and even decline in organized sector employment were some of the more disturbing features of the period after 1990, especially given that industrial output increased manifold and the service sector (in which much of the organised employment was based) was the most dynamic element in national income growth.7 This was due to the decline in public sector employment, which was not compensated for by the increase in private organised sector employment. Further, several “economic reform” measures — such as trade liberalization, the reduction of credit allocation to the priority sector and the removal of various forms of support — worked against the interests of most small producers, who accounted not only for the most labour-intensive forms of urban production, but also for the dominant part of urban manufacturing employment.

The fallout of all this has been a very significant increase in self-employment among all categories of workers in India. The increase has been sharpest among rural women, where self-employment now accounts for nearly two-thirds of all jobs. But it is also remarkable for urban workers, both men and women, among whom the self-employed constitute 45 and 48 per cent of all usual status workers respectively. All told, therefore, around half of the work force in India currently does not work for a direct employer. This is true not only in agriculture, but increasingly in a wide range of non-agricultural activities. Further, more than half of men and nearly two-thirds of women among such self-employed workers reported monthly remuneration that is very low, indeed below the official minimum wages in most states.

The notion of the “working poor” therefore has to go beyond those in direct wage employment, to those engaged in often precarious and generally low-paying self employment. This, in turn, requires a significant rethinking of the way analysts and policy makers deal with the notion of “workers”. Several new policy problems emerge: the difficulty of ensuring decent conditions of work when the absence of a direct employer means that self-exploitation by workers in a competitive market is the greater danger; the difficulty of assessing and then ensuring “living wages” when wages are not received by such workers, who instead depend on uncertain returns from various activities that are typically petty in nature; the need to develop new forms of policy intervention to improve work conditions and strategies of worker mobilisation in this context. Self-employment thus also brings home the urgent need to provide basic social security that covers not only workers in the unorganised sector, but also those who typically work for themselves.

The growth of rural non-farm activities and employment has contributed to the reduction in rural poverty in India as in other countries, especially China. Further, the subsequent deceleration of poverty reduction, especially in rural India in the later period, can be related to the stagnation of rural employment opportunities in the 1990s and thereafter. Similarly, in urban India, changes in the nature of employment and inadequate generation of productive income opportunities have been major factors in the persistence of poverty. Thus, in India, rapid economic growth has not contributed to substantial poverty reduction, because of the negative effects of macroeconomic policies and processes on food prices and employment generation.

Hence, poverty reduction has depended on the extent to which the following features have been achieved: a relatively egalitarian growth path; increases in agricultural productivity that help raise wages and keep food prices under control; expansion of non-agricultural employment, including in rural areas; and direct public action in the form of poverty eradication programmes aimed at generating productive employment for the poor. The process of fairly continuous poverty reduction from the late 1970s to the early 1990s hinged on a combination of a certain growth pattern with expansion of rural non-agricultural employment led by public expenditure increases. The subsequent slowdown in the pace of poverty reduction has been associated with macro policies that have adversely affected employment generation, especially rural employment generation, possibly worsened inequality in consumption and contributed to an increase in the relative price of food.

Conclusion

These differing stories of poverty reduction in the two countries that were among the high-growth economies of the past three decades provide some important lessons. The first is that economic growth per se need not deliver either income poverty reduction or improvements in the conditions of human poverty. Instead, what matters crucially is the nature of the growth: the extent to which the growth is associated with growing inequalities that do not allow the benefits of growth to reach the poor; the extent to which the structural change involved in the growth process generates sufficient opportunities for productive non-agricultural employment; the extent to which markets and states function in ways that ensure the provision of basic needs and universal access to essential social services. All this also means that government mediation of the process of global economic integration matters in affecting the processes that will ultimately determine the extent to which economic growth delivers better conditions for the poor.

It should be clear that for China, the egalitarianism that the Chinese revolution ensured and the control the state could continue to exercise because of the persistence of substantial state ownership of and investment in capital assets, as well as the continuance of the earlier financial structure and system, meant that the process of global economic integration was carried out under fundamentally different premises from that which occurred in India. To a significant extent, some basic development issues, including ensuring adequate food supplies and universal primary education, were already dealt with. The domestic market for consumption goods was also significantly larger than proved to be the case in India. The control retained by the Chinese state over financial institutions and the activities of state owned enterprises (SOEs) allowed it to sustain high levels of investment and to deal with volatility, to prevent undesired levels of inflation from persisting beyond relatively short periods. In the event, the state ensured that cyclical fluctuations occurred around a high overall trend rate of income growth.

The early phase of economic reforms in China, which essentially involved increasing remuneration to farmers, operated substantially to reduce poverty and deprivation. Subsequently, the heavy emphasis on infrastructure development, combined with some “controlled” trade and investment liberalization, created much greater possibilities for employment-generating, export-oriented industrialization, which became the next engine of growth. As this occurred in a context of still heavily regulated and monitored imports, it ensured that export employment provided a net addition to aggregate manufacturing, rather than having to balance for losses in employment in other domestic sectors, since these did not really have to face import competition on par with other countries that underwent trade liberalization in that period. When import liberalization accelerated, some devaluation of the yuan in 1994 limited import competition. Thereafter, entry into the WTO required more sweeping import liberalisation, but to some extent, that impact was counterbalanced by access to other markets that enabled the continuous expansion of exports with a cheap currency policy.

While delivering growth, the transition to a market-driven system in China proved to be disequalizing beyond a point, not only in income terms, but also with reference to basic services. But recent measures by the Chinese state aimed at countering such tendencies and the migration-mediated process of trickle- down have helped to check these disequalizing outcomes. However, in as much as the current pattern of economic expansion is predicated on high rates of saving and investment as well as loosening the earlier credit and cash planning system, the dangers of volatile growth and inadequate reductions in unemployment and poverty persist. These will require appropriate macroeconomic corrections as well as supportive policies, especially in the new international context in which external markets are likely to play a dampening rather than a dynamic role. Since new growth stimuli will have to be sought in the new situation, and these are most likely to come from within the domestic market, this may be the moment to embark on a wage-led economic path that will simultaneously deliver growth and reduce poverty.

In comparison, India, with its market-driven and demand-constrained system, has not only failed to deliver the same growth success, but has also been far less successful with poverty reduction. Clearly, macroeconomic flexibility in a market-driven environment is not the best recipe either for growth and stability or for poverty reduction. India’s growth experience, while higher than for many other developing countries, was still less than the rapid growth experienced by China and other East and Southeast Asian economies. And more fundamentally, it could not deliver the desired structural change in terms of the composition of output and employment that would have ensured substantial poverty reduction.