What are the consequences of the implementation of neo-liberal economic philosophy for industrialization and development of poor countries? The answer: de-industrialization of many low-income countries; destruction of their food production (influenced also by protectionist agricultural policies of developed countries), thus their heavy dependence on food imports. The boom in commodity prices had improved the balance of payments of some developing countries temporarily before the “busts” emerged. But, even then, it had a detrimental impact on some other developing countries, through the hike in food and fuel prices, which were influenced by speculative activities of the transnational corporations.

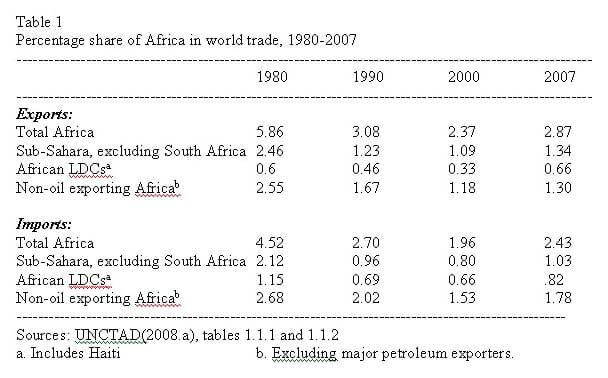

The situation in African countries in particular, most of which are among the least developed, has been critical. Premature trade liberalization made the continent, particularly Sub-Saharan countries, marginalized from international trade despite slight gains, due to the commodity boom, before the development of the crisis (Table 1).

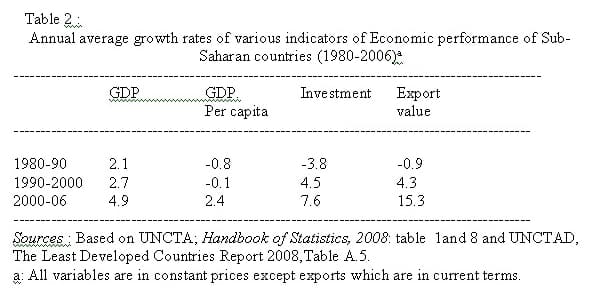

In the particular case of Sub-Saharan countries, not only did growth in GDP not keep pace with population growth before the recent commodity boom, but more importantly growth of exports was, in contrast to the neo-liberal view, either negative (during the 1980s) or slow during the 1990s (Table 2). So was growth in investment.

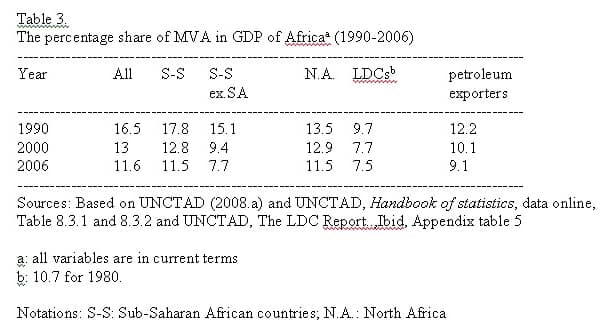

Yet, the process of de-industrialization, which had prevailed in the 1980s, continued not only in the 1990s but also during 2000-06 despite the commodity boom and some improvement in GDP growth (Table 3).

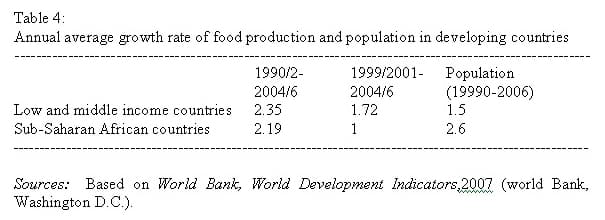

Food production was another victim (Table 4). As a result, the poor developing countries became heavily dependent on imports of food, particularly from developed countries. For example, for the African countries as a whole, the ratio of (X-M)/X (the value of exports minus imports, as a share of exports) for total trade in food fell from 51.6 in 1970 to -50.2 in 2005, and the corresponding ratio for trade with developed countries fell from 58 to -86.1 over the same period. To provide one example at the country/commodity level, while Ghana was self-sufficient in rice in the 1970s, the liberalization of the agricultural sector led to the import/production ratio of 79 in 2003. Import of rice from the USA, the price of which was 34 per cent below the cost of production in 2003, played an important part.

The deregulation of the market has helped speculative activities by transnational corporations, not only in the international financial and fuel markets, but also in the internal markets of staple foods of developing countries. For example, in the case of Mexico, speculation by four transnational corporations resulted in a sharp increase in domestic prices of corn in 2006 reaching over 100% of their purchase price of domestically produced corn. There is ample evidence in other countries. The food and fuel crisis preceded the financial and economic crisis.

Mehdi Shafaeddin is an Iranian-Swiss development economist with D.Phil from Oxford University. This article was first published by Triple Crisis on 25 March 2010; it is reproduced here for non-profit educational purposes.

|

| Print