For the second consecutive month, the economy created virtually no jobs, net of temporary Census jobs. The Labor Department reported that the economy lost 131,000 jobs in July, 12,000 less than the 143,000 drop in the number of temporary Census workers. The June numbers were revised down by 100,000 to show a gain of only 4,000 non-Census jobs.

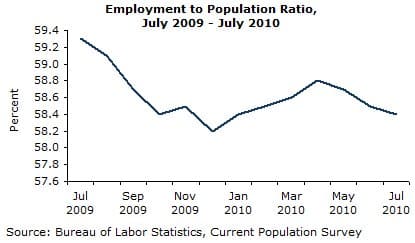

The job loss corresponds to a decline in labor force participation. While the unemployment rate has edged down by 0.2 percentage points to 9.5 percent since May, this is attributable to people who gave up looking for work and left the labor force. The employment to population ratio fell by 0.3 percentage points to 54.4 percent, only slightly above the 54.2 percent low in December. The drop is entirely due to a falloff in employment among women. Their EPOP fell by 0.2 percentage points in July, while the EPOP for men edged up by 0.1 percentage points. The EPOP for men now stands 0.6 percentage points above the low hit last December, while it is only 0.1 percentage points higher for women.

African Americans were also hit especially hard. The EPOP for African Americans is back at its low point for the downturn and the EPOP for African American women hit a new low at 54.4 percent, 0.1 percentage points lower than the December ratio.

By education level, the less educated appear to be the big gainers, with a 1.8 percentage-point increase in the EPOP for those without a high school degree. Those with some college had a 0.8 percentage-point decline in their EPOP and those with college degrees had a 1.1 percentage-point drop to 72.7 percent, the lowest level of the downturn.

By age group, the big gainers continued to be the over-55 cohort, which added 54,000 jobs in July, bringing the 3-month gain to 182,000. Older women accounted for 167,000 of this rise in employment. By contrast, employment for women between the ages of 35-44 fell by 253,000 (1.8%) and for women between 45-54 by 186,000 (1.2%) since May.

There were substantial declines in all the measures of duration of unemployment. This likely reflects many long-term unemployed dropping out of the workforce after losing benefits. The percent of multiple jobholders dropped by 0.3 percentage points to the lowest on record. This presumably reflects difficulty in getting jobs.

There are very few obvious sources of job growth on the establishment side. Manufacturing added 36,000 jobs, but most of this increase was attributable to a 20,500 rise in jobs in the auto industry and a 9,100 increase in jobs in fabricated metals. Most of these rises are attributable to the fact that Detroit auto makers did not shut down in July to change models. The underlying rate of job growth in manufacturing is very weak, even if at all positive.

Retail trade added 6,700 jobs, but with a 13,000 downward revision to last month’s job loss number, employment is still 14,000 below the May level. Financial services lost 17,000 jobs, with real estate counting for more than half of the loss. Professional and business services are now shedding jobs, with the sector losing 13,000 jobs last month. Employment services lost 23,300 jobs, a bad harbinger for future job growth. Even the restaurant sector is losing jobs, shedding 10,600 workers in July, the 3rd consecutive decline.

State and local governments shed 48,000 jobs in July, a result of budget cutting coinciding with the new fiscal year. The only sectors that added substantial numbers of jobs were health care (27,800) and, strangely, ground transit which added 10,600 jobs in July, 2.5 percent of employment in the sector.

There was a small uptick in average hours (all in the goods-producing sector), but this just returned hours to the May level. There is zero evidence to support the claim that firms are reluctant to hire because of uncertainty, since this would imply that they were increasing hours. Nominal wages rose at just a 1.4 percent annual rate, also not a good sign.

With the end of the inventory cycle, a huge wave of state and local cutbacks, and further declines in house prices on the way, the situation looks bleak for the second half of 2010.

Dean Baker is the co-director of the Center for Economic and Policy Research (CEPR). He is the author of False Profits: Recovering from the Bubble Economy. He also has a blog Beat the Press, where he discusses the media’s coverage of economic issues. This article was first published by CEPR on 6 August 2010 under a Creative Commons license.

| Print