Wages and Depressions

Sooner or later any bubble bursts, leading to falling asset prices as investors flee to safe liquidity. Distress selling and debt liquidation by the market participants follow. For Irving Fisher (1933), it is of key importance that an asset price deflation leads — via falling asset prices and a distorted financial system — to a lack of demand in the goods market and finally to deflation. Falling goods market prices then lead to an increase in the real debt burden, whereas lack of demand and deflation and increasing real debt reinforce each other until the economic boat capsizes. The driving force for goods market deflation is thus a lack of goods market demand.

John Maynard Keynes (1930) added another important element to the analysis of recessions. He argued that changes in nominal wages, more precisely nominal unit labour costs, are the backbone of inflationary and deflationary processes. Unit labour costs depend on nominal wage increases and productivity increases. If nominal wage increases are identical with productivity increases, there are no changes in wage costs and there is neither wage inflation nor wage deflation. During an economic boom with falling unemployment rates, there is always the danger that demand-driven inflation in the goods market will trigger wage inflation. More importantly in our context, a demand-driven deflation, falling production and increasing unemployment can lead to wage deflation if nominal wages do not increase at least in line with productivity. Keynes’ wage deflation argument can easily be combined with Fisher’s debt deflation model. Then it becomes more understandable that not all asset price deflations lead to disastrous goods market deflation. As long as the nominal wage anchor is upheld even in situations of high unemployment, an asset price deflation and a demand deflation do not lead to a cumulative deflation. Only falling nominal wages open the floodgates to a destructive deflationary process (Herr, 2009).

The wage deflation argument also sheds light on the Great Depression. Bernanke (2000) and others argued that the huge employment losses during the Great Depression were caused by insufficient nominal wage cuts, which led real wages to explode. High real wages, so the argument runs, lead to falling labour demand and high unemployment. The same argument was used for Japan. In the traditional neoclassical and New Keynesian view, after the 1980s real wages in Japan were excessively high and labour markets not flexible enough. Real wages were considered to be too high for full employment. Unions were accused of reacting in an inadequate way and opposing sufficient nominal and real wage cuts (Akerlof, Dickens and Perry, 1996; Baig, 2003; Bigsten, 2005; Takenaka and Yasui, 2005).

We disagree with these neoclassical arguments. Nominal wage cuts pushed the deflation even further and led to the explosion of the debt burden and the collapse of the economy. A key point is that workers are not even able to reduce real wages by cutting nominal wages. In Keynes’ words: “There may exist no expedient by which labour as a whole can reduce its real wage to a given figure by making revised money bargains with the entrepreneurs” (1936, p. 13). As to wages and the Great Depression, Keynes argues: “It is not very plausible to assert that unemployment in the United States in 1932 was due either to labour obstinately refusing to accept a reduction of money-wages or to its obstinately demanding a real wage beyond what the productivity of the economic machine was capable of furnishing” (ibid., p. 9). As will be seen, in Japan it was also the misguided cut in nominal wages that stimulated deflation, and it did not lead to the real wage cuts sought.

Wage Developments in Japan

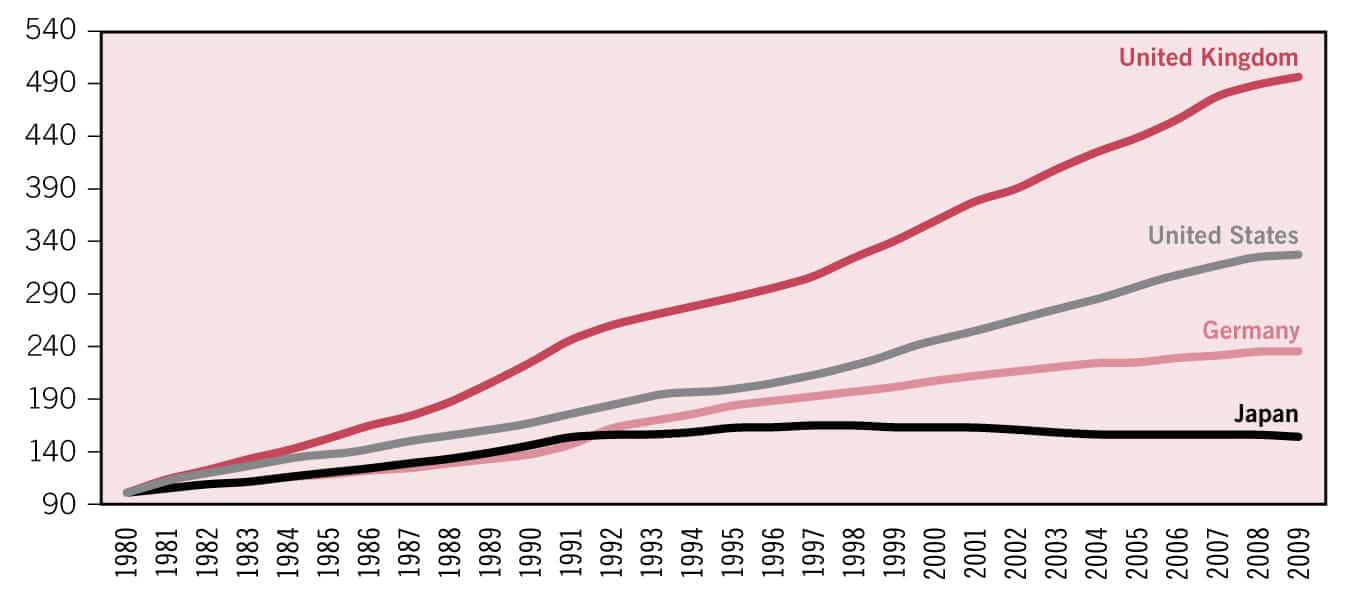

After the end of the bubble, nominal wage increases became very low, and they even fell after the shock of the Asian crisis. Only after 2005 did nominal wages stop falling. They have increased only very slightly since then. Figure 6, illustrating nominal wage increases in Japan, Germany, the United Kingdom and the United States, shows that nominal wages in Japan did not increase in such a way as to secure a low positive inflation rate, which is also the target of the Bank of Japan. Figure 6 also indicates that Germany is in a similar position with respect to low nominal wage increases.

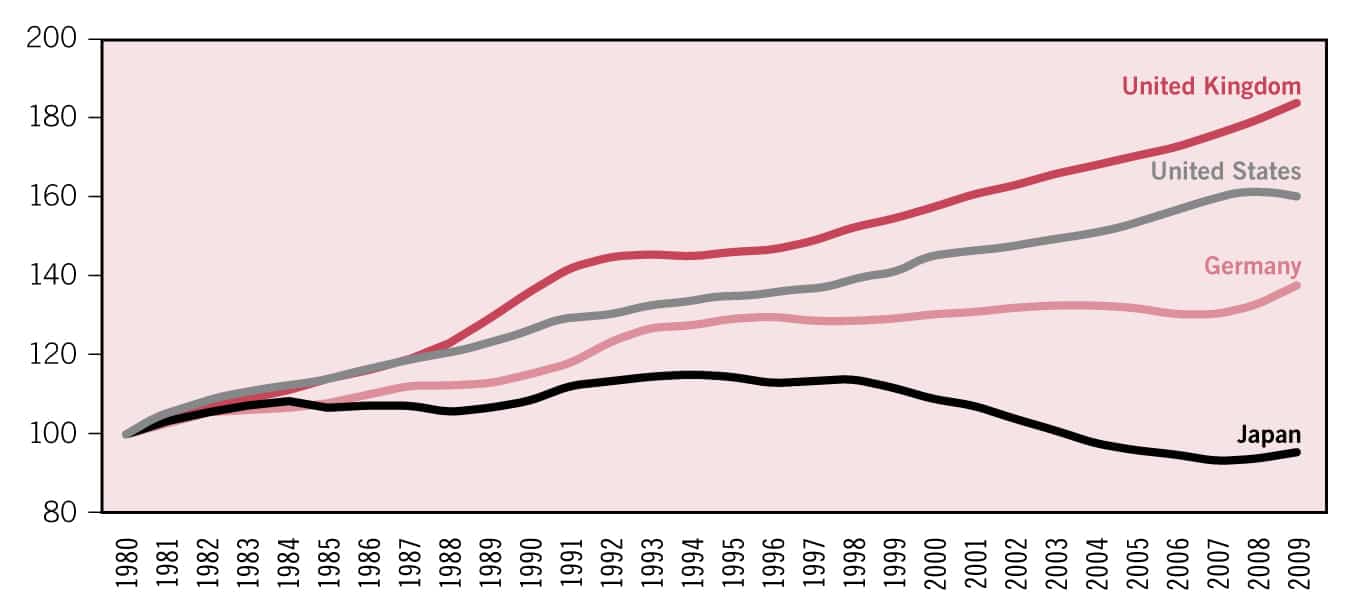

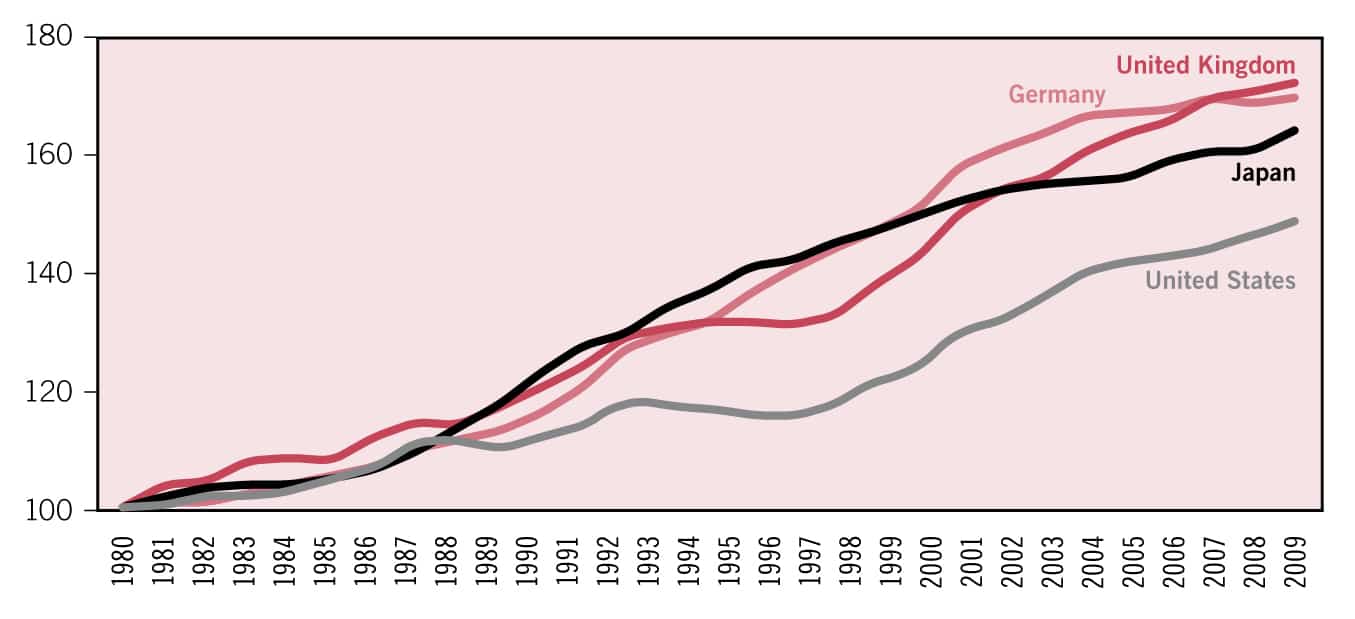

Nominal unit labour costs are the most important factor in the determination of price levels. Unit labour costs depend, as mentioned, on productivity changes and on changes in nominal wages. Trend productivity in Japan increased continuously even after the end of the bubble. Taking nominal wage development into account, it is no surprise that unit labour costs in the second half of the 1990s started to decrease substantially in Japan (see figure 7). Overall, the level of nominal unit labour costs in the United Kingdom and the United States increased in a way that led to moderate inflation rates, which were very much in line with the implicit or explicit inflation targets of the central bank. Due to the low nominal wage increases, unit labour costs in Germany stagnated and brought the country close to deflation. Keynes’ argument that nominal wages do not determine real wages is fully confirmed in Japan. In spite of falling nominal unit labour costs, real hourly compensation of employees in Japan did not decline. Indeed, it increased, reflecting productivity gains (see figure 8).3

Figure 6. Nominal compensation per employee, total economy, 1980-2009 (index 1980 = 100)

Source: Ameco (2010).

Figure 7. Nominal unit labour costs, total economy, 1980-2009 (index 1980 = 100)

Source: Ameco (2010).

Figure 8. Real average hourly compensation per employee, total economy 1980-2009 (index 1980 = 100)

Source: Authors’ calculation, based on Ameco (2010).

Why did the nominal wage anchor in Japan break down and create a dangerous situation, which could have ultimately resulted in a 1930s-style development? The answer lies in the special Japanese labour market situation and the changes it went through.

Official unemployment was around 1 per cent in the 1960s and increased slowly to almost 3 per cent in the mid-1980s, then came down again to 2.1 per cent in 1990, due to economic stabilization. Up to 2003, it increased to nearly 6 per cent, a rate that was reached again in 2009 after a few years of improvement (Ameco, 2010). However, real unemployment figures are higher, as many people who are out of work do not register as unemployed. Furthermore, the development of unemployment has to be seen against the background that the Japanese labour market has a high flexibility in working hours. Freeman and Weitzman (1987, p. 96) see the build-up and reduction of overtime as an important means for Japanese businesses to react to upward and downward swings in economic growth. In the face of low or negative economic growth after the end of the bubble, reducing overtime was quite obviously no longer sufficient to maintain high levels of employment. Overall, the increase in unemployment must be considered as a deep shock for Japanese society.

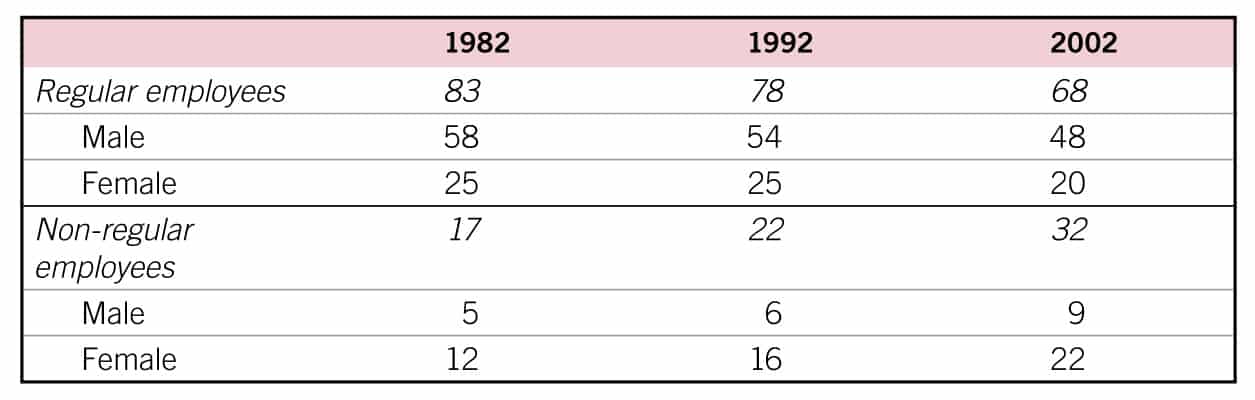

The Japanese labour market has long been divided into regular and non-regular employees. Regular employees used to have lifelong employment guarantees in the company for which they first worked, long-term career prospects, relatively high wages and good fringe benefits. Non-regular employees are short-term contract employees, temporary employees and part-time employees; they earn less than regular employees and it is relatively easy to terminate their employment. Table 1 shows that the number of regular workers dropped from 83 per cent in 1982 to 68 per cent in 2002. The Japanese Ministry of Internal Affairs and Communications reports that in 2008 the percentage of regular workers dropped to below 66 per cent. Female employees are much more affected than male employees. The burden of the Japanese crisis was disproportionately borne by women (Nakata and Miyazaki, 2010). In spite of the increase in non-regular employment, the wage structure (in terms of nominal wages per hour) in Japan did not change much.4 This group of employees has obviously long served as a buffer against changes in economic growth. The wage income of non-regular employees fluctuates widely according to the volume of employment.

Table 1. Composition of employees in the non-agricultural sector, 1982-2002

Note: All figures in per cent of total employees, without executives of corporations. Some numbers do not add up due to rounding.

Source: Nakata and Miyazaki (2010), p. 193, based on data from the Japanese Ministry of Internal Affairs and Communications.

It is also noteworthy that the Japanese wage system is characterized by high bonus payments. Besides the 12 monthly salaries, Japanese employees receive a bonus payment twice a year. This bonus system provides pay flexibility that can be applied at short notice and leads to strongly pro-cyclical wage developments.5 The bonus system adds to the danger that during periods of low growth, the income of employees will drop substantially.

Of key importance is the wage-bargaining system in Japan and the orientation of labour unions. There are mainly company-level unions that organize more or less only regular employees. Regular employees often automatically become members of the corresponding company-based union. Non-regular employees, on the other hand, are usually excluded from membership by their statutes. Company-level unions are members of national union federations, but wage negotiations de facto take part at the company level. Rebick (2001, p. 136) found that union membership dropped mainly because of the increase in non-regular jobs. Nationwide wage coordination is traditionally handled by employer organizations and not by unions. A small number of firms on an industry or multi-industry basis, mainly from the export sector, the government and union federations discuss wages and recommend a certain wage development. Union federations are weak and do not play an important role in this process. Wage recommendations are more or less passively accepted by company-based unions. Employers’ organizations, government and union federations have all been following a corporatist mercantile strategy. Wage developments take account of international competitiveness. As the Bank of Japan intervenes in the foreign exchange market, targeted exchange rate movements play an important role in wage developments. “Although exports are a relatively small share of GDP, these discussions are based on the requirements of maintaining as far as possible cost competiveness. They therefore involve anticipating with government likely exchange rate movements” (Soskice, 1990, p. 41).6 It is more than accidental that the second industrial country with high current account surpluses, Germany, also has very low wage increases. In Germany too, a mercantilist orientation during wage negotiations can be observed in many cases. However, it is only to be expected that unions in the German export sector, which negotiate with employers’ organizations, will be less radical in following mercantilist wage restraint than in the Japanese type of wage coordination, which is organized by a handful of big export-oriented firms. Additionally, in Japan company-level wage negotiations in a situation of a severe economic crisis always tend to lead to wage cuts, as the microeconomic logic of improving the firm’s competitiveness by undercutting the costs of other firms becomes overwhelming.

The potential role of minimum wages in preventing a deflationary development was not brought to bear in Japan. During the deflationary periods, the National Council, which recommends the annual changes, froze minimum wages. Between 1999 and 2006, there were very small changes in minimum wages, if any at all (Nakakubo, 2009, p. 27; Kambayashi, Kawaguchi and Yamada, 2008). On the other hand, looking at the wage structure, we can see that the livelihoods of the poorest workers have improved and that the wage gap between the lowest- and the average-paid workers from the end of 1980s until 2005 actually narrowed. This was especially apparent in the low-wage prefectures (Kawaguchi and Mori, 2009, p. 12). Hence, we can argue that the minimum wage was not used as a mechanism to prevent the deflationary development, but it certainly contributed to preventing the widening of the wage gap and was at least able to protect the lowest-paid from any such widening.

The share of wages in national income has been shrinking throughout the past three decades, from over 70 per cent in the 1970s to 57 per cent in 2008 (Ameco, 2010). This fall is the strongest of any industrial country. The falling wage share is reflected in the trend towards more unequal household income distribution. The Gini coefficient for disposable income increased in Japan from 0.30 in 1985 to 0.35 in 2005. In 2005 this indicator stood at 0.38 for the United States, 0.335 for the United Kingdom, 0.30 for Germany, 0.23 for Sweden and 0.27 for Austria (OECD, 2009b). Higher profit shares on national income reflect the increased power of the financial system and the firm sector in Japan which allowed a higher profit mark-up. The more unequal income distribution also added to the poor demand in domestic goods markets, together with the deflation in goods and asset markets and the increase in the number of people living in precarious working conditions.

3 Real compensation per employee did not increase as much as real hourly compensation per employee (Ameco, 2010). Obviously employees worked fewer hours.

4 Comparing average wages from 1995 to 2000 and from 2001 to 2007, the Gini index for wage income in Japan only changed from 29.63 to 28.90. This is a slightly more equal distribution of wages, as inequality increases with the value of the Gini index. Wage inequality in Japan is more or less at the mid-point in the ranking of industrial countries. In the period from 2001 to 2007, for example, Sweden had a value of 23.4, Denmark 23.8, Germany 26.0 and the United Kingdom 34.0 (ILO, 2009, p. 96).

5 For instance, the special cash earnings (in which the biggest share belongs to bonuses) were reduced sharply from an annual average of 107,944.00 yen in 1998 to 60,649.00 yen in 2004. After two years of slight increases, cash earnings were reduced again in 2007 (Ministry of Health, Labour and Welfare, various years).

6 Similarly: “The pattern of export sector led coordinated wage moderation in Japan was established in 1975 immediately after the first oil crisis and continued thereafter even during the economic boom of the 1980s” (Hiwatari, 2002, p. 14).

References

Ameco, Economic and Financial Affairs database of the European Commission (various years), available at: ec.europa.eu/economy_finance/ameco/user/

Akerlof, G.; Dickens, W.; Perry, G. 1996. The Macroeconomics of Low Inflation, Brookings Papers on Economic Activity 1, pp. 1-59.

Baig, T. 2003. Understanding the Costs of Deflation in the Japanese Context, IMF Working Paper 03/215.

Bernanke, B.S. 2000. Essays on the Great Depression (Princeton, NJ, Princeton University Press).

Bigsten, A. 2005. “Can Japan Make a Comeback?”, in World Economy Paper, Vol. 28, Issue 4, pp. 595-606.

Fisher, I. 1933. “The Debt-Deflation Theory of Great Depressions”, in Econometrica, Vol. 1, pp. 337-357.

Freeman, R., Weitzman, M. 1987. “Bonuses and Employment in Japan”, in The Japanese Economy, Part 2, Vol. 6, pp. 221-246.

Herr, H. 2009. “The Labour Market in a Keynesian Economic Regime: Theoretical Debate and Empirical Findings”, in Cambridge Journal of Economics, Vol. 33, pp. 949-965.

Hiwatari, N. 2002. Economic Downturn, Unemployment, and Policy Reform in Germany and Japan: Wage Moderation and Compensation Policies in Coordinated Market Economies, paper presented at the annual meeting of the American Political Science Association, Boston, MA, 29 Aug.-1 Sep.

ILO. 2009. Global Wage Report (Geneva).

Kambayashi, R.; Kawaguchi, D.; Yamada, K. 2008. Minimum Wage in Deflationary Economy: Experience of Japan, 1994-2003, Global COE Hi-Stat Discussion Paper Series (available at: ideas.repec.org/s/hst/ghsdps.html) gd09-074, Institute of Economic Research, Hitotsubashi University.

Kawaguchi, D., Mori, Y. 2009. Is Minimum Wage an Effective Anti-Poverty Policy in Japan?, RIETI Discussion Paper Series 09-E-032 (available at: www.rieti.go.jp/jp/publications/dp/09e032.pdf).

Keynes, J. M. 1930. A Treatise on Money, Vol. 1, The Pure Theory of Money (London, MacMillan, Collected Writings, Vol. V).

Ministry of Health, Labour and Welfare, Report of Monthly Labour Survey, Statistics and Information Department, various years.

Nakakubo, H. 2009. “A New Departure in the Japanese Minimum Wage Legislation”, in Japan Labor Review, 6 (2), Spring 2009, pp. 22-38.

Nakata, Y.F.; Miyazaki, S. 2010. “Increasing Labour Flexibility during the Recession in Japan: The Role of Female Workers in Manufacturing”, in C. Brown, B. Eichengreen and M. Reich (eds): Labour in the Era of Globalisation (Cambridge, Cambridge University Press), pp. 191-210.

OECD. 2009b. OECD — Society at a Glance 2009 (Paris).

Rebick, M. 2001. “Japanese Labour Markets: Can We Expect Significant Change?”, in M. Blomström, B. Gangnes and S. La Croix (eds): Japan’s New Economy — Continuity and Change in the Twenty-First Century (New York, Oxford University Press).

Soskice, D. 1990. “Wage Determination: the Changing Role of Institutions in Advanced Industrial Countries”, in Oxford Review of Economic Policy, Vol. 6, pp. 36-61.

Takenaka, S.; Yasui, K. 2005. Deflation and Nominal Wage Rigidity: Evidence from Japan, Discussion Paper No. 05-21.

Hansjörg Herr and Milka Kazandziska, Berlin School of Economics. The text above is an excerpt from Herr and Kazandziska’s “The Labour Market and Deflation in Japan,” which was first published in International Journal of Labour Research 2.1 (2010), a publication of the International Labour Office; it is reproduced here for non-profit educational purposes. Click here to download the entire issue of International Journal of Labour Research in which “The Labour Market and Deflation in Japan” was published.

| Print